TransUnion Bundle

Can TransUnion Continue Its Ascent in the Data Analytics Realm?

TransUnion, a titan in the information and insights sector, is charting an ambitious course for future growth. The recent acquisition of a majority stake in Trans Union de Mexico, S.A., S.I.C., signals a bold move to dominate the Spanish-speaking Latin American credit bureau market. This strategic expansion is just one facet of TransUnion's evolving TransUnion SWOT Analysis, which outlines its strengths, weaknesses, opportunities, and threats in the competitive landscape.

This article dives deep into the TransUnion growth strategy, examining its strategic initiatives and international expansion plans. We'll analyze the company's future prospects, including its revenue growth forecast and investment potential within the dynamic financial services market. Furthermore, we'll explore how TransUnion navigates the credit reporting industry, leveraging data analytics trends to maintain its competitive edge and deliver value to stakeholders.

How Is TransUnion Expanding Its Reach?

The expansion initiatives of TransUnion are focused on bolstering its market position through strategic acquisitions, new product launches, and geographical expansion. These efforts aim to capitalize on the evolving needs of the financial services market and the increasing demand for data analytics solutions. The company's approach is designed to drive sustainable growth and enhance its competitive advantage within the credit reporting industry.

TransUnion's growth strategy includes a multi-faceted approach to expand its business. This involves entering new markets, launching innovative products, and strategically acquiring businesses. These initiatives are designed to increase revenue streams and maintain a competitive edge in the rapidly evolving financial landscape.

The company is actively pursuing a multi-faceted approach to expand its business, focusing on new market entry, product launches, and strategic acquisitions. This strategy is designed to capitalize on the evolving needs of the financial services market and the increasing demand for data analytics solutions. The company's approach is designed to drive sustainable growth and enhance its competitive advantage within the credit reporting industry.

In early 2025, TransUnion announced the acquisition of a majority stake in Trans Union de Mexico, S.A., S.I.C., the consumer credit business of Buró de Crédito. This $560 million transaction is expected to close by the end of 2025. This move is aimed at expanding its international consumer credit operations.

TransUnion's international markets are projected to continue strong growth, with an expected range of 8%-10% in 2025. India is projected to grow between 15%-20%, though some deceleration is anticipated due to regulatory adjustments. These expansions are a key part of TransUnion's future prospects.

In 2024, TransUnion introduced several new solutions, including TruIQ Advanced Acquisition, TruAudience, TruValidate, and TruLookup. These products enhance capabilities in data analytics, marketing, fraud prevention, and identity verification. The company is also expanding its consumer offerings.

TransUnion is broadening its reach in the consumer market through direct and indirect channels. The company is focusing on helping consumers manage their financial future and protect their identity. A new freemium credit education and monitoring offering was announced in February 2025.

These strategic initiatives are designed to drive speed to market, scale, and differentiation, leveraging the company's technology infrastructure. This is part of the TransUnion growth strategy. For more information, you can explore the Owners & Shareholders of TransUnion.

TransUnion's expansion initiatives are focused on geographical expansion, product innovation, and strategic acquisitions. These strategies are designed to increase market share and diversify revenue streams. The company is investing in technology to drive innovation and improve its competitive position.

- Acquisition of Buró de Crédito in Mexico to boost international consumer credit operations.

- Launch of a new credit bureau in Brazil to expand its international footprint.

- Introduction of new products like TruIQ Advanced Acquisition and TruAudience to enhance data analytics and fraud prevention.

- Focus on consumer market expansion through direct and indirect channels.

