ZJLD Group Bundle

Who Really Owns ZJLD Group?

Ever wondered about the forces shaping the future of China's baijiu market? Understanding the ZJLD Group SWOT Analysis is essential for investors. This exploration unveils the intricate ZJLD Group ownership structure, from its IPO debut to its current stakeholders. Discover the key players behind this rapidly growing beverage giant.

Unraveling who owns ZJLD is critical for anyone seeking to understand its strategic direction and growth potential. This analysis goes beyond the surface, examining the ZJLD Group company profile and its evolution since its 2023 IPO. We'll explore the ZJLD Group structure, including major shareholders and the influence they wield, providing actionable insights for informed decision-making.

Who Founded ZJLD Group?

The initial ownership structure of the ZJLD Group company was heavily influenced by its founder, Wu Xiangdong. At the time of the initial public offering (IPO) in April 2023, the founder, through Zhenjiu Holding, held a significant stake in the company. This concentrated ownership structure is a key aspect of understanding who owns ZJLD.

Another major player in the early ownership of ZJLD Group was KKR, a global investment firm. KKR, through Zest Holdings, held a substantial stake, demonstrating early external validation. The company's incorporation in the Cayman Islands in 2021 further shaped its ownership and operational structure.

Understanding the ZJLD Group ownership structure is essential for investors and stakeholders. The company's early ownership, with strong founder control and the backing of a major investment firm, set the stage for its market approach. This structure facilitated the company's growth plans, particularly within the baijiu industry.

Wu Xiangdong, the founder, had a substantial influence on ZJLD Group. His control was exercised through Zhenjiu Holding, which held a major share at the time of the IPO. This high level of founder ownership is a key aspect of the ZJLD Group ownership structure.

KKR's investment through Zest Holdings was a crucial part of the early ownership. This investment provided external validation and supported the company's strategic goals. KKR's involvement underscores the importance of external investment in ZJLD Group's early development.

The IPO in April 2023 marked a significant milestone for ZJLD Group. This event provides a clear snapshot of the ownership structure, with founder Wu Xiangdong and KKR as key stakeholders. The IPO date is crucial when analyzing the ZJLD Group ownership history.

ZJLD Group's incorporation in the Cayman Islands in 2021 is an important detail. This legal structure influenced the company's operations and financial strategies. The location is relevant when considering the ZJLD Group legal structure.

The early ownership structure reflected a vision for market expansion, particularly in the baijiu industry. The strategies employed by ZJLD Group were influenced by the early stakeholders. The company's approach is a key element in understanding ZJLD Group's company profile.

While specific details on early agreements are not publicly detailed, the strong founder ownership and KKR's early involvement shaped the company's trajectory. These agreements played a role in the ZJLD Group structure. Understanding these agreements is key to finding ZJLD Group ownership information.

The initial ownership of ZJLD Group was characterized by strong founder control and significant investment from KKR. This structure played a crucial role in the company's early development and strategic direction. For more insights, see the Growth Strategy of ZJLD Group.

- Wu Xiangdong's Dominance: The founder's substantial stake through Zhenjiu Holding provided a solid foundation.

- KKR's Strategic Role: KKR's investment offered external validation and strategic support.

- IPO as a Milestone: The IPO in April 2023 provided a clear view of the ownership structure.

- Market Expansion Focus: The early ownership structure supported the company's growth within the baijiu industry.

- Legal Structure: The company was incorporated in the Cayman Islands in 2021.

