UFP Technologies Bundle

How did UFP Technologies evolve into a medical device powerhouse?

Founded in 1963 as United Packaging Corporation, UFP Technologies has charted an impressive course. Initially focused on protective packaging, primarily for electronics, the company has strategically transformed over the decades. Today, it stands as a crucial outsource partner to leading medical device manufacturers worldwide.

This UFP Technologies SWOT Analysis will explore the company's journey, highlighting its pivotal moments and strategic shifts. From its Woburn, MA, beginnings to its current market dominance, understanding the UFP Technologies history provides valuable insights. Learn about the company profile, its evolution in manufacturing, and its significant impact on the medical industry, including its innovative foam products.

What is the UFP Technologies Founding Story?

The story of UFP Technologies, a company deeply rooted in manufacturing, began in 1963. It started as United Packaging Corporation. The founders, William H. Shaw, Robert W. Drew, and Richard L. Bailly, set up shop in Woburn, Massachusetts. Their initial focus was on protective packaging, mainly for the electronics industry.

The company quickly evolved. In 1964, it moved its headquarters to Georgetown, Massachusetts, expanding its footprint. This early growth set the stage for future developments. The company's evolution reflects the dynamic nature of the manufacturing sector and its ability to adapt to market demands.

The history of UFP Technologies is marked by strategic shifts and acquisitions. The company's journey is a testament to its resilience and adaptability. A look at the Growth Strategy of UFP Technologies reveals the company's ongoing efforts to stay ahead in a competitive market.

UFP Technologies' trajectory is a story of growth and strategic adaptation. Here's a look at some key moments:

- 1963: Founded as United Packaging Corporation in Woburn, Massachusetts.

- 1964: Relocated headquarters to Georgetown, Massachusetts.

- 1967: Renamed to United Foam Plastics Corporation.

- 1993: Acquired Moulded Fibre Technology; went public on NASDAQ (UFPT) and changed its name to UFP Technologies, Inc.

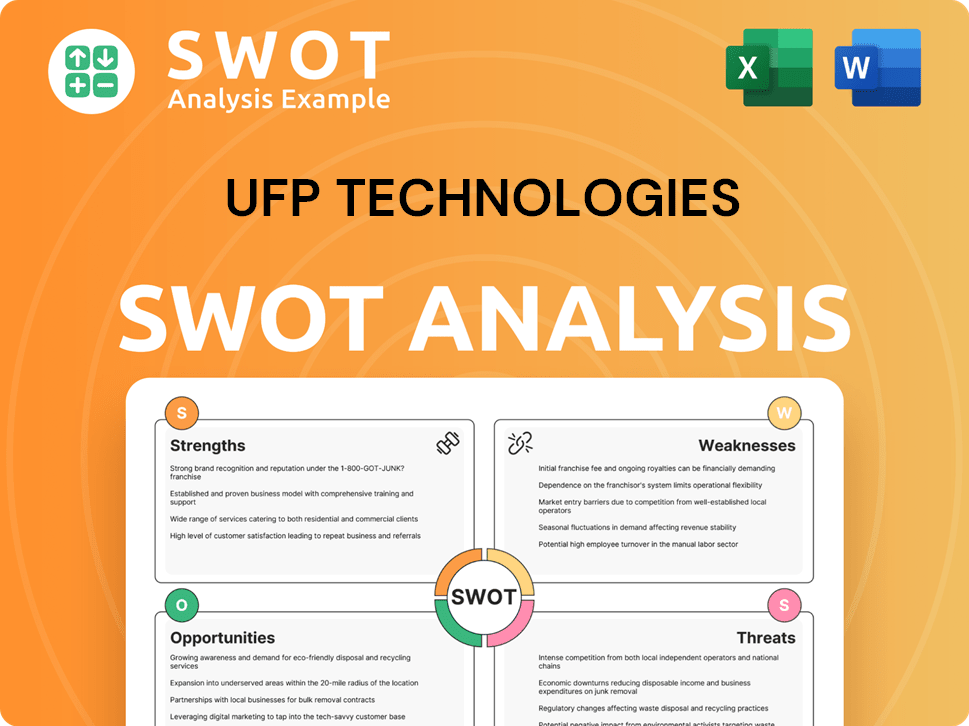

UFP Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of UFP Technologies?