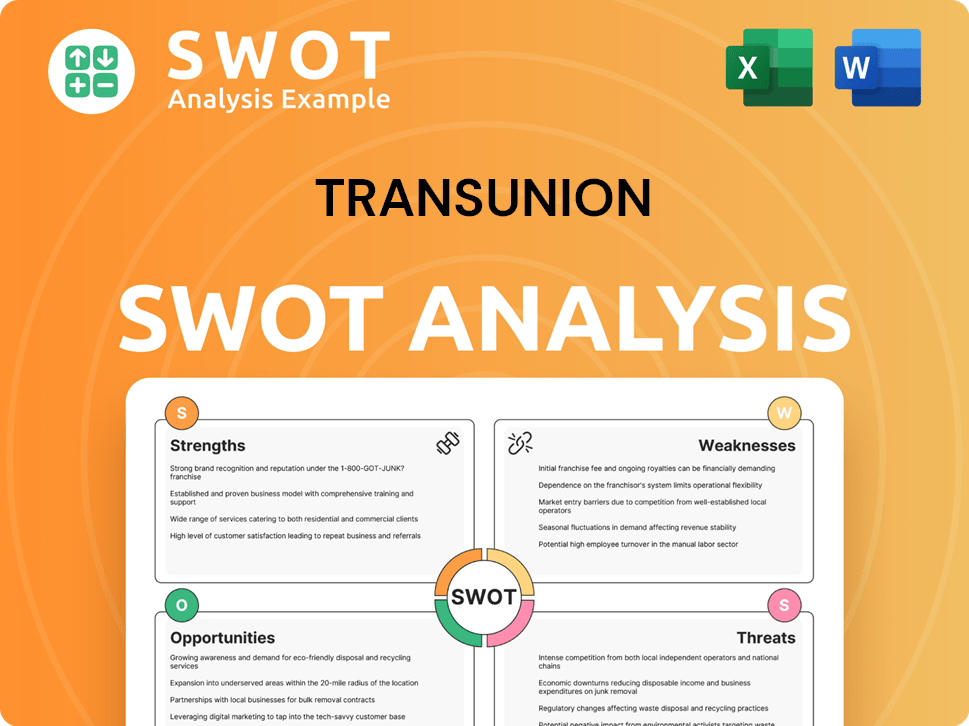

TransUnion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TransUnion Invest in Innovation?

The company's growth strategy is heavily reliant on continuous innovation and technological advancements to maintain its competitive edge within the credit reporting industry. This focus allows the company to adapt to the evolving needs of the financial services market and capitalize on data analytics trends. The company's future prospects are closely tied to its ability to successfully implement its technology initiatives and leverage emerging technologies.

The company's approach to innovation is centered around enhancing its existing solutions and expanding into new markets. This strategy involves significant investments in research and development and a commitment to digital transformation. The company's ability to effectively manage consumer data privacy is also crucial for maintaining trust and ensuring sustainable growth.

A key aspect of the company's strategy involves a global cloud-based approach to streamline product development and increase operational efficiency. This proactive stance is designed to avoid the need for another major technology overhaul in the foreseeable future. The company's strategic initiatives in 2024 and beyond are geared towards strengthening its market position and driving long-term growth.

The company is in the final phase of a major technology investment, with approximately $90 million allocated for 2024 and 2025. This investment is designed to transform the company's global technology infrastructure and customer applications.

OneTru™, the core solutions enablement platform, was launched in 2024. It centralizes common product services such as data management, identity resolution, analytics, and delivery. This platform is a hub for innovation.

Key milestones in 2024 included re-platforming the FactorTrust short-term lending credit bureau and migrating internal global data and analytics environments. Foundational work was completed to support U.S. and India migrations in 2025.

The company is actively exploring the use of Artificial Intelligence (AI) across its offerings. This is guided by its Data Risk Committee. The company is also expanding its data and analytics capabilities.

New product launches in 2024, such as TruIQ Data Enrichment and TruValidate fraud mitigation, are contributing to a strong pipeline and business wins. These launches support the company's growth strategy.

The company focuses on machine learning and AI to enhance its solutions. This expansion aims to further penetrate existing industry verticals and extend into new markets. This is a key part of their long-term growth outlook.

The company's digital transformation strategy is central to its long-term success. The company's investments in technology and innovation are designed to drive sustainable growth and maintain a competitive advantage. For more insights into the company's target market, consider reading this article: Target Market of TransUnion.

- The company is investing approximately $90 million in technology during 2024 and 2025.

- OneTru™ is the core solutions enablement platform launched in 2024.

- The company is leveraging AI and machine learning to enhance its solutions.

- New product launches in 2024 are contributing to a strong business pipeline.

