Wilmar International Bundle

How Does Wilmar International Thrive in the Global Agribusiness Arena?

Wilmar International, a powerhouse in the agribusiness sector, generated a staggering US$67.38 billion in revenue in 2024, showcasing its immense scale and influence. This Singapore-based giant is deeply involved in palm oil cultivation, edible oils, and oilseed crushing, along with a vast array of consumer products and industrial ingredients. With over 1,000 manufacturing plants and a global distribution network, understanding Wilmar International SWOT Analysis is key to grasping its complex operations.

This deep dive into Wilmar Company will explore its vertically integrated business model, which allows it to control the entire supply chain from sourcing palm oil to distribution. We'll examine Wilmar operations, including its key products, financial performance, and strategic responses to fluctuating commodity prices and global challenges. Discover how Wilmar International maintains its competitive edge and contributes to the global food supply through its extensive agribusiness network.

What Are the Key Operations Driving Wilmar International’s Success?

The core of Wilmar International's operations lies in its vertically integrated agribusiness model. This model encompasses the entire value chain, from the initial sourcing of agricultural commodities to processing, branding, merchandising, and distribution. This comprehensive approach is fundamental to how the Wilmar Company creates and delivers value to its customers worldwide.

The company's extensive portfolio includes oil palm cultivation, oilseed crushing, edible oils refining, flour and rice milling, sugar milling and refining, and the manufacturing of consumer products. It also produces ready-to-eat meals, central kitchen products, specialty fats, oleochemicals, biodiesel, and fertilizers. Wilmar operations also extend to merchandising, distribution, and owning a fleet of vessels.

Serving diverse customer segments globally, Wilmar International has a significant presence in China, India, Indonesia, and over 50 other countries. Its operational processes are supported by over 1,000 manufacturing plants and a comprehensive distribution network. For instance, through its associate Adani Wilmar Limited (AWL) in India, it expanded its distribution of essential food products to over 121 million households in 2024.

Wilmar's integrated model allows it to extract margins at every step of the value chain. This leads to significant operational synergies and cost efficiencies. This integrated approach provides a competitive edge, allowing it to supply quality products at competitive costs.

The company's global presence is supported by a vast distribution network. This network ensures that products reach consumers across numerous countries. Expansion, such as the commissioning of an integrated manufacturing complex in Gohana, Haryana, India, in January 2025, enhances its ability to deliver competitive products.

The supply chain is a critical component of Wilmar's operations. The company is committed to achieving 100% traceability to plantations by 2025. As of December 2024, it had achieved 91.0% traceability to plantation and 98.5% traceability to palm oil mills.

This robust infrastructure and integrated business model translate into customer benefits. Customers gain access to a wide range of accessible and competitively priced food and industrial products. To learn more about the company's strategic moves, read about the Growth Strategy of Wilmar International.

Wilmar's key products include a wide array of food and industrial products derived from palm oil and other agricultural commodities. The company's operations are structured to ensure efficiency and sustainability across its diverse business segments.

- Oil palm cultivation and processing.

- Oilseed crushing and edible oils refining.

- Manufacturing of consumer products and specialty fats.

- Sugar milling and refining.

