TransUnion Bundle

Who Does TransUnion Serve?

Understanding customer demographics and target markets is crucial for any company aiming for sustained growth. For TransUnion SWOT Analysis, a global information and insights company, this understanding is paramount in the dynamic landscape of credit and risk management. The evolving needs of consumers, especially the digitally native generation, are reshaping how companies assess creditworthiness and deliver financial solutions. This article dives deep into TransUnion's customer base and market strategies.

TransUnion's journey from a B2B credit bureau to a diversified information solutions provider reflects its strategic adaptation to technological advancements and shifting consumer behaviors. This evolution is particularly evident in the company's response to the growing emphasis on data privacy and financial empowerment. A detailed market analysis reveals the company's ability to cater to a wide range of needs, from credit reporting to identity theft protection, across various customer demographics. Analyzing TransUnion's customer data provides valuable insights into its market share, customer acquisition strategies, and the demographic profile of its users.

Who Are TransUnion’s Main Customers?

Understanding the Customer demographics and target market of TransUnion is crucial for appreciating its business model. TransUnion operates in both the business-to-business (B2B) and business-to-consumer (B2C) sectors, each with distinct customer profiles. This dual approach allows TransUnion to provide a wide range of services, from credit reporting to identity theft protection, catering to diverse needs across the financial landscape.

In the B2B segment, TransUnion serves financial institutions, insurance providers, and healthcare companies, offering them essential data solutions. The B2C side directly engages with consumers through its platform, providing tools for credit management and identity protection. This dual strategy reflects TransUnion's commitment to serving both businesses and individuals, making it a key player in the credit and consumer data industry. To understand the company better, you can read a Brief History of TransUnion.

TransUnion's ability to adapt to changing market demands and consumer behaviors is evident in its strategic focus on digital engagement and educational content, especially in the B2C sector. This approach ensures that the company remains relevant and valuable to its diverse customer base.

The B2B segment primarily includes financial services institutions such as banks and credit unions. These institutions rely on TransUnion for credit reports, risk scores, and analytics to make informed lending decisions. Other key customers include insurance providers and healthcare companies who use TransUnion's data for identity verification and fraud detection.

The B2C segment consists of individual consumers who access TransUnion's services directly through its platform. This includes a broad range of individuals seeking credit reports, credit scores, credit monitoring, and identity theft protection. This segment is characterized by a diverse demographic profile, including different ages, income levels, and levels of financial literacy.

For B2B customers, key demographics are defined by the size and type of business, their regulatory environment, and their specific data needs. In the B2C segment, while specific demographic breakdowns are not publicly detailed, the focus is on individuals needing financial transparency and security. Younger adults (18-34) are an important demographic, as they enter the credit market. Older adults may be more focused on identity protection.

TransUnion has increased its focus on digital engagement and educational content to cater to the B2C market. This shift is driven by increased consumer awareness about credit and regulatory mandates. The company's strategic initiatives include enhancing its digital platform and providing resources to help consumers understand and manage their credit profiles, reflecting a commitment to customer education and empowerment.

TransUnion's market analysis reveals a strong presence in the credit reporting and consumer data industry. The company's ability to adapt to changing market dynamics is crucial for maintaining its competitive edge. The increasing demand for self-service financial tools and the need for robust identity protection services drive TransUnion's strategic direction.

- TransUnion's revenue in 2023 was approximately $3.9 billion.

- The company's B2B segment continues to be a significant revenue driver, with financial services institutions representing a substantial portion of its customer base.

- The B2C segment is growing, reflecting increased consumer demand for credit monitoring and identity theft protection services.

- TransUnion's market share in the credit reporting industry is substantial, positioning it as a key player.

