Aytu Bundle

Can Aytu BioPharma Thrive in the Competitive Pharma Landscape?

Aytu BioPharma, Inc. has carved a niche in the specialty pharmaceutical industry, focusing on novel products to address significant patient needs. Founded in 2015, the company has rapidly evolved, becoming a notable player in the primary care and pediatric markets. With a portfolio of prescription products and a promising pipeline, Aytu BioPharma is poised for growth.

To understand Aytu's potential, we'll examine its Aytu SWOT Analysis, expansion plans, and financial outlook. This deep dive will explore Aytu's strategic initiatives, including its approach to innovation and technology within the dynamic healthcare market. Investors and analysts alike will gain valuable insights into the Aytu company growth strategy and future prospects, assessing its potential in the pharmaceutical industry. This analysis also covers the Aytu stock analysis and its long-term investment outlook.

How Is Aytu Expanding Its Reach?

The Aytu company growth strategy focuses on expanding its business through new product launches, market penetration, and strategic partnerships. This approach aims to address unmet medical needs within its primary care and pediatric markets. A key element of their expansion strategy involves the continuous development and commercialization of new prescription products. This diversification is crucial for capturing new patient populations and increasing revenue streams.

Aytu's expansion also includes exploring international opportunities, although specific details on timelines and geographical targets are not widely publicized. The company may also pursue new business models, such as licensing agreements or co-promotion partnerships, to access new customer bases and leverage existing market infrastructures. Their strategic focus on commercial products, like its ADHD drug, is designed to maximize market share and drive revenue growth in established therapeutic areas.

Advancing the product pipeline, including late-stage clinical assets, is a critical milestone for future growth. These initiatives are designed to stay ahead of industry changes and enhance the company's competitive position in the specialty pharmaceutical market. For a deeper dive into their financial structure, you can explore Revenue Streams & Business Model of Aytu.

The company focuses on introducing new prescription products to diversify its offerings. This includes the development and commercialization of assets like AR101, an enzymatic therapeutic for Vascular Ehlers-Danlos Syndrome. These launches are crucial for targeting new patient populations and expanding revenue streams. This strategy is a core component of the Aytu company growth strategy.

Aytu aims to increase its market share within the primary care and pediatric markets. This involves targeting existing therapeutic areas, such as ADHD, to maximize revenue growth. Efforts to enhance market presence are a significant part of their strategic initiatives. This approach is vital for Aytu future prospects.

The company explores partnerships, including licensing agreements and co-promotion deals, to access new customer bases. This approach leverages existing market infrastructures to broaden reach. These collaborations are essential for enhancing Aytu Bioscience's market presence.

While specific details are not widely publicized, Aytu is exploring opportunities for international expansion. This could involve entering new geographical markets to increase its global footprint. This initiative is a key element of Aytu company expansion plans.

Aytu's key growth drivers include new product launches, market penetration, and strategic partnerships. The company is focused on advancing its product pipeline and commercializing new prescription products. These efforts are designed to diversify revenue streams and capture new patient populations. This is part of Aytu company financial performance.

- The company is focusing on advancing its product pipeline, including late-stage clinical assets.

- Strategic partnerships, such as licensing agreements and co-promotion deals, are being explored.

- International expansion is also a focus, although specific details are not widely available.

- These initiatives are designed to enhance the company's competitive position in the specialty pharmaceutical market.

