UFP Technologies Bundle

Who Really Calls the Shots at UFP Technologies?

Unraveling the UFP Technologies SWOT Analysis can be a gateway to understanding its competitive edge. Knowing the UFP Technologies ownership structure is key for making informed investment decisions. From its humble beginnings to its current market position, the evolution of UFP Technologies is a fascinating study in corporate governance and strategic direction.

Understanding the UFP Technologies parent company and its investors offers a deeper insight into its strategic decisions. The company's history, including its founders and key shareholders, has significantly shaped its trajectory. Investigating the UFP Technologies stock performance and who are the major shareholders of UFP Technologies provides a comprehensive view of its financial health. This exploration will also touch upon aspects like the company structure and the impact of public shareholding on its overall strategy, helping you understand how to invest in UFP Technologies stock.

Who Founded UFP Technologies?

The specifics of the initial equity distribution among the founders of what is now known as UFP Technologies are not publicly available in detail. The company, originally named United Packaging Corporation, was established in 1993. The transition from its founding to becoming a publicly traded entity involved a shift from private ownership, likely including the founders and early investors, to a broader base of shareholders through an initial public offering (IPO).

Early agreements, such as vesting schedules and buy-sell clauses, would have significantly influenced the initial ownership structure and control dynamics. These arrangements are typical in the early stages of a company's lifecycle. Any initial ownership disputes or buyouts would have also played a role in defining the early distribution of control, reflecting the founding team's vision and the evolving business strategy.

Understanding the early ownership of UFP Technologies provides context for its evolution. The company's journey from its inception to its current status as a publicly traded entity highlights the changes in ownership structure. This includes the impact of early agreements and potential disputes on the distribution of control and the company's overall strategic direction.

The initial ownership structure of UFP Technologies involved founders and early investors. Details of the exact equity split are not available in public records. Early agreements and potential disputes shaped the control and direction of the company.

UFP Technologies transitioned from private ownership to a publicly traded company. This transition involved an IPO, which broadened the shareholder base. The company's history reflects changes in its ownership structure over time.

Founded in 1993 as United Packaging Corporation, the company's early structure was privately held. The founding team's vision and the initial agreements were critical. The evolution of the company's ownership structure is a key aspect of its history.

Vesting schedules and buy-sell clauses influenced the initial ownership landscape. These agreements are common in the early stages of a company. They played a crucial role in defining control and ownership.

UFP Technologies' current status as a publicly traded company reflects a significant change. This transition involved an initial public offering (IPO). The IPO broadened the shareholder base.

Any initial ownership disputes or buyouts shaped the early distribution of control. These events influenced the company's strategic direction. They reflect the founding team's vision and evolving business strategy.

The early ownership of UFP Technologies involved founders and early investors. The company's transition to a publicly traded entity is a key aspect of its history. Understanding the initial ownership structure provides context for its evolution and current status. For more information, you can read about the Growth Strategy of UFP Technologies.

- The company was founded in 1993 as United Packaging Corporation.

- The initial ownership structure involved founders and early backers.

- The transition to a public company broadened the shareholder base.

- Early agreements and potential disputes influenced control.

UFP Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has UFP Technologies’s Ownership Changed Over Time?

The ownership structure of UFP Technologies, a publicly traded company under the ticker symbol UFPT, is primarily composed of institutional investors, company insiders, and retail investors. As of June 5, 2025, institutional shareholders hold a significant portion, owning 107.67% of the company. Company insiders hold 16.35%, while retail investors hold 0.00%.

The company's financial performance and strategic acquisitions have likely influenced its ownership structure. In 2024, UFP Technologies reported net sales of $504.4 million, marking a 26.1% increase from the previous year. The first quarter of 2025 showed continued growth, with net sales reaching $148.1 million, a 41% increase compared to Q1 2024. This growth, especially in its MedTech business, which saw a 50.4% increase in sales to $135.4 million in Q1 2025, has likely attracted investor interest.

| Shareholder Type | Ownership Percentage (as of June 5, 2025) | Notes |

|---|---|---|

| Institutional Investors | 107.67% | Includes major firms like BlackRock, Vanguard, and State Street Corp. |

| Company Insiders | 16.35% | William Shaw is the largest individual insider shareholder. |

| Retail Investors | 0.00% |

Major institutional shareholders of UFP Technologies include BlackRock, Inc., Wasatch Advisors Inc, and Vanguard Group Inc. William Shaw, an insider, is the largest individual shareholder, holding 288,924 shares, representing 3.75% of the company. The company's strong financial results, including a 31.3% increase in net income for 2024, have likely contributed to the interest from institutional investors. You can find more information on the company's performance and history in this article: 0.

UFP Technologies' ownership is dominated by institutional investors, reflecting confidence in its growth. Strong financial performance and strategic acquisitions have likely boosted investor interest.

- Institutional ownership exceeds 100% due to reporting methods.

- Insiders hold a significant portion of the shares.

- Consistent revenue growth, especially in MedTech, drives investor interest.

- The company is a publicly held company, trading on the NASDAQ Stock Market LLC.

UFP Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on UFP Technologies’s Board?

The current board of directors at UFP Technologies plays a vital role in the company's governance. R. Jeffrey Bailly serves as both Chairman of the Board and Chief Executive Officer. The board is primarily composed of independent directors, with Mr. Croteau serving as the Lead Independent Director since July 2021. This structure promotes independent oversight and decision-making.

