Asahi Group Holdings Bundle

How Does the Asahi Company Conquer the Global Beverage Market?

Asahi Group Holdings, a global beverage titan, reigns supreme with its iconic Asahi Super Dry beer and a diverse portfolio spanning alcoholic and non-alcoholic drinks. This strategic expansion and diverse product offerings have fueled impressive market penetration and financial success across international markets. Understanding the inner workings of Asahi Group Holdings SWOT Analysis is essential for anyone seeking to understand the global beverage industry's dynamics and the drivers of its continued growth.

The Asahi business model, characterized by its robust financial performance and extensive global footprint, exemplifies its industry standing. With a strong presence in key markets and a focus on innovation, Asahi continues to expand its reach and diversify its product lines within the beverage industry. Delving into Asahi Group Holdings' core operations, revenue streams, and strategic moves will provide a holistic view of how this global leader functions and generates profit, particularly within the Japanese beer market.

What Are the Key Operations Driving Asahi Group Holdings’s Success?

Asahi Group Holdings creates value by producing and distributing a wide range of alcoholic beverages, soft drinks, and food products globally. The company's core operations revolve around manufacturing, quality control, and innovation. Their flagship product, Asahi Super Dry beer, is a key driver of their business, demonstrating their brewing expertise and commitment to quality.

The company's business model focuses on delivering high-quality products efficiently through a complex supply chain and a global distribution network. They adapt their offerings to local preferences while maintaining brand consistency, particularly for premium beer brands. This approach enables them to provide a diverse range of products to various markets.

The Target Market of Asahi Group Holdings is broad, encompassing consumers worldwide who enjoy alcoholic and non-alcoholic beverages and food products. Their operational uniqueness lies in their ability to balance global brand consistency with localized product adaptations.

Asahi Group Holdings utilizes sophisticated manufacturing processes, including advanced brewing technologies. They focus on efficiency and environmental responsibility in their production facilities. This ensures consistent product quality and supports their sustainability initiatives.

The company maintains a complex supply chain to ensure timely delivery of products. This includes robust logistics, a vast distribution network, and strategic partnerships. They leverage efficient global operations to reach diverse markets effectively.

Asahi invests heavily in research and development to create new products and adapt to changing consumer preferences. They continuously innovate to maintain a competitive edge in the beverage industry. This includes exploring new flavors and product formats.

Asahi employs targeted marketing strategies to promote its brands globally. They focus on building strong brand recognition and loyalty among consumers. Their marketing efforts support their global expansion and market penetration.

Asahi Group Holdings operates a diversified business model, focusing on both alcoholic and non-alcoholic beverages. Their success is built on a combination of global scale and local market adaptation, particularly in the Japanese beer market. The company's corporate structure supports its diverse portfolio and international presence.

- Global Presence: Asahi has a significant presence in multiple countries, including Australia, the United Kingdom, and various Asian markets.

- Product Diversification: Besides beer, the company offers a wide range of soft drinks and food products, reducing its reliance on a single product category.

- Strategic Acquisitions: Asahi has expanded its portfolio and market reach through strategic acquisitions, such as the acquisition of Peroni and Grolsch.

- Financial Performance: In recent financial reports, Asahi Group Holdings has demonstrated consistent revenue growth, driven by strong performance in key markets. For example, in 2024, the company reported a revenue of approximately ¥2.7 trillion.

