Aurora Bundle

Decoding Aurora Cannabis: How Does This Cannabis Giant Operate?

Aurora Cannabis Inc. stands as a key player in the global cannabis market, offering a wide range of products for both medical and recreational use. With an extensive network of production facilities and retail channels, Aurora has established a significant presence. But how does this leading cannabis company function, and what drives its financial success?

To truly understand Aurora Company, it's essential to delve into its operational strategies and revenue models. Aurora's commitment to research and development is also a key factor, positioning it at the forefront of cannabis innovation. For a deeper dive into Aurora's strategic strengths and weaknesses, consider reviewing the Aurora SWOT Analysis to gain valuable insights into the company's competitive landscape and future prospects, as well as how Aurora AI is used.

What Are the Key Operations Driving Aurora’s Success?

The core of the company's operations revolves around the cultivation, processing, and distribution of cannabis products. This encompasses a wide array of offerings, including dried flower, oils, edibles, and other derivatives. The company caters to both medical patients and recreational consumers, ensuring a diverse product portfolio to meet varying needs.

Operational efficiency is a key focus, with sophisticated cultivation techniques, stringent quality control, and a streamlined supply chain. This integrated approach allows for greater control over product quality and cost management. The company's value proposition is centered on providing safe, effective, and diverse cannabis products through multiple sales channels.

The company's commitment to research and development further differentiates it from some competitors, potentially leading to innovative products and applications. This focus on innovation, coupled with its operational strengths, contributes to its market differentiation. The company aims to provide a reliable supply of cannabis products to its target markets.

The company cultivates cannabis in licensed facilities, adhering to strict quality control measures. Processing involves transforming raw cannabis into various product forms, such as oils and edibles. This ensures product consistency and availability for consumers.

The company utilizes multiple channels, including direct-to-consumer platforms and partnerships with distributors and retailers. This multi-channel approach ensures broad market reach. The company focuses on efficient supply chain management to meet consumer demand.

The company offers a diverse range of products, including dried flower, oils, edibles, and other derivatives. This variety caters to both medical patients and recreational users. The company's product offerings are designed to meet diverse consumer preferences.

The company invests in research and development to innovate and improve its products. This includes exploring new applications and enhancing product efficacy. This commitment helps the company stay competitive in the evolving cannabis market.

The company's value proposition centers on providing a diverse product portfolio, reliable supply, and a focus on product safety and efficacy. This approach contributes to its market differentiation. The company aims to build a strong brand reputation.

- Diverse Product Range: Offering a wide variety of cannabis products to meet different consumer needs.

- Reliable Supply Chain: Ensuring consistent product availability through efficient operations.

- Focus on Safety and Efficacy: Prioritizing product quality and consumer well-being.

- Innovation: Investing in research and development for new products and applications.

