Wilmar International Bundle

How did Wilmar International rise to become a global agribusiness giant?

From a small Singapore-based startup to a global powerhouse, Wilmar International's story is one of strategic vision and relentless execution. Founded in 1991, the company revolutionized the palm oil industry through vertical integration, a move that set the stage for its remarkable expansion. Today, Wilmar's influence extends far beyond its palm oil roots, impacting markets worldwide.

This Wilmar International SWOT Analysis provides an in-depth look at the company's journey, from its early days in Singapore to its current status as a leading agribusiness conglomerate. Explore the brief history of Wilmar International company, tracing its evolution and understanding the key decisions that shaped its trajectory. Delve into the Wilmar company profile to uncover the strategies that propelled its growth and its impact on the global market.

What is the Wilmar International Founding Story?

The founding of Wilmar International marked the beginning of a significant player in the global agribusiness sector. The brief history of Wilmar International company starts on April 1, 1991, when Martua Sitorus and Kuok Khoon Hong joined forces to establish the company. Their vision was to create a fully integrated agribusiness that could manage the entire value chain.

Kuok Khoon Hong, with experience in commodities trading, and Martua Sitorus, who had expertise in palm oil cultivation, combined their skills. The company's initial focus was on integrating various aspects of palm oil production. This strategic approach aimed to reduce inefficiencies and costs within the industry.

Wilmar's early business model centered on integrating cultivation, milling, refining, and distribution. Initial funding came from the founders and their associates. The name 'Wilmar' is a combination of the founders' names, highlighting their collaborative effort. The company's establishment benefited from the economic growth in Southeast Asia during the 1990s.

Wilmar International was founded on April 1, 1991, by Martua Sitorus and Kuok Khoon Hong.

- Kuok Khoon Hong, a nephew of Robert Kuok, brought commodities trading experience.

- Martua Sitorus contributed expertise in palm oil cultivation and processing.

- The goal was to create an integrated agribusiness, controlling the value chain.

- The initial problem addressed was the fragmented palm oil industry.

The company's headquarters are located in Singapore. Wilmar International's early product offerings primarily revolved around refined palm oil and its derivatives. The company's strategic integration of operations, from plantations to consumer products, set it apart. Wilmar's early success was also fueled by the growing demand for edible oils in the rapidly developing economies of Southeast Asia. The founders' initial investment and support from their networks provided the necessary capital. The company's strategic approach to integrating its operations, from plantation to consumer products, helped it establish a strong market position.

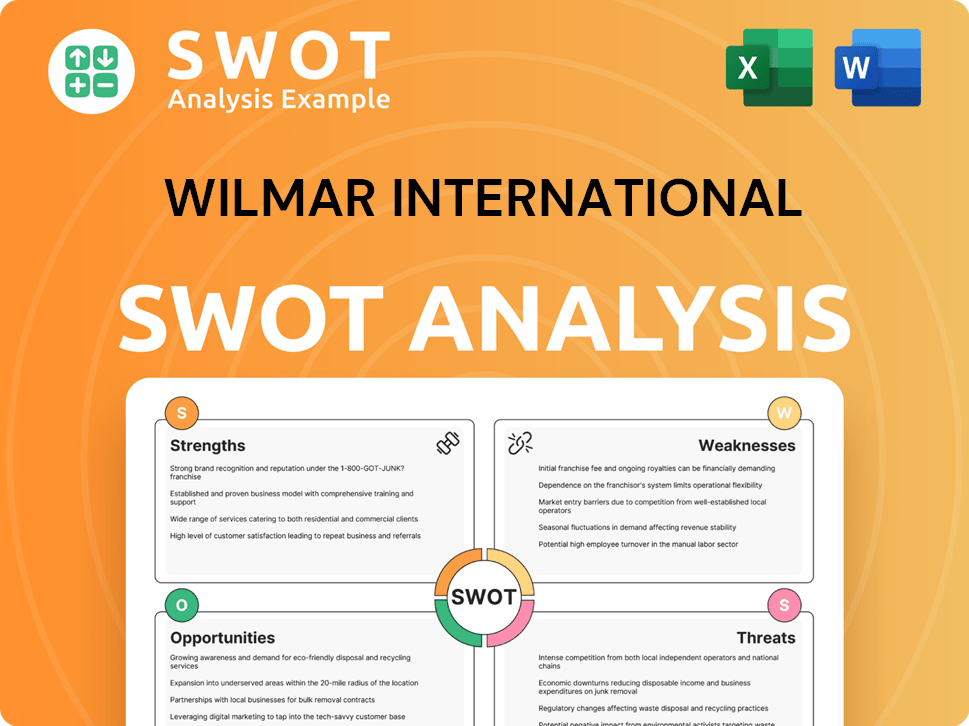

Wilmar International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Wilmar International?

