Veradigm Bundle

How Does Veradigm Stack Up in the Cutthroat Healthcare Tech Arena?

The healthcare technology sector is a battlefield of innovation, where companies constantly vie for dominance. Veradigm, a key player in this dynamic market, offers a suite of solutions designed to transform healthcare delivery. Understanding the Veradigm SWOT Analysis is crucial to grasp its position.

This analysis delves into the Veradigm competitive landscape, providing a comprehensive Veradigm market analysis to identify its strengths and weaknesses. We'll explore Veradigm competitors, evaluate Veradigm's financial performance, and assess its strategic positioning within the broader Healthcare IT competition landscape. This deep dive aims to equip you with the insights needed to evaluate Veradigm's potential.

Where Does Veradigm’ Stand in the Current Market?

Veradigm holds a significant position within the healthcare technology industry, offering comprehensive IT solutions and data analytics to healthcare providers, payers, and life sciences companies. Its core operations revolve around providing Electronic Health Records (EHR), financial management, population health management, and consumer solutions, along with consulting, managed IT, and other related services. The company's value proposition lies in its ability to streamline healthcare operations, improve patient outcomes, and provide data-driven insights.

The company serves a diverse customer base, including physicians, hospitals, and various healthcare organizations across North America, Asia, Australia, the Middle East, and the UK. Veradigm's focus on customer satisfaction and its commitment to research and development are key elements in maintaining its competitive edge. Veradigm’s solutions are designed to meet the evolving needs of the healthcare market, making it a crucial player in the industry.

Veradigm's market position is strengthened by its recurring revenue model, which accounts for approximately 80% of its total revenue. This provides a degree of stability and predictability in its financial performance. The company's presence in the small and mid-market healthcare provider segments further solidifies its market penetration.

Veradigm's primary offerings include EHR systems, financial management solutions, population health management tools, and consumer solutions. These solutions are designed to improve efficiency and patient care. The company also provides consulting, managed IT, and educational services.

Veradigm serves a wide range of customers, including physicians, hospitals, health systems, and payers. Its customer base spans across North America, Asia, Australia, the Middle East, and the UK. This diverse customer base supports the company's revenue streams.

For fiscal year 2024, Veradigm reported estimated GAAP revenue between $583 million and $588 million. The company ended 2024 with a net cash position of $87 million. While facing some challenges in 2024, it maintains a strong recurring revenue rate.

Veradigm's Payer Analytics has been recognized as a top provider for two consecutive years (2024 and 2025). In Q1 2024, Veradigm's payer solutions saw a 15% increase in client adoption. This recognition underscores the company's strong position in the market.

Veradigm's strengths include a comprehensive suite of healthcare IT solutions and a strong focus on customer satisfaction. The company's recurring revenue model also provides financial stability. However, Veradigm faces challenges such as customer attrition and project delays, particularly in its payer and life science group.

- Strong Market Position: Veradigm is a key player in the healthcare IT sector.

- Comprehensive Solutions: Offers a wide range of IT solutions for healthcare providers and payers.

- Financial Stability: High recurring revenue rate and a solid cash position.

- Challenges: Customer attrition and project delays impacting financial performance.

Veradigm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Veradigm?

The healthcare information technology market is highly competitive, and the Veradigm competitive landscape is shaped by a diverse group of companies. These competitors present both direct and indirect challenges, influencing the company's market position and strategic decisions. Understanding the Veradigm market analysis is crucial to assess its performance and future potential.

Several key players compete with Veradigm, each with its own strengths and weaknesses. These competitors challenge Veradigm's market share through various strategies, including comprehensive product offerings, user-friendly interfaces, and a focus on specific market segments. The competitive dynamics are constantly evolving due to mergers, acquisitions, and the emergence of new technologies.

Veradigm's company overview reveals it operates within a dynamic environment. The company faces competition from established and emerging players, each vying for market share. A thorough Veradigm competitors analysis is essential to understand the company's position and challenges.

Epic Systems is a major competitor known for its comprehensive EHR systems. Its extensive functionality and interoperability are often used by large hospitals, academic medical centers, and integrated healthcare networks. Epic's strong presence in the enterprise market poses a significant challenge to Veradigm, particularly in securing large-scale contracts.

