Aytu Bundle

Can Aytu BioPharma Conquer the Competitive Pharmaceutical Arena?

Aytu BioPharma, Inc. (Nasdaq: AYTU) has undergone a significant transformation, evolving into a key player in the pharmaceutical market, particularly within the ADHD and pediatric healthcare sectors. From its origins as Rosewind Corporation to its current iteration, the company's strategic acquisitions and financial performance paint a compelling picture. Understanding the Aytu SWOT Analysis is crucial to grasping its position.

This exploration delves into the intricate competitive landscape surrounding the Aytu company, analyzing its key rivals and the evolving industry trends. By examining its recent financial performance, including its impressive growth in net income and adjusted EBITDA, we can assess Aytu Bioscience's market share and strategic positioning. We'll also uncover the challenges and opportunities that shape the Aytu company's future outlook within the competitive pharmaceutical industry.

Where Does Aytu’ Stand in the Current Market?

Aytu BioPharma focuses on the specialty pharmaceutical market, specifically targeting the primary care and pediatric sectors. The company's core operations revolve around commercializing novel products to address significant patient needs. This strategic focus allows Aytu BioPharma to concentrate its resources on high-margin prescription (Rx) products, including treatments for ADHD and various pediatric conditions.

The value proposition of Aytu BioPharma lies in its ability to identify and bring to market innovative pharmaceutical products. By focusing on the Rx segment, the company aims to provide effective treatments while capitalizing on market opportunities. The divestiture of its Consumer Health business in July 2024 has further enabled Aytu BioPharma to streamline its operations and enhance its financial performance.

In Q3 fiscal 2025, the ADHD Portfolio, including Adzenys XR-ODT® and Cotempla XR-ODT®, saw a net revenue increase of 25% to $15.4 million compared to Q3 fiscal 2024. The Pediatric Portfolio, consisting of Karbinal® ER, Poly-Vi-Flor®, and Tri-Vi-Flor®, experienced an even more significant increase of 77% in net revenue, reaching $3.1 million in the same period. This growth demonstrates the effectiveness of Aytu BioPharma’s strategies.

Aytu BioPharma reported a positive adjusted EBITDA of $3.9 million in Q3 fiscal 2025, up from $0.9 million in the prior year period. As of March 31, 2025, the company's cash and cash equivalents stood at $18.2 million. These figures highlight the company's improved financial standing and operational efficiency.

The company is leveraging its commercial platform, including Aytu RxConnect, to drive prescription growth and maintain its market presence. The strategic divestiture of the Consumer Health business allows Aytu BioPharma to focus on higher-margin Rx products. This streamlined approach is designed to enhance profitability and market share.

As of June 5, 2025, Aytu BioPharma had a market capitalization of $9.2 million with 6.17 million shares outstanding. The trailing 12-month revenue as of March 31, 2025, was $81.7 million. These financial metrics provide an overview of the company's current valuation and revenue generation.

Aytu BioPharma's strategic initiatives and financial performance indicate a focused approach to growth within the pharmaceutical market. The company's ability to increase revenue in key segments, improve financial health, and streamline operations positions it well for future success. To further understand the company's trajectory, consider exploring the Growth Strategy of Aytu.

Aytu BioPharma's market position is supported by its financial performance and strategic focus on the Rx segment. The company's recent developments and financial improvements are crucial for understanding its competitive advantages within the pharmaceutical industry.

- Trailing 12-month revenue of $81.7 million as of March 31, 2025.

- Market capitalization of $9.2 million as of June 5, 2025.

- Positive adjusted EBITDA of $3.9 million in Q3 fiscal 2025.

- Significant revenue growth in both the ADHD and Pediatric Portfolios.

