ZJLD Group Bundle

Can ZJLD Group Company Maintain Its Momentum in the Baijiu Market?

ZJLD Group Company, a leading player in China's baijiu industry, has captured significant market share with its flagship brand, Zhen Jiu. Founded in 1975, the company has strategically built a diverse portfolio of brands, including Zhen Jiu and Li Du, to cater to a wider consumer base. With a 2024 revenue of RMB 7.07 billion, ZJLD Group's ZJLD Group SWOT Analysis reveals the strategies behind its success and the challenges it faces.

This exploration delves into the Growth Strategy and Future Prospects of ZJLD Group Company, examining its Business Development initiatives and Market Analysis. We'll analyze its Financial Performance, expansion plans, and how it's adapting to market changes. Understanding the ZJLD Group Company's Growth Strategy is crucial for investors and strategists looking to understand investment opportunities, the company's competitive advantage, and its long-term goals.

How Is ZJLD Group Expanding Its Reach?

ZJLD Group Company is actively pursuing several expansion initiatives to fuel its future Growth Strategy, focusing on both market penetration and product diversification. This strategic approach is designed to capitalize on emerging opportunities and strengthen the company's position within the competitive baijiu market. These initiatives are crucial for achieving the company's long-term goals and enhancing its Financial Performance.

A key element of ZJLD Group's strategy involves a dual-channel growth model for Zhen Jiu. This approach has shown significant progress, particularly in the premium baijiu business division, where double-digit growth was achieved in 2024. The company is refining its development and conversion model for high-quality external customers, optimizing the organizational structure of its premium baijiu division to support this expansion.

In the second half of 2024, Zhen Jiu plans to introduce banquet products in the sub-high-end price range, aiming to capture a broader market segment. Simultaneously, the company will upgrade its Zhen 30 and Zhen 15 series, enhancing their appeal and market competitiveness. These initiatives are part of a broader effort to strengthen ZJLD Group Company's market share analysis and adapt to market changes.

The dual-channel growth approach for Zhen Jiu, a core part of ZJLD Group Company's Growth Strategy, has seen significant progress. This strategy focuses on refining customer development and optimizing organizational structures. The aim is to boost sales and increase market share within the premium baijiu sector.

Li Du is leveraging distillery tours and newly excavated Tang Dynasty Hongzhou Kiln relics to boost brand appeal. The expansion includes the establishment of two major product lines: 'Li Du Gaoliang' and the 'Li Du Wang' series. The high-end 'Li Du Gaoliang 1308' is targeting nationwide distribution.

ZJLD Group is expanding its global brand influence. In April 2024, a seminar was held in Hong Kong and Macau to explore the international potential of the Li Du brand. The international debut of Li Du Song Banquet took place in Kyoto, Japan, in May 2024.

Zhen Jiu's production capacity reached 40,000 tons in 2024, with base liquor inventory expected to exceed 100,000 tons. The company completed a semi-finished-product warehouse for Li Du Zheng Jia Shan in the first half of 2024. Construction of three new distilleries with a designed production capacity of 3,000 tons of base liquor per annum is expected to be deployed in September 2024.

Li Du, another national brand within the group, is focusing on amplifying its brand appeal. This includes distillery tours and leveraging the historical significance of newly excavated Tang Dynasty Hongzhou Kiln relics during its distillery expansion, which is planned for 2025. Li Du is also establishing two major product matrices: the flagship 'Li Du Gaoliang' and the 'Li Du Wang' series. The high-end 'Li Du Gaoliang 1308' is designed for nationwide distribution and is priced over RMB 1,000, targeting a premium consumer segment. For more insights, you can read about the Marketing Strategy of ZJLD Group.

ZJLD Group's expansion initiatives include strategic market penetration and product diversification. The company is focusing on premium baijiu and international markets. The expansion is supported by increased production capacity and infrastructure development.

- Dual-channel growth model for Zhen Jiu with double-digit growth in premium baijiu.

- Li Du's brand enhancement through distillery tours and new product lines.

- International expansion efforts with seminars and events in key markets.

- Increased production capacity with Zhen Jiu reaching 40,000 tons in 2024.