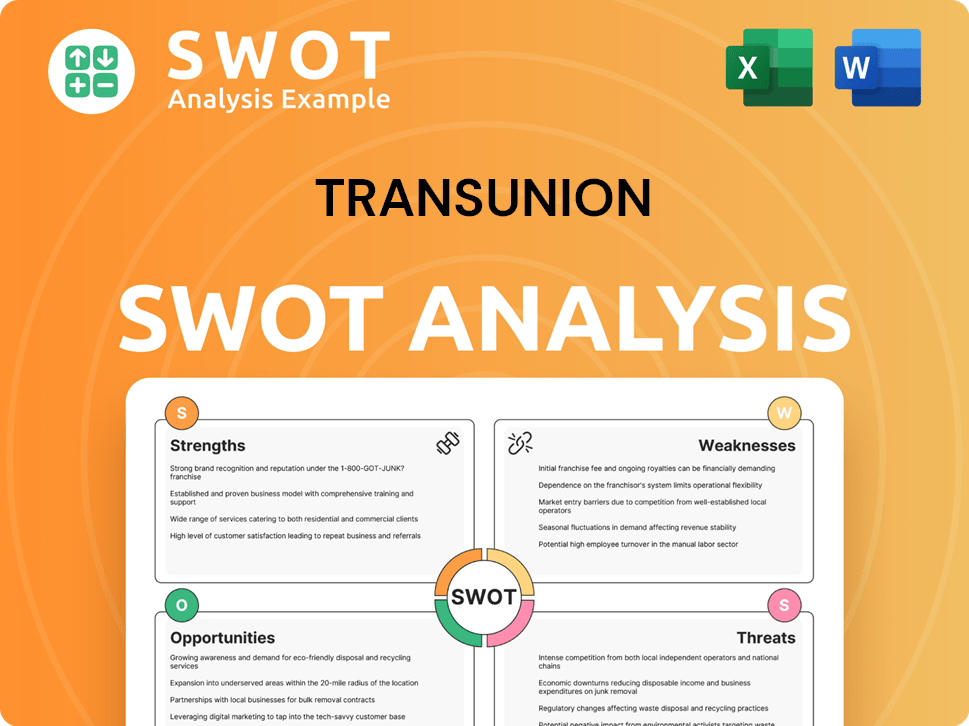

TransUnion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do TransUnion’s Customers Want?

Understanding the customer needs and preferences is crucial for a company like TransUnion, which operates in the complex world of consumer data and credit reporting. Its diverse customer base, spanning both businesses and individual consumers, requires a nuanced approach to meet their specific demands. This involves tailoring products and services to address the unique challenges and goals of each segment.

For businesses, the primary focus is on data accuracy, risk mitigation, and operational efficiency. Individual consumers, on the other hand, prioritize financial empowerment and security. By analyzing the specific needs of each group, TransUnion can refine its offerings and maintain its position in the market. This includes providing tools for credit monitoring, fraud detection, and educational resources.

The company's success hinges on its ability to provide valuable services that meet the evolving needs of its customers. This involves continuous innovation in data analytics, credit scoring models, and fraud prevention tools. By understanding these preferences, TransUnion can improve customer satisfaction and drive sustainable growth. The Growth Strategy of TransUnion is deeply intertwined with its ability to meet these customer needs.

TransUnion's B2B clients, primarily in financial services, require accurate and timely data for informed decision-making. They need tools to mitigate risk and improve operational efficiency. The market analysis for these clients often involves regulatory compliance and the ability to automate lending processes.

- Data Accuracy: Banks and financial institutions rely on precise credit data to assess risk.

- Fraud Detection: Robust tools are essential to prevent financial losses.

- Advanced Analytics: Portfolio management requires sophisticated analytical capabilities.

- Regulatory Compliance: Meeting compliance requirements is a top priority.

Individual consumers seek financial empowerment and security. They need clarity about their credit health and tools to monitor their credit for inaccuracies. Their preferences include transparency and the ability to achieve financial goals.

- Credit Monitoring: Consumers need to track their credit scores and reports.

- Identity Theft Protection: Security against fraud is a major concern.

- User-Friendly Tools: Ease of access to information is crucial.

- Educational Resources: Understanding credit scores and financial management is essential.