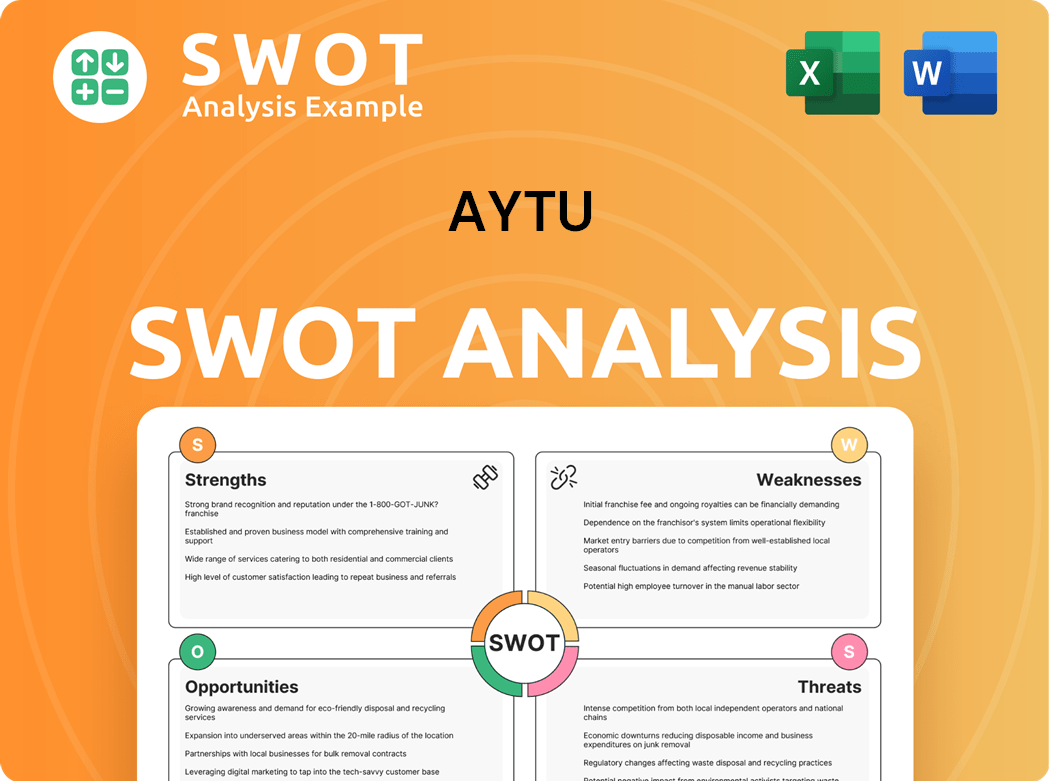

Aytu SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Aytu?

The competitive landscape for Aytu BioPharma, a specialty pharmaceutical company, is complex. The company faces challenges from both direct and indirect competitors within the pharmaceutical market. Understanding this competitive environment is crucial for assessing Aytu's market position and future prospects.

Aytu BioPharma's performance is influenced by various factors, including pricing strategies, product innovation, brand recognition, and distribution networks. A thorough market analysis is essential to understanding the dynamics and challenges within this sector. The Growth Strategy of Aytu provides additional insights into the company's strategic approach.

Key competitors in the Aytu BioPharma competitive landscape include established pharmaceutical companies and emerging players. These companies compete across various therapeutic areas, including those where Aytu offers products like Adzenys XR-ODT® and Cotempla XR-ODT® for ADHD.

Key competitors identified include Novartis, Antares Pharma, Takeda Pharmaceutical, Tris Pharma, and Johnson & Johnson Innovative Medicine.

Other companies listed as competitors or alternatives include Talphera, Inc. (TLPH), Citius Pharmaceuticals (CTXR), Athira Pharma, Inc. (ATHA), Evoke Pharma (EVOK), and Kiora Pharmaceuticals, Inc. (KPRX).

Additionally, companies in the 'pharmaceutical products' industry, such as Century Therapeutics (IPSC), Reviva Pharmaceuticals (RVPH), PepGen (PEPG), Artiva Biotherapeutics (ARTV), Mural Oncology (MURA), OS Therapies (OSTX), PMV Pharmaceuticals (PMVP), Opus Genetics (IRD), Adverum Biotechnologies (ADVM), and Anebulo Pharmaceuticals (ANEB), also compete.

