Asahi Group Holdings Bundle

Who Drinks Asahi? Unveiling the Customer Behind the Brand

From its groundbreaking launch of Asahi Group Holdings SWOT Analysis to its global presence, understanding Asahi's customer base is key to its continued success. But who exactly are the people choosing Asahi Super Dry and other offerings? This exploration dives deep into the company's customer demographics and target market, providing critical insights for investors, analysts, and anyone interested in the beverage industry.

This deep dive into Asahi Group Holdings' market analysis will uncover the consumer profile, including age range of Asahi beer consumers, gender distribution of Asahi drinkers, and their geographic location. We'll examine Asahi Group Holdings market segmentation strategy and how the company caters to diverse tastes, including how Asahi targets millennials and other key demographics. Analyzing Asahi Group Holdings consumer preferences will reveal how the brand maintains its market share and adapts to the ever-evolving needs of its target audience, impacting Asahi's target market in Japan, the United States, and beyond.

Who Are Asahi Group Holdings’s Main Customers?

Understanding the customer demographics and target market of Asahi Group Holdings is crucial for grasping its market position. The company primarily operates in the Business-to-Consumer (B2C) sector, though it also engages in Business-to-Business (B2B) transactions through its distribution network. This dual approach allows it to reach a broad audience, from individual consumers to commercial entities like retailers and restaurants.

Asahi Group Holdings' flagship product, Asahi Super Dry, has traditionally targeted males aged late 20s to 50s who appreciate its crisp taste and quality. However, the company has been actively working to broaden its appeal. This includes efforts to attract younger consumers and women, particularly in markets like Japan, where the core beer market is mature. This strategic shift reflects an understanding of evolving consumer preferences and the need for diversification.

Beyond beer, the company's portfolio includes soft drinks and food products, broadening its customer base. These products cater to a wider demographic, including families and health-conscious individuals across all age groups. The company's market analysis reveals a strategic focus on both premium and mass-market segments.

The primary consumer profile for Asahi Super Dry historically includes males aged late 20s to 50s. This demographic appreciates the beer's crisp taste and the brand's association with quality. The company has been expanding its reach to younger consumers and women.

Asahi Group Holdings' market segmentation strategy involves targeting various groups. This includes premium beer consumers, families, and health-conscious individuals. The company uses different product lines and marketing approaches to reach these diverse segments.

Asahi Group Holdings has expanded its international presence significantly. Key markets include Europe and Australia, where it has acquired strong local brands. These acquisitions have broadened its customer base and diversified its revenue streams.

Premium beer offerings typically appeal to middle to higher-income consumers, especially in developed markets. Education and occupation often correlate with income, influencing purchasing patterns for premium products. The company's strategy considers these income-based differences.

The geographic location of Asahi's target market has shifted over time. While Japan remains a key market, the company has expanded its global footprint through acquisitions and strategic investments. This diversification is evident in its financial reports, which highlight increased international sales contributions. For instance, in 2024, international sales accounted for a significant portion of the company's revenue, reflecting its global expansion efforts. To learn more about the company's growth strategy, you can read about the Growth Strategy of Asahi Group Holdings.

Asahi Group Holdings targets several key customer segments across different geographic locations and income levels. The company's strategy focuses on both premium and mass-market segments, adapting to local preferences and market conditions. This approach has allowed it to maintain a strong global presence.

- Males aged late 20s to 50s: The core demographic for Asahi Super Dry, valuing quality and taste.

- Younger Consumers and Women: Targeted through specific product lines and marketing campaigns.

- Middle to Higher-Income Consumers: Especially in developed markets, for premium offerings.

- International Consumers: Customers in Europe and Australia, through acquisitions of local brands.

