Asahi Group Holdings Bundle

Can Asahi Group Holdings Maintain Its Global Beverage Dominance?

Asahi Group Holdings, a titan in the beverage industry, has masterfully navigated the complexities of global markets, evolving from its Japanese roots to become a worldwide force. Its strategic acquisitions, including iconic brands like Peroni and Pilsner Urquell, have significantly reshaped its Asahi Group Holdings SWOT Analysis and expanded its international footprint. This journey of growth and adaptation makes Asahi Group Holdings a compelling case study for investors and strategists alike.

This exploration delves into Asahi Group Holdings' Growth Strategy and examines its Asahi Future Prospects, providing a detailed market analysis of its operations. We'll dissect the company's Company Performance, evaluating its strategic acquisitions and their impact on Asahi Group Holdings revenue growth and Asahi Group Holdings market share analysis. Furthermore, we'll consider the Asahi Group Holdings expansion strategy and identify potential Asahi Group Holdings investment opportunities within the dynamic Beverage Industry.

How Is Asahi Group Holdings Expanding Its Reach?

Asahi Group Holdings' Growth Strategy centers on expanding its global footprint and diversifying its product offerings. The company is focusing on premiumization, new market entries, and strategic acquisitions to drive future growth in the Beverage Industry. This multi-faceted approach aims to enhance Company Performance and capitalize on emerging consumer trends.

A key element of Asahi's Growth Strategy involves expanding its global brands, especially targeting a compound annual growth rate (CAGR) of at least 10% for Asahi Super Dry's international sales by 2027. Simultaneously, Asahi is increasing its focus on higher-value beer-adjacent categories, like ready-to-drink (RTD) beverages, non-alcoholic beers, and adult soft drinks, with a goal of these categories contributing 20% or more to total sales by 2030.

The Market Analysis indicates a strong emphasis on geographical expansion. Europe and Japan are expected to be key drivers of core operating profit growth. In April 2025, Asahi will streamline its regional headquarters structure, integrating Oceania and Southeast Asia RHQs to enhance operational efficiency, which is part of its Asahi Future Prospects.

Asahi is prioritizing the expansion of its global brands, with a strong focus on achieving a CAGR of at least 10% for Asahi Super Dry's international sales until 2027. The company aims to increase its market share in key regions. This strategy supports long-term Asahi Group Holdings revenue growth.

Asahi is broadening its portfolio to include higher-value beer-adjacent categories. The company is targeting 20% or more of total sales from these categories by 2030. This includes RTD beverages, non-alcoholic beer, and adult soft drinks, which enhances Asahi Group Holdings brand portfolio analysis.

Geographical expansion remains a key priority for Asahi, with Europe and Japan expected to drive core operating profit growth. Oceania is anticipated to return to growth in the second half of 2025, fueled by RTD segment expansion, price adjustments, and cost efficiencies. This strategic move is part of Asahi's Asahi Group Holdings global market presence.

Asahi Group Foods plans to acquire Leiber GmbH by the end of April 2025, expanding its presence in the food and biotechnology sectors. The acquisition of Octopi Brewing in January 2024 supports the manufacturing and expansion of global brands. These acquisitions are part of Asahi Group Holdings strategic acquisitions.

Asahi Group Holdings is implementing several key initiatives to drive future growth. These initiatives include expanding global brands, diversifying into higher-value categories, and strategically expanding its geographical footprint. These efforts are supported by strategic acquisitions, enhancing the company's long-term outlook.

- Expansion of Asahi Super Dry with a 10% CAGR target.

- Focus on higher-value categories, targeting 20% of sales by 2030.

- Geographical expansion with a focus on Europe, Japan, and Oceania.

- Strategic acquisitions, such as Leiber GmbH, to enhance market presence.

For more insights into the ownership structure and financial performance, consider reviewing the information on Owners & Shareholders of Asahi Group Holdings.

