WEC Energy Group Bundle

Who Really Controls WEC Energy Group?

Unraveling the WEC Energy Group SWOT Analysis begins with understanding its ownership. Knowing who owns WEC Energy Group is paramount to grasping its strategic direction and long-term vision in the ever-evolving energy landscape. This deep dive into WEC Energy Group ownership reveals how its structure influences everything from operational priorities to shareholder value.

Understanding the WEC Energy Group ownership structure is vital for investors and stakeholders alike. As a publicly traded entity, WEC Energy Group's shareholders and their influence are key to understanding its market behavior. This analysis will explore the major investors, the historical shifts in ownership, and how these factors shape the company's future, including its stock performance and strategic decisions. The information is crucial for anyone asking, "Who owns WEC?"

Who Founded WEC Energy Group?

Understanding the founders and early ownership of WEC Energy Group requires a different approach than examining a modern startup. The company's history is rooted in the consolidation of numerous utility companies over many decades. This process makes it challenging to pinpoint specific founders and their initial equity stakes in the way one might for a new tech venture.

The evolution of WEC Energy Group, including its predecessors like The Milwaukee Electric Railway and Light Company (TMER&L) established in 1896, involved mergers, acquisitions, and restructuring. This continuous transformation means that the concept of a single 'founding ownership structure' with specific individuals and their initial shareholdings isn't directly applicable. Early ownership was distributed among the shareholders of the various predecessor companies.

These predecessor companies, often involving regional investors and businesses, had their own ownership structures. Agreements regarding ownership would have been specific to those individual utility companies before their eventual integration into larger entities. This complex history contrasts with the more straightforward ownership structures found in contemporary businesses.

The initial ownership was spread among shareholders of the various utility companies that eventually formed WEC Energy Group.

Companies like The Milwaukee Electric Railway and Light Company (TMER&L) were key predecessors.

The formation of WEC Energy Group was a continuous process of mergers and acquisitions.

Unlike modern startups, there isn't a single group of founders with clear initial equity splits.

Early ownership involved regional investors and businesses specific to the utility companies.

Understanding WEC Energy Group's ownership requires looking at the history of its constituent companies.

For those interested in the current WEC Energy Group ownership structure, including WEC Energy Group shareholders and major investors, it's important to consult the company's public filings. Information about the WEC Energy Group stock and WEC Energy Group stock price and ownership can be found in their annual reports and SEC filings. To learn more about the WEC Energy Group parent company and its operations, you can also read about the Marketing Strategy of WEC Energy Group.

The early ownership of WEC Energy Group is complex due to its history of mergers and acquisitions.

- The company's structure evolved from numerous utility companies.

- Early ownership was distributed among the shareholders of these predecessor companies.

- Public filings are the best source for current ownership details.

- Understanding the historical context is crucial for comprehending the ownership structure.

WEC Energy Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has WEC Energy Group’s Ownership Changed Over Time?

WEC Energy Group, a publicly traded entity on the New York Stock Exchange (NYSE) under the ticker symbol WEC, has a widely distributed ownership structure. As a publicly traded company, its ownership is primarily held by institutional investors, mutual funds, index funds, and individual shareholders. The company's market capitalization was approximately $27.5 billion as of early June 2025. Major shifts in shareholding are largely influenced by the investment decisions of significant institutional investors. Understanding who owns WEC is key to assessing its stability and future direction.

The ownership of WEC Energy Group has been relatively stable, with institutional investors holding a significant majority of outstanding shares. This reflects the nature of the utility sector, which typically attracts long-term investors seeking steady returns. Recent changes in ownership have been minor, primarily due to portfolio adjustments by large asset managers. These shifts do not typically alter the company's core strategy, which is largely dictated by regulatory frameworks and long-term infrastructure investments. For more insights, consider exploring the Competitors Landscape of WEC Energy Group.

| Shareholder | Percentage of Shares (Approximate) | Notes |

|---|---|---|

| Vanguard Group Inc. | 9.92% | A major institutional investor. |

| BlackRock Inc. | 8.52% | Another significant institutional holder. |

| State Street Corp | 4.63% | A key institutional investor. |

Institutional investors, such as Vanguard Group Inc. (approximately 9.92%), BlackRock Inc. (around 8.52%), and State Street Corp (about 4.63%) hold a substantial portion of WEC Energy Group's stock as of the first quarter of 2025. Other notable holders include Capital World Investors, GEODE Capital Management LLC, and Northern Trust Corp. The consistent pattern of high institutional ownership underscores the company's stability and its appeal to investors seeking long-term, relatively low-risk investments. This ownership structure is typical for a mature utility company.