The early growth of UFP Technologies, originally known as United Foam Plastics Corporation, marked a significant shift from protective packaging to specialized foam components. This expansion included strategic moves into the medical sector and diversification through acquisitions. The company's focus on innovation and strategic acquisitions has been key to its evolution and market position. This UFP Technologies history showcases its adaptability and growth.

In 1976, UFP Technologies began precision molding cross-linked polyethylene foam components, serving military, consumer, and industrial markets. The company introduced compression-molded medical protective packaging in 1988, signaling its early strategic alignment with the medical sector. The acquisition of Moulded Fibre Technology in 1993 added custom molded fiber packaging to their portfolio, diversifying their material expertise.

Following its IPO in 1993, UFP Technologies, Inc. invested in cleanroom production in 1994 to serve its expanding medical customer base. By 2008, medical sales accounted for 50% of the company's $100 million revenue. This strategic focus on the medical market intensified, driving further investments and acquisitions.

Between 2008 and 2013, UFP Technologies acquired five businesses to bolster its foam offerings for medical clients, becoming the largest customer of lightweight crosslinked foam in North America. These proactive acquisitions helped mitigate supply chain issues during later global crises. In 2016, the company relocated its headquarters to Newburyport, Massachusetts.

In 2024, UFP Technologies completed four acquisitions: Welch Fluorocarbon, AJR Enterprises, Marble Medical, and AQF Medical. These acquisitions strengthened their platform, particularly in the safe patient handling space. The company reported record 2024 net sales of $504.4 million, a 26.1% increase from $400.1 million in 2023, with medical sales increasing by 30.2% to $450.8 million. In the first quarter of 2025, net sales reached $148.1 million, a 41.1% increase year-over-year, with medical market sales growing by 50.4% to $135.4 million. The Advanced Components business saw a 15% decline due to resource reallocation towards MedTech opportunities.

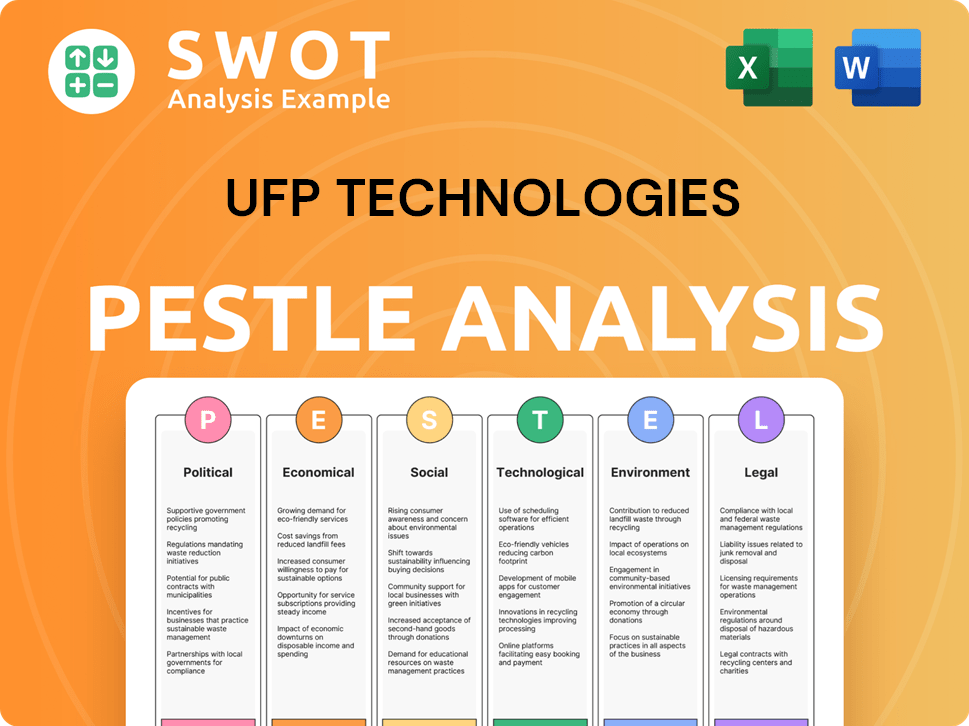

UFP Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in UFP Technologies history?