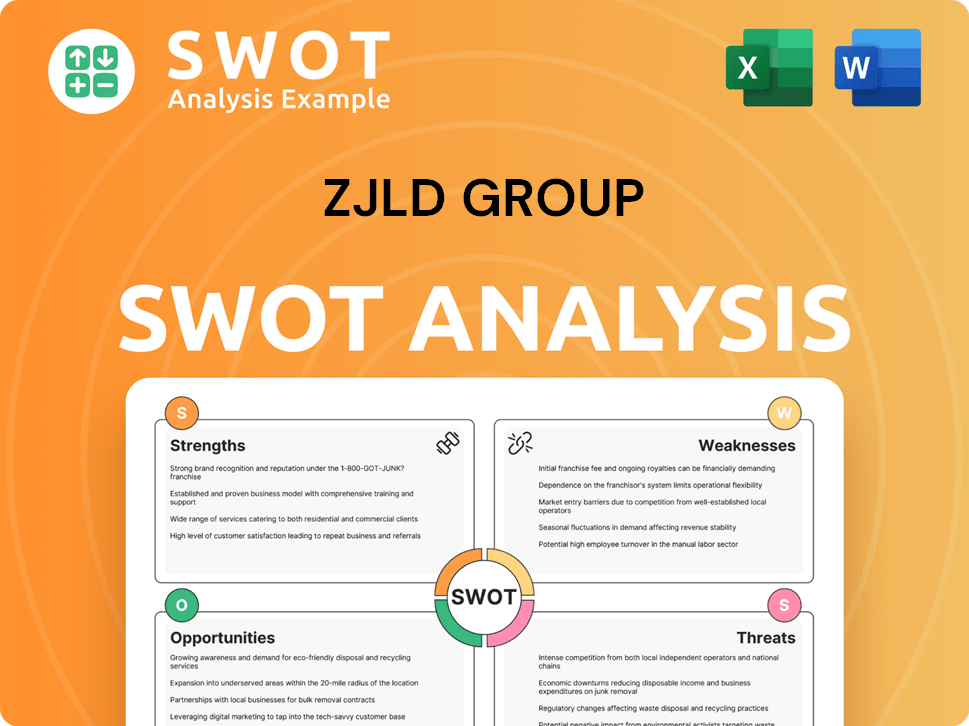

ZJLD Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ZJLD Group Invest in Innovation?

ZJLD Group Company leverages innovation and technology as core drivers for sustained growth and the modernization of the baijiu industry. The company's commitment to sustainability and responsible business practices is deeply integrated into its Environmental, Social, and Governance (ESG) initiatives. This approach not only enhances its brand image but also aligns with evolving consumer preferences and regulatory demands.

The company focuses on product upgrades and enhancements to meet consumer needs. This includes the launch of new product lines and the improvement of existing ones. ZJLD Group also utilizes digital tools to reinforce channel monitoring and adjust channel policies for premium and deluxe product series, optimizing order and price stability.

ZJLD Group's commitment to innovation is evident in its product development and operational strategies. The company's focus on sustainability, product enhancements, and digital tools underscores its dedication to long-term growth and market leadership. For more insights, you can also read a Brief History of ZJLD Group.

In early 2024, the company launched Zhen Jiu 2013 Real Vintage Baijiu, expanding its package-free product line within the deluxe price range. This line uses biodegradable materials and features a minimalist design, catering to business banquets and private collectors.

ZJLD Group transitioned from ceramic to glass bottles in some packages due to the high energy consumption of ceramic bottle firing and their inability to be recycled. This shift supports environmental goals.

Li Du upgraded its main product lines in February 2024, launching the second generation of Li Du Sorghum 1955 and Li Du Sorghum 1975. These upgrades enhance product appeal and market competitiveness.

Zhen Jiu introduced an upgraded series of tasting events and distillery tours in the first half of 2024, known as 'National Banquet • Zhen.' This initiative integrates baijiu with culinary offerings to enhance consumer experience and brand power.

The company utilizes digital tools to reinforce channel monitoring and adjust channel policies for premium and deluxe product series. This optimizes order and price stability, supporting financial performance.

Zhen Jiu was recognized as a 'National Green Factory' by the Ministry of Industry and Information Technology of the People's Republic of China in March 2024. This recognition highlights the company's commitment to sustainability.

ZJLD Group's growth strategy incorporates several key innovation and technology initiatives designed to enhance its market position and operational efficiency. These strategies include sustainable packaging, product upgrades, and digital channel management.

- Sustainable Packaging: The use of biodegradable materials and minimalist designs for packaging, reducing environmental impact and appealing to eco-conscious consumers.

- Product Enhancements: Regular upgrades to product lines, such as the second generation of Li Du Sorghum, to maintain competitiveness and meet evolving consumer preferences.

- Digital Channel Management: Implementing digital tools for channel monitoring and policy adjustments to optimize order and price stability, thereby improving financial performance.

