Aytu Bundle

How Does Aytu Company Thrive in the Pharma World?

Aytu BioPharma, Inc. is making waves in the specialty pharmaceutical sector, focusing on unmet needs in primary care and pediatrics. With recent strategic moves like a reverse stock split in April 2025, Aytu Company is actively working to boost its market position and attract investment. Understanding how Aytu products generate revenue and operate is key to gauging its investment potential.

To truly understand Aytu BioScience, it's essential to delve into its operational strategies and financial performance. From its prescription products to its developing pipeline, Aytu's ability to navigate the complex pharma landscape directly impacts its success. For a deeper dive into the company's strengths and weaknesses, consider exploring the Aytu SWOT Analysis, which provides valuable insights into its strategic positioning. Analyzing Aytu financials and staying updated on Aytu stock are crucial for informed decision-making.

What Are the Key Operations Driving Aytu’s Success?

Aytu BioPharma, often referred to as Aytu Company, focuses on identifying, developing, and commercializing prescription products. Their primary areas of focus include primary care and pediatric segments. The company's strategy involves a mix of in-house expertise and strategic partnerships to bring products to market.

The core of Aytu's operations revolves around its product portfolio, which includes treatments for conditions like hypogonadism (Testopel) and ADHD (Adzenys XR-ODT and Cotempla XR-ODT). They also address needs in Prader-Willi Syndrome and related growth hormone deficiencies (Zimhi). Aytu's value proposition lies in offering specialized treatments, often targeting underserved patient populations.

Aytu's approach to the market involves a dedicated sales force and digital platforms to educate healthcare professionals and support patients. A key aspect of their strategy is acquiring established products, as seen with the acquisition of products from Neos Therapeutics in 2021, to broaden their commercial reach. This strategy allows Aytu to potentially capture significant market share in niche therapeutic areas.

Aytu's product portfolio includes treatments for hypogonadism, ADHD, and Prader-Willi Syndrome. The company focuses on primary care and pediatric segments. These products are marketed to healthcare providers and patients.

Aytu manages clinical trials, navigates FDA regulatory pathways, and establishes sales and marketing infrastructures. They work with contract manufacturers and manage distribution networks. A targeted sales force educates physicians about Aytu products.

The company's supply chain involves contract manufacturers and distribution networks. This ensures product availability in pharmacies and healthcare settings. Aytu focuses on efficient distribution to support patient access to medications.

Aytu has expanded its portfolio through acquisitions, such as the purchase of products from Neos Therapeutics. This strategy helps broaden their commercial reach. The acquisitions contribute to Aytu's growth and market presence.

Aytu differentiates itself by focusing on niche markets and underserved patient populations. This approach allows them to capture market share in specific therapeutic areas. Their specialized treatments may not be widely available from larger pharmaceutical companies.

- Focus on niche markets and underserved patient populations.

- Acquisition of established products to broaden commercial reach.

- Offering specialized treatments not widely available.

- Leveraging a targeted sales force and digital platforms.

