WEC Energy Group Bundle

How Does WEC Energy Group Power Your World?

As a leading WEC Energy Group SWOT Analysis reveals, this Midwest utility giant is more than just a provider; it's a cornerstone of the region's infrastructure. With millions of customers across Wisconsin, Illinois, Michigan, and Minnesota, WEC Energy Group plays a crucial role in delivering essential electricity and natural gas services. Understanding the inner workings of this utility company is key for anyone looking to navigate the energy landscape.

This exploration into WEC Energy Group operations will uncover its core services, revenue generation, and strategic direction. From individual investors tracking the WEC Energy Group stock price to customers seeking insights, this analysis provides a comprehensive look at how this energy provider operates. We'll delve into its WEC Energy Group's mission, financial performance, and its position within the evolving energy market.

What Are the Key Operations Driving WEC Energy Group’s Success?

The core operations of WEC Energy Group are centered on delivering electricity and natural gas to its customers. As a leading utility company, it serves residential, commercial, and industrial sectors. The company operates through regulated utility subsidiaries, including Wisconsin Electric Power Company and Wisconsin Gas LLC, ensuring essential energy services.

WEC Energy Group's value proposition lies in providing reliable and efficient energy. It focuses on regulated utility services, which offer stable cash flows. The company's commitment to modernizing infrastructure and integrating renewable energy enhances its market position. Additionally, its environmental stewardship, aiming for net-zero carbon emissions by 2050, aligns with evolving customer and regulatory expectations.

The company generates electricity from various sources, including natural gas, coal, renewables, and hydroelectric power. This electricity is then transmitted and distributed through extensive networks to end-users. For natural gas, the process involves sourcing and distributing gas through pipelines. WEC Energy Group also invests in advanced grid technologies to improve reliability and integrate renewable energy sources. In 2023, the company's consolidated net income was approximately $1.6 billion, demonstrating its financial strength.

WEC Energy Group generates electricity from a diverse mix of sources. These include natural gas, coal, renewables (wind and solar), and hydroelectric power. The company's power plants are strategically located to serve its customer base efficiently.

Natural gas is sourced and distributed through an extensive pipeline network. This network ensures reliable delivery to homes and businesses. The company manages its supply chain to maintain the integrity and safety of its distribution systems.

WEC Energy Group invests in advanced grid technologies. These investments enhance reliability and integrate renewable energy sources. The company focuses on modernizing its infrastructure to meet customer needs.

The company's supply chain involves procuring fuel, equipment, and technology. Partnerships with energy producers and equipment manufacturers are crucial. Distribution networks are localized to ensure direct delivery to customers.

WEC Energy Group's operations are characterized by regulated utility services, ensuring stable cash flows. The company's focus on infrastructure modernization and renewable energy integration enhances its reliability. Its commitment to environmental stewardship, aiming for net-zero carbon emissions by 2050, is a key aspect of its value proposition.

- Regulated Utility Model: Provides stable and predictable cash flows.

- Infrastructure Investment: Modernizes the grid and integrates renewables.

- Environmental Goals: Targets net-zero carbon emissions by 2050.

- Customer Focus: Prioritizes reliable and efficient energy delivery.

WEC Energy Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WEC Energy Group Make Money?

Understanding how WEC Energy Group operates involves examining its revenue streams and monetization strategies. The company primarily generates revenue through its regulated utility operations, which provide a stable and predictable income stream. This approach is crucial for the WEC Energy Group operations and its overall financial health.

The vast majority of WEC Energy Group's revenue comes from the sale and delivery of electricity and natural gas to its residential, commercial, and industrial customers. Charges include energy consumption (kilowatt-hours for electricity and therms or cubic feet for natural gas) as well as fixed service charges. For the fiscal year 2024, WEC Energy Group reported total revenues of approximately $8.9 billion, with regulated utility operations accounting for the predominant share.

Within these regulated operations, revenue is largely determined by approved rates set by state regulatory commissions, such as the Public Service Commission of Wisconsin. These rates allow the company to recover its operating costs, capital investments, and earn a reasonable return on its invested capital. This regulatory framework provides significant revenue stability, which is a key characteristic of a utility company.

