ZJLD Group Bundle

How Does ZJLD Group Thrive in the Baijiu Market?

ZJLD Group, a leading name in China's baijiu industry, has captured significant attention since its 2023 IPO. This company, recognized as the third-largest private baijiu entity by revenue, offers a compelling case study in strategic market positioning. Understanding ZJLD Group SWOT Analysis is key to grasping its competitive advantages.

This exploration delves into the core of How ZJLD works, examining its ZJLD operations and ZJLD business model. We'll uncover how ZJLD Company has managed to modernize the traditional baijiu sector and what drives its financial success, including its ZJLD Group financial performance as of late 2024. This analysis is essential for anyone interested in ZJLD Group investment opportunities or the broader alcoholic beverage landscape.

What Are the Key Operations Driving ZJLD Group’s Success?

The core operations of the ZJLD Group, also known as ZJLD Company, revolve around the production and distribution of baijiu products. The company's business model is centered on serving a diverse customer base across China. This involves a complex process from the initial stages of qu-making to the final packaging of the product, ensuring the delivery of high-quality baijiu.

ZJLD Group's value proposition lies in its multi-brand strategy and commitment to traditional baijiu-brewing techniques. This approach is combined with modern technology, focusing on premiumization. This strategy allows the company to offer a wide variety of baijiu products with different aromas to meet various consumer preferences. The company's operations are designed to maintain its market position and differentiate itself through brand recognition and quality.

The company's operational process involves meticulous baijiu making, including qu-making, fermentation, distillation, blending, and packaging. The company strategically positions its sauce aroma baijiu production in the Zunyi region of Guizhou, known for ideal conditions. As of December 31, 2024, ZJLD Group operated seven production facilities in China. The company also focuses on continuous improvement in energy and water efficiency, with over 50% of its electricity consumption coming from green electricity in 2024.

ZJLD Group operates four major baijiu brands: Zhen Jiu, Li Du, Xiang Jiao, and Kai Kou Xiao. Each brand caters to different preferences and market positions, including sauce aroma, mixed aroma, and strong aroma baijiu. Zhen Jiu is the flagship brand.

The company relies on a nationwide network of distributors and a direct sales team. Distributor sales accounted for 89.9% of the Group's total revenue in 2024, reaching approximately RMB 6,355.7 million. ZJLD Group enhances channel monitoring through digital tools.

Zhen Jiu, the flagship brand, focuses on high-quality sauce aroma baijiu, contributing approximately 63.4% of the company's revenue in 2024. Li Du offers mixed aroma baijiu. Xiang Jiao and Kai Kou Xiao are leading regional brands with diversified aroma offerings.

ZJLD Group emphasizes continuous improvement in energy and water efficiency. The company focuses on optimizing order and price stability, particularly for premium and deluxe product series. This approach is part of the growth strategy of ZJLD Group.

ZJLD Group's operations are characterized by a multi-brand strategy, a focus on traditional baijiu-brewing techniques, and a commitment to premiumization. The company's structure is designed to optimize its market position.

- Multi-brand strategy to cater to various consumer preferences.

- Emphasis on traditional baijiu-brewing techniques combined with modern technology.

- Focus on premiumization to enhance brand value and customer satisfaction.

- Strategic location of production facilities in key regions.

