Asahi Group Holdings Bundle

How Does Asahi Group Holdings Stack Up in the Global Beverage Battle?

Asahi Group Holdings, a titan in the global beverage industry, faces a constantly shifting competitive landscape. With a history rooted in Japanese brewing, the company has expanded its reach and diversified its portfolio. Understanding the challenges and opportunities within this dynamic environment is crucial for investors and strategists alike. This analysis provides a comprehensive look at Asahi's position.

From its origins in Japan, Asahi Group Holdings SWOT Analysis has grown into a global force, but its success hinges on navigating the complex world of the beer industry and beyond. This exploration will dissect the company's competitive advantages, scrutinize its market share, and identify its main rivals. The following sections will provide a detailed Asahi market analysis, revealing how Asahi Group Holdings maintains its position in the beverage industry.

Where Does Asahi Group Holdings’ Stand in the Current Market?

Asahi Group Holdings maintains a strong market position in the global beverage industry, especially within the beer sector. A detailed Asahi market analysis reveals its dominance in Japan and significant international growth through strategic acquisitions. The company’s success is built on a diverse portfolio that includes alcoholic and non-alcoholic beverages, catering to a wide consumer base.

The company's core operations revolve around producing and distributing a broad range of beverages. Its value proposition lies in providing high-quality products that meet diverse consumer preferences, ranging from its flagship Asahi Super Dry beer to premium brands like Peroni Nastro Azzurro and Grolsch. This strategy allows it to capture a larger share of the market, including both mainstream and premium segments, and expand its global footprint.

Geographically, Asahi's presence spans across Asia, Europe, and Oceania, allowing it to serve a broad customer base. The company has strategically expanded its presence, particularly in premium markets through acquisitions, allowing it to diversify its revenue streams. For instance, the company reported revenue of ¥2,767.9 billion in fiscal year 2023, showcasing its financial strength within the beverage industry.

Asahi Group Holdings' market position in Japan is particularly strong. The company holds a leading share in the Japanese beer market, solidifying its dominance. This strong position in its home market provides a solid foundation for its global expansion and competitive strategy.

The company's product portfolio includes a wide array of alcoholic beverages, with Asahi Super Dry as its flagship product. It also includes other beer brands like Peroni Nastro Azzurro and Grolsch. Furthermore, Asahi has a strong presence in soft drinks and food products, diversifying its offerings.

Asahi has a robust presence across Asia, Europe, and Oceania. This global footprint allows it to serve a broad customer base, ranging from mainstream consumers to those seeking premium offerings. Its strategic acquisitions have expanded its reach.

Asahi Group Holdings reported revenue of ¥2,767.9 billion in fiscal year 2023. This demonstrates its significant scale and financial health within the beer industry. This financial performance supports its continued growth and competitive positioning.

Asahi has strategically shifted its positioning by expanding into premium markets through acquisitions, such as the former SABMiller brands in Europe. This move has allowed it to cater to more affluent consumer segments and diversify its revenue streams. Digital transformation also plays a key role.

- Focus on premium brands like Peroni and Grolsch.

- Expansion into new geographic markets.

- Embracing digital transformation for distribution and consumer engagement.

- Continuous innovation in product offerings.

