Wilmar International Bundle

Can Wilmar International Continue Its Dominance in the Global Agribusiness Arena?

Founded in Singapore in 1991, Wilmar International has grown into a global powerhouse, but what's next for this agricultural giant? This Wilmar International SWOT Analysis offers a deep dive into its strategies. We'll explore how Wilmar plans to navigate the complexities of the market and secure its future.

Wilmar International's strategic focus on business development and market expansion is key to understanding its future prospects. From its early days, the company has consistently adapted to evolving market dynamics, as seen with its recent food park expansion. Examining Wilmar's growth strategy, including its investments in innovation and its approach to sustainability, will reveal its potential for sustained success in the face of global challenges and geopolitical uncertainties. This detailed company analysis will explore the financial performance and growth trajectory of Wilmar International.

How Is Wilmar International Expanding Its Reach?

Wilmar International's growth strategy centers on aggressive expansion initiatives to fortify its market position and diversify revenue streams. The company is actively exploring new markets and broadening its product categories, with a strong emphasis on healthier, safer, and tastier food options.

A key aspect of Wilmar's future prospects involves strategic geographical expansion, especially in emerging markets where the demand for sustainable products is on the rise. This expansion is supported by targeted acquisitions and joint ventures, aimed at increasing market share and operational efficiency.

Product diversification, particularly in consumer branded products (CBP) and central kitchen businesses, is another core element of Wilmar's growth strategy. This approach includes integrated marketing campaigns, expanded distribution networks, and the use of digital tools to reach new markets and build strong customer relationships.

Wilmar is focusing on entering new markets and expanding its product offerings. In 2024, this included introducing new rice, wheat flour, edible oils, and central kitchen products in China. This diversification aims to meet evolving consumer demands and increase revenue streams.

Geographical expansion is a significant part of Wilmar's growth strategy, particularly in emerging markets. The company is increasing its stake in Adani Wilmar Limited (AWL) in India, with plans to acquire up to 31.06% from Adani Commodities LLP. This move is expected to boost profitability and strengthen its position in the Indian market.

Wilmar is committed to sustainability, aiming for 100% traceability to palm oil mills by 2024 and to oil palm plantations by 2025. As of December 2024, Wilmar achieved 91.0% traceability to plantation and 98.5% traceability to palm oil mills, reflecting its dedication to responsible sourcing.

Wilmar is leveraging strategic partnerships to enhance its global impact. A notable example is its joint venture with Kellogg Company in China. These collaborations are designed to align with consumer preferences and support the company's growth in key markets.

Wilmar International's Target Market of Wilmar International is focused on expanding its consumer branded products (CBP) and central kitchen businesses. The company's integrated marketing strategy, coupled with the expansion of its warehouse and channel networks and the use of digital tools, aims to reach new markets and build strong customer relationships. The company's commitment to sustainability is also a key factor in its expansion efforts.

Wilmar's expansion strategy involves market entry, product diversification, and strategic partnerships. The company's focus on sustainability, with high traceability rates for palm oil, further supports its growth initiatives.

- Entering new markets and broadening product categories, such as healthier food options in China.

- Increasing stake in Adani Wilmar Limited (AWL) in India to strengthen market position.

- Focusing on consumer branded products (CBP) and central kitchen businesses.

- Achieving high traceability rates in its palm oil supply chain.