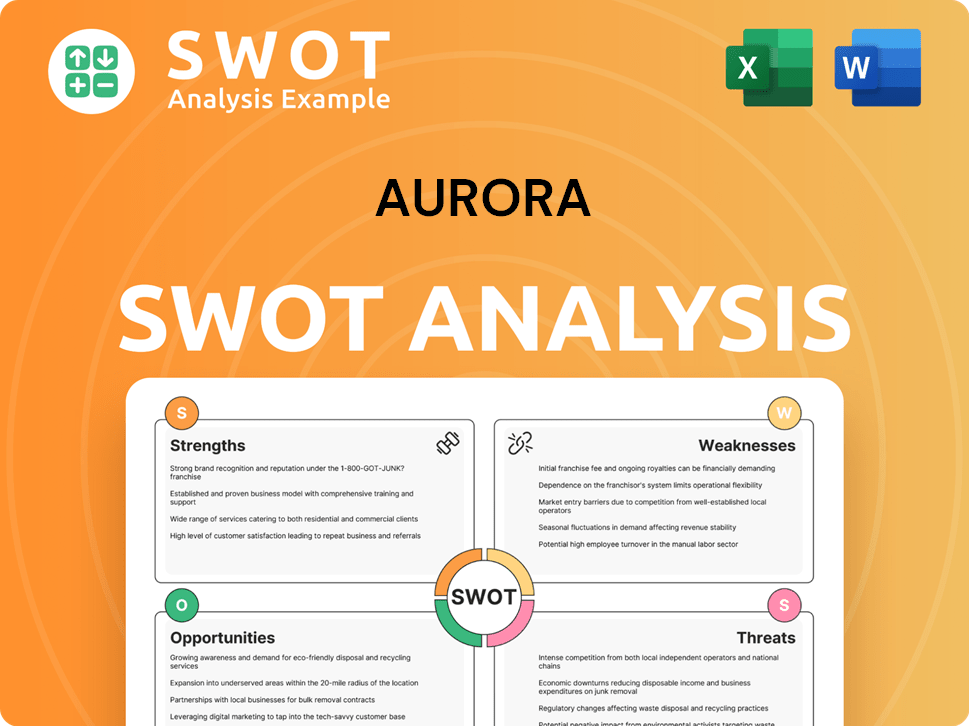

Aurora SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Aurora Make Money?

The Aurora Company generates revenue primarily through the sale of its cannabis products. The company focuses on both medical and recreational cannabis markets, with a diverse product range including dried flower, cannabis oils, and various derivative products.

The company's revenue streams are diversified, with a significant portion coming from medical cannabis sales and recreational cannabis sales. The company employs various monetization strategies, including direct product sales and potentially tiered pricing models, to maximize revenue.

The company's financial performance demonstrates its revenue generation capabilities. For the three months ended December 31, 2024, the company reported net revenue from cannabis of $64.0 million. Medical cannabis revenue contributed $37.2 million, representing approximately 58% of total cannabis net revenue, while recreational cannabis net revenue was $26.8 million during the same period.

The primary revenue streams for the Aurora Company are the sales of medical and recreational cannabis products. The company's revenue is significantly influenced by the sales of dried flower, cannabis oils, and derivative products.

The company places a strong emphasis on the medical cannabis market. This focus often involves a subscription-like model for recurring patient orders, ensuring a stable revenue stream for the company.

The company utilizes various monetization strategies. These include direct product sales and potentially tiered pricing models for different product lines or bulk purchases. Strategic partnerships and international market expansion also contribute to diversified revenue sources.

The company adapts its revenue mix to capitalize on the evolving regulatory landscape and consumer preferences. This includes expanding its product offerings into higher-margin derivative products. The company is also pursuing growth in international medical cannabis markets.

In the three months ended December 31, 2024, the company reported net revenue from cannabis of $64.0 million. Medical cannabis revenue was $37.2 million, representing approximately 58% of the total cannabis net revenue. Recreational cannabis net revenue was $26.8 million during the same period.

The company's growth strategy includes expansion into international markets to diversify revenue streams. This expansion is critical for long-term financial sustainability and growth.

The Aurora Company's revenue streams and monetization strategies are crucial for its financial performance. The company's focus on medical cannabis, direct sales, and market expansion are key drivers.

- Medical Cannabis Sales: A significant portion of revenue comes from medical cannabis, often through subscription-based models.

- Recreational Cannabis Sales: The company also generates revenue from recreational cannabis sales, with a focus on product diversification.

- Product Diversification: Expanding into higher-margin derivative products and other offerings.

- Strategic Partnerships: Collaborations to expand market reach and product offerings.

- International Expansion: Growth in international medical cannabis markets to diversify revenue.

For more insights, consider reading about the Growth Strategy of Aurora.

