AVEVA Group Bundle

Who's Who in the Industrial Software Arena: A Look at AVEVA Group?

In the ever-evolving world of industrial software, understanding the competitive landscape is paramount. AVEVA Group, now part of Schneider Electric, is a key player driving digital transformation across various sectors. But who are its main rivals, and how does AVEVA maintain its edge? This analysis dives deep into the AVEVA Group SWOT Analysis, market dynamics, and strategic positioning.

This exploration of the AVEVA Group competitive landscape will dissect its position within the AVEVA industry, examining its key AVEVA competitors and their strategies. We'll conduct a thorough AVEVA market analysis to assess its market share and competitive advantages in the context of the latest trends in the industrial software market. By understanding AVEVA's competitive strategy, we can gain valuable insights into its future growth prospects and its ability to navigate the challenges and opportunities presented by the digital transformation space.

Where Does AVEVA Group’ Stand in the Current Market?

AVEVA Group holds a strong market position within the industrial software industry, particularly in engineering and operations solutions. The company is recognized as a leader in key segments, including engineering design, asset performance management (APM), and manufacturing execution systems (MES). AVEVA's offerings, such as its unified operations center and data platform, are critical for enabling digital twins and operational efficiency, positioning it strongly in the industrial internet of things (IIoT) space. This robust position is a key factor in understanding the AVEVA Group competitive landscape.

AVEVA's primary product lines, including AVEVA Plant, AVEVA Marine, AVEVA PI System, and AVEVA Unified Operations Center, cater to diverse customer segments such as oil and gas, power, chemicals, marine, infrastructure, and food and beverage. These diverse offerings contribute to AVEVA's broad market reach. The acquisition by Schneider Electric in 2023 has further solidified its market standing, integrating AVEVA's software capabilities with Schneider Electric's expertise in energy management and industrial automation. This strategic alignment enhances AVEVA's ability to offer end-to-end solutions, expanding its reach and deepening its penetration in existing and new markets. A detailed AVEVA market analysis is essential for understanding its competitive dynamics.

Geographically, AVEVA boasts a significant global presence, with strong footholds in Europe, North America, and Asia-Pacific. While specific financial health metrics post-acquisition are integrated within Schneider Electric's broader reporting, prior to the acquisition, AVEVA demonstrated strong financial performance, indicative of its market leadership and robust business model. The company's focus on sustainability and digital transformation initiatives continues to drive its positioning in an industrial landscape increasingly prioritizing efficiency and environmental responsibility. For more insights, consider reading an article about the company's overview and its competitors: AVEVA Group company overview and its competitors.

AVEVA consistently ranks as a leader in several key segments within the industrial software market. This leadership is supported by its comprehensive suite of solutions that cater to various industries.

The acquisition by Schneider Electric has enhanced AVEVA's market position by integrating its software capabilities with Schneider Electric's expertise. This partnership expands AVEVA's reach and deepens its market penetration.

AVEVA has a significant global presence, with strong footholds in Europe, North America, and Asia-Pacific. This widespread presence enables AVEVA to serve a diverse customer base across different regions.

AVEVA's product portfolio includes solutions like AVEVA Plant, AVEVA Marine, and AVEVA PI System. These products cater to various industries, including oil and gas, power, and chemicals.

Several factors influence AVEVA's market position, including its market share, revenue growth, and customer base. Understanding these indicators is crucial for assessing its competitive standing. Key aspects to consider include:

- Market share in key segments such as engineering design and asset performance management.

- Revenue growth compared to competitors in the industrial software market.

- Customer satisfaction and retention rates, reflecting the value of AVEVA's solutions.

- Impact of strategic partnerships and acquisitions on market reach and capabilities.

