Unifi Bundle

What's the Story Behind Unifi's Success?

Unifi, Inc. has transformed the textile industry, but its roots are firmly planted in a traditional business model. From its inception in 1971, Unifi has navigated a complex landscape of market shifts and technological advancements. This journey has led to the development of innovative products, including the groundbreaking REPREVE® brand, that changed the company's strategic direction towards sustainability.

Unifi's story is a testament to its adaptability and forward-thinking approach, evolving from a polyester yarn texturizer to a leader in sustainable textiles. Today, Unifi continues to innovate, with a focus on circular solutions and sustainable options. To better understand its strategic position, consider a detailed Unifi SWOT Analysis to see how the company is positioned in the market, especially in regions like Unifi Malaysia.

What is the Unifi Founding Story?

The story of the Unifi company began in July 1971, in Greensboro, North Carolina. The company was the brainchild of George Allen Mebane IV, who, along with Bill Kretzer and several other executives, left Universal Textured Yarns to embark on their own venture. Their initial focus was on texturing polyester, a response to the changing needs of the textile market.

Unifi's first plant, located in Yadkin County, was dedicated to texturizing polyester yarn. This marked the beginning of their journey in the textile industry. The early years were crucial in establishing their foundation and setting the stage for future growth and expansion.

Unifi began with private investment and industry expertise, common for manufacturing startups of that time. The business model focused on producing and processing multi-filament polyester and nylon yarns, including specialty yarns. These were sold to other yarn manufacturers, knitters, and weavers. Unifi's early growth included a fabric dyeing and finishing plant in Rocky Mount, demonstrating early vertical integration.

- Unifi's initial focus was on texturizing polyester yarn.

- The company commenced operations through private investment.

- The business model was centered on producing multi-filament polyester and nylon yarns.

- Early expansion included a fabric dyeing and finishing plant.

The early 1970s provided a favorable environment for Unifi's establishment and growth. The textile market was rapidly evolving, creating opportunities for companies like Unifi to innovate and meet new demands. This period set the stage for Unifi's future success and its impact on the industry. For more details on the company's ownership and stakeholders, you can read about the Owners & Shareholders of Unifi.

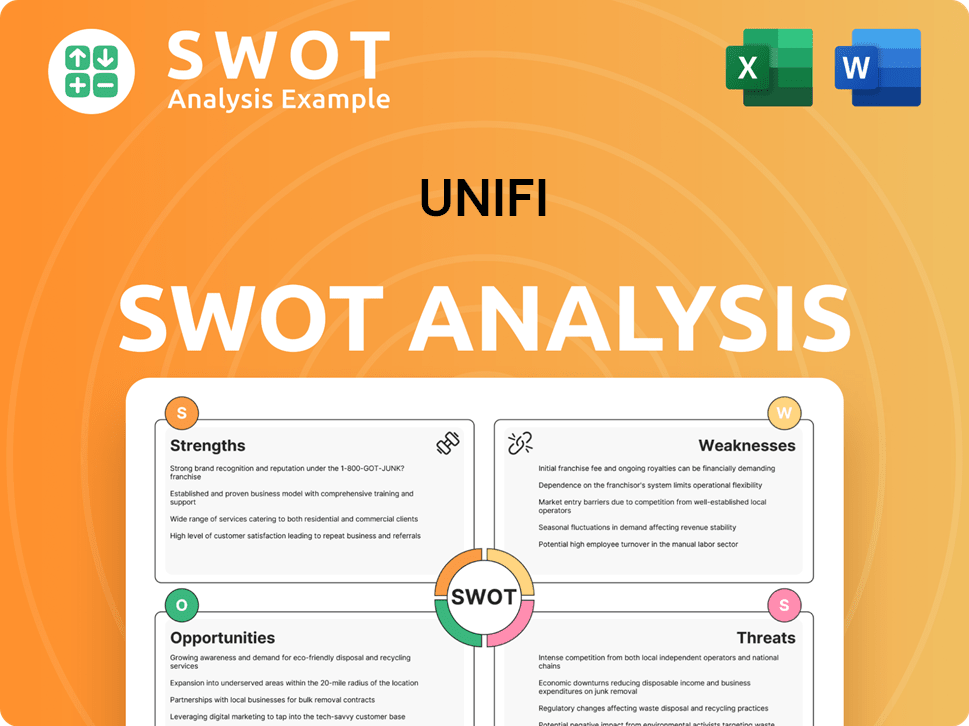

Unifi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Unifi?