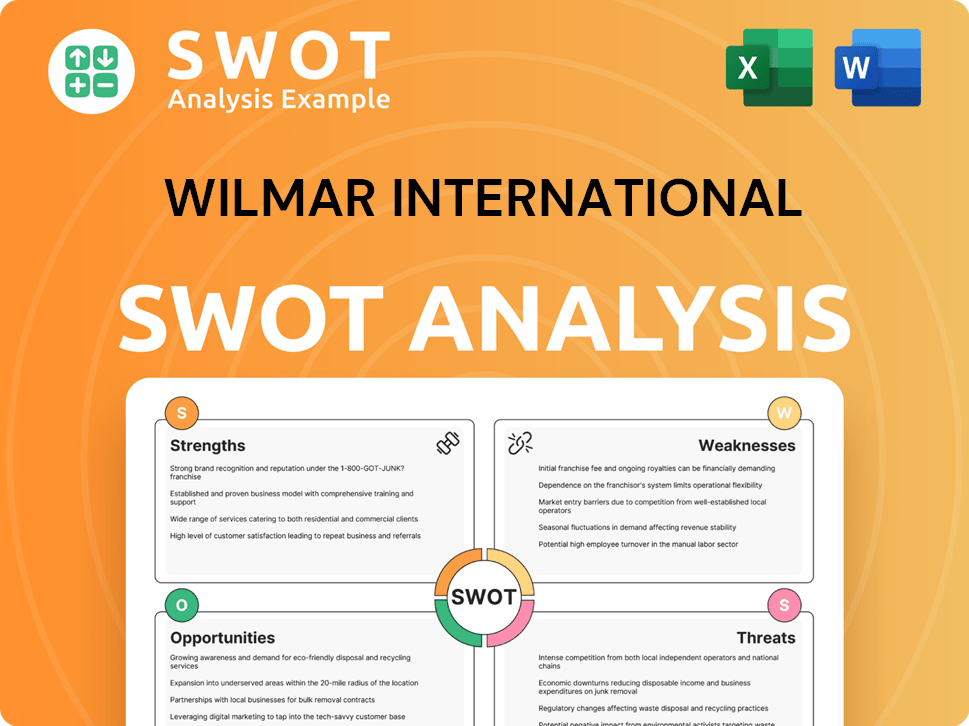

Wilmar International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wilmar International Invest in Innovation?

Innovation and technology are central to the Mission, Vision & Core Values of Wilmar International's growth strategy. The company focuses on enhancing production capabilities and improving efficiency through technological advancements. This commitment supports its goal of producing better and safer products.

Wilmar International invests significantly in research and development (R&D) to improve product quality and develop new offerings. This includes a focus on plant-based proteins, reflecting a response to changing consumer preferences and market demands. The company's approach to digital transformation also involves using digital tools to reach new markets and strengthen customer relationships, as part of its integrated marketing strategy, which fuels its business development.

Sustainability is deeply integrated into Wilmar's innovation strategy, a critical aspect of its future prospects. The company is committed to reducing its environmental impact through various initiatives, including the use of renewable energy sources and emissions reduction targets.

Wilmar increased its investment in research and development (R&D) in 2024 to improve product quality, reduce costs, and develop new offerings.

Wilmar uses digital tools to reach new markets and build strong customer relationships. This is part of its integrated marketing strategy.

Sustainability is a core part of Wilmar's innovation strategy. The company is focused on reducing its environmental impact.

Wilmar has set near-term emissions reduction targets. The company aims to reduce Scope 1 and 2 emissions by 50.4% and Scope 3 emissions by 30.0% by 2032 from a 2022 baseline.

By 2050, Wilmar aims for a 90.0% reduction in emissions across Scope 1, 2, and 3.

Renewable energy sources accounted for 51.8% of Wilmar's total energy consumption in 2024. Its palm oil and sugar mills derive 98.7% of their energy needs from renewable sources.

Wilmar's commitment to sustainability and innovation has been recognized through various accolades. These achievements highlight the company's leadership in the agribusiness sector and its focus on sustainable practices.

- Science Based Targets initiative (SBTi) validated Wilmar's emissions targets in March 2025.

- Reduced Scope 1 and 2 absolute greenhouse gas (GHG) emissions by 4.3% in 2024.

- Reduced Scope 1 FLAG emissions by 18.3% from the previous year.

- Recognized in the Dow Jones Best-in-Class World Index for four consecutive years.

- Recognized in the Dow Jones Best-in-Class Asia Pacific Index for the fifth consecutive year under the Food Products category.

