Aurora Bundle

How Does Aurora Company Navigate the Cannabis Industry's Competitive Waters?

The cannabis industry is a whirlwind of change, and Aurora SWOT Analysis is a significant player in this evolving market. From its roots in medical cannabis to its expansion into recreational products, Aurora has charted a course through complex regulations and shifting consumer preferences. This exploration dives into the heart of Aurora's competitive landscape, examining its position within the market, its key rivals, and the strategies that will define its future.

Understanding the Aurora Company competitive landscape is crucial for investors and industry watchers alike. This detailed market analysis will dissect Aurora's business strategy, its market share, and its competitive advantages and disadvantages, providing a comprehensive view of its performance compared to competitors. We'll also explore the challenges and opportunities facing Aurora Company within the broader cannabis industry, offering insights into its growth strategy and future outlook.

Where Does Aurora’ Stand in the Current Market?

Aurora Cannabis Inc. has established a significant market position within the Canadian cannabis sector, alongside expanding its international presence. The company is recognized as a leading licensed producer in Canada based on revenue and production capacity. Its product range includes dried flower, pre-rolls, cannabis oils, capsules, edibles, and concentrates, serving both medical patients and adult-use consumers.

Geographically, Aurora's strongest presence is in Canada, where it operates several licensed production facilities. The company has strategically expanded internationally, particularly in medical cannabis markets like Germany, Australia, and Poland, leveraging its expertise in cultivation and product development. This market analysis provides insights into Aurora's competitive landscape.

Aurora has evolved its market positioning, transitioning from a focus on medical cannabis to embracing the adult-use market following legalization in Canada. This diversification of offerings and customer segments has been crucial to its growth. The company has focused on optimizing its operations and rationalizing its asset base to improve profitability and efficiency. In its fiscal second quarter of 2024, Aurora reported an adjusted EBITDA of $4.3 million, marking its fifth consecutive quarter of positive adjusted EBITDA.

Aurora maintains a strong position in the Canadian market, often cited as a leader in the medical cannabis segment. While specific market share data fluctuates, Aurora consistently ranks among the top licensed producers by revenue. The company's focus on both medical and adult-use markets supports its broad market presence.

Aurora has strategically expanded its international footprint, especially in medical cannabis markets. Key markets include Germany, Australia, and Poland. This expansion leverages Aurora's expertise in cultivation and product development, aiming to capitalize on the growing global demand for medical cannabis products.

Aurora offers a comprehensive range of cannabis products, including dried flower, pre-rolls, oils, capsules, edibles, and concentrates. This diverse portfolio caters to both medical patients and adult-use consumers. The company's product offerings are designed to meet various consumer preferences and needs within the market.

Aurora has shown improvements in its adjusted EBITDA, indicating a focus on achieving sustainable profitability. In its fiscal second quarter of 2024, the company reported an adjusted EBITDA of $4.3 million, a significant marker of its financial health. This positive trend reflects Aurora's efforts to streamline operations and enhance efficiency.

Aurora faces challenges such as intense competition and regulatory hurdles but also has opportunities. The company can leverage its established brand and operational expertise to expand its global presence. Strategic partnerships and innovation in product development are crucial for maintaining a competitive edge in the Aurora Company competitive landscape.

- Intense competition from other licensed producers in Canada and internationally.

- Evolving regulatory environments and compliance requirements.

- Opportunities for growth in emerging medical cannabis markets.

- Potential for strategic partnerships and acquisitions to expand market share.