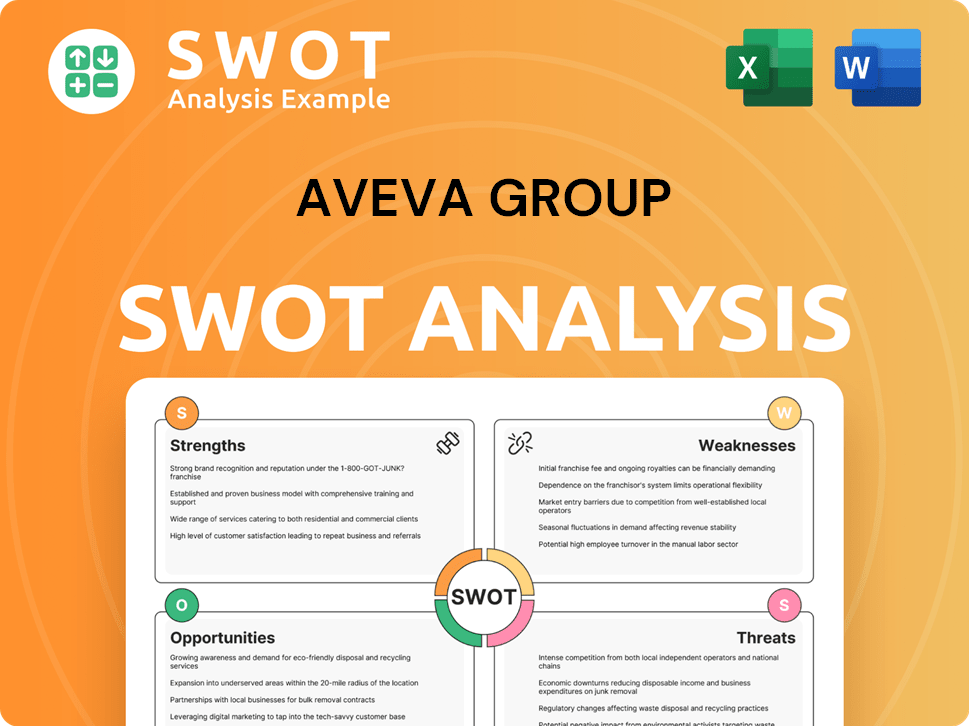

AVEVA Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AVEVA Group?

The Growth Strategy of AVEVA Group is significantly shaped by its competitive environment within the industrial software sector. This landscape is characterized by a mix of established giants and specialized firms, all vying for market share in a rapidly evolving digital transformation space. Understanding the key players and their strategies is crucial for assessing AVEVA's market position and future prospects.

The competitive dynamics are further complicated by ongoing consolidation and the emergence of new technologies. These factors necessitate a continuous evaluation of AVEVA's competitive advantages and potential threats, ensuring its ability to adapt and thrive in a dynamic market. The industrial software market is expected to continue its robust growth, with projections indicating substantial expansion in the coming years.

Siemens is a major direct competitor, particularly through its Xcelerator portfolio. This suite includes CAD, PLM, MES, and industrial IoT solutions. Siemens' strong presence in automation hardware provides a synergistic advantage.

AspenTech specializes in asset optimization software, particularly for process industries. It directly competes with AVEVA in engineering, manufacturing, and supply chain optimization solutions.

Dassault Systèmes competes in plant design and simulation with its DELMIA and ENOVIA brands. This positions it as a key player in the engineering software market.

Bentley Systems focuses on infrastructure engineering software. It competes with AVEVA in specific segments of the market, particularly in areas related to infrastructure projects.

SAP and Oracle offer broader ERP systems that include elements of manufacturing operations management or asset management. This creates indirect competition with AVEVA's offerings.

Emerging players specializing in AI, machine learning, or cloud-native solutions pose a disruptive threat. These companies challenge traditional software models and compete for market share.

The AVEVA Group competitive landscape continues to evolve due to consolidation and technological advancements. The acquisition of AVEVA by Schneider Electric reshaped the competitive dynamics, creating a larger, more integrated solution provider. This trend highlights the ongoing need for companies to adapt and innovate to maintain their AVEVA market share. Understanding the strengths and weaknesses of each competitor is crucial for AVEVA market analysis and strategic decision-making. The industrial software market is expected to reach significant values in the coming years, with increasing demand for digital transformation solutions.