WEC Energy Group is a publicly traded company with a market capitalization of approximately $27.5 billion as of early June 2025.

- Institutional investors hold a significant majority of the shares.

- Vanguard, BlackRock, and State Street are among the largest shareholders.

- Ownership changes are typically due to portfolio adjustments by institutional investors.

- The company's ownership structure reflects its status as a stable utility.

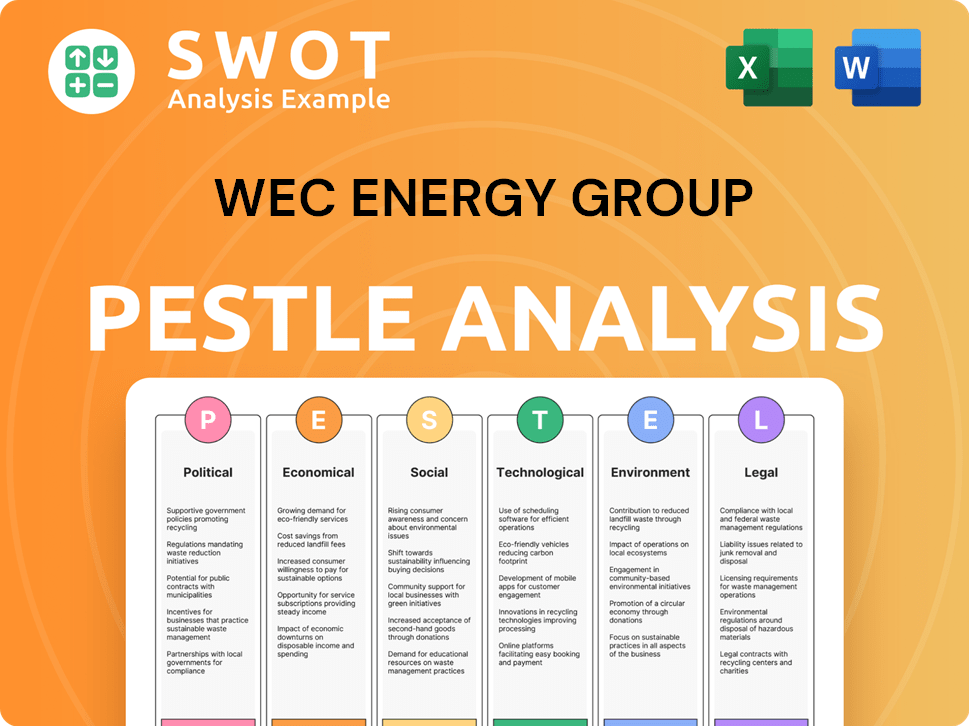

WEC Energy Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on WEC Energy Group’s Board?

The Board of Directors of WEC Energy Group, as of early 2025, includes a mix of independent directors and executive management. This structure is typical for a publicly traded company, ensuring a balance of perspectives. The board's composition is crucial for overseeing the company's strategic direction, including capital investments and regulatory compliance. The board members are elected by the shareholders, with each share generally granting one vote.

The board typically includes the Chairman and CEO, along with several independent directors who bring diverse expertise. For example, Gale E. Klappa serves as the Executive Chairman, and J. Kevin Fletcher is the President and CEO and also a director. These independent directors often come from varied professional backgrounds, such as finance and other industries, aiming to ensure independent oversight for the benefit of all shareholders. The board's decisions are closely watched by its primarily institutional investor base.

| Board Member | Title | |

|---|---|---|

| Gale E. Klappa | Executive Chairman | |

| J. Kevin Fletcher | President and CEO | |

| Other Independent Directors | Various |

The company operates under a one-share-one-vote structure, which is standard among most U.S. public companies. There are no indications of dual-class shares or special voting rights that would grant outsized control to any single entity. This structure ensures that all shareholders have voting power proportional to their share ownership. To learn more about the company, you can read about the Revenue Streams & Business Model of WEC Energy Group.