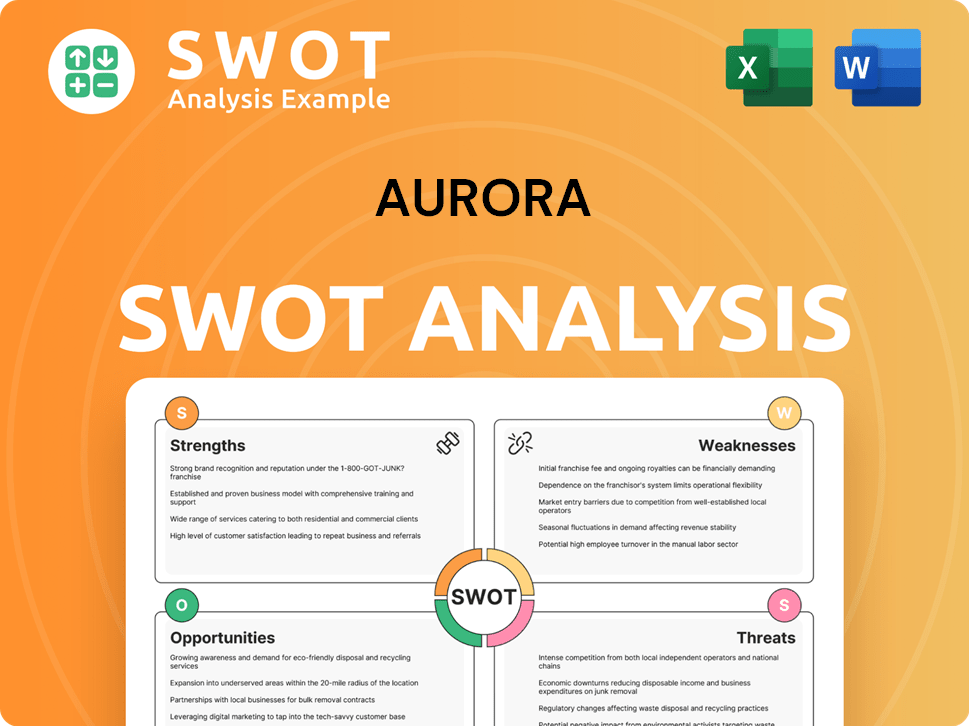

Aurora SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Aurora?

The competitive landscape for Aurora Cannabis Inc. is dynamic and multifaceted, encompassing both direct and indirect competitors within the global cannabis market. A thorough Aurora Company competitive landscape analysis reveals a complex interplay of established players, emerging firms, and the persistent influence of the illicit market. This environment demands strategic agility and continuous innovation to maintain or gain market share.

Aurora Company market analysis indicates that the company faces significant challenges and opportunities. The legal cannabis industry is still evolving, with regulatory changes, consumer preferences, and technological advancements constantly reshaping the competitive dynamics. Understanding the strengths, weaknesses, opportunities, and threats (SWOT) of its competitors is crucial for Aurora to formulate effective business strategies.

The Aurora Company industry is characterized by intense competition, driven by factors such as product differentiation, pricing strategies, distribution networks, and brand recognition. The ability to navigate these complexities and adapt to the changing market conditions is critical for Aurora's long-term success. Strategic partnerships, technological innovation, and effective marketing campaigns play vital roles in shaping the competitive dynamics.

Canopy Growth Corporation is a major direct competitor, challenging Aurora across various product segments. Tilray Brands, formed through mergers, presents a formidable challenge with its diverse brand portfolio. Cronos Group, backed by Altria Group, competes through premium products and R&D.

The illicit market continues to pose a challenge to legal cannabis sales, representing significant indirect competition. Emerging international companies and new entrants from the pharmaceutical or consumer packaged goods sectors also indirectly compete.

High-profile battles often manifest as market share shifts in specific product categories or provinces. Competition is particularly fierce in edibles and concentrates. Product launches, pricing strategies, and marketing campaigns drive these shifts.

The evolving regulatory environment significantly impacts the competitive landscape. Changes in regulations can affect product offerings, market access, and operational costs. Staying compliant and adapting to these changes is crucial.

Product innovation is a key driver of competition in the cannabis market. Companies are constantly developing new products, formulations, and delivery methods to capture consumer interest. This includes exploring different strains, cannabinoid profiles, and consumption methods.

Distribution networks and retail presence are critical for market access and sales. Companies with strong distribution channels and a wide retail footprint have a significant competitive advantage. This includes both online and brick-and-mortar stores.

Aurora Company's competitors include both Canadian and international cannabis producers. Analyzing these competitors helps in understanding their strengths, weaknesses, and strategies.

- Canopy Growth Corporation: Strong brand recognition and extensive distribution networks. They compete across all segments.

