WEC Energy Group Bundle

How Does WEC Energy Group Stack Up in the Energy Arena?

The utility sector is experiencing a seismic shift, fueled by the push for sustainability and technological leaps. This dynamic environment presents both challenges and opportunities for established players like WEC Energy Group. Understanding the competitive landscape is crucial for investors, analysts, and anyone seeking to navigate the evolving energy market.

This analysis dives deep into WEC Energy Group's position, examining its market share and industry rivals within the utility sector. We'll explore WEC Energy Group's competitive advantages and dissect its strategic initiatives. For a detailed look at its strengths and weaknesses, consider our WEC Energy Group SWOT Analysis to gain a comprehensive understanding of this energy company analysis and its future outlook.

Where Does WEC Energy Group’ Stand in the Current Market?

WEC Energy Group's core operations center on the generation, transmission, and distribution of electricity and the distribution of natural gas. The company's value proposition lies in providing reliable and affordable energy to its customers, primarily within regulated service territories. This focus on regulated utilities provides a stable foundation for the energy company analysis, offering predictable revenue streams and a degree of insulation from market volatility.

The company's strategic emphasis on cleaner energy sources, including significant investments in renewable energy projects, reflects a commitment to sustainability. This approach is increasingly important to customers and aligns with the broader industry trends. The company's commitment to a diversified energy portfolio, including both traditional and renewable sources, is a key aspect of its WEC Energy Group market position analysis.

WEC Energy Group's financial health, as reflected in its Q1 2025 earnings, demonstrates its robust positioning within the utility sector. The company's consistent performance underscores its ability to navigate the complexities of the energy market. The company's operational and financial standing within the industry is stable.

WEC Energy Group holds a dominant market share in Wisconsin, serving approximately 1.1 million electric and 1.1 million natural gas customers through its We Energies subsidiary. Its presence extends into Illinois, Michigan, and Minnesota. The regulated nature of the utility sector influences the company's market share.

As of Q1 2025, WEC Energy Group reported solid financial results, with earnings per share aligning with expectations. This financial stability allows for continued investment in infrastructure and renewable energy initiatives. This financial performance is a key indicator in the WEC Energy Group financial performance review.

WEC Energy Group is actively investing in renewable energy projects to diversify its portfolio and reduce its carbon footprint. The company's strategic shift towards cleaner energy sources is a key element of its long-term growth strategy. These initiatives are part of the WEC Energy Group's growth strategies.

The company benefits from its regulated utility model, providing stable revenue and a degree of protection from market fluctuations. Its scale, financial strength, and strategic investments in renewable energy give it a competitive edge. Further insights can be found in the Target Market of WEC Energy Group.

WEC Energy Group's strengths include its dominant position in Wisconsin, financial stability, and strategic investments in renewable energy. Potential weaknesses could include regulatory risks and the capital-intensive nature of the utility business. Understanding these factors is crucial for any energy company analysis.

- Dominant market share in Wisconsin.

- Strong financial performance and stability.

- Strategic investments in renewable energy.

- Exposure to regulatory risks.

WEC Energy Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging WEC Energy Group?

In the regulated utility sector, the competitive landscape for WEC Energy Group is shaped by service area boundaries and regulatory frameworks. Direct competition is less about head-to-head battles and more about strategic positioning, operational efficiency, and the ability to adapt to evolving energy market dynamics. This includes attracting investment, securing favorable regulatory outcomes, and efficiently managing infrastructure.

WEC Energy Group's ability to maintain and grow its market position depends on its responses to these competitive pressures. This includes investments in grid modernization, renewable energy projects, and customer service enhancements. The company's financial performance and strategic initiatives are also key factors in its competitive standing.

ComEd, a subsidiary of Exelon Corporation, serves northern Illinois, including Chicago. It operates under similar regulatory environments and competes for capital and talent in the broader Midwest energy market. ComEd focuses on electricity transmission and distribution.

Xcel Energy serves parts of Minnesota and Wisconsin, with a strong focus on renewable energy. Its operations in Minnesota and Wisconsin create a regional competitive dynamic. Xcel Energy has ambitious clean energy goals, posing a competitive benchmark.

DTE Energy, based in Michigan, provides electricity and natural gas. Its strategic moves in grid modernization and clean energy can influence the competitive landscape. DTE Energy operates in a neighboring state.

