Veradigm Bundle

How has Veradigm Transformed Healthcare?

Veradigm, a key player in healthcare technology, has a compelling story of evolution and innovation. From its inception in 1986 as Allscripts Healthcare Solutions, Inc., the company has consistently adapted to the changing needs of the healthcare industry. This Veradigm SWOT Analysis provides a deep dive into its strategic positioning.

The Veradigm company background reveals a journey marked by significant milestones in EHR software and healthcare data analytics. Understanding the Veradigm timeline and acquisition history is crucial to grasping its current market share and its relationship with Allscripts. Exploring Veradigm's financial performance and product evolution provides valuable insights for investors and industry analysts alike, making it a compelling subject for anyone interested in the future of healthcare technology and Veradigm's healthcare solutions.

What is the Veradigm Founding Story?

The story of Veradigm's beginnings starts in 1986 with the establishment of Allscripts Healthcare Solutions, Inc. in Chicago, Illinois. This marked the initial step toward what would become a major player in the healthcare technology sector. The early focus was on supplying prepackaged medications, a move designed to boost efficiency in how physicians delivered care.

While specific founders aren't always highlighted in available records, the company was built by a team of experts from the healthcare and technology fields. They saw a need for new solutions to improve patient care and streamline healthcare operations. This foundational vision set the stage for the company's future direction.

The launch of its first software product, an e-prescribing system, in 1998 was a pivotal moment, signifying a shift toward healthcare technology. This early adoption of digital tools demonstrated a forward-thinking approach. Allscripts, now known as Veradigm, has since evolved into a company that focuses on integrated data systems and services. It blends data-driven clinical insights with actionable tools for various healthcare stakeholders. The name change to Veradigm Inc. in January 2023 highlighted this expanded focus on tech and healthcare analytics.

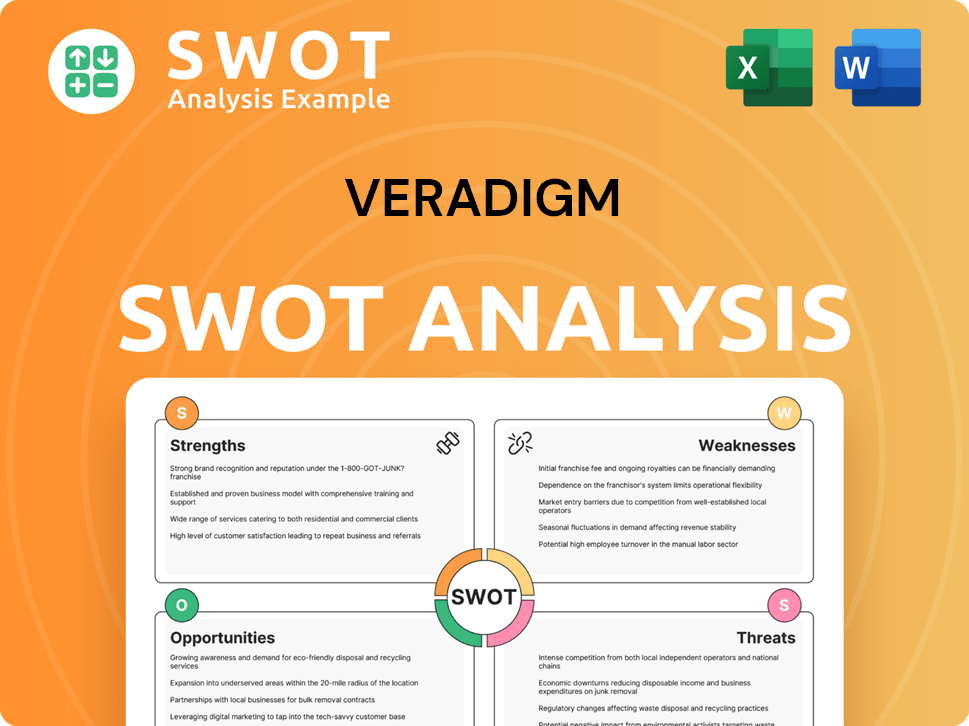

Veradigm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Veradigm?

The early growth and expansion of Veradigm, formerly Allscripts, showcases a strategic build-up in the healthcare technology sector. Through a series of acquisitions and mergers, the company broadened its capabilities beyond its initial e-prescribing system. This growth trajectory highlights its ambition to become a leading provider of healthcare solutions. Understanding the Marketing Strategy of Veradigm can provide further insights into its development.

