Wilmar International Bundle

How Does Wilmar International Stack Up in the Agribusiness Arena?

Wilmar International, a titan in the agribusiness sector, has witnessed remarkable growth since its inception in 1991. Today, it's a global force, deeply involved in everything from palm oil cultivation to consumer product manufacturing. Understanding the Wilmar International SWOT Analysis is key to grasping its strategic positioning.

This exploration of Wilmar International's competitive landscape is vital for anyone seeking to understand the dynamics of the agribusiness industry. We'll dissect Wilmar's market position, analyze its key competitors, and examine the strategies that drive its financial performance. By focusing on Wilmar analysis, we aim to provide actionable insights into industry competition and the company's future outlook.

Where Does Wilmar International’ Stand in the Current Market?

Wilmar International holds a strong market position in the global agribusiness sector, particularly in palm oil and edible oils. It is recognized as the world's largest palm oil refiner and a leading processor and merchandiser of palm and lauric oils. The company's operations span across the entire value chain, from cultivation to distribution, providing a significant advantage in cost efficiency and supply chain control.

The company's core offerings include edible oils, sugar, oilseeds, grains, and specialty fats, serving a wide range of customers. Wilmar strategically shifted its focus from raw commodity processing to value-added products and consumer brands. This diversification has helped the company capture higher margins and build brand loyalty, contributing to its robust financial health and market influence.

Geographically, Wilmar has a substantial presence across Asia, Africa, Europe, and the Americas. It has a particularly strong foothold in emerging markets. With a reported revenue of US$67.2 billion in 2023, the company demonstrates its substantial operational capacity and significant market influence. For a deeper dive into the company's background, you can read more in the Brief History of Wilmar International.

The competitive landscape for Wilmar International includes major players in the agribusiness sector. While specific market share data fluctuates, Wilmar consistently maintains a leading position in the palm oil and edible oils markets. Key competitors include other large-scale agribusiness companies that compete across various segments such as processing, trading, and distribution of agricultural commodities.

Wilmar's strategic initiatives focus on value-added products, brand building, and geographic expansion. The company's integrated business model, covering the entire value chain, provides a significant competitive advantage. This integration enhances cost efficiency and supply chain control. Wilmar's investments in sustainability and innovation further strengthen its market position.

In 2023, Wilmar reported a revenue of US$67.2 billion, reflecting its substantial operational capacity and market influence. The revenue breakdown is diversified across various segments, including oil palm plantations, oilseed crushing, consumer products, and other related businesses. The company's financial performance is closely tied to the global demand for edible oils, food products, and agricultural commodities.

Wilmar's global presence extends across Asia, Africa, Europe, and the Americas, with a strong focus on emerging markets. Its extensive network of operations includes processing plants, distribution centers, and trading offices. The company's reach into key Asian markets such as China, India, and Indonesia is particularly strong, driven by high demand for its products.

Wilmar faces challenges such as fluctuating commodity prices, geopolitical risks, and sustainability concerns. Opportunities include growing demand in emerging markets, expansion into value-added products, and investments in sustainable practices. The company's ability to navigate these challenges and capitalize on opportunities will be crucial for its future growth.

- Commodity price volatility.

- Geopolitical risks in key markets.

- Growing demand in emerging markets.

- Expansion into value-added product lines.