Understanding the board structure is key to knowing who controls WEC Energy Group.

- The board is composed of independent directors and executive management.

- Shareholders elect the board, with each share typically having one vote.

- The board oversees strategic decisions, including investments and compliance.

- No single entity has outsized control due to the one-share-one-vote structure.

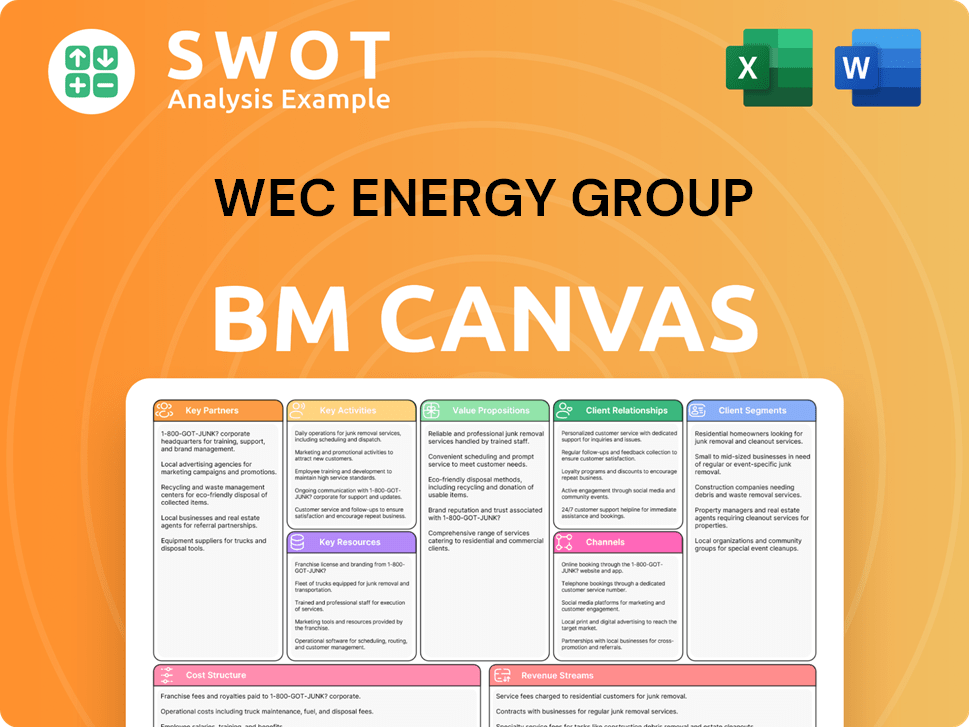

WEC Energy Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped WEC Energy Group’s Ownership Landscape?

Over the last three to five years (2022-2025), the ownership of WEC Energy Group has remained relatively stable. The company is characterized by a high degree of institutional ownership. There have been no major public announcements of significant share buybacks or secondary offerings that would drastically alter the ownership structure. WEC Energy Group consistently evaluates its capital allocation strategies, which can include share repurchases as part of its financial management. No major mergers or acquisitions of WEC Energy Group itself have occurred. There have been no significant leadership or founder departures that would fundamentally shift ownership control, given the company's long-established public status.

