Zovio Bundle

What Happened to Zovio?

Dive into the Zovio SWOT Analysis to understand the company's journey. Zovio, a once-influential player in the ed-tech sector, shaped the online higher education landscape. Its story, from ambitious beginnings to its eventual closure, offers valuable insights into the industry's volatile nature.

The brief history of Zovio company reveals a tale of innovation and challenges. Initially known as Bridgepoint Education, Zovio's background includes a strategic focus on online program management and student support. Understanding Zovio's timeline, including its acquisitions and mergers, is crucial for grasping its impact on online education and its ultimate fate. Exploring Zovio's key milestones and business model evolution provides context for its rise and fall within the competitive education industry.

What is the Zovio Founding Story?

The story of the Zovio company began in 2004. Initially, the company operated under the name Bridgepoint Education, Inc. The founding of Zovio coincided with the growing recognition of the potential of online learning.

The founders saw an opportunity to connect traditional academic institutions with the increasing demand for flexible, online education. Their aim was to provide comprehensive online program management (OPM) services to universities. This would enable them to offer high-quality online degrees and certificates.

The early mission of the company was to provide comprehensive online program management (OPM) services to universities. This included everything from technology platforms to marketing, enrollment, and student support services. The original business model involved a revenue-sharing arrangement with partner institutions. Zovio received a percentage of tuition revenue from the online programs it helped manage. This approach allowed universities to broaden their reach without major upfront investments in online infrastructure. The company's establishment took place during a period of rapid growth in the for-profit education sector.

Here's a look at some key aspects of Zovio's early history:

- Founded in 2004 as Bridgepoint Education, Inc.

- Focused on online program management (OPM) services.

- Provided technology, marketing, and student support.

- Used a revenue-sharing business model with universities.

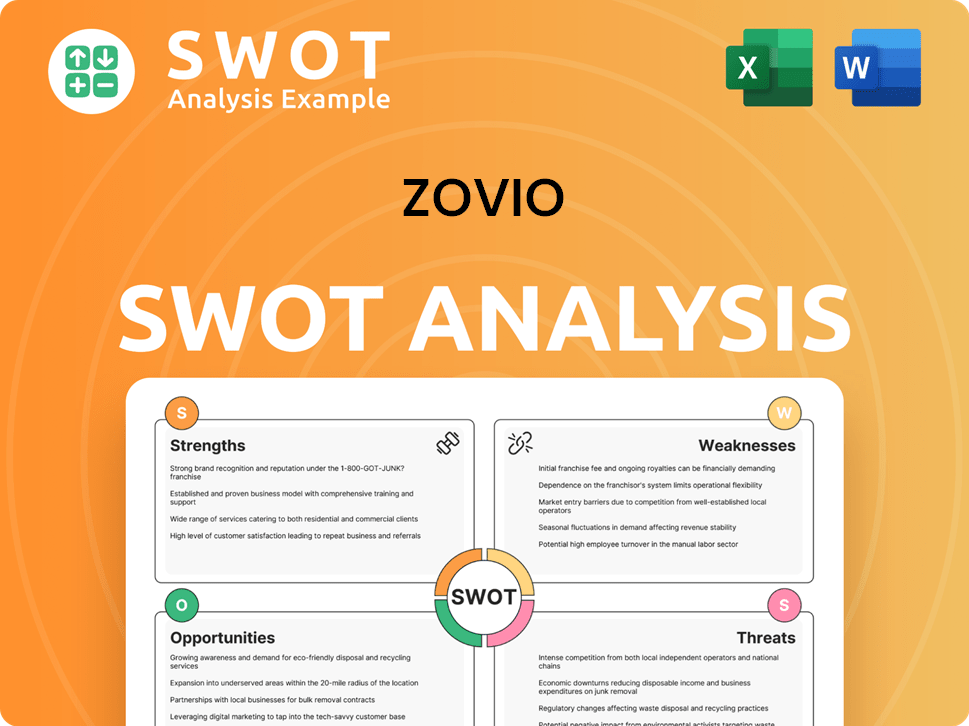

Zovio SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Zovio?

The early phase of the Zovio company, operating as Bridgepoint Education, was marked by significant growth. This expansion was fueled by partnerships with institutions such as Ashford University and the University of the Rockies, which it owned and operated. The company focused on scaling its technology platform and student support services to accommodate a rapidly increasing student body.

Bridgepoint Education went public in 2009, a key milestone that provided capital for further expansion. This period saw increased investment in marketing and recruitment efforts, leading to substantial growth in student numbers. The company's early history included aggressive expansion of online program offerings.

Rapid expansion attracted scrutiny regarding student outcomes, loan defaults, and marketing practices. In response to these pressures and a strategic shift, Bridgepoint Education rebranded as Zovio in 2018. This rebranding signaled a pivot towards offering its OPM services to a broader range of third-party universities.