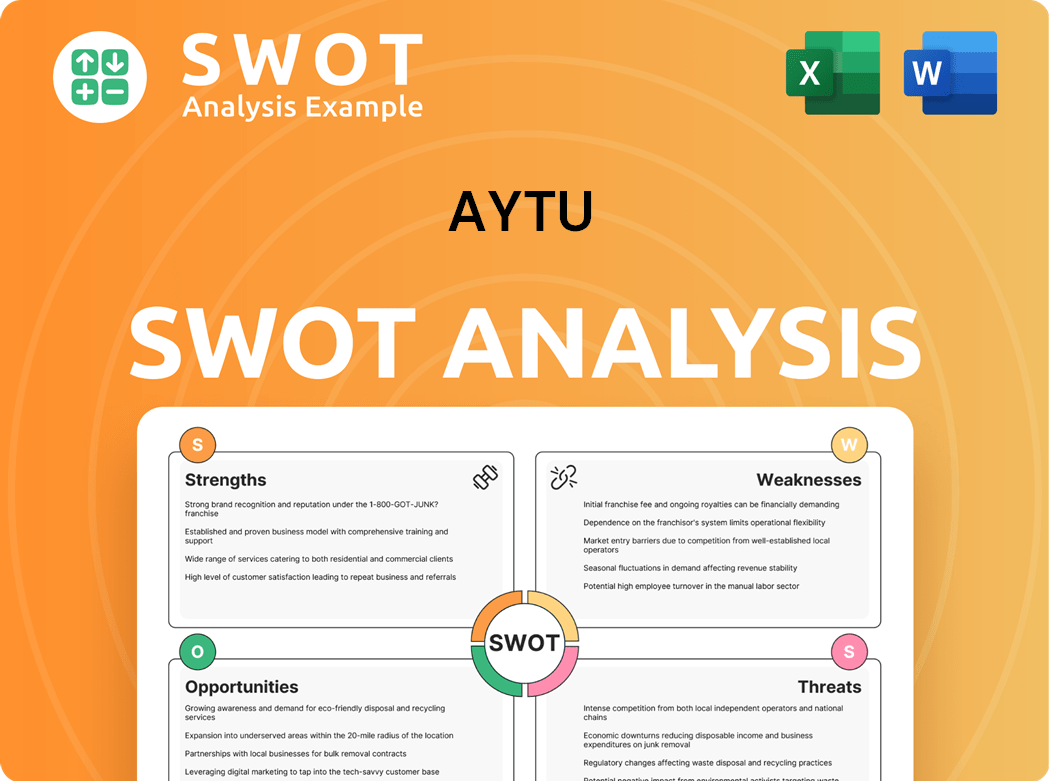

Aytu SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Aytu Make Money?

The primary revenue stream for Aytu BioPharma comes from the sale of its prescription pharmaceutical products. The company, also known as Aytu Company, generates income through the commercialization of its marketed portfolio, which includes drugs like Testopel, Adzenys XR-ODT, Cotempla XR-ODT, and Zimhi. This approach is central to understanding how does Aytu BioScience make money.

Aytu BioPharma's financial performance is heavily reliant on these product sales. For the fiscal year ending June 30, 2024, Aytu reported total revenues of approximately $86.8 million. This highlights the importance of its marketed drugs in driving the company's financial results, offering insights into Aytu financials.

The monetization strategy of Aytu BioPharma revolves around the volume-based sales of its prescription drugs. This involves direct sales to wholesalers and distributors, who then supply pharmacies and healthcare providers. The company also engages in managed care contracting to ensure its products are covered by insurance plans, which affects patient access and prescribing rates. For more details, you can read about the Marketing Strategy of Aytu.

Aytu BioPharma's revenue model is primarily driven by the sale of its pharmaceutical products, with a focus on volume-based sales and managed care contracting. The company's approach involves direct sales to wholesalers and distributors, alongside efforts to secure insurance coverage for its products. This is crucial for understanding Aytu BioScience investor relations.

- Product Sales: Main revenue source from prescription drugs like Testopel, Adzenys XR-ODT, Cotempla XR-ODT, and Zimhi.

- Wholesale and Distribution: Sales to wholesalers and distributors who supply pharmacies and healthcare providers.

- Managed Care Contracting: Securing insurance coverage to increase patient access and prescribing rates.

- Premium Pricing: Potential for premium pricing on specialty products.

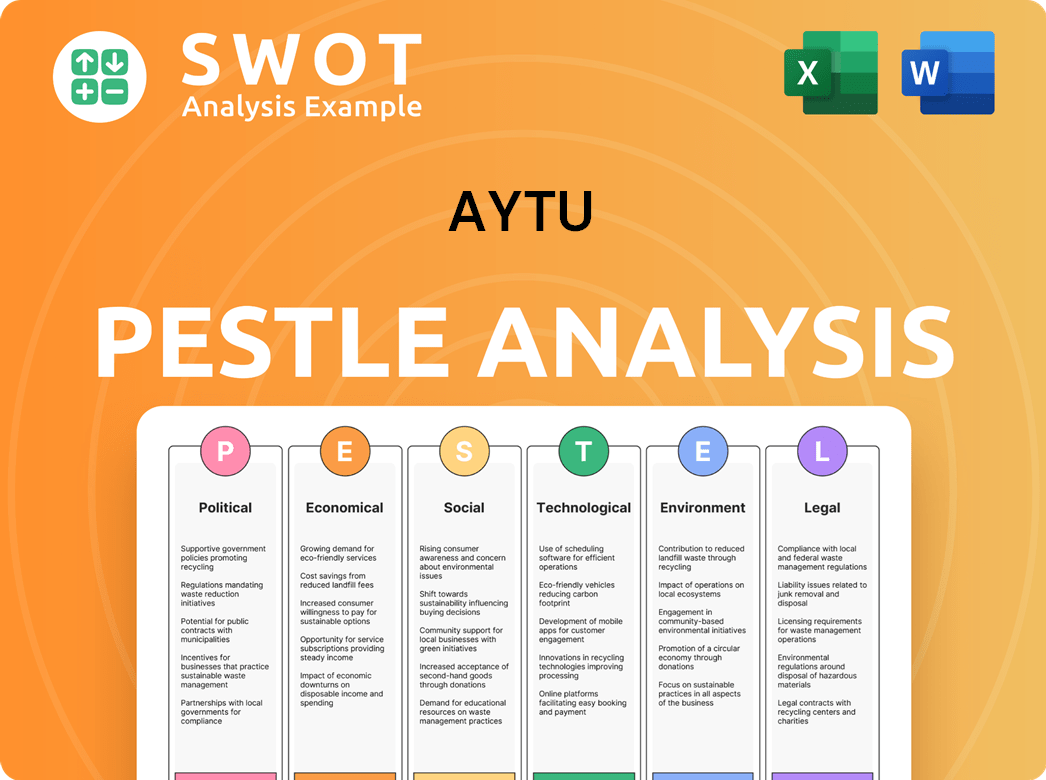

Aytu PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Aytu’s Business Model?