The UFP Technologies has a rich history marked by strategic shifts and significant achievements. The company's evolution reflects its adaptability and commitment to innovation, particularly in the medical sector. This UFP Company profile highlights key milestones that have shaped its trajectory.

| Year | Milestone |

|---|---|

| 1988 | Introduction of compression-molded medical protective packaging. |

| 1994 | Investment in cleanroom production to serve the growing medical customer base. |

| 2008 | The medical market accounted for 50% of UFP's revenue. |

| 2011 | Unification of brand strategy to provide a common identity across all markets. |

| 2022 | Sale of the Molded Fiber Business to CKF, Inc. |

| 2024 | Named one of the 'Best and Brightest Companies to Work For® in the Nation'. |

| 2025 | The COO of the MedTech division resigned in March. |

UFP Technologies has consistently demonstrated its commitment to innovation, developing products to meet evolving market needs. The company has secured patents for various innovations, including a trim component for vehicle interiors, showcasing its diverse engineering capabilities.

This innovation in 1988 was a pivotal moment, marking its entry into the medical market. This packaging provided crucial protection for medical devices.

Starting in 1994, cleanroom production was a key step in serving the medical customer base. This ensured products met stringent industry standards.

Patents for this component highlight its engineering capabilities beyond medical applications. This shows its versatility in different industries.

Developed through partnerships, this product demonstrates its focus on medical solutions. This innovation improves patient safety and care.

Bioshell, a single-use bioprocess bag protection, is another product from its collaborations. This product is designed for biopharmaceutical applications.

Collaborations with 25 of the top 30 medical device businesses showcase its ability to create custom solutions. These collaborations have led to innovative products.

Despite its successes, UFP Technologies has faced challenges, including economic downturns and competitive pressures. The company's reliance on a few key customers, and the strategic reallocation of resources, present potential risks and opportunities.

Like many manufacturing companies, UFP Technologies is vulnerable to economic fluctuations. These downturns can impact sales and profitability.

The company operates in a competitive market, requiring continuous innovation. Competition can affect market share and pricing.

Reliance on a few key customers poses a risk if their financial condition changes. In 2021 and 2022, one customer represented approximately 10% of gross accounts receivable.

The Advanced Components business experienced a 15% decline in Q1 2025. This led to a strategic reallocation of resources.

The resignation of the COO of the MedTech division in March 2025 required careful management. The company maintained strong fundamentals during this transition.

The company must navigate market fluctuations while maintaining a strong financial position. This requires strategic agility and financial discipline.

To overcome these challenges, UFP Technologies has employed several strategies. These include strategic pivots, such as focusing on high-growth opportunities in the MedTech sector, and streamlining operations. The company's current P/E ratio is 27.84, and analysts forecast EPS of $9.27 for fiscal year 2025. For more details on UFP Technologies' competitive landscape, consider reading this article about UFP Technologies' competitors.

