Aytu Bundle

Who Really Owns Aytu BioPharma?

Delving into Aytu BioPharma's ownership provides a critical lens through which to understand its strategic maneuvers and future prospects. The recent upsized public offering, a testament to investor confidence, has injected significant capital into the company. This financial infusion is specifically earmarked for the commercialization of Aytu SWOT Analysis, a key initiative, illustrating how ownership directly fuels growth and innovation.

Understanding the dynamics of Aytu Company Owner is essential for anyone tracking the pharmaceutical sector. The company, now publicly traded as Aytu BioScience, has seen its ownership evolve since its founding in April 2015. Examining the Aytu BioScience ownership structure, including its major shareholders and the influence of its board of directors, offers valuable insights into the company's direction and its potential for future success. Knowing Who owns Aytu is vital to understanding the company's trajectory.

Who Founded Aytu?

The company, now known as Aytu BioPharma, Inc., was established in April 2015. The founders were Joshua R. Disbrow and Jarrett Disbrow. This marked the beginning of the company's journey in the pharmaceutical sector.

Joshua R. Disbrow has been the Chief Executive Officer since the company's inception. He also became a member of the Board of Directors in January 2016. Jarrett Disbrow, currently the Chief Business Officer since November 2022, also played a key role in the company's early development.

The founders' prior experiences significantly influenced the company's direction. Joshua Disbrow's background included leading Luoxis Diagnostics, which was later integrated into Aytu. Jarrett Disbrow's experience with Vyrix Pharmaceuticals and Arbor Pharmaceuticals provided valuable insights into the industry. The focus on acquisitions and in-licensing of pharmaceutical products was a key strategy from the start.

Joshua R. Disbrow has been the CEO since the company's founding. He also joined the Board of Directors in January 2016.

The company was co-founded in April 2015. This marked the official start of Aytu BioPharma, Inc.

Jarrett Disbrow is the Chief Business Officer. He joined in November 2022.

The initial strategy involved acquiring and in-licensing pharmaceutical products. This approach was influenced by the founders' previous ventures.

Initially, the company concentrated on urological wellness. Later, it expanded into areas like diabetes supportive care and ADHD treatment.

Josh Disbrow's experience at Ampio Pharmaceuticals and Jarrett Disbrow's work at Arbor Pharmaceuticals shaped the company's early direction.

The specific details of the initial equity distribution among the founders are not publicly available. However, the founders' strategic vision, influenced by their prior experiences, played a crucial role in shaping the company's early growth. The focus on acquisitions and in-licensing was evident from the start, demonstrating a clear strategy for expanding Aytu's portfolio. For more detailed information on the company's financial performance and strategic direction, you can explore a comprehensive analysis of the company's operations.

Understanding the early ownership and leadership of Aytu BioScience is crucial for investors and stakeholders. Knowing who owns Aytu and the history of Aytu BioScience ownership provides insights into the company's strategic direction.

- Joshua R. Disbrow and Jarrett Disbrow co-founded Aytu BioPharma, Inc.

- The company's initial strategy focused on acquisitions and in-licensing.

- Early leadership roles were held by individuals with significant experience in the pharmaceutical industry.

- The company's focus has evolved from urological wellness to include other therapeutic areas.

- The founders' past ventures influenced the company's strategic direction.