The early growth of Wilmar International, a prominent player in the agribusiness sector, was marked by swift expansion and strategic integration within the palm oil industry. Following its establishment in 1991, the

The initial team expansion at

A significant driver of early growth was

Market reception to

Pivotal decisions during this time included aggressive investment in plantation development and the expansion of refining capacities, solidifying its position as a major player in the palm oil industry.

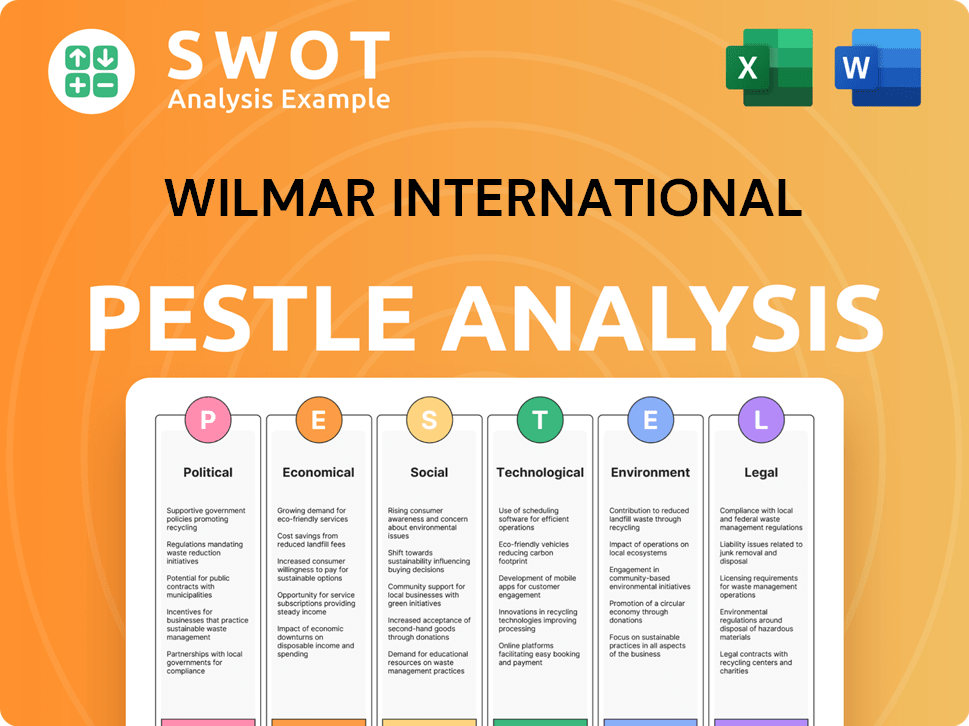

Wilmar International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Wilmar International history?

The Wilmar International journey, a significant part of Wilmar history, is marked by substantial achievements in the agribusiness sector. The Wilmar company has evolved significantly since its inception, achieving global recognition and influence.

| Year | Milestone |

|---|---|

| 1991 | Founded in Singapore, marking the beginning of its journey in the agribusiness sector. |

| 2000 | Listed on the Singapore Exchange, which was a pivotal moment in its corporate growth. |

| 2007 | Acquired a significant stake in the Indonesian plantation company, further expanding its palm oil operations. |

| 2013 | Committed to a No Deforestation, No Peat, No Exploitation (NDPE) policy, demonstrating its commitment to sustainability. |

| 2020 | Achieved record revenue, reflecting its strong market position and operational efficiency. |

Wilmar International has consistently demonstrated innovation in its operations. A key innovation is its fully integrated agribusiness model, which covers the whole value chain. This approach has enhanced efficiency and control over its products, setting a benchmark in the industry.

This model integrates all aspects of the business, from cultivation to distribution. It includes oil palm plantations, oilseed crushing plants, and consumer product manufacturing, enhancing efficiency.

Wilmar International has invested heavily in sustainable practices. This includes obtaining certifications for sustainable palm oil production, reflecting a commitment to environmental responsibility.