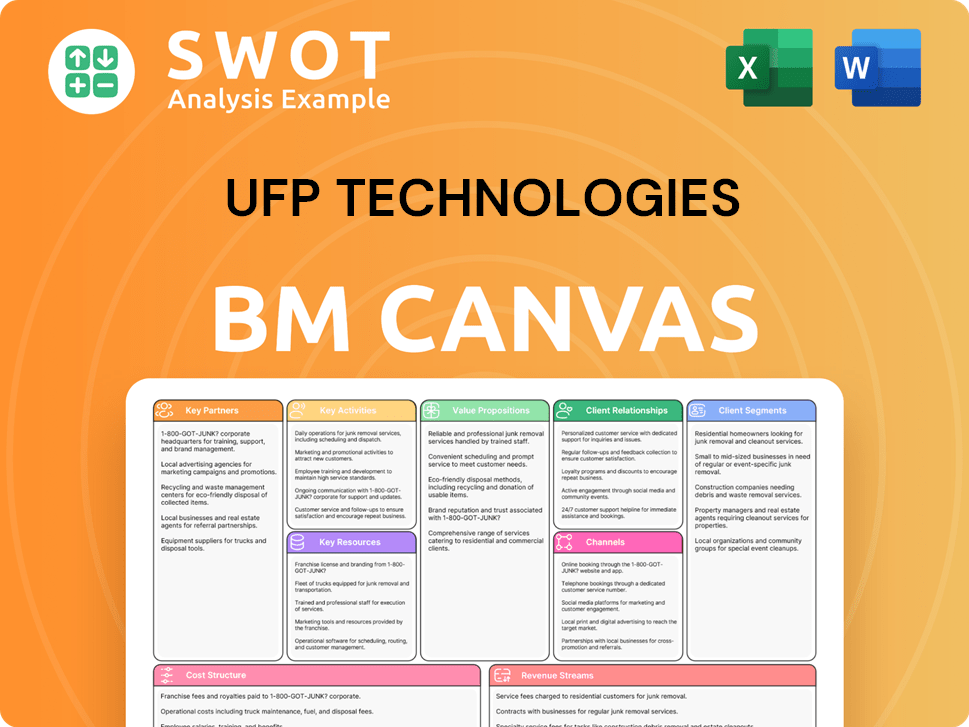

UFP Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for UFP Technologies?

The UFP Technologies company profile reveals a rich history, starting with its founding in 1963 as United Packaging Corporation in Woburn, MA. Over the years, the company has evolved, expanding operations and strategically adapting to market demands. Key milestones include name changes, facility relocations, and significant acquisitions, all contributing to its growth in the foam products and manufacturing sectors. The company's journey reflects a consistent focus on innovation and strategic expansion.

| Year | Key Event |

|---|---|

| 1963 | United Packaging Corporation founded in Woburn, MA. |

| 1964 | Expanded operations and relocated headquarters to Georgetown, MA. |

| 1967 | Name changed to United Foam Plastics Corporation. |

| 1976 | Began precision molding cross-linked polyethylene foam. |

| 1988 | Introduced compression molded medical protective packaging. |

| 1993 | Acquired Moulded Fibre Technology; completed IPO and changed name to UFP Technologies, Inc. |

| 1994 | Invested in cleanroom production for the medical customer base. |

| 2008-2013 | Acquired five businesses to strengthen foam offerings for medical clients. |

| 2011 | Unveiled new unified brand and tagline: Shaping Innovation™. |

| 2016 | Relocated headquarters to Newburyport, MA. |

| 2022 | Sold Molded Fiber Business to CKF, Inc.; sales exceeded $300 million; opened new medical manufacturing operation in Tijuana, Mexico. |

| 2023 | Added to the S&P SmallCap 600 index. |

| 2024 | Completed four acquisitions (Welch Fluorocarbon, AJR Enterprises, Marble Medical, AQF Medical); reported record net sales of $504.4 million. |

| February 25, 2025 | Announced record 2024 financial results. |

| May 6, 2025 | Announced record Q1 2025 results, with net sales of $148.1 million. |

| August 5, 2025 | Estimated date for Q2 2025 earnings report. |

UFP Technologies plans to expand its operations in the Dominican Republic, reflecting strategic growth and investment. This expansion supports increased demand and new business wins. The company is focused on strengthening its manufacturing capabilities to meet growing market needs.

The company aims to launch two major programs in the second half of 2025. UFP Technologies is also pursuing acquisitions to bolster its platform and increase customer value. These initiatives are supported by its strong financial position, enabling debt reduction.

Long-term goals include achieving 7-10% annual unit sales growth, including acquisitions, and at least 10% of sales from new products. The company targets 12.5% EBITDA margins. Analysts project earnings and revenue to grow by 12.7% and 7.4% per annum, respectively.

UFP Technologies continues to focus on the high-growth, high-margin MedTech segment. This strategic focus is expected to drive future success. The company's strategy aligns with its founding vision of providing innovative, custom-engineered solutions.

UFP Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of UFP Technologies Company?

- What is Growth Strategy and Future Prospects of UFP Technologies Company?

- How Does UFP Technologies Company Work?

- What is Sales and Marketing Strategy of UFP Technologies Company?

- What is Brief History of UFP Technologies Company?

- Who Owns UFP Technologies Company?

- What is Customer Demographics and Target Market of UFP Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.