- Consumer Experience: Enhancing consumer engagement through upgraded tasting events and distillery tours that integrate baijiu with culinary offerings.

- Green Initiatives: Achieving 'National Green Factory' status, reflecting a commitment to sustainable manufacturing practices.

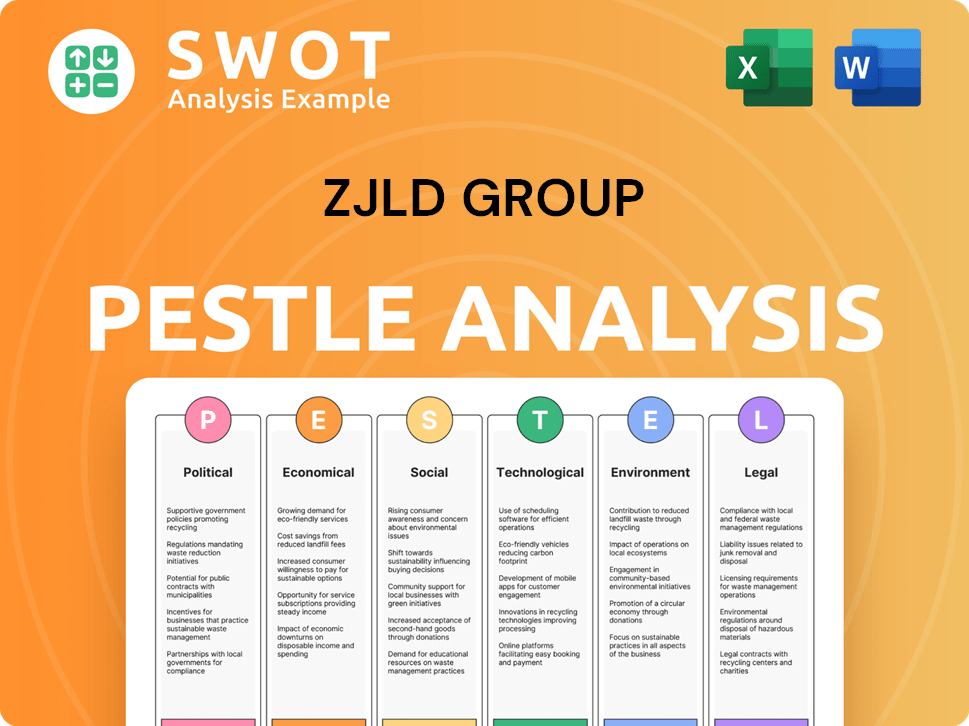

ZJLD Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ZJLD Group’s Growth Forecast?

The financial performance of ZJLD Group Company in 2024 reveals a stable foundation despite industry challenges. The company's ability to maintain a steady revenue stream and improve its cash flow indicates resilience and effective management strategies. This performance sets a positive tone for future growth and expansion plans.

For the fiscal year ending December 31, 2024, ZJLD Group Company reported a revenue of approximately RMB 7,066.8 million. While this represents a slight increase of 0.5% from the RMB 7,030.5 million in 2023, it underscores the company's capacity to navigate market fluctuations. The increase in gross profit, up 1.5% to RMB 4,143.0 million, further supports this stability, with a consistent gross profit margin of 58.6%.

Despite a significant decline in profit attributable to equity shareholders, the adjusted net profit increased by 3.3% to RMB 1,676.3 million. This increase, along with a substantial surge in net cash generated from operating activities, highlights the company's improving financial health and operational efficiency. These factors contribute to a positive outlook for the future prospects of ZJLD Group.

ZJLD Group Company's revenue for 2024 was approximately RMB 7,066.8 million, showing a slight increase. Gross profit increased by 1.5% to RMB 4,143.0 million, with a stable gross profit margin. Adjusted net profit increased by 3.3% to RMB 1,676.3 million, indicating effective cost management.

Net cash generated from operating activities surged by 116.3% to RMB 781.0 million in 2024. This significant increase demonstrates improved financial health and operational efficiency. The strong cash flow provides a solid foundation for future investments and growth.

Analysts forecast earnings growth of 18.6% and revenue growth of 9.1% per annum for ZJLD Group Company in 2025. EPS is expected to grow by 18.4% per annum. Management anticipates stable or improved sales in the second half of 2025, supporting these positive projections.

The company plans to launch the Zhen 50 Series in 2025 to commemorate Zhen Jiu's 50th anniversary. A final cash dividend of HKD 0.21 per share was announced for the financial year ending December 31, 2024. These initiatives highlight ZJLD Group's commitment to growth and shareholder value.