Indirect competition comes from independent power producers (IPPs) and distributed energy resources (DERs). DERs, like rooftop solar, can reduce demand for grid-supplied power. Decarbonization and electrification also present competition in attracting investments.

WEC Energy Group focuses on grid modernization, renewable energy projects, and customer service. These initiatives are key to maintaining and growing its market position. The company's financial performance and strategic initiatives are also key factors in its competitive standing.

Evolving energy market dynamics include the shift towards decarbonization and electrification. These shifts influence investment and innovation. The company's responses to these competitive pressures are key.

The competitive landscape for WEC Energy Group involves both direct and indirect competition. Key factors include regulatory environments, infrastructure development, and clean energy initiatives. Understanding these factors is crucial for energy company analysis.

- Regulatory Environment: Compliance and strategic navigation of state and federal regulations.

- Infrastructure Development: Investments in grid modernization and expansion to meet growing energy demands.

- Clean Energy Initiatives: Development and integration of renewable energy sources to meet sustainability goals.

- Customer Service: Enhancing customer experience through digital tools and responsive support.

- Financial Performance: Maintaining strong financial health to fund strategic investments and provide returns.

For more insights into the company's history and development, you can refer to the Brief History of WEC Energy Group.

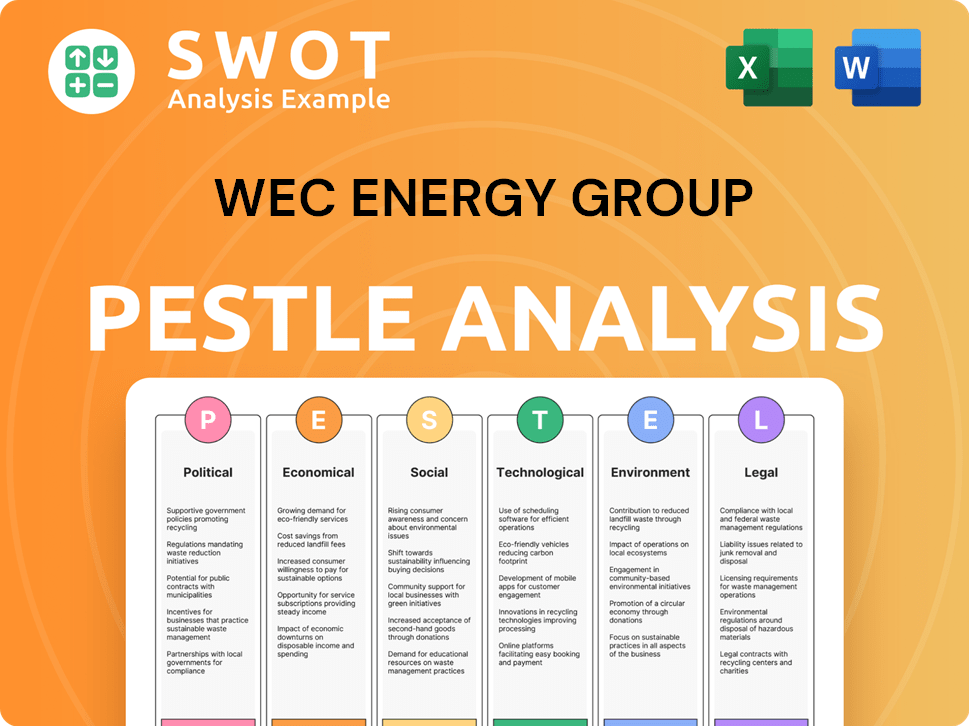

WEC Energy Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives WEC Energy Group a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of WEC Energy Group involves analyzing its key strengths and strategic positioning within the utility sector. The company's success is built upon a foundation of regulated utility operations, substantial infrastructure investments, and a commitment to operational excellence. This approach has allowed WEC Energy Group to establish a strong foothold in its service territories and maintain a competitive edge.

WEC Energy Group's strategic moves, including significant investments in infrastructure and renewable energy sources, are critical to its long-term success. These initiatives are designed to modernize the grid, enhance service reliability, and align with the evolving demands of the energy market. The company's focus on operational efficiency and customer relationships further strengthens its market position.

The competitive edge of WEC Energy Group is defined by its ability to provide reliable and sustainable energy solutions. The company's diversified energy portfolio and strategic investments in renewable energy, such as plans to add 3,300 megawatts of new solar, wind, and battery storage by the end of 2028, are key differentiators. This focus on innovation and customer satisfaction helps WEC Energy Group navigate the challenges of the utility sector.

