TransUnion Bundle

How Well Does TransUnion Navigate the Data-Driven World?

In today's complex financial ecosystem, understanding the TransUnion SWOT Analysis is crucial for making informed decisions. TransUnion, a global information and insights company, plays a pivotal role in helping businesses assess risk and empowering consumers to manage their credit. Founded in 1968, it has evolved from a leasing business into a data giant, making it a key player in the financial world.

This exploration of the TransUnion competitive landscape provides a deep dive into its market positioning. We'll examine TransUnion competitors and dissect the strategies that have fueled its growth, offering a comprehensive TransUnion market analysis. Understanding the dynamics of credit reporting agencies and conducting a thorough credit bureau comparison is essential in today's market, and this analysis aims to provide that.

Where Does TransUnion’ Stand in the Current Market?

TransUnion holds a strong market position within the global information and insights industry, particularly in credit reporting and risk assessment. It's consistently ranked among the top providers worldwide, often alongside Experian and Equifax, forming part of the 'Big Three' credit bureaus in the U.S.

The company's core offerings include credit reports, risk scores, fraud prevention, and identity management solutions. These services cater to a wide range of customers, including financial institutions, insurance companies, healthcare providers, and government agencies. TransUnion's strategic focus on digital transformation and diversification of offerings, incorporating advanced analytics, AI, and machine learning, further strengthens its market position.

Geographically, TransUnion has a significant international presence, operating in over 30 countries across North America, Latin America, Europe, Africa, and Asia. This broad reach enables it to adapt to various regulatory environments and market needs, solidifying its global footprint. For a detailed look at the company's ownership, you can explore Owners & Shareholders of TransUnion.

TransUnion is a leading player in the credit reporting agencies sector. While specific market share data for 2024-2025 is proprietary, it consistently competes with Experian and Equifax. These three firms dominate the credit bureau comparison landscape in the U.S.

In the first quarter of 2024, TransUnion reported revenues of approximately $994 million. This financial performance highlights the company's substantial scale and financial stability. The company's consistent revenue generation underscores its strong position in the industry.

TransUnion serves diverse customer segments. These include financial institutions, insurance companies, healthcare providers, and government agencies. The company's credit risk solutions are integral to lending decisions within the financial services sector.

TransUnion operates in over 30 countries, with a strong presence in North America, Latin America, Europe, Africa, and Asia. This global footprint allows it to cater to various regulatory environments and market needs. Its international reach is a key factor in its competitive advantages.

TransUnion is strategically positioned to emphasize digital transformation and diversify its offerings. This involves moving beyond traditional credit reporting to embrace advanced analytics, artificial intelligence, and machine learning.

- Focus on data-driven insights

- Expansion into new markets

- Development of innovative products

- Investment in technology and analytics

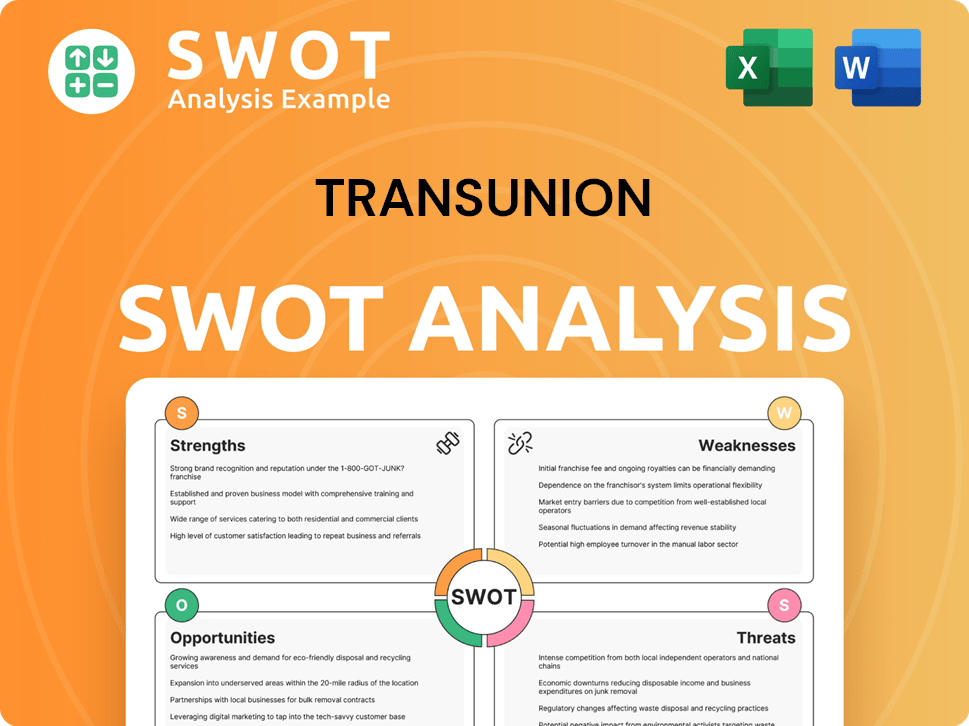

TransUnion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TransUnion?

