Aurora Bundle

Can Aurora Cannabis Thrive in the Evolving Cannabis Market?

From its humble beginnings in Edmonton, Aurora Cannabis has become a global player in the cannabis industry. But what does the future hold for this Canadian giant? This article dives deep into Aurora's Aurora SWOT Analysis, exploring its ambitious growth strategy and the exciting future prospects that lie ahead.

Understanding Aurora Company's growth strategy is crucial for investors and industry watchers alike. We'll conduct a thorough Aurora Company market analysis, examining its strategic planning and financial performance to provide a comprehensive view of its potential. This analysis will also explore the challenges and opportunities shaping Aurora Company's business strategy in the coming years, offering valuable insights into its future prospects and competitive landscape.

How Is Aurora Expanding Its Reach?

The Aurora Company growth strategy focuses heavily on expansion to drive future success. This involves both international and domestic initiatives designed to capture market share and improve financial performance. The company's approach is multifaceted, incorporating strategic partnerships, product innovation, and operational efficiency to navigate the evolving cannabis industry.

Aurora Company future prospects are closely tied to its ability to execute these expansion plans effectively. The company aims to leverage its existing infrastructure and expertise to capitalize on emerging opportunities in both medical and recreational cannabis markets. This includes a focus on product diversification and cost optimization to maintain a competitive edge. Strategic planning is a key component of Aurora's success.

Aurora Company business strategy is centered on sustainable growth and value creation for its stakeholders. This approach involves a blend of organic growth and strategic acquisitions, allowing the company to adapt to changing market dynamics. The company's commitment to innovation and operational excellence is expected to support its long-term objectives.

Aurora is actively expanding its international presence, particularly in medical cannabis markets. Key regions include Germany, Poland, and Australia, where the regulatory environments are becoming more favorable. The company leverages its expertise in medical cannabis to establish a strong foothold in these emerging markets. For example, Aurora Europe, its German subsidiary, plays a crucial role in distributing medical cannabis products across the European Union.

Domestically, Aurora is refining its product portfolio and retail strategies to cater to evolving consumer preferences. This includes introducing new product formats and brands in the recreational market. The company focuses on optimizing its production facilities to enhance efficiency and reduce costs, supporting scalable growth. Aurora consistently evaluates market trends to inform its product development pipeline, ensuring it remains competitive.

Strategic partnerships and potential mergers and acquisitions are integral to Aurora's growth strategy. These initiatives allow the company to access new technologies, distribution networks, or market segments. In 2024, Aurora completed the acquisition of MedReleaf Australia, strengthening its position in the Australian medical cannabis market. These moves are designed to diversify revenue streams and maintain a competitive edge.

Aurora Company financial performance is a key indicator of its success in executing its growth strategy. The company's ability to manage costs, increase revenue, and achieve profitability will be critical. The company's strategic planning includes financial forecasting and performance monitoring to ensure it meets its objectives. Aurora's ability to adapt to market changes is crucial for long-term success.

Aurora's expansion initiatives are designed to diversify revenue streams and capture new customer bases. The company's strategic planning includes a focus on both organic growth and strategic acquisitions to drive long-term value. These strategies are supported by a commitment to innovation and operational excellence.

- International Market Penetration: Focus on medical cannabis markets in Europe and Australia.

- Product Innovation: Introduction of new product formats and brands to meet consumer demand.

- Operational Efficiency: Optimization of production facilities to reduce costs and improve scalability.

- Strategic Partnerships: Leveraging collaborations to access new technologies and distribution networks.

For additional insights into the company's core values and mission, you can explore the article on Mission, Vision & Core Values of Aurora.

Aurora SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Aurora Invest in Innovation?

The focus of the company's growth strategy includes a significant investment in innovation and technology. This commitment is aimed at enhancing product offerings and achieving sustained growth within the competitive cannabis market. The company's strategic approach involves continuous research and development to stay ahead.

The company's strategic planning emphasizes the application of technology to improve various aspects of its operations. This includes optimizing supply chain management and enhancing customer engagement through digital platforms. Through these efforts, the company aims to maintain its competitive edge and meet evolving consumer demands.

The company's future prospects are closely tied to its ability to innovate and adapt to the evolving cannabis market. By focusing on scientific research and product development, the company aims to create higher-quality products and discover new therapeutic applications. This approach is crucial for long-term success in the industry.