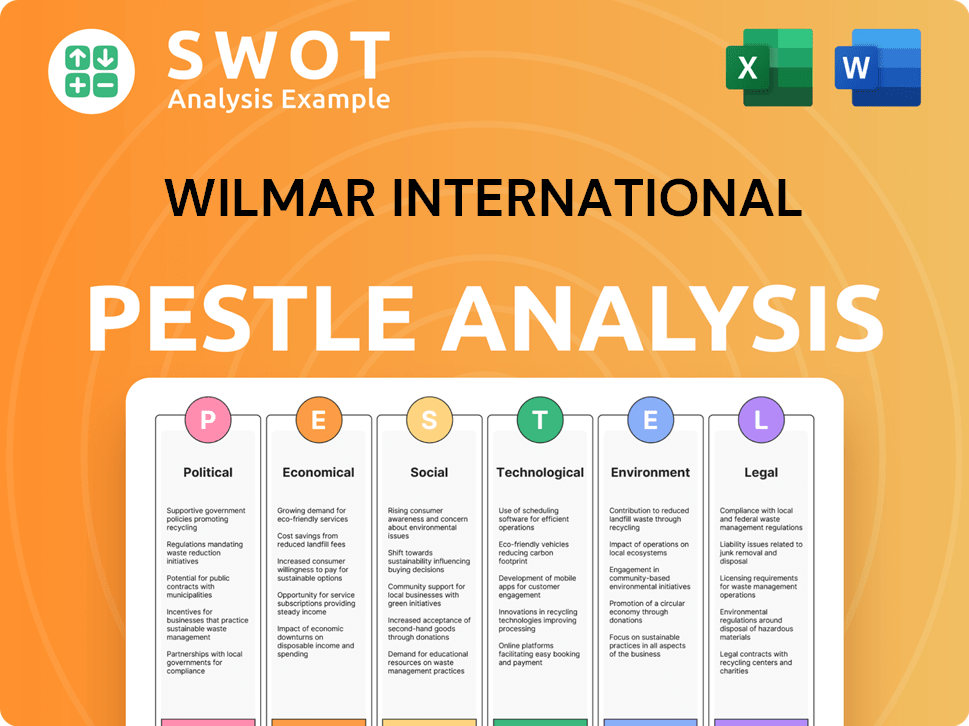

Wilmar International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Wilmar International’s Growth Forecast?

The financial outlook for Wilmar International for 2025 indicates a recovery following a challenging 2024. The company's performance in 2024 was affected by fluctuating commodity prices and geopolitical uncertainties. Despite these challenges, the company is showing signs of resilience and strategic adaptation.

In 2024, Wilmar reported a core net profit of US$1.16 billion and revenue of US$67.38 billion. Diluted earnings per share stood at 18.7 US cents. The net profit for the year was US$1.17 billion, which was a 23% decrease from 2023, with a profit margin of 1.7%.

Looking ahead, analysts project a rebound in Wilmar's financial performance. The Growth Strategy of the company is focused on leveraging its strengths in key markets and adapting to changing market dynamics. This includes strategic investments and operational improvements.

Analysts forecast Wilmar's adjusted net profit to recover to US$1.58 billion in 2025 and further increase to US$1.86 billion in 2026. Revenue is expected to rise to US$76.65 billion in 2025 and US$83.58 billion in 2026, demonstrating a positive Growth Strategy trajectory.

The first quarter of 2025 showed promising results, with a 4.4% year-on-year increase in core net profit to US$343.0 million. Revenue for Q1 2025 reached US$16.2 billion, a 3.3% increase compared to the previous year. This positive start sets a strong foundation for the Future Prospects.

Strong performances in the Food Products and Plantation and Sugar Milling segments, along with higher contributions from associates and joint ventures, particularly in China, India, and Southeast Asia, drove the growth in Q1 2025. The company's strategic focus on these key regions is a key aspect of its Business Development.

Palm oil refining margins are expected to remain challenging, and the food segment may face headwinds due to subdued sales. However, strong soybean crushing margins and a record soybean crop in Brazil are expected to support the oilseeds business. This highlights the importance of diversification in the Market Expansion strategy.

Wilmar's financial health is further underscored by its reduced net debt, which decreased by 9.6% to US$16.85 billion as of March 31, 2025. The net gearing ratio improved to 0.83x, indicating strong liquidity and financial stability. Management's cautiously optimistic outlook for FY2025 reflects confidence in its strategic initiatives and operational capabilities. For a deeper dive into the company's operations and strategies, you can read more in this detailed article about Wilmar International.

The company is actively monitoring and managing the impact of geopolitical events on its operations and supply chains. This proactive approach is crucial for mitigating risks and ensuring business continuity.

Wilmar continues to invest in sustainable agriculture practices and is committed to addressing environmental challenges. These initiatives are integral to the company's long-term Growth Strategy.

Investment in research and development remains a key focus, driving innovation and enhancing the company's competitive edge. This supports the company's long-term Future Prospects.

Efficient supply chain management is critical to Wilmar's success, ensuring the timely delivery of products and optimizing operational efficiency. This is a core part of the Company Analysis.

Wilmar employs robust risk management strategies to navigate market volatility and protect its financial performance. This includes hedging and diversification strategies.