The Growth Strategy of TransUnion is significantly influenced by the competitive landscape it navigates. TransUnion's market position is shaped by its direct and indirect competitors, demanding continuous adaptation and innovation. Understanding these dynamics is crucial for assessing TransUnion's strategic moves and financial performance.

The competitive environment for TransUnion involves a complex interplay of established players and emerging disruptors. The company's ability to maintain and grow its market share depends on its capacity to differentiate itself through product offerings, technological advancements, and strategic partnerships. This analysis provides an overview of the key competitors shaping TransUnion's business environment.

TransUnion operates within a highly competitive landscape, facing challenges from both direct and indirect competitors. Its most significant direct rivals are Experian and Equifax, often referred to as the 'Big Three' credit bureaus globally. Experian, a global information services company, offers a comprehensive suite of services including credit services, decision analytics, and marketing services, with a strong presence in consumer credit and data analytics. Equifax, another major player, provides credit information, analytics, and technology services, with a notable focus on workforce solutions and identity verification. These competitors challenge TransUnion across all its core business lines through similar product offerings, global reach, and ongoing innovation in data analytics and fraud prevention. High-profile 'battles' often revolve around securing major client contracts, developing superior analytical models, and expanding into new geographic markets or industry verticals.

The competitive landscape includes both direct and indirect competitors, each with unique strengths and strategies. The 'Big Three' credit bureaus – Experian, Equifax, and TransUnion – dominate the market, offering similar services but competing fiercely for market share and client contracts. Recent financial data highlights the competitive intensity within this sector.

- Experian: Experian's revenue for fiscal year 2024 was reported at $6.61 billion, demonstrating its strong market presence and competitive edge.

- Equifax: Equifax reported revenues of approximately $5.1 billion in 2024, showcasing its significant market share and competitive positioning.

- FICO: FICO is a key competitor in the analytics space, with its credit scoring models widely used across the industry.

- LexisNexis Risk Solutions: This company competes in areas such as fraud prevention and identity verification.

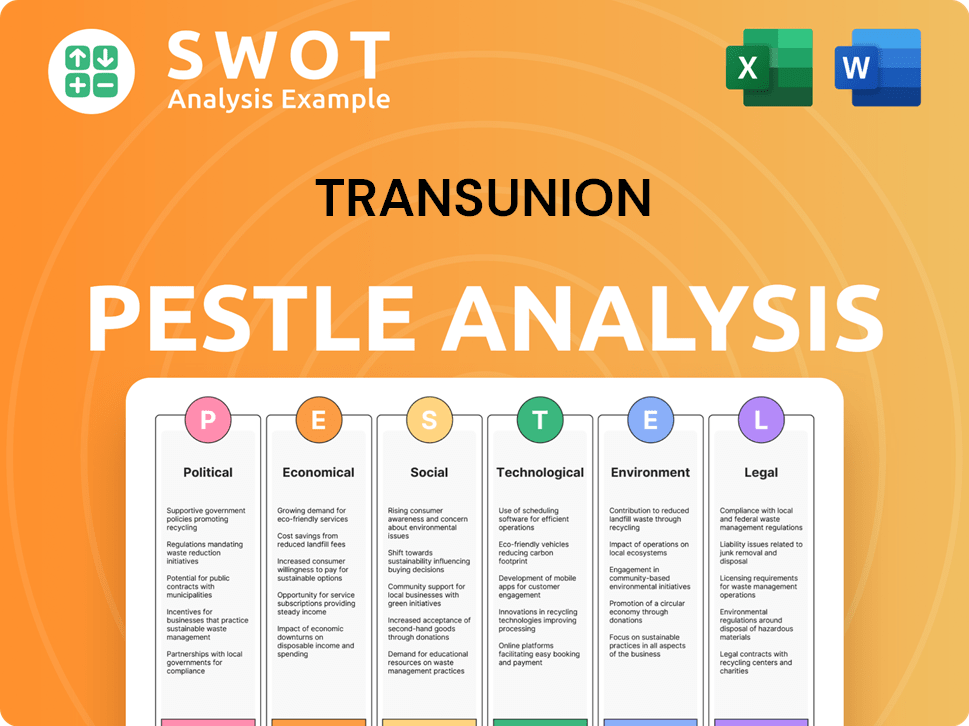

TransUnion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TransUnion a Competitive Edge Over Its Rivals?