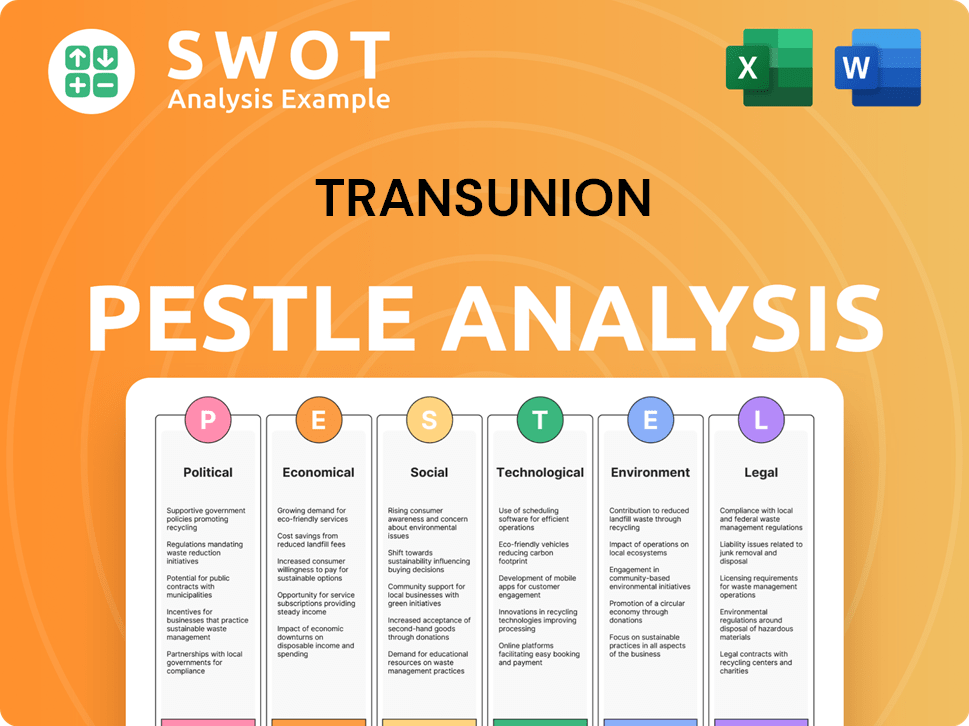

TransUnion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TransUnion’s Growth Forecast?

The financial performance of TransUnion in 2024 reflects a robust period of growth, driven by strategic initiatives and expansion across key markets. The company's ability to navigate economic fluctuations and leverage data analytics trends has positioned it favorably within the credit reporting industry and the broader financial services market. A detailed TransUnion company analysis reveals a focus on innovation and adapting to evolving consumer needs.

TransUnion's revenue for 2024 reached $4,183.8 million, a 9.2% increase compared to 2023. This growth was fueled by strong performances in both U.S. Markets and International segments. The company's strategic investments in data and technology, coupled with its focus on risk management solutions, have contributed to its success. For a deeper understanding of the company's core principles, you can explore the Mission, Vision & Core Values of TransUnion.

Looking ahead, TransUnion's future prospects appear promising, with continued growth expected in 2025. The company's focus on international expansion plans and its commitment to digital transformation strategy are key factors driving its long-term growth outlook.

Total revenue for 2024 was $4,183.8 million, a 9.2% increase year-over-year. This growth highlights the effectiveness of TransUnion's strategic initiatives in the financial services market.

Operating income significantly rose to $666.7 million in 2024 from $128.5 million in 2023. Net income for 2024 was $302.3 million, a substantial improvement from a net loss of $190.8 million in 2023.

For the fourth quarter of 2024, total revenue was $1,037 million, a 9% increase compared to the same period in 2023. This demonstrates consistent growth and market resilience.

TransUnion anticipates revenue growth of 3.5%-5% in 2025, or 4.5%-6% on an organic constant currency basis. This projection reflects a cautious yet optimistic outlook.

The U.S. markets are expected to see mid-single-digit percentage growth in 2025. Mortgage revenue is projected to grow by 20% driven by pricing, indicating a strong focus on this sector.

International markets are anticipated to continue solid growth, with India's growth moderating in the first half of 2025 before reaccelerating. The full-year growth in India is expected to be around 10%.