Several factors influence the competitive landscape, including technological innovation, market consolidation, and customer demand for integrated solutions. These factors shape the AVEVA industry and the strategies of its competitors.

- Technological Innovation: The adoption of AI, machine learning, and cloud-based solutions.

- Market Consolidation: Acquisitions and mergers reshaping the competitive landscape.

- Customer Demand: The need for integrated solutions and digital transformation.

- Geographic Presence: The extent of global operations and market penetration.

- Pricing Strategies: Competitive pricing models and value propositions.

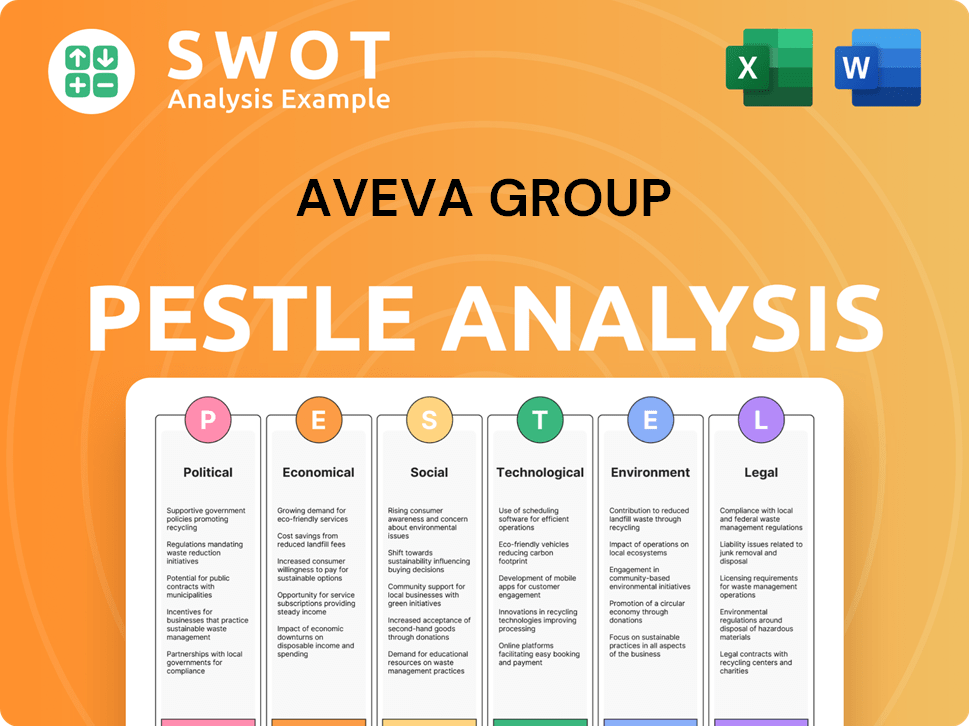

AVEVA Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AVEVA Group a Competitive Edge Over Its Rivals?

The competitive landscape for AVEVA Group is shaped by its robust competitive advantages, including proprietary technology, a comprehensive software portfolio, and strong customer relationships. These factors position the company favorably against its rivals in the industrial software market. A detailed Owners & Shareholders of AVEVA Group analysis reveals insights into the company's market positioning and strategic direction.

AVEVA's success is also underpinned by its brand equity and strategic partnerships, further solidifying its market position. Continuous investment in research and development, coupled with an extensive global support network, helps sustain its competitive edge. The ongoing shift towards cloud-based solutions and digital twin technology are areas where AVEVA is actively leveraging its strengths.

The company faces competition from various players in the AVEVA industry, each vying for market share and customer loyalty. Understanding these competitive dynamics is crucial for evaluating AVEVA's long-term growth prospects and strategic initiatives. The company's ability to adapt and innovate will determine its continued success in this dynamic environment.

AVEVA's proprietary technology, especially its AVEVA PI System, is a key differentiator. This system is a leading data infrastructure for real-time operational data. Continuous investment in R&D ensures that AVEVA stays ahead in the market.

AVEVA offers an integrated software suite spanning engineering, design, operations, and performance optimization. This unified platform reduces complexity and improves efficiency for customers. This breadth is a distinct advantage over point solution providers.

