23andMe Bundle

What Led to 23andMe's Downfall?

The direct-to-consumer genetic testing market witnessed a seismic shift in March 2025 when 23andMe filed for Chapter 11 bankruptcy. This event, following a 2023 data breach and declining demand, marks a pivotal moment for the pioneering company. Founded in 2006, 23andMe once held a $6 billion market cap, but its valuation plummeted, highlighting the intense pressures within the 23andMe SWOT Analysis and the broader genetic testing industry.

Understanding the 23andMe competitive landscape is crucial to grasping the company's struggles and future prospects. This analysis will delve into 23andMe competitors, market positioning, and the evolving dynamics of the genetic testing industry. We will explore the 23andMe market analysis, including its distinct advantages and the broader trends shaping the future of direct-to-consumer genetics and the DNA testing companies.

Where Does 23andMe’ Stand in the Current Market?

Prior to its bankruptcy filing in March 2025, 23andMe held a significant position in the direct-to-consumer genetic testing market. The company's core operations revolved around providing genetic testing services directly to consumers, offering insights into ancestry, health predispositions, and inherited traits. This business model aimed to empower individuals with information about their genetic makeup, facilitating proactive health management and a deeper understanding of their heritage.

The company's value proposition centered on providing accessible and personalized genetic information. 23andMe offered a range of services, including ancestry reports, health predisposition reports, and carrier status reports. These services aimed to provide customers with valuable insights into their health risks and ancestral origins. The company also had a therapeutics unit focused on drug development and research, leveraging its extensive genetic database.

In 2023, the direct-to-consumer genetic DNA tests market was valued at approximately $2.1 billion and is projected to reach $5.3 billion by 2032, growing at a CAGR of 12.1% between 2024 and 2032. The U.S. genetic testing market alone generated a revenue of $4,384.3 million in 2024 and is expected to reach $13,922.2 million by 2030, with ancestry and ethnicity being the largest segment in 2024. 23andMe and AncestryDNA were identified as the two largest players in the 23andMe competitive landscape, with 23andMe holding a 30% market share and AncestryDNA holding 25% as of March 2026. However, despite its market position, 23andMe faced financial challenges that ultimately led to its bankruptcy.

23andMe was a leading player in the direct-to-consumer genetics market. The company held a significant market share, competing with other DNA testing companies like AncestryDNA. A detailed 23andMe market analysis reveals its strong presence before its financial struggles.

23andMe offered a range of services, including ancestry reports, health predisposition reports, and carrier status reports. These services provided customers with insights into their health risks and ancestral origins. The company also had a therapeutics unit.

The company experienced a decline in financial health, with its market capitalization falling from a peak of $6 billion in 2021 to approximately $50 million by early 2025. In the second quarter of Fiscal Year 2024, 23andMe reported cash and cash equivalents of $256 million, a decrease from $387 million in March 2023.

The financial distress led to a Chapter 11 bankruptcy filing. The future prospects of 23andMe are uncertain. For more details, you can read about the Owners & Shareholders of 23andMe.

The direct-to-consumer genetics market is experiencing substantial growth. 23andMe's competitive advantages included its brand recognition and extensive customer database. However, the company faced challenges that impacted its market position.

- Market growth driven by increasing consumer interest in personalized health information.

- Intense competition from other players in the genetic testing industry.

- Financial difficulties leading to bankruptcy.

- Impact of 23andMe's financial struggles on its market share.

