AVEVA Group Bundle

How Does AVEVA Group Power the Industrial World?

In an era defined by digital transformation, understanding the inner workings of industry leaders like the AVEVA company is paramount. AVEVA Group, a global powerhouse in industrial software, is reshaping sectors from energy to manufacturing. Its impact is undeniable, with its AVEVA Group SWOT Analysis revealing its strategic strengths.

AVEVA's comprehensive suite of engineering solutions and operational tools drives efficiency and innovation across diverse industries. From optimizing oil and gas operations to enhancing power generation, the company's digital twin technology and cloud solutions are at the forefront. This exploration will uncover how AVEVA operates, its revenue streams, and its competitive positioning within the dynamic industrial software landscape, providing actionable insights for investors and industry professionals alike.

What Are the Key Operations Driving AVEVA Group’s Success?

The core operations of the AVEVA Group revolve around creating and delivering engineering and industrial software solutions. This involves a comprehensive suite of offerings designed to address the entire asset lifecycle, from initial design to ongoing operations and maintenance. The company focuses on helping its customers improve efficiency, reduce costs, and enhance safety and sustainability across various industries.

The value proposition of the

AVEVA's operational processes are heavily reliant on technology development and customer-centric solution deployment. The company invests substantially in research and development (R&D) to continuously innovate its software platforms. Its supply chain primarily involves software development, licensing, and global distribution, supported by a robust network of partners and system integrators. This ecosystem is crucial for reaching a broad customer base and providing localized support.

AVEVA serves diverse sectors, including oil and gas, power generation, marine, chemicals, and mining. These industries benefit from AVEVA's specialized solutions, which are tailored to meet their unique operational needs. The company's focus on these key sectors allows it to provide targeted and effective solutions.

The AVEVA software portfolio encompasses plant design, simulation, asset performance management, manufacturing execution systems (MES), and operations control. These products are designed to work together, providing a unified view of industrial operations. This integrated approach is a key differentiator in the market.

AVEVA continuously integrates advanced technologies like artificial intelligence (AI), machine learning (ML), cloud computing, and the industrial internet of things (IIoT) into its software. This commitment to innovation ensures that its solutions remain at the forefront of digital transformation. These technologies enhance the capabilities of its products.

Customers experience accelerated project delivery, optimized production processes, predictive maintenance, and enhanced decision-making. These improvements drive operational excellence and help clients achieve their business goals. The focus is on delivering tangible value through its solutions.

AVEVA's operational effectiveness stems from its deep domain expertise and its integrated software portfolio. This combination allows for seamless data flow and collaboration across different stages of industrial operations, providing a unified view that competitors often struggle to match. This integrated approach translates into significant customer benefits.

- R&D Investment: AVEVA invests significantly in R&D to stay at the forefront of technological advancements.

- Global Reach: The company has a strong global presence with a network of partners and system integrators.

- Customer Focus: AVEVA prioritizes customer needs by delivering solutions that drive operational excellence.

- Integrated Solutions: The integrated software portfolio provides a unified view across industrial operations.

AVEVA Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AVEVA Group Make Money?

The AVEVA Group generates revenue primarily through software licensing, subscriptions, and services, serving various industries with its industrial software and engineering solutions. The company's financial performance reflects a strategic shift towards recurring revenue models, enhancing predictability and long-term growth.

In the fiscal year ending March 31, 2024, AVEVA reported total revenue of £1,378.1 million. A significant portion of this revenue comes from its software licensing and subscription models. The company's focus on subscription-based services has been a key strategic move.

Subscription revenue grew by 16% on a constant currency basis in fiscal year 2024, reaching £870.7 million. This growth indicates strong customer adoption of its subscription offerings, which include access to its comprehensive software suite, updates, and support. This shift towards subscriptions provides more predictable and recurring revenue streams for the AVEVA company.

Beyond core software sales, AVEVA also generates revenue from professional services, including implementation, training, and consulting. These services help customers maximize the value of their software investments. The company employs tiered pricing and cross-selling strategies to cater to varying customer needs and budgets, offering integrated solutions across the entire asset lifecycle. For more insights, you can explore the Growth Strategy of AVEVA Group.