- Tilray Brands, Inc.: Diverse brand portfolio and significant international operations. Focus on both medical and adult-use markets.

- Cronos Group Inc.: Focus on premium products and strategic investments in R&D. Strategic partnerships with Altria Group.

- Other Licensed Producers: Numerous other licensed producers in Canada and emerging international companies. They challenge Aurora through specialized product offerings, regional dominance, or competitive pricing.

- Illicit Market: The illicit market continues to pose a challenge to legal cannabis sales.

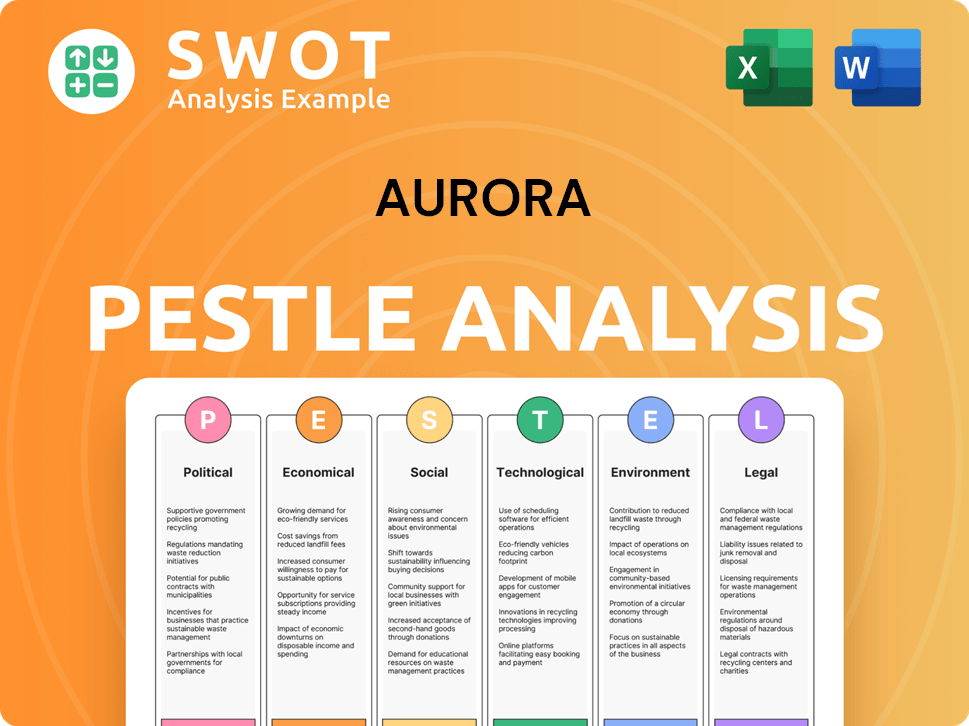

Aurora PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Aurora a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Aurora Company involves assessing its key advantages in the cannabis industry. The firm has carved a niche through strategic cultivation and production capabilities, backed by significant investments in large-scale facilities. This has historically allowed for economies of scale, potentially lowering production costs. However, the company has adjusted its asset base over time, focusing on operational efficiency and profitability.

Aurora also benefits from a diverse product portfolio, including dried flower, oils, and edibles, catering to a wide range of consumer preferences and medical needs. This diversified product range allows Aurora to capture a broader market segment. Furthermore, the company's early mover advantage in international medical cannabis markets, such as Germany and Australia, contributes significantly to its competitive edge. This global presence provides diversification and reduces reliance on any single market.

Aurora's commitment to research and development in the cannabis field is another key advantage. This investment in R&D supports product innovation and differentiation, which is crucial in a rapidly evolving market. The company's brand recognition and customer loyalty, built over years as a prominent licensed producer, also play a vital role. These advantages are continuously evolving as Aurora adapts its business strategy to the changing market dynamics.

Aurora Company's large-scale cultivation facilities were once among the largest globally, enabling significant production capacity. This scale advantage allowed Aurora to potentially lower production costs per gram. Although the company has rationalized its asset base, its expertise in large-scale, high-quality cultivation remains a notable competitive advantage.