AVEVA has a long-standing reputation for reliability and innovation, fostering strong customer loyalty. This reputation is particularly strong in critical industries like oil and gas, power, and marine. This has led to a large installed base.

Strategic partnerships, such as the full integration with Schneider Electric, expand AVEVA's reach. These collaborations integrate its software with a broader range of industrial hardware and energy management solutions. This enhances its competitive standing.

AVEVA's competitive advantages include its proprietary technology, comprehensive software portfolio, and strong customer relationships. These advantages are crucial for its success in the AVEVA competitive landscape. The company's strategic moves, such as partnerships and acquisitions, further enhance its market position.

- Proprietary Technology: AVEVA PI System, a leading data infrastructure.

- Integrated Software Suite: Spanning engineering, design, and operations.

- Brand Equity: Strong reputation in critical industries.

- Strategic Partnerships: Expanding reach and integrating solutions.

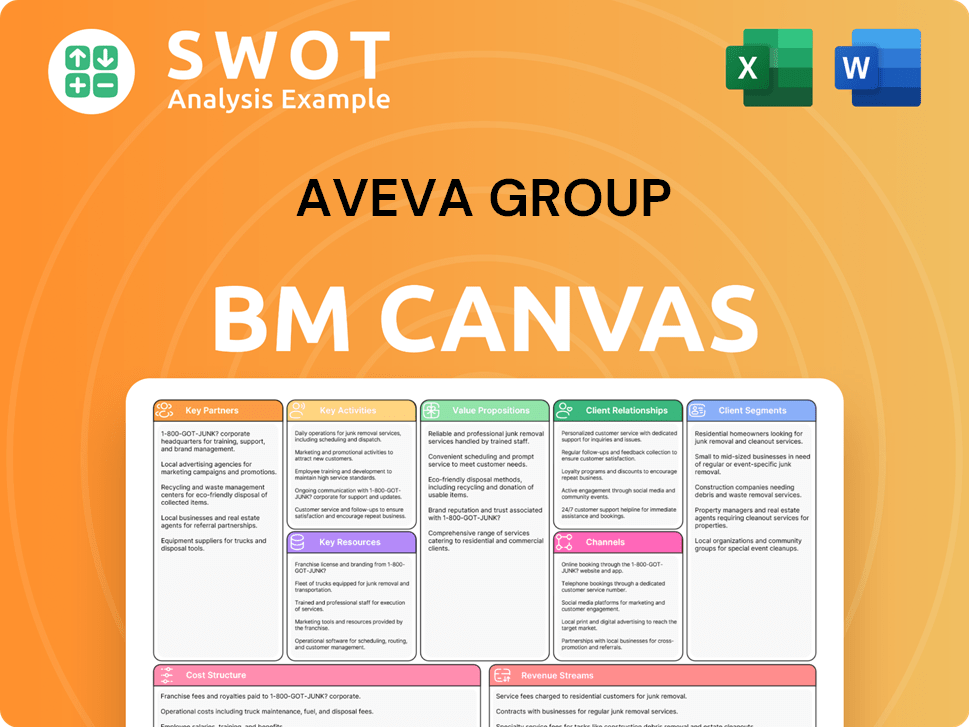

AVEVA Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AVEVA Group’s Competitive Landscape?

The AVEVA Group competitive landscape is shaped by the interplay of industry trends, technological advancements, and strategic partnerships. The company faces both challenges and opportunities in a dynamic market, requiring continuous adaptation and innovation to maintain its position. Understanding these factors is crucial for assessing AVEVA's future prospects and its ability to compete effectively.

The industrial software market is experiencing significant shifts, driven by digital transformation and the adoption of IIoT. This creates both risks and opportunities for AVEVA, demanding strategic agility. The company's ability to navigate these changes will determine its success in the coming years.

Digital transformation and IIoT are major drivers, increasing demand for integrated software solutions. Sustainability and energy efficiency are also becoming increasingly important, influencing operational strategies. The rise of AI and machine learning is reshaping the competitive landscape.