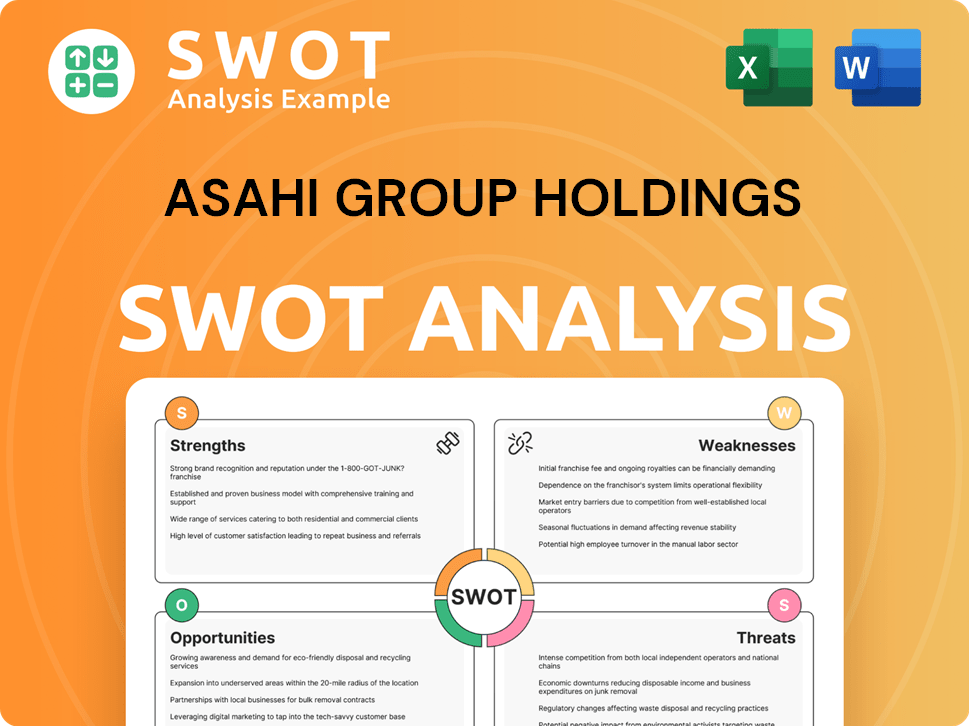

Asahi Group Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Asahi Group Holdings Make Money?

Asahi Group Holdings generates revenue primarily through the sale of its diverse product portfolio. This includes alcoholic beverages like beer, wine, and spirits, along with non-alcoholic beverages such as soft drinks, coffee, and tea, and various food products. The company's business model is centered around a wide range of products to cater to different consumer preferences and market segments.

The company's financial performance is a key indicator of its success. In the fiscal year ending December 31, 2024, Asahi Group Holdings reported net sales of JPY 2,776.4 billion. This showcases the company's strong position in the beverage industry and its ability to generate substantial revenue from its operations. The Asahi company continues to adapt and innovate to maintain its market position.

The Asahi business model incorporates several monetization strategies to maximize profitability. These include strategic pricing across different markets and product tiers, and leveraging its extensive distribution networks to maximize market penetration. The focus on premiumization, particularly with brands like Asahi Super Dry, allows for higher profit margins. Asahi's diversified portfolio helps mitigate risks associated with fluctuations in demand for any single product category or region.

Asahi Group Holdings employs a multi-faceted approach to generate revenue and maximize profitability. This includes direct product sales, strategic pricing, and leveraging its distribution networks. The company's focus on premium products and expansion into new markets are key components of its strategy.

- Product Sales: The primary revenue stream comes from selling alcoholic and non-alcoholic beverages, as well as food products. The alcoholic beverage segment, particularly beer, is a major contributor, driven by strong performance in international markets.

- Strategic Pricing: Asahi uses strategic pricing across different markets and product tiers to optimize revenue. Premium brands like Asahi Super Dry command higher prices, boosting profit margins.

- Distribution Network: The company’s extensive distribution networks are leveraged to maximize market penetration. This ensures products reach a wide consumer base, contributing to sales growth.

- Premiumization: Focusing on premium brands allows for higher profit margins. This strategy is evident in the success of brands like Asahi Super Dry.

- Market Expansion: Asahi explores opportunities for revenue expansion through strategic acquisitions and by entering new product categories or geographical markets. Recent focus includes health and wellness products and expansion in Southeast Asia.