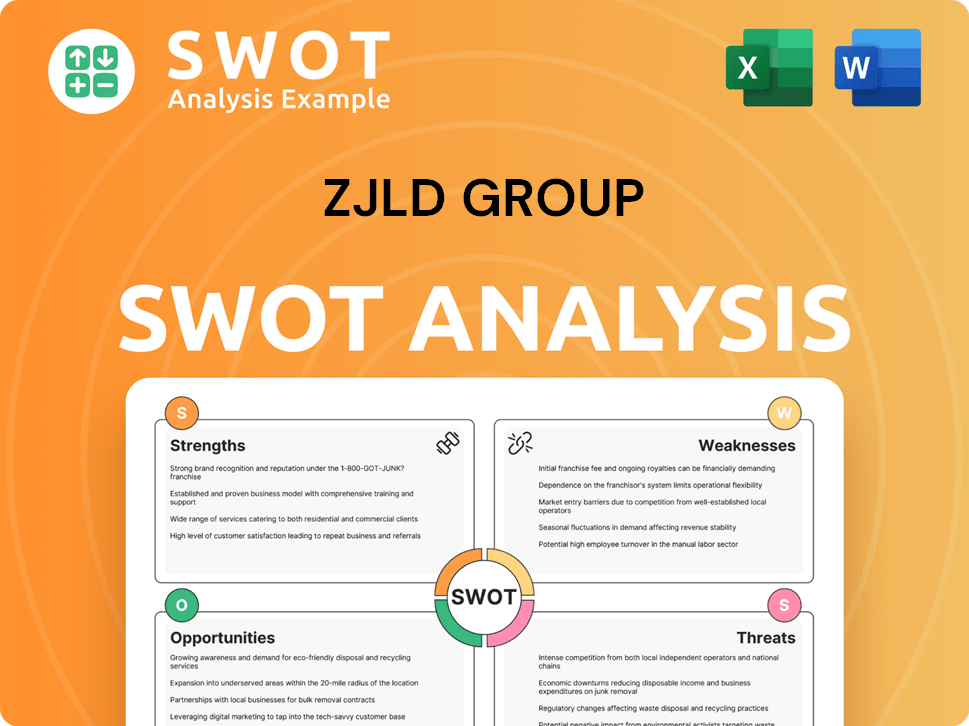

ZJLD Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ZJLD Group’s Ownership Changed Over Time?

The ZJLD Group's ownership structure underwent a significant transformation with its listing on the main board of the Hong Kong Stock Exchange on April 27, 2023. This initial public offering (IPO) involved the sale of 490,699,800 shares at an offering price of HKD 10.82 per share, which successfully raised over HKD 5.3 billion, equivalent to approximately USD 676 million. This event marked a pivotal moment, shifting the company from primarily private ownership to a publicly traded entity, opening it up to a broader range of investors.

Despite the IPO, the founder and individual insiders of the ZJLD Group continue to hold a significant portion of the company's shares. As of February 10, 2025, these insiders collectively own a substantial 69% of the company. This concentration of ownership highlights the founder's continued influence and strategic control over the company's direction, even after becoming a publicly listed entity. This structure is a key aspect of understanding the ZJLD Group ownership dynamics.

| Shareholder | Stake as of February 10, 2025 | Stake as of June 2023 |

|---|---|---|

| Wu Xiangdong (Founder) | 67% | - |

| Second Largest Shareholder | 13% | - |

| Third Largest Shareholder | 1.8% | - |

| KKR & Co. Inc. | - | 16% |

| Public | 16% | - |

Beyond the founder, major stakeholders include KKR & Co. Inc., which held a 16% stake in ZJLD Group as of June 2023. Institutional investors also hold stakes, though their portion is smaller. As of April 30, 2025, Vanguard Total International Stock Index Inv. holds 0.21% of total shares, and Vanguard Emerging Markets Stock Index Inv. holds 0.19%. Other institutional investors include China Universal Consume Sel 2Y Own Eq A, Vanguard Instl Ttl Intl Stk Mkt Idx TrII, and Yinhua Fuli Selected Alloc A. The general public, including retail investors, owns a 16% stake in the company. For more insights, consider exploring the Competitors Landscape of ZJLD Group.

The ownership structure of ZJLD Group is characterized by a significant concentration of shares with the founder, Wu Xiangdong, despite the company's public listing.

- Founder Wu Xiangdong holds a controlling stake, ensuring strategic influence.