Rapid technological evolution requires continuous R&D investment. Cybersecurity threats to industrial control systems are a growing concern. New market entrants specializing in niche AI or cloud-native solutions could disrupt traditional business models. Adapting to these challenges is vital for AVEVA’s long-term growth.

Emerging markets offer significant growth potential as industrialization and digitalization expand. Digital twins present a substantial growth avenue, with increasing demand across industries. Expanding cloud offerings and leveraging partnerships can provide comprehensive solutions. These opportunities could boost AVEVA's market share.

AVEVA's strategy likely involves continued innovation, strategic partnerships, and a strong customer focus. This approach will help the company navigate industry trends and maintain its competitive edge. Investment in R&D and strategic acquisitions are crucial.

The global industrial software market is projected to reach $650 billion by 2030, with a CAGR of over 10% from 2023 to 2030. Digital transformation initiatives are driving increased demand for integrated solutions, like those offered by AVEVA. Cybersecurity spending in the industrial sector is expected to grow significantly.

- The IIoT market is growing rapidly, expected to reach $1.1 trillion by 2028.

- Cloud computing adoption in manufacturing is increasing, with a projected market size of $70 billion by 2027.

- The demand for digital twins is rising, with the market estimated to reach $35.7 billion by 2027.

- Sustainability initiatives are pushing for optimized resource utilization and reduced waste.

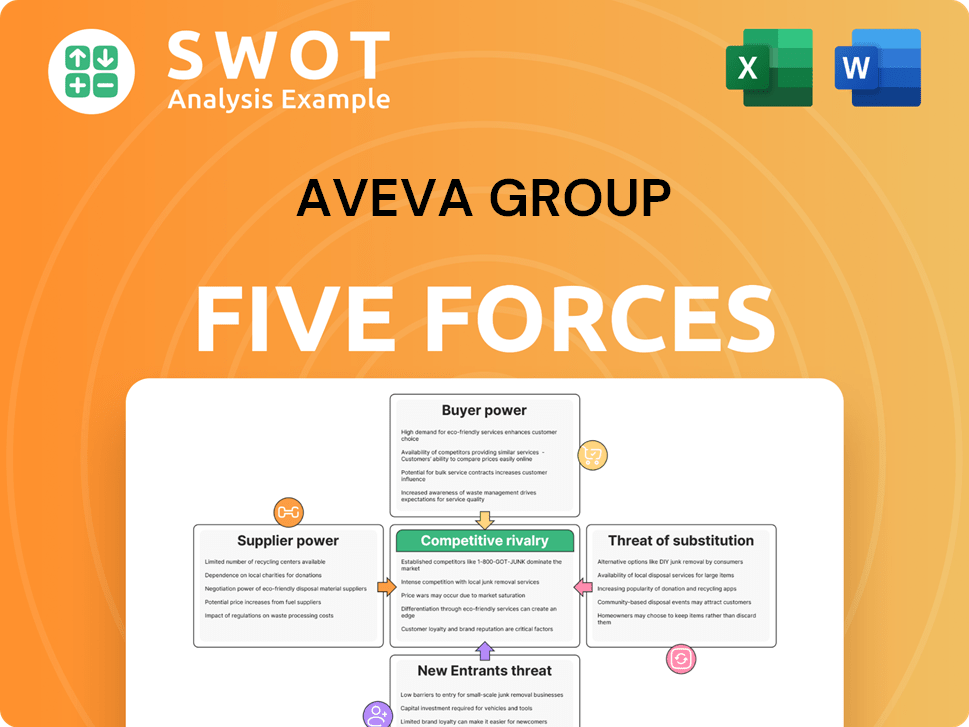

AVEVA Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVEVA Group Company?

- What is Growth Strategy and Future Prospects of AVEVA Group Company?

- How Does AVEVA Group Company Work?

- What is Sales and Marketing Strategy of AVEVA Group Company?

- What is Brief History of AVEVA Group Company?

- Who Owns AVEVA Group Company?

- What is Customer Demographics and Target Market of AVEVA Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.