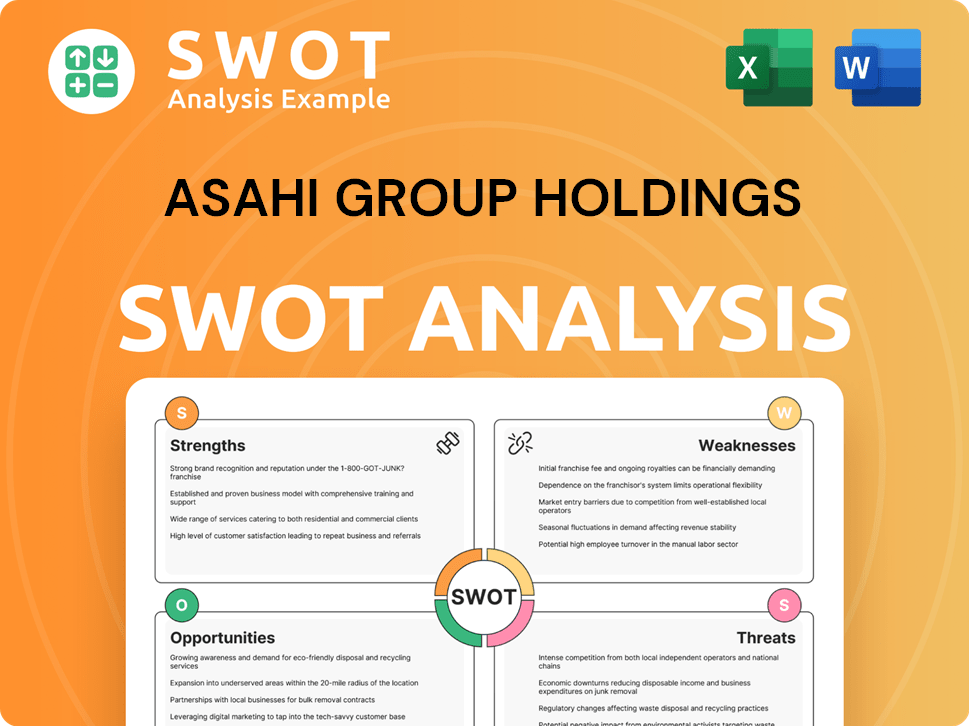

Asahi Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Asahi Group Holdings Invest in Innovation?

Asahi Group Holdings is actively employing innovation and technology to drive its growth strategy, focusing on digital transformation, research and development (R&D), and sustainability initiatives. This approach is crucial for navigating the dynamic beverage industry and maintaining a competitive edge. The company's strategic investments and commitments reflect a forward-thinking approach aimed at long-term value creation.

The company is committed to achieving cost efficiencies through digital transformation and streamlined marketing expenditures. This is part of a broader strategy to improve overall company performance. The company’s focus on healthier offerings and high-value products underscores its responsiveness to evolving consumer trends and preferences, ensuring it remains relevant in a changing market.

Asahi Europe & International (AEI) has implemented Microsoft Copilot for Microsoft 365 E3 to enhance productivity and foster innovation, improving strategic planning and critical thinking. This adoption of cutting-edge technology is a key aspect of its digital transformation efforts. The company’s commitment to innovation extends to its 'Asahi Carbon Zero' initiative, aiming for net zero CO2 emissions by 2040.

Asahi Group Holdings plans to achieve significant cost savings through digital transformation and marketing optimization. The company aims to save more than JPY10 billion in Japan, EUR100 million in Europe, and AUD70 million in Oceania. These savings are expected to enhance profitability and support further investment in growth initiatives.

R&D investments are focused on expanding growth areas, including healthier offerings and high-value products across all segments. This strategic focus is designed to meet evolving consumer preferences and drive revenue growth. The company is exploring new avenues for innovation, such as turning brewing by-products into agricultural innovation.

Asahi Group Holdings is committed to ambitious sustainability targets, including achieving net-zero CO2 emissions by 2040. The company has set interim targets, such as a 40% reduction in Scopes 1 and 2 emissions by 2025. Asahi joined RE100 in October 2020, committing to 100% renewable electricity by 2040.

Asahi Beverages aims for 100% of its primary packaging to be recyclable, reusable, or compostable by the end of 2025. By 2030, the company targets an average of over 50% recycled content in its glass bottles and aluminum cans, and a transition to 100% eco-friendly materials for PET bottles.

Asahi actively engages with external innovators, demonstrated by the launch of the Sustainability Growth Platform in November 2024. In May 2025, the company selected nine startup partners for sustainability challenges. This collaborative approach fosters innovation and accelerates the development of sustainable solutions.

The adoption of Microsoft Copilot by AEI demonstrates the company's commitment to leveraging technology for enhanced productivity and strategic planning. This initiative is part of a broader strategy to improve operational efficiency and foster a culture of innovation across the organization.