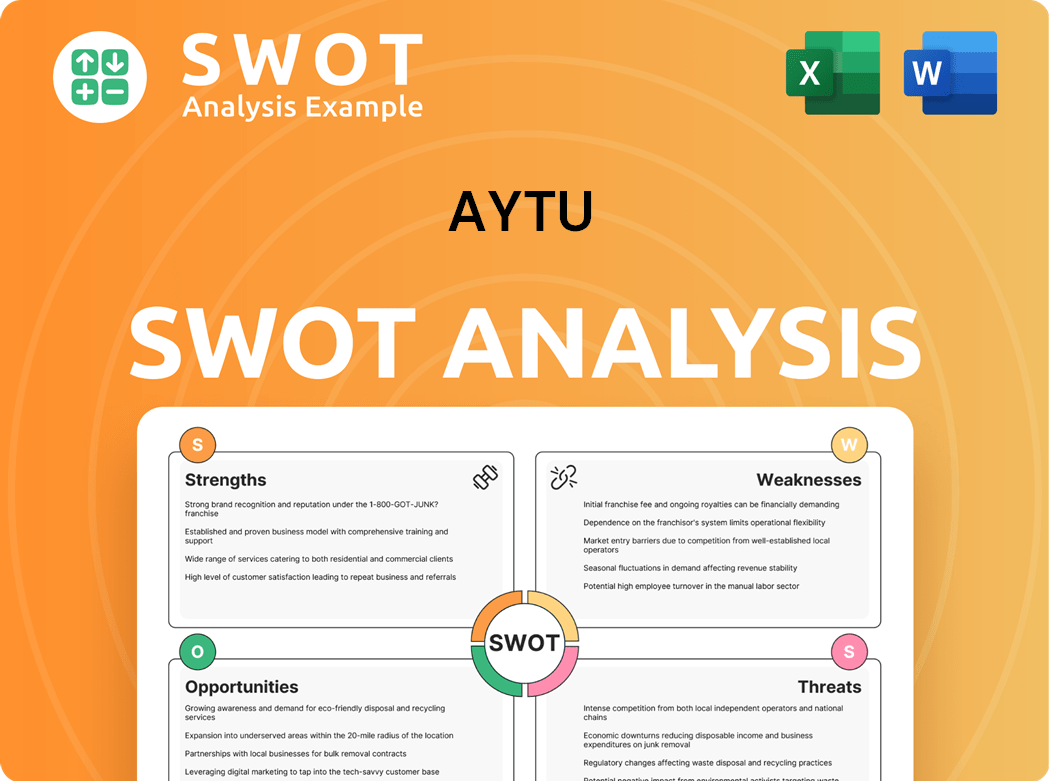

Aytu SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Aytu’s Ownership Changed Over Time?

The ownership structure of Aytu BioPharma, also known as Aytu BioScience, has seen significant changes since its inception in 2015. The company's transition to a publicly traded entity on Nasdaq (AYTU) has been a pivotal event. As of June 11, 2025, the stock price was at $1.93 per share, a decrease of 35.02% from $2.97 per share on June 12, 2024. These fluctuations highlight the dynamic nature of Aytu's ownership and its dependence on market performance.

Institutional investors are key players in Aytu's ownership, holding 33.49% of the company's stock as of May 2025. This significant stake underscores the influence of institutional decisions on the company's strategy and financial health. The evolution of the ownership structure is a critical factor in understanding the company's strategic direction and financial stability. The company's growth strategy, as discussed in Growth Strategy of Aytu, is heavily influenced by these ownership dynamics.

| Metric | Value | Date |

|---|---|---|

| Share Price | $1.93 | June 11, 2025 |

| Institutional Ownership | 33.49% | May 2025 |

| Shares Purchased by Institutions (Last 24 Months) | 1,289,710 | Various |

Major institutional stakeholders include Nantahala Capital Management, LLC, and Stonepine Capital Management, LLC. Stonepine Capital Management LLC, for example, held 463,721 shares with a market value of $556K as of May 14, 2025, representing 7.516% ownership. Recent financing efforts have been led by Nantahala Capital Management and Stonepine Capital Management. In the last 24 months, institutional investors have collectively purchased 1,289,710 shares, valued at approximately $2.41 million.

Aytu BioScience's ownership structure is dynamic, with institutional investors playing a major role.

- Institutional investors hold a significant portion of the company's stock.

- Major shareholders like Nantahala Capital Management and Stonepine Capital Management influence strategic decisions.

- Recent financing activities highlight the reliance on external funding for growth.

- The stock price has fluctuated, reflecting market dynamics and investor sentiment.