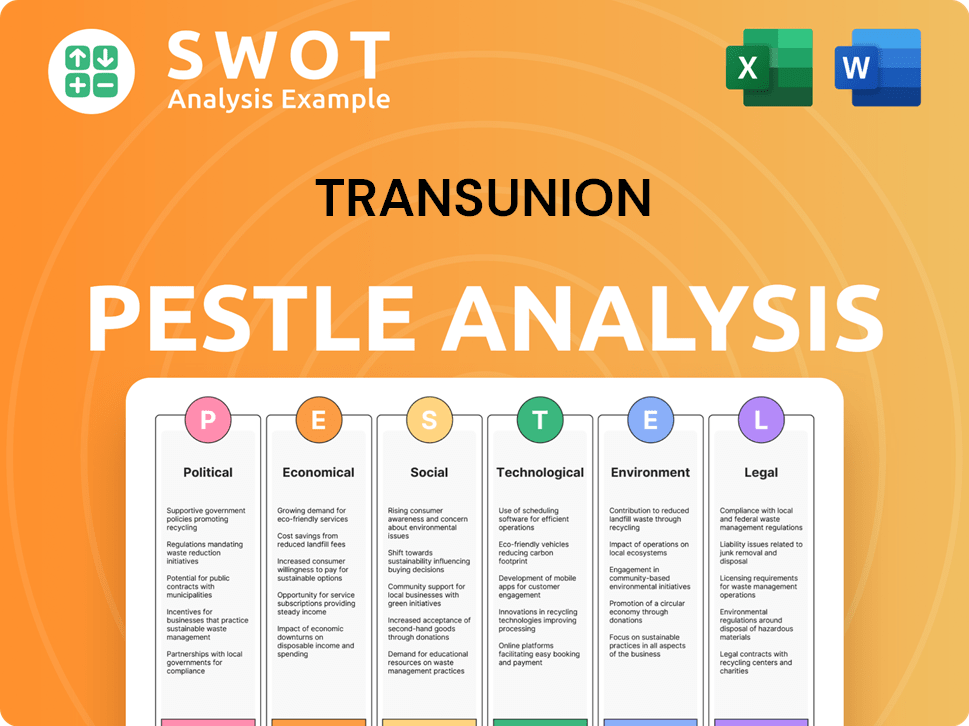

TransUnion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does TransUnion operate?

TransUnion's geographical market presence is extensive, with significant operations spanning North America, Latin America, Africa, and Asia. The company strategically positions itself in both established and emerging markets to capitalize on growth opportunities. Its diverse presence allows it to cater to a wide range of customers and adapt to varying economic conditions and regulatory environments.

In North America, TransUnion holds a strong market share, particularly in the United States, where it is one of the leading credit reporting agencies. Beyond North America, the company has expanded its footprint into Latin America, with key markets in Brazil, Mexico, and Colombia. Further expansion includes a presence in Africa, with a focus on South Africa, and the Asia-Pacific region, targeting countries like India and the Philippines.

This global approach enables TransUnion to serve a diverse customer base and address the unique needs of each region. The company's ability to adapt its services to local market conditions, comply with data privacy regulations, and form strategic partnerships is crucial for its continued success and growth. This strategic geographical distribution is a key factor in its overall business strategy.

The United States remains a primary market for TransUnion, where it provides services to a vast array of clients, including major financial institutions and individual consumers. The company's strong brand recognition and market share in the U.S. are key drivers of its revenue. TransUnion's focus in North America includes advanced analytics and fraud solutions, catering to a mature market.

TransUnion has strategically expanded into Latin America, with a focus on countries like Brazil, Mexico, and Colombia. These markets offer significant growth opportunities due to increasing credit economies and evolving regulatory landscapes. The company adapts its credit information and risk management solutions to align with local market needs and regulations.

Africa, particularly South Africa, represents a key market for TransUnion. The company offers solutions ranging from credit reporting to fraud prevention, addressing the specific needs of the region. With expanding financial sectors, the demand for robust credit and information solutions continues to grow.

