TransUnion Bundle

How Well Do You Know TransUnion?

Ever wondered how a company fundamentally changes the financial landscape? TransUnion, a global powerhouse, has been quietly revolutionizing how we understand credit and risk. From its humble beginnings to its current industry dominance, TransUnion's story is one of remarkable evolution and strategic foresight. Discover the fascinating TransUnion SWOT Analysis and its impact on the financial world.

The TransUnion company journey began in 1968, transforming from a holding company to a leading credit bureau. Understanding the TransUnion history is crucial to grasping its current influence on consumer credit and the broader economy. Its evolution reflects significant changes in the credit reporting industry, impacting how businesses and consumers interact with financial data. This deep dive into TransUnion will uncover key milestones and its lasting legacy.

What is the TransUnion Founding Story?

The Growth Strategy of TransUnion began with its official founding on February 8, 1968, in Chicago, Illinois. Initially, the company served as a holding entity for the Union Tank Car Company, a railcar leasing business. This marked the beginning of the

A pivotal moment in

The primary issue

TransUnion pioneered the use of automated tape-to-disc transfer to update consumer files, a significant advancement in the credit reporting industry.

- The company's early focus was on providing credit information to businesses.

- The acquisition of CBCC in 1969 marked its entry into the credit bureau sector.

- The initial problem was the inefficiency and cost of manually updating credit files.

- TransUnion's early innovations set the stage for its future growth and impact on

.

In 1981, The Marmon Group acquired

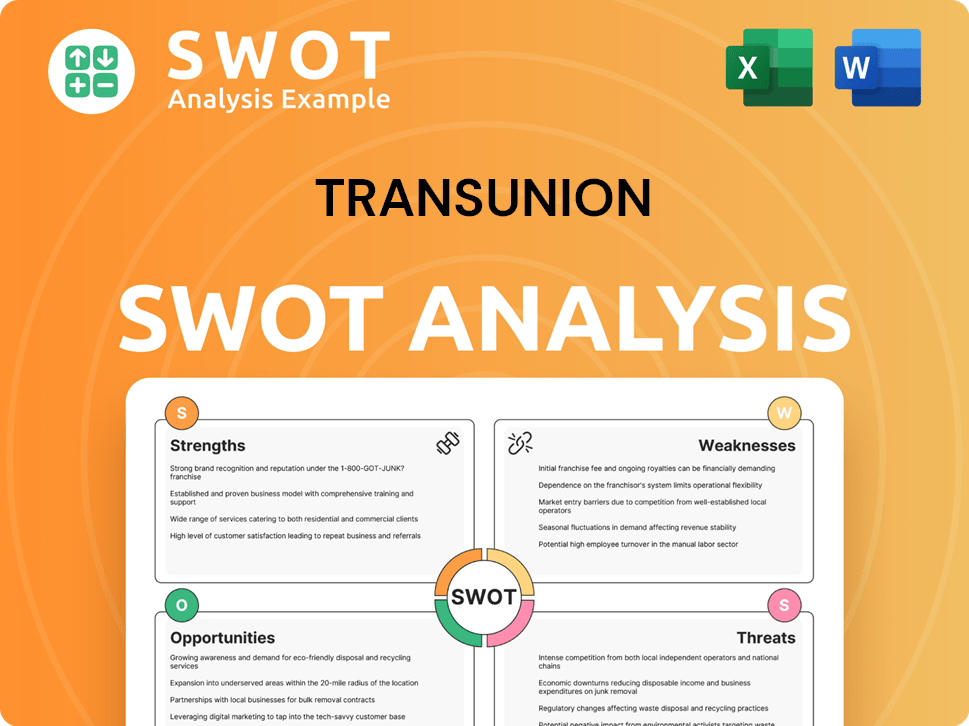

TransUnion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of TransUnion?

The early growth of the TransUnion company was marked by technological advancements and strategic market diversification. Following the 1969 acquisition of the Credit Bureau of Cook County, the company quickly automated its data processes, a pivotal move in the credit reporting industry. This early focus on automation laid the groundwork for future expansion and solidified its position in the market.

In the 1970s, TransUnion focused on solidifying its position in the credit reporting sector. By the 1980s, the company expanded its services to include credit monitoring and fraud detection. This expansion reflected a growing need for comprehensive consumer credit solutions. These advancements were crucial in shaping the company's trajectory.

International expansion began in 1988, with entry into Canada and other global markets, establishing TransUnion Canada in 1989. This marked a significant step in becoming a global information solutions provider. The move into international markets broadened the company's reach and impact on the global credit landscape.

The 1990s saw TransUnion extending its operations beyond traditional credit reporting, strengthening its analytics and decisioning capabilities through strategic acquisitions. This expansion included business-to-business offerings. This diversification allowed the company to offer a wider range of services and cater to various market needs.