These competitors challenge Aytu BioPharma through pricing, product development, brand recognition, distribution, and technological advancements. Mergers and acquisitions also shape the market.

In the ADHD market, where Aytu offers products, competition is direct with other companies offering similar formulations. This competition directly impacts market share.

Mergers and alliances within the pharmaceutical industry significantly influence the competitive dynamics. Larger entities may acquire innovative companies, consolidating market power and expanding product portfolios.

Aytu BioPharma faces both challenges and opportunities within this competitive landscape. Understanding the competitive landscape is crucial for Aytu's strategic planning and market positioning.

- Pricing Strategies: Competitors may employ aggressive pricing to gain market share, impacting Aytu's revenue.

- Product Innovation: The rapid pace of innovation requires Aytu to continuously develop and launch new products.

- Brand Recognition: Established brands have a significant advantage, requiring Aytu to invest in marketing and brand building.

- Distribution Networks: Effective distribution is critical, requiring Aytu to build and maintain strong distribution channels.

- Technological Advancements: Staying ahead of technological advancements in drug development and delivery is crucial.

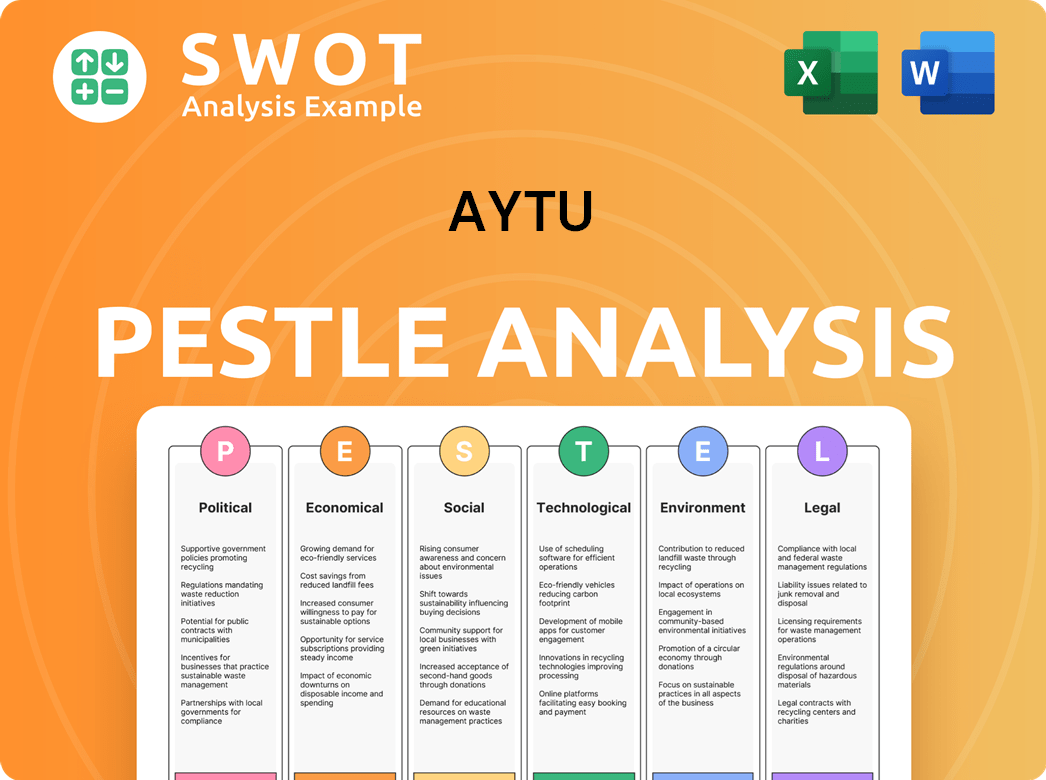

Aytu PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Aytu a Competitive Edge Over Its Rivals?