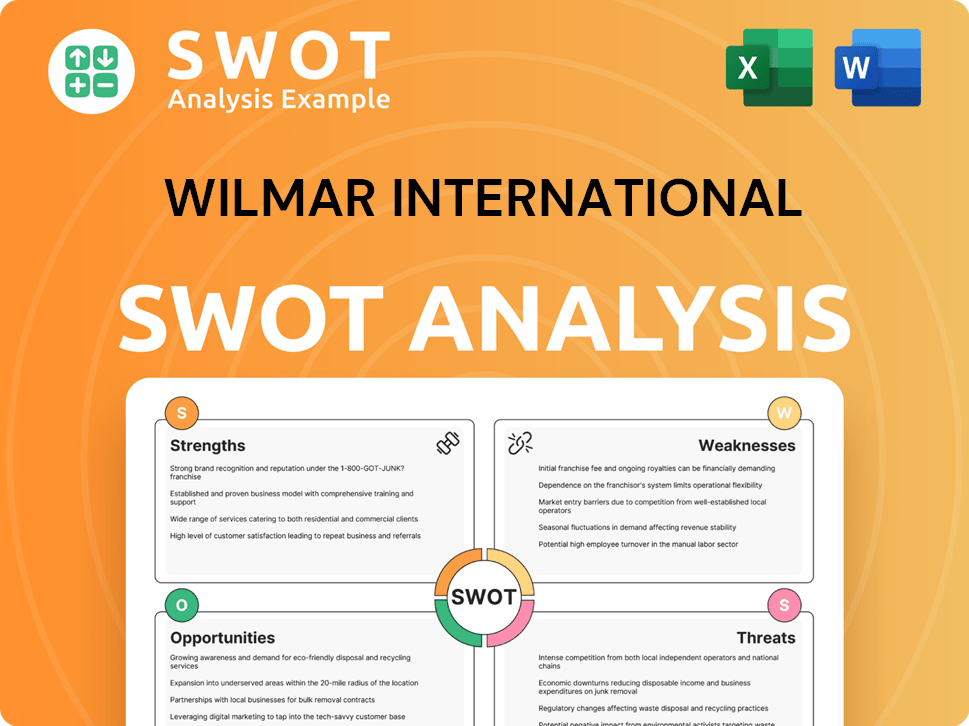

Wilmar International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Wilmar International Make Money?

The revenue streams and monetization strategies of Wilmar International are central to its success in the agribusiness sector. The company leverages an integrated value chain to generate revenue from various activities. For the financial year 2024, the company's total revenue reached a substantial US$67.38 billion, showcasing its significant market presence.

Wilmar's approach to monetization focuses on capturing value at each stage of its integrated value chain. From the cultivation and processing of raw materials such as palm oil and oilseeds to the manufacturing and distribution of consumer products, the company aims to extract margins. This strategy is supported by its ongoing efforts to expand market share, particularly in emerging markets, indicating a focus on volume growth and market penetration.

The company's financial performance underscores its diversified revenue streams. The Feed and Industrial Products segment was the primary revenue driver, contributing US$42.3 billion, or 63% of total revenue. The Food Products segment also saw a significant increase in pre-tax profit, reaching US$502.1 million in FY2024, driven by stronger sales volume. The company is anticipating a recovery in earnings in 2025, driven by improvements in palm production and tropical oil refining margins, as well as positive soybean crush margins in China.

The Feed and Industrial Products segment generated US$42.3 billion in revenue, making up 63% of the total. This segment is a key driver of the overall financial performance of Wilmar International.

The Food Products segment saw a rise in pre-tax profit to US$502.1 million in FY2024. This increase was supported by an 8% rise in overall sales volume, reaching 33.0 million metric tonnes.

Wilmar focuses on extracting margins across its integrated value chain. This strategy includes the cultivation, processing, manufacturing, and distribution of products. The company is expanding its market share, particularly in emerging markets.

Wilmar anticipates a recovery in earnings in 2025. This recovery is expected to be driven by improvements in palm production, tropical oil refining margins, and positive soybean crush margins in China.

The Feed and Industrial Products segment experienced a decrease in pre-tax profit to US$829.5 million in FY2024. The Food Products segment's revenue grew by 2% to US$28.83 billion in FY2024.

The company's focus on expanding its market share in emerging markets suggests a strategy of volume growth and market penetration. This approach is key to the company's long-term revenue strategy.

Wilmar International's revenue streams are primarily driven by its Feed and Industrial Products segment and its Food Products segment. The company uses an integrated approach to maximize profit across its supply chain.

- Feed and Industrial Products: This segment is the largest contributor to total revenue, showcasing the importance of this area to Wilmar's overall financial performance.

- Food Products: The company's food products segment saw a rise in revenue, driven by increased sales volume across various product categories.

- Integrated Value Chain: Wilmar's ability to extract margins at each step of its integrated value chain is a key monetization strategy.

- Market Expansion: The company's focus on expanding its market share in emerging markets suggests a strategy of volume growth and penetration.