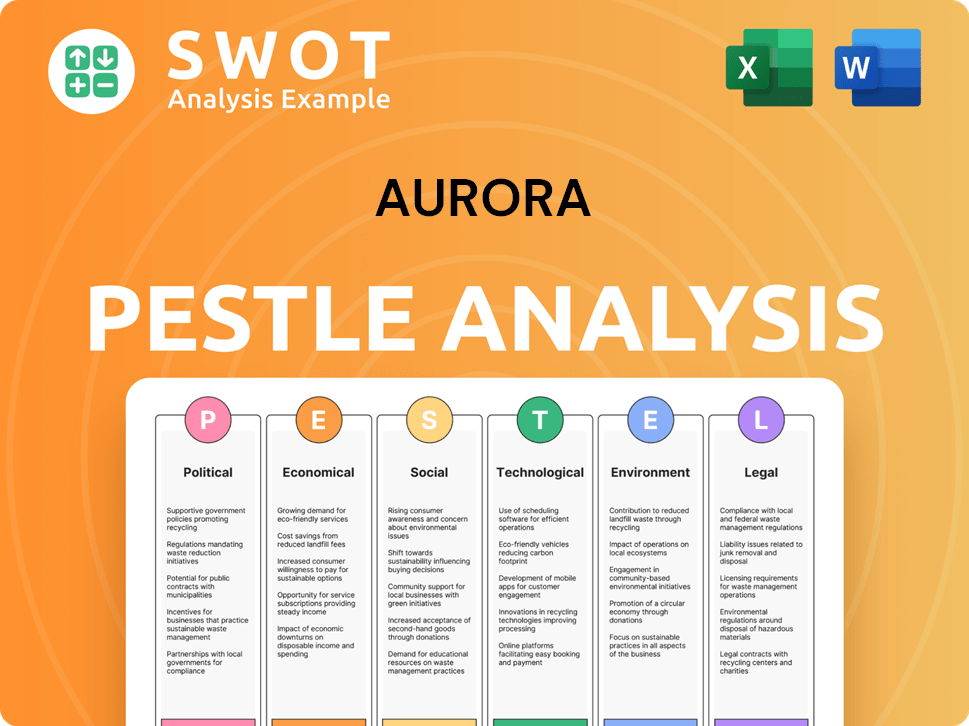

Aurora PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Aurora’s Business Model?

Aurora Cannabis has experienced a series of key milestones and strategic shifts that have significantly influenced its operational and financial performance. These include expanding its licensed production facilities and forming strategic alliances to penetrate new markets. The company has focused on international medical cannabis markets, which has been a key strategic move to diversify revenue streams. This approach has been essential for navigating the evolving cannabis industry.

Operational challenges, such as regulatory hurdles and market saturation, have been addressed through process optimization and a focus on higher-margin products. Aurora's competitive advantages include a strong brand presence and substantial cultivation capacity. Aurora continues to adapt to industry trends by investing in research and operational efficiencies. For example, the company has been focused on the growing demand for specific cannabis formats.

The company's ability to adapt to new trends, such as the growing demand for specific cannabis formats or the increasing importance of sustainability in cultivation practices, by investing in research and operational efficiencies is crucial. Aurora's strategic decisions and operational adjustments have been pivotal in shaping its position in the cannabis market. The company's approach to innovation and market expansion has been instrumental in its development.

Aurora has expanded its licensed production facilities, including the Aurora Sky facility. This facility was once among the largest cannabis cultivation facilities globally. Strategic partnerships have been crucial for international market entry and product development. For example, the company has focused on expanding its presence in international medical cannabis markets.

Aurora has focused on international medical cannabis markets to diversify revenue streams. The company has optimized its cultivation processes and streamlined operations. It has also focused on higher-margin product categories to improve profitability. These moves have helped the company adapt to market changes.

Aurora has a strong brand presence in both medical and recreational markets. It has significant cultivation capacity, which allows it to meet market demand. The company is committed to research and development, which supports product innovation. Aurora continues to adapt to changing market conditions.

The company has faced operational challenges, including regulatory hurdles and market saturation. Aurora responded by optimizing its cultivation processes and streamlining operations. It has focused on higher-margin product categories. This has helped the company to stay competitive.

Aurora's financial performance has been influenced by its strategic decisions and market conditions. The company's focus on international markets and high-margin products has been key. Aurora's ability to adapt to market changes is crucial for its long-term success. To understand the target market of Aurora, you can read this article: Target Market of Aurora.

- Aurora has focused on expanding its presence in international medical cannabis markets.

- The company has optimized its cultivation processes and streamlined operations.

- Aurora has a strong brand presence and significant cultivation capacity.

- The company is committed to research and development to support product innovation.