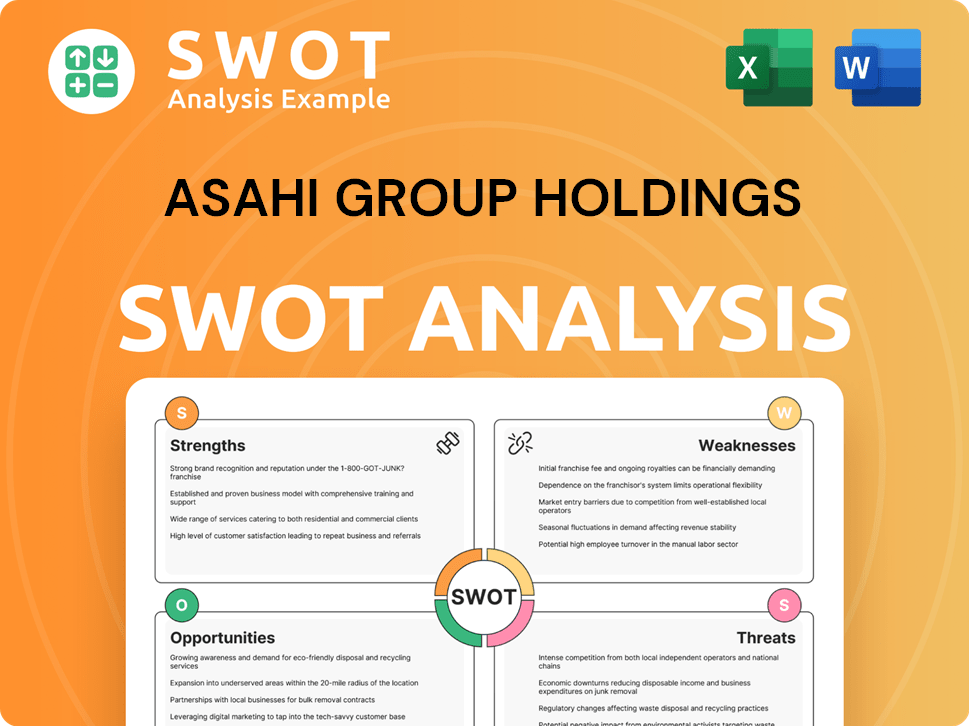

Asahi Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Asahi Group Holdings?

The Competitive Landscape for Asahi Group Holdings is characterized by intense rivalry across its diverse business segments, particularly in the beer and beverage industries. The company faces both direct and indirect competitors, ranging from global giants to regional players, each vying for market share and consumer preference. Understanding this landscape is crucial for evaluating Asahi's market position and future growth prospects.

Asahi's strategic responses to competitive pressures include product innovation, brand building, and expansion into high-growth markets. The company's ability to navigate these challenges will significantly influence its financial performance and long-term sustainability. A detailed Asahi market analysis reveals the intricacies of its competitive environment.

The Asahi Group Holdings faces a multifaceted competitive landscape. This includes global beer giants, regional breweries, and major players in soft drinks and food products. The competitive dynamics are constantly evolving due to mergers, acquisitions, and shifts in consumer preferences. To learn more about their target audience, see the Target Market of Asahi Group Holdings.

The primary competitors in the beer market include Anheuser-Busch InBev (AB InBev), Heineken, and Kirin Holdings. AB InBev, the world's largest brewer, presents a significant challenge due to its vast global presence and diverse brand portfolio. Heineken competes with strong international presence and premium brands.

AB InBev's competitive advantages include a vast distribution network, aggressive marketing strategies, and economies of scale. Its global brands like Budweiser and Corona allow it to compete effectively across various markets. Recent data indicates AB InBev's revenue for 2023 was approximately $59.38 billion.

Heineken holds a strong international presence, particularly in Europe and Asia, with premium brands like Heineken Lager and Amstel. Heineken's revenue in 2023 was about €36.4 billion.

Kirin Holdings directly challenges Asahi in the Japanese market with brands like Kirin Ichiban. Kirin focuses on product innovation and marketing strategies tailored to Japanese consumers. Kirin's revenue for 2023 was approximately ¥2.1 trillion.

Asahi also competes with numerous regional brewers and craft beer companies that offer niche products. These companies often leverage local appeal and unique brewing techniques. The craft beer market continues to grow, with a significant impact on the beer industry.

In the soft drinks sector, Asahi competes with Coca-Cola and PepsiCo, which have extensive product portfolios and massive marketing budgets. The food products segment also faces competition from various local and international food manufacturers. Coca-Cola's revenue in 2023 was approximately $45.75 billion.

The competitive landscape is shaped by aggressive expansion, pricing pressures, and marketing wars, particularly in emerging markets. Mergers and acquisitions, such as those in the craft beer space, further reshape the dynamics. E-commerce and direct-to-consumer models also pose new challenges.