As of May 1, 2025, the independent directors include Messrs. Croteau, Kozin, Hassett, and Oberdorf, and Mses. Feldmann and Hudson. Mitchell C. Rock is the President, a role he has held since February 2024. Christopher Litterio serves as General Counsel and Senior Vice President of Human Resources, joining the company in November 2017. The Board aims for a diverse skill set among its members to ensure comprehensive guidance. All directors attended the 2024 Annual Meeting. For those interested in learning more about the company's origins, you can explore the Brief History of UFP Technologies.

| Director | Title | Since |

|---|---|---|

| R. Jeffrey Bailly | Chairman of the Board, CEO | - |

| Mr. Croteau | Lead Independent Director | July 2021 |

| Mitchell C. Rock | President | February 2024 |

The voting structure for UFP Technologies common stock is typically one-share-one-vote. There is no public information suggesting any special voting rights that would grant outsized control to specific individuals or entities beyond their shareholding percentages. The company is committed to sound corporate governance practices to maintain investor trust. For UFP Technologies investors, understanding the board's composition and voting structure is key to assessing the company's governance and future prospects.

The board is led by a combination of the CEO and an independent Lead Director, ensuring balanced oversight.

- Independent directors make up the majority of the board.

- One-share-one-vote structure is standard, providing equal voting power to shareholders.

- Understanding the board's composition is essential for investors.

- The company prioritizes sound corporate governance.

UFP Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped UFP Technologies’s Ownership Landscape?

In the past few years, UFP Technologies has shown substantial growth, significantly influencing its ownership structure. The company's financial performance has been robust, with net sales in 2024 reaching $504.4 million, a rise of 26.1% from the previous year. This strong performance continued into the first quarter of 2025, with net sales of $148.1 million, marking a 41.1% increase compared to Q1 2024. This growth has been fueled by strategic acquisitions and expansions, particularly in the MedTech sector, which now accounts for over 90% of its revenue.

The company's ownership profile, while primarily institutional, has seen some insider selling activities. R. Jeffrey Bailly, Chairman and CEO, and Ronald J. Lataille, Chief Financial Officer, have engaged in stock sales. The company's strong financial position, with $13.8 million in cash from operations in Q1 2025 and a leverage ratio below 1.5 times, suggests potential for future strategic initiatives that could impact ownership. The announcement of Q2 2025 earnings is scheduled for July 30, 2025, which may provide further insights into the company's performance and potential shifts in ownership.

The company's strategic moves, including acquisitions like AJR Enterprises and expansions into new manufacturing facilities, reflect its commitment to growth. These actions, coupled with consistent financial success, are likely to continue shaping the

The company's stock performance is closely tied to its financial results and strategic decisions. Investors watch for insider trading activity as an indicator. The company's strong cash flow and manageable debt levels suggest financial stability.

Institutional investors hold a significant portion of the company's stock. Recent insider selling activities have been observed, but no insider purchases were reported. The ownership structure may be affected by future acquisitions or share buybacks.

Acquisitions and expansions are key components of the company's growth strategy. The MedTech sector is a primary focus, driving significant revenue growth. New facilities and expansions enhance its operational capabilities.

Strong financial results in 2024 and Q1 2025 demonstrate the company's financial health. The company's leverage ratio is below 1.5 times, indicating a solid financial position. The company's ability to generate cash supports future growth.

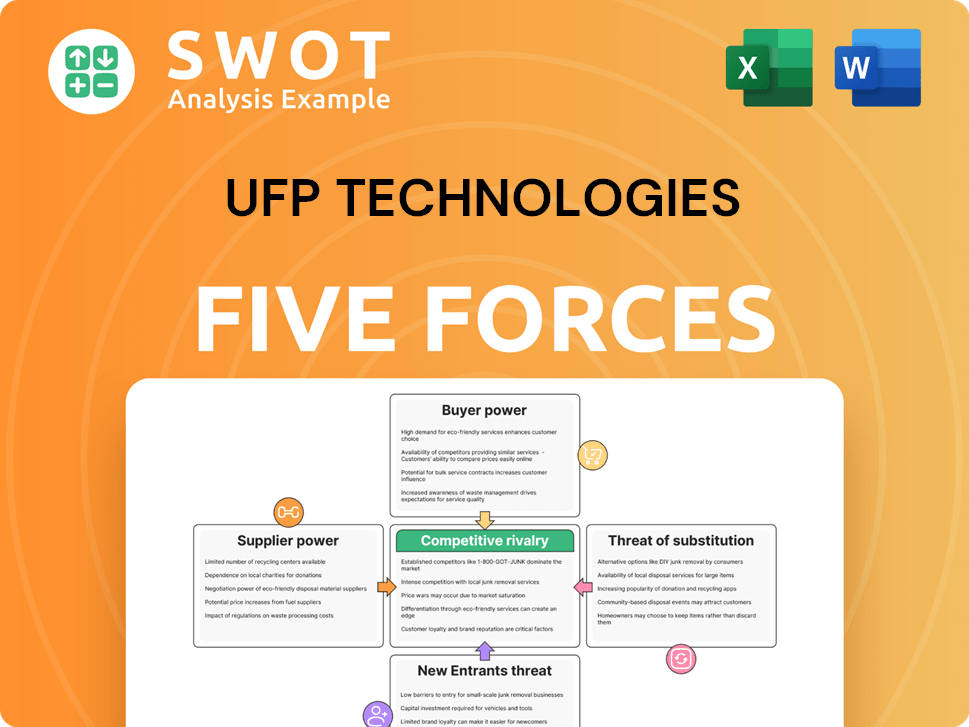

UFP Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UFP Technologies Company?

- What is Competitive Landscape of UFP Technologies Company?

- What is Growth Strategy and Future Prospects of UFP Technologies Company?

- How Does UFP Technologies Company Work?

- What is Sales and Marketing Strategy of UFP Technologies Company?

- What is Brief History of UFP Technologies Company?

- What is Customer Demographics and Target Market of UFP Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.