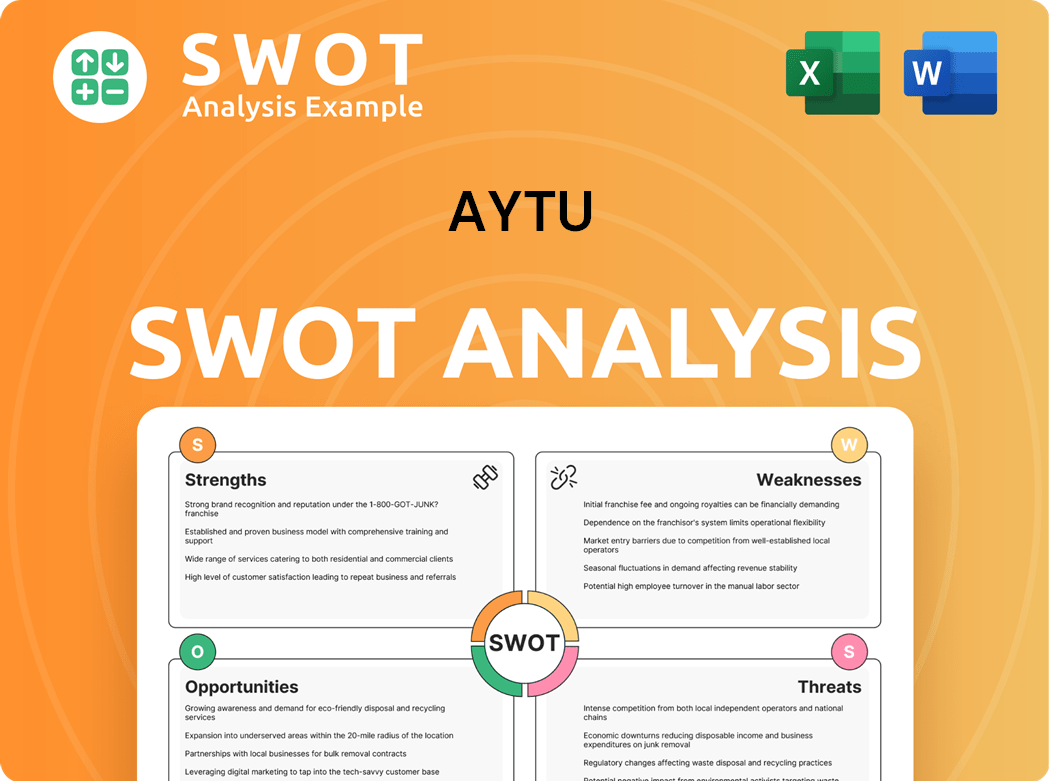

Aytu SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Aytu Invest in Innovation?

The core of the Aytu company growth strategy revolves around innovation and technology, with a significant emphasis on developing novel therapeutic solutions. Their approach is rooted in substantial investments in research and development (R&D), driving the advancement of their product pipeline. This strategic focus aims to address unmet medical needs through cutting-edge treatments.

A key example of this strategy is the development of AR101, an enzymatic therapeutic designed for Vascular Ehlers-Danlos Syndrome (vEDS). This highlights their commitment to in-house development of specialized treatments, demonstrating a proactive approach to addressing rare genetic disorders. This focus on R&D is crucial for their future prospects.

While the company does not extensively highlight digital transformation or the use of AI or IoT, their technological leverage is primarily within scientific R&D. They concentrate on creating new chemical entities or novel formulations to improve patient outcomes. The successful commercialization of products within primary care and pediatrics further supports their growth objectives.

Aytu's investment in R&D is a critical component of their strategy. These investments are aimed at advancing their product pipeline and developing novel therapeutic solutions. This focus is crucial for their long-term growth.

The development of AR101 for vEDS showcases Aytu's commitment to addressing rare genetic disorders. This enzymatic therapeutic represents a cutting-edge approach, demonstrating their innovation capabilities. This project is a key part of their product pipeline.

Aytu's technological leverage lies in scientific R&D, specifically in creating new chemical entities and novel formulations. This focus aims to improve efficacy and patient benefits. This approach supports their overall growth strategy.

The successful development and marketing of products within primary care and pediatrics are key growth drivers. This commercial success directly contributes to Aytu's growth objectives. This shows their ability to bring products to market.

Aytu's strategic initiatives include a focus on R&D, product pipeline development, and commercialization of new products. These initiatives are designed to drive sustained growth. The company's approach is data-driven.

In the competitive pharmaceutical industry, Aytu's focus on innovation and R&D helps them differentiate. Their ability to develop and market new products is a key factor. Understanding the competitive landscape is crucial for Aytu's future.

Aytu's primary technological focus is on R&D, developing new chemical entities and novel formulations. This approach is central to their growth strategy and future prospects. The company's commitment to innovation is evident in its product pipeline.

