Zovio Bundle

What Went Wrong at Zovio?

Zovio, once a prominent player in the edtech space, embarked on a journey that saw it evolve from a for-profit college operator to an education technology services provider. Founded with a vision to revolutionize learning, the company aimed to reshape higher education through technology. But what were the key factors that shaped Zovio's trajectory, and what ultimately led to its closure?

This Zovio SWOT Analysis delves into the intricacies of Zovio's Zovio growth strategy, examining its Zovio future prospects and the significant challenges it faced. We will explore the Zovio company analysis, including its Zovio business model, Zovio market position, and Zovio financial performance to understand the decisions that shaped its fate and offer insights into the broader edtech landscape, addressing questions like: What is Zovio's growth strategy in the education sector and How has Zovio adapted to the changing education landscape?

How Is Zovio Expanding Its Reach?

Prior to its dissolution, the company, formerly known as Zovio, embarked on several expansion initiatives. These strategies aimed to diversify its business model and adapt to the evolving education landscape. The company's approach included strategic acquisitions and partnerships, all geared towards growth and sustainability within the education technology sector.

The company's initiatives were designed to broaden its service offerings and access new customer segments. The company's primary focus was to leverage its position in the market to capitalize on opportunities and enhance its overall market position. These efforts highlight the company's ambition to remain a significant player in the education technology industry.

One of the key expansion strategies involved acquiring other education technology companies. In April 2019, the company acquired TutorMe, an on-demand online tutoring provider. This move was part of its shift towards becoming an online program manager (OPM). These acquisitions were intended to broaden its service offerings beyond its owned universities and access new customer segments.

Another significant initiative was the sale of Ashford University to the University of Arizona in 2020. This strategic move allowed the company to shed its role as a for-profit college operator. This transition allowed the company to focus entirely on providing educational technology services to UAGC under a 15-year Strategic Services Agreement.

Under the agreement with the University of Arizona Global Campus (UAGC), the company was to provide services like recruiting, financial aid counseling, and IT support. The company would receive a share of the university's tuition revenue. This partnership was seen as an opportunity to leverage the University of Arizona's brand and reputation to target a global audience and expand customer segments, including international students.

- The company was expected to provide comprehensive services to UAGC.

- The company's revenue model was based on a share of UAGC's tuition revenue.

- The partnership aimed to expand the company's reach to a global audience.

- The agreement was intended to provide long-term financial stability.

Despite these efforts, the company's pivot to an educational services provider ultimately unraveled. UAGC enrollment declined, and the OPM services agreement became a loss contract for the company. The company's financial performance suffered, leading to the sale of key assets. The company's business model faced significant challenges, impacting its overall financial health and investment potential. You can learn more about the Revenue Streams & Business Model of Zovio.

Zovio SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Zovio Invest in Innovation?

The company's innovation and technology strategy centered on leveraging technology to drive growth within the education technology services sector. The core of the strategy was providing innovative, personalized solutions to higher education institutions and employers. This approach aimed to address the 'skills-to-employment' challenge, using data analytics to enhance the learner experience and outcomes.

The company’s approach emphasized the use of proprietary advanced data analytics to identify meaningful ways to enhance the learner experience and deliver strong outcomes. This focus on technology was also evident in its physical infrastructure. In 2019, the company relocated its headquarters to Chandler, Arizona, to a 130,000-square-foot facility designed to support innovation and growth.

Through subsidiaries like Fullstack Academy and TutorMe, the company aimed to offer cutting-edge educational solutions. Fullstack Academy provided coding and data analytics bootcamps, aligning with the growing demand for tech skills. TutorMe offered on-demand online tutoring, providing personalized support to students across various subjects. However, financial difficulties led to the company's dissolution in 2022.

The company heavily invested in data analytics to personalize learning experiences. This involved using data to understand student needs and tailor educational content. The goal was to improve student outcomes and engagement through targeted interventions.

The company invested in state-of-the-art facilities to foster innovation. The new headquarters in Chandler, Arizona, featured an open-concept workspace. This design aimed to encourage collaboration and support the development of new technologies.

Fullstack Academy and TutorMe were key subsidiaries. Fullstack Academy offered coding bootcamps, addressing the demand for tech skills. TutorMe provided on-demand tutoring services, supporting students across various subjects. These offerings were part of the company's broader strategy to apply its technology and capabilities to priority market needs.

