ZJLD Group Bundle

How Did ZJLD Group Company Conquer the Baijiu Market?

Ever wondered how a single distillery transformed into a baijiu powerhouse? ZJLD Group Company, a leading name in the Chinese beverage industry, boasts a fascinating ZJLD Group SWOT Analysis that reveals its strategic evolution. From its humble beginnings in 1975, ZJLD history is a testament to innovation and adaptability in the competitive world of premium spirits. Discover the key milestones that shaped ZJLD's journey.

The ZJLD company profile showcases a remarkable trajectory, starting with the establishment of Zhen Jiu in the baijiu-rich region of Guizhou. This ZJLD background highlights its commitment to preserving traditional brewing techniques while embracing modern advancements. Understanding ZJLD's timeline is crucial for grasping its impact on the industry and its strategic positioning in the market today. Explore the brief history of ZJLD Group Company to uncover the secrets behind its success.

What is the ZJLD Group Founding Story?

The story of the ZJLD Group Company, often referred to as ZJLD, begins with the vision of Wu Xiangdong, a veteran of the baijiu industry. The company's roots are intertwined with the acquisition and revitalization of established distilleries, marking a strategic approach to building a premium liquor brand. The company's story is a journey of acquiring historical assets and transforming them into thriving businesses.

Wu Xiangdong, the founder, brought over two decades of experience to the table, including the establishment of the baijiu brand Jinliufu. His focus on acquiring distilleries and investing in baijiu brewing was a key element in the formation of ZJLD Group. This strategy was not just about acquiring assets; it was about reviving the legacy and stories behind each brand.

The company's founding in November 2003 was a pivotal moment, but the acquisitions that followed were crucial. The acquisition of Li Du and Zhen Jiu in 2009, along with the earlier acquisition of the Xiang Jiao production plant, were significant. These distilleries, once underperforming, became the foundation for ZJLD's growth. This is a brief history of ZJLD Group Company.

The acquisition of Li Du and Zhen Jiu in 2009 was a critical step in ZJLD's early years.

- Li Du's history includes a fermentation pit dating back to the Yuan Dynasty, a key element in its appeal.

- Zhen Jiu is recognized as a legendary brand among modern Chinese distilleries.

- Wu Xiangdong's strategy focused on enhancing product quality through investment in plant restoration, equipment upgrades, and technique improvements.

- The company's initial business model involved revitalizing acquired brands and enhancing product quality.

The initial funding for these acquisitions and subsequent developments likely came from Wu Xiangdong's previous successes and strategic investments. The cultural and economic context of the early 2000s in China, marked by growing consumer demand and a burgeoning market for traditional Chinese products, likely influenced the pursuit of this venture. The company's commitment to quality and the revival of historical brands have been central to its identity. This is a look into the ZJLD history.

The company's approach to business, as highlighted in Mission, Vision & Core Values of ZJLD Group, emphasizes a commitment to quality and the preservation of heritage. This dedication to quality has been a driving force in shaping the company's trajectory. This is a ZJLD company profile.

The company's early years were marked by a focus on acquiring and revitalizing distilleries with rich histories. The company's growth strategy has been built on the foundation of these acquisitions. The company's evolution is a testament to its commitment to quality and heritage.