- R&D Investments: Significant investments in research and development drive the advancement of their product pipeline.

- AR101: The development of AR101 for vEDS highlights their commitment to specialized treatments.

- Product Commercialization: Successful commercialization of products in primary care and pediatrics contributes to their growth.

- Market Focus: They target specific patient populations, which helps in achieving their growth objectives.

For further insights into the target market of the company, consider reading about the Target Market of Aytu. This will help understand the company's strategic positioning.

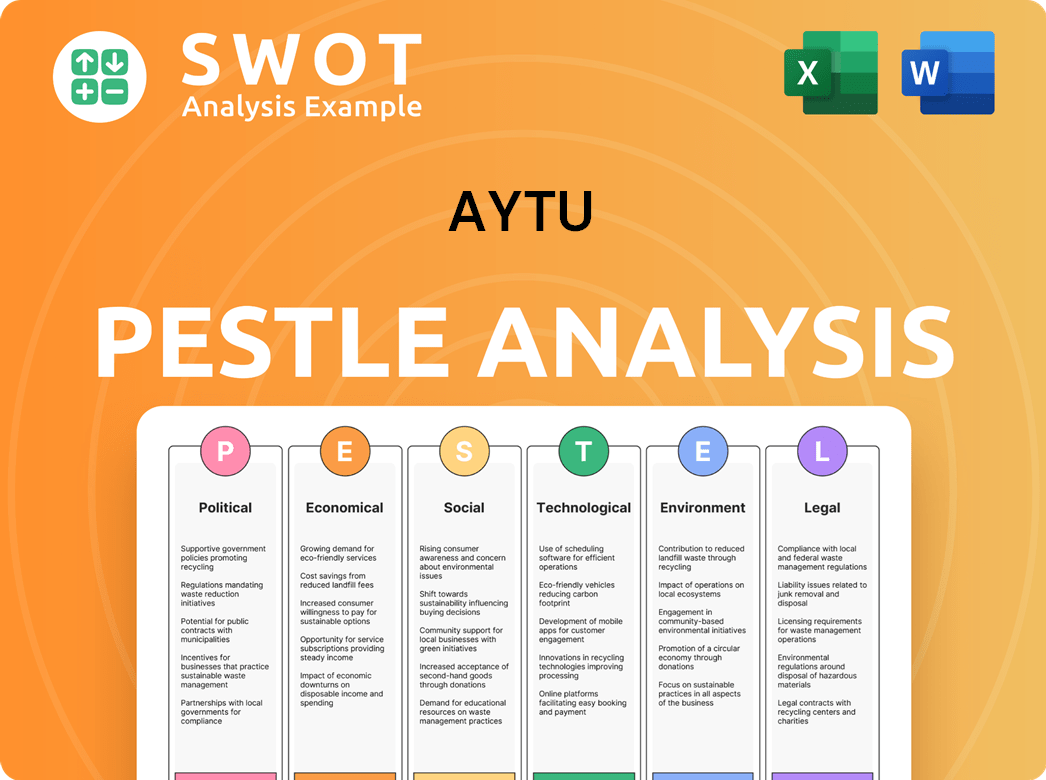

Aytu PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Aytu’s Growth Forecast?

The financial outlook for Aytu BioPharma is centered on achieving profitability and sustainable growth. The company is focused on improving its financial performance through its commercial product portfolio and ongoing pipeline development. This involves strategies to manage cash reserves and explore capital raise opportunities to support research and development (R&D) and commercialization efforts.

In the fiscal second quarter of 2024, Aytu reported net revenue of $23.1 million, an increase from $22.6 million in the prior quarter. This indicates a positive trend in its commercial operations. Moreover, the company is working to reduce operating expenses, which decreased by 27% to $12.3 million in the same period. This reduction contributes to an improved financial position, showing a commitment to operational efficiency and financial health.