The trajectory of the Aytu Company, now known as Aytu BioPharma, has been marked by strategic shifts and key milestones. The company's journey includes significant acquisitions and adaptations within the pharmaceutical industry. These moves have been crucial in shaping its market position and financial performance. Understanding these elements provides insight into how Aytu BioPharma navigates the competitive landscape.

Aytu BioPharma's evolution includes mergers, acquisitions, and strategic realignments. The merger with Innovus Pharmaceuticals in 2020 broadened its product portfolio, though the focus has since returned to prescription pharmaceuticals. The acquisition of Neos Therapeutics in 2021, which brought Adzenys XR-ODT and Cotempla XR-ODT into the portfolio, expanded its presence in the ADHD market. These strategic moves have been vital for growth and market penetration.

Recent developments, such as the 1-for-20 reverse stock split in April 2025, reflect Aytu's efforts to maintain its Nasdaq listing and potentially attract institutional investors. These financial maneuvers are key in managing the company's capital structure and investor relations. The company continues to adapt its strategies to meet market demands and regulatory changes.

Aytu's major milestones include the merger with Innovus Pharmaceuticals in 2020, expanding its product offerings. The acquisition of Neos Therapeutics in 2021 added ADHD medications to its portfolio. These moves have been critical for Aytu's strategic growth and market positioning.

Strategic moves include the reverse stock split in April 2025, aimed at maintaining Nasdaq listing and attracting investors. Aytu has focused on niche markets to develop expertise and establish a stronger presence. These actions demonstrate Aytu's proactive approach to financial and operational challenges.

Aytu's competitive advantages stem from its focus on niche markets, allowing it to develop expertise and establish a stronger presence in specific therapeutic areas. Its portfolio of commercialized products provides a steady revenue base. The company continues to adapt by exploring potential new product candidates and optimizing commercial strategies.

Aytu's financials are influenced by its strategic decisions and market dynamics. The company's ability to manage its capital structure, as seen with the reverse stock split, is crucial. The company's financial health is directly impacted by its product sales and pipeline development. For more details on Aytu's growth, see the Growth Strategy of Aytu.

Aytu faces operational challenges, including navigating the competitive pharmaceutical market and managing supply chain logistics. Its competitive advantages include a focus on niche markets and a portfolio of commercialized products. These factors influence Aytu's ability to generate revenue and invest in future products.

- Supply chain management for specialized products.

- Evolving regulatory landscapes.

- Focus on niche markets for expertise.

- Commercialized product portfolio for revenue.