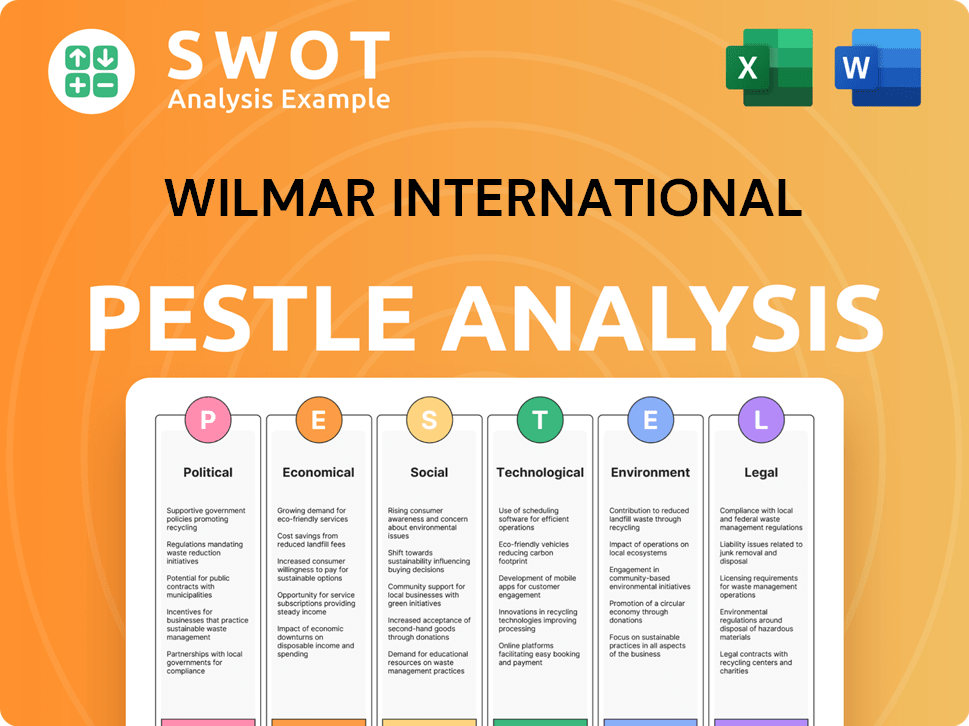

Wilmar International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Wilmar International’s Business Model?

The evolution of Wilmar International, a major player in the agribusiness sector, is marked by strategic moves and significant milestones. A key focus has been on enhancing operational efficiency and reducing capital expenditure, particularly with the completion of several key projects in FY2024. These initiatives underscore the company's commitment to expanding its downstream capabilities and broadening its geographical footprint, solidifying its position in the global market.

Wilmar's strategic approach includes continuous investments in its infrastructure and acquisitions to strengthen its market position. The company's integrated business model, which spans the entire value chain, from sourcing to distribution, provides a significant competitive advantage. This model allows Wilmar to optimize margins and achieve economies of scale, contributing to its sustained financial performance.

The company's commitment to sustainability and supply chain transparency is also a core element of its strategy. Wilmar's focus on environmental stewardship and responsible sourcing practices, including its progress in supply chain traceability, enhances its reputation and strengthens its relationships with stakeholders. This commitment is demonstrated through its continued inclusion in the Dow Jones Sustainability Indices (DJSI) World Index.

In June 2024, Wilmar's sixth food park and central kitchen in Shenyang, China, began partial operations, with four more food parks under construction. In India, its associate Adani Wilmar Limited (AWL) acquired a 67% stake in Omkar Chemicals Industries Private Limited in 2024. An integrated manufacturing complex in Gohana, Haryana, India, was commissioned in January 2025.

Wilmar increased its investment in Unity Foods Limited (UFL), a Pakistan-listed edible oils and fats producer, from 29% to 42% through a public offer. These moves reflect Wilmar's strategic focus on expanding its presence in emerging markets and diversifying its product offerings. The company aims to strengthen its position in the global food supply chain.