Aytu BioPharma's competitive advantages are rooted in its specialized product offerings, efficient operations, and strategic market approach. The company's focus on the ADHD market, particularly with its extended-release, orally disintegrating tablets (ODTs) like Adzenys XR-ODT and Cotempla XR-ODT, sets it apart. Adzenys XR-ODT is the first and only ODT extended-release amphetamine, providing a unique selling proposition in the pharmaceutical market.

The company's strategic moves, such as divesting its Consumer Health business in July 2024, have streamlined operations, allowing for a sharper focus on the higher-margin prescription (Rx) segment. This strategic shift has improved gross margins, with the Rx Segment achieving a gross margin of 75% in fiscal 2024. Aytu's commitment to clinical research and its proprietary commercial platform, Aytu RxConnect, further strengthen its market position.

By leveraging these advantages in marketing, product development, and strategic partnerships, Aytu aims to maintain and expand its market share. The company's financial performance reflects these strategic initiatives, with adjusted EBITDA swinging from negative $21.5 million in fiscal 2022 to a positive $9.2 million in fiscal 2024. For more details on the company's financial strategies, see Revenue Streams & Business Model of Aytu.

Aytu's ADHD portfolio, featuring Adzenys XR-ODT and Cotempla XR-ODT, offers innovative extended-release ODTs. Adzenys XR-ODT is the first and only ODT extended-release amphetamine. These products provide a unique approach to managing attention deficit hyperactivity disorder, differentiating Aytu in the competitive landscape.

The divestiture of the Consumer Health business in July 2024 allowed Aytu to focus on higher-margin Rx segments. This strategic move led to improved gross margins, with the Rx segment achieving a gross margin of 75% in fiscal 2024. Operational streamlining and cost-saving initiatives have significantly improved financial performance.

Aytu RxConnect, a network of approximately 1,000 pharmacies, enhances product accessibility. This platform promotes transparent drug pricing and improves patient adherence. Aytu's commercial platform offers a significant differentiator in the market, improving patient outcomes and market reach.

Aytu's financial performance reflects its strategic initiatives and operational efficiencies. Adjusted EBITDA improved from negative $21.5 million in fiscal 2022 to a positive $9.2 million in fiscal 2024. These improvements indicate the effectiveness of the company's strategic focus.

Aytu BioPharma's competitive advantages include innovative product formulations and patient access programs. These strengths are leveraged in marketing, product development, and strategic partnerships. The company's focus on the ADHD market and strategic operational improvements have led to positive financial results.

- Innovative ADHD product portfolio with extended-release ODTs.

- Strategic divestiture of the Consumer Health business to focus on higher-margin Rx segments.

- Proprietary commercial platform, Aytu RxConnect, enhancing product accessibility.

- Improved financial performance, with a positive swing in adjusted EBITDA.