Oracle Health (formerly Cerner) offers a wide array of health IT solutions, including EHR, revenue cycle management, and population health management. Their integrated platform presents a significant challenge to Veradigm. The scale and scope of Oracle Health's offerings allow it to compete across various segments of the healthcare IT market.

athenahealth provides cloud-based services for healthcare organizations, emphasizing a user-friendly interface and customer service. Its focus on ease of use and customer satisfaction makes it a strong competitor, particularly in the ambulatory care market. The company's approach to service delivery differentiates it from competitors like Veradigm.

eClinicalWorks is a significant player in the EHR market, offering solutions for various healthcare settings. Its focus on providing comprehensive EHR solutions makes it a direct competitor to Veradigm. The company's market presence and product offerings contribute to the competitive landscape.

NextGen Healthcare is a key competitor offering EHR and practice management solutions. It competes directly with Veradigm, particularly in the ambulatory care space. The company's market position and product offerings make it a significant player in the healthcare IT market.

Other notable competitors include Greenway Health, MEDITECH, DrChrono, CareCloud, and Tebra. These companies offer various solutions and compete for market share. The competitive landscape also includes emerging players and specialized solution providers.

The competitive landscape is dynamic, with mergers and acquisitions reshaping the market. For example, Tebra was formed through the combination of Kareo and PatientPop. New entrants and emerging technologies, such as AI integration, are also influencing the market. Understanding the competitive dynamics is crucial for assessing Veradigm's financial performance and strategic positioning. For further insights into the company's ownership and financial structure, consider exploring Owners & Shareholders of Veradigm.

Several factors contribute to the competitive dynamics in the healthcare IT market. These factors influence the competitive landscape and impact Veradigm's competitive advantages in healthcare.

- Product Suite: The comprehensiveness and functionality of EHR and related solutions are critical.

- User Experience: Ease of use and customer service are essential for attracting and retaining clients.

- Market Segment: The focus on specific segments, such as large hospitals or ambulatory care, influences competition.

- Interoperability: The ability to integrate with other systems and share data is increasingly important.

- Technology Adoption: The integration of new technologies, such as AI, can provide a competitive edge.

Veradigm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Veradigm a Competitive Edge Over Its Rivals?

Analyzing the Veradigm competitive landscape reveals key strengths that set it apart in the healthcare IT sector. The company leverages its extensive data network and deep industry expertise to gain a competitive edge. This approach, combined with a commitment to innovation, positions it uniquely within the healthcare IT competition.

Veradigm's strategic moves, including investments in AI and partnerships, are designed to enhance its market position. These initiatives are supported by a strong financial foundation, as evidenced by its positive net cash position of $87 million at the end of 2024. This financial health enables the company to pursue long-term growth strategies and adapt to evolving market dynamics.

The company's competitive edge is further sharpened by its focus on interoperability and its ability to provide valuable insights to healthcare organizations. By connecting healthcare providers, payers, and life sciences entities, Veradigm facilitates data-driven decision-making, which is crucial for optimizing operations and improving patient outcomes. This strategy is detailed further in Revenue Streams & Business Model of Veradigm.

The Veradigm Network is a significant competitive advantage, connecting healthcare entities and facilitating data collection. This network provides access to a vast amount of de-identified patient data, which is essential for research and improving patient care. With over 154 million unique patients nationally, the network offers unparalleled reach.

Veradigm's proprietary technologies and data analytics expertise enable it to offer valuable insights to healthcare organizations. Using advanced analytics and natural language processing, the company extracts crucial information from unstructured clinical notes. This capability allows for a more comprehensive understanding of patient health and supports informed decision-making.

Veradigm's years of experience in the healthcare industry provide a deep understanding of the sector's challenges and opportunities. This expertise allows the company to tailor solutions to meet specific client needs effectively. The company's ability to adapt to market changes and client demands is a key differentiator.

The company's commitment to AI and innovation is a major strength, with AI being used in billing, clinical decisions, and automation to boost efficiency. Veradigm is incorporating AI capabilities into its products to enhance clinical decision-making and improve patient outcomes. Anticipated real revenue and margin expansion from new AI-driven data products are expected in 2025.

Veradigm's competitive advantages include its extensive data network, deep industry expertise, and commitment to innovation. The company's focus on interoperability and its ability to provide valuable insights to healthcare organizations are also key strengths. These factors enable Veradigm to maintain a strong position within the dynamic healthcare market.

- Veradigm Network: Connects healthcare providers, payers, and life sciences entities.

- Data Analytics: Leverages advanced tools for valuable insights.

- Industry Expertise: Deep understanding of healthcare challenges.

- Innovation: Focus on AI and interoperability.

Veradigm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Veradigm’s Competitive Landscape?

The healthcare technology industry is experiencing significant shifts, driven by technological advancements, regulatory changes, and a growing emphasis on data-driven solutions. As a key player, understanding the Veradigm competitive landscape is crucial. The industry is seeing a surge in AI and machine learning integration, alongside a focus on population health and cybersecurity. The global accountable care solutions market was valued at $17.99 billion in 2024 and is projected to reach $62.66 billion by 2032.