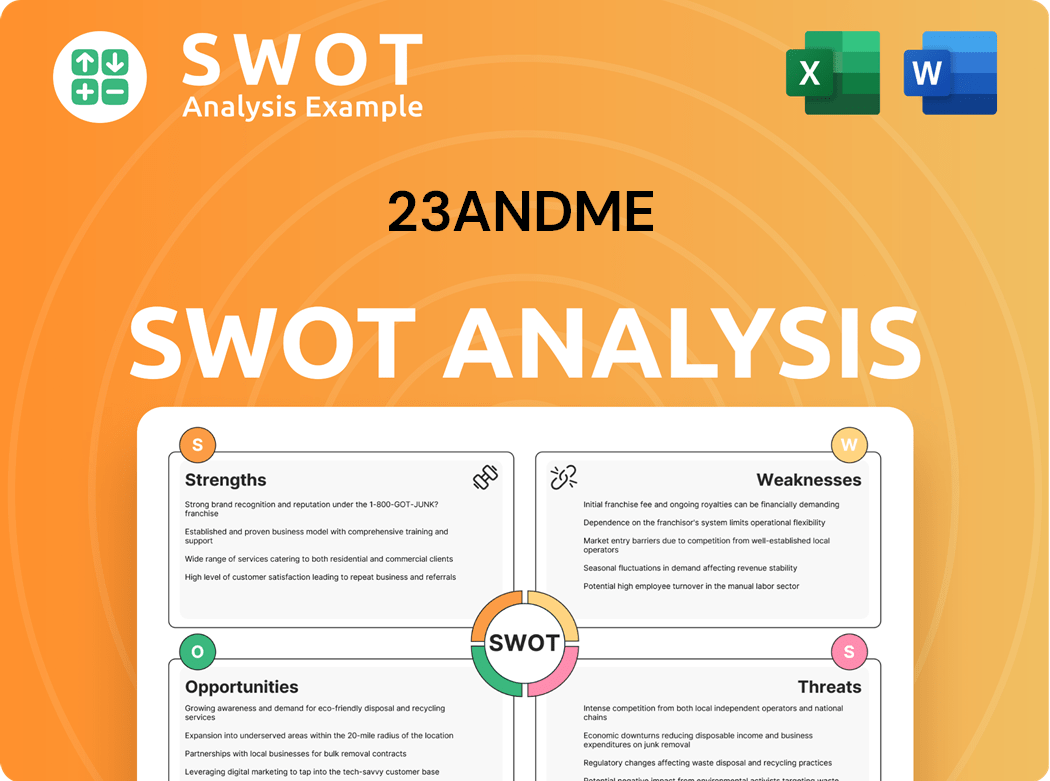

23andMe SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging 23andMe?

The 23andMe competitive landscape is dynamic, with many players vying for market share in the direct-to-consumer (DTC) genetic testing industry. Understanding the key 23andMe competitors and how they position themselves is crucial for anyone looking to gain insights into their ancestry, health, or both. This market analysis reveals the competitive pressures and strategic moves that shape the industry.

The genetic testing industry is experiencing growth, but also faces challenges such as increased competition and evolving consumer preferences. The direct-to-consumer genetics market is influenced by factors like technological advancements, regulatory changes, and the increasing consumer interest in personalized health information. The competitive environment is constantly evolving, with companies adapting their strategies to maintain or gain a competitive edge.

Several companies directly challenge 23andMe. These competitors offer various services, including ancestry analysis, health reports, and wellness recommendations. They compete on various factors, including database size, pricing, and the range of services offered. The 23andMe market share 2024 figures, and those of its competitors, are subject to change due to market dynamics and strategic initiatives.

AncestryDNA is a major competitor, particularly in the ancestry discovery market. They focus on helping users build family trees and discover their ethnic origins. AncestryDNA boasts the largest DNA database globally.

MyHeritage DNA is another key player, emphasizing family history and genealogy tools. They offer DNA matching services and tools for building family trees. MyHeritage DNA provides a comprehensive platform for exploring family history.

FamilyTreeDNA focuses on both ancestry and health insights. They offer a range of DNA tests and tools. FamilyTreeDNA provides a platform for users to explore their genetic ancestry and connect with relatives.

Living DNA provides ancestry and wellness insights. They offer detailed ancestry reports and personalized health information. Living DNA differentiates itself through its focus on regional ancestry breakdowns.

Nebula Genomics offers whole-genome sequencing, providing a comprehensive view of an individual's genetic makeup. They focus on advanced genetic testing and data analysis. Nebula Genomics provides a detailed look at an individual's DNA.

Vitagene focuses on health and wellness recommendations based on genetic data. They provide personalized reports and supplement recommendations. Vitagene aims to provide actionable insights for improving health.

The competitive landscape also includes companies like Everly Health and Color Genomics. Everly Health has expanded its offerings in genetic testing and health services. Color Genomics focuses on clinical-grade health tests and genetic screening. These companies challenge 23andMe by offering different services and targeting various market segments. To learn more about how 23andMe approaches its marketing, you can read the Marketing Strategy of 23andMe.