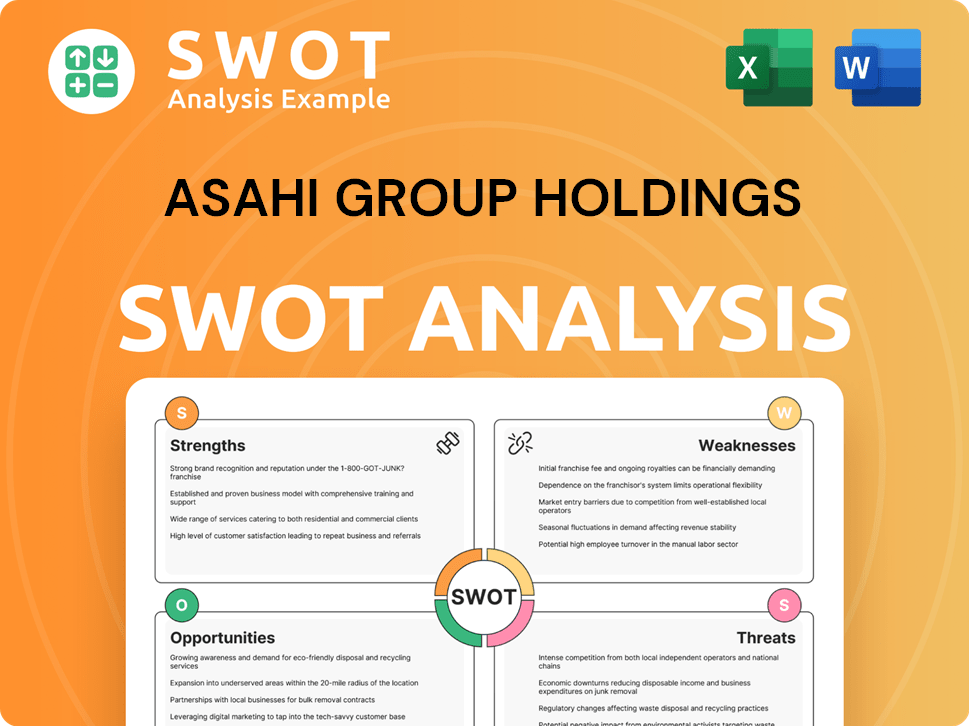

Asahi Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Asahi Group Holdings’s Customers Want?

Understanding the customer needs and preferences is crucial for businesses like Asahi Group Holdings, which operates in the competitive beverage industry. The company's success hinges on its ability to meet the diverse demands of its consumer base, ranging from beer enthusiasts to health-conscious individuals seeking non-alcoholic options. Analyzing the Customer demographics and understanding the Asahi Group Holdings target market provides insights into consumer behavior and helps tailor products and marketing strategies effectively.

The purchasing decisions of consumers are influenced by various factors, including taste, brand reputation, and social occasions. For instance, the crisp, dry finish of Asahi Super Dry appeals to many beer drinkers, while others may prioritize health and wellness, driving demand for low-sugar or natural ingredient beverages. Asahi Group Holdings employs market analysis to understand these evolving preferences and adapt its offerings accordingly.

Asahi Group Holdings' approach to its Consumer profile and Demographic segmentation involves a deep understanding of its customers' needs and preferences. Factors such as product quality, effective branding, and positive consumption experiences contribute to customer loyalty. The company addresses consumer pain points by offering a wide range of products, including traditional lagers, craft beers, and non-alcoholic options. This ensures that Asahi can cater to a broad spectrum of tastes and preferences.

For beer consumers, taste profile, especially the crisp, dry finish of Asahi Super Dry, is a primary driver. Brand reputation for quality and consistency also plays a significant role in consumer choice. Social occasions and relaxation are key motivations for consumption, making convenience and availability crucial.

In the non-alcoholic beverage segment, health and wellness trends significantly influence consumer preferences. Consumers seek options with lower sugar content, natural ingredients, or functional benefits. Asahi has been actively developing and promoting products that align with these health-conscious trends.

Loyalty factors often stem from consistent product quality, effective branding, and positive consumption experiences. Authenticity and brand heritage are increasingly important, which Asahi leverages through its long history and traditional brewing methods. The company addresses common pain points by offering diverse flavor profiles.

Asahi tailors its marketing and product features to specific segments. Marketing for Asahi Super Dry emphasizes its refreshing qualities, targeting adults who enjoy a premium beer experience. Marketing for non-alcoholic options highlights health benefits and suitability for daily consumption. The company adapts its offerings regionally.

In Europe, Asahi focuses on premium local brands that cater to specific regional tastes and preferences, leveraging the established loyalty these brands command. This localized approach ensures that product features and marketing messages align with the unique demands of each market. Regional adaptation is key to success.

Unmet needs, such as the demand for sustainable packaging or transparent ingredient sourcing, are increasingly influencing product development. Asahi has responded by investing in sustainable practices, reflecting a broader trend towards environmental responsibility. This is an important factor for modern consumers.

Asahi Group Holdings' success depends on understanding and adapting to consumer needs. The company's approach includes tailoring products and marketing to specific segments. This involves a deep understanding of What are the demographics of Asahi beer drinkers, Asahi Group Holdings target audience analysis, and Who is Asahi's ideal customer.

