Unifi Bundle

Who Really Owns Unifi?

Understanding the Unifi SWOT Analysis is essential for investors and stakeholders. Unifi, a prominent

This article will explore the

Who Founded Unifi?

The origins of the company, now known as Unifi, trace back to July 1971. It was founded by George Allen Mebane IV, Bill Kretzer, and several other executives. They left Universal Textured Yarns to establish their own textile venture. This move marked the beginning of a new company focused on polyester texturing.

George Allen Mebane IV spearheaded the initial efforts. The company began operations in Greensboro, North Carolina, with its first plant in Yadkin County. This early focus on manufacturing was a key element of their strategy.

The company's initial funding came from private investment and industry expertise. This was a common approach for manufacturing startups at the time. Mebane and his co-founders invested their personal funds and secured a $6 million bank loan. This was after selling their shares in Universal Textured Yarns for $1 million in 1971.

George Allen Mebane IV, Bill Kretzer, and other executives were the founders of the company.

The company's initial focus was on polyester texturing.

Operations began in Greensboro, North Carolina, with the first plant in Yadkin County.

The company was launched using private investment and a $6 million bank loan.

The founders sold their shares in Universal Textured Yarns for $1 million in 1971 before starting the new company.

The company expanded rapidly, including the acquisition of nylon production through the merger with Macfield Inc. in 1991.

The early strategy emphasized investing in cutting-edge manufacturing equipment. This was done to gain a long-term cost and quality advantage. The company's aggressive expansion and technological investment were a reflection of the founding team's vision. By 1996, the company operated 20 mills. This rapid growth set the stage for its future in the textile industry. For more details, you can read a Brief History of Unifi.

Understanding the early history of the company provides insights into its strategic direction and growth trajectory. The founders' decisions shaped the company's initial focus and expansion plans.

- The company was founded in July 1971.

- Initial funding included private investment and a bank loan.

- The company expanded rapidly, opening multiple facilities.

- The founding team aimed for market dominance and efficiency.

Unifi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Unifi’s Ownership Changed Over Time?

The journey of Unifi, Inc. (NYSE: UFI) began as a publicly traded entity, with its initial public offering (IPO) occurring before the provided information, but it has been publicly traded since at least 1973. As of June 13, 2025, the company's market capitalization stands at approximately $94.74 million. Over the past year, its market cap has decreased by -20.72%, reflecting changes in market dynamics and investor sentiment. This evolution in market value is a key indicator of the company's performance and the confidence of investors.

The ownership structure of the Unifi company has evolved over time, with significant shifts in shareholder composition. Institutional investors hold a substantial portion of the company's shares, reflecting the influence of large financial entities. As of March 2025, institutional investors held 53.74% of Unifi's shares, while mutual funds held 26.59%. Insiders, as of March 2025, held 17.69% of the company's shares, a slight decrease from 17.70%, indicating a relatively stable insider stake.

| Shareholder | Stake (as of May 2025) | Shares Held |

|---|---|---|

| Pinnacle Associates Ltd. | 5.474% | 1,004,564 |

| Azarias Capital Management, L.P. (as of April 2025) | 5.141% | 943,364 |

| Minerva Advisors LLC | 4.947% | 907,774 |

| 22nw, LP | 3.984% | 731,535 |

The strategic direction of Unifi has been influenced by its ownership structure, particularly with the focus on sustainability. The introduction of the REPREVE® brand marked a significant transformation, shifting the company from a commodity textile producer to an innovator in recycled fibers. This strategic pivot aligns with the growing global demand for sustainable materials, reflecting how ownership and strategic decisions can impact the company's market positioning and future growth prospects. This shift demonstrates how the Unifi company has adapted to changing market demands.

Understanding the Unifi ownership structure is crucial for investors and stakeholders. Key institutional investors and insider holdings provide insights into the company's stability and strategic direction.

- Institutional investors hold a majority of shares.

- The REPREVE® brand showcases a commitment to sustainability.

- Market capitalization and stock performance reflect investor confidence.

- Changes in ownership can influence strategic decisions.

Unifi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Unifi’s Board?

The current board of directors of the Unifi company plays a crucial role in guiding the company's strategic direction and ensuring effective governance. Edmund Ingle, serving as the Chief Executive Officer, is also a Director since June 14, 2020. Andrew Eaker, the Executive Vice President and Chief Financial Officer since January 2024, also holds a key leadership position. This structure highlights the importance of experienced leadership in driving the Unifi corporation's operations.

Other members of the board and their committee affiliations include Eva Zlotnicka (Audit Committee, Governance Committee Chair, Nominating Committee Chair, Finance Committee), Kenneth Langone (Compensation Committee, Governance Committee, Nominating Committee, Executive Committee), Francis Blake (Compensation Committee Chair), Rhonda Ramlo (Audit Committee), and Suzanne Present (Audit Committee Chair). These individuals contribute to the oversight of various aspects of the Unifi provider's operations, ensuring accountability and strategic alignment. Recent changes include the resignation of Gregory K. Sigmon as Executive Vice President, General Counsel, and Corporate Secretary, effective March 22, 2024, and the retirement of Archibald Cox, Jr. as Lead Independent Director in February 2024. These changes reflect ongoing adjustments in leadership and governance.

| Board Member | Title | Committee Affiliations |

|---|---|---|

| Edmund Ingle | CEO and Director | N/A |

| Andrew Eaker | Executive Vice President and CFO | N/A |

| Eva Zlotnicka | Director | Audit Committee, Governance Committee Chair, Nominating Committee Chair, Finance Committee |

| Kenneth Langone | Director | Compensation Committee, Governance Committee, Nominating Committee, Executive Committee |

| Francis Blake | Director | Compensation Committee Chair |

| Rhonda Ramlo | Director | Audit Committee |

| Suzanne Present | Director | Audit Committee Chair |

Unifi's common stock, traded on the NYSE under the symbol 'UFI,' is the only class of stock, with each share entitling the holder to one vote. This one-share-one-vote structure means that voting power directly corresponds to share ownership, clarifying the Unifi ownership structure. As of September 3, 2024, the beneficial ownership of common stock by each director, director nominee, and named executive officer, as well as by all directors and executive officers as a group, is disclosed in SEC filings, providing transparency into the company's ownership and control. For more insights into the company's strategic moves, consider the Growth Strategy of Unifi.