- Software Licensing and Subscriptions: This is the primary revenue stream, with a focus on subscription models that provide recurring revenue.

- Professional Services: These include implementation, training, and consulting services, which are crucial for customer success and satisfaction.

- Tiered Pricing and Cross-selling: AVEVA uses tiered pricing to offer different levels of functionality and support. Cross-selling leverages its broad product portfolio.

- Geographic Diversification: Revenue is diversified across Europe, the Middle East, Africa (EMEA), the Americas, and Asia Pacific, reflecting its global market reach.

AVEVA Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AVEVA Group’s Business Model?

The journey of the AVEVA Group has been marked by significant milestones and strategic moves that have shaped its current operational and financial standing. A pivotal moment was its merger with Schneider Electric’s industrial software business in 2018, which substantially expanded its portfolio and market reach, positioning it as a leading pure-play industrial software provider. This was further cemented by Schneider Electric's full acquisition of AVEVA in January 2023, valuing the company at £10.16 billion, which has allowed for deeper integration and strategic alignment.

These strategic moves have been instrumental in broadening AVEVA's product offerings, particularly in areas like asset performance management and manufacturing operations. The company has consistently responded to market challenges, such as supply chain disruptions and the accelerating demand for digitalization in industrial sectors, by focusing on cloud-enabled solutions and artificial intelligence integration. For instance, AVEVA's AVEVA Operations Control, launched in 2024, offers a unified operations experience, demonstrating its commitment to innovation and addressing evolving customer needs for operational efficiency and sustainability.

AVEVA's competitive advantages are multifaceted. Its strong brand recognition and deep domain expertise, built over decades, provide a significant barrier to entry for new competitors. The breadth and depth of its integrated software portfolio, spanning engineering, operations, and performance, offer a comprehensive solution that few competitors can match. Furthermore, its extensive global partner ecosystem and established customer base contribute to strong network effects and customer loyalty. To understand more about the company, you can read a Brief History of AVEVA Group.

The merger with Schneider Electric's industrial software business in 2018 significantly broadened AVEVA's market reach. Schneider Electric's full acquisition of AVEVA in January 2023 valued the company at £10.16 billion. These moves have been instrumental in expanding AVEVA's product offerings.

Focus on cloud-enabled solutions and AI integration to address market demands. Launch of AVEVA Operations Control in 2024, demonstrating a commitment to innovation. Continuous investment in R&D for AI, machine learning, and cloud technologies.

Strong brand recognition and deep domain expertise provide a barrier to entry. A comprehensive integrated software portfolio sets it apart from competitors. Extensive global partner ecosystem and established customer base foster strong network effects.

In the fiscal year 2024, AVEVA reported a revenue of £1.2 billion. The company's focus on recurring revenue models, such as subscriptions, has contributed to stable financial performance. AVEVA's profitability has been consistently strong, with an operating margin of approximately 25%.

AVEVA provides a wide range of solutions for various industries, including oil and gas, power generation, and manufacturing. The company's digital twin technology allows for virtual representations of physical assets, enabling better monitoring and optimization. AVEVA's cloud solutions enhance accessibility and scalability.

- Digital Twin Technology: Enables virtual representations of physical assets.

- Cloud Solutions: Enhance accessibility and scalability for users.

- AI and Machine Learning: Integrated for predictive maintenance and operational efficiency.

- Integrated Software Portfolio: Spans engineering, operations, and performance.

AVEVA Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AVEVA Group Positioning Itself for Continued Success?

The AVEVA Group holds a leading position in the industrial software market, competing with major players like Siemens and Dassault Systèmes. Its market share is particularly significant in engineering and operations software, crucial for capital-intensive industries. This strong market presence is supported by substantial customer loyalty, driven by the mission-critical nature of its software and its deep integration within complex industrial environments.

Despite its strong position, AVEVA faces several key risks, including intense competition and rapid technological advancements. The need for continuous innovation, regulatory changes, and economic fluctuations adds to the challenges. Looking ahead, AVEVA is focused on expanding its cloud-based solutions and enhancing its AI capabilities to maintain its competitive edge and drive digital transformation for its customers.