Analyzing the Brief History of TransUnion reveals its strategic evolution and competitive positioning within the credit reporting industry. The company's journey is marked by significant milestones, including technological advancements, strategic acquisitions, and global expansions. These moves have solidified its market presence and enhanced its ability to compete effectively.

The competitive edge of TransUnion is defined by its robust data assets, advanced analytics, and strong brand reputation. TransUnion's ability to provide comprehensive credit information and risk assessment tools positions it favorably against its competitors. The company's focus on innovation and customer service further strengthens its market position.

The TransUnion competitive landscape is shaped by its data-driven solutions and global footprint. The company's strategic initiatives, including investments in technology and data security, are critical for maintaining its competitive advantage. These efforts support its long-term growth and ability to adapt to market changes.

TransUnion possesses a vast database of consumer and business credit data, which is a primary competitive advantage. This extensive data allows for comprehensive risk assessments and identity verification. The company's analytical models are continuously refined through machine learning and AI, offering superior predictive insights to clients.

As one of the 'Big Three' credit reporting agencies, TransUnion has built a strong reputation for reliability. This reputation fosters deep trust with financial institutions and other key customers. High customer loyalty and recurring revenue streams are a direct result of this trust.

TransUnion's global distribution network, spanning over 30 countries, enhances its competitive edge. This allows the company to serve multinational clients and adapt to diverse regulatory environments. The company's diversified revenue streams contribute to its financial stability.

TransUnion leverages its advantages in marketing by emphasizing data accuracy and innovative solutions. It also focuses on product development by integrating new data sources and analytical techniques. Strategic partnerships with fintech companies and other data providers help expand its offerings.

The TransUnion competitive advantages include its extensive data assets, advanced analytical capabilities, and strong brand equity. These strengths are difficult for new entrants to replicate. The company's global presence and diversified offerings further enhance its market position.

- Extensive Data Assets: Vast databases of consumer and business credit data.

- Advanced Analytics: Sophisticated credit scoring algorithms and fraud detection systems.

- Brand Equity: Reputation for reliability and accuracy, fostering trust.

- Global Presence: Operations in over 30 countries, serving multinational clients.

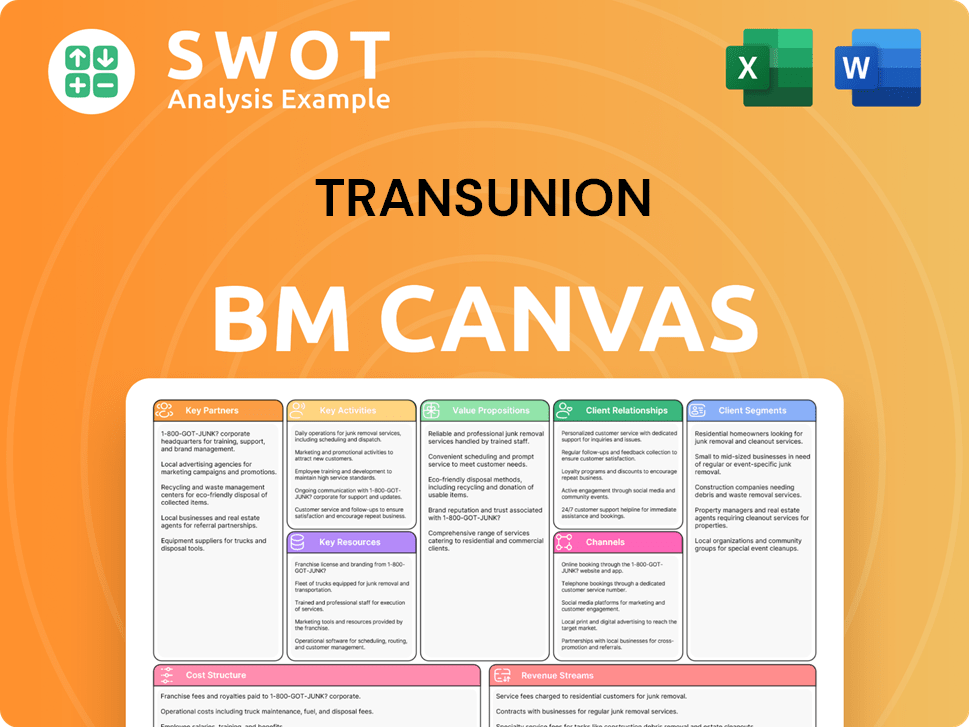

TransUnion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TransUnion’s Competitive Landscape?