Aurora has established a strong presence in international medical cannabis markets, including Germany, Australia, and Poland. This global footprint provides diversification and reduces the company's dependence on any single market. Securing licenses and distribution channels in these key jurisdictions gives Aurora an early mover advantage.

The company offers a diverse product range, including dried flower, oils, edibles, and other cannabis-derived products. This broad portfolio caters to a wide spectrum of consumer preferences and medical needs. Diversification helps Aurora capture a larger market share and meet varied consumer demands.

Aurora invests in cannabis research and development to advance the understanding and application of cannabis. This commitment to R&D can lead to product innovation and differentiation. The company's focus on R&D helps maintain its competitive edge in a rapidly evolving market.

Aurora Company's competitive advantages include its large-scale cultivation, diversified product offerings, and international presence. Its early entry into key medical cannabis markets and ongoing investments in research and development further strengthen its market position. For a deeper understanding of Aurora's business model, consider reading about the Revenue Streams & Business Model of Aurora.

- Large-scale cultivation and production capabilities, enabling economies of scale.

- A broad product portfolio catering to diverse consumer preferences and medical needs.

- Established presence in international medical cannabis markets, providing diversification.

- Investment in research and development for product innovation and differentiation.

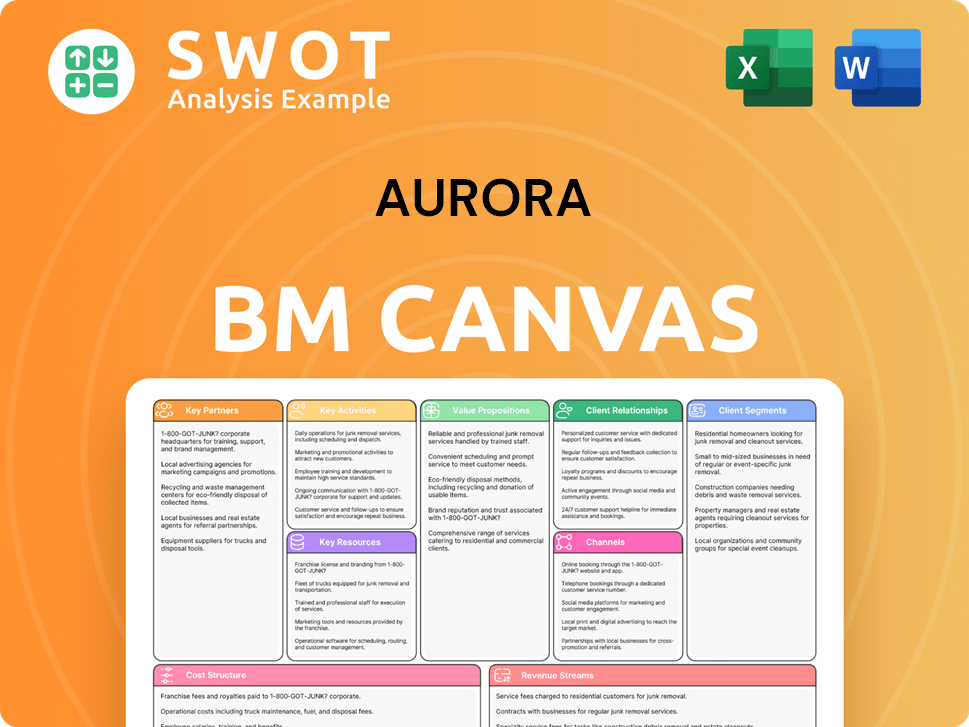

Aurora Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Aurora’s Competitive Landscape?

The global cannabis industry is experiencing significant shifts, influencing the Aurora Company competitive landscape. Key trends include ongoing legalization efforts worldwide, technological advancements in cultivation and product development, and evolving consumer preferences towards diverse cannabis product formats. These factors present both growth opportunities and challenges for companies like Aurora.

The Aurora Company market analysis reveals a sector marked by increasing regulation, intensified competition, and economic pressures. The illicit market and potential oversupply in legal markets pose specific threats. Conversely, opportunities arise from emerging medical cannabis markets, product innovation, and strategic partnerships. Aurora's business strategy focuses on achieving profitability, optimizing operations, and selectively pursuing growth opportunities.