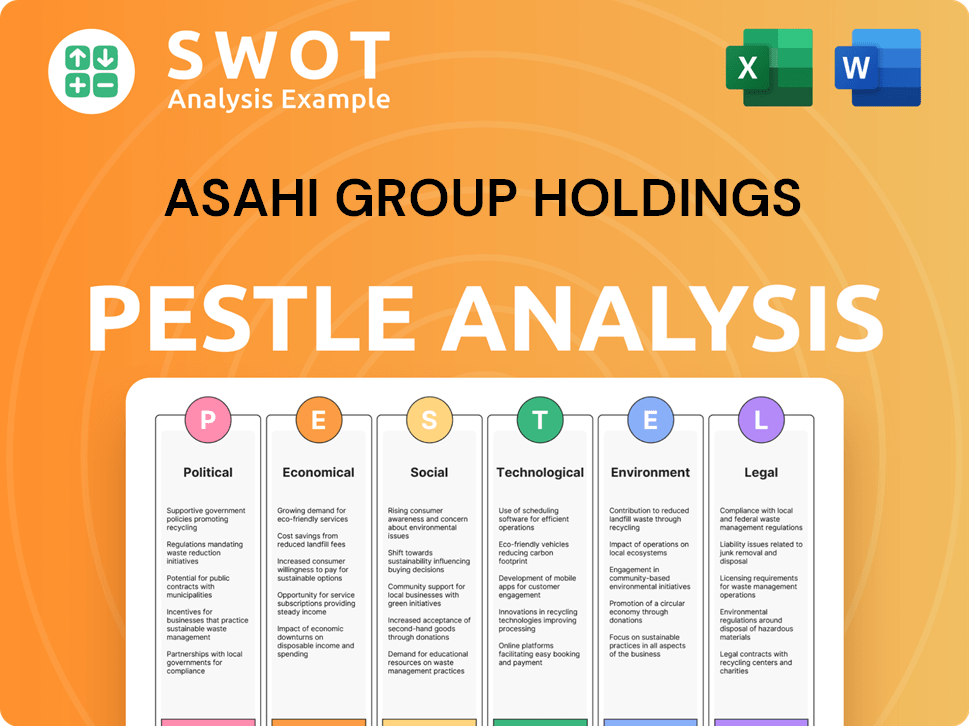

Asahi Group Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Asahi Group Holdings’s Business Model?

The evolution of Asahi Group Holdings has been marked by strategic decisions and key milestones. A pivotal moment was the 1987 launch of Asahi Super Dry, which transformed the Japanese beer market. This product became a cornerstone of the company's brand, significantly boosting its market presence. The company's journey reflects its adaptability and strategic foresight in the competitive beverage industry.

Strategic acquisitions have been a key driver of Asahi's global expansion. Purchases of various beer brands in Europe and Oceania have significantly broadened its international footprint. These moves have enabled Asahi to capture substantial market share in crucial international markets. The company's focus on both organic growth and strategic acquisitions has been fundamental to its success.

Asahi Group Holdings has navigated various operational challenges, including supply chain disruptions and evolving consumer preferences. The company has invested in resilient logistics and adapted its product development to meet new demands. This includes the growing interest in low-alcohol and non-alcoholic beverages, ensuring its continued relevance and competitiveness in a dynamic market.

The launch of Asahi Super Dry in 1987 was a defining moment, revolutionizing the Japanese beer market. Strategic acquisitions in Europe and Oceania have significantly expanded its global presence. These moves have allowed Asahi to gain substantial market share in key international markets.

Asahi has focused on global expansion through acquisitions, diversifying its revenue streams. The company has adapted to changing consumer preferences by investing in product innovation. It has also implemented resilient logistics to manage supply chain disruptions effectively.

Asahi's strong brand recognition, particularly for Asahi Super Dry, gives it a significant advantage. Its extensive global distribution network supports its market reach. The company leverages economies of scale in production and distribution.

Asahi is committed to sustainability, developing environmentally friendly packaging. It is expanding its range of healthier beverage options to meet evolving consumer demands. These initiatives ensure the company's continued relevance in the market.