The early years of the company saw rapid expansion following its establishment in 1971. The company quickly expanded its operations, opening additional facilities and establishing a fabric dyeing and finishing plant. By the late 1980s and early 1990s, it had become one of the largest textile companies in the United States. This period was marked by significant growth and strategic acquisitions.

A key milestone was the 1991 acquisition of Macfield Inc., significantly boosting production capacity and market share, particularly in nylon. Further diversification occurred in 1993 with the acquisition of cotton yarn producers. By 1996, the company operated 20 mills, showcasing substantial growth in a relatively short period.

The 1990s brought increased competition from Asian companies, leading to bankruptcies among many U.S. fabric-weaving customers. In response, the company implemented cost-cutting measures, including layoffs and plant closures. The American workforce shrank from 5,126 to 3,431 between 2000 and 2005, reflecting the industry's challenges.

The company rebounded and returned to profitability by 2010, largely by embracing the niche market for polyester yarns made from recycled plastics. This strategic shift laid the groundwork for its flagship REPREVE® brand. This move towards sustainability helped the company navigate challenging market conditions.

As of fiscal year 2024, the company reported net sales of approximately $688.8 million. In Q3 fiscal 2025, net sales were $146.6 million, a decrease of 1.6% from Q3 fiscal 2024. REPREVE Fiber products accounted for $44.7 million, or 31% of net sales, in Q3 fiscal 2025. The Mission, Vision & Core Values of Unifi highlight the company's commitment to innovation and sustainability.

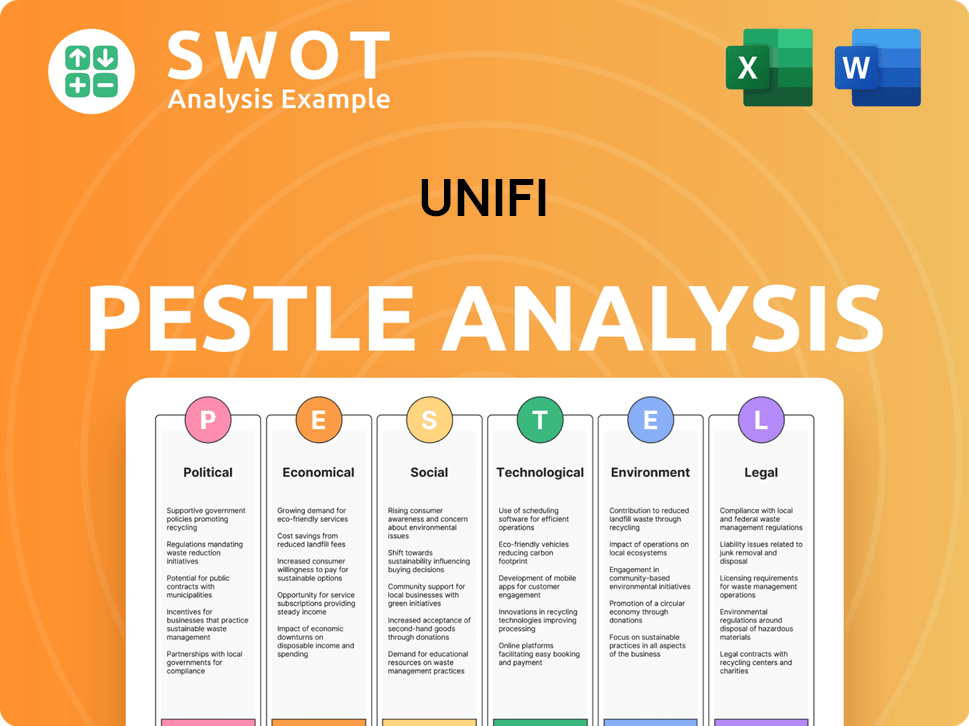

Unifi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Unifi history?