The cannabis industry is witnessing a global trend of legalization, driving market expansion. Advancements in cultivation and product development are leading to innovation. Consumer preferences are shifting towards diverse product formats like edibles and concentrates. These trends shape the Aurora Company industry and its competitive dynamics.

Increased regulation and compliance costs pose operational complexities. Intensified competition, including new market entrants, could lead to price compression. Economic shifts, such as inflation, may impact consumer demand. The illicit market and potential oversupply remain significant challenges for Aurora and its competitors.

Emerging medical cannabis markets provide growth opportunities, leveraging established international presence. Product innovation in higher-margin segments offers avenues for differentiation. Strategic partnerships can strengthen market position. Aurora's focus on profitability and operational efficiency supports its growth prospects.

Aurora is deploying strategies to enhance its competitive position. This includes focusing on premium products and expanding its medical cannabis footprint. Improving operational efficiencies is also a key focus to remain resilient. For more on this, see the Growth Strategy of Aurora.

The Aurora Company's market share is influenced by its ability to navigate regulatory hurdles and economic pressures. The company's success hinges on its capacity to innovate and adapt to evolving consumer preferences. Strategic partnerships and operational efficiencies are critical for long-term sustainability.

- Focus on premium product offerings to maintain margins.

- Expand presence in medical cannabis markets for growth.

- Improve operational efficiencies to reduce costs.

- Monitor and respond to changes in consumer demand.

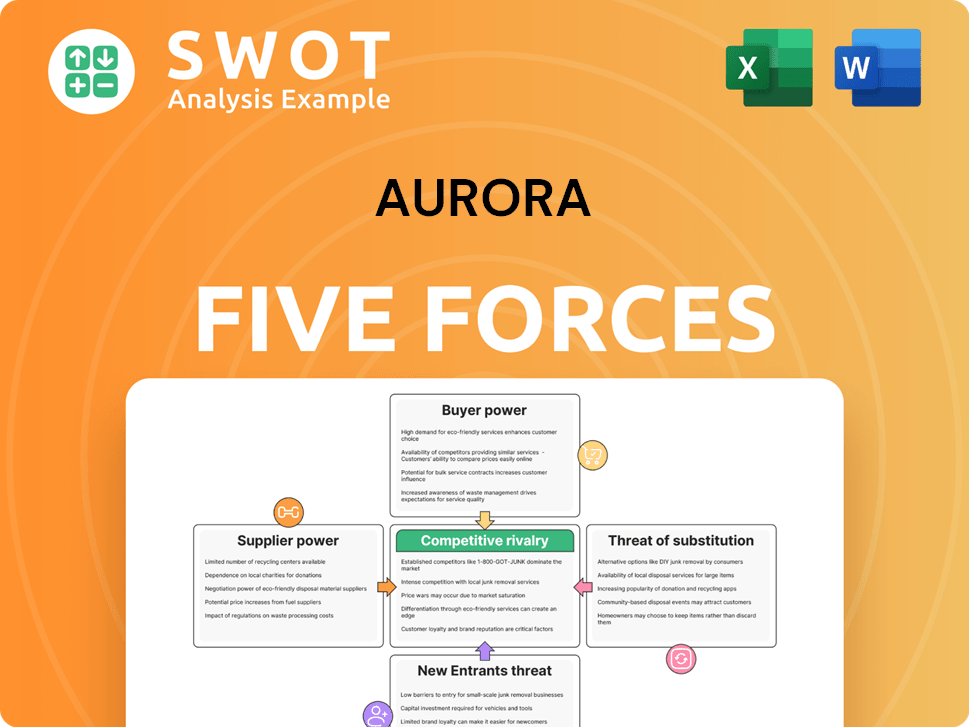

Aurora Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aurora Company?

- What is Growth Strategy and Future Prospects of Aurora Company?

- How Does Aurora Company Work?

- What is Sales and Marketing Strategy of Aurora Company?

- What is Brief History of Aurora Company?

- Who Owns Aurora Company?

- What is Customer Demographics and Target Market of Aurora Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.