WEC Energy Group Bundle

How Well Do You Know WEC Energy Group's Past?

Journey back in time to explore the fascinating WEC Energy Group SWOT Analysis and uncover the roots of a modern energy giant. From its humble beginnings in 1896 Milwaukee, Wisconsin, as The Milwaukee Electric Railway and Light Company (TMER&L), this company has undergone a remarkable transformation. Discover how this utility company evolved from providing electric railway and light services to becoming a major player in the energy sector.

Understanding the WEC Energy history provides crucial context for investors and strategists alike. The evolution of We Energies and Wisconsin Energy Corporation reflects broader trends in the energy industry. Exploring the early history of We Energies, its mergers, acquisitions, and strategic decisions offers valuable insights into its current market position and future prospects. Delving into the company's timeline reveals key events that shaped its trajectory, making it a compelling case study for anyone interested in the energy sector.

What is the WEC Energy Group Founding Story?

The story of WEC Energy Group, a major player in the energy sector, begins in 1896. That year marked the founding of The Milwaukee Electric Railway and Light Company (TMER&L) in Milwaukee, Wisconsin. This early establishment laid the groundwork for what would eventually become a significant energy company.

TMER&L, a subsidiary of the North American Company, initially focused on providing interurban rail service. This service covered a vast 12,000-square-mile area in southeastern Wisconsin. The company's primary mission was to address the growing need for urban transportation and illumination, using the innovative power of electricity.

The initial business model revolved around generating and distributing electricity. This power was first used for the electric railway system, with surplus electricity later sold to individuals and businesses. This approach marked the beginning of the WEC Energy history.

A key innovation occurred at the East Wells Power Plant (Oneida Street Station) in 1919. Experiments demonstrated that using pulverized coal significantly reduced the cost of producing electric power, which was a major step forward. This innovation helped the company expand its services.

- The company's early focus was on providing electricity for both transportation and general use.

- The development of the electric railway system was a core part of the company's initial operations.

- Efficiency improvements, such as the use of pulverized coal, were crucial for cost savings.

- The company's growth was closely tied to the industrialization and urbanization of cities like Milwaukee.

WEC Energy Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of WEC Energy Group?

The early growth of WEC Energy Group involved significant developments and strategic expansions that shaped its foundation. This period saw the company evolve through key acquisitions and investments in infrastructure, laying the groundwork for its future. These early decisions were crucial in establishing the company's presence and ability to serve a growing customer base.

In 1921, the North American Company established Wisconsin Electric Power Company. This company built and operated the Lakeside Power Plant in St. Francis, Wisconsin, which was the world's first to exclusively burn pulverized coal. The Port Washington Power Plant, built in 1935, set world records for steam plant economy with its 80-megawatt units.

A pivotal moment occurred in 1938 when Milwaukee Electric Railway and Light merged into Wisconsin Electric. This was followed by the acquisition of Wisconsin Gas & Electric Company and Wisconsin Michigan Power Company in 1941. By 1946, Wisconsin Electric became independent, no longer a subsidiary of the North American Company, marking a significant shift in its corporate structure.

The mid-20th century saw the addition of the first 120-megawatt unit at Oak Creek Power Plant in 1953, with seven more units added by 1968. The 908-megawatt Point Beach Nuclear Plant began operation in the 1970s. These expansions were crucial for meeting the growing energy demands.

In 1987, Wisconsin Electric reorganized as a holding company, Wisconsin Energy Corporation. This restructuring included the creation of subsidiaries like Wispark, Wisvest, and Witech, indicating a move towards diversification. This period of early growth laid the foundation for WEC Energy Group's current scale, serving approximately 4.7 million customers across Wisconsin, Illinois, Michigan, and Minnesota.