The history of the Unifi company is marked by significant developments and strategic shifts that have shaped its trajectory in the telecommunications sector. From its inception, Unifi has aimed to provide advanced internet services, contributing significantly to Malaysia's digital landscape. The company's journey reflects its commitment to technological innovation and its response to market dynamics.

| Year | Milestone |

|---|---|

| 2007 | Launch of REPREVE®, a flagship brand of recycled performance fibers. |

| 2024 | REPREVE® accounted for 32% of Unifi's revenue. |

| February 2025 | Announcement of the consolidation of U.S. manufacturing footprint, including the sale of the Madison, North Carolina facility. |

| April 2025 | Launch of REPREVE® with CiCLO® technology, a biodegradable recycled polyester and nylon offering. |

Unifi has consistently focused on innovation, particularly in sustainable practices. The introduction of REPREVE® in 2007, which transforms plastic bottles into recycled fibers, was a groundbreaking move. This initiative has positioned Unifi as a leader in environmentally responsible practices, with a target of recycling 50 billion bottles by December 2025.

REPREVE® transforms plastic bottles and other waste into sustainable solutions for various applications. The company has recycled over 40 billion plastic bottles as of April 2025, demonstrating its commitment to sustainability.

The launch of REPREVE® with CiCLO® technology in April 2025 offers biodegradable recycled polyester and nylon. This innovation addresses microplastic fiber pollution, further enhancing Unifi's sustainability efforts.

Unifi collaborates with various brands and manufacturers to integrate REPREVE® fibers into their products. These partnerships expand the reach of sustainable materials across different industries.

Despite its innovations, Unifi has faced challenges, including market downturns and competitive pressures. The American textile industry experienced intense competition from cheaper Asian products in the 1990s, impacting Unifi's customers. In fiscal year 2024, Unifi reported a net loss of $35.9 million, reflecting the cyclical nature of the textile industry and softer demand.

The textile industry faces cyclical fluctuations, with periods of decreased demand impacting sales. In fiscal year 2024, net sales decreased to $600.0 million due to softer demand and customer inventory destocking.

Unifi faces competition from other players in the textile market, requiring continuous innovation and efficiency improvements. Understanding the competitive landscape of Unifi is essential for strategic planning.

The company must manage operational costs and adapt to changing market conditions to maintain profitability. The consolidation of the U.S. manufacturing footprint is a response to these challenges.