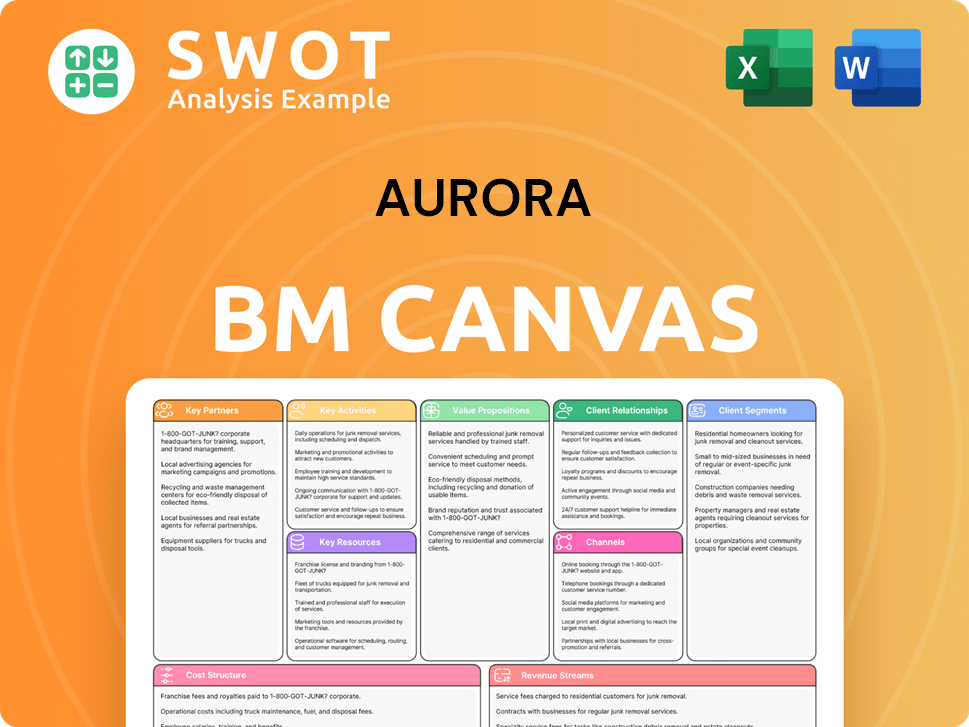

Aurora Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Aurora Positioning Itself for Continued Success?

The global cannabis market is a dynamic space, and the positioning of Aurora Cannabis is a key factor for investors and stakeholders. Aurora has carved out a notable presence in the industry, particularly in the Canadian medical cannabis market, where it has maintained a strong foothold. Its market share and customer loyalty are influenced by product quality, brand recognition, and its distribution networks. The recreational market in Canada is highly competitive, and Aurora has strategically focused on the higher-margin medical cannabis segment and international expansion to capitalize on opportunities.

Looking ahead, Aurora's strategic initiatives include continued expansion in international medical cannabis markets, optimization of its production facilities, and ongoing investment in research and development to bring new and innovative products to market. The company's leadership has emphasized a focus on profitability and sustainable growth. Aurora aims to sustain and expand its ability to generate revenue by capitalizing on global medical cannabis opportunities and maintaining a strong product portfolio. For more insights into the company's marketing strategies, you can refer to Marketing Strategy of Aurora.

Aurora Cannabis holds a significant position in the global cannabis industry, particularly within the Canadian medical cannabis market. The company's strategy emphasizes high-margin medical cannabis and international expansion. Aurora's brand recognition and distribution networks are key to its market share.

Key risks include evolving regulations in various jurisdictions, intense competition from established and new players, and shifts in consumer preferences. Economic factors like inflation or disposable income changes also pose risks. These factors can affect consumer spending on cannabis products.

Aurora's future outlook involves continued international expansion in medical cannabis markets. It also includes optimizing production facilities and investing in research and development. The company is focused on profitability and sustainable growth, aiming to capitalize on global opportunities.

Strategic initiatives include expanding in international medical cannabis markets and optimizing production. Aurora continues to invest in R&D for new products. The company focuses on profitability and sustainable growth to maintain revenue.

Aurora's financial performance is closely tied to market trends in the cannabis industry. The company's ability to adapt to changing regulations and consumer preferences is crucial. Aurora's strategic focus on high-margin medical cannabis is a key element of its financial strategy.

- Market Share: Aurora's market share in the Canadian medical cannabis segment.

- Revenue Growth: The company's revenue growth is influenced by expansion into international markets.

- Profitability: The focus on profitability and sustainable growth is a core strategic initiative.

- Competition: Intense competition from established and new players.

Aurora Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aurora Company?

- What is Competitive Landscape of Aurora Company?

- What is Growth Strategy and Future Prospects of Aurora Company?

- What is Sales and Marketing Strategy of Aurora Company?

- What is Brief History of Aurora Company?

- Who Owns Aurora Company?

- What is Customer Demographics and Target Market of Aurora Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.