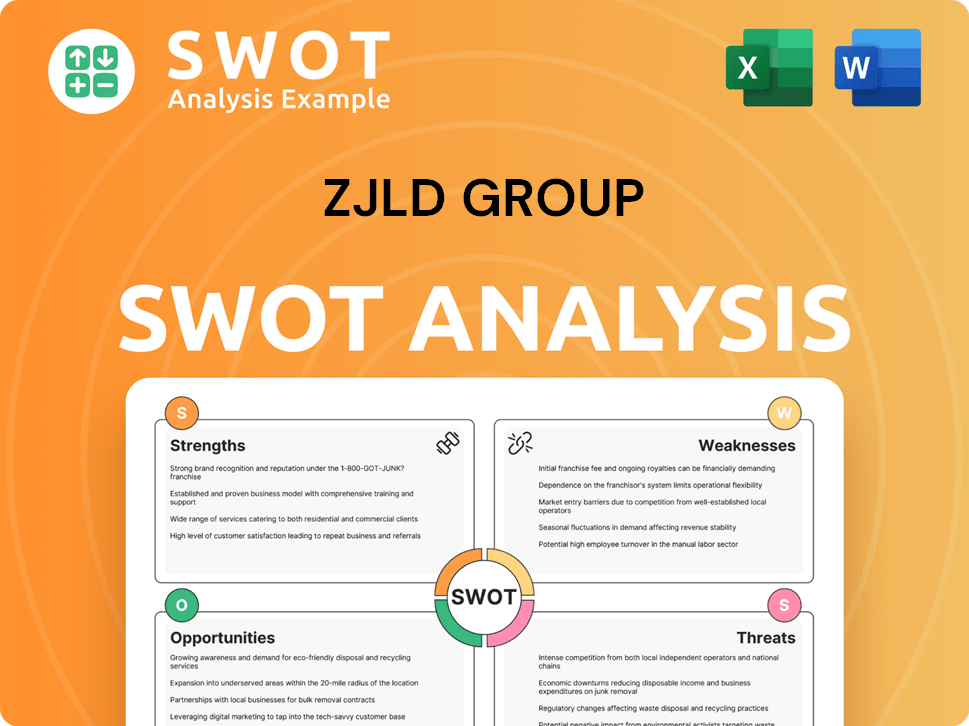

ZJLD Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ZJLD Group?

The early growth and expansion of ZJLD Group Company, a significant player in the baijiu industry, involved strategic acquisitions and a strong focus on product quality and market presence. This period saw substantial investments in revitalizing acquired brands and expanding production capacities. The company also broadened its product portfolio and distribution networks to cater to diverse consumer preferences and increase its reach across China, marking key milestones in its ZJLD history.

Following acquisitions like Xiang Jiao, Li Du, and Zhen Jiu in 2009, ZJLD Group Company focused on revitalizing these assets. A major investment of over RMB 10 billion was made to revitalize the Zhen Jiu brand. This investment significantly boosted production capacity to 35,000 kiloliters by 2023, from just 2,000 kiloliters in 2009.

The product range expanded to include sauce-aroma, mixed-aroma, and strong-aroma baijiu, catering to varied consumer tastes. ZJLD Group Company strengthened its distribution network, using both traditional and new channels. This strategy empowered distributors, driving sell-through and expanding its reach across China, which is a key part of the Marketing Strategy of ZJLD Group.

A strategic focus on premium and above-price-range baijiu products was evident. In the first half of 2024, the revenue from premium offerings increased, with their share rising from 62.3% to 67.1%. ZJLD Group Company's listing on the Main Board of the Hong Kong Stock Exchange on April 27, 2023, provided capital for further expansion.

Zhen Jiu maintained its position as the fourth-largest sauce-aroma baijiu brand in China in 2023 and 2024. Li Du remained the fifth-largest mixed-aroma baijiu brand in China, showing the highest year-on-year growth rate in 2024. International efforts included the Li Du Song Banquet in Kyoto, Japan, in May 2024, marking its formal entry onto the international stage.