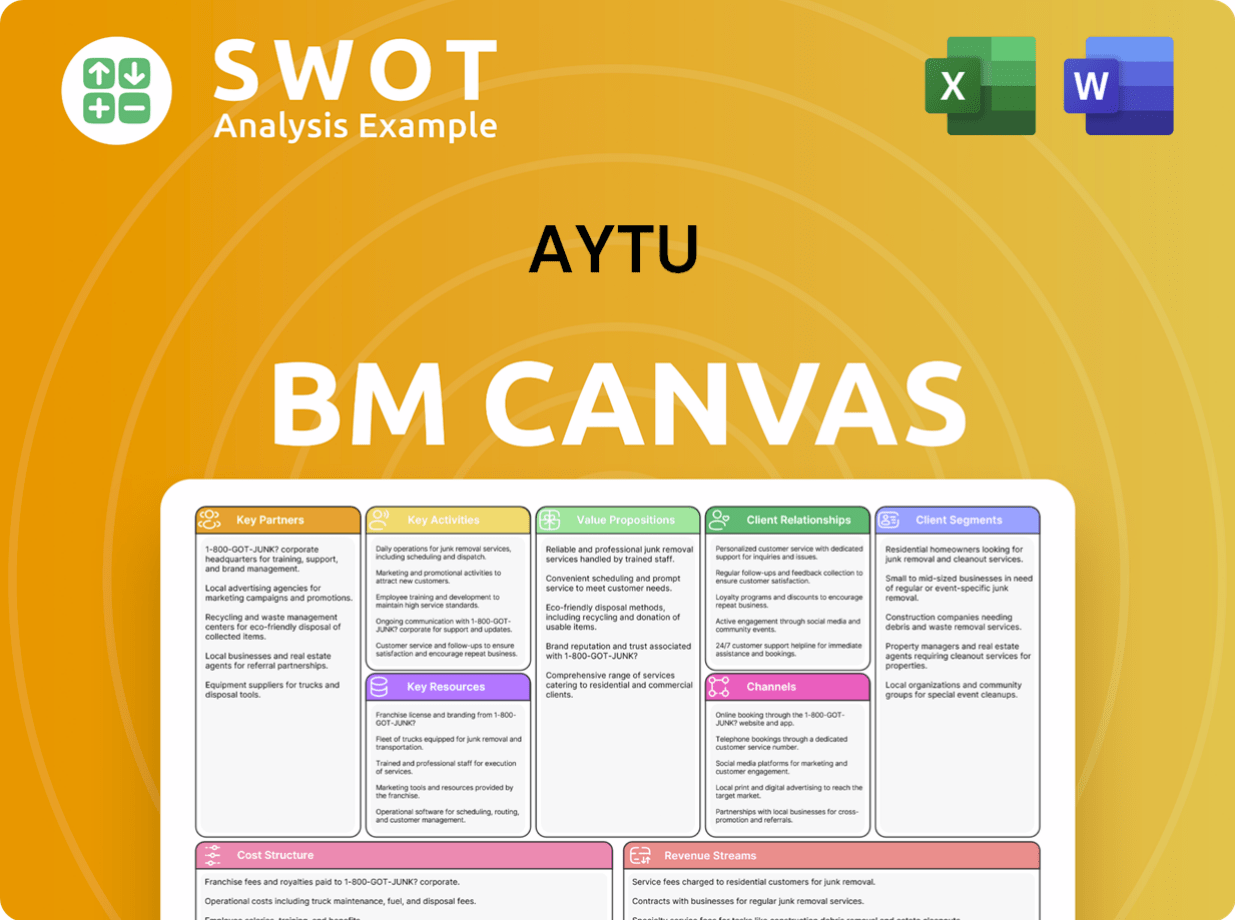

Aytu Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Aytu Positioning Itself for Continued Success?

Understanding the operational dynamics of the Aytu Company involves assessing its position within the competitive specialty pharmaceutical sector. Aytu BioScience, as it's also known, carves out a niche by concentrating on the primary care and pediatric markets. Its success hinges on the effectiveness and market acceptance of Aytu products like Testopel, Adzenys XR-ODT, Cotempla XR-ODT, and Zimhi, alongside its ability to navigate the complex landscape of healthcare regulations and reimbursement policies.

The future outlook for Aytu BioScience is influenced by several factors, including its ability to advance its product pipeline, manage financial performance, and respond to market changes. The company's strategic initiatives, such as developing novel therapeutic solutions and potentially expanding through acquisitions, are key to sustaining and growing its revenue streams. The company's leadership is focused on addressing significant patient needs and creating shareholder value through focused commercialization efforts and pipeline development.

Aytu Company operates in the specialty pharmaceutical industry, targeting specific markets. Competition comes from both large and smaller firms. Customer loyalty is built on product effectiveness and physician prescribing patterns, supported by targeted sales and marketing.

Key risks include competition, changes in healthcare policies, and regulatory hurdles. Product liability and the uncertainties of pharmaceutical development also pose challenges. These factors can impact the company's financial performance and market position.

Strategic initiatives involve advancing the product pipeline and exploring acquisitions. Aytu’s leadership is committed to meeting patient needs and creating shareholder value. The company aims to sustain revenue growth by commercializing novel therapies in its target markets.

Revenue generation is primarily driven by sales of Aytu products, with factors such as market demand, pricing, and competition affecting financial outcomes. The company's ability to successfully commercialize new products and manage operational costs is crucial for its financial health.

Aytu BioScience is focused on expanding its product portfolio and advancing its pipeline, including its investigational drug for Prader-Willi Syndrome. The company's approach to the market involves a targeted commercialization strategy aimed at addressing specific patient needs within its chosen therapeutic areas. For further insights into the company's history and evolution, consider reading Brief History of Aytu.

- Pipeline Development: Advancing clinical trials and regulatory submissions for new products.

- Commercialization: Strengthening sales and marketing efforts for existing products.

- Market Expansion: Exploring opportunities to broaden its market reach and product offerings.

- Financial Strategy: Managing costs and securing funding to support operations and growth.

Aytu Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aytu Company?

- What is Competitive Landscape of Aytu Company?

- What is Growth Strategy and Future Prospects of Aytu Company?

- What is Sales and Marketing Strategy of Aytu Company?

- What is Brief History of Aytu Company?

- Who Owns Aytu Company?

- What is Customer Demographics and Target Market of Aytu Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.