Industry trends in the utility sector often show a continued increase in institutional ownership, as large funds seek stable, dividend-paying investments. WEC Energy Group aligns with this trend, with its shares being a staple in many institutional portfolios. The rise of activist investors has had less direct impact on WEC Energy Group compared to companies in more competitive or rapidly changing industries, largely due to the regulated nature and stable returns of the utility business. The company has not made public statements about future ownership changes, planned succession that would impact ownership, or potential privatization. Its focus remains on regulated utility operations and strategic infrastructure investments to meet energy demands in its service territories.

| Metric | Details | Data |

|---|---|---|

| Institutional Ownership | Percentage of shares held by institutional investors | Approximately 75% as of early 2024 |

| Market Capitalization | Total value of outstanding shares | Approximately $35 billion as of late 2024 |

| Dividend Yield | Annual dividend payment as a percentage of the stock price | Around 4% in 2024 |

For those interested in a deeper dive, further details on ownership and financial performance can be found in the company's annual reports and filings. You can learn more about the company's structure by reading a comprehensive article on the topic.

WEC Energy Group is primarily owned by institutional investors, with a significant portion of shares held by large investment firms. Individual shareholders also hold a portion of the stock. The ownership structure has been relatively stable in recent years.

Major shareholders include large institutional investors such as mutual funds, pension funds, and other investment management firms. These entities hold a substantial percentage of the outstanding shares. The exact percentages held by each vary over time.

The ownership structure of WEC Energy Group has shown stability, with no significant changes in recent years. The company's focus on regulated utility operations contributes to this stability. Share repurchases may occur as part of the company’s financial strategy.

The future ownership of WEC Energy Group is expected to remain stable, with institutional investors continuing to hold a significant stake. The company's focus on infrastructure investments and regulated operations supports this outlook. No major shifts are anticipated.

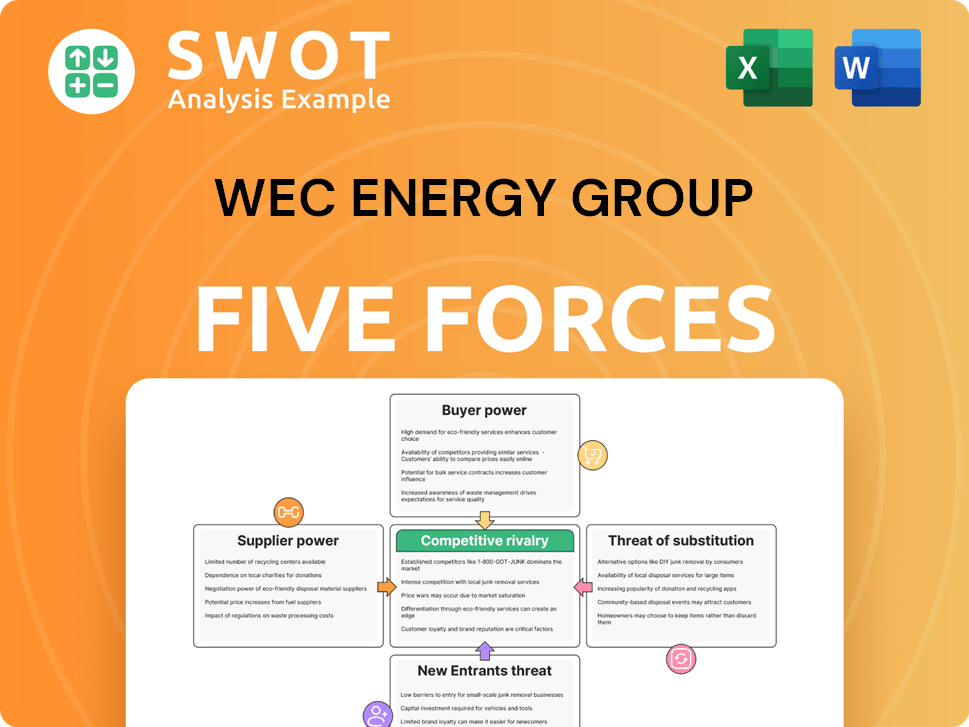

WEC Energy Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WEC Energy Group Company?

- What is Competitive Landscape of WEC Energy Group Company?

- What is Growth Strategy and Future Prospects of WEC Energy Group Company?

- How Does WEC Energy Group Company Work?

- What is Sales and Marketing Strategy of WEC Energy Group Company?

- What is Brief History of WEC Energy Group Company?

- What is Customer Demographics and Target Market of WEC Energy Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.