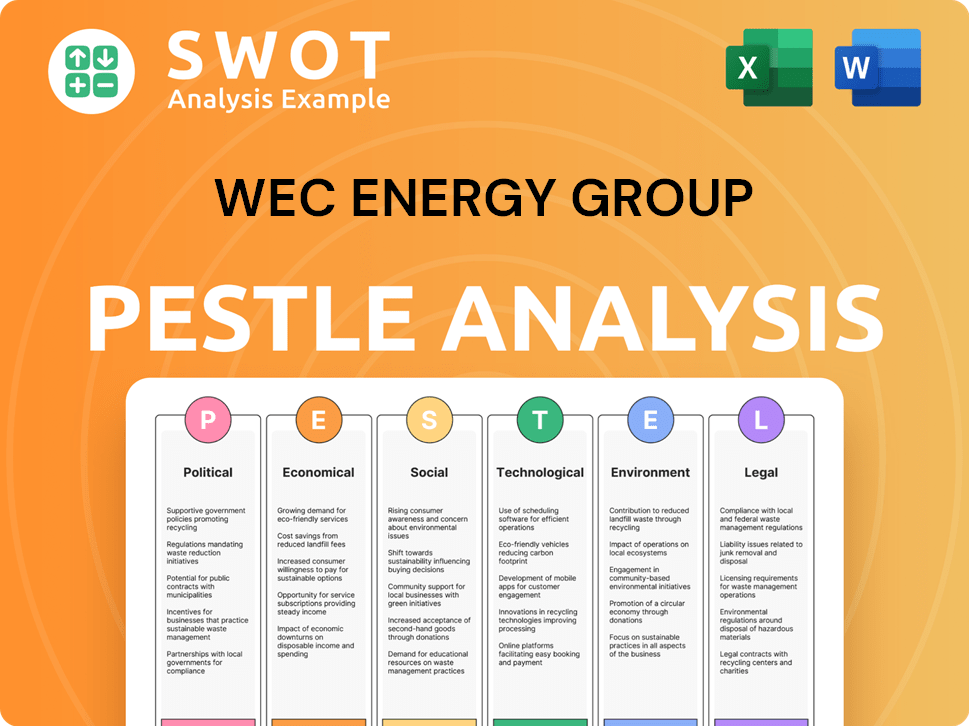

WEC Energy Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in WEC Energy Group history?

The WEC Energy Group's history is marked by significant milestones that have shaped its evolution into a leading utility company. From pioneering technological advancements to strategic acquisitions and a strong commitment to environmental goals, the company has consistently adapted and grown. Understanding the WEC Energy history provides valuable insights into its current operations and future prospects.

| Year | Milestone |

|---|---|

| 1919 | The East Wells Power Plant pioneered the use of pulverized coal, reducing energy production costs and conserving fuel. |

| 1921 | The Lakeside Power Plant became the world's first to exclusively burn pulverized coal, showcasing the company's commitment to technological advancement. |

| 2015 | The $9.1 billion acquisition of Integrys Energy Group formed WEC Energy Group, creating one of the largest electric and natural gas utilities in the Midwest. |

| 2024 | Retired coal units 5-6 at Oak Creek Power Plant in May. |

WEC Energy Group has consistently embraced innovation to improve efficiency and sustainability. The early adoption of pulverized coal technology was a significant step in reducing costs and conserving resources. The company continues to invest in renewable energy sources and advanced technologies to meet its environmental goals.

The use of pulverized coal in 1919 at the East Wells Power Plant and later at the Lakeside Power Plant in 1921 was a major technological advancement. This innovation reduced energy production costs and improved fuel efficiency, setting a precedent for future technological investments.

Recent additions of major solar projects, such as the Paris and Darien Solar Energy Centers, demonstrate the company's commitment to renewable energy. These projects contribute to the company's goal of reducing carbon emissions and transitioning to cleaner energy sources.

WEC Energy Group aims to reduce carbon dioxide emissions by 60% by the end of 2025 and 80% by the end of 2030, compared to 2005 levels. The company is also working towards eliminating coal as an energy source by the end of 2032.

The company is targeting net-zero methane emissions from its natural gas distribution system by the end of 2030. This initiative reflects a commitment to reducing environmental impact and promoting sustainability in its operations.

The 2015 acquisition of Integrys Energy Group was a strategic move that expanded WEC Energy Group's customer base and service territory. This acquisition helped the company grow its presence across multiple states.

WEC Energy Group consistently delivers solid financial results, reporting a net income of $1.5 billion, or $4.83 per share, for 2024. The company's ability to maintain strong financial performance is a key indicator of its success.

The company has faced several challenges, including regulatory disallowances and the need to adapt to changing energy landscapes. Despite these obstacles, WEC Energy Group has demonstrated resilience and a commitment to long-term value creation. For more information about the competitive environment, consider exploring the Competitors Landscape of WEC Energy Group.

Regulatory disallowances, such as the charge of 6 cents per share in 2024 related to certain capital expenditures, can impact financial results. These challenges require careful financial planning and strategic management.