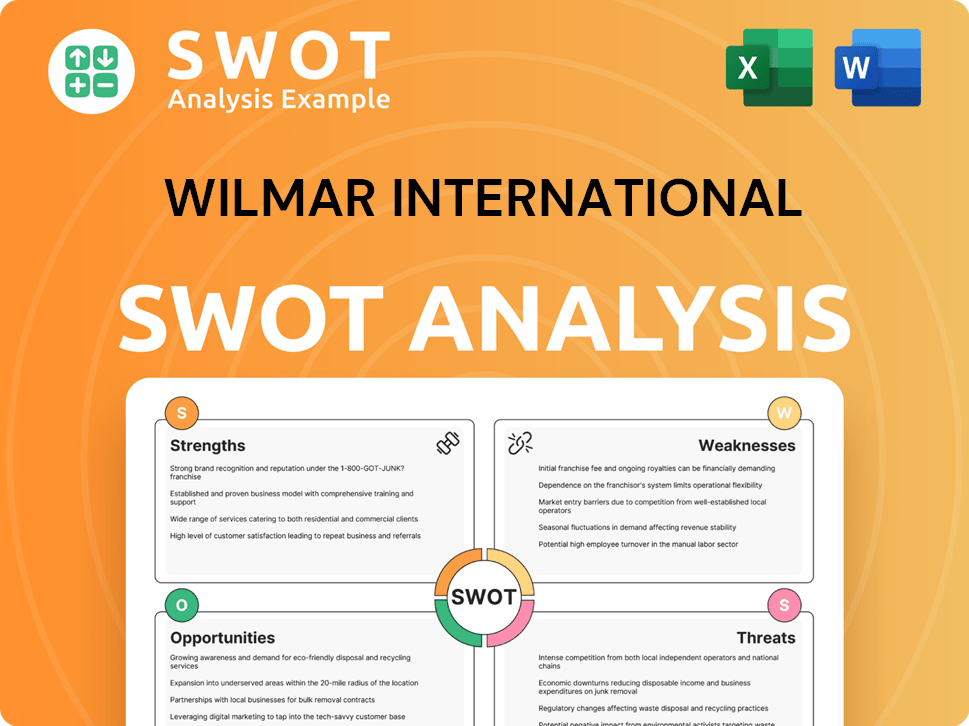

Wilmar International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Wilmar International?

Understanding the Revenue Streams & Business Model of Wilmar International involves a deep dive into its competitive landscape. This analysis is crucial for investors and strategists aiming to assess Wilmar's market position and future prospects. The competitive environment significantly impacts Wilmar's financial performance and strategic decisions.

The Wilmar analysis reveals a complex web of competitors across its diverse business segments. These competitors range from global giants to regional specialists, each vying for market share and influencing the industry's dynamics. This chapter will explore the key players challenging Wilmar International.

In the palm oil and edible oils refining sector, Wilmar faces strong competition. Key rivals include Archer Daniels Midland (ADM), Bunge Limited, Cargill, and Louis Dreyfus Company (often referred to as the 'ABCD' companies). These companies have extensive global networks and diversified agricultural portfolios. Their vast trading capabilities, logistical expertise, and access to diverse commodity sources pose significant challenges to Wilmar.

ADM, Bunge, and Cargill are major players in the agribusiness sector, competing directly with Wilmar in oilseed crushing and grain processing. They leverage their scale and established relationships with farmers and end-users to gain market share. These companies' financial strength and global reach are significant competitive advantages.

In the consumer products segment, Wilmar competes with numerous local and international food companies. These companies produce branded cooking oils, flour, and other food staples, with competition often revolving around brand recognition, distribution reach, and pricing strategies. This segment is highly competitive due to the presence of many players.

In certain regions, state-owned enterprises or large domestic players can pose significant competition. They often have localized market knowledge and government support. These entities can be formidable competitors due to their specific advantages in their respective markets. For example, in the sugar segment, Wilmar faces competition from major global sugar producers and traders.

Emerging players, particularly those focused on sustainable and traceable sourcing, are also beginning to disrupt the traditional competitive landscape. They push all industry participants to adapt their practices. These companies often emphasize ethical and environmentally friendly practices, attracting consumers focused on sustainability.

Mergers and alliances, such as joint ventures in specific processing facilities or distribution networks, can reshape competitive dynamics. These collaborations consolidate market power or create new integrated players. These strategic moves can significantly impact the market share and competitive positioning of all involved parties.

Wilmar's competitive strategies include leveraging its integrated business model, focusing on operational efficiency, and expanding its distribution network. The company also invests in research and development to innovate and differentiate its products. These strategies are essential for maintaining a strong market position analysis in the face of intense industry competition.

Several factors contribute to the competitive dynamics in Wilmar's operating segments. These include:

- Scale and Efficiency: The ability to process large volumes of commodities efficiently.