- Market share is a key indicator of competitive success. Asahi's market share varies by region and product category.

- The beverage industry is characterized by intense competition and rapid changes.

- Asahi's market position in Japan is particularly important, given its home market advantage.

- Asahi Group Holdings competitive advantages include its strong brand portfolio and distribution network.

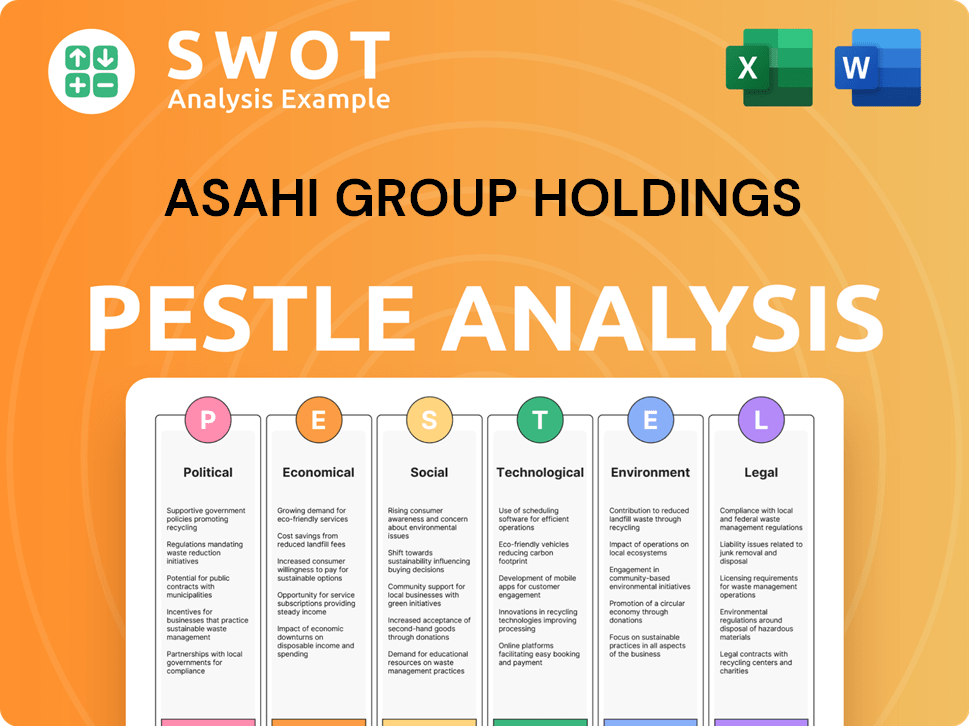

Asahi Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Asahi Group Holdings a Competitive Edge Over Its Rivals?

Asahi Group Holdings maintains a strong competitive position in the global beverage industry. The company's success stems from a combination of factors, including robust brand recognition, extensive distribution networks, and strategic acquisitions. In a recent Asahi market analysis, these elements are crucial for understanding its competitive advantages and market dynamics.

The company's flagship product, Asahi Super Dry, is a key driver of its success, with a loyal consumer base and premium pricing power. Furthermore, Asahi's strategic moves, such as acquiring international brands, have expanded its global reach and diversified its product portfolio. This has allowed the company to strengthen its position in the premium segment and access new consumer demographics.

Asahi Group Holdings faces ongoing challenges from competitors and evolving consumer preferences, necessitating continuous innovation and brand-building efforts. Understanding the competitive landscape is essential for investors and industry analysts looking at the beverage industry.

Asahi Super Dry is a globally recognized brand, known for its distinctive 'Karakuchi' (dry) taste. This strong brand recognition enables premium pricing and helps maintain market share. The brand's reputation is a key competitive advantage in the global beer market.

Asahi boasts well-established distribution networks, especially in Japan and key international markets. These networks ensure efficient product delivery to various retail outlets, bars, and restaurants. This logistical advantage is significant in the competitive beverage industry.

Asahi leverages economies of scale in production and procurement due to its large operational footprint. This allows for cost efficiencies in manufacturing and sourcing raw materials. These efficiencies contribute to competitive pricing and higher profit margins.