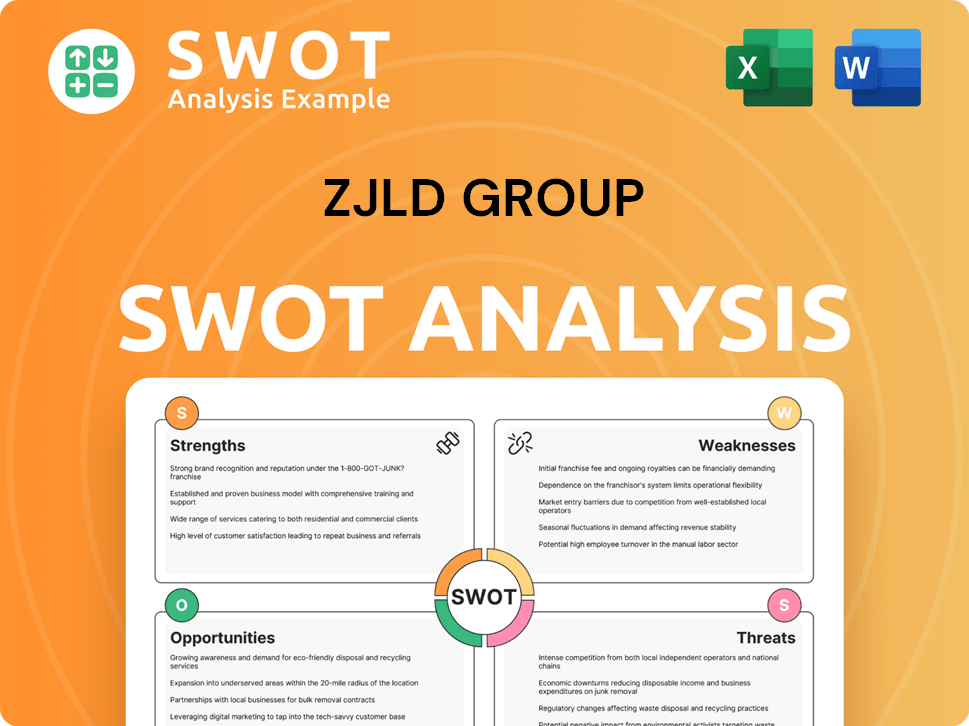

ZJLD Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ZJLD Group Make Money?

The primary revenue source for the ZJLD Group comes from selling alcoholic beverages, mainly baijiu. The company has a diverse portfolio of products across different price points and aroma profiles. Understanding how ZJLD Group generates revenue is key to evaluating its financial health and market position.

In 2024, ZJLD Group reported a total revenue of RMB 7,066,784,000, slightly up from RMB 7,030,467,000 in 2023. The gross profit for the same period was RMB 4,143,040,000, with a gross profit margin of 58.6%. These figures highlight the company's financial performance and its ability to maintain profitability.

The company's revenue streams are primarily driven by the sales of its four main brands: Zhen Jiu, Li Du, Xiang Jiao, and Kai Kou Xiao. Zhen Jiu is the major contributor, accounting for approximately 63.4% of the total revenue in 2024. Li Du contributed about 18.6%, while Xiang Jiao and Kai Kou Xiao made up 11% and 5%, respectively, in the same year. This breakdown shows the importance of each brand to ZJLD Group's overall financial success and its market share.

ZJLD Group employs several strategies to monetize its products and expand its market presence. A key focus is on premium and above-price-range baijiu offerings, which have shown growth. The company also uses a dual-channel approach for Zhen Jiu, differentiating between traditional and emerging channels. For more context on the competitive landscape, consider reading about the Competitors Landscape of ZJLD Group.

- Premiumization: Revenue from premium and above-price-range baijiu rose, increasing its share of overall revenue from 62.3% to 67.1% in the first half of 2024.

- Dual-Channel Strategy: Zhen Jiu utilizes a dual-channel growth strategy, tailoring product portfolios, pricing, and channel networks for traditional and emerging channels.

- Experiential Marketing: Initiatives like high-end tasting events, such as 'National Banquet • Zhen' and 'Holy Land Distillery Tour,' boost sales.

- International Expansion: The company is exploring duty-free distribution channels in Hong Kong, Macau, and Southeast Asia.