A key development in the early 2000s was TransUnion's entry into the direct-to-consumer market. The acquisition of TrueCredit.com in 2002 allowed consumers online access to their credit reports and scores. This move was a significant step towards enhancing consumer access to their credit information.

By 2014, TransUnion's revenue reached US$1.3 billion. Significant leadership transitions and capital raises during this period included the acquisition by The Marmon Group in 1981, and later by Goldman Sachs Capital Partners and Advent International in 2010. These efforts shaped TransUnion's trajectory from a domestic credit bureau to a global information solutions provider. The company's evolution reflects a commitment to innovation and strategic growth, as highlighted in the Marketing Strategy of TransUnion.

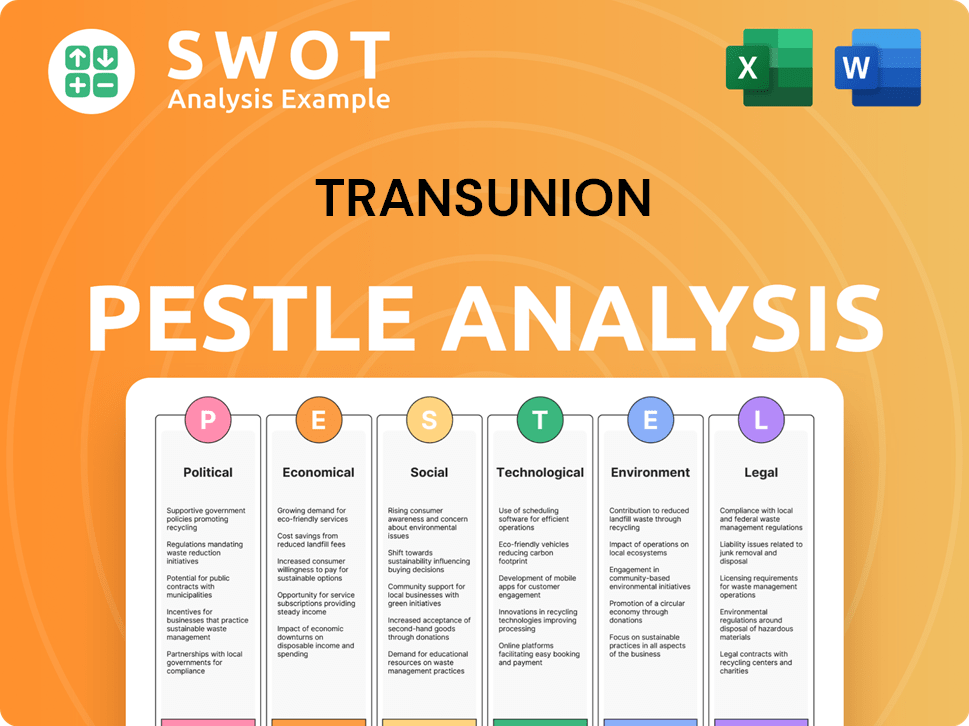

TransUnion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in TransUnion history?

The TransUnion company has a rich TransUnion history, marked by several key milestones that have shaped its evolution as a leading credit bureau. From its early days to its current status, the company has consistently adapted to the changing landscape of consumer credit and financial services. Understanding the TransUnion company background provides valuable insight into its current operations and future prospects.

| Year | Milestone |

|---|---|

| 2013 | Launched CreditVision, enhancing traditional credit scores with trended data. |

| 2013 | Acquired TLO LLC. |

| 2017 | CFPB fined TransUnion $5.5 million and ordered $17.6 million in restitution. |

| 2018 | Acquired CallCredit Information Group. |

| 2021 | Acquired Neustar for $3.1 billion and Sontiq for $638 million. |

| 2024 | Introduced the OneTru™ solution enablement platform. |

| Jan 2025 | Bought a majority stake in its Mexican arm for around $560 million. |

TransUnion has consistently introduced innovative solutions to meet evolving market demands. The introduction of CreditVision in October 2013 was a significant step, providing more predictive insights into consumer behavior. Recent developments, such as the OneTru™ platform launched in 2024, showcase the company's commitment to leveraging data and technology for advanced solutions.

CreditVision, launched in October 2013, enhanced traditional credit scores with trended data to better predict consumer repayment and debt behavior, improving the accuracy of credit report assessments.

SmartMove™ offers services like landlord credit and background checks, expanding TransUnion's offerings beyond traditional credit reporting to meet diverse consumer needs.

OneTru™, introduced in 2024, manages, governs, analyzes, and delivers data, identity, and insights, powering several B2B product lines and enhancing fraud detection capabilities.

TransUnion is expanding its AI capabilities to support autonomous decision-making and predictive scoring, improving the efficiency and accuracy of its services.