- KKR & Co. Inc. remains a major stakeholder.

- Institutional investors have smaller, but significant, holdings.

- The general public holds a 16% stake.

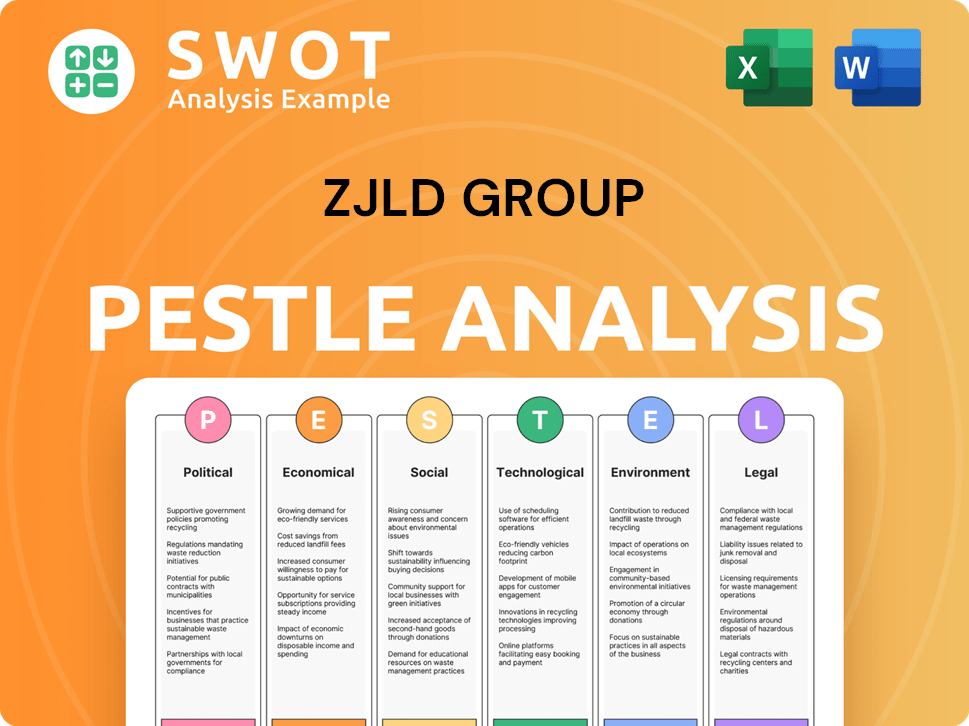

ZJLD Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ZJLD Group’s Board?

As of June 4, 2025, the board of directors of ZJLD Group includes executive, non-executive, and independent non-executive directors. The executive directors are Mr. Wu Xiangdong (Chairman), Mr. Yan Tao, Mr. Wu Qirong, Ms. Zhu Lin, and Mr. Luo Yonghong. Mr. Sun Zheng serves as the non-executive director. The independent non-executive directors are Mr. Li Dong, Ms. Yan Jisheng, and Mr. Huang Ching-Shuan Johnson. Mr. Wu Xiangdong, the founder and chairman, holds a significant stake, providing considerable control over the company.

Mr. Ng Kwong Chue Paul retired from his executive director role on May 9, 2025, to focus on other personal commitments, while he will serve as a senior advisor. Mr. Wu Qirong was nominated for election as an executive director at the Annual General Meeting on May 9, 2025. The current board structure reflects a blend of experience and independence, guiding the company's strategic direction.