Several factors influence the competitive dynamics in the DTC genetic testing market. These factors include pricing strategies, the size and scope of DNA databases, the types of reports offered, and the presence of additional services.

- Pricing: Competitors often use different pricing models to attract customers.

- Database Size: The size of a company's DNA database is crucial for matching users with relatives. AncestryDNA has a significant advantage in this area.

- Report Types: The range and depth of reports offered vary among competitors. Some focus on ancestry, while others emphasize health insights.

- Additional Services: Genealogy tools, health and wellness recommendations, and other services differentiate companies.

23andMe PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives 23andMe a Competitive Edge Over Its Rivals?

Understanding the competitive landscape for 23andMe involves recognizing its core strengths. Despite facing challenges, the company has carved out a position in the direct-to-consumer genetics market. Analyzing its competitive advantages is crucial for investors and stakeholders.

The company's approach has been to offer a comprehensive suite of genetic testing services. This includes ancestry, health predisposition reports, and wellness insights. 23andMe has also focused on leveraging its large customer database for research and development purposes. This has enabled partnerships and collaborations within the healthcare sector.

In the ever-evolving 23andMe competitive landscape, the company has demonstrated resilience. It continues to adapt to market changes and technological advancements. This includes ongoing efforts to improve its testing accuracy and expand its service offerings.

23andMe differentiates itself through its broad range of genetic testing options. These options cover ancestry, health predispositions, and carrier status. This comprehensive approach provides a broader perspective than some competitors. This can attract a wider customer base.

A significant advantage for 23andMe is its extensive database of genetic information. This resource supports research and drug development efforts. The database allows the company to identify drug targets and advance personalized medicine. This offers a unique competitive edge.

23andMe emphasizes empowering individuals with their genetic information. They provide personalized health insights and actionable recommendations. The company focuses on providing up-to-date information. This is achieved through continuous research and algorithm updates.

Strategic partnerships and the move into telehealth services have enhanced 23andMe's offerings. These moves have expanded the company's reach and service capabilities. The past collaboration with GSK demonstrates the company's approach to partnerships.

23andMe's competitive advantages include comprehensive testing, a large customer database, and a focus on personalized health insights. The company's strategic partnerships and telehealth initiatives further strengthen its position in the 23andMe competitive landscape. These factors contribute to its ability to compete effectively within the genetic testing industry.

- Comprehensive Testing: Offers a wide array of genetic tests.

- Extensive Database: Leverages a large customer database for research.

- Personalized Insights: Focuses on providing actionable health information.

- Strategic Partnerships: Collaborates to expand service offerings.

23andMe Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping 23andMe’s Competitive Landscape?

The 23andMe competitive landscape is shaped by dynamic industry trends, significant challenges, and emerging opportunities. Understanding these factors is crucial for assessing its market position and future outlook. The direct-to-consumer genetics market, where 23andMe operates, is experiencing both rapid growth and increasing scrutiny.

The company's recent financial struggles, including a bankruptcy filing in March 2025, highlight the risks associated with the business model and the competitive pressures within the genetic testing industry. A comprehensive 23andMe market analysis is essential to navigate the complexities of this evolving sector, considering its competitors and the broader trends impacting the industry.

The genetic testing industry is witnessing significant technological advancements, especially in next-generation sequencing (NGS), enhancing the precision and accessibility of tests. There's a rising demand for personalized medicine, integrating genetic data into healthcare for diagnosis, treatment, and prevention. Increased awareness of genetic disorders and proactive healthcare approaches are also driving market growth. The global genetic testing market is projected to reach a valuation of $49.72 billion by 2033.

Regulatory restrictions and the need for standardization in genetic testing remain significant hurdles. Privacy concerns and ethical issues surrounding the use of genetic data are paramount. The lack of adequate genetic counseling to help individuals understand their results is another challenge. For 23andMe, the bankruptcy filing presents immediate challenges, including restructuring and finding a buyer. The decline in demand for one-time ancestry kits and revenue diversification struggles have been key factors.