Aytu's financial strategy is designed to support its R&D and commercialization efforts. The company's net loss improved to $3.0 million in Q2 2024, compared to $6.8 million in the previous quarter, demonstrating progress toward profitability. The potential of its late-stage clinical assets, like AR101, is expected to significantly impact future revenue streams upon successful commercialization. For investors considering the Owners & Shareholders of Aytu, understanding these financial dynamics is crucial.

Aytu's net revenue in the fiscal second quarter of 2024 was $23.1 million, up from $22.6 million in the prior quarter. This growth indicates a positive trend in its commercial operations and reflects the company's efforts to expand its market presence. This growth is a key indicator of the company's ability to generate revenue.

Operating expenses decreased by 27% to $12.3 million in the fiscal second quarter of 2024. This reduction in expenses significantly improves the company's financial position and demonstrates a commitment to operational efficiency. The ability to manage and reduce costs is crucial for achieving profitability.

The net loss improved to $3.0 million in Q2 2024, compared to $6.8 million in the previous quarter. This improvement shows progress towards profitability and highlights the effectiveness of the company's financial strategies. Reducing losses is a critical step towards long-term financial stability.

The company's late-stage clinical assets, such as AR101, hold significant potential to impact future revenue streams upon successful commercialization. The success of these assets is crucial for future growth. The development and commercialization of new products are essential for the company's long-term success.

Aytu's financial strategy includes managing its cash reserves and exploring avenues for capital raises to support ongoing R&D and commercialization efforts. Effective capital management is essential for funding operations and driving growth. This strategy ensures the company can continue its research and development activities.

Specific long-term revenue targets and profit margins are subject to market dynamics and clinical trial outcomes. Understanding the healthcare market outlook and the pharmaceutical industry trends is critical for investors. External factors can significantly influence the company's financial performance.