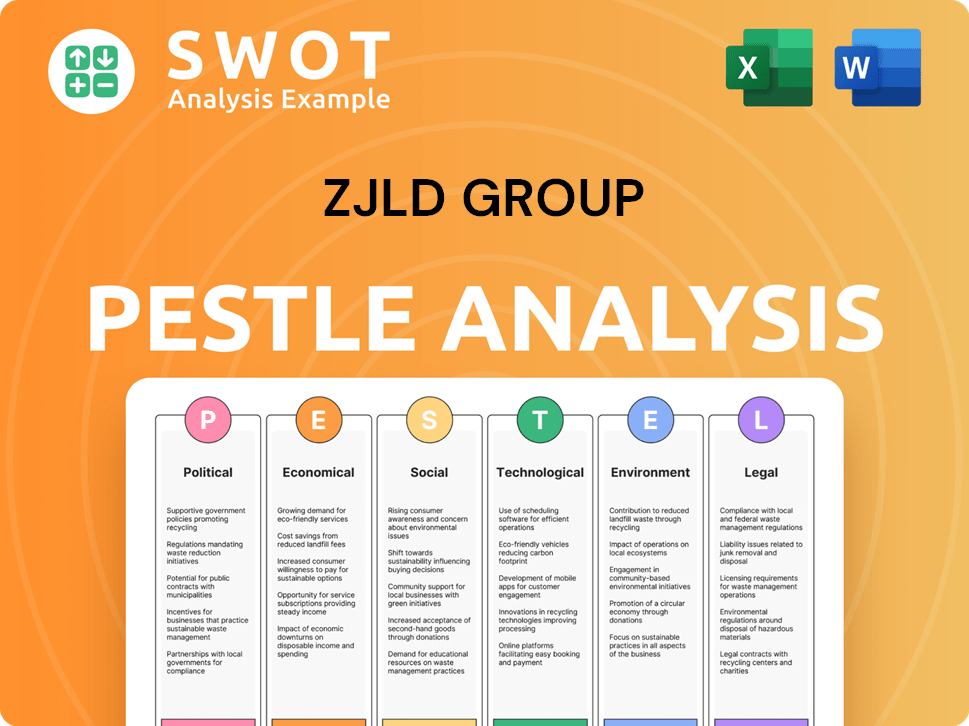

ZJLD Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ZJLD Group history?

The ZJLD Group Company has a rich history marked by significant achievements and strategic expansions. Key milestones highlight the company's growth and its increasing presence in the market, reflecting its commitment to excellence and innovation.

| Year | Milestone |

|---|---|

| April 27, 2023 | Successful listing on the Main Board of the Hong Kong Stock Exchange, marking the largest IPO of the year. |

| September 4, 2023 | Inclusion in the Hang Seng Composite Index, enhancing its visibility and market presence. |

| December 15, 2023 | Inclusion in four FTSE Global Equity Index Series indices by FTSE Russell, broadening its international investor base. |

| October 2024 | Received an 'AA' ESG rating, acknowledging its commitment to environmental, social, and governance practices. |

| November 2024 | Awarded 'The Listed Company of the Year 2024' by the Hong Kong Institute of Financial Analysts and Professional Commentators Limited. |

Innovation is a cornerstone of ZJLD's strategy, with a focus on blending traditional baijiu-brewing techniques with modern technology. The company has implemented projects such as the 'Ceramic-to-Glass' initiative to promote sustainability and introduced high-end package-free products, demonstrating a commitment to environmental responsibility and consumer demand.

This project aims to replace ceramic bottles with recyclable glass, addressing environmental concerns and promoting sustainability.

Introduction of high-end package-free baijiu products, with an annual sales volume of 3.6 million bottles, each embedded with an NFC chip for traceability.

The Zhenjiu brand was recognized as a 'National Green Factory' for its sustainable practices.

Despite its successes, ZJLD has faced challenges, particularly a weakened consumption demand in the baijiu industry starting from the second quarter of 2024. The company responded by implementing inventory control, stabilizing pricing, and adapting its product layout.

The company faced sluggish market dynamics and downward price pressure on top sauce liquors.

ZJLD focused on controlling inventory, stabilizing pricing, and adapting product layout to navigate industry trends.

Implemented a dual-channel growth strategy for Zhen Jiu since Q4 2023, recognizing the distinct characteristics of traditional and emerging channels.