The rebranding aimed to emphasize Zovio's role as an education technology services provider. The company diversified its business model beyond its owned entities. Despite these efforts, Zovio continued to navigate a complex and evolving regulatory and competitive landscape.

Key milestones for Zovio include the 2009 IPO and the 2018 rebranding. These events reflect the company's adaptation to challenges and strategic shifts in the education sector. The company's history is a story of growth, challenges, and strategic pivots.

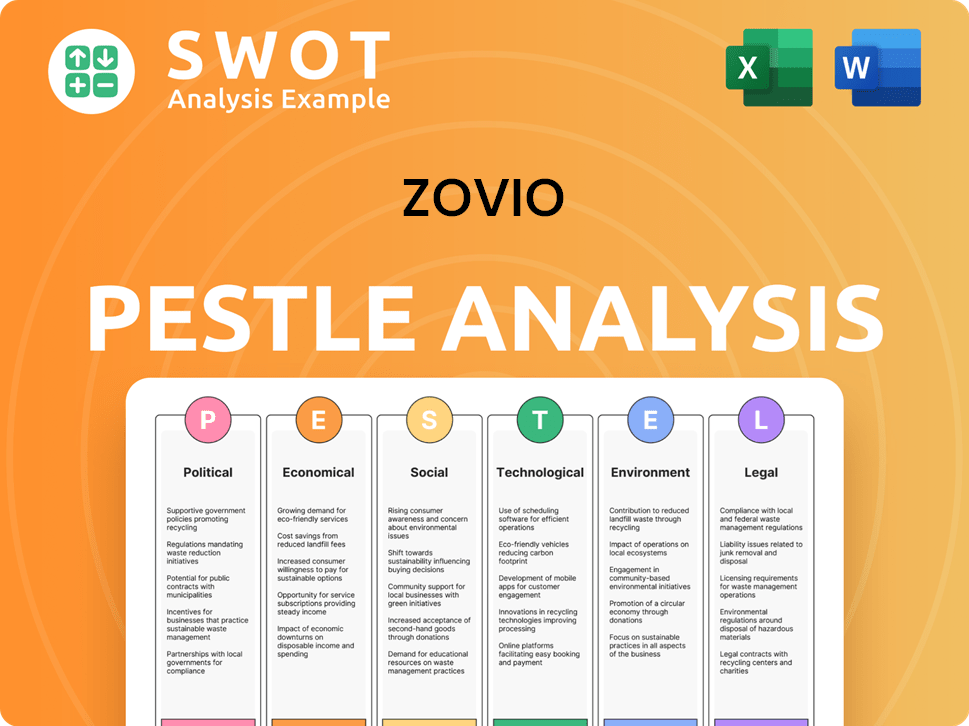

Zovio PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Zovio history?

The Zovio history is marked by significant milestones, innovations, and challenges that shaped its trajectory in the education technology sector. From its early days as Bridgepoint Education to its later evolution as Zovio, the company navigated a complex landscape, ultimately leading to its operational cessation.

| Year | Milestone |

|---|---|

| 2009 | Initial Public Offering (IPO) provided capital for expansion in the online education market. |

| 2018 | Strategic pivot and rebranding to focus on providing education technology services. |

| 2020 | Ashford University transitioned to the University of Arizona Global Campus. |

Zovio innovated by developing comprehensive online learning platforms and support services, aiming to provide a seamless digital education experience for students. This included curriculum development, marketing, enrollment management, and student retention services, which were groundbreaking in their integrated approach for many institutions.

Zovio created comprehensive online learning platforms. These platforms provided a full suite of services, from curriculum development to student support, all integrated into a single system.

The company focused on designing and developing online curricula. This included creating engaging and effective educational content tailored for digital delivery.

Zovio provided marketing and enrollment management services to attract and enroll students. These services helped institutions reach a wider audience and manage the enrollment process efficiently.

The company implemented student retention services to improve student success rates. These services included academic advising and support to help students stay engaged and complete their programs.

Zovio invested in robust technology infrastructure to support its online learning platforms. This included servers, software, and other tools necessary for delivering educational content and services.

Zovio utilized data analytics to track student performance and improve its services. This data-driven approach allowed the company to make informed decisions and enhance the overall learning experience.

Zovio faced significant challenges, particularly stemming from its association with the for-profit education sector, including intense regulatory scrutiny. The company settled with the Consumer Financial Protection Bureau (CFPB) in 2019, paying $23.5 million in restitution and forgiving millions in private student loan debt.

Zovio faced intense regulatory scrutiny from various government agencies. This included investigations into its recruitment practices and concerns over student debt and academic outcomes.

The company reached legal settlements with regulatory bodies. These settlements often involved significant financial penalties and required Zovio to change its business practices.

Zovio suffered reputational damage due to the controversies surrounding its business practices. This damage made it harder for the company to attract students and form partnerships.