The company invests heavily in research and development to advance the understanding and application of cannabis. This includes exploring new cultivation techniques and developing novel cannabis-derived products. These efforts are aimed at creating higher-quality products and increasing efficiency.

The company is focused on digital transformation to optimize supply chain management and enhance customer engagement. This includes the use of digital platforms to streamline operations and improve the customer experience. These strategies are essential for maintaining a competitive advantage.

The company is exploring the potential of minor cannabinoids and terpenes to create differentiated products. This involves developing products with specific effects to meet evolving consumer demands. This strategic approach is key to driving growth.

The company collaborates with academic institutions and external innovators to stay at the forefront of cannabis science and technology. These partnerships are crucial for staying competitive and driving innovation. Such alliances help in expanding the company's knowledge base.

By continuously innovating, the company aims to maintain its competitive advantage in the cannabis market. This includes creating higher-quality products and meeting evolving consumer demands. This approach is essential for long-term success.

The company aims to contribute to the broader scientific understanding of cannabis through its research and development efforts. This includes exploring new therapeutic applications for cannabinoids. This focus helps in advancing the field of cannabis science.

The company's Revenue Streams & Business Model of Aurora highlights the importance of innovation and technology in its business strategy. This includes significant investments in research and development to improve product offerings and operational efficiency.

- R&D Focus: Continuous investment in research and development to explore new cultivation techniques, develop novel products, and improve extraction methods.

- Digital Optimization: Efforts to optimize supply chain management and enhance customer engagement through digital platforms.

- Product Differentiation: Exploring minor cannabinoids and terpenes to create differentiated products with specific effects.

- Strategic Partnerships: Collaborations with academic institutions and external innovators to stay at the forefront of cannabis science and technology.

- Market Analysis: The company's market analysis focuses on identifying and capitalizing on opportunities for growth.

Aurora PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Aurora’s Growth Forecast?

The financial outlook for the company, often referred to as the "Aurora Company," centers on achieving sustainable profitability and generating positive cash flow. This strategic shift is critical in the evolving cannabis industry. The company's financial performance is closely watched by investors and analysts, with a focus on its ability to maintain and improve its financial health.

For the fiscal year 2024, the company reported net revenue of $67.4 million in Q3 2024. Within this, medical cannabis revenue reached $60.2 million, accounting for 89% of the total net revenue. This highlights the company's strong position in the Canadian medical cannabis market and its growing international presence. The company's financial strategy includes disciplined capital allocation and a focus on cost management to enhance profit margins.

The company's strategic plans for market expansion and product innovation are aimed at building a resilient and profitable business. The company's emphasis on medical cannabis and international expansion is expected to contribute to stable and growing revenue streams. The company has also highlighted its adjusted EBITDA profitability for several consecutive quarters, indicating improved operational efficiency. This commitment to financial discipline and strategic growth positions the company for long-term success. To learn more about its origins, you can read a Brief History of Aurora.

The company's market analysis focuses on the medical cannabis sector, both in Canada and internationally. The company is strategically positioned to capitalize on the growing demand for medical cannabis products. It aims to expand its presence in key markets while maintaining a focus on high-quality products and patient care.

The company's strategic planning involves a multi-faceted approach, including product innovation, market expansion, and operational efficiency. The company is focused on sustainable growth through strategic partnerships and investments. This strategic planning aims to create long-term value for shareholders.

The company's financial performance is measured by key metrics such as revenue growth, profitability, and cash flow. The company's Q3 2024 results show a strong focus on the medical cannabis market. The company is committed to improving its financial performance through cost management and strategic investments.

The company's business strategy centers on the medical cannabis market. The focus is on product innovation, market expansion, and operational efficiency. The company aims to build a resilient and profitable business through strategic initiatives. The company's business strategy is designed to ensure long-term sustainability and growth.

The company's growth strategy is centered on expanding its presence in the medical cannabis market. The company is focused on strategic planning for sustainable growth. The company's future prospects are tied to its ability to execute its business strategy and capitalize on market opportunities.

- Focus on medical cannabis revenue.

- International market expansion.

- Cost management and operational efficiency.

- Product innovation and strategic partnerships.

Aurora Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Aurora’s Growth?

The growth strategy of Aurora Company faces several hurdles that could affect its future prospects. These challenges include intense competition, regulatory shifts, and potential supply chain disruptions. Understanding these risks is crucial for any market analysis of Aurora Company and its strategic planning.

