Veradigm Bundle

Who Really Owns Veradigm?

Understanding a company's ownership is crucial for investors and stakeholders alike. Veradigm, formerly known as Allscripts Healthcare Solutions, Inc., has undergone significant transformations since its founding in 1986. Knowing "Who owns Veradigm" provides vital insights into its strategic direction and future potential. This exploration will uncover the key players behind this healthcare technology leader.

This analysis of Veradigm SWOT Analysis will explore the evolution of Veradigm's ownership, examining its parent company, key investors, and the impact of its rebranding. We'll dissect the company's ownership structure, including founder stakes and public shareholders, to provide a comprehensive understanding of its current state and future prospects. This investigation will also touch upon the company's financial performance and market share, offering a holistic view of Veradigm's position in the healthcare technology landscape and how the Veradigm ownership impacts its operations.

Who Founded Veradigm?

The company now known as Veradigm, originally started as Allscripts Healthcare Solutions, Inc., was established in 1986. The initial ownership structure of Allscripts likely involved a combination of founders, early investors, and venture capital, common for technology companies during that period.

While specific details about the initial equity split among the founders are not readily available in the provided search results, the company's early days likely involved private funding and a core group of individuals driving its initial vision. Over the years, the company has grown through various mergers and acquisitions, changing its ownership landscape.

The early vision for the company was to leverage technology to address the complex challenges facing the healthcare industry. This involved a focus on innovation and efficiency, which attracted early backers like angel investors or venture capital firms.

Early funding rounds for technology companies in the 1980s and 1990s typically involved seed funding from angel investors or venture capital.

The initial vision focused on applying technology to improve healthcare efficiency and address industry challenges.

Over time, Veradigm ownership structure has evolved through mergers, acquisitions, and changes in the parent company.

Is Veradigm a public company? Yes, Veradigm is a publicly traded company, which means its ownership is distributed among shareholders.

Understanding the Veradigm parent company and its relationship to Allscripts Veradigm is crucial for understanding the Veradigm ownership.

Analyzing Veradigm market share and its competitors provides insights into its competitive landscape.

Understanding the Veradigm company history and the evolution of its ownership structure is essential for investors and stakeholders. The company's journey from its founding as Allscripts to its current form reflects significant changes in the healthcare technology sector. For more information, you can explore the Target Market of Veradigm.

- The company was founded in 1986.

- Early funding likely came from angel investors and venture capital.

- The initial vision focused on healthcare technology solutions.

- Ownership has evolved through mergers and acquisitions.

- Veradigm is a publicly traded company.

Veradigm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Veradigm’s Ownership Changed Over Time?

The story of Growth Strategy of Veradigm began with its IPO on July 23, 1999, when it was known as Allscripts Healthcare Solutions, Inc. This marked the start of its journey as a publicly traded company. The company's ownership structure has seen shifts over time, with Allscripts Healthcare Solutions as a major stakeholder. As of June 12, 2025, the market capitalization of Veradigm is approximately $747.25 million.

A significant event impacting its ownership was the delisting from Nasdaq in 2024 due to noncompliance with timely financial reporting. This led to its stock trading on the OTC Markets under the symbol 'MDRX.' This change has influenced the dynamics of Veradigm ownership, with institutional investors playing a key role. The company is currently working to meet financial reporting requirements and plans to relist its common stock.

| Ownership Details | Shareholder | Shares Held (as of March 17, 2025) |

|---|---|---|

| Major Shareholder | Stonehill Capital Management LLC | 12.45% (21,141,983 shares) |

| Institutional Shareholder | Stonehill Institutional Partners, L.P. | 6.76% |

| Institutional Shareholder | Newtyn Management, LLC | 6.18% |

| Institutional Shareholder | Stonehill Master Fund Ltd. | 5.69% |

| Institutional Shareholder | Silver Point Capital, L.P. | 5.10% |

| Institutional Shareholder | Kent Lake PR LLC | 3.02% |

Allscripts Healthcare Solutions, the parent company, holds a controlling stake in Veradigm, influencing its operational and strategic decisions. However, other institutional investors also have significant holdings. As of June 11, 2024, institutional investors held a total of 6,466,184 shares. The influence of major shareholders like Stonehill Capital Management can significantly impact company strategy and governance. This dynamic ownership structure is critical for understanding the future of Veradigm.