This dynamic environment presents both opportunities and challenges for Veradigm. Strategic partnerships and the development of new products are vital for expansion. However, increased competition and evolving customer expectations demand continuous innovation. Furthermore, the company is working on addressing past financial reporting issues and navigating cybersecurity threats, which are critical for maintaining its market position and ensuring sustainable growth. For a deeper dive into the company's mission and strategy, explore the Growth Strategy of Veradigm.

Key trends include the integration of AI and ML for predictive analytics and automation. There's also a rising focus on population health management and cybersecurity. The healthcare IT market is becoming increasingly crowded, leading to intensified competition.

Veradigm faces challenges related to financial reporting and internal control deficiencies. Cybersecurity threats pose a continuous risk, requiring ongoing investment. Maintaining a competitive edge in a crowded market is also critical.

Expanding into new markets and developing new products and services are key. Strategic partnerships are crucial for expanding reach and capabilities. The company is exploring opportunities in emerging technologies like AI to enhance its solutions.

Veradigm is focusing on cost optimization and AI-enabled solutions to enhance operational efficiency. The company's commitment to interoperability and its extensive data network are expected to drive growth. Refining the go-forward plan after exploring strategic alternatives is also a priority.

Veradigm's position in the healthcare software market is influenced by its extensive data network and commitment to interoperability. The company is actively incorporating AI into its products, with expectations for real revenue and margin expansion from AI-driven data products by 2025. These initiatives are designed to enhance its competitive standing in the healthcare IT landscape.

- Extensive Data Network: Provides a robust foundation for data-driven solutions.

- Interoperability Focus: Enhances data sharing and integration across healthcare systems.

- AI Integration: Leverages AI for improved analytics and operational efficiency.

- Strategic Partnerships: Collaborations to expand reach and capabilities.

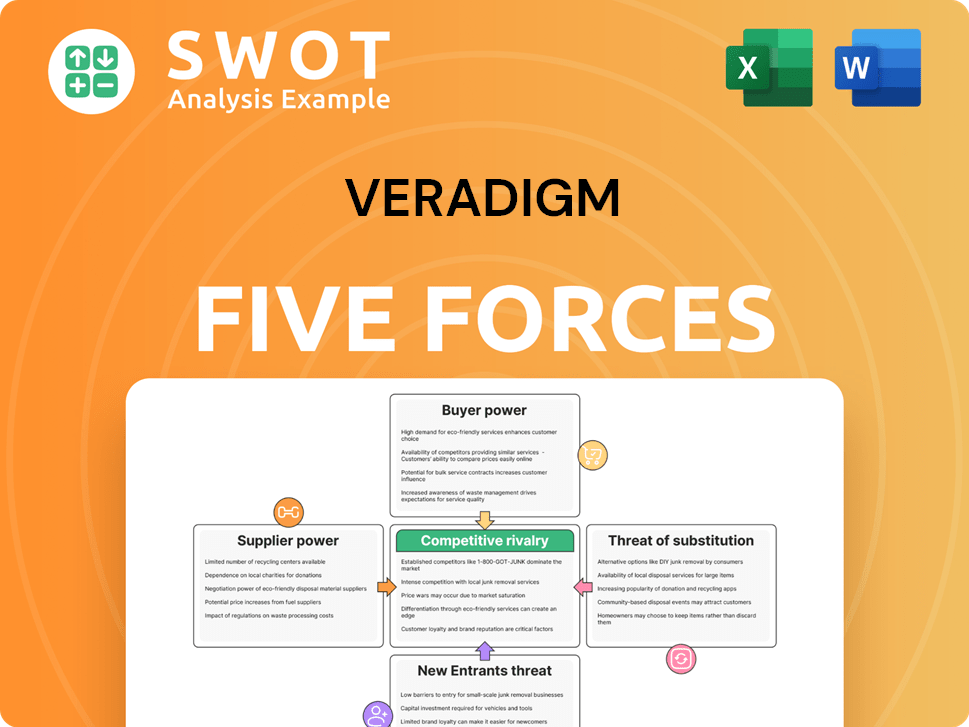

Veradigm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veradigm Company?

- What is Growth Strategy and Future Prospects of Veradigm Company?

- How Does Veradigm Company Work?

- What is Sales and Marketing Strategy of Veradigm Company?

- What is Brief History of Veradigm Company?

- Who Owns Veradigm Company?

- What is Customer Demographics and Target Market of Veradigm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.