Beyond direct energy sales, WEC Energy Group also generates revenue from other sources. These include late payment fees, reconnection fees, and potentially some revenue from non-utility energy infrastructure investments.

- Late Payment and Reconnection Fees: These fees contribute to the company's revenue, although they are a smaller portion compared to energy sales.

- Non-Utility Investments: Revenue from non-utility energy infrastructure investments, though less significant, adds to the overall revenue mix.

The company's monetization strategy is rooted in its ability to provide essential energy services as a regulated monopoly in its service areas. This allows for a consistent customer base and revenue stream, supported by ongoing investments in infrastructure upgrades and maintenance, which are then recovered through approved rates. There are no significant differences in revenue mix by region as the business model is largely consistent across its regulated utility subsidiaries. The focus remains on maximizing efficiency within its regulated operations to optimize its allowed rate of return. To learn more about the company's origins, you can read the Brief History of WEC Energy Group.

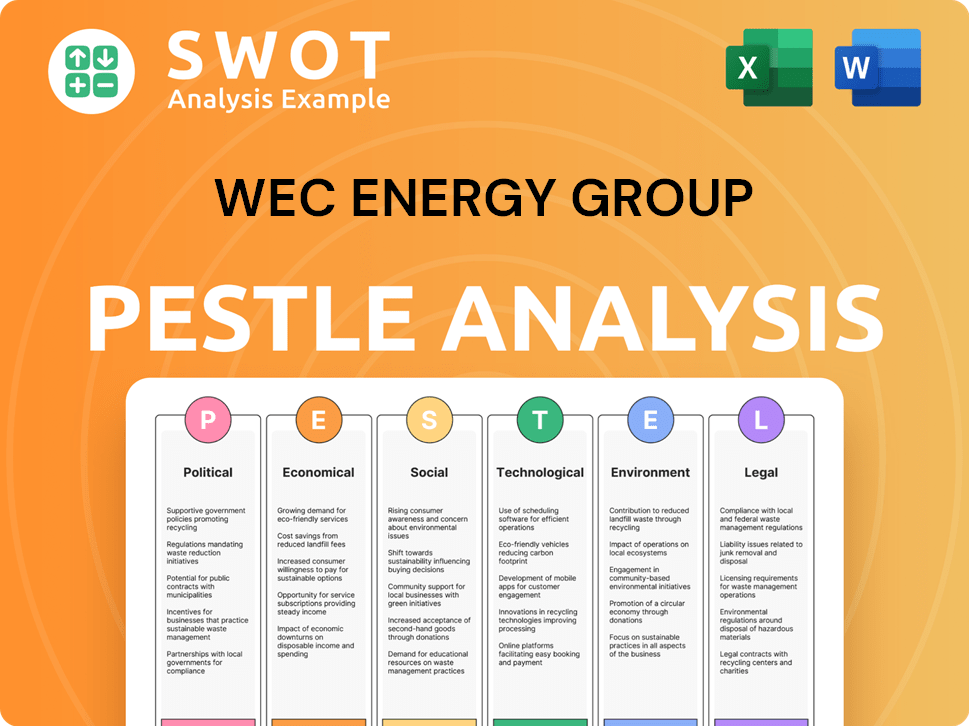

WEC Energy Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped WEC Energy Group’s Business Model?

WEC Energy Group, a prominent utility company, has undergone significant transformations, marked by key milestones and strategic shifts. The company's evolution reflects its commitment to adapting to the changing energy landscape, particularly in the context of transitioning towards cleaner energy sources. These strategic moves have been crucial in shaping its operational framework and financial outcomes.

A key strategic move has been the substantial investment in renewable energy. This commitment is a response to industry trends and regulatory changes. The company's focus on environmental responsibility and sustainability has become a core element of its business strategy, influencing its investments and operational decisions.

The company faces operational and market challenges, including managing the transition away from fossil fuels while ensuring grid reliability and affordability for customers. Regulatory hurdles and the need to secure approvals for new projects are ongoing challenges. WEC Energy Group's response has been to diversify its energy mix, invest in modernizing its infrastructure, and focus on operational efficiencies.

WEC Energy Group's history includes significant milestones, such as acquisitions and infrastructure projects. These moves have expanded its service territory and enhanced its operational capabilities. The company has consistently adapted to industry changes, including technological advancements and evolving regulatory environments.