- Global Reach: Extensive distribution networks and access to global markets.

- Brand Recognition: Strong consumer brands and product differentiation.

- Sustainability: Commitment to sustainable sourcing and environmental practices.

- Innovation: Development of new products and technologies.

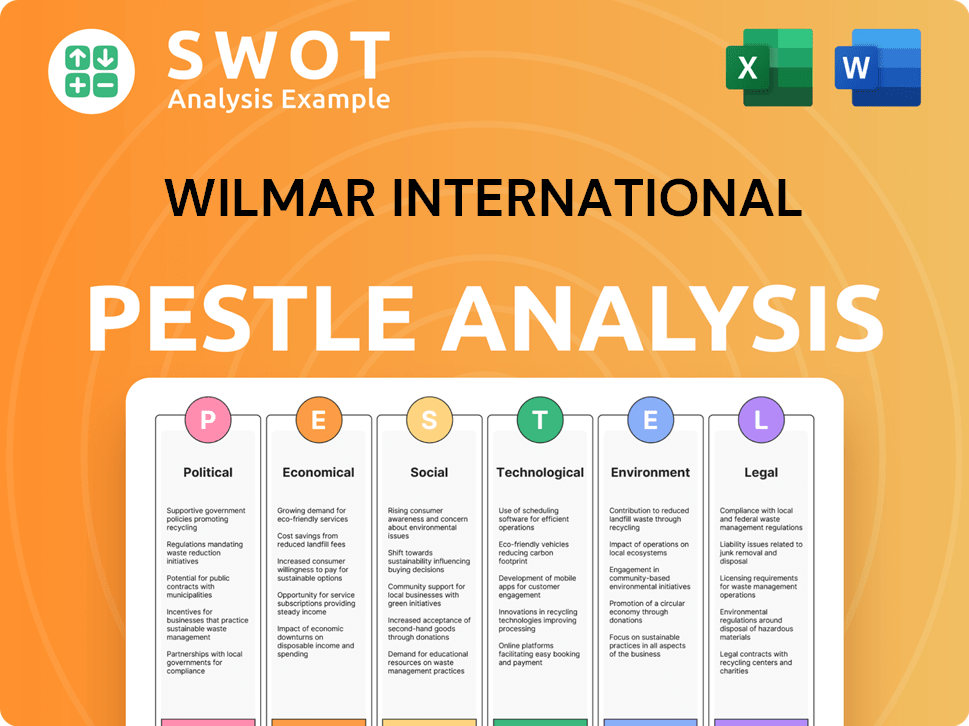

Wilmar International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Wilmar International a Competitive Edge Over Its Rivals?

Understanding the Wilmar International competitive landscape involves analyzing its key strengths and how it maintains its market position. This analysis helps in assessing its performance against competitors and understanding its strategic initiatives. The company's integrated business model, global presence, and brand equity are crucial factors in its success. For a deeper dive into their approach, consider the Marketing Strategy of Wilmar International.

Wilmar analysis reveals that its competitive advantages are rooted in its 'seed-to-shelf' approach, spanning from oil palm cultivation to consumer product manufacturing. This vertical integration provides cost efficiencies and quality control. The company's substantial scale enables economies of scale in procurement, processing, and logistics, which lowers per-unit costs compared to smaller rivals. This scale is a significant factor in its ability to maintain and grow its market share.

Industry competition is a key factor in assessing Wilmar's performance. The company faces challenges from aggressive competitors and shifts in consumer preferences. Continuous innovation and adaptation are essential for Wilmar to maintain its competitive edge and capitalize on future opportunities.

Wilmar's integrated model, from cultivation to consumer products, ensures cost efficiencies and quality control. This approach allows them to capture value at multiple stages, reducing the impact of commodity market volatility. This model is a core strength in the agribusiness sector.

As one of the largest agribusiness groups, Wilmar benefits from substantial economies of scale. This advantage allows for lower per-unit costs in procurement, processing, and logistics. This scale is a key factor in maintaining a competitive edge.