Veradigm's ownership structure is complex, involving both a parent company and various institutional investors.

- Allscripts Healthcare Solutions is the parent company and a major stakeholder.

- Stonehill Capital Management LLC is a significant shareholder.

- The company's delisting from Nasdaq and efforts to relist have influenced the ownership dynamics.

- Institutional investors collectively held a substantial number of shares.

Veradigm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Veradigm’s Board?

As of March 19, 2025, the Board of Directors for Veradigm has seen recent changes. New independent directors, Jonathan Sacks and Bruce Felt, have joined. Jonathan Sacks, a Partner at Stonehill Capital Management LLC, brings financial expertise, while Bruce Felt, with a background as a CFO, will chair the Audit Committee. Lou Silverman became a board member in February 2025 and is succeeding Greg Garrison as Chairman. Vinit Asar will chair the Nominating and Governance Committee. These changes reflect a focus on strengthening governance and financial controls.

The composition of the board and the influence of major shareholders are key aspects of Veradigm's ownership structure. For example, Stonehill Capital Management's representation on the board indicates significant voting power. This is further emphasized by an agreement with Kent Lake, an investor holding approximately 4.2% of the company's shares, allowing for the designation of replacement directors under certain circumstances. These developments are occurring amidst financial reporting challenges and a review of strategic alternatives, as discussed in a brief history of Veradigm.

| Director | Title | Affiliation |

|---|---|---|

| Lou Silverman | Chairman | |

| Jonathan Sacks | Director | Partner, Stonehill Capital Management LLC |

| Bruce Felt | Director, Chair of Audit Committee | |

| Vinit Asar | Chair of Nominating and Governance Committee |

The board's composition reflects the influence of major shareholders. Changes in leadership and the addition of new directors are part of a strategic shift. These moves aim to improve financial oversight and governance within the company.

- Jonathan Sacks represents a major shareholder.

- Bruce Felt brings financial experience to the Audit Committee.

- Lou Silverman is the new Chairman.

- Kent Lake, holding approximately 4.2% of shares, has influence over director appointments.

Veradigm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Veradigm’s Ownership Landscape?

In the past few years, the ownership structure of Veradigm has seen significant shifts. The company, previously known as Allscripts Healthcare Solutions, Inc., rebranded as Veradigm Inc. in January 2023, following the sale of its hospital and large physician practice business segment in March 2022. This restructuring has influenced the composition of its shareholders and the strategic direction of the company. The increased influence of institutional investors is a notable trend in Veradigm ownership.

As of March 17, 2025, Stonehill Capital Management LLC holds the largest share of Veradigm, with 12.45% of the shares. Other key institutional investors include Silver Point Capital, L.P. (5.10%) and Newtyn Management, LLC (6.18%). Institutional investors held approximately 1.08% of shares in May 2025, while mutual funds held 6.11%. The changing ownership landscape reflects adjustments in the company's strategic focus and market position. The dynamics of Veradigm's stock and its ownership structure are closely linked to the company's financial performance and strategic initiatives.

| Shareholder | Percentage of Shares (as of March 17, 2025) | Notes |

|---|---|---|

| Stonehill Capital Management LLC | 12.45% | Largest shareholder |

| Silver Point Capital, L.P. | 5.10% | Significant institutional holder |

| Newtyn Management, LLC | 6.18% | Significant institutional holder |

Veradigm has faced challenges, including financial reporting delays, leading to its delisting from Nasdaq in 2024. The company is working towards filing its delayed financial reports, aiming to become current by 2026. The search for a permanent CEO continues, with Tom Langan serving as interim CEO until July 2025. Lee Westerfield, interim CFO, has had his term extended until June 30, 2025. Veradigm's financial performance in 2024 is estimated with revenues between $583 million and $588 million, and a GAAP net loss between $46 million and $49 million. Revenue for 2025 is expected to be approximately flat compared to 2024. As of December 31, 2024, Veradigm reported a net cash position of $87 million. For more information about Veradigm's history and market position, you can read the article about Veradigm here: 0.