The increasing adoption of genetic testing in oncology and pharmacogenomics presents growth opportunities. Leveraging large genetic databases for drug discovery and personalized therapeutics is a significant potential. Emerging markets also offer expansion possibilities. The court-supervised sale process could lead to an acquisition, providing capital and strategic direction to overcome current difficulties and capitalize on future opportunities. Exploring the Growth Strategy of 23andMe can offer additional insights.

The company's financial difficulties, including the bankruptcy filing in March 2025, have significantly impacted its operations. The decline in demand for ancestry kits and challenges in diversifying revenue streams have contributed to these issues. A key aspect of 23andMe's future will depend on its ability to restructure, find a buyer, and adapt to the changing market dynamics. This involves addressing regulatory hurdles, privacy concerns, and competition from other DNA testing companies.

The 23andMe competitive landscape is complex, with a need to address both immediate and long-term challenges. The company's future hinges on strategic decisions regarding its business model, market positioning, and ability to innovate. Key factors include navigating regulatory landscapes, managing data privacy, and capitalizing on opportunities in personalized medicine and drug discovery.

- Addressing regulatory hurdles and privacy concerns.

- Diversifying revenue streams beyond ancestry kits.

- Exploring partnerships for drug discovery and personalized therapeutics.

- Improving customer experience and genetic counseling services.

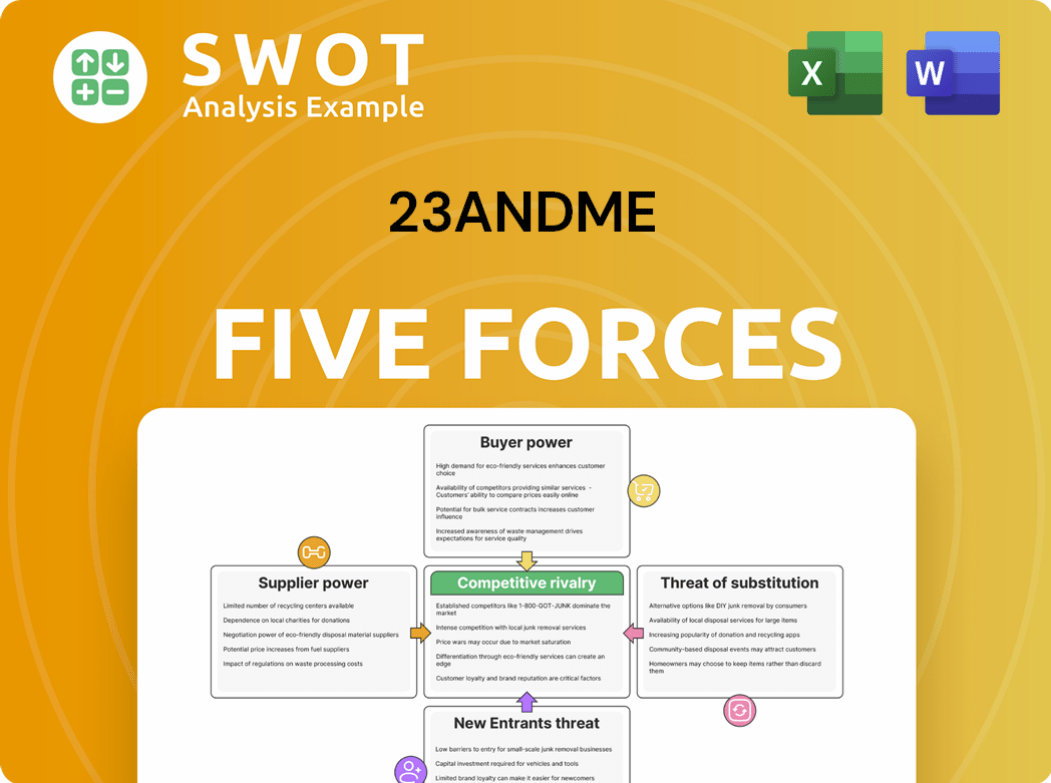

23andMe Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of 23andMe Company?

- What is Growth Strategy and Future Prospects of 23andMe Company?

- How Does 23andMe Company Work?

- What is Sales and Marketing Strategy of 23andMe Company?

- What is Brief History of 23andMe Company?

- Who Owns 23andMe Company?

- What is Customer Demographics and Target Market of 23andMe Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.