Wilmar's strong brand equity, particularly in its consumer products segment, fosters customer loyalty. Popular cooking oil brands in various Asian markets contribute significantly to market share. This brand recognition provides a competitive advantage.

Wilmar's extensive distribution networks across Asia, Africa, and other key regions provide unparalleled market access. This widespread reach allows the company to effectively distribute its products and maintain a strong presence in diverse markets.

Wilmar International's competitive advantages are multifaceted, contributing to its strong position in the global agribusiness market. These advantages include its integrated model, economies of scale, brand equity, and extensive distribution network.

- Vertical Integration: Ensures control over the supply chain, from raw materials to finished goods.

- Global Presence: Operates in key markets across Asia, Africa, and other regions.

- Brand Recognition: Strong brand presence in consumer markets, particularly in cooking oils.

- Operational Efficiency: Achieves cost efficiencies through scale and integrated operations.

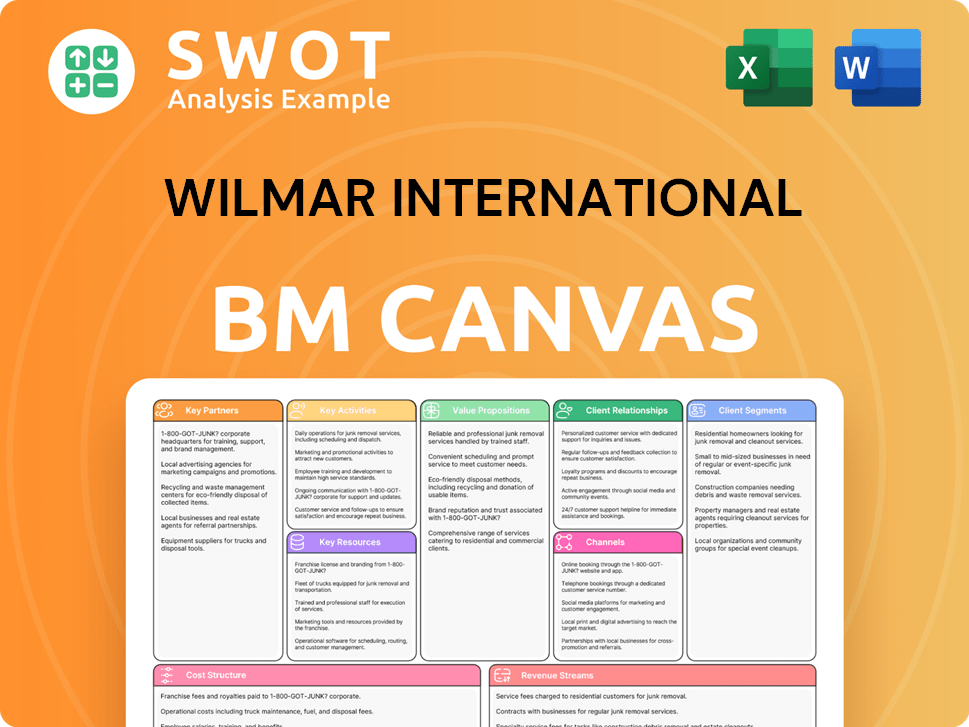

Wilmar International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Wilmar International’s Competitive Landscape?

The Wilmar International competitive landscape is shaped by global agribusiness trends, presenting both challenges and opportunities. The company's strategic initiatives and market position are critical in navigating these dynamics. Understanding the industry competition and Wilmar's financial performance is key to evaluating its future outlook.

Industry competition is intensifying due to factors like technological advancements, sustainability concerns, and evolving consumer preferences. Wilmar's ability to adapt to these changes will determine its success. A comprehensive Wilmar analysis reveals the need for strategic initiatives focused on diversification and innovation to ensure resilience and growth.

The agribusiness sector is witnessing rising global food demand, with a focus on sustainable sourcing. Technological advancements such as precision agriculture and data analytics are transforming operations. Consumer preferences are also evolving, influencing product innovation and market strategies.