WEC Energy Group benefits from predictable cash flows due to its regulated utility status. State regulatory commissions approve the company's rates of return, providing financial stability. This regulatory framework ensures consistent revenue generation and supports long-term investment strategies.

The company's vast network of power plants, transmission lines, and distribution networks creates a high barrier to entry. WEC Energy Group's ongoing capital investment plan, projected at approximately $23.7 billion through 2028, reinforces this advantage. This investment modernizes the grid and integrates cleaner energy sources, supporting reliable service delivery.

WEC Energy Group generates electricity from a mix of sources, including natural gas, coal, and renewables. This diversification enhances reliability and mitigates risks from fuel price fluctuations. The company is strategically investing in renewable energy to meet future energy demands.

Operational efficiency and experience contribute to WEC Energy Group's competitive edge. The company's experienced workforce efficiently manages assets and maintains high service reliability. Strong customer relationships built over decades contribute to customer loyalty and trust.

WEC Energy Group's competitive advantages include its regulated revenue streams, extensive infrastructure, diversified energy portfolio, and operational efficiency. These factors contribute to its strong market position and ability to provide reliable energy services. For more insights, explore the Marketing Strategy of WEC Energy Group.

- Stable Revenue: Regulated utility model ensures predictable cash flows.

- Infrastructure: Extensive network provides a high barrier to entry.

- Diversification: Mix of fuel sources enhances reliability.

- Efficiency: Experienced workforce optimizes operations.

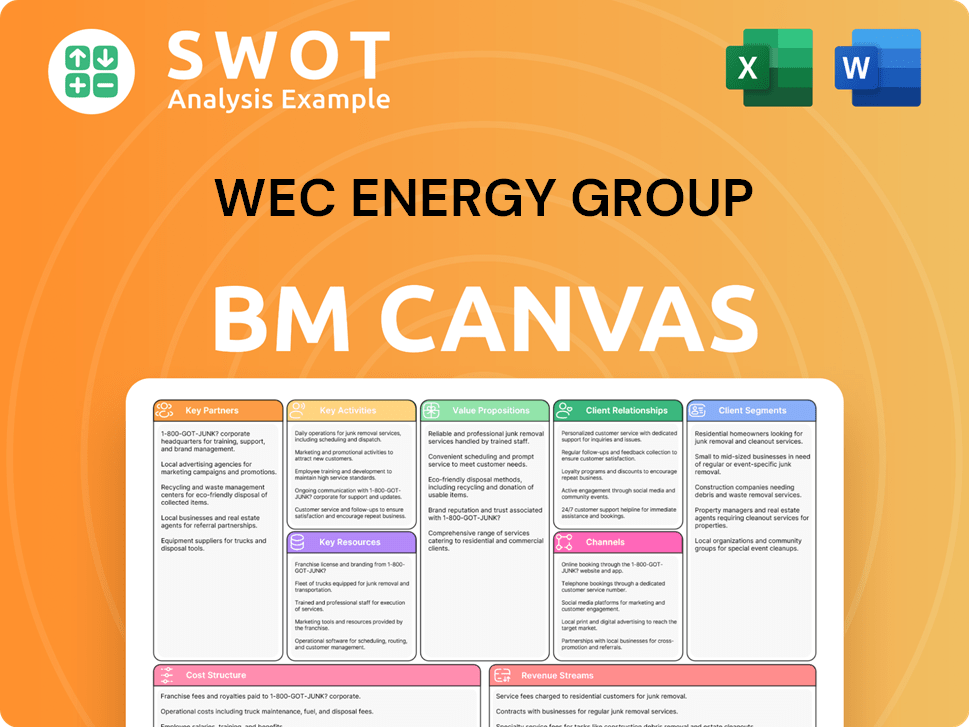

WEC Energy Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping WEC Energy Group’s Competitive Landscape?

The WEC Energy Group, a prominent player in the utility sector, faces a dynamic competitive landscape. The company's market position is shaped by its strategic initiatives and ability to navigate industry trends. An in-depth energy company analysis is crucial to understand its strengths, weaknesses, and future outlook.

WEC Energy Group's risks include regulatory changes and the need for significant capital investments. The future outlook for the company depends on its ability to adapt to evolving consumer preferences and technological advancements. Analyzing the competitive landscape reveals key industry rivals and their impact on WEC Energy Group's market share.