TruVision credit risk products, powered by OneTru, offer enhanced credit risk assessment tools, helping businesses make more informed decisions.

Unified identity capabilities, also powered by OneTru, improve identity verification processes, enhancing security and reducing fraud.

Despite its successes, TransUnion has faced challenges, including regulatory scrutiny and legal battles. The company has also navigated a competitive landscape, responding with strategic acquisitions and innovations. For more insights into the company's structure, you can explore Owners & Shareholders of TransUnion.

In January 2017, the CFPB fined TransUnion $5.5 million and ordered $17.6 million in restitution for allegedly deceiving consumers about the usefulness and cost of credit scores, highlighting regulatory challenges.

A $60 million verdict against TransUnion in an FCRA case in California in June 2017 underscores legal risks associated with credit report accuracy and compliance.

The credit bureau industry is competitive, requiring TransUnion to continually innovate and adapt to maintain its market position, driving strategic acquisitions.

Integrating acquired companies, such as Neustar and Sontiq, presents operational and financial challenges, demanding careful management and strategic alignment.

Changes in the financial services market, including the rise of fintech, require TransUnion to adapt its products and services to remain relevant, driving innovation in areas like AI.

OneTru powered several B2B product lines, including TruVision credit risk products, unified identity capabilities for TruAudience, and TruValidate fraud solutions, leading to increased fraud capture rates by 162% for a major financial institution.

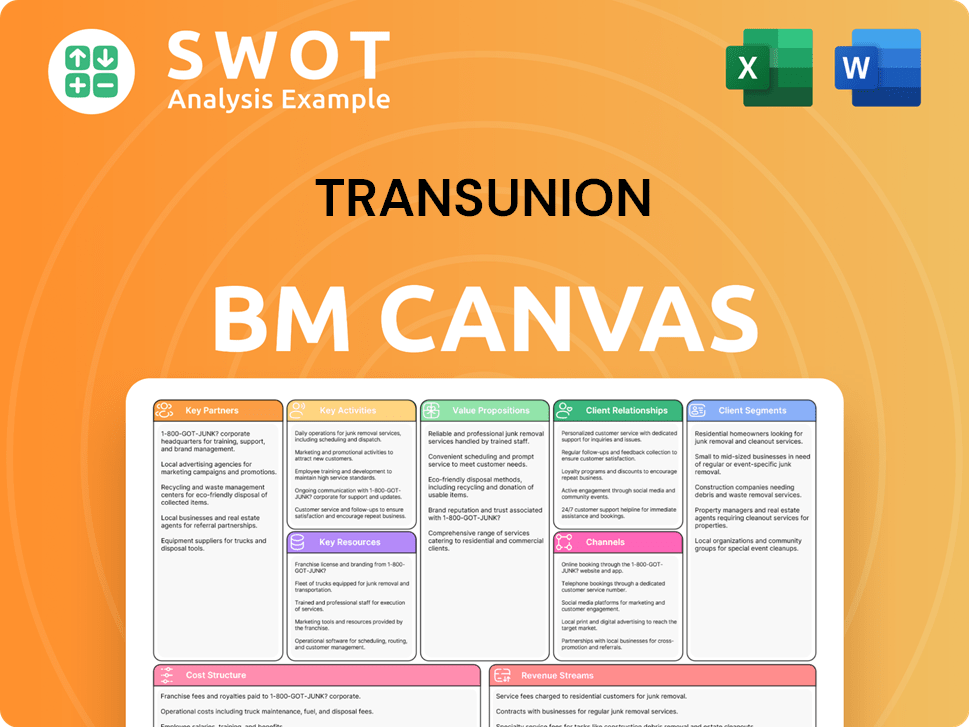

TransUnion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for TransUnion?

The TransUnion company has a rich past, marked by strategic expansions and technological advancements. The brief history of TransUnion includes significant acquisitions and the launch of innovative services, establishing it as a key player in the credit reporting industry. From its beginnings as a holding company to its current status as a publicly traded entity, TransUnion's journey reflects its adaptability and commitment to serving consumers and businesses. The TransUnion history is a testament to its growth and evolution within the financial sector.