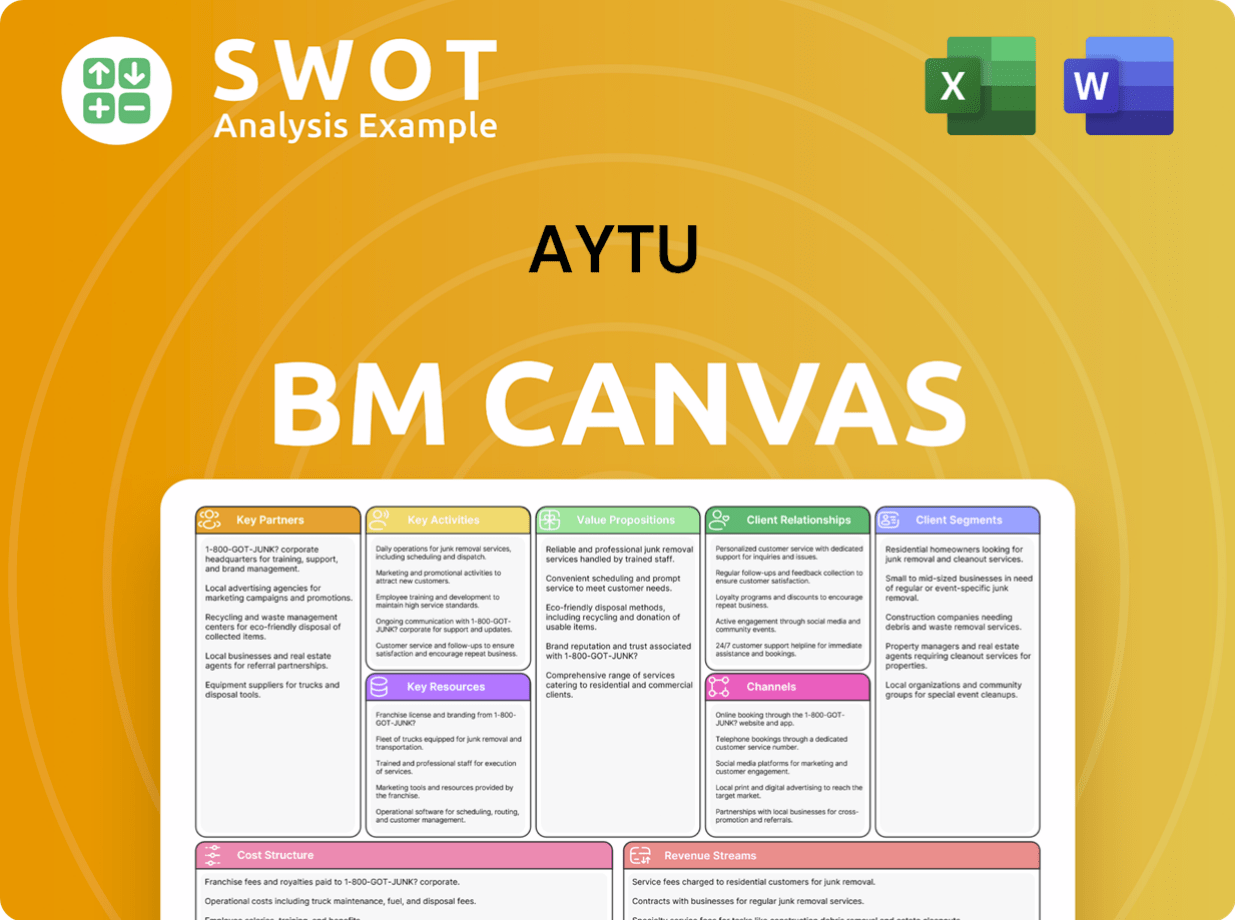

Aytu Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Aytu’s Competitive Landscape?

The specialty pharmaceutical industry is dynamic, influenced by technological advancements, regulatory changes, and evolving patient preferences. The Brief History of Aytu reveals its strategic alignment with these trends, particularly in user-friendly drug delivery systems like orally disintegrating tablets for ADHD and its pediatric product lines. Regulatory approvals and market access are critical, and the company's focus on addressing unmet medical needs, such as its Orphan Drug designation for AR101, positions it for potential market exclusivity and growth.

The competitive landscape of Aytu BioPharma involves navigating both challenges and opportunities. New market entrants, shifts in healthcare models, and payor coverage changes pose potential threats. However, Aytu's proactive approach, including product innovations and strategic partnerships, demonstrates its commitment to diversification and expansion. This strategy aims to optimize its commercial infrastructure and explore additional product acquisitions, with the ultimate goal of generating positive cash flows and increasing stockholder value.

The pharmaceutical market is currently experiencing a surge in demand for innovative drug delivery systems, with a specific focus on patient-centric solutions. The trend towards value-based care and personalized medicine is also reshaping the industry. These trends directly impact Aytu's strategic direction.

Aytu faces challenges from new competitors, changing business models, and shifts in payor coverage. Competition can intensify, especially in the ADHD market. Furthermore, the company must navigate complex regulatory pathways and maintain a strong market position.