The energy industry is undergoing a significant transformation, driven by the transition to clean energy and grid modernization. Regulatory changes and the adoption of distributed energy resources are also key trends. These trends present both challenges and opportunities for WEC Energy Group.

Challenges include managing the intermittency of renewable energy sources, rising infrastructure costs, and the impact of distributed energy resources. Adapting to these challenges is vital for maintaining competitiveness and ensuring grid stability. The company must also navigate evolving regulatory landscapes.

Opportunities exist in the growth of electric vehicles, energy storage technologies, and renewable natural gas. Leveraging expertise in natural gas distribution and exploring new revenue streams are key. WEC Energy Group can capitalize on these opportunities to enhance its market position.

WEC Energy Group is focusing on smart capital deployment, operational efficiency, and a diversified energy portfolio. These strategic initiatives aim to build a cleaner, more resilient, and digitally advanced utility. This approach is key to long-term success.

WEC Energy Group is actively working towards a 60% reduction in carbon emissions from 2005 levels by 2030 and an 80% reduction by 2050. The company plans to build 3,300 megawatts of new solar, wind, and battery storage by 2028. For more details on their strategic approach, see the Growth Strategy of WEC Energy Group. The company's commitment to these initiatives demonstrates its proactive approach to the evolving utility sector.

Understanding the competitive landscape involves analyzing the key industry rivals and their strategies. WEC Energy Group's financial performance review and strategic initiatives provide insights into its market position. The company's response to market challenges will shape its future outlook.

- The transition to clean energy and the integration of renewable sources.

- Grid modernization and the adoption of smart grid technologies.

- Evolving regulatory landscapes and their impact on operations.

- The growth of electric vehicles and the development of energy storage.

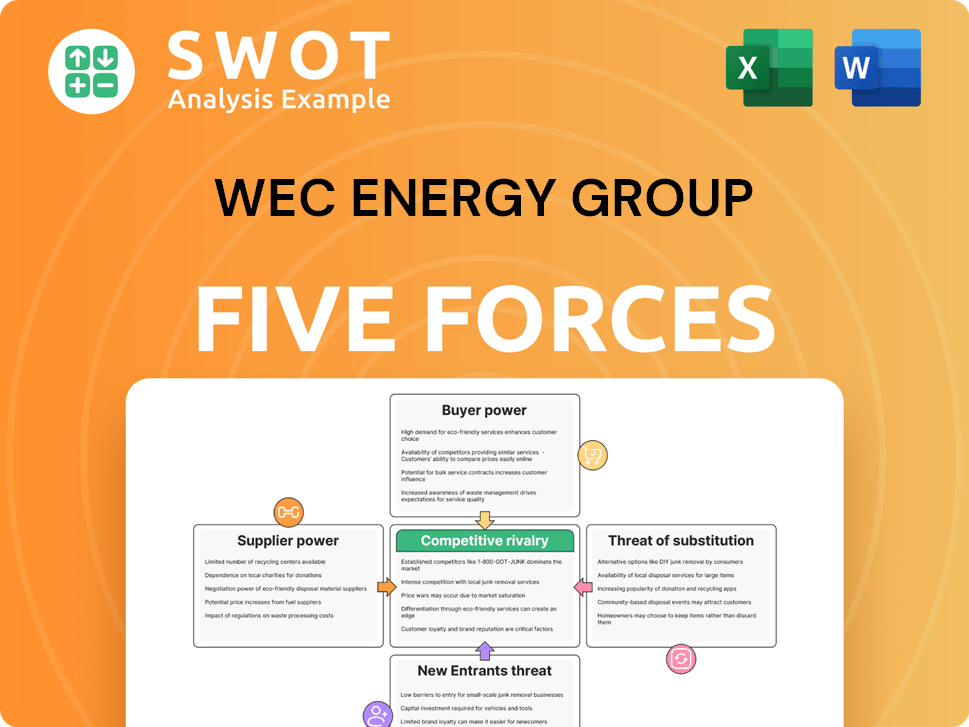

WEC Energy Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WEC Energy Group Company?

- What is Growth Strategy and Future Prospects of WEC Energy Group Company?

- How Does WEC Energy Group Company Work?

- What is Sales and Marketing Strategy of WEC Energy Group Company?

- What is Brief History of WEC Energy Group Company?

- Who Owns WEC Energy Group Company?

- What is Customer Demographics and Target Market of WEC Energy Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.