The company experienced financial performance issues. These issues were often linked to the costs of legal settlements, declining enrollment, and increased competition.

Zovio faced increasing competition from other online education providers. This competition made it more difficult for the company to maintain market share and profitability.

The company's business model faced challenges. These challenges included the need to adapt to changing market conditions and regulatory requirements.

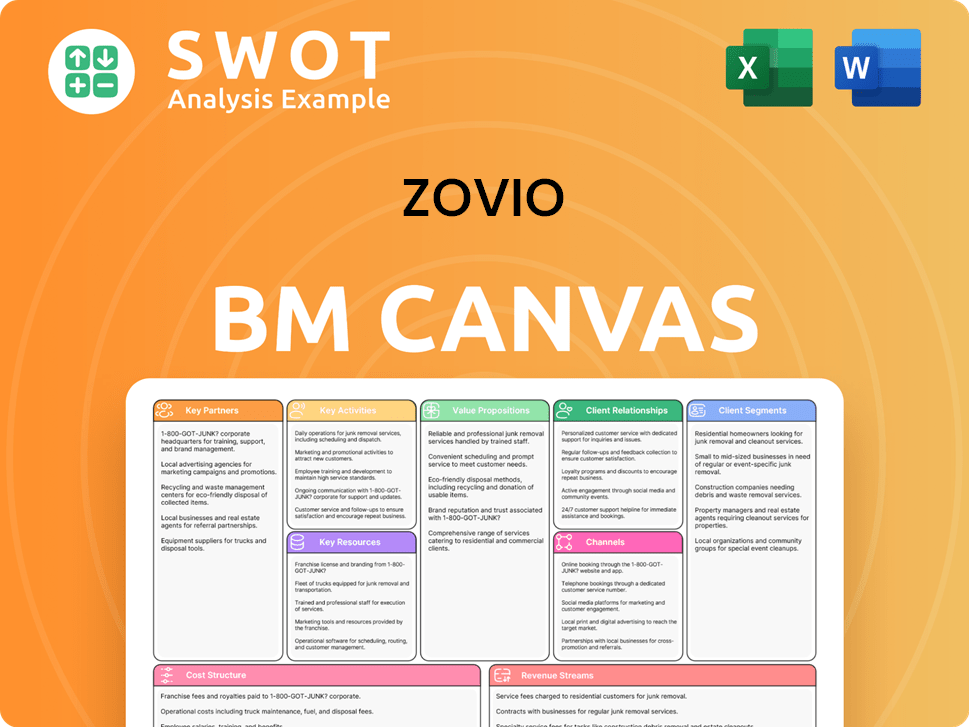

Zovio Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Zovio?

The Zovio company's history is marked by several key events, ultimately leading to its cessation of operations. From its founding as Bridgepoint Education to its strategic shifts and eventual closure, the journey of Zovio reflects the dynamic nature of the education technology sector. The Zovio history includes significant partnerships, acquisitions, and regulatory challenges that shaped its trajectory.

| Year | Key Event |

|---|---|

| 2004 | Founded as Bridgepoint Education. |

| 2009 | Bridgepoint Education goes public. |

| 2018 | Bridgepoint Education rebrands as Zovio, shifting towards an education technology services model. |

| 2019 | Zovio settles with the Consumer Financial Protection Bureau (CFPB) over allegations of deceptive lending practices. |

| 2020 | Ashford University transitions to the University of Arizona Global Campus (UAGC) under a new partnership, a significant strategic divestiture. |

| 2022 | Zovio announces its intent to cease operations. |

The future outlook for Zovio is non-existent due to the company's closure. The business model, dependent on partnerships for online program management, proved unsustainable. Market dynamics, increased regulatory oversight, and competitive pressures contributed to its demise. The company's legacy serves as a cautionary tale within the education technology sector.

The closure of Zovio highlights the volatility in the ed-tech space. Companies must continually innovate to survive. The industry faces ongoing consolidation and strategic realignments. For-profit education models, like Zovio's, often face intense scrutiny and must navigate complex regulations.

The partnership with the University of Arizona Global Campus was a key strategic move. This transition of Ashford University marked a significant change. Such partnerships and divestitures reflect the company's attempts to adapt to market pressures.

Regulatory issues, such as the CFPB settlement, impacted Zovio's operations. The company's financial performance over time reflects the challenges. The closure underscores the importance of sustainable business models and compliance in the education sector. For more details on the company's background and milestones, you can refer to this article about Zovio.

Zovio Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Zovio Company?

- What is Growth Strategy and Future Prospects of Zovio Company?

- How Does Zovio Company Work?

- What is Sales and Marketing Strategy of Zovio Company?

- What is Brief History of Zovio Company?

- Who Owns Zovio Company?

- What is Customer Demographics and Target Market of Zovio Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.