The Asia-Pacific region, including countries like India and the Philippines, is of significant importance to TransUnion. The company addresses the unique challenges and opportunities presented by rapidly developing financial sectors. TransUnion's presence in this region supports financial inclusion initiatives and digital transformation.

TransUnion customizes its offerings by adapting data models to regional credit behaviors, complying with local data privacy regulations, and forming strategic partnerships with local financial institutions. This localized approach is crucial for success in diverse markets. The company's commitment to understanding and meeting the specific needs of each region is a key element of its strategy. For a deeper dive into the company's strategic approach, consider exploring the Marketing Strategy of TransUnion.

- Data Adaptation: Tailoring data models to reflect regional credit behaviors.

- Compliance: Adhering to local data privacy regulations.

- Partnerships: Collaborating with local financial institutions.

- Market Focus: Prioritizing high-growth economies.

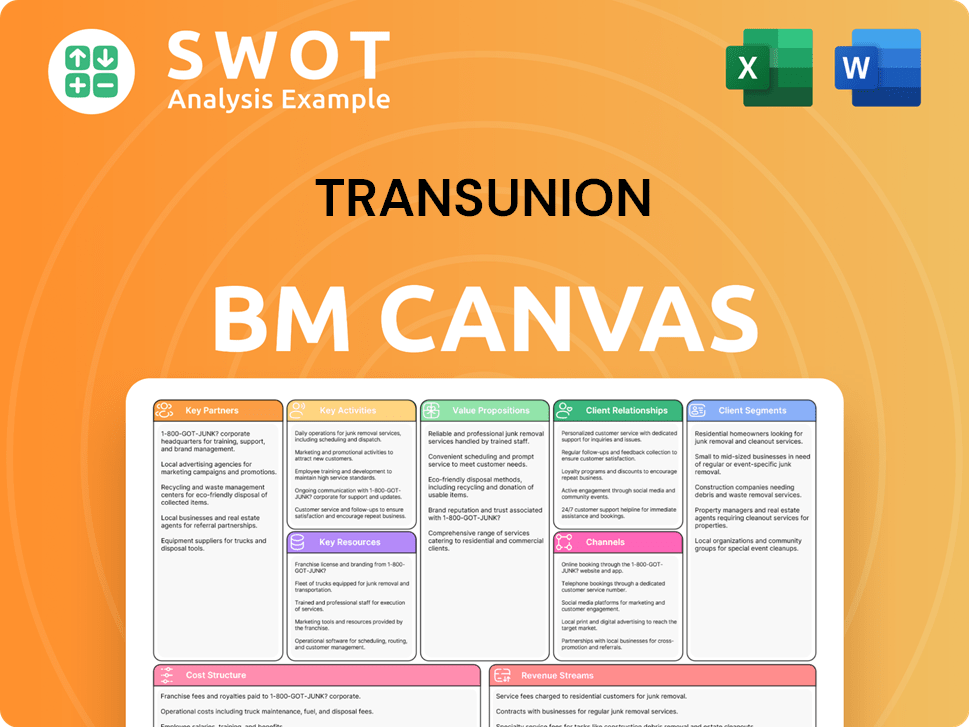

TransUnion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does TransUnion Win & Keep Customers?

The company, known for its credit reporting and consumer data services, employs distinct strategies for customer acquisition and retention across its B2B and B2C segments. Its approach is multifaceted, leveraging both traditional and digital channels, along with sophisticated data analytics. This dual focus allows the company to cater to a broad range of clients, from financial institutions to individual consumers, ensuring a comprehensive market presence.

For its business-to-business (B2B) segment, the company focuses on direct sales and targeted marketing, emphasizing its expertise in risk management and fraud prevention. In the consumer-facing (B2C) segment, it utilizes digital marketing, including SEO, paid advertising, and social media campaigns. This dual strategy ensures the company reaches both corporate clients and individual consumers effectively.

Retention strategies involve delivering consistent value through high-quality data and responsive customer service for B2B clients. For B2C customers, it offers personalized experiences through its online platform, providing credit updates and educational resources. These strategies are designed to foster long-term relationships and encourage ongoing subscriptions.