Wilmar's integrated agribusiness model provides a significant advantage, allowing margin extraction across the value chain and economies of scale. Its solid reputation for high-quality food products strengthens its market position. The company's commitment to sustainability, including its inclusion in the DJSI World Index and SBTi validation, is also a key competitive edge.

Despite challenges such as fluctuating commodity prices and weak consumer spending in China, Wilmar anticipates a recovery in earnings in 2025. This is driven by improved palm production and tropical oil refining margins. The company's focus on operational efficiency and strategic investments is expected to support its financial performance.

Wilmar's commitment to sustainability is a key competitive advantage, with its fourth consecutive inclusion in the Dow Jones Sustainability Indices (DJSI) World Index 2024. The Science Based Targets initiative (SBTi) validated its emissions targets in March 2025. The company has also made substantial progress in supply chain traceability, achieving 91.0% traceability to plantation and 98.5% traceability to palm oil mills by December 2024.

- Wilmar's focus on sustainable practices enhances its brand reputation and market position.

- The company's supply chain transparency efforts build trust with consumers and stakeholders.

- These sustainability initiatives contribute to long-term value creation and resilience.

- For more insights, explore the Growth Strategy of Wilmar International.

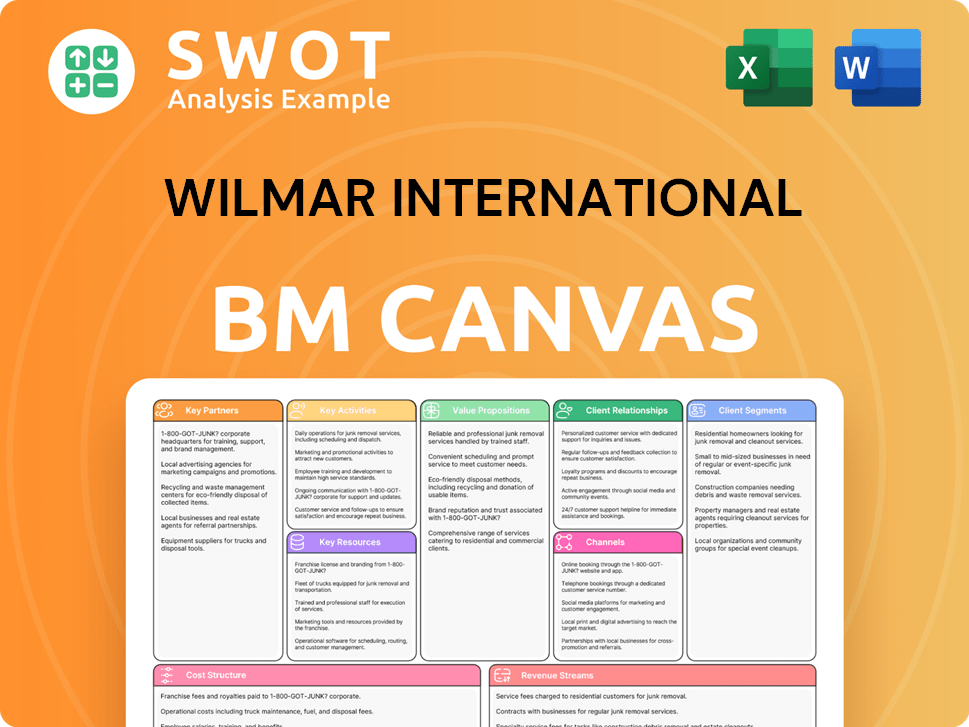

Wilmar International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Wilmar International Positioning Itself for Continued Success?

Wilmar International holds a significant position in the global agribusiness sector. As a leading agribusiness group in Asia, it's among the largest listed companies on the Singapore Exchange. Its extensive operations and integrated supply chain, including a vast network of distribution, reinforce its market dominance.

Despite its strong market position, Wilmar faces several risks. These challenges include ongoing land confiscation issues and a bribery investigation in Indonesia. Geopolitical volatility and currency fluctuations in key emerging markets can also impact its operations. Additionally, the company navigates challenges in the palm oil refining margins and the food segment, which may affect its financial performance.