The company has strategically acquired international premium brands like Peroni Nastro Azzurro and Grolsch. This has expanded its global reach and diversified its brand portfolio, strengthening its position in the premium segment. These acquisitions provide access to new consumer demographics.

Asahi Group Holdings' competitive advantages are multifaceted, including strong brand recognition, efficient distribution, and strategic acquisitions. These elements support its market position and financial performance. For a detailed look, consider this article on Asahi Group Holdings' competitive advantages.

- Brand Strength: Asahi Super Dry's brand equity allows premium pricing.

- Distribution Network: Extensive networks ensure product availability.

- Economies of Scale: Large-scale operations drive cost efficiencies.

- Strategic Acquisitions: International brands expand market reach.

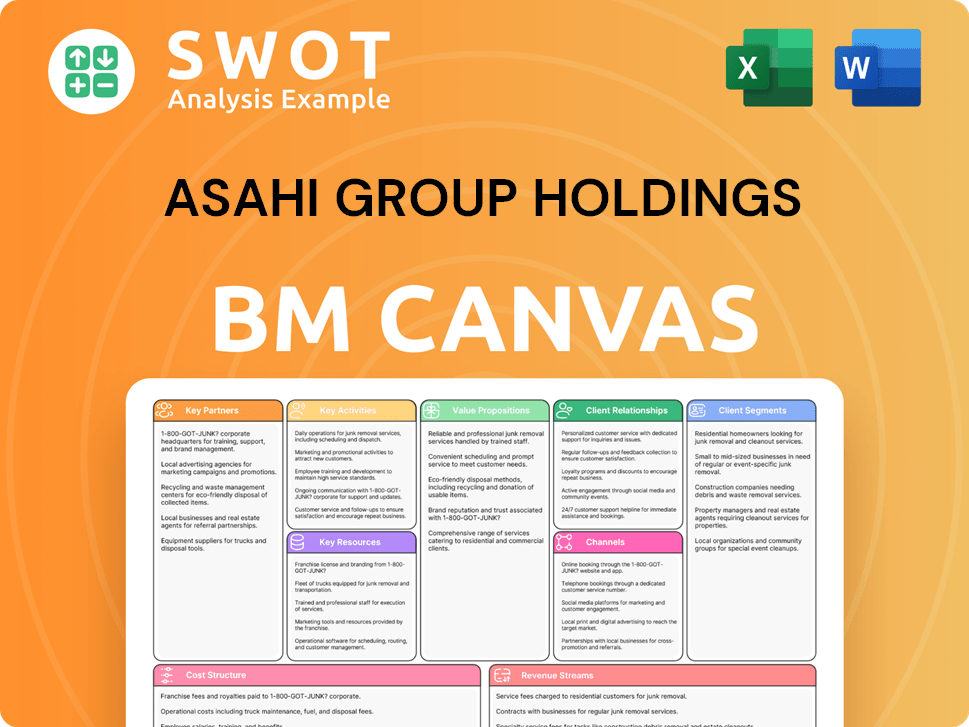

Asahi Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Asahi Group Holdings’s Competitive Landscape?

The beverage industry is undergoing significant shifts, impacting companies like Asahi Group Holdings. Understanding the competitive landscape is crucial for investors and strategists. This analysis explores industry trends, future challenges, and opportunities for Asahi, providing insights into its market position and potential growth strategies.

Asahi's performance is influenced by global economic factors, consumer preferences, and regulatory environments. This chapter examines these elements to provide a comprehensive view of Asahi's competitive dynamics, including its market share, key competitors, and strategic initiatives. For more detailed information on the company's ownership structure, consider reading the article about Owners & Shareholders of Asahi Group Holdings.

The beer industry and broader beverage market are shaped by several trends. There is increasing consumer demand for health-conscious beverages, including low-alcohol and non-alcoholic options. Premiumization is another key trend, with consumers willing to pay more for higher-quality products.