Wilmar maintains a significant market share and continues to explore opportunities for further growth in key markets. This is a key element of its Market Expansion plans.

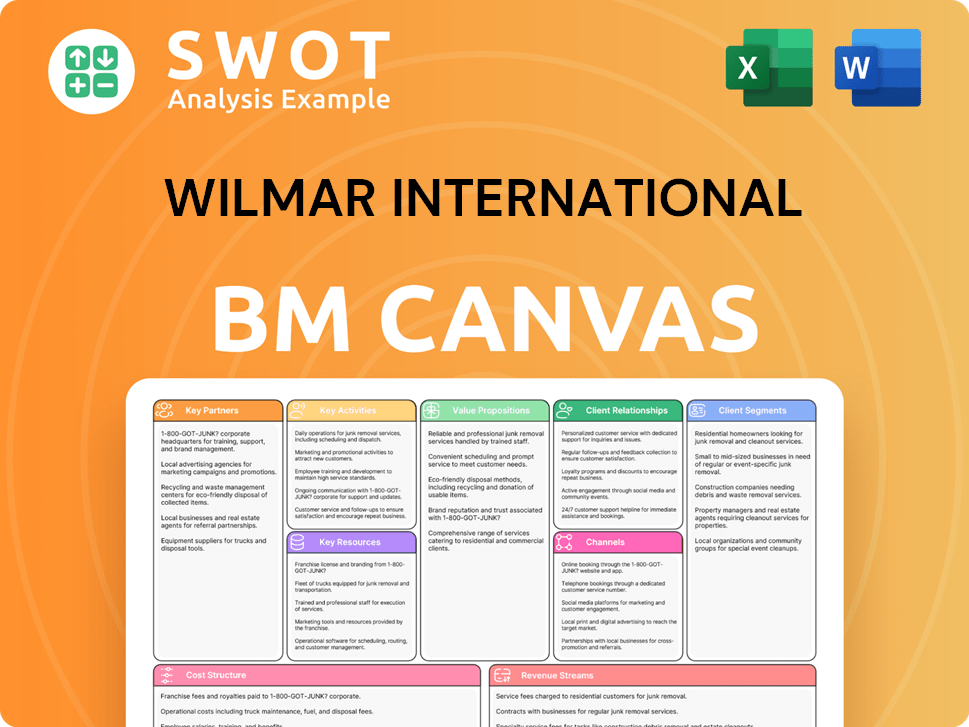

Wilmar International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Wilmar International’s Growth?

Several potential risks and obstacles could affect the Growth Strategy and Future Prospects of Wilmar International. These challenges range from market dynamics and regulatory changes to operational issues. Understanding these risks is crucial for assessing the company's ability to achieve its long-term goals and maintain its position in the global market.

Wilmar International faces ongoing challenges from market competition and fluctuating commodity prices. The palm oil refining margins are expected to remain challenging, and the food segment may experience subdued sales, affecting margins. These factors require the company to continuously adapt its strategies to navigate market volatility and maintain profitability.

Regulatory changes and geopolitical instability also pose significant risks to Wilmar International. An ongoing bribery investigation and land confiscation issues tied to a palm oil corruption case in Indonesia could exert short-term pressure on its share price. Moreover, rising geopolitical volatility, including new US tariffs, may increase operational risk and costs. These factors require the company to continuously adapt its strategies to navigate market volatility and maintain profitability.

Wilmar International operates in a highly competitive market, with fluctuating commodity prices impacting profitability. In 2024, declining sugar prices affected the sugar business, despite overall higher profits in most core businesses. Palm oil refining margins are expected to remain challenging.

Wilmar International faces regulatory scrutiny and geopolitical risks. An ongoing bribery investigation and land confiscation issues in Indonesia could impact the company. Rising geopolitical volatility and new US tariffs may increase operational risks and costs.

Achieving full supply chain transparency remains a challenge for Wilmar International. Complex commodity transportation and trading structures in countries like China and India pose difficulties. The slow recovery in China's consumer spending has affected Wilmar International's largest profit contributor.

The slow recovery in China's consumer spending has affected Wilmar International's largest profit contributor, Yihai Kerry Arawana (YKA), contributing to earnings misses in 2024. While a sales recovery trend was observed in 3Q24, a gradual recovery is anticipated.