Aurora's business strategy must navigate a complex landscape. Internal resource constraints and the need for continuous innovation also present significant obstacles. Addressing these issues is key to ensuring the financial performance and sustained growth of the company.

The company's ability to adapt and innovate will be critical. For investors considering how to invest in Aurora Company, awareness of these risks is essential. A thorough understanding of both the challenges and opportunities will shape the company's trajectory in the coming years.

The cannabis market is highly competitive, with many licensed producers vying for market share. This competition can lead to lower prices and challenges in maintaining brand loyalty. Target Market of Aurora provides further insights into the competitive landscape.

Evolving cannabis laws, taxation policies, and product regulations pose significant risks. Delays in regulatory approvals can hinder expansion plans. These changes directly affect the company's strategic planning and market access.

Disruptions in cultivation, processing, or distribution can affect product availability. Unforeseen events, such as agricultural challenges or logistical bottlenecks, could arise. These vulnerabilities can impact Aurora Company's financial performance.

New cultivation methods or product innovations by competitors can challenge Aurora's market position. Continuous innovation is crucial to stay ahead. This affects Aurora Company's future prospects and requires constant adaptation.

Limited availability of skilled labor or capital for expansion can hinder growth. Addressing these internal constraints is vital. Proper resource allocation is key to Aurora Company's business strategy.

Changing consumer tastes and global economic conditions can influence demand. These factors require flexibility in Aurora Company's market analysis. Adapting to these shifts is crucial for long-term success.

Aurora addresses these risks through diversification of its product portfolio and market presence. Robust risk management frameworks are essential. Continuous monitoring of the regulatory landscape is also vital for sustainable growth.

The company has demonstrated its ability to adapt by streamlining operations. Focusing on higher-margin medical cannabis products is a key strategy. This approach has helped navigate market shifts effectively.

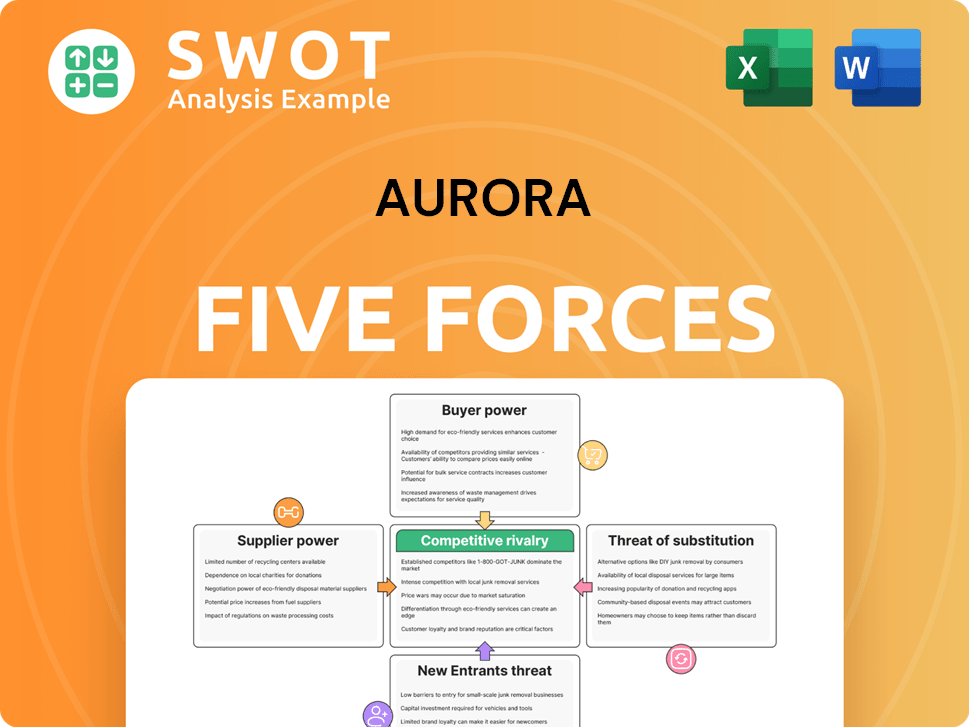

Aurora Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aurora Company?

- What is Competitive Landscape of Aurora Company?

- How Does Aurora Company Work?

- What is Sales and Marketing Strategy of Aurora Company?

- What is Brief History of Aurora Company?

- Who Owns Aurora Company?

- What is Customer Demographics and Target Market of Aurora Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.