Allscripts, the predecessor to Veradigm, significantly expanded its offerings through acquisitions. Key acquisitions included those in 2001, 2006, and 2008, which added EHR systems, practice management, and care management solutions. The merger with Misys Healthcare Systems LLC in 2008 was a pivotal step in its expansion.

In 2010, Allscripts integrated Eclipsys in a $1.3 billion deal, which expanded its client base. Further acquisitions included McKesson's hospital IT business in 2017 for $185 million and Practice Fusion in early 2018 for $100 million. These strategic moves solidified its position in the healthcare IT sector.

The company also made strategic divestments to focus on core offerings. Allscripts sold its EPSi business for $365 million in late 2020 and CarePort Health for $1.35 billion in December 2020. These moves helped refine its focus within the healthcare technology market.

Veradigm operates in a competitive landscape with major players like Epic Systems Corporation and Oracle Health. As of December 31, 2021, Veradigm had 4,582 employees. In 2023, Veradigm's estimated GAAP revenue was between $620 million and $625 million, with an adjusted EBITDA of $139 million to $144 million. The recurring revenue rate was around 80% in Q4 2024.

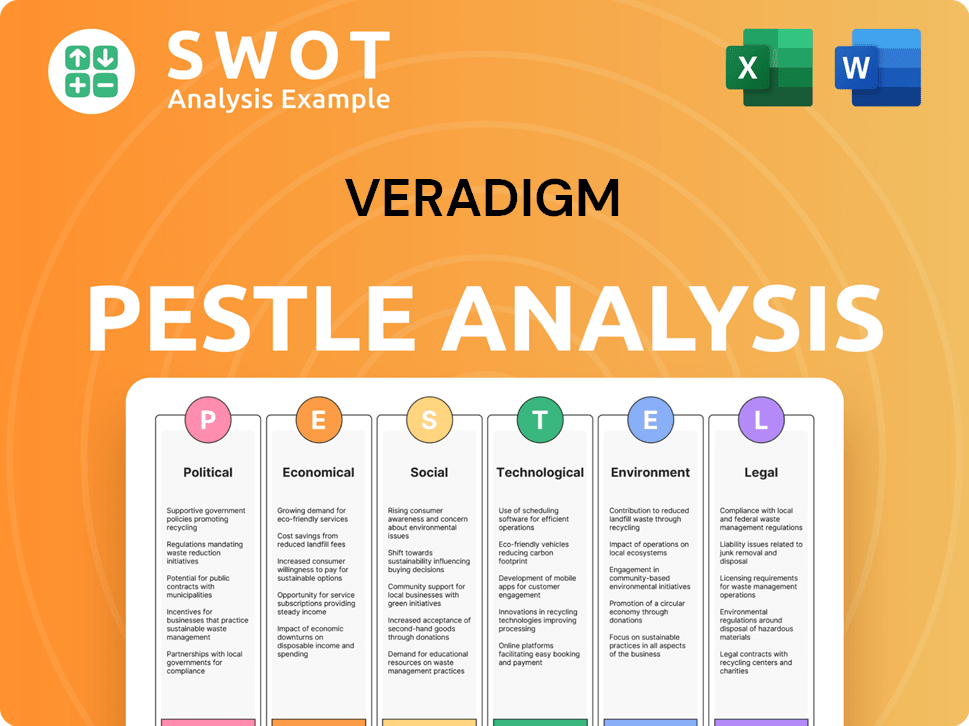

Veradigm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Veradigm history?

The Veradigm company, formerly known as Allscripts, has a rich

| Year | Milestone |

|---|---|

| 1998 | Introduced its first e-prescribing system, marking its initial entry into healthcare software. |

| Ongoing | Expanded capabilities through strategic mergers and acquisitions, integrating EHR systems, practice management, and care management solutions. |

| 2025 | Announced advancements in using AI to generate real-world evidence for GLP-1 receptor agonists by curating EHR data. |

| 2025 | Recognized with a KLAS 2025 Points of Light Award for optimizing value-based care. |

| 2025 | Black Book ranked Veradigm Payer Analytics as the #1 Overall Payer Analytics Solution Vendor. |

| 2025 | Partnered with Onpoint Healthcare Partners to offer AI-driven workflow automation. |

Throughout its evolution,

Veradigm is utilizing AI to generate real-world evidence, particularly for treatments like GLP-1 receptor agonists. This involves curating data from EHR systems to provide insights.

The introduction of its first e-prescribing system in 1998 was a pivotal innovation. This marked a significant step into the realm of

Veradigm partnered with Onpoint Healthcare Partners to offer AI-driven workflow automation. This partnership aims to streamline processes.

Veradigm Payer Analytics was ranked as the #1 Overall Payer Analytics Solution Vendor in 2025. This highlights its strength in data analytics.