- Market Segmentation: Asahi employs a Asahi Group Holdings market segmentation strategy, targeting different consumer groups with tailored products and marketing.

- Regional Adaptation: The company adapts its offerings regionally, focusing on local brands to cater to specific tastes.

- Sustainability: Responding to consumer demand for sustainable practices, Asahi invests in eco-friendly initiatives.

- Consumer Behavior: Understanding Asahi beer consumer behavior helps in product development and marketing.

- Target Market: Analyzing Asahi's target market in Japan and Asahi's target market in the United States is crucial for strategic decisions.

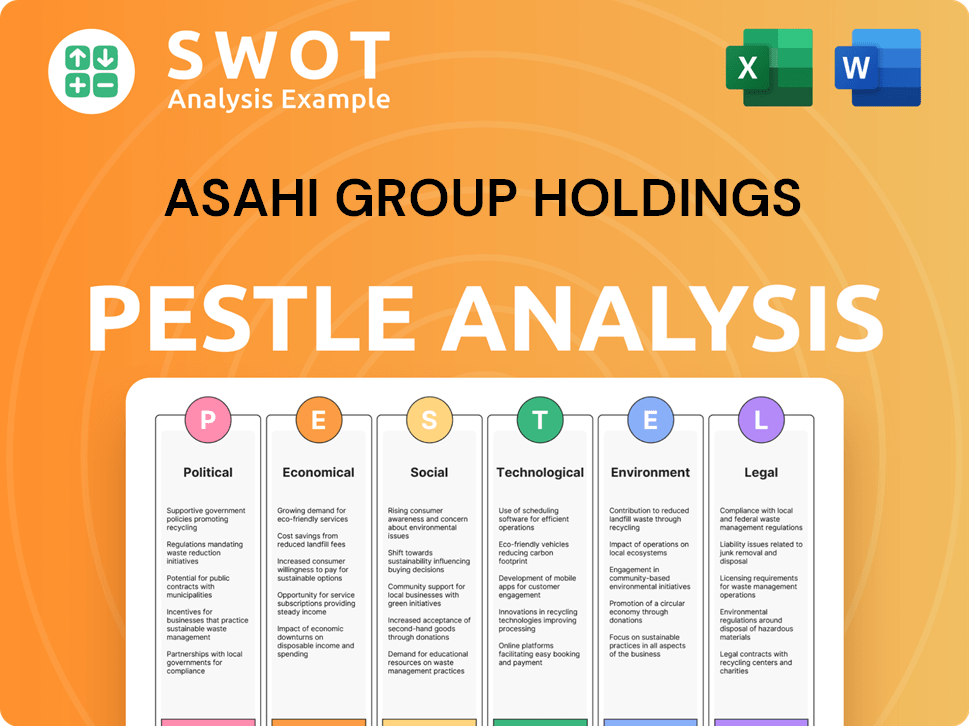

Asahi Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Asahi Group Holdings operate?

The geographical market presence of Asahi Group Holdings is extensive, with major operations across Asia, Europe, and Oceania. The company's strongest market share and brand recognition are in Japan, its home market. Strategic acquisitions have significantly expanded its international footprint, enabling it to tap into diverse consumer markets.

In Europe, Asahi has a robust presence, particularly in countries like Italy, the UK, and the Netherlands, following key acquisitions. In Oceania, the acquisition of Carlton & United Breweries (CUB) in Australia solidified Asahi's position. This expansion strategy allows the company to leverage established brands and cater to regional preferences.

Differences in customer demographics, preferences, and buying power across these regions necessitate a localized approach. Asahi tailors its offerings and marketing campaigns to reflect local cultural nuances and consumer behaviors. This ensures that the brand resonates with consumers in each specific market, driving sales and brand loyalty.

Asahi Super Dry remains a dominant force in Japan, the company's home market. Owners & Shareholders of Asahi Group Holdings benefit from this strong presence. The focus is on maintaining market share and brand loyalty within the domestic market.

Acquisitions of Peroni, Grolsch, and Meantime have established a strong presence in Europe. The company leverages these brands to cater to diverse consumer preferences. Market analysis in Europe is crucial for understanding consumer profiles.

The acquisition of Carlton & United Breweries (CUB) in Australia has solidified Asahi's position. This has given the company a significant share of the Australian beer market. Understanding Asahi Group Holdings target market is key.