Continuous investment in technology and research for sustainable practices has been a focus. This includes advancements in traceability and efficient processing methods.

The company has restructured its supply chains for greater traceability and transparency. This helps in managing risks and meeting stakeholder demands.

Wilmar International actively engages in multi-stakeholder dialogues to address environmental and social concerns. This collaborative approach strengthens its sustainability efforts.

Expanding its portfolio beyond palm oil, with investments in sugar, grains, and consumer products. This diversification strategy helps in mitigating risks.

Despite its successes, Wilmar International has faced significant challenges. Navigating volatile commodity prices and managing complex supply chains across diverse geographies have been ongoing issues. The company has also had to address environmental concerns related to palm oil cultivation.

Fluctuations in commodity prices impact profitability and require effective risk management strategies. This includes hedging and diversification.

Increasing scrutiny over environmental practices related to palm oil cultivation has led to the need for sustainable practices. This includes the NDPE policy and transparency.

Managing complex supply chains across diverse geographies poses logistical and operational challenges. This requires robust tracking and compliance systems.

Addressing criticisms and campaigns from environmental organizations regarding deforestation and land use. This requires continuous improvement in sustainability practices.

Responding to increasing demands from consumers, investors, and regulators for sustainable practices. This involves transparent reporting and stakeholder engagement.

Navigating geopolitical risks and trade tensions that can disrupt supply chains and impact operations. This requires a diversified and resilient business model.

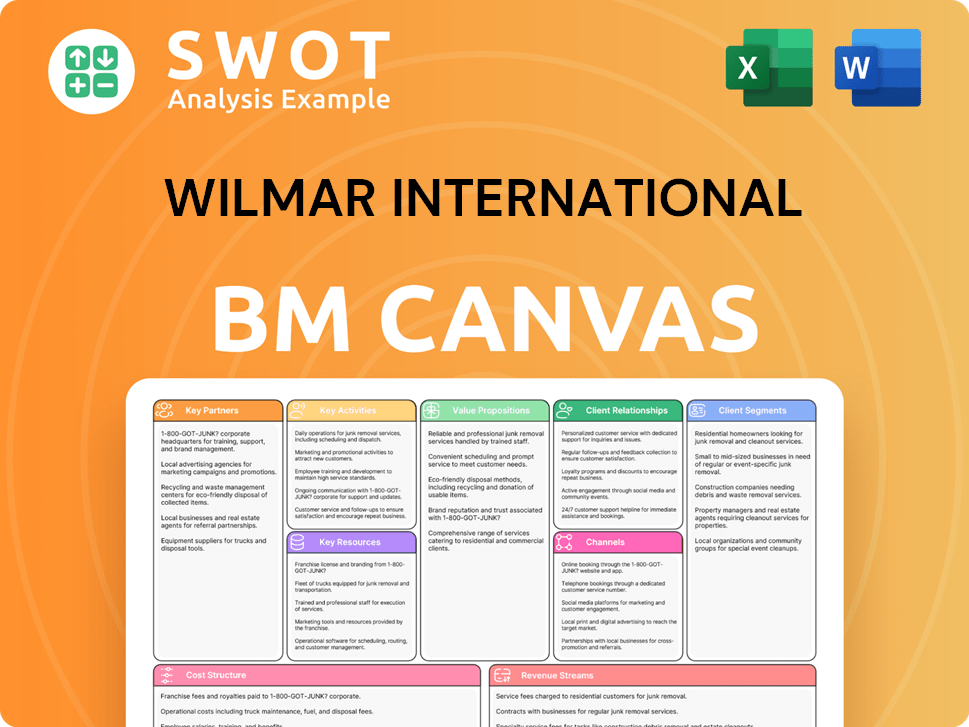

Wilmar International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Wilmar International?

A brief history of Wilmar International company reveals a journey of significant growth and strategic expansions. The company's evolution, marked by key acquisitions and sustainability initiatives, has positioned it as a leading player in the global agribusiness sector, with a strong presence in Singapore and beyond.