Adjusted EBITDA is expected to grow 3%-6% in 2025. Adjusted diluted EPS is projected to increase by 1%-4%, reflecting the company's profitability goals.

As of December 31, 2024, TransUnion had $679.5 million in cash and cash equivalents. A new share repurchase authorization of up to $500 million has been announced, demonstrating confidence in the company's financial health.

TransUnion executed several debt refinancing transactions in 2024 and prepaid $150 million of its Senior Secured Term Loan B-5. The company is also lowering its target leverage ratio to under 2.5x.

Capital expenditures are expected to be 8% of revenue in 2025, returning to 6% in 2026 and beyond. This reflects a strategic approach to investment and long-term growth.

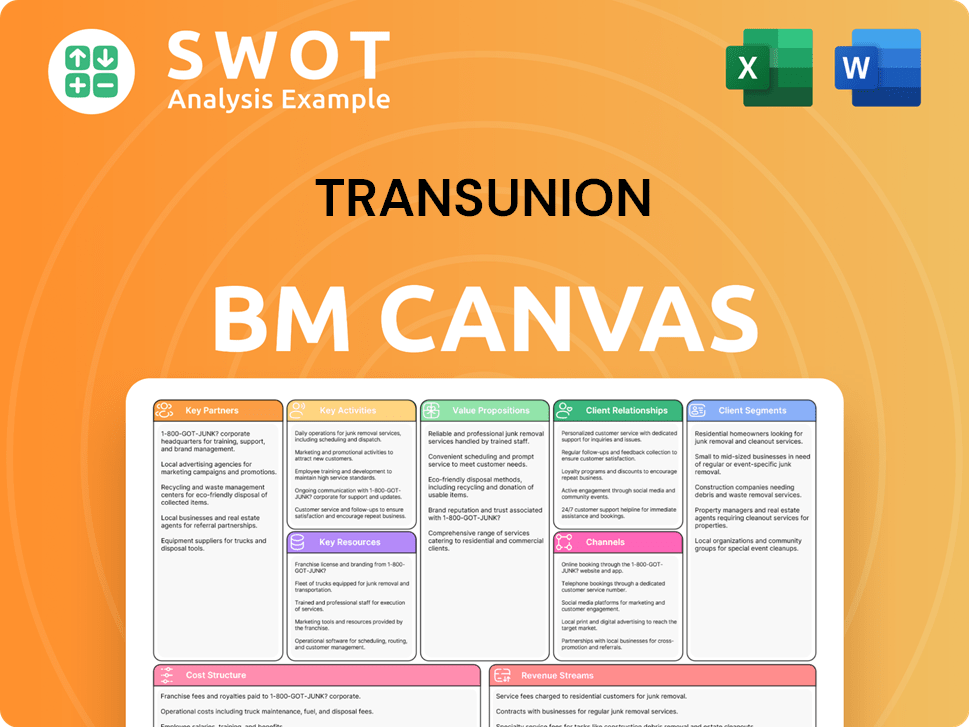

TransUnion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TransUnion’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the TransUnion growth strategy and TransUnion future prospects. The company faces several challenges that could impact its ability to achieve its strategic goals, including market concentration and regulatory changes. A thorough TransUnion company analysis must consider these factors to assess the long-term viability of the business.

Market dynamics, competition, and technological advancements are key areas of concern. The credit reporting industry is subject to economic fluctuations and regulatory scrutiny. Furthermore, the increasing demand for real-time data and analytics poses a constant need for technological adaptation and infrastructure upgrades.

The company's significant exposure to the U.S. financial services and consumer credit industries makes it vulnerable to economic downturns. Intense competition within the risk and information services industry could also threaten its market share and pricing power. The financial services market is constantly evolving, requiring adaptability.

TransUnion's reliance on the U.S. financial services and consumer credit sectors means economic downturns in these areas could negatively impact its demand for services. This concentration increases the risk associated with cyclical economic trends. The credit reporting industry is sensitive to these shifts.

Regulatory scrutiny, such as the CFPB's allegations against TransUnion's Tenant and Employment screening business in March 2022, poses a significant obstacle. Tightening regulations on lending in India are expected to slow market growth in 2025. Compliance costs and potential penalties could affect financial performance.