The company aimed to bridge the gap between education and employment. By providing insights and solutions, the company sought to help its partners address the 'skills-to-employment' challenge. This involved aligning educational programs with industry needs.

The company aimed to be at the forefront of educational innovation. This involved developing cutting-edge solutions and leveraging technology to transform the learning experience. The focus was on creating dynamic and inspiring work environments to support these goals.

The company's strategy prioritized addressing market needs through its technology and capabilities. This involved identifying and responding to the evolving demands of the education sector. The goal was to provide solutions that met current and future challenges.

The company's technology strategy included several key initiatives aimed at driving growth and enhancing educational offerings. These initiatives were designed to leverage data analytics, improve student outcomes, and address the evolving needs of the education sector. However, despite these efforts, the company faced significant financial challenges.

- Data Analytics: The company used advanced data analytics to personalize learning experiences and improve outcomes.

- Online Learning Platforms: The company invested in online learning platforms to expand its reach and offer flexible educational options.

- Subsidiaries: Fullstack Academy and TutorMe, provided coding bootcamps and on-demand tutoring.

- Infrastructure: The new headquarters in Chandler, Arizona, was designed to support innovation and collaboration.

The company's approach to technology and innovation was ambitious, but its financial struggles ultimately led to its dissolution. For more context on the company's history, you can read the Brief History of Zovio.

Zovio PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Zovio’s Growth Forecast?

The financial trajectory of the company, which traded under the ticker symbol ZVO on NASDAQ, took a significant downturn leading up to its operational cessation. The company's performance highlights the critical importance of a robust and adaptable business model in the volatile education technology sector. A comprehensive Zovio's target market analysis would have been crucial for understanding the company's position.

In 2020, the company reported an annual loss of $61 million. The following year, 2021, saw a further decline, with revenue dropping to $263 million and a net loss of -$42 million. The company's total assets were reported at $161 million, reflecting a shrinking financial base. These figures underscore the challenges the company faced in maintaining financial stability.

Despite initial expectations, the agreement with the University of Arizona Global Campus (UAGC) did not provide the anticipated revenue stream. Enrollment figures for UAGC faltered, and the agreement eventually became a financial burden for the company. This shift in fortunes highlighted the risks associated with relying on a single, large-scale partnership.

To address its financial difficulties and generate cash, the company initiated a series of asset sales. This included the sale of TutorMe, its online tutoring division, for $55 million in May 2022. The proceeds were used to eliminate debt and pay a $22.4 million fine stemming from a California lawsuit. These actions were indicative of the company's struggle to maintain solvency.

The UAGC terminated its contract with the company in August 2022, and the company sold all remaining assets related to the UAGC Services Agreements. By September 2022, the board announced a plan to liquidate and dissolve the company. The sale of Fullstack Academy, its final major asset, was projected to generate between $34 million and $55 million.

The company sold its last asset before officially closing down. Shareholders were projected to receive only a portion of the proceeds from the liquidation, potentially less than $20 million. This outcome reflects the significant erosion of shareholder value. The company's actions highlight the importance of strategic planning and adaptability in the face of market changes.

As of May 25, 2025, the company's market capitalization was $6.8K. The stock price was significantly below its 52-week high, and the company does not pay dividends. This data underscores the complete loss of investor confidence and the ultimate failure of the business model. The company's financial performance and ultimate closure serve as a cautionary tale for investors.

Zovio Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Zovio’s Growth?

The path of Zovio, formerly Bridgepoint Education, was fraught with significant risks and obstacles that ultimately led to its dissolution. These challenges stemmed from a combination of market pressures, regulatory issues, and internal operational difficulties. Understanding these factors is crucial for a comprehensive Zovio company analysis.

A primary hurdle was the intense competition within the for-profit higher education sector, coupled with increased regulatory scrutiny. The company's past, including allegations of misleading marketing practices, further complicated its position. This environment demanded constant adaptation and substantial investment, which Zovio struggled to maintain.

Declining enrollment at the University of Arizona Global Campus (UAGC) and the loss of a key contract were major blows to Zovio's financial stability. The company’s inability to achieve profitability and its projected negative cash flows from operations highlighted the severity of its challenges. These issues significantly impacted Zovio's financial performance and its ability to execute its Zovio growth strategy.

Intense competition within the for-profit higher education sector and increased regulatory scrutiny created a challenging environment for Zovio. The company's past legal issues and allegations of misleading practices further complicated its market position. These factors significantly impacted Zovio's market share in the edtech industry.