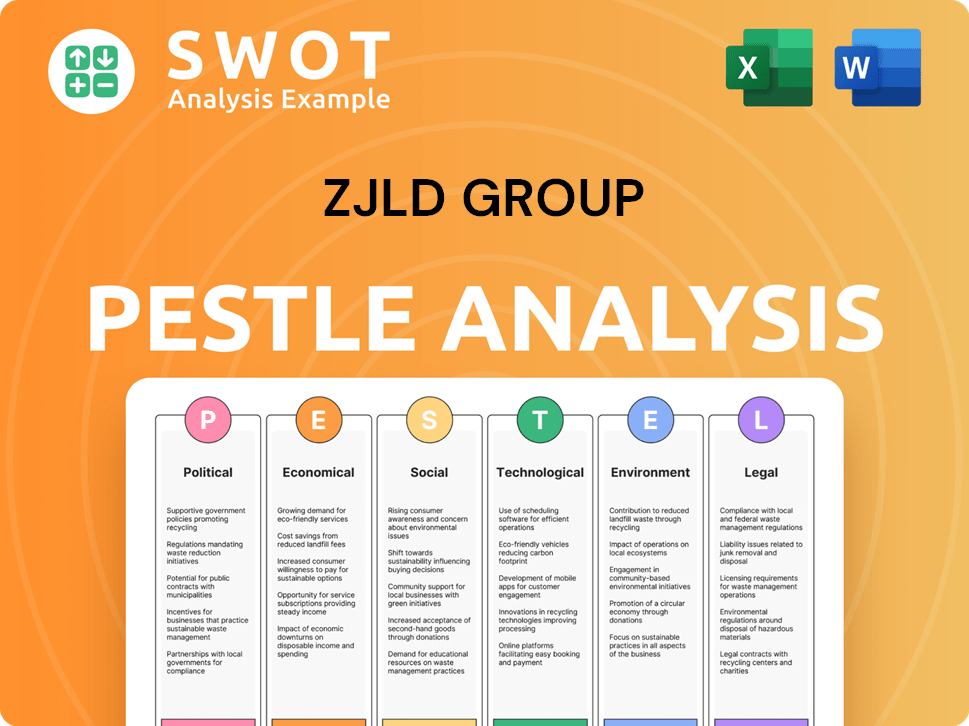

ZJLD Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ZJLD Group’s Business Model?

Understanding the inner workings of the ZJLD Group, it's essential to examine its key milestones, strategic moves, and competitive advantages. These elements collectively define the company's trajectory and market position. The company has demonstrated significant growth and strategic foresight, especially in the competitive baijiu industry.

The ZJLD Group's journey is marked by strategic decisions and operational enhancements. From its initial public offering to its expansion plans, the company has consistently aimed to strengthen its market presence and operational capabilities. This focus, coupled with a commitment to product quality and brand reputation, has allowed it to navigate industry challenges effectively.

The company's commitment to sustainable practices and technological integration further sets it apart. By focusing on premium products and efficient distribution, ZJLD Group has positioned itself for continued success in the dynamic baijiu market. This approach highlights its dedication to both quality and environmental responsibility.

A significant milestone for ZJLD Group was its listing on the Main Board of the Hong Kong Stock Exchange on April 27, 2023, which was the largest IPO on the HKEX that year. This was followed by its inclusion in the Hang Seng Composite Index in September 2023 and the FTSE Global Equity Index Series in December 2023. These inclusions enhanced its visibility and investor confidence.

ZJLD Group has focused on capacity expansion and product premiumization. The company plans to increase overall base liquor production capacity by 26,000 tons before 2024. Strategic moves like optimizing the product structure by focusing on higher-margin products and refining its dual-channel growth strategy for distribution have been key to its sustained performance.

The company's competitive advantages stem from its multi-brand strategy, strong brand reputation, and high-quality products. Zhen Jiu has maintained its position as the fourth largest sauce-aroma baijiu brand in China for two consecutive years (2023 and 2024) by revenue. ZJLD Group's commitment to inheriting time-honored baijiu-brewing techniques while integrating modern technology provides a unique product quality.