| Director | Role | Status |

|---|---|---|

| Mr. Wu Xiangdong | Executive Director, Chairman | Active |

| Mr. Yan Tao | Executive Director | Active |

| Mr. Wu Qirong | Executive Director | Active |

| Ms. Zhu Lin | Executive Director | Active |

| Mr. Luo Yonghong | Executive Director | Active |

| Mr. Sun Zheng | Non-Executive Director | Active |

| Mr. Li Dong | Independent Non-Executive Director | Active |

| Ms. Yan Jisheng | Independent Non-Executive Director | Active |

| Mr. Huang Ching-Shuan Johnson | Independent Non-Executive Director | Active |

The voting structure at ZJLD Group generally follows a one-share-one-vote principle. At the Annual General Meeting, each shareholder is entitled to one vote per share. The substantial insider ownership, with Mr. Wu Xiangdong holding 67% of the shares, indicates that insiders have significant voting power, which can heavily influence company decisions. This concentrated ownership structure is a key aspect of understanding the ZJLD Group ownership and its potential impact on the company's strategic direction. There have been no recent proxy battles or activist investor campaigns reported.

The board of directors at ZJLD Group includes a mix of executive, non-executive, and independent non-executive directors, ensuring diverse perspectives. Mr. Wu Xiangdong, as the largest shareholder, holds substantial voting power, influencing company decisions.

- The board comprises experienced professionals.

- Shareholders vote on a one-share-one-vote basis.

- Insider ownership is a key factor in company control.

- No recent proxy battles have been reported.

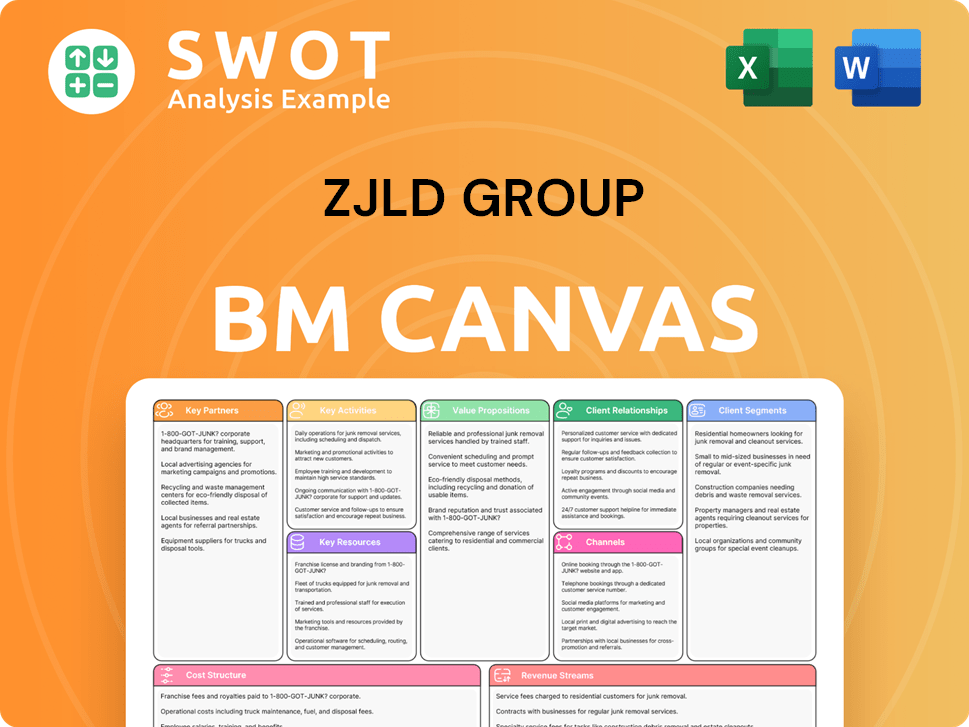

ZJLD Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ZJLD Group’s Ownership Landscape?

In the past few years, the ZJLD Group company has seen significant developments, particularly with its initial public offering (IPO) on the Hong Kong Stock Exchange in April 2023, which raised over HKD 5.3 billion. Founder Wu Xiangdong has maintained a substantial ownership stake. As of February 2025, he held 67% of the outstanding shares, indicating a strong control over the company's direction. This ownership structure is a key aspect of understanding the ZJLD Group ownership and its future strategies.