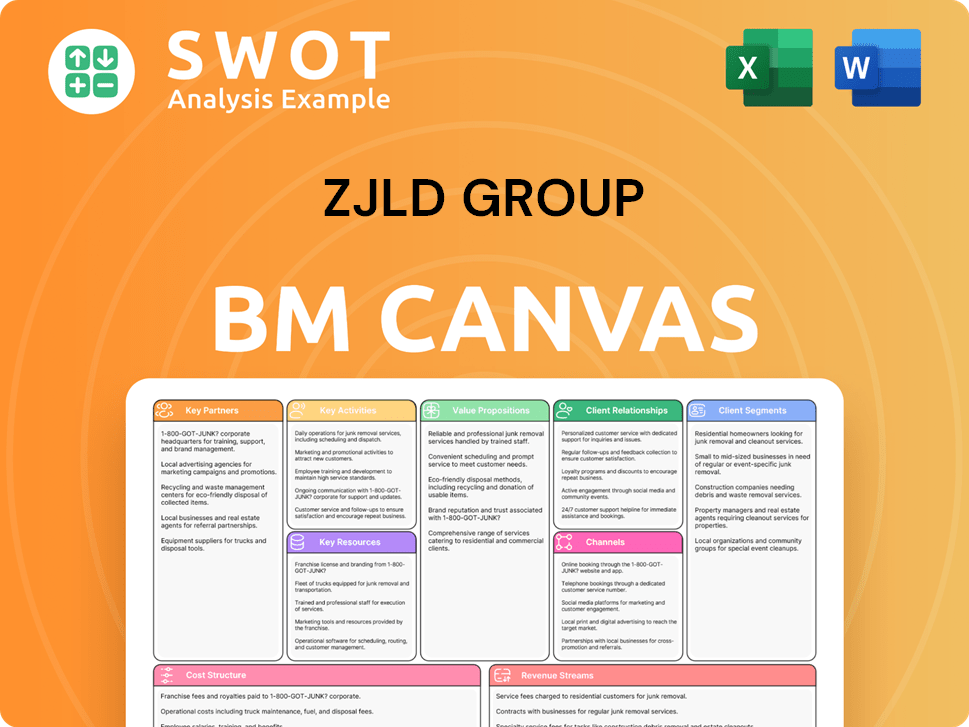

ZJLD Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ZJLD Group?

The ZJLD Group Company has a rich history, marked by strategic acquisitions and significant growth, particularly for its key brands. Starting with the establishment of Zhen Jiu in 1975, the company has grown through acquisitions and strategic moves, culminating in a successful IPO in 2023 and inclusion in major stock indices. These milestones highlight the evolution and expansion of ZJLD within the baijiu industry.

| Year | Key Event |

|---|---|

| 1975 | Zhen Jiu, a flagship brand of ZJLD Group, is established in Zunyi, Guizhou. |

| 1988 | Zhen Jiu receives the National Quality Award and is designated as one of two sauce-aroma baijiu served at state banquets. |

| Early 2000s | Wu Xiangdong, founder of ZJLD Group, begins acquiring distilleries, including Xiang Jiao. |

| November 2003 | ZJLD Group is founded by Wu Xiangdong. |

| 2009 | Li Du and Zhen Jiu distilleries are acquired by ZJLD Group, leading to significant investment in Zhen Jiu. |

| April 27, 2023 | ZJLD Group successfully lists on the Main Board of the Hong Kong Stock Exchange, marking the largest IPO of the year. |

| September 4, 2023 | ZJLD Group is included as a constituent stock in the Hang Seng Composite Index. |

| December 15, 2023 | ZJLD Group is included in four indices of the FTSE Global Equity Index Series by FTSE Russell. |

| December 2023 | ZJLD is recognized by Wind as one of the 'Top 100 Companies in ESG Practices' and receives an 'AA' ESG rating. |

| May 2024 | Li Du Song Banquet makes its global premiere in Kyoto, Japan, signifying Li Du's formal entry onto the international stage. |

| June 2024 | ZJLD Group holds its 2024 Annual General Meeting and Investor Day Event in Zunyi, Guizhou Province. |

| September 2024 | ZJLD is awarded the 'Outstanding Social Sustainable Awards' and 'Outstanding Green Sustainable Awards' by Metro Finance's 'GBA ESG Achievement Awards 2024.' |

| October 2024 | ZJLD is again rated 'AA' for ESG by Wind and recognized among the 'Top 100 Companies in ESG Practices' for 2024. |

| November 2024 | ZJLD is awarded 'The Listed Company of the Year 2024' by the Hong Kong Institute of Financial Analysts and Professional Commentators Limited. |

| December 2024 | ZJLD is awarded the '2024 Hong Kong Corporate Governance and ESG Excellence Award' by the Chamber of Hong Kong Listed Companies. |

| December 31, 2024 | ZJLD Group reports revenue of RMB 7,066,784,000 and a 116.3% surge in net cash generated from operating activities to RMB 781,003,000. |

In 2025, ZJLD Group will emphasize high-quality and sustainable development. The year marks Zhen Jiu's 50th anniversary, with plans for extensive brand building and promotional activities. The company aims to achieve breakthroughs in brand building, quality enhancement, channel innovation, and social responsibility.