Strategic moves include substantial investments in renewable energy projects and modernizing its infrastructure. The company plans to invest approximately $5.4 billion in its capital plan from 2025-2029, with a significant portion allocated to cleaner energy projects. This reflects a commitment to sustainability and long-term growth.

WEC Energy Group's competitive advantages stem from its position as a regulated utility, providing a stable customer base and predictable revenue. Brand strength and customer loyalty are also significant. Economies of scale and a focus on environmental responsibility enhance its long-term viability and appeal.

Challenges include managing the transition from fossil fuels and ensuring grid reliability. The company's responses involve diversifying its energy mix and investing in modern infrastructure. Regulatory hurdles and securing project approvals remain ongoing challenges.

WEC Energy Group's financial performance is influenced by its strategic initiatives and operational efficiency. The company's commitment to renewable energy projects and infrastructure modernization is expected to drive future growth. The company's focus on environmental responsibility and adaptation to new trends, such as distributed energy resources, supports its long-term business model.

- The company's regulated utility status provides a stable revenue stream.

- Investments in renewable energy and smart grid technologies are key.

- Strategic focus on environmental responsibility enhances long-term viability.

- For a deeper understanding of how the company stacks up, explore the Competitors Landscape of WEC Energy Group.

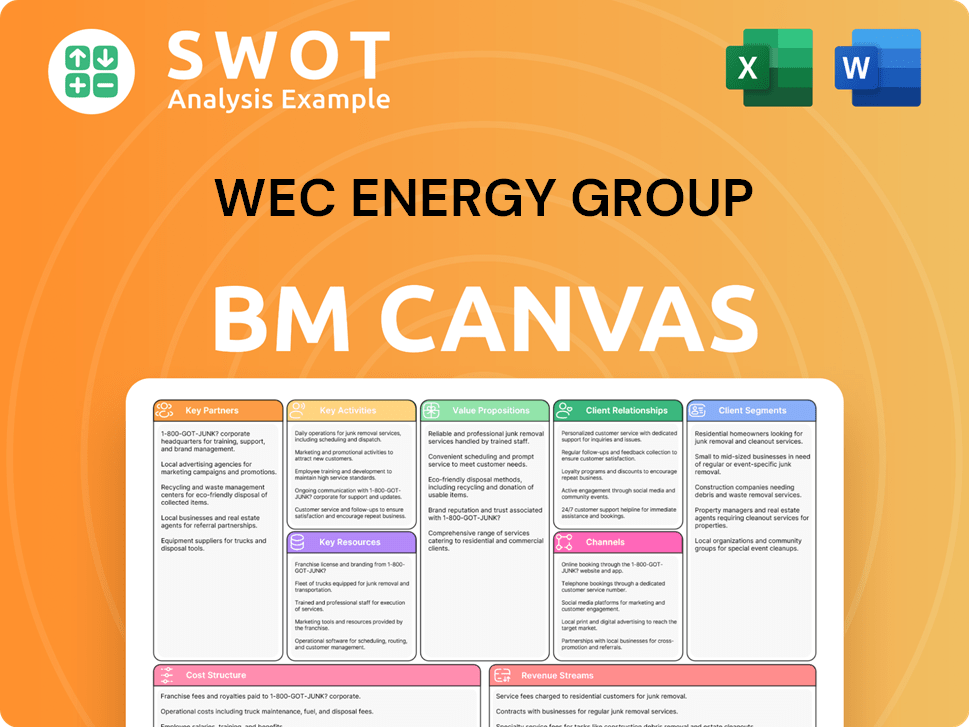

WEC Energy Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is WEC Energy Group Positioning Itself for Continued Success?

The company holds a strong market position within the regulated utility sector, particularly in the Midwest. As a regulated monopoly, it faces limited direct competition within its service territories, which include Wisconsin, Illinois, Michigan, and Minnesota. The company's market share is defined by its geographic reach and customer base, which, as of early 2025, exceeds 4.7 million electric and natural gas customers. Customer loyalty is typically high due to the essential nature of the services provided.