In recent financial reports, Asahi Group Holdings has demonstrated robust performance. The company's strategic acquisitions and brand strength have contributed to its solid financial results. Asahi's focus on innovation and sustainability continues to drive its market position.

- Revenue: In the fiscal year 2023, Asahi Group Holdings reported revenues of approximately ¥2.7 trillion.

- Operating Profit: The operating profit for the same period was around ¥290 billion.

- Market Share: Asahi holds a significant share in the Japanese beer market and a growing presence internationally.

- Global Presence: The company's global operations include significant market shares in Europe and Oceania.

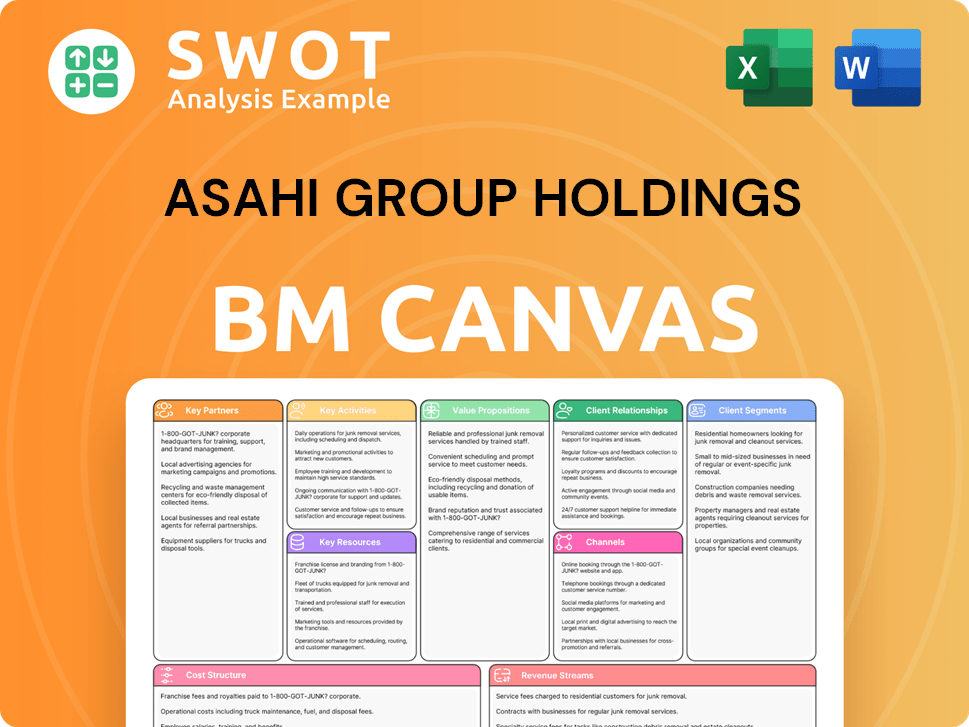

Asahi Group Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Asahi Group Holdings Positioning Itself for Continued Success?

Asahi Group Holdings holds a strong position in the beverage industry, competing with major international players. The company's success is driven by its popular beer brands and a growing presence in soft drinks and food products, particularly in regions like Japan, Europe, and Oceania. Customer loyalty, especially for brands like Asahi Super Dry, significantly contributes to its stable revenue base and global reach. Understanding the Growth Strategy of Asahi Group Holdings is key to appreciating its industry standing.

However, Asahi faces risks such as fluctuating raw material costs and intense competition. Changing consumer preferences and potential regulatory changes also pose challenges. Geopolitical instability and economic downturns in key markets could impact operations. Looking ahead, Asahi is focused on sustainable growth through premium product offerings, digital transformation, and expansion into emerging markets, particularly in Asia. The company is also committed to environmental sustainability.

Asahi Group Holdings is a leading player in the global beverage industry, with a strong presence in the Japanese beer market. Its market share in key regions is substantial, driven by popular brands. The company's diverse portfolio includes beer, soft drinks, and food products, contributing to its robust position.