Asahi Group Holdings' growth strategy is underpinned by innovation, technological advancements, and a strong commitment to sustainability. These initiatives are expected to drive long-term value and enhance the company's competitive position in the beverage industry. For more insights into the company's history and evolution, you can read the Brief History of Asahi Group Holdings.

- Digital transformation to improve efficiency and reduce costs.

- R&D investments focused on healthier and high-value products.

- Ambitious sustainability targets, including net-zero emissions by 2040.

- Sustainable packaging initiatives, aiming for 100% recyclable packaging by 2025.

- Collaboration with external innovators to accelerate sustainable solutions.

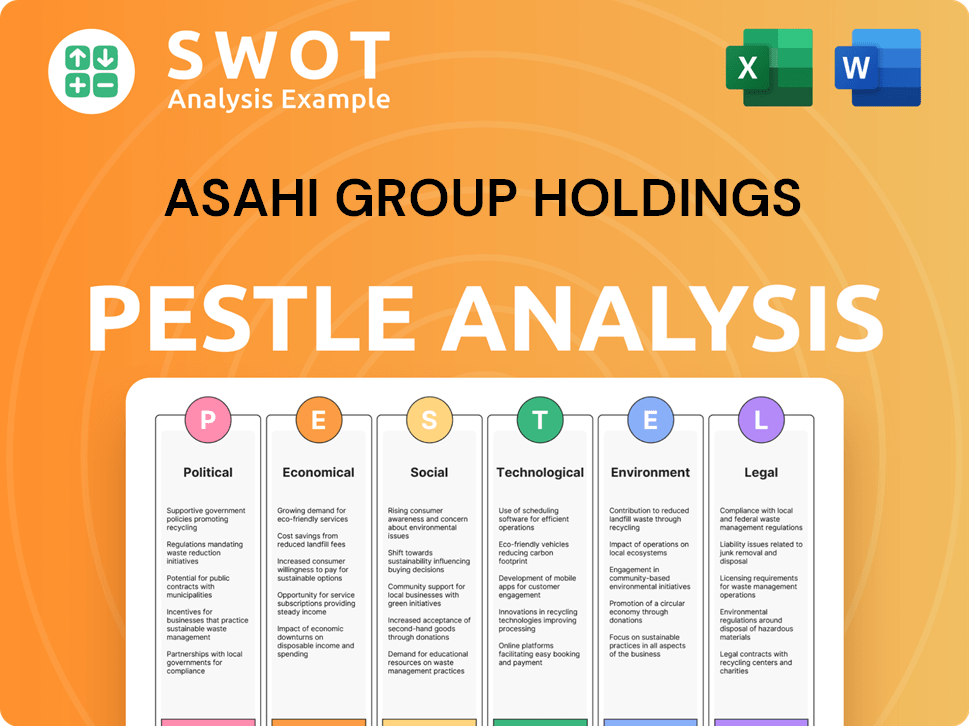

Asahi Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Asahi Group Holdings’s Growth Forecast?

The financial outlook for Asahi Group Holdings indicates continued expansion, driven by strategic initiatives. The company's focus on premiumization and cost efficiencies is expected to fuel revenue and profit growth. This strategy is designed to strengthen its position within the competitive beverage industry.

For the fiscal year 2025, Asahi Group Holdings projects a revenue increase of 3.3% year-on-year. This growth is primarily attributed to improvements in price mix and the expansion of premium categories. The company's commitment to enhancing shareholder value is evident through its dividend policy and strategic financial management.

In 2024, Asahi Group Holdings achieved record highs across all earnings categories, with revenue up 2.1% year-on-year and core operating profit increasing 3.7% year-on-year. This performance reflects the success of its strategies and the resilience of its business model. The company's focus on Asahi Future Prospects is clear.

For fiscal year 2025, Asahi Group Holdings anticipates a 3.3% year-on-year increase in revenue. This growth is supported by strategic pricing and premium category expansion. This demonstrates a proactive approach to market analysis and adapting to consumer trends.

Core operating profit (constant currency) is projected to increase by over 3.2% in FY25. This growth is a result of premiumization efforts and cost efficiencies. The company's ability to manage costs effectively contributes to its financial health.

The company plans to increase dividends by 6% year-on-year to JPY52 per share for FY25. This translates to approximately a 3% yield at a JPY1,800 share price. This reflects a commitment to returning value to shareholders.

Asahi intends to repurchase approximately 150 million shares issued during the 2020 acquisition of Carlton & United Breweries. However, buybacks in 2025 are likely to be limited due to moderating free cash flow expectations. This is part of the Asahi Group Holdings expansion strategy.