Asahi localizes its offerings by maintaining the distinct identities and brewing traditions of its acquired brands. Marketing campaigns are tailored to reflect local cultural nuances. This helps in effective demographic segmentation.

Asahi's strategy involves consolidating its position in key markets and optimizing its global supply chain. The company is focused on premiumization in developed markets and exploring growth opportunities in emerging economies. Recent financial reports highlight the significant contribution of international sales to overall revenue.

- Premiumization: Focus on high-end products in developed markets.

- Emerging Markets: Exploring growth opportunities in new regions.

- Supply Chain: Optimizing global operations for efficiency.

- Revenue: Strong contribution from both domestic and international sales.

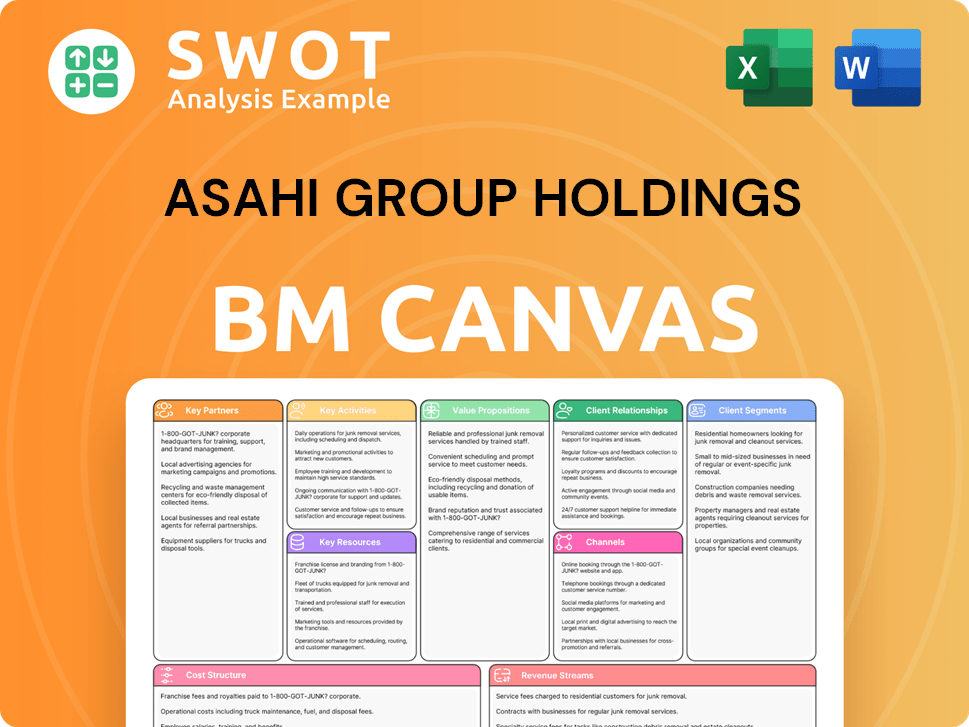

Asahi Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Asahi Group Holdings Win & Keep Customers?

Asahi Group Holdings employs a multifaceted approach to customer acquisition and retention, focusing on a blend of traditional and digital marketing strategies. Their customer acquisition strategies involve extensive advertising campaigns across various platforms, including television, print, and digital media. The company also leverages influencer marketing, particularly to reach younger demographics, and sponsors major sporting events and cultural festivals to enhance brand visibility. For example, the partnership with the Rugby World Cup in 2023 significantly boosted its global presence, demonstrating the effectiveness of strategic sponsorships.

The company's sales tactics involve strong relationships with retailers to ensure prominent product placement and attractive promotional offers. In the B2B segment, dedicated sales teams work with distributors and on-premise accounts to ensure widespread availability. Retention strategies at Asahi are centered on building brand loyalty and enhancing the customer experience. This includes maintaining consistent product quality, which is paramount for a beverage company. While specific loyalty programs for individual consumers are not widely publicized for its core beer brands, the company focuses on creating personalized experiences through targeted digital marketing and content that resonates with specific consumer segments.

Customer data, though not detailed publicly, is undoubtedly utilized to refine marketing campaigns and product development, likely through CRM systems that track sales data and consumer engagement. Asahi also invests in after-sales service, particularly for its B2B clients, ensuring efficient delivery and support. Changes in strategy over time reflect the broader shift towards digital engagement and a greater emphasis on sustainability and health-conscious offerings. For instance, the increased focus on non-alcoholic and low-alcohol beverages is a direct response to evolving consumer preferences and aims to retain customers who are reducing their alcohol intake.