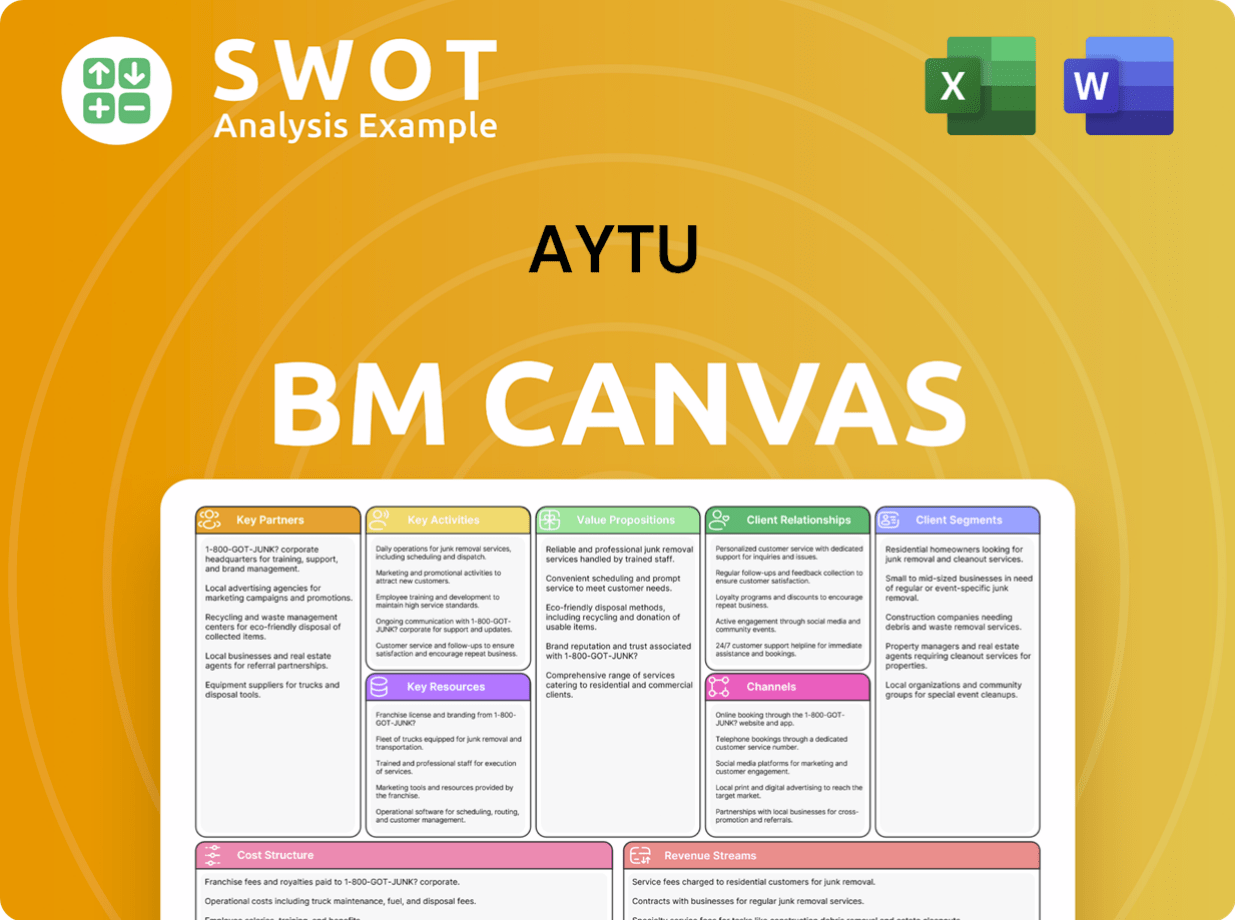

Aytu Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Aytu’s Growth?

The path for Aytu BioPharma, like any pharmaceutical company, is fraught with potential pitfalls. Understanding these risks is crucial for anyone considering an investment or analyzing the company's strategic direction. Several factors could impede Aytu's progress, from fierce competition to unforeseen regulatory hurdles.

The pharmaceutical industry is inherently competitive, with established players and emerging biotechs constantly vying for market share. Additionally, changes in regulations and the complexities of clinical trials can significantly impact product development timelines and costs. Furthermore, supply chain disruptions, as seen during the COVID-19 pandemic, can create operational challenges.

Addressing these challenges requires a proactive approach, including diversification of the product portfolio and robust risk management strategies. Navigating these obstacles is critical for Aytu to achieve its growth objectives and create value for its stakeholders. For a deeper understanding of the company's rivals, consider exploring the Competitors Landscape of Aytu.

The pharmaceutical industry is intensely competitive. Aytu faces competition from large, established companies and smaller, innovative biotech firms. This competitive landscape can impact Aytu's ability to gain market share and maintain pricing power.

Regulatory changes pose a significant risk. The approval process for new drugs is lengthy and stringent. Any shifts in regulatory requirements could delay or halt product development and commercialization, affecting the company's financial performance.

Supply chain vulnerabilities are a concern, especially for a company that relies on external manufacturers and distributors. Global events, such as pandemics, can disrupt supply chains, leading to production delays and increased costs. The COVID-19 pandemic highlighted these risks.

Technological advancements can be both an opportunity and a risk. If competitors introduce superior or more cost-effective therapies, Aytu's products could become less competitive. This requires continuous innovation and adaptation.

Internal resource constraints, including funding for R&D and commercialization, can impede growth. Attracting and retaining top talent is also crucial. Efficient resource allocation is essential for achieving strategic goals.

Evolving healthcare policies and pricing pressures continue to shape the future trajectory of the company. Changes in reimbursement policies or pricing regulations can impact revenue and profitability. This requires constant monitoring and adaptation.

Aytu BioPharma addresses these risks through various strategies. Diversifying its product portfolio helps mitigate reliance on any single product. The company also uses risk management frameworks to assess and prepare for potential challenges. These proactive measures are essential for navigating the complex pharmaceutical landscape.

Recent examples of the company's ability to navigate obstacles include managing the complexities of clinical trials. Adapting to market shifts for its commercial products is also crucial. These experiences demonstrate the company's resilience and ability to adjust to changing circumstances.

Aytu Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aytu Company?

- What is Competitive Landscape of Aytu Company?

- How Does Aytu Company Work?

- What is Sales and Marketing Strategy of Aytu Company?

- What is Brief History of Aytu Company?

- Who Owns Aytu Company?

- What is Customer Demographics and Target Market of Aytu Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.