The company's B2B acquisition strategy involves direct sales teams targeting financial institutions and insurance providers. It uses targeted marketing campaigns highlighting its risk management and data analytics expertise. Industry conferences and webinars also play a key role in attracting new clients.

Retention focuses on delivering consistent value through high-quality data and responsive customer service. Regular account reviews and proactive problem-solving are crucial. Tailored solutions and integration into clients' systems enhance stickiness.

The company leverages a strong digital marketing presence, including SEO, paid advertising, and social media campaigns. Partnerships with financial literacy platforms and direct-to-consumer outreach are also vital. Free credit reports are used as an initial hook.

Retention involves delivering personalized experiences through its online platform and mobile app. Regular credit updates, alerts, and educational resources are provided. Customer data and CRM systems are used for targeted communications.

The company’s continuous evolution in customer acquisition and retention strategies reflects its commitment to adapting to the changing market dynamics. The increasing focus on direct-to-consumer digital engagement and mobile accessibility is a response to the preferences of a digitally native consumer base. These changes have positively impacted customer loyalty and lifetime value, leading to higher engagement rates and lower churn, particularly within its consumer credit monitoring subscriptions. Further insights into the financial aspects can be found in the Revenue Streams & Business Model of TransUnion.

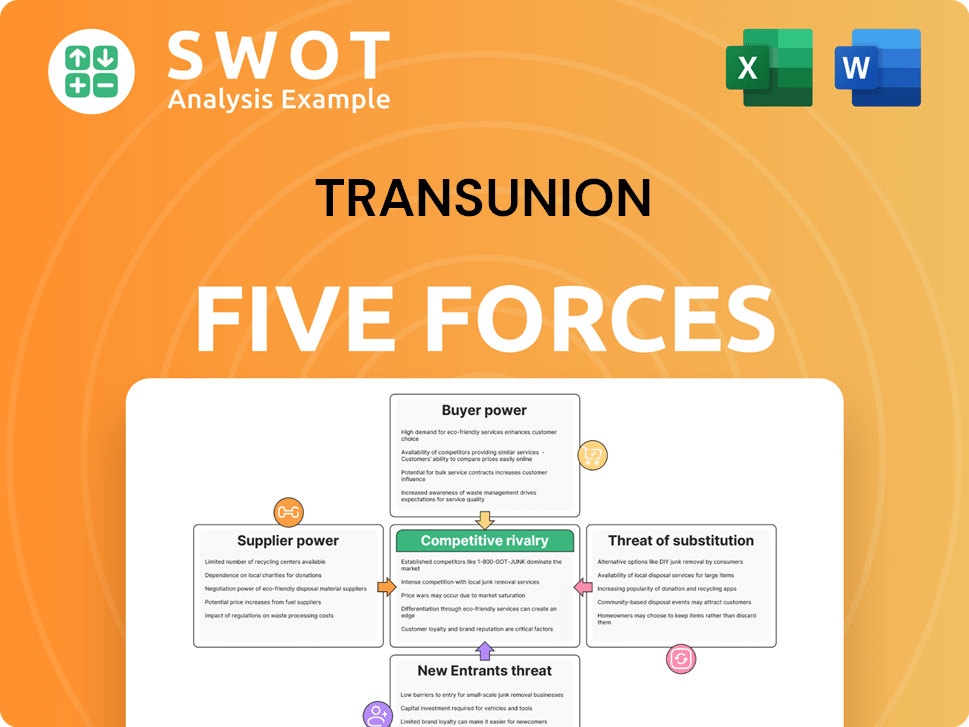

TransUnion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TransUnion Company?

- What is Competitive Landscape of TransUnion Company?

- What is Growth Strategy and Future Prospects of TransUnion Company?

- How Does TransUnion Company Work?

- What is Sales and Marketing Strategy of TransUnion Company?

- What is Brief History of TransUnion Company?

- Who Owns TransUnion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.