Meeting ambitious environmental goals, such as achieving net carbon neutrality by 2050, requires significant investments and strategic shifts. This includes transitioning away from fossil fuels and investing in renewable energy sources.

The energy market is constantly evolving, with changes in customer preferences, technological advancements, and regulatory requirements. Adapting to these market dynamics is crucial for long-term success.

Despite challenges, the company has maintained a strong financial performance, with a net income of $1.5 billion, or $4.83 per share, for 2024. This demonstrates the company's ability to navigate obstacles and deliver value.

WEC Energy Group has increased dividends for 22 consecutive years, reflecting its financial stability and commitment to shareholders. This consistent dividend growth underscores the company's disciplined financial management.

The company reaffirmed its 2025 earnings guidance of $5.17 to $5.27 per share, indicating confidence in its future performance. This positive outlook reflects the company's strategic planning and operational efficiency.

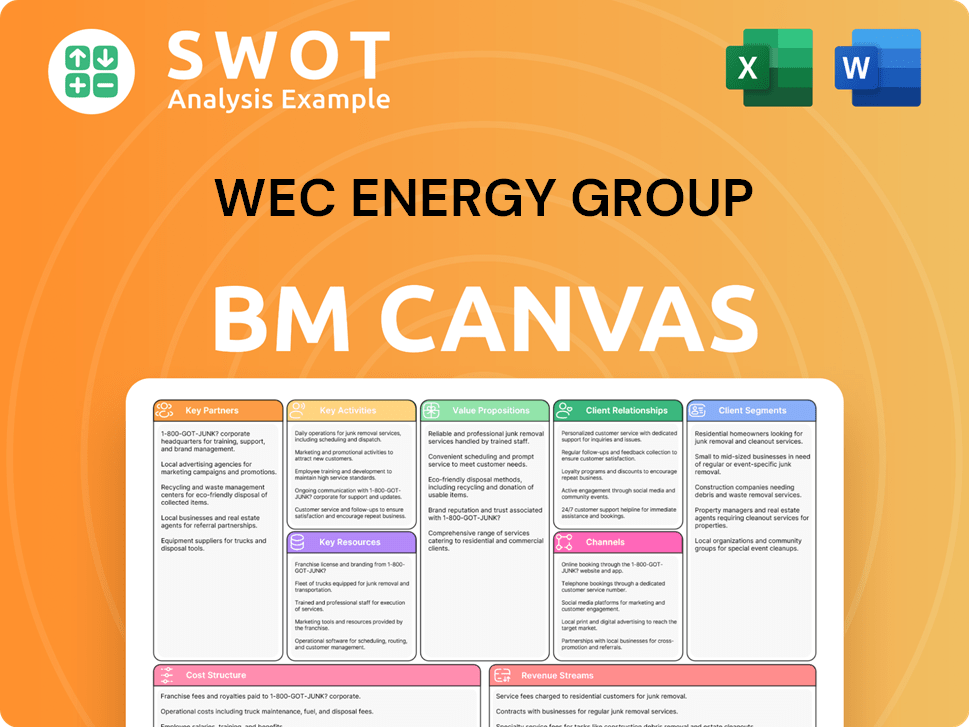

WEC Energy Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for WEC Energy Group?

The WEC Energy Group has a long and interesting history. It began in 1896 with the formation of The Milwaukee Electric Railway and Light Company (TMER&L). Over the years, it has seen many changes, including the formation of Wisconsin Electric Power Company in 1921, the reorganization as Wisconsin Energy Corporation in 1987, and the merger of Wisconsin Electric and Wisconsin Gas to form We Energies in 2002. A major milestone was the 2015 acquisition of Integrys Energy Group, which led to the creation of WEC Energy Group.

| Year | Key Event |

|---|---|

| 1896 | The Milwaukee Electric Railway and Light Company (TMER&L) is formed in Milwaukee, Wisconsin. |

| 1919 | Experiments at the East Wells Power Plant demonstrate the efficiency of pulverized coal. |

| 1921 | Wisconsin Electric Power Company is formed, and the Lakeside Power Plant begins operation. |

| 1938 | Milwaukee Electric Railway and Light merges into Wisconsin Electric Power Co. |

| 1946 | Wisconsin Electric becomes an independent company. |

| 1987 | Wisconsin Electric reorganizes as a holding company, Wisconsin Energy Corporation. |

| 2002 | Wisconsin Electric and Wisconsin Gas begin operating as We Energies. |

| 2015 | Wisconsin Energy completes the $9.1 billion acquisition of Integrys Energy Group, forming WEC Energy Group. |