As of March 31, 2025, Asahi Group Holdings reported a trailing 12-month revenue of $19.4 billion. The net debt to EBITDA ratio declined to 2.5x at the end of 2024, aligning with its financial soundness policy guidelines. For more insights, consider reading about the Marketing Strategy of Asahi Group Holdings.

The company's focus on premium products is a key driver of revenue growth. This strategy allows Asahi Group Holdings to increase unit sales prices and improve profitability. This is a key element of their Growth Strategy.

Cost efficiencies are crucial for maintaining and improving profit margins. These measures support the company's overall financial performance and contribute to its long-term investment outlook. This is vital for Asahi Group Holdings investment opportunities.

Asahi Group Holdings aims to increase dividends to over 4% by 2030. This is achieved through a combination of dividend growth and share buybacks. This demonstrates a commitment to shareholder value.

The company plans to repurchase shares to enhance shareholder returns. This strategy is subject to free cash flow expectations and market conditions. This is a part of their strategic acquisitions strategy.

The net debt to EBITDA ratio has been reduced, reflecting strong financial management. This strengthens the company's ability to navigate economic challenges. This is crucial for Asahi Group Holdings competitive landscape.

A stronger Japanese Yen could limit core operating profit growth on an actual currency basis. The company is carefully managing its currency exposure. This is a factor in Asahi Group Holdings impact of economic factors.

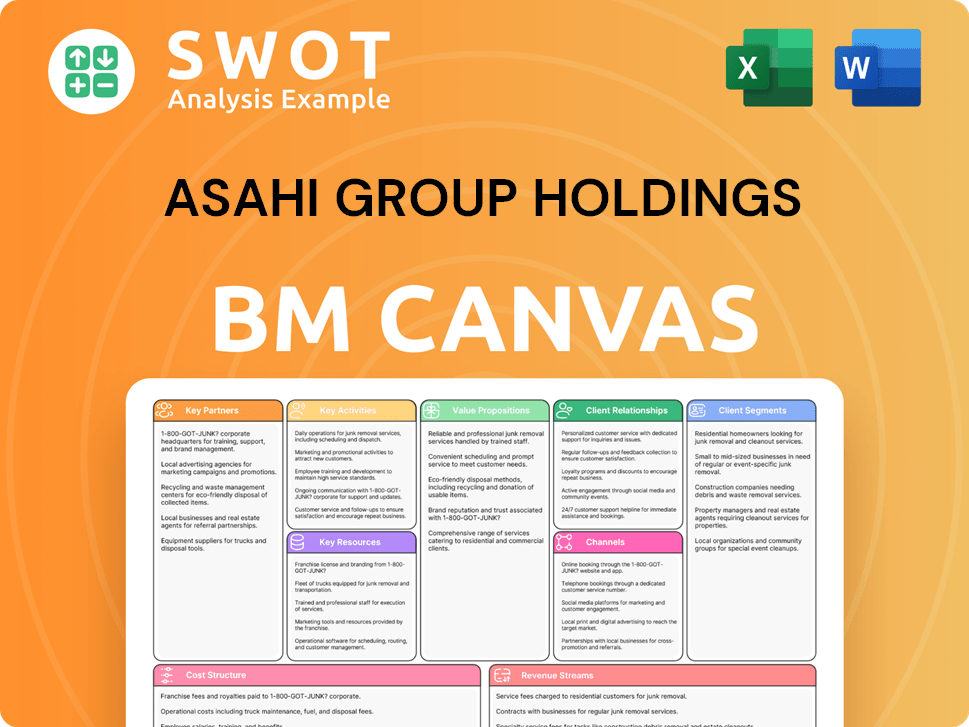

Asahi Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Asahi Group Holdings’s Growth?

The Asahi Group Holdings faces several potential risks and obstacles that could influence its Growth Strategy and Asahi Future Prospects. These challenges range from financial and market-related issues to shifts in consumer preferences and regulatory changes. Understanding these risks is crucial for evaluating the company's long-term performance and investment potential within the Beverage Industry.

One significant risk is the impact of currency fluctuations, specifically a stronger Japanese Yen, which could limit core operating profit growth. Additionally, the company must navigate a dynamic global beverage market and evolving consumer tastes. The company's ability to adapt to these challenges will be critical for maintaining and expanding its market position, requiring continuous innovation and strategic adjustments.