Climate change impacts on crop production and stricter environmental regulations pose risks. Increasing scrutiny over agricultural practices, particularly concerning deforestation and labor rights, can lead to higher costs. Geopolitical tensions and trade policies introduce volatility into commodity markets.

Emerging markets with growing populations and disposable incomes offer significant growth potential. Product innovation, such as healthier food ingredients and plant-based alternatives, presents opportunities. Strategic partnerships and acquisitions can provide avenues for expansion and diversification.

Wilmar's competitive strategies involve diversification, innovation, and enhanced supply chain resilience. The company is investing in sustainable palm oil production and traceability. Focusing on these areas will help navigate future challenges and seize opportunities.

In 2024, the global edible oils market was valued at approximately $190 billion, with an expected CAGR of 4.5% from 2024 to 2030. Palm oil production in Indonesia and Malaysia, key regions for Wilmar, faced challenges due to El Niño in 2024, impacting yields. Wilmar's focus on sustainable practices, such as its NDPE (No Deforestation, No Peat, No Exploitation) policy, is increasingly important.

- The market share of Wilmar in the global palm oil market is estimated to be around 20-25% as of early 2025.

- Wilmar's revenue breakdown in 2024 showed a significant portion from its oil palm and sugar businesses.

- Strategic initiatives include investments in sustainable agriculture and expansion in emerging markets.

- The company is also focusing on product innovation, such as healthier food ingredients and plant-based alternatives.

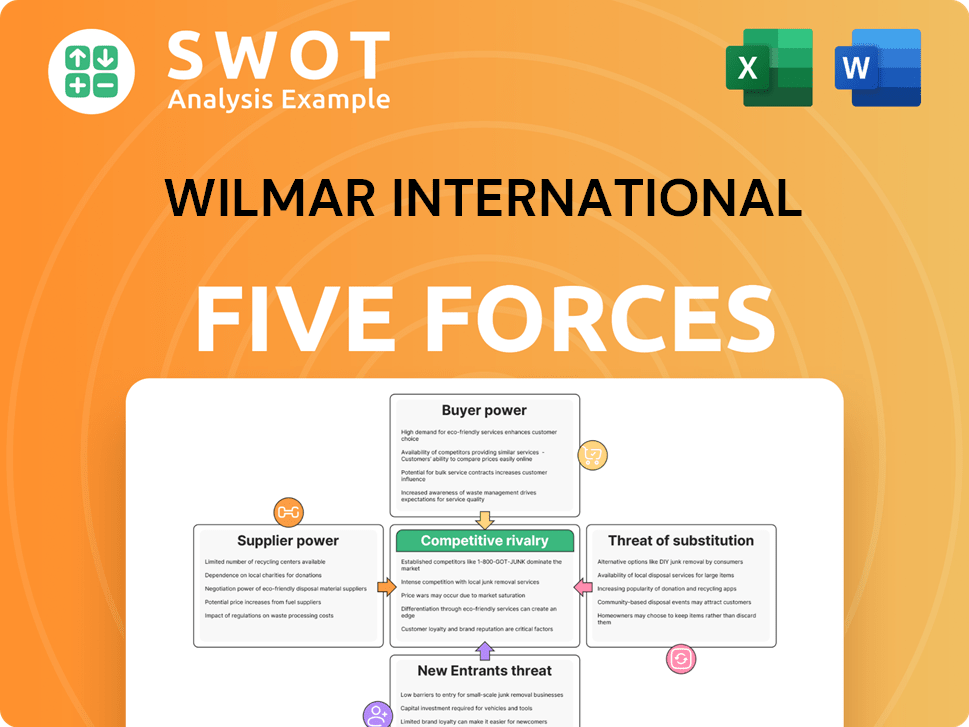

Wilmar International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wilmar International Company?

- What is Growth Strategy and Future Prospects of Wilmar International Company?

- How Does Wilmar International Company Work?

- What is Sales and Marketing Strategy of Wilmar International Company?

- What is Brief History of Wilmar International Company?

- Who Owns Wilmar International Company?

- What is Customer Demographics and Target Market of Wilmar International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.