| Year | Key Event |

|---|---|

| 2006 | Wilmar International listed on the Singapore Exchange. |

| 2007 | Acquired Kuok Group's palm oil and agribusiness interests, substantially increasing its scale. |

| 2010 | Entered the sugar business with the acquisition of Sucrogen from CSR Limited in Australia. |

| 2013 | Committed to a 'No Deforestation, No Peat, No Exploitation' (NDPE) policy, a landmark sustainability pledge. |

| 2014 | Established a joint venture with Archer Daniels Midland (ADM) for global edible oils. |

| 2018 | Continued expansion in China, a key market for its consumer products and feed ingredients. |

| 2020 | Navigated global supply chain disruptions and shifts in consumer demand due to the COVID-19 pandemic. |

| 2023 | Wilmar International reported robust financial results, with significant contributions from its Food Products segment. |

| 2024 | Focuses on enhancing operational efficiency and expanding its downstream processing capabilities, particularly in specialty fats and oleochemicals. |

| 2025 | Expected to continue investing in sustainable practices and exploring new growth avenues in alternative proteins and bio-based materials, aligning with evolving global consumer preferences and environmental regulations. |

Wilmar International is strategically expanding its presence in emerging markets, particularly in Asia and Africa. The demand for food products and agricultural commodities is projected to rise in these regions. This expansion aligns with the company's long-term growth strategy, focusing on areas with high growth potential.

The company is heavily investing in research and development to enhance the nutritional value and sustainability of its products. Industry trends such as increasing demand for sustainable sourcing, plant-based alternatives, and digital transformation in agriculture are likely to influence Wilmar’s future direction. This focus reflects a commitment to meeting global food demands responsibly.

Analyst predictions suggest continued steady growth for Wilmar, driven by its diversified portfolio and strong market positions. Leadership statements emphasize a commitment to sustainable growth and value creation for shareholders. The company's diversified portfolio helps maintain financial stability and growth potential.

Wilmar’s future outlook ties back to its founding vision of being a leading integrated agribusiness, now with a greater emphasis on sustainability and innovation. This strategic focus includes exploring new growth avenues in alternative proteins and bio-based materials. The company aims to meet evolving global consumer preferences and environmental regulations.

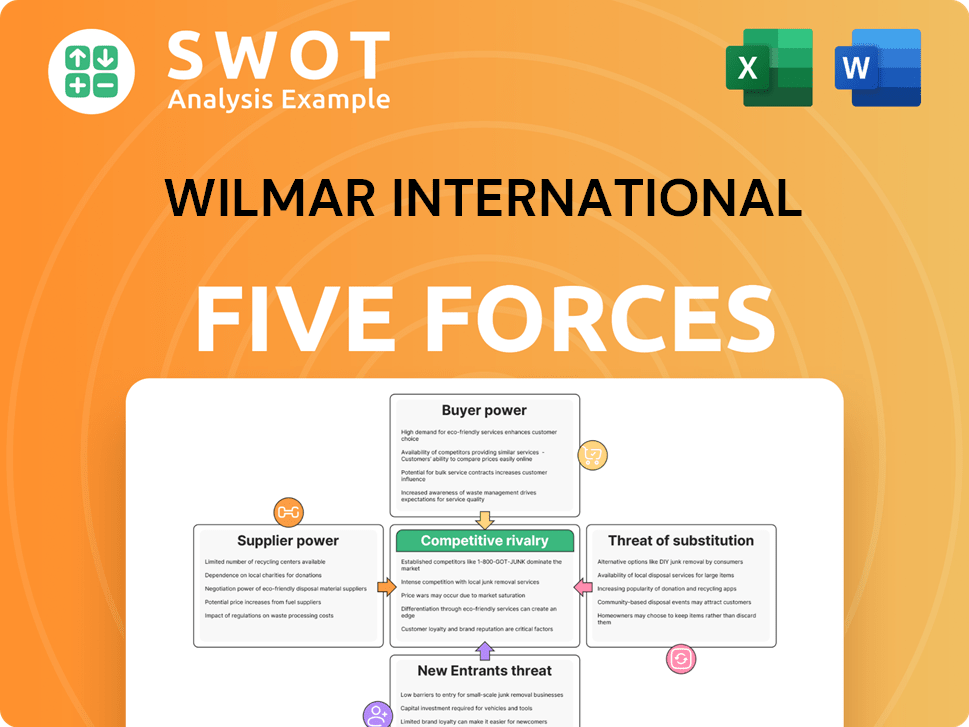

Wilmar International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Wilmar International Company?

- What is Growth Strategy and Future Prospects of Wilmar International Company?

- How Does Wilmar International Company Work?

- What is Sales and Marketing Strategy of Wilmar International Company?

- What is Brief History of Wilmar International Company?

- Who Owns Wilmar International Company?

- What is Customer Demographics and Target Market of Wilmar International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.