Asahi utilizes extensive advertising campaigns across television, print, and digital platforms to reach a wide audience. These campaigns are designed to increase brand awareness and attract new customers. The use of digital platforms has increased in recent years to target specific demographics more effectively.

Influencer marketing plays a growing role, especially for reaching younger demographics. This strategy involves collaborations with social media personalities to promote specific product lines and enhance brand visibility. This approach helps Asahi connect with consumers in a more relatable way.

Asahi's sales tactics include strong relationships with retailers to ensure prominent product placement and attractive promotional offers. Dedicated sales teams work with distributors and on-premise accounts to ensure widespread product availability. This approach is crucial for maximizing sales.

Retention strategies focus on building brand loyalty and enhancing the customer experience. This includes maintaining consistent product quality and creating personalized experiences through targeted digital marketing. These efforts aim to increase customer lifetime value.

Asahi's approach to customer acquisition and retention is multi-faceted, combining traditional and digital marketing efforts. The company's success in the market depends on its ability to understand and respond to consumer preferences. For more insights into the financial aspects of Asahi Group Holdings, you can explore the Revenue Streams & Business Model of Asahi Group Holdings.

- Digital Marketing: Increased focus on online advertising and social media campaigns to reach a wider audience.

- Product Innovation: Launching new products, such as non-alcoholic beverages, to cater to evolving consumer preferences.

- Brand Partnerships: Collaborating with influencers and sponsoring events like the Rugby World Cup to enhance brand visibility.

- Customer Data Analysis: Utilizing CRM systems to refine marketing campaigns and product development based on consumer behavior.

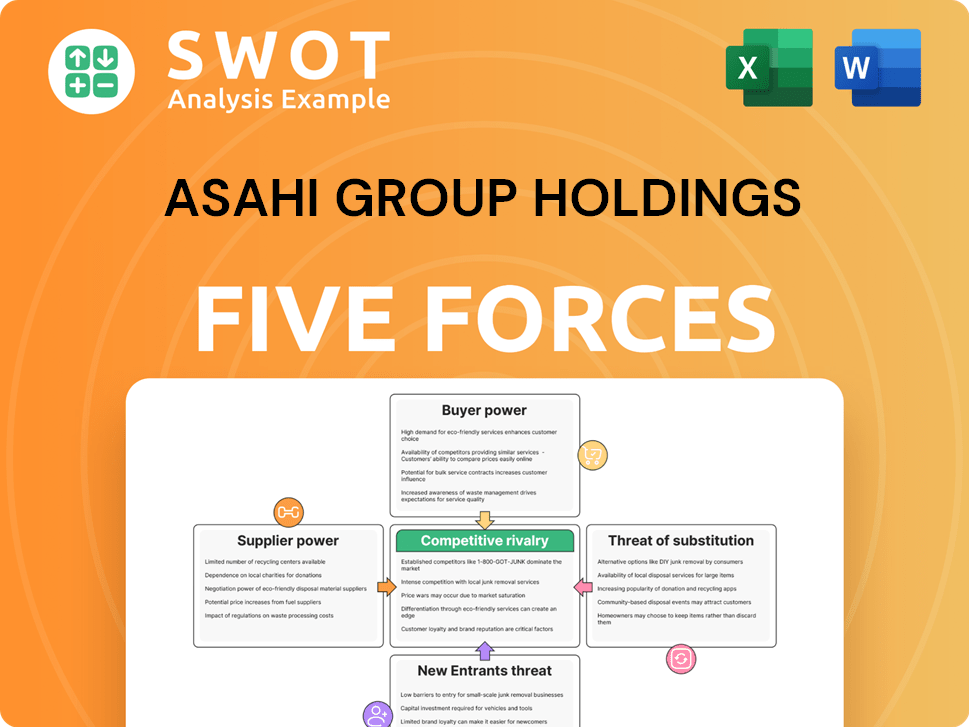

Asahi Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Asahi Group Holdings Company?

- What is Competitive Landscape of Asahi Group Holdings Company?

- What is Growth Strategy and Future Prospects of Asahi Group Holdings Company?

- How Does Asahi Group Holdings Company Work?

- What is Sales and Marketing Strategy of Asahi Group Holdings Company?

- What is Brief History of Asahi Group Holdings Company?

- Who Owns Asahi Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.