Handling sensitive consumer data presents substantial risks. Failure to properly secure infrastructure and applications could lead to reputational damage, legal fines, and operational disruptions. In 2024, there were 970 data breaches exposing 640 million consumer records, increasing the risk of tax fraud.

The continuous demand for real-time data and fully integrated solutions requires constant adaptation. While TransUnion is investing heavily in its technology infrastructure, it must keep pace with evolving data analytics trends. Innovation is crucial to maintaining a competitive edge.

TransUnion's multi-year transformation strategy, which includes optimizing its operating model and advancing technology, will affect approximately 10% of its current workforce through relocation and position eliminations. This restructuring could create short-term operational challenges.

Intense competition within the risk and information services industry poses a constant threat to TransUnion's market share and pricing power. The competitive landscape is dynamic, with new entrants and evolving business models. Maintaining a competitive advantage requires continuous innovation and strategic agility.

TransUnion addresses these risks by diversifying its portfolio across markets, verticals, and products to reduce exposure to cyclical trends. The company's transformation plan aims to optimize operations and enhance technology infrastructure, with expected annual savings of $120 to $140 million upon completion. Management also actively monitors market trends, such as the expected moderation in credit card balance growth and stabilization of delinquencies in 2025.

Adaptation is key to navigating these challenges. This includes continuous monitoring of market trends and adjusting lending strategies. For example, the company is actively working with government agencies and financial institutions to combat tax fraud. For more insights, you can read about the TransUnion strategic initiatives 2024.

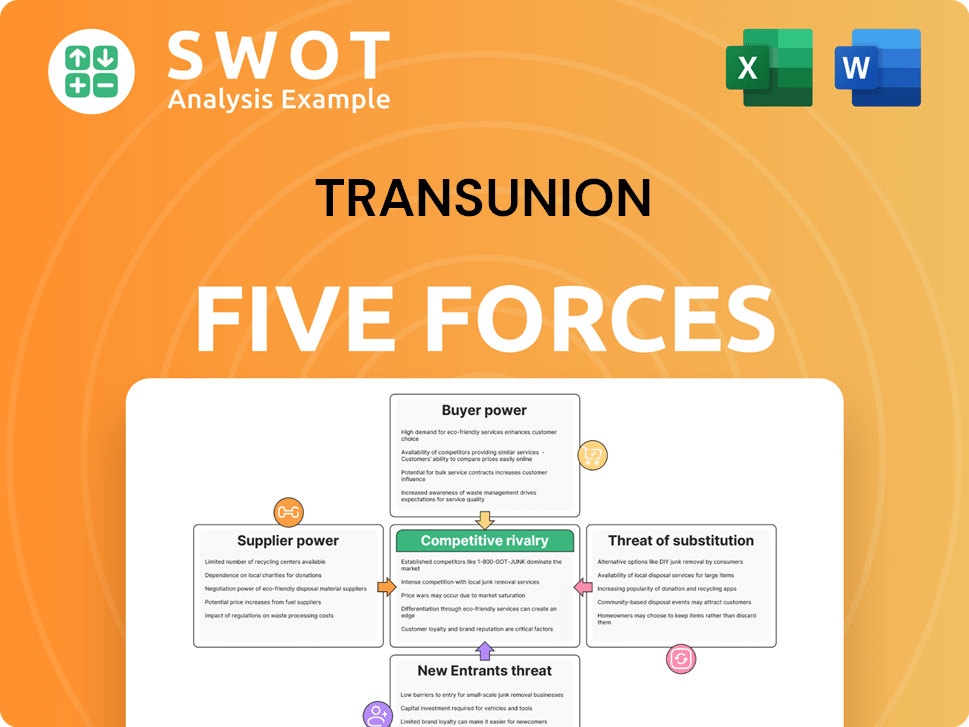

TransUnion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TransUnion Company?

- What is Competitive Landscape of TransUnion Company?

- How Does TransUnion Company Work?

- What is Sales and Marketing Strategy of TransUnion Company?

- What is Brief History of TransUnion Company?

- Who Owns TransUnion Company?

- What is Customer Demographics and Target Market of TransUnion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.