Despite industry adjustments in 2024, ZJLD Group achieved a 116.3% surge in net cash generated from operating activities, rising to RMB 781,003,000, showcasing its operational resilience. Zhen Jiu's base liquor reserve reached 90,000 tons and production capacity surpassed 41,000 tons as of May 2024. This reflects strong financial health and operational efficiency.

ZJLD Group's operational strategies include capacity expansion and product premiumization. The company's focus on sustainable product strategies, such as achieving an ESG 'AA' rating from Wind in 2024 and aiming for 100% green electricity consumption by 2025, demonstrates its commitment to environmental responsibility.

- Successful IPO on the HKEX in April 2023.

- Inclusion in the Hang Seng Composite Index and FTSE Global Equity Index Series.

- Focus on increasing base liquor production capacity by 26,000 tons before 2024.

- Achieved a 116.3% surge in net cash from operating activities in 2024.

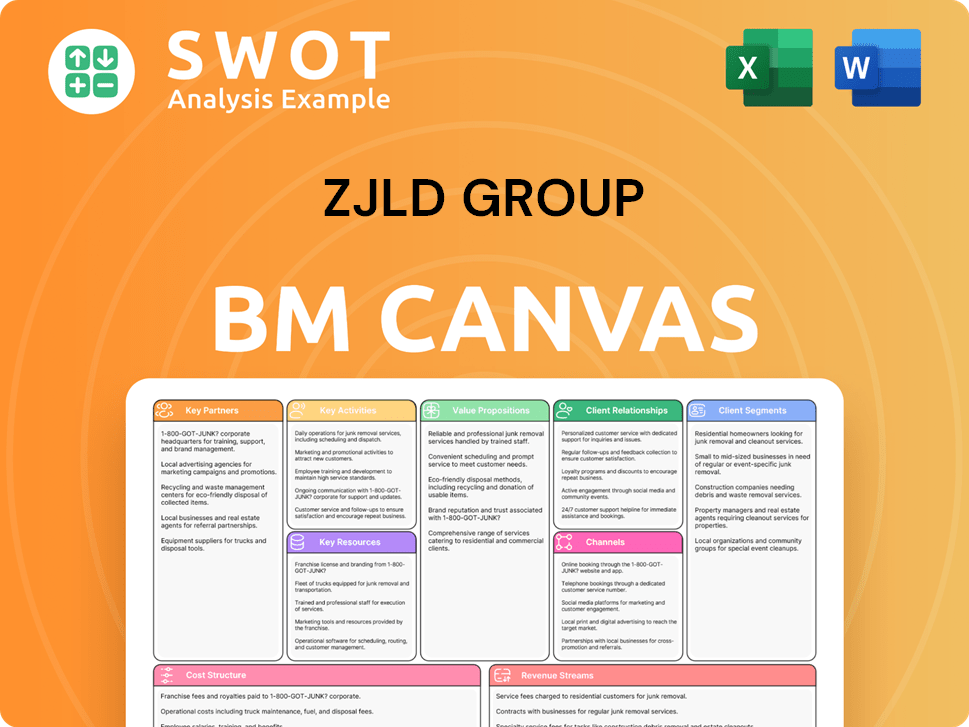

ZJLD Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ZJLD Group Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook of ZJLD Group. ZJLD Group, a significant player in China's baijiu industry, held the position of the third-largest private baijiu company by revenue in 2023, according to Frost & Sullivan. Its flagship brand, Zhen Jiu, consistently ranks among the top baijiu brands in China, demonstrating a strong market presence.

Despite its robust market position, ZJLD Group faces inherent challenges. The baijiu industry is undergoing adjustments, and the company is exposed to market fluctuations and intense competition. Additionally, consumer preference shifts, regulatory changes, and the emergence of new competitors pose potential risks to ZJLD Group's operations. For more details, you can read about Owners & Shareholders of ZJLD Group.