The declining enrollment at UAGC, after selling Ashford University, and the subsequent loss of a key contract significantly impacted the company's financial health. These issues, combined with an inability to achieve profitability, led to projected negative cash flows. This situation directly affected Zovio's financial health and investment potential.

The rapidly changing landscape of online education and the need for continuous technological innovation posed ongoing challenges. Zovio’s attempts to pivot to an education technology services company required substantial investment and adaptability. Addressing these technological disruptions was a key challenge for Zovio's growth.

Internal resource constraints and operational difficulties hampered Zovio’s ability to adapt and compete effectively. The company's inability to achieve profitability and the need for continuous innovation required substantial investment and adaptability. These constraints limited the company's ability to implement its Zovio business model effectively.

Zovio attempted to mitigate risks through strategic decisions, such as the sale of TutorMe for $55 million. While these efforts helped eliminate debt and pay off legal obligations, they were insufficient to overcome the compounding financial and operational difficulties. These decisions impacted how Zovio adapted to the changing education landscape.

Ultimately, the company’s leadership determined that a turnaround was not possible, leading to the decision to liquidate its remaining operations and dissolve. This decision marked the end of Zovio's journey in the education sector, highlighting the severity of its challenges. For more information, you can read about Owners & Shareholders of Zovio.

In November 2021, Zovio faced a $22.4 million fine due to a California Attorney General case filed in 2017, highlighting the legal and regulatory risks the company faced. These legal battles were a significant drain on resources and contributed to the company’s financial struggles.

The 15-year contract to provide online program management services to UAGC became a 'loss contract,' significantly affecting Zovio's financial stability. The termination of this contract in August 2022 further worsened the company's precarious financial position, impacting its ability to compete with other edtech companies.

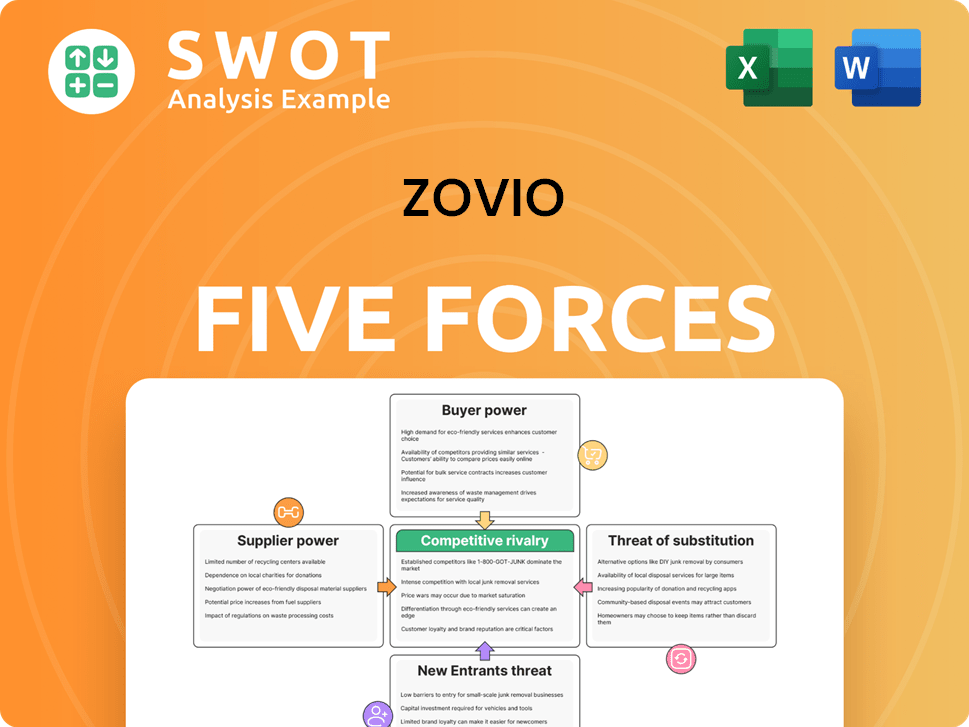

Zovio Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zovio Company?

- What is Competitive Landscape of Zovio Company?

- How Does Zovio Company Work?

- What is Sales and Marketing Strategy of Zovio Company?

- What is Brief History of Zovio Company?

- Who Owns Zovio Company?

- What is Customer Demographics and Target Market of Zovio Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.