Aytu has significant opportunities for growth through product innovation, strategic partnerships, and portfolio diversification. Expanding into new therapeutic areas, such as the recent agreement for EXXUA, can leverage its existing commercial infrastructure. The company's focus on its CNS-focused sales team and Aytu RxConnect platform is crucial.

Aytu's competitive landscape is shaped by its product portfolio and strategic moves. The company’s focus on CNS and pediatric products positions it well. The market analysis suggests a need for continued innovation and strategic adaptability to maintain its competitive edge.

Aytu's future hinges on its ability to capitalize on industry trends, mitigate challenges, and seize opportunities. The company's recent developments and strategic initiatives are critical to its long-term success.

- Product Pipeline: The success of AR101 and other pipeline products is essential.

- Strategic Partnerships: Collaborations like the EXXUA agreement are vital for portfolio expansion.

- Market Access: Securing favorable payor coverage for its products is crucial.

- Financial Performance: Generating positive cash flows and increasing stockholder value remain top priorities.

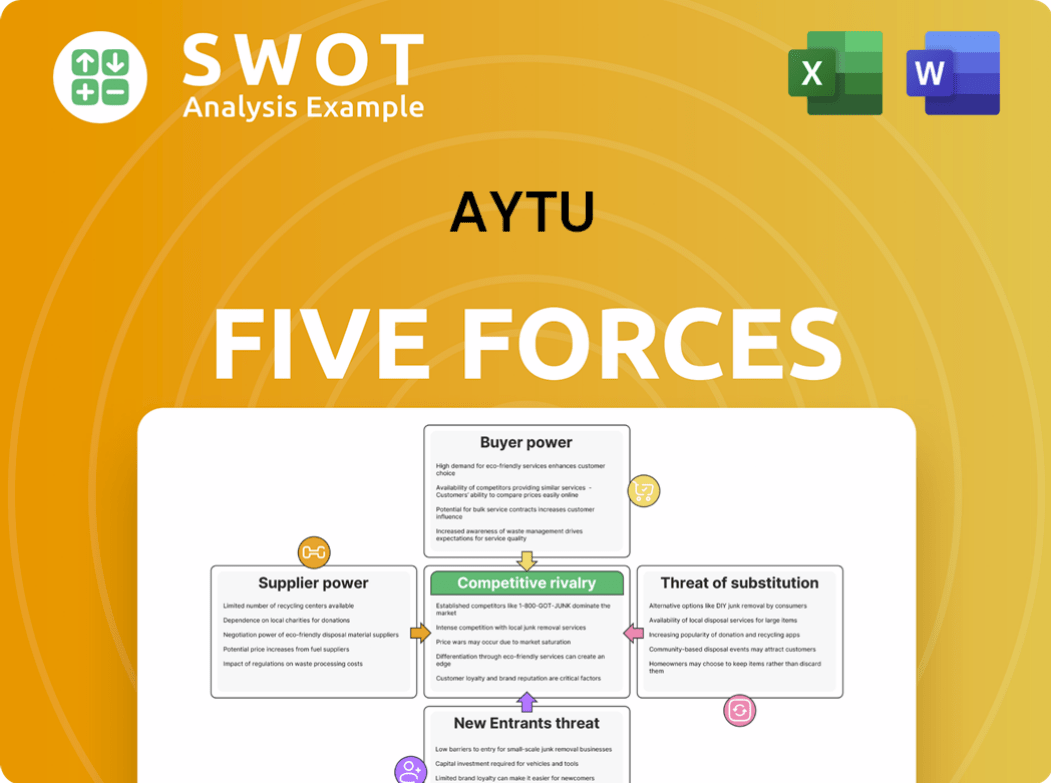

Aytu Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aytu Company?

- What is Growth Strategy and Future Prospects of Aytu Company?

- How Does Aytu Company Work?

- What is Sales and Marketing Strategy of Aytu Company?

- What is Brief History of Aytu Company?

- Who Owns Aytu Company?

- What is Customer Demographics and Target Market of Aytu Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.