Veradigm received the KLAS 2025 Points of Light Award for optimizing value-based care. This recognizes its efforts in this area.

The company expanded its capabilities through strategic mergers and acquisitions, including integrating

Despite its achievements,

Veradigm confirmed it had overstated revenue in prior year-end financial statements from 2020 and 2022 due to 'internal control failures,' while understating revenue in 2021. This necessitated extensive audits and restatements.

Significant delays in filing financial reports resulted in Veradigm's delisting from the Nasdaq stock exchange in February 2024. This impacted its market presence.

The company explored strategic alternatives, including a potential sale or merger, but concluded this process in January 2025 without a deal. This led to a shift in focus.

For fiscal year 2024, Veradigm's revenue is estimated to be between $583 million and $588 million, with a net loss estimated between $49 million and $46 million. This reflects a decline from the previous year.

Veradigm is now focusing on a standalone strategy, emphasizing operational improvements, cost optimization, and strengthening internal controls. This is a key part of its recovery plan.

The company's net cash position as of December 31, 2024, was $87 million. This provides a financial foundation for its ongoing operations.

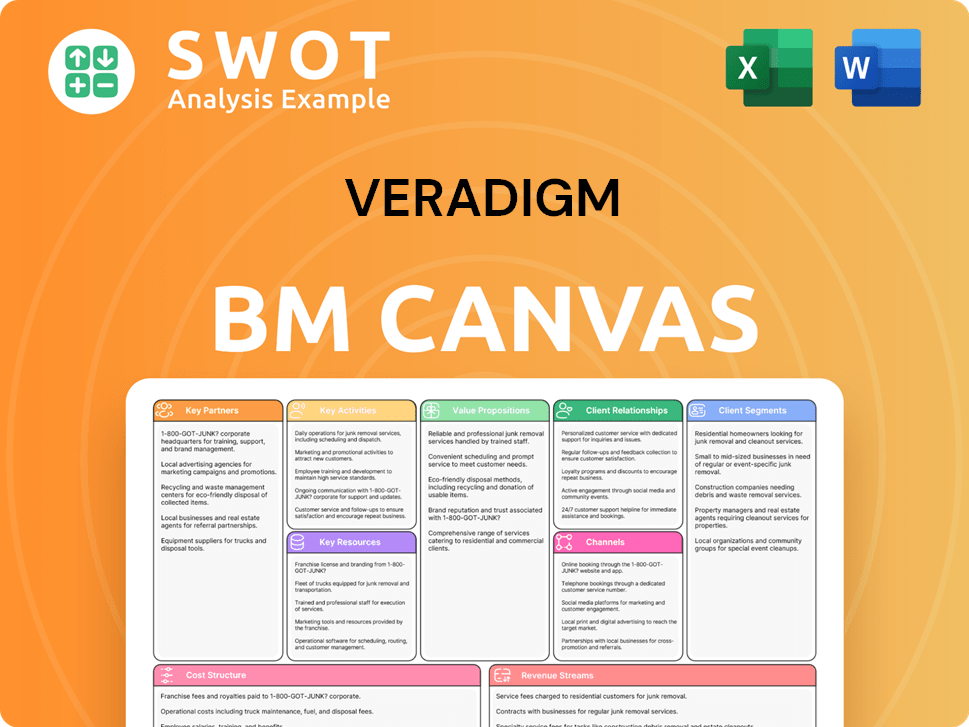

Veradigm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Veradigm?

The Veradigm history is a story of strategic shifts and acquisitions within the healthcare technology sector. Initially founded as Allscripts Healthcare Solutions, Inc. in 1986, the company launched its first e-prescribing software in 1998. Key milestones include the 2008 merger with Misys Healthcare Systems LLC and the 2010 acquisition of Eclipsys. Further expansion came with the 2017 acquisition of McKesson's hospital IT business and the 2018 purchase of Practice Fusion. The company strategically divested its EPSi business and CarePort Health in 2020, and rebranded as Veradigm Inc. in January 2023. Recent developments include the acquisition of ScienceIO in February 2024, enhancing its AI capabilities, and the acquisition of Koha Health in January 2024.