Asahi faces risks from fluctuating raw material costs and intense competition. Changing consumer preferences towards healthier options and regulatory changes pose challenges. Geopolitical instability and economic downturns could impact operations and revenue. These factors require careful management and strategic planning.

Asahi focuses on sustainable growth through premium product offerings, digital transformation, and emerging market expansion. The company is committed to environmental sustainability, aiming to reduce its carbon footprint. Continuous innovation and strategic investments are key to maintaining and expanding profitability.

In recent financial reports, Asahi Group Holdings has shown resilience. For example, in 2024, the company reported a revenue of over ¥2.7 trillion. The company's operating profit was approximately ¥280 billion. These figures reflect the company's strong market position and effective strategies.

Asahi's strategic initiatives focus on expanding its premium product offerings and investing in digital transformation. The company aims to strengthen its presence in emerging markets, especially in Asia. These initiatives are designed to drive sustainable growth and enhance its competitive advantage in the beverage industry.

- Expansion of premium brands.

- Digital transformation investments.

- Focus on emerging markets (Asia).

- Sustainability and environmental goals.

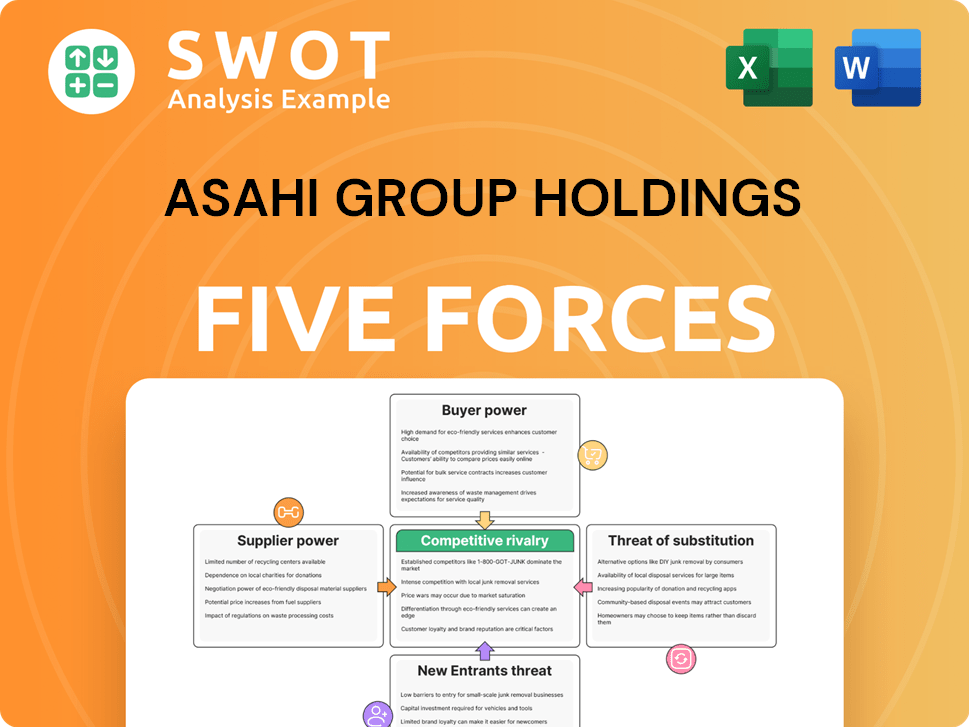

Asahi Group Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Asahi Group Holdings Company?

- What is Competitive Landscape of Asahi Group Holdings Company?

- What is Growth Strategy and Future Prospects of Asahi Group Holdings Company?

- What is Sales and Marketing Strategy of Asahi Group Holdings Company?

- What is Brief History of Asahi Group Holdings Company?

- Who Owns Asahi Group Holdings Company?

- What is Customer Demographics and Target Market of Asahi Group Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.