The return on equity (ROE) for the trailing twelve months to December 2024 was 9.5%. The future ROE is speculated to rise to 12% despite an anticipated increase in the payout ratio. These figures reflect the company's ability to generate profits and provide returns to shareholders.

- The company's strategic initiatives, such as the launch of the Zhen 50 Series, are expected to drive future growth.

- The consistent dividend payments demonstrate ZJLD Group Company's commitment to rewarding shareholders.

- The positive financial indicators suggest that ZJLD Group Company is well-positioned for continued success.

- The company's focus on innovation and market adaptation is crucial for long-term sustainability.

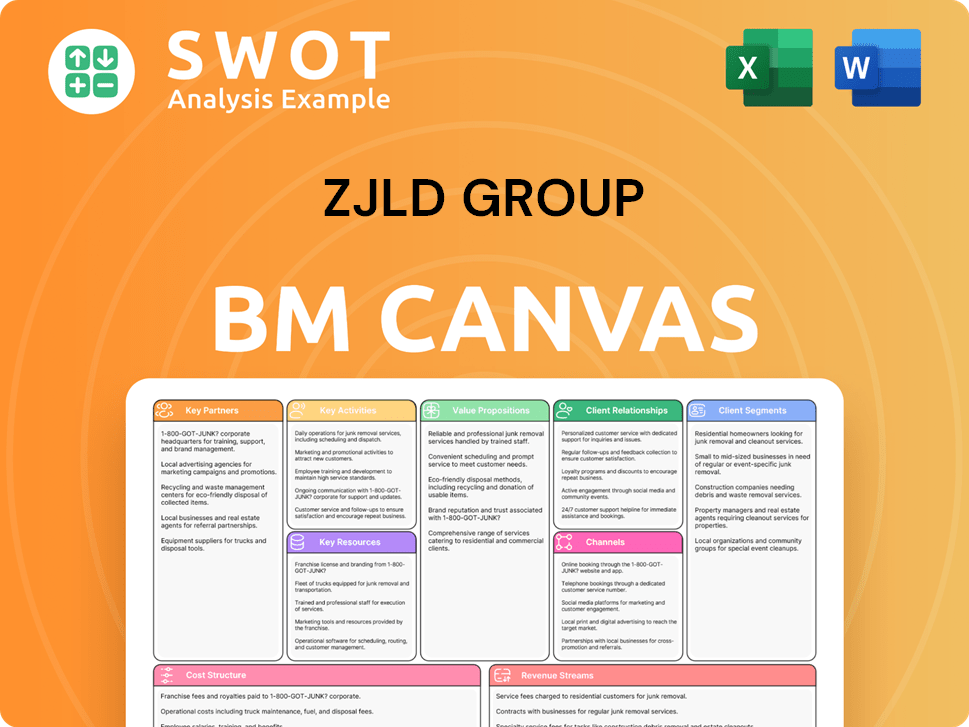

ZJLD Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ZJLD Group’s Growth?

The ZJLD Group Company faces several potential risks and obstacles in its pursuit of Growth Strategy and Future Prospects. The dynamic market environment, particularly within the baijiu industry, presents challenges that could impact the company's Financial Performance. Understanding these risks is crucial for investors and stakeholders assessing the company's long-term viability and potential for Business Development.

One significant risk is fluctuating consumer demand, which can be influenced by broader economic pressures. The baijiu industry experienced a slowdown in consumption in 2024, starting in the second quarter, leading to sluggish market conditions. The company must navigate intense competition, adapt to evolving industry trends, and maintain a strong market position to achieve its Growth Strategy. The company is actively monitoring the situation, implementing measures to control inventory, and stabilizing pricing to ensure healthy channel stock levels.

The company's stock price performance relative to industry benchmarks highlights potential market perception risks. While the stock price has shown stability in the past three months, it underperformed the Hong Kong Beverage industry, which returned -18.4% over the past year, and the Hong Kong Market, which returned 16.9% over the same period. This suggests potential headwinds within the industry or market perception challenges that ZJLD Group Company must address to achieve its Future Prospects.

The baijiu market's inherent volatility poses a risk, with economic downturns and shifts in consumer preferences directly impacting sales. The company's ability to forecast and respond to these market changes is critical. The company's ability to adapt to the changing market conditions is crucial for sustainable growth.