Asahi faces challenges from intensified competition, particularly from craft brewers and private labels. Regulatory changes, especially concerning alcohol consumption and environmental sustainability, pose ongoing hurdles. Geopolitical instability and economic shifts can also impact supply chains and consumer spending.

Significant growth opportunities exist in emerging markets, especially in Asia and Africa, where beverage consumption is rising. Product innovations, such as functional beverages, also present avenues for growth. Strategic partnerships and digital transformation can enhance market reach.

Asahi is deploying strategies focused on sustainable growth, brand premiumization, and digital transformation. These initiatives aim to maintain its competitive position and adapt to the dynamic beverage market. Recent acquisitions have also played a key role in its growth strategy.

The global beer market was valued at approximately $620 billion in 2023, with projections for continued growth. Asahi's strategic focus on premium brands, such as Peroni and Asahi Super Dry, has allowed it to capture higher profit margins. The Asia-Pacific region represents a significant growth opportunity, with increasing disposable incomes and urbanization driving beverage consumption.

- Market Share: Asahi holds a significant market share in Japan and Australia, and is expanding its presence globally.

- Premiumization: The trend towards premium products is evident in consumer preferences and spending habits.

- Digital Transformation: E-commerce and digital marketing are becoming increasingly important for reaching consumers.

- Sustainability: Environmental concerns are influencing product development and operational practices.

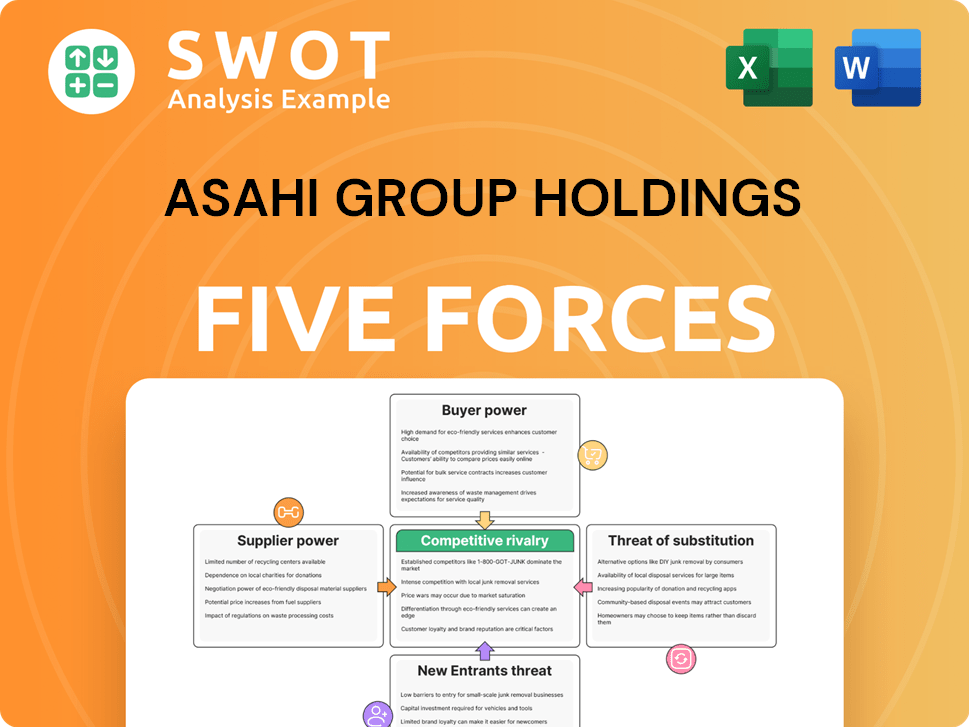

Asahi Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Asahi Group Holdings Company?

- What is Growth Strategy and Future Prospects of Asahi Group Holdings Company?

- How Does Asahi Group Holdings Company Work?

- What is Sales and Marketing Strategy of Asahi Group Holdings Company?

- What is Brief History of Asahi Group Holdings Company?

- Who Owns Asahi Group Holdings Company?

- What is Customer Demographics and Target Market of Asahi Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.