Veradigm Inc. rebranded in January 2023, previously known as Allscripts Healthcare Solutions, Inc. This change followed the sale of a major business segment in March 2022. The rebranding marked a strategic shift in the company's focus and operations. The name change reflects a new direction for the company.

Institutional investors now hold a significant portion of Veradigm's shares. Stonehill Capital Management LLC is the largest shareholder. Silver Point Capital, L.P. and Newtyn Management, LLC also hold substantial stakes. This indicates a growing influence of institutional investors in the company.

Veradigm faced financial reporting delays, leading to its delisting from Nasdaq in 2024. The company is working to catch up on its filings. The company's financial performance in 2024 is estimated with revenues between $583 million and $588 million.

Tom Langan became interim CEO in June 2024, replacing Dr. Yin Ho. Langan is expected to depart in July 2025. Lee Westerfield, interim CFO, has had his term extended until June 30, 2025. The board is searching for a permanent CEO.

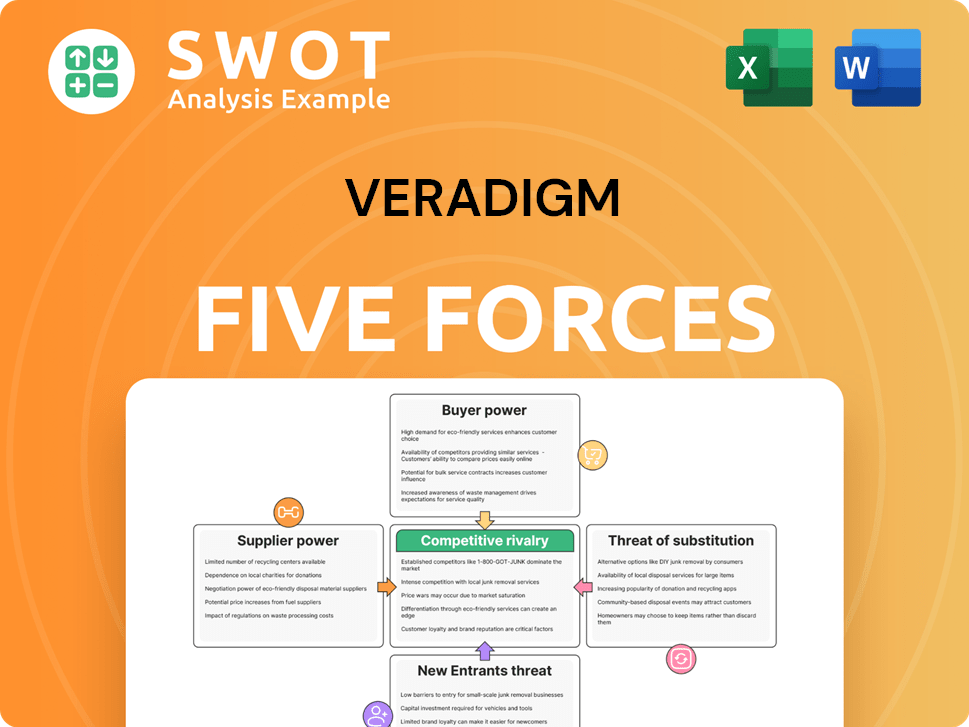

Veradigm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Veradigm Company?

- What is Competitive Landscape of Veradigm Company?

- What is Growth Strategy and Future Prospects of Veradigm Company?

- How Does Veradigm Company Work?

- What is Sales and Marketing Strategy of Veradigm Company?

- What is Brief History of Veradigm Company?

- What is Customer Demographics and Target Market of Veradigm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.