Intense competition within the baijiu industry requires constant innovation and adaptation. ZJLD Group Company must continuously enhance its brand, base liquor quality, distribution channels, and team capabilities to maintain its competitive edge. The company's ability to differentiate itself from competitors is crucial for market share.

Economic downturns can significantly reduce consumer spending on discretionary items like premium baijiu. This can lead to decreased sales and profitability. The company's ability to manage costs and maintain profitability during economic downturns is essential.

Changes in government regulations, such as those related to alcohol production, taxation, and marketing, can impact the company's operations and profitability. The company must stay informed about regulatory changes and adapt its strategies accordingly. These changes can affect the Impact of regulations on ZJLD Group's growth.

Disruptions in the supply chain, such as those related to raw materials or distribution, can impact production and sales. The company must develop robust supply chain management strategies to mitigate these risks. This can affect the ZJLD Group Company's strategic partnerships.

Negative publicity or changes in consumer perception of the brand can damage its reputation and reduce sales. The company must proactively manage its brand image and address any negative publicity promptly. The company's ability to maintain a positive brand image is vital.

In 2025, ZJLD Group Company plans to focus on high-quality and sustainable development, aiming for breakthroughs in brand building, quality enhancement, channel innovation, and social responsibility. The company views current industry difficulties as opportunities for restructuring and reshuffling for brands with solid business foundations like Zhen Jiu and Li Du. ZJLD Group Company is adopting a differentiation development strategy to overcome obstacles and capitalize on hidden opportunities. The company's Growth Strategy includes continuous innovation and adaptation to emerging industry trends.

The Market Analysis indicates that the baijiu market is highly competitive, with numerous brands vying for market share. The company's stock performance, which underperformed the Hong Kong Beverage industry, suggests potential market perception risks or broader industry headwinds. The company's ability to maintain a strong market position is crucial for its Future Prospects. For more insights, you can read about Owners & Shareholders of ZJLD Group.

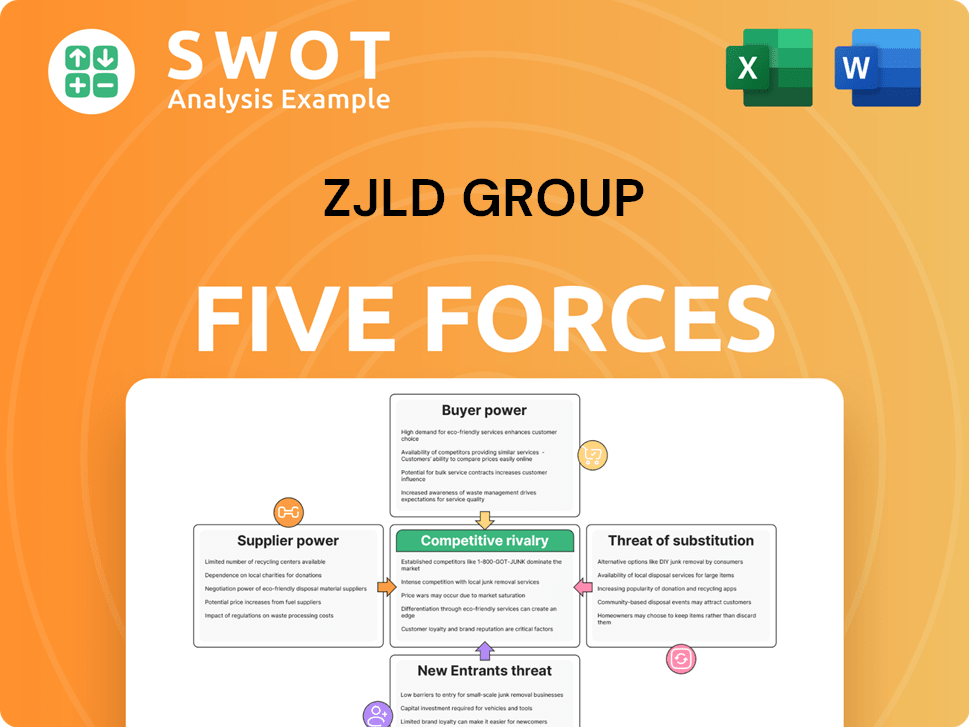

ZJLD Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ZJLD Group Company?

- What is Competitive Landscape of ZJLD Group Company?

- How Does ZJLD Group Company Work?

- What is Sales and Marketing Strategy of ZJLD Group Company?

- What is Brief History of ZJLD Group Company?

- Who Owns ZJLD Group Company?

- What is Customer Demographics and Target Market of ZJLD Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.