ZJLD Group is a major player in the Chinese baijiu market. In 2023, it was the third-largest private baijiu company by revenue. The Zhen Jiu brand is consistently ranked among the top baijiu brands in China.

The baijiu industry faces market adjustments and intense competition. Changes in consumer preferences and regulatory shifts can impact ZJLD Group. New competitors also pose a risk to the company's market share and financial performance.

ZJLD Group aims for high-quality and sustainable development. The company plans to invest in brand building, quality enhancement, and channel innovation. Expansion into diverse consumption scenarios and premium markets is also planned.

Analysts forecast ZJLD Group to grow earnings by 18.6% and revenue by 9.1% per annum. The company's long-term vision is to become a 'world-class spirit company' by focusing on fine baijiu and creating shareholder value.

ZJLD Group's strategic initiatives for 2025 and beyond include several key areas. These initiatives are designed to strengthen the company's market position and drive sustainable growth. The company is focusing on several strategies to improve its market share, revenue, and customer satisfaction.

- Continued investment in brand building.

- Enhancement of product quality.

- Channel innovation and expansion.

- Optimization of the distributor network.

- Upgrade of experiential marketing initiatives.

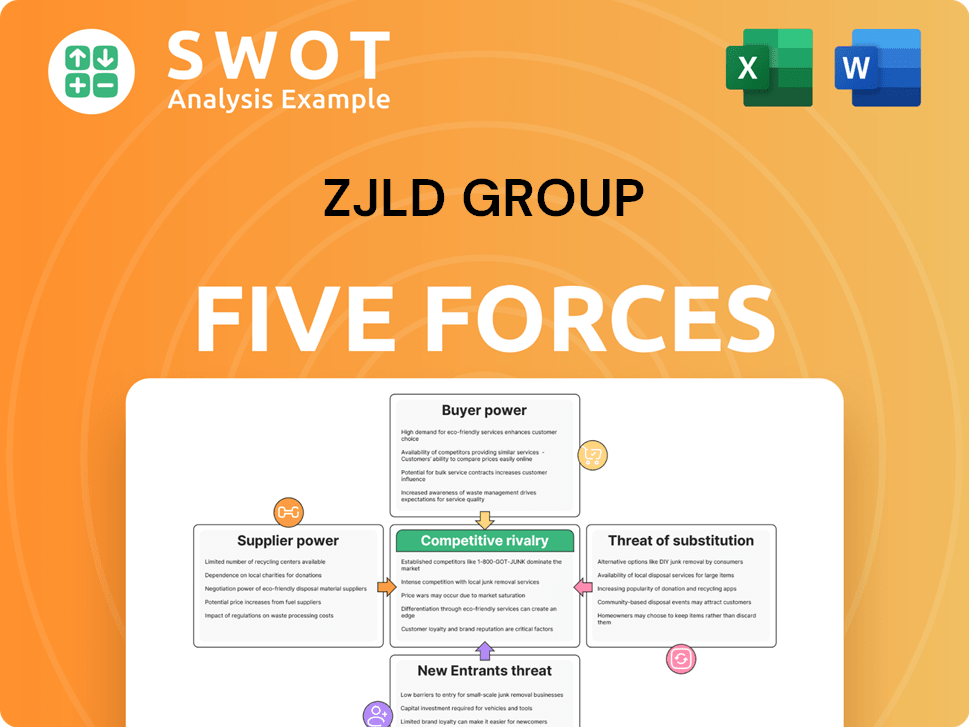

ZJLD Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ZJLD Group Company?

- What is Competitive Landscape of ZJLD Group Company?

- What is Growth Strategy and Future Prospects of ZJLD Group Company?

- What is Sales and Marketing Strategy of ZJLD Group Company?

- What is Brief History of ZJLD Group Company?

- Who Owns ZJLD Group Company?

- What is Customer Demographics and Target Market of ZJLD Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.