The board of directors oversees Unifi's strategic direction. Key figures include the CEO and CFO, along with various committee members. This structure ensures accountability and effective governance within the Unifi company.

- Edmund Ingle serves as CEO and Director.

- Andrew Eaker is the Executive Vice President and CFO.

- The company operates under a one-share-one-vote system.

- Board member affiliations include Audit, Compensation, and Governance committees.

Unifi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Unifi’s Ownership Landscape?

Over the past few years, Unifi, Inc. has undertaken several strategic initiatives impacting its ownership profile. The company has focused on profitability improvements, including cost reductions and sales transformation, aiming to boost operating margins. These efforts are designed to strengthen the company's financial standing and are crucial for attracting and maintaining investor confidence. The company has been working on enhancements for REPREVE®, which may further solidify its market position.

In the realm of share repurchases, Unifi had an authorized program. However, the company did not repurchase any shares in fiscal years 2024 and 2025. Leadership changes also occurred in January 2024, with key promotions within the executive team. Furthermore, in May 2025, Unifi announced the sale of a manufacturing facility in Madison, North Carolina, for $53.2 million, with the proceeds earmarked for debt reduction and strengthening the balance sheet. These moves are part of a broader strategy to enhance operational efficiency and financial performance.

| Metric | Details | As of |

|---|---|---|

| Institutional Ownership | 117 institutional owners | June 2025 |

| Shares Held by Institutions | 10,663,693 shares | June 2025 |

| Percentage of Shares Outstanding | 58.08% | June 2025 |

| Share Price Decline | 18.17% | June 2025 |

The Unifi company, has seen significant changes in its ownership structure. The company's focus on cost reductions, sales transformation, and strategic asset sales is aimed at improving financial performance and shareholder value. Institutional investors hold a significant portion of the shares, reflecting confidence in the company's direction. The company's ability to navigate a dynamic market while maintaining its financial health will be key to its long-term success. For more insights, you can read the article on Unifi's evolution.

Institutional ownership in Unifi has increased, with over half of the outstanding shares held by institutions as of June 2025. The company has been working on strategic initiatives, including cost reductions and sales transformations, to improve profitability. These efforts, along with the sale of a manufacturing facility, indicate a focus on strengthening the balance sheet and enhancing financial performance.

The sale of a manufacturing facility for $53.2 million in May 2025 is a significant move. The proceeds from this sale are allocated towards debt reduction and strengthening the balance sheet. This strategic decision highlights the company's commitment to improving its financial health and operational efficiency. The company's leadership changes and strategic initiatives reflect its focus on long-term growth.

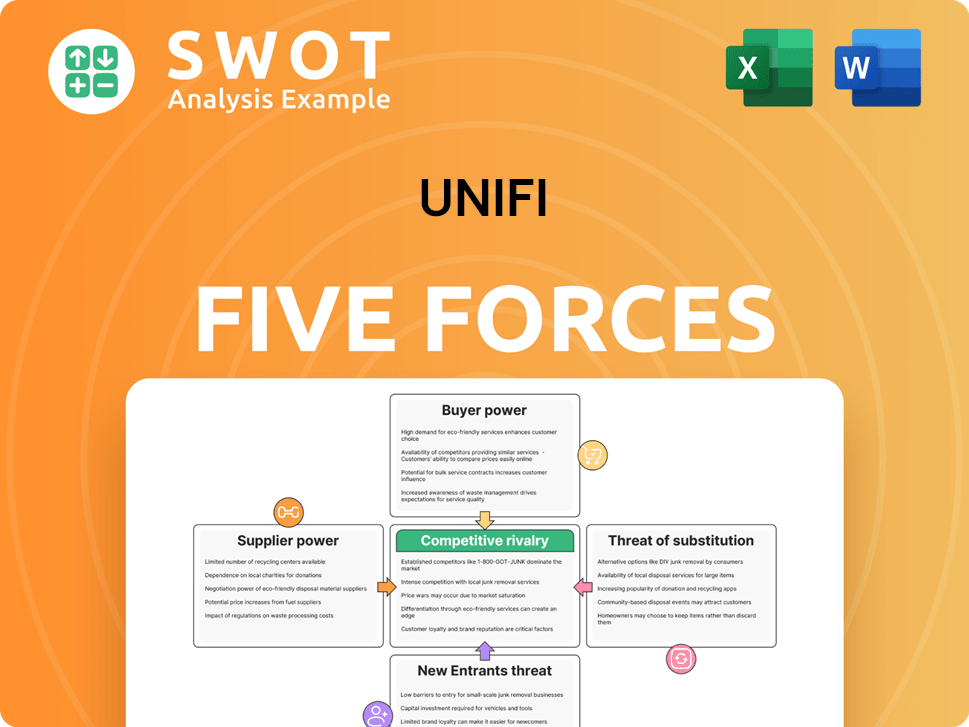

Unifi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Unifi Company?

- What is Competitive Landscape of Unifi Company?

- What is Growth Strategy and Future Prospects of Unifi Company?

- How Does Unifi Company Work?

- What is Sales and Marketing Strategy of Unifi Company?

- What is Brief History of Unifi Company?

- What is Customer Demographics and Target Market of Unifi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.