The TransUnion competitive landscape is significantly influenced by industry trends, future challenges, and emerging opportunities. The company faces a dynamic environment shaped by technological advancements, regulatory changes, and evolving consumer behaviors. An in-depth TransUnion market analysis reveals that the firm must continually adapt to maintain its position.

TransUnion competitors and the broader credit reporting agencies sector are navigating a period of rapid transformation. The rise of alternative data sources and increasing regulatory scrutiny are reshaping the industry. Understanding these elements is crucial for evaluating TransUnion's strategic direction and long-term viability.

Technological advancements, especially in AI and machine learning, are reshaping the credit reporting sector. Regulatory changes, such as GDPR and CCPA, demand increased compliance efforts. Consumer preferences are leaning towards greater transparency and control over personal data, influencing service offerings.

The emergence of alternative data sources may reduce reliance on traditional credit scores. The increasing adoption of blockchain for identity verification poses a potential disruption. Aggressive new competitors and heightened regulatory scrutiny could increase operational costs.

Significant growth opportunities exist in emerging markets with underdeveloped credit infrastructures. Product innovations, such as advanced predictive analytics, can expand into new sectors. Strategic partnerships with fintech firms offer avenues for offering embedded finance solutions.

TransUnion's competitive position is expected to evolve through continued investment in advanced analytics. Expansion into new global markets is a key strategy. Strategic acquisitions to integrate innovative technologies and diversify service offerings are also important.

The TransUnion competitive landscape is characterized by both established players and emerging disruptors. The company's ability to leverage technology and adapt to regulatory changes will be crucial. For instance, in 2024, TransUnion's revenue was approximately $3.9 billion, reflecting its market position and financial performance.

- TransUnion vs Experian comparison reveals that both companies compete in similar markets, with Experian holding a larger market share.

- TransUnion vs Equifax analysis shows that Equifax also competes in the credit reporting and analytics space, with each having unique strengths.

- TransUnion's business strategy includes expanding its data and analytics capabilities.

- Understanding TransUnion's key competitors report helps to identify potential threats and opportunities.

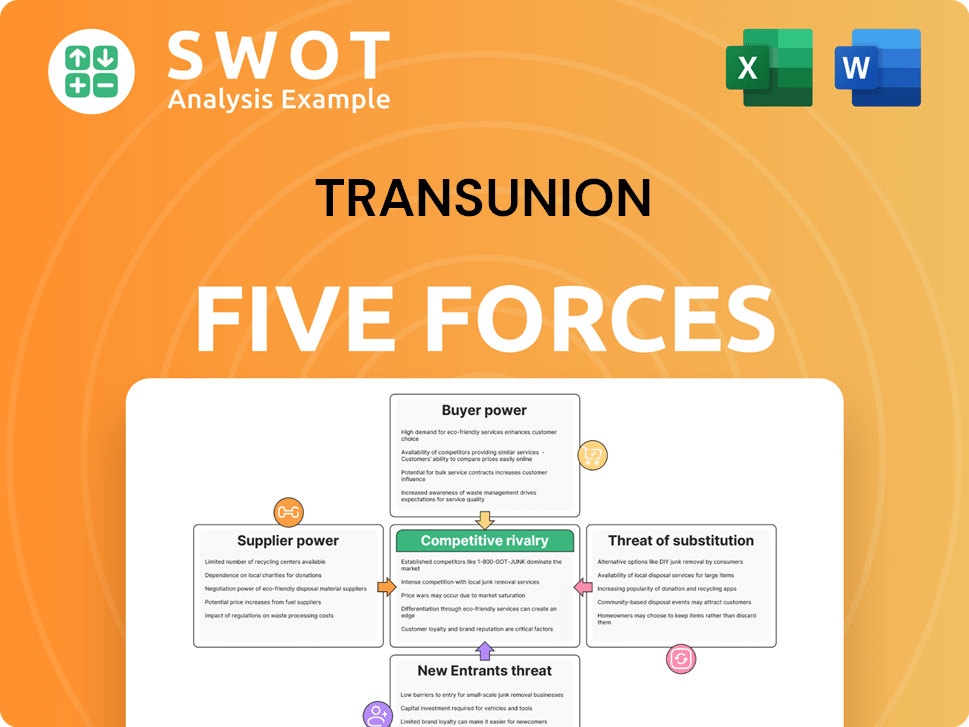

TransUnion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TransUnion Company?

- What is Growth Strategy and Future Prospects of TransUnion Company?

- How Does TransUnion Company Work?

- What is Sales and Marketing Strategy of TransUnion Company?

- What is Brief History of TransUnion Company?

- Who Owns TransUnion Company?

- What is Customer Demographics and Target Market of TransUnion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.