These risks can directly impact Wilmar International's financial performance. Declining sugar prices, challenging palm oil refining margins, and subdued sales in the food segment can all affect revenue and profitability. The ongoing investigation could also exert short-term pressure on its share price.

Wilmar International addresses these risks through diversification, its integrated business model, and strategic planning. Its diversified supply chain, spanning 15 countries and over 20 commodities, acts as a buffer against geopolitical tensions and trade barriers. The company's substantial cash reserves, amounting to US$6.2 billion as of Q1 2025, also provide a liquidity moat.

Market volatility, particularly in commodity prices, poses a significant risk. Declining sugar prices in 2024 impacted the sugar business, despite overall higher profits in most core businesses. Palm oil refining margins are expected to remain challenging, affecting overall profitability. The food segment may experience subdued sales and a shift to more affordable products, which may impact margins.

Wilmar International faces regulatory and legal risks, including an ongoing bribery investigation and land confiscation issues related to a palm oil corruption case in Indonesia. While no formal charges have been filed, the investigation could exert short-term pressure on its share price. Compliance with regulations is crucial, and any adverse findings could impact operations.

Achieving full transparency in its supply chain remains a challenge for Wilmar International, particularly in complex commodity transportation and trading structures in countries like China and India. The slow recovery in China's consumer spending has affected Wilmar International's largest profit contributor, Yihai Kerry Arawana (YKA), contributing to earnings misses in 2024. While a sales recovery trend was observed in 3Q24, a gradual recovery is anticipated.

Rising geopolitical volatility, including new US tariffs, may increase operational risk and costs for Wilmar International. This necessitates proactive risk management strategies. The company's diversified supply chain, spanning 15 countries and over 20 commodities, acts as a buffer against geopolitical tensions and trade barriers. To learn more about its business model, read Revenue Streams & Business Model of Wilmar International.

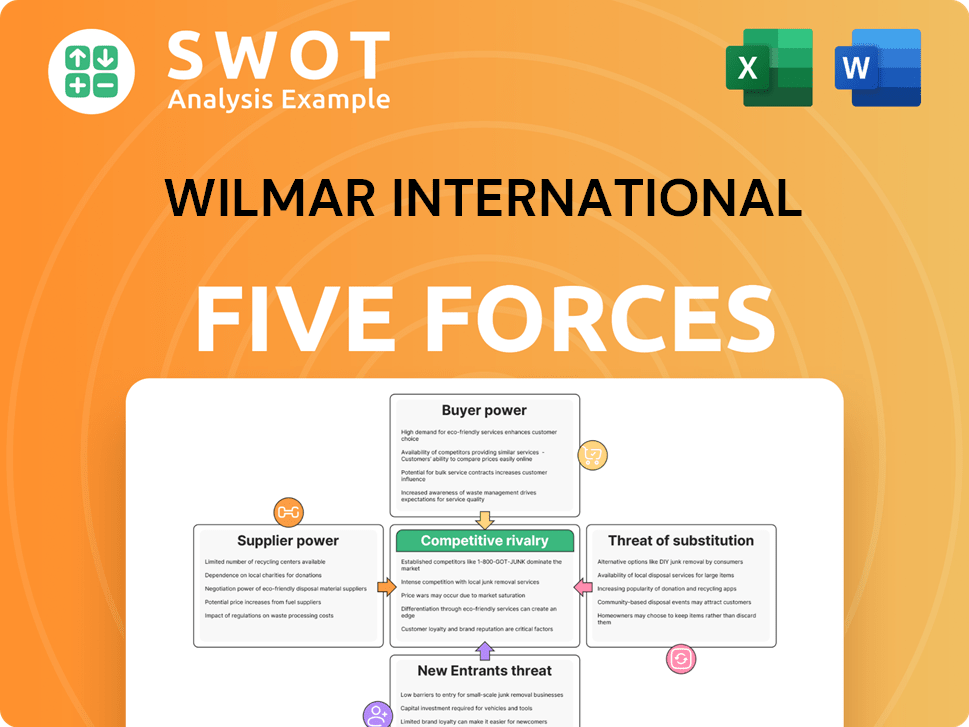

Wilmar International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wilmar International Company?

- What is Competitive Landscape of Wilmar International Company?

- How Does Wilmar International Company Work?

- What is Sales and Marketing Strategy of Wilmar International Company?

- What is Brief History of Wilmar International Company?

- Who Owns Wilmar International Company?

- What is Customer Demographics and Target Market of Wilmar International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.