| Year | Key Event |

|---|---|

| 1986 | Founded as Allscripts Healthcare Solutions, Inc. in Chicago, IL. |

| 1998 | Launched its first software product, an e-prescribing system. |

| 2008 | Merged with Misys Healthcare Systems LLC, forming Allscripts-Misys Healthcare Solutions Inc. |

| 2010 | Acquired Eclipsys in a $1.3 billion deal. |

| 2017 | Acquired McKesson's hospital and health systems IT business for $185 million. |

| 2018 | Purchased Practice Fusion for $100 million. |

| 2020 (Q4) | Sold EPSi business for $365 million and CarePort Health for $1.35 billion. |

| January 2023 | Rebranded from Allscripts to Veradigm Inc., reflecting an expanded focus on healthcare data and analytics. |

| February 2024 | Delisted from Nasdaq due to delays in financial reporting and acquired ScienceIO for $140 million, enhancing AI capabilities. |

| January 2024 | Acquired Koha Health. |

| January 2025 | Concluded the exploration of strategic alternatives without a sale or merger, opting for a standalone strategy. |

| March 2025 | Provided updated financial ranges for fiscal years 2023 and 2024, and an outlook for 2025, while continuing efforts to remediate internal control deficiencies. |

| March 2025 | Partnered with Onpoint Healthcare Partners to offer AI-driven workflow automation. |

| May 2025 | Announced advancement in using AI for GLP-1 real-world evidence generation and received a KLAS 2025 Points of Light Award. |

Veradigm anticipates its 2025 revenue to remain relatively flat compared to 2024, with an estimated range between $583 million and $588 million. The company is concentrating on cost optimization and the enhancement of AI-enabled solutions. These strategies are pivotal for navigating the current market dynamics.

Veradigm aims to complete its financial reporting remediation by 2026 and plans to relist its common stock on a national securities exchange. Exploring additional debt financing is also on the agenda to support strategic initiatives. This proactive approach is crucial for stabilizing its financial position.

The company plans to drive growth through increased provider participation and improved connectivity within the Veradigm Network. This strategy focuses on expanding its user base and enhancing the value of its healthcare solutions. This will be key to its long-term success.

Veradigm’s leadership is confident in its business model, emphasizing the importance of delivering end-to-end solutions for clients. The company plans to transform health, insightfully, leveraging its platforms, data, expertise, connectivity, and scale. This vision aims to create a significant impact in the healthcare technology field.

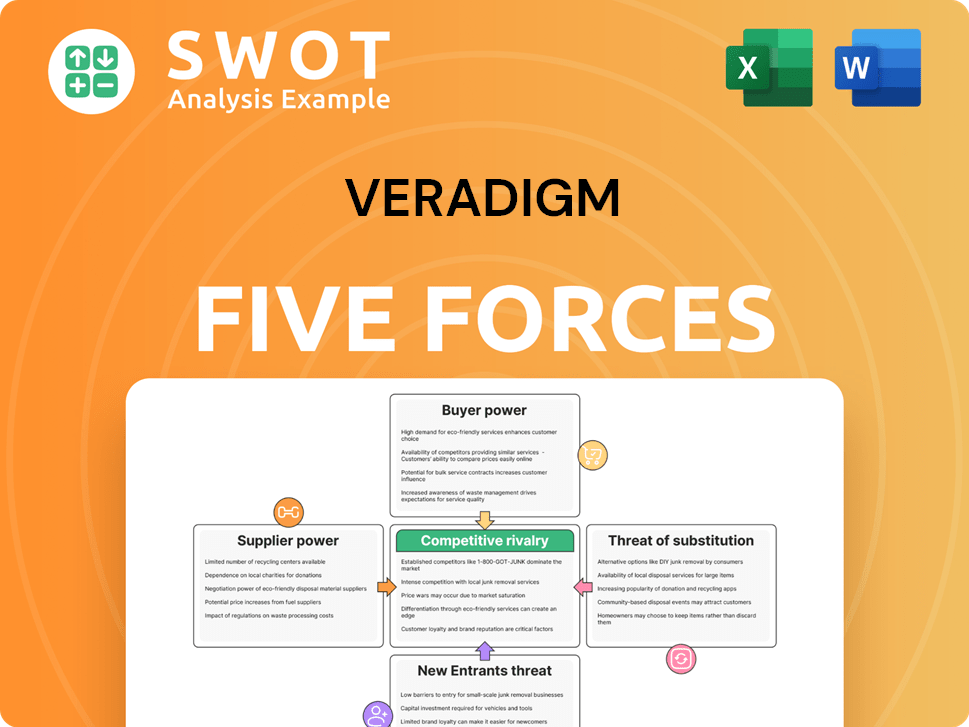

Veradigm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Veradigm Company?

- What is Growth Strategy and Future Prospects of Veradigm Company?

- How Does Veradigm Company Work?

- What is Sales and Marketing Strategy of Veradigm Company?

- What is Brief History of Veradigm Company?

- Who Owns Veradigm Company?

- What is Customer Demographics and Target Market of Veradigm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.