Recent financial reports for the fiscal year ending December 31, 2024, reveal a slight increase in revenue by 0.5% and gross profit by 1.5% compared to the previous year. However, the profit attributable to equity shareholders decreased significantly by 43.1%. Despite this, net cash generated from operating activities more than doubled, surging by 116.3%. These figures provide insights into the ZJLD Group structure and its financial performance.

Leadership changes have also occurred, with Mr. Ng Kwong Chue Paul retiring as an executive director and company secretary on May 9, 2025. Mr. Wu Qirong was nominated as an executive director. Furthermore, Mr. Wang Lianbo was appointed as the authorized representative for service of process in Hong Kong and as joint company secretary, effective June 4, 2025. These changes may reflect the ongoing evolution of the ZJLD Group shareholders and its governance.

The founder's continued majority ownership suggests stability in the ZJLD Group ownership structure. This can influence long-term strategies.

While revenue and gross profit showed modest growth, the significant drop in profit attributable to equity shareholders and the surge in net cash from operations require closer examination to understand the ZJLD Group financial reports fully.

Recent changes in the board and company secretary roles may indicate shifts in corporate governance and future strategic directions for the ZJLD Group company.

The company's multi-brand strategy aligns with broader industry trends, suggesting efforts to broaden its consumer base. This will impact the ZJLD Group major stakeholders.

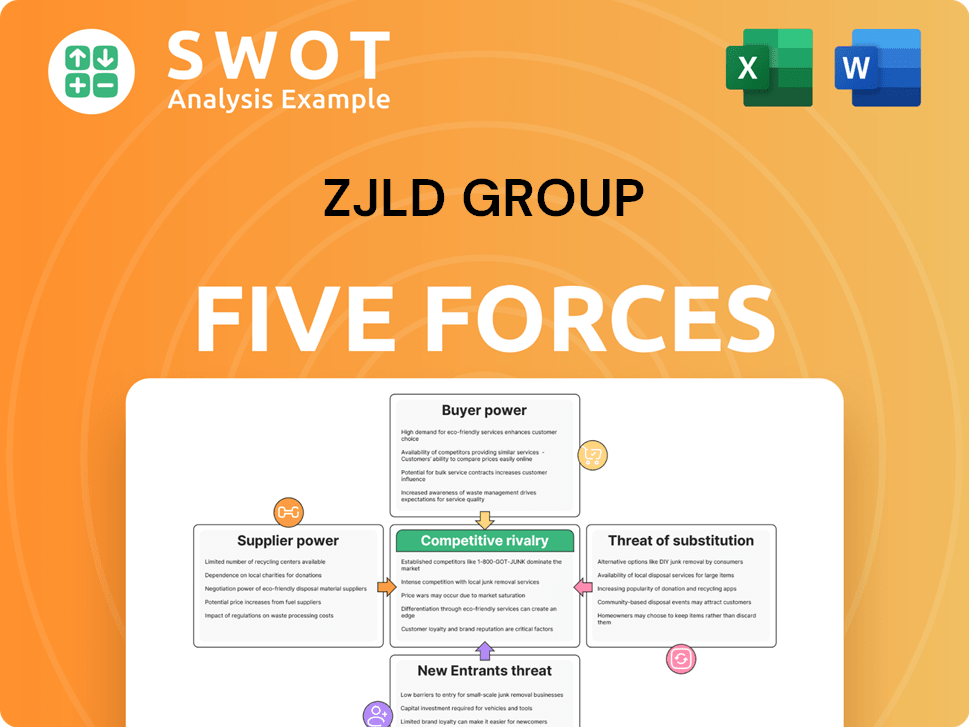

ZJLD Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ZJLD Group Company?

- What is Competitive Landscape of ZJLD Group Company?

- What is Growth Strategy and Future Prospects of ZJLD Group Company?

- How Does ZJLD Group Company Work?

- What is Sales and Marketing Strategy of ZJLD Group Company?

- What is Brief History of ZJLD Group Company?

- What is Customer Demographics and Target Market of ZJLD Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.