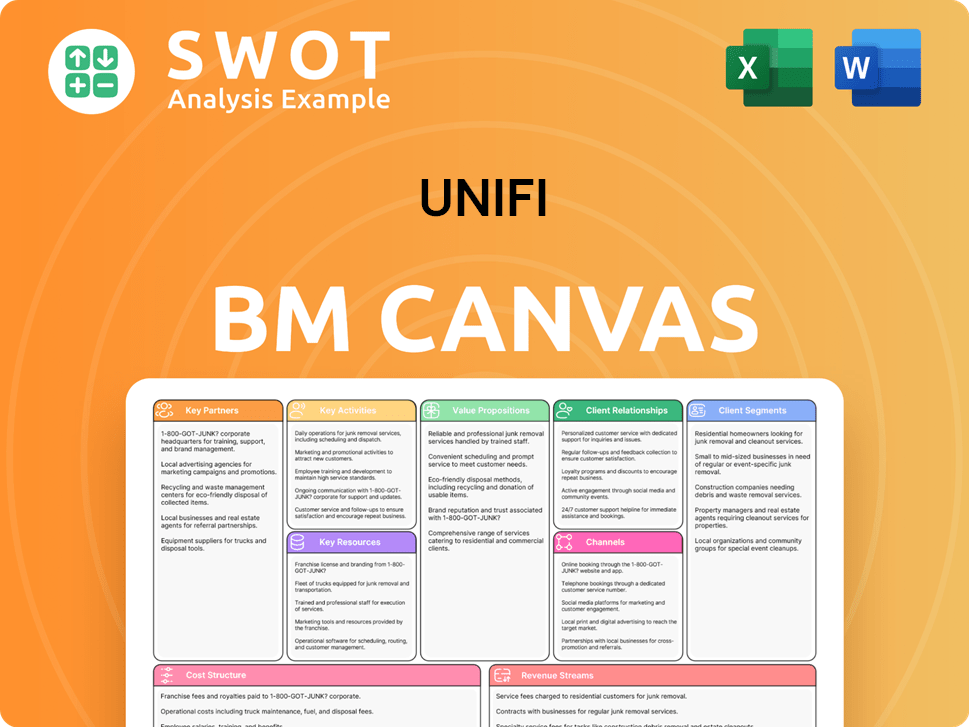

Unifi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Unifi?

The Unifi company has a rich history, marked by strategic shifts and innovations. Founded in 1971 by George Allen Mebane IV, it began as a polyester texturing business in Greensboro, North Carolina. Over the years, Unifi expanded its production capabilities, diversified its product offerings, and made significant strides in sustainable materials, culminating in its current focus on circular and sustainable solutions. A detailed look at the evolution of the Unifi history reveals its adaptability and commitment to innovation.

| Year | Key Event |

|---|---|

| 1971 | Established in Greensboro, North Carolina, by George Allen Mebane IV, focusing on polyester texturing. |

| 1991 | Acquired Macfield Inc., significantly expanding production capacity and market share. |

| 1993 | Began acquiring cotton yarn producers, diversifying its product portfolio. |

| 2007 | Launched REPREVE®, its flagship brand of recycled performance fibers, marking a major strategic shift towards sustainability. |

| 2010 | Returned to profitability, largely aided by its focus on recycled polyester yarns. |

| Fiscal Year 2024 | Reported net sales of approximately $600.0 million and a net loss of $35.9 million, reflecting market headwinds. |

| August 2024 | Launched ThermaLoop, a down-like insulation material made from 100% recycled polyester. |

| October 2024 | Reported Q1 fiscal 2025 net sales of $147.4 million, an increase of 6% from Q1 fiscal 2024. REPREVE® Fiber products contributed $44.7 million to net sales. |

| February 2025 | Announced the consolidation of its U.S. manufacturing footprint, including the transition of yarn production from its Madison, North Carolina facility and its sale. |

| April 2025 | Launched REPREVE® with CiCLO® technology, offering biodegradable recycled polyester and nylon. |

| May 2025 | Announced the sale of its Madison, North Carolina manufacturing facility for $53.2 million, with proceeds to be used to repay debt. |

The company is optimistic about future growth, driven by increasing demand for sustainable materials. Initiatives like 'Beyond Apparel,' which includes sales in the carpet and military markets, are key. This expansion strategy is supported by the growing market for eco-friendly products. The company's focus on sustainability positions it well for long-term success.

Unifi anticipates a return to EBITDA profitability by late 2025 and expects positive free cash flow generation. Capital expenditures are projected to be between $14-16 million for fiscal year 2025. These investments include costs related to the U.S. manufacturing transition, reflecting a commitment to operational efficiency.

The company plans to continue optimizing its operations and making strategic investments in innovation. This includes technological advancements and resilience, ensuring long-term shareholder value. These investments are crucial for maintaining a competitive edge in the market. This approach supports the company's vision for a circular and sustainable future.

Unifi's vision centers on circular and sustainable solutions becoming the only choice. This commitment is tied to technological investment and resilience. The launch of REPREVE® with CiCLO® technology in April 2025, demonstrates its commitment to biodegradable materials. This focus on sustainability is a core part of its strategy.

Unifi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Unifi Company?

- What is Growth Strategy and Future Prospects of Unifi Company?

- How Does Unifi Company Work?

- What is Sales and Marketing Strategy of Unifi Company?

- What is Brief History of Unifi Company?

- Who Owns Unifi Company?

- What is Customer Demographics and Target Market of Unifi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.