| Year | Key Event |

|---|---|

| 1968 | Founded in Chicago, Illinois, as a holding company for Union Tank Car Company. |

| 1969 | Entered the credit reporting industry by acquiring Credit Bureau of Cook County. |

| 1981 | Acquired by The Marmon Group for approximately $688 million. |

| 1988 | Began international expansion, starting with a presence in Canada. |

| 1999 | Launched its first online credit monitoring service. |

| 2002 | Entered the direct-to-consumer market by acquiring TrueCredit.com. |

| 2010 | Acquired by Goldman Sachs Capital Partners and Advent International. |

| 2013 | Launched CreditVision, incorporating trended data into credit scores and acquired TLO LLC. |

| 2015 | Became a publicly traded company on the NYSE under the symbol 'TRU'. |

| 2017 | Fined $5.5 million and ordered to pay $17.6 million in restitution by the CFPB. |

| 2018 | Announced intent to acquire UK-based CallCredit Information Group for $1.4 billion. |

| 2021 | Completed acquisitions of Neustar ($3.1 billion) and Sontiq ($638 million). |

| 2023 | Rebranded thousands of B2B products into seven business lines. |

| 2024 | Reported annual revenue of $4.18 billion. |

| January 2025 | Acquired a majority stake in its Mexican arm for approximately $560 million. |

| Q1 2025 | Reported total revenue of $1.096 billion, an 8% increase on a constant currency basis compared to Q1 2024, with net income of $148 million. |

| Q2 2025 | Plans to roll out a freemium credit solution. |

In 2025, TransUnion anticipates continued growth with increasing new account originations. Mortgage originations are expected to reach approximately 5.7 million, while unsecured personal loan originations are projected to reach around 20.8 million. The company forecasts an organic constant currency revenue growth of 4.5% to 6% for the year.

Strategic initiatives include a focus on mortgage and emerging verticals, innovation, and acquisitions. The company is leveraging its OneTru platform and AI-driven tools to modernize infrastructure, aiming for $200 million in free cash flow improvements by 2026 and $95 million in annual operating expense savings by the end of 2024. These efforts align with its commitment to 'Information for Good®'.

The company's Q1 2025 results showed a strong start to the year, with revenue reaching $1.096 billion, an 8% increase on a constant currency basis compared to Q1 2024. Net income attributable to TransUnion for the quarter was $148 million. These financial achievements highlight the company's solid position and growth trajectory in the credit reporting and consumer credit market.

As a leading credit bureau, TransUnion offers a variety of services related to credit report and consumer credit. The company's evolution, as detailed in a related article, has positioned it to meet the changing needs of consumers and businesses alike. The company's history reflects its commitment to providing valuable insights.

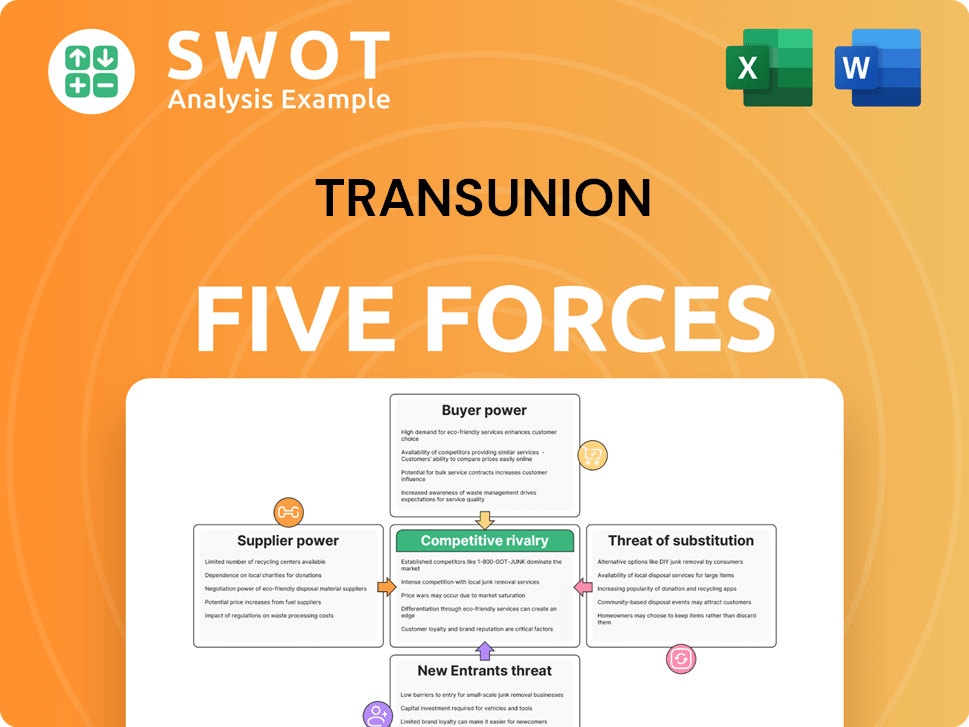

TransUnion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of TransUnion Company?

- What is Growth Strategy and Future Prospects of TransUnion Company?

- How Does TransUnion Company Work?

- What is Sales and Marketing Strategy of TransUnion Company?

- What is Brief History of TransUnion Company?

- Who Owns TransUnion Company?

- What is Customer Demographics and Target Market of TransUnion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.