Wilmar International is a leading player in the agribusiness sector, particularly in Asia. It operates on a large scale with integrated operations and a broad distribution network. Its associate Adani Wilmar Limited (AWL) strengthened its position in the FMCG market in India, reaching over 121 million households in 2024.

Key risks for Wilmar include land confiscation issues and a bribery investigation. Rising geopolitical volatility, currency fluctuations in emerging markets, and challenges in palm oil refining margins also pose risks. Slow recovery in China operations further impacts the company's financial performance.

Wilmar anticipates a rebound in earnings in 2025, driven by higher soybean crushing utilization and strong demand for soybean meal. The company plans to gain market share in the food products segment. Strategic initiatives include optimizing food parks and expanding in specialty chemicals.

Wilmar is focused on optimizing its food parks and expanding into specialty chemicals. The company is also set to benefit from the B40 biodiesel mandate in Indonesia. These initiatives are designed to improve efficiency and drive growth.

Wilmar's strong fundamentals and ESG credentials provide a foundation for long-term value creation. Investors should closely monitor global trade policies and commodity price trends. The company's focus on sustainability and its peer-beating scale are key strengths.

- Monitor global trade policies

- Watch commodity price trends

- Evaluate the impact of the B40 biodiesel mandate in Indonesia

- Assess the recovery pace of China operations

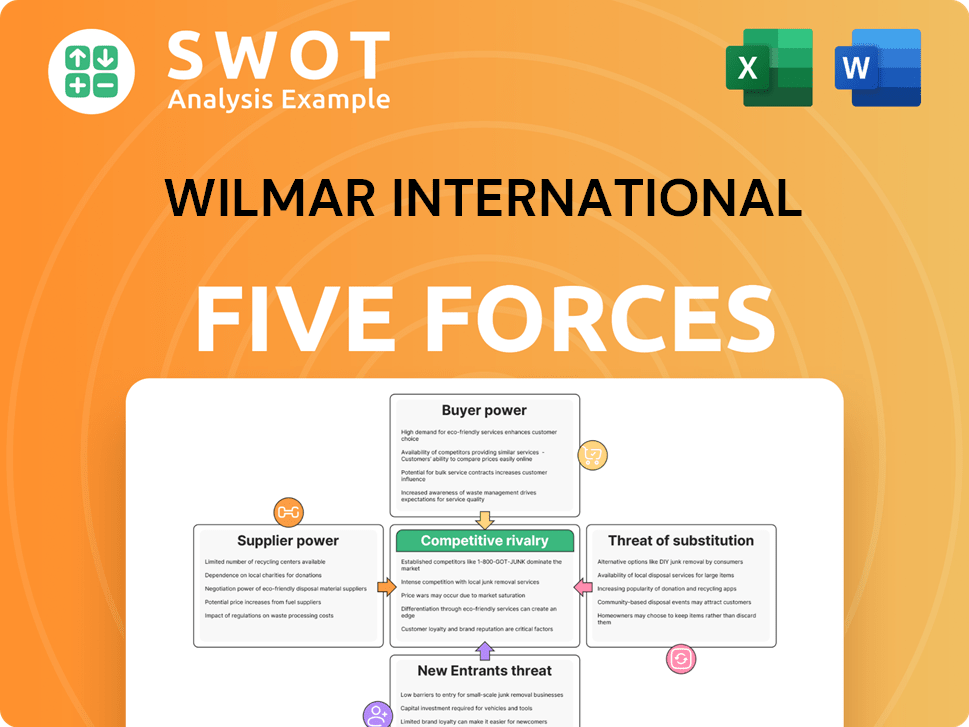

Wilmar International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Wilmar International Company?

- What is Competitive Landscape of Wilmar International Company?

- What is Growth Strategy and Future Prospects of Wilmar International Company?

- What is Sales and Marketing Strategy of Wilmar International Company?

- What is Brief History of Wilmar International Company?

- Who Owns Wilmar International Company?

- What is Customer Demographics and Target Market of Wilmar International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.