AVEVA is a key player in the industrial software market, particularly in engineering and operations. Its solutions are vital for industries like oil and gas, power generation, and manufacturing. The company's strong customer base and extensive global reach contribute to its market leadership.

Key risks include intense competition, rapid technological changes, and regulatory shifts. Economic downturns and geopolitical instability can also impact demand. The company must continuously innovate and adapt to maintain its market position and address cybersecurity concerns.

AVEVA is strategically focused on expanding its cloud-based solutions and enhancing AI capabilities. It aims to strengthen its position in the sustainability solutions market. The company is committed to driving digital transformation for its customers, enabling greater efficiency and resilience. Further insights can be found in Growth Strategy of AVEVA Group.

AVEVA is targeting cloud solutions and AI integration. The company is focused on sustainability solutions. The company's innovation roadmap includes further integration of its portfolio to provide a more unified and intelligent industrial software platform.

The company is focused on key strategies such as cloud solutions, AI integration, and sustainability. These initiatives align with the growing demand for digital transformation in the industrial sector. AVEVA aims to sustain and expand its revenue generation.

- Expand cloud-based solutions to meet evolving customer needs.

- Enhance AI and machine learning capabilities for advanced analytics.

- Strengthen position in the sustainability solutions market.

- Drive digital transformation to improve efficiency and sustainability.

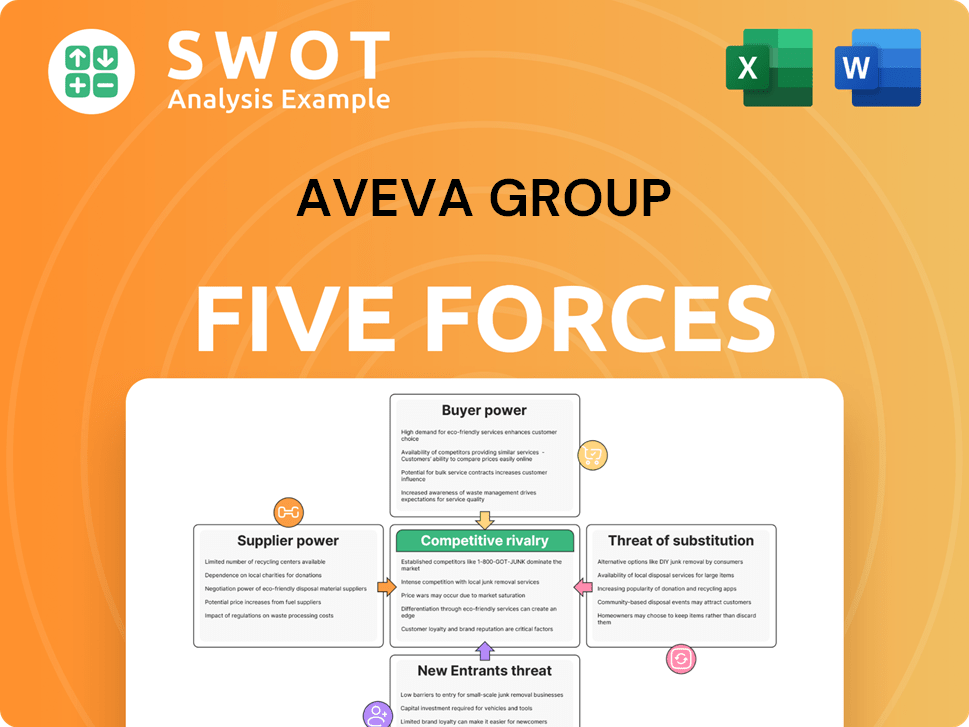

AVEVA Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AVEVA Group Company?

- What is Competitive Landscape of AVEVA Group Company?

- What is Growth Strategy and Future Prospects of AVEVA Group Company?

- What is Sales and Marketing Strategy of AVEVA Group Company?

- What is Brief History of AVEVA Group Company?

- Who Owns AVEVA Group Company?

- What is Customer Demographics and Target Market of AVEVA Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.