| 2024 | WEC Energy Group reports net income of $1.5 billion, or $4.83 per share, and retires coal units 5-6 at Oak Creek Power Plant. |

| January 2025 | Increases quarterly cash dividend by 6.9% to 89.25 cents per share, marking the 22nd consecutive year of dividend increases. |

| Q1 2025 | Reports net income of $724.2 million, or $2.27 per share, and places the Darien Solar project into service. |

| May 2025 | Chairman Gale Klappa and CEO Scott Lauber highlight exceptional 2024-2025 performance, including launching the largest five-year capital plan. |

| June 2025 | Announces pricing of $775 million of 3.375% Convertible Senior Notes due 2028, with proceeds for general corporate purposes, including short-term debt repayment. |

WEC Energy Group is implementing a $28 billion five-year capital plan for 2025-2029. This includes over $9.1 billion in new renewable investments. The company aims to more than quadruple its carbon-free generation.

The company targets a 60% reduction in carbon dioxide emissions by the end of 2025 and an 80% reduction by the end of 2030. It plans to achieve net carbon neutrality by 2050 and eliminate coal as an energy source by the end of 2032.

WEC Energy Group anticipates 4.5-5% annual electric sales growth by 2027. This growth is partly driven by increasing demand from AI data centers. Analysts predict earnings growth of 7.9% and revenue growth of 5.5% per annum.

The company focuses on enhancing value for customers and stockholders. It emphasizes disciplined capital allocation, operational excellence, and a commitment to a clean energy future. WEC Energy Group is also working towards net-zero methane emissions from its natural gas distribution system by the end of 2030.

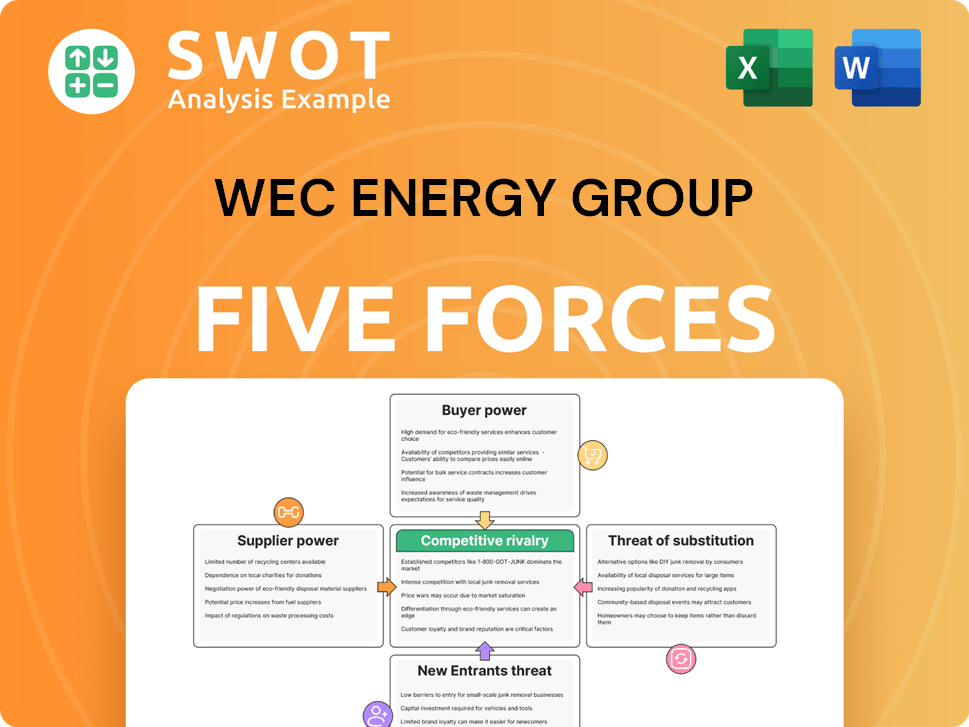

WEC Energy Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of WEC Energy Group Company?

- What is Growth Strategy and Future Prospects of WEC Energy Group Company?

- How Does WEC Energy Group Company Work?

- What is Sales and Marketing Strategy of WEC Energy Group Company?

- What is Brief History of WEC Energy Group Company?

- Who Owns WEC Energy Group Company?

- What is Customer Demographics and Target Market of WEC Energy Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.