However, the company faces several risks. Regulatory changes, especially concerning environmental regulations and rate-setting, can significantly impact its operations and revenue. The shift towards cleaner energy sources requires substantial capital investment, and recovering these costs through approved rates is crucial. Technological advancements in distributed generation and energy storage, changing consumer preferences for renewable energy, and economic downturns in its service territories also pose challenges.

As a regulated utility, the company benefits from a stable customer base and limited competition. Its service area includes key Midwestern states, providing a large customer base. The company's operations are heavily influenced by regulatory frameworks and the essential nature of its services.

Regulatory changes and environmental regulations are key risks. The need for substantial capital investments in cleaner energy and technological disruptions, such as distributed generation, pose challenges. Economic downturns and changing consumer preferences also impact the company.

The company is focused on modernizing infrastructure and integrating renewable energy sources. Its capital plan includes significant investments in cleaner energy projects, supporting sustainability goals. The company aims to maintain operational excellence and prudent financial management.

The company plans to invest in its regulated asset base for predictable returns. Strategic expansion of its renewable energy portfolio aligns with environmental goals and long-term growth opportunities in the evolving energy landscape. This approach is detailed further in an article about the Target Market of WEC Energy Group.

The company's strategy centers on infrastructure modernization and renewable energy integration. The capital plan for 2025-2029 emphasizes cleaner energy projects. Leadership focuses on operational excellence and financial management.

- Investment in cleaner energy sources.

- Enhancing grid reliability.

- Focus on customer satisfaction.

- Prudent financial management.

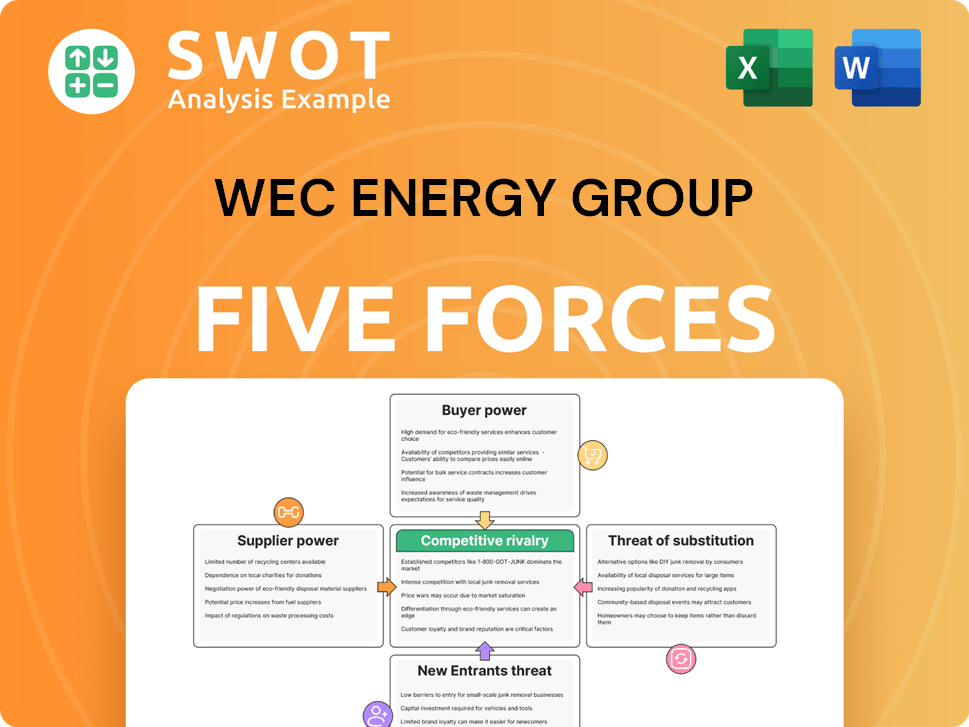

WEC Energy Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WEC Energy Group Company?

- What is Competitive Landscape of WEC Energy Group Company?

- What is Growth Strategy and Future Prospects of WEC Energy Group Company?

- What is Sales and Marketing Strategy of WEC Energy Group Company?

- What is Brief History of WEC Energy Group Company?

- Who Owns WEC Energy Group Company?

- What is Customer Demographics and Target Market of WEC Energy Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.