The company's Market Analysis reveals that the Oceania business underperformed in 2024, reporting an 8.2% decline in Core Operating Profit. Furthermore, the company's original target of 15% for non-alcoholic and low-alcohol beverages by 2025 was difficult to reach. These factors highlight the need for proactive risk management and strategic agility to ensure sustained Company Performance.

A stronger Japanese Yen presents a financial risk, potentially limiting core operating profit growth. On an actual currency basis, a stronger JPY is assumed to limit core operating profit growth to 0.7% year-on-year in 2025.

Continued market softness in Oceania and slower-than-expected progress in cost efficiency savings pose challenges. The Oceania business saw an 8.2% decline in Core Operating Profit in 2024 due to tough market conditions.

Shifts in consumer preferences, such as increasing health consciousness, require adaptation and investment. The company aims to increase the share of non-alcoholic and low-alcohol beverages to 20% by 2030.

Regulatory changes related to alcohol consumption and environmental standards present ongoing risks. These changes necessitate continuous monitoring and compliance efforts.

Slower-than-expected progress in achieving cost efficiency savings poses a challenge to profitability. The company must continually manage costs to maintain financial health.

The dynamic and competitive global beverage market requires continuous adaptation. The company faces competition from various beverage producers.

Asahi Group Holdings addresses these risks through diversification of its product portfolio, ongoing cost management, and a focus on premiumization. Enterprise risk management (ERM) is emphasized across the entire group. The company also employs a whistleblowing system, 'Speak Up,' to detect and resolve problems early. You can find more detailed information about the company's strategies in this article about Asahi Group Holdings.

The 'Risk Management Committee' monitors risk management initiatives. Individual companies identify and evaluate critical risks, developing action plans to address them. This proactive approach helps to mitigate potential negative impacts.

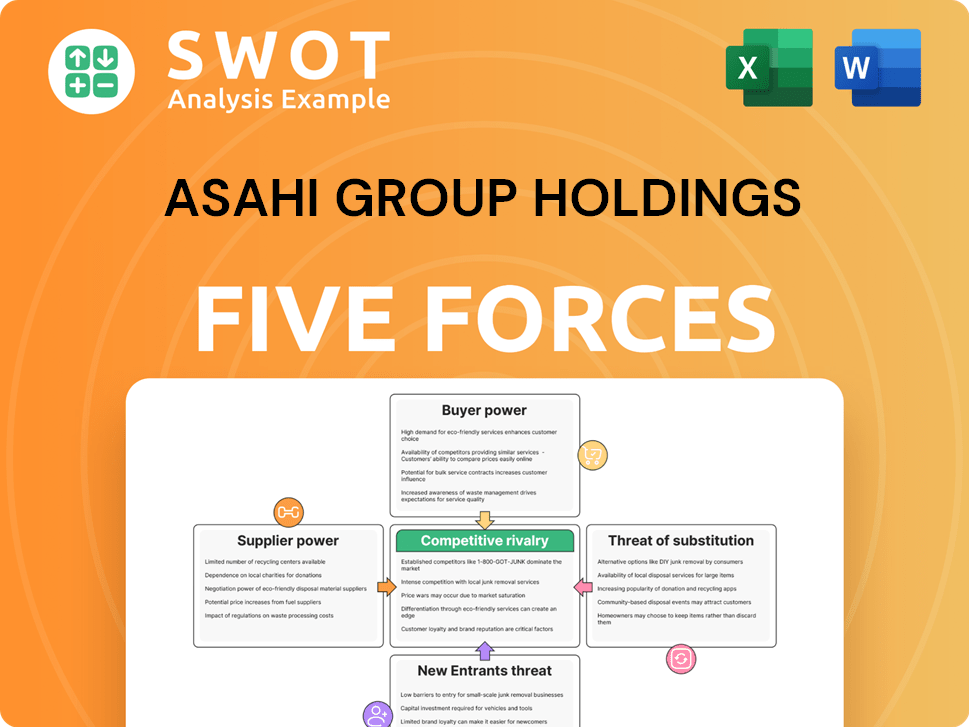

Asahi Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Asahi Group Holdings Company?

- What is Competitive Landscape of Asahi Group Holdings Company?

- How Does Asahi Group Holdings Company Work?

- What is Sales and Marketing Strategy of Asahi Group Holdings Company?

- What is Brief History of Asahi Group Holdings Company?

- Who Owns Asahi Group Holdings Company?

- What is Customer Demographics and Target Market of Asahi Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.