ZJLD plans to strengthen its market position in the sauce-aroma baijiu and premium baijiu markets. Strategic initiatives include expanding diverse consumption scenarios, such as banquets, and exploring segmented sales channels. Management expects sales in the first half of 2025 to be no less than that of the second half of 2024.

ZJLD's long-term strategy includes optimizing its product line, strengthening brand promotion, and expanding into overseas markets. The company is also focused on cultivating corporate client resources to expand business-driven demand. This approach aligns with the founding vision of creating high-quality baijiu products.

Analysts expect ZJLD's brand revenue performance to remain stable in 2025, with potential improvement starting from Q3 2025. The company's focus on sustainable development and strategic initiatives is expected to drive long-term growth. The company reported revenue of RMB 7,066,784,000 and a 116.3% surge in net cash generated from operating activities to RMB 781,003,000 in 2024.

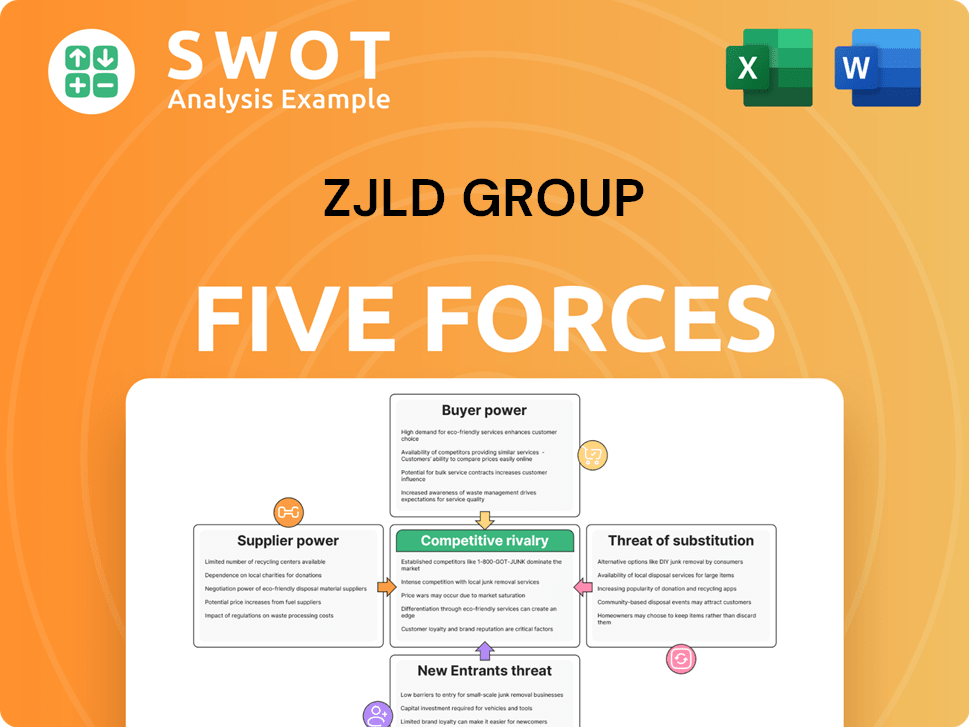

ZJLD Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ZJLD Group Company?

- What is Growth Strategy and Future Prospects of ZJLD Group Company?

- How Does ZJLD Group Company Work?

- What is Sales and Marketing Strategy of ZJLD Group Company?

- What is Brief History of ZJLD Group Company?

- Who Owns ZJLD Group Company?

- What is Customer Demographics and Target Market of ZJLD Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.