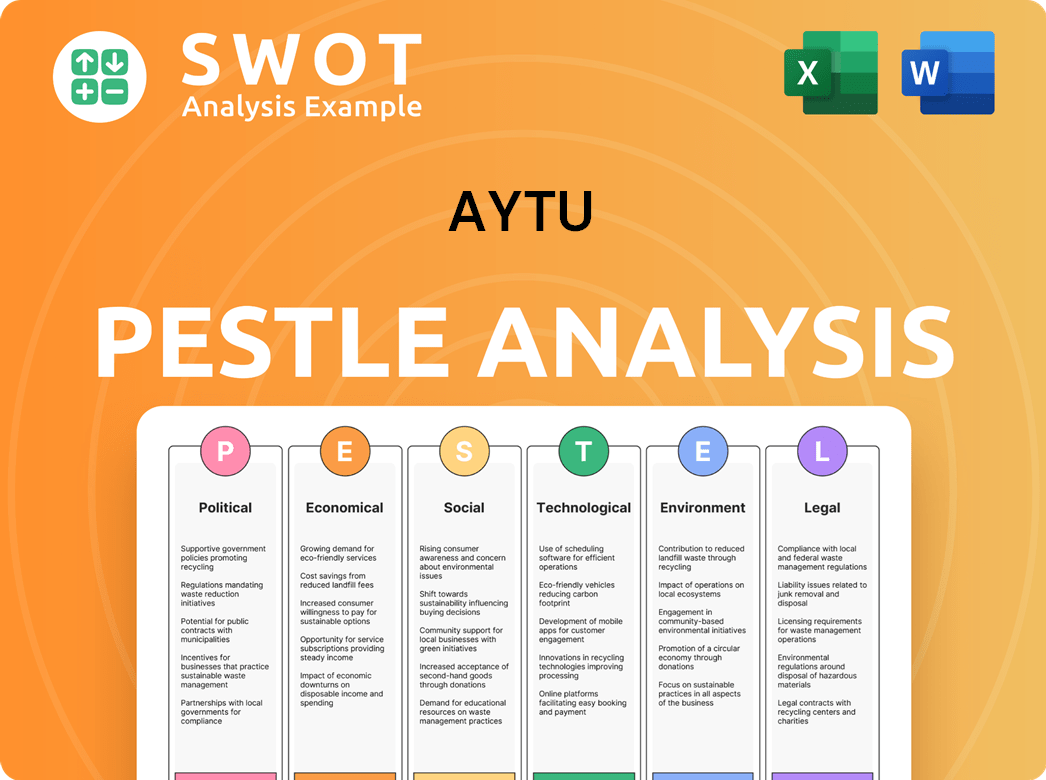

Aytu PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Aytu’s Board?

As of recent filings, the leadership of Aytu BioPharma includes Joshua R. Disbrow as Chief Executive Officer. In November 2024, the Board of Directors separated the roles of Chairman of the Board and Chief Executive Officer, appointing John A. Donofrio, Jr. as the new Chairman, replacing Joshua R. Disbrow in that role. Ryan Selhorn assumed the role of Chief Financial Officer, Corporate Secretary, and Treasurer in November 2024. Greg Pyszczymuka serves as Chief Commercial Officer since January 2022, and Jarrett Disbrow is the Chief Business Officer. The presence of founders like Joshua R. Disbrow in key executive roles and on the board signifies their continued influence on the company's direction. For more details on the company's background, you can refer to Brief History of Aytu.

The composition of the board and the specific representation of major shareholders or independent seats aren't fully detailed in the provided data. However, the structure indicates a standard corporate governance model where key decisions are made by the board, with significant roles held by individuals with a long-standing association with the company. This structure is typical for publicly traded companies, aiming to balance the interests of management, shareholders, and other stakeholders.

| Executive Role | Name | Date of Appointment/Change |

|---|---|---|

| Chief Executive Officer | Joshua R. Disbrow | Current |

| Chairman of the Board | John A. Donofrio, Jr. | November 2024 |

| Chief Financial Officer, Corporate Secretary, and Treasurer | Ryan Selhorn | November 2024 |

| Chief Commercial Officer | Greg Pyszczymuka | January 2022 |

| Chief Business Officer | Jarrett Disbrow | Current |

The voting structure at Aytu BioPharma typically operates on a one-share-one-vote basis, a standard practice for publicly traded companies. In May 2025, shareholders approved an amendment to the 2023 Equity Incentive Plan, increasing the shares reserved for issuance by 300,000 shares. This action underscores the importance of shareholder approval in significant corporate matters. No information indicates any special voting rights or structures that would grant outsized control to particular individuals or entities, suggesting a generally equitable distribution of voting power among shareholders.

Understanding the ownership structure of Aytu BioScience, including its board of directors and voting rights, is crucial for investors. The board's composition and the voting mechanisms directly influence the company's strategic decisions and financial performance.

- The CEO and Chairman roles were separated in November 2024.

- Shareholders approved increasing the share reserve by 300,000 shares in May 2025.

- The standard voting structure is one-share-one-vote.

- Key executives include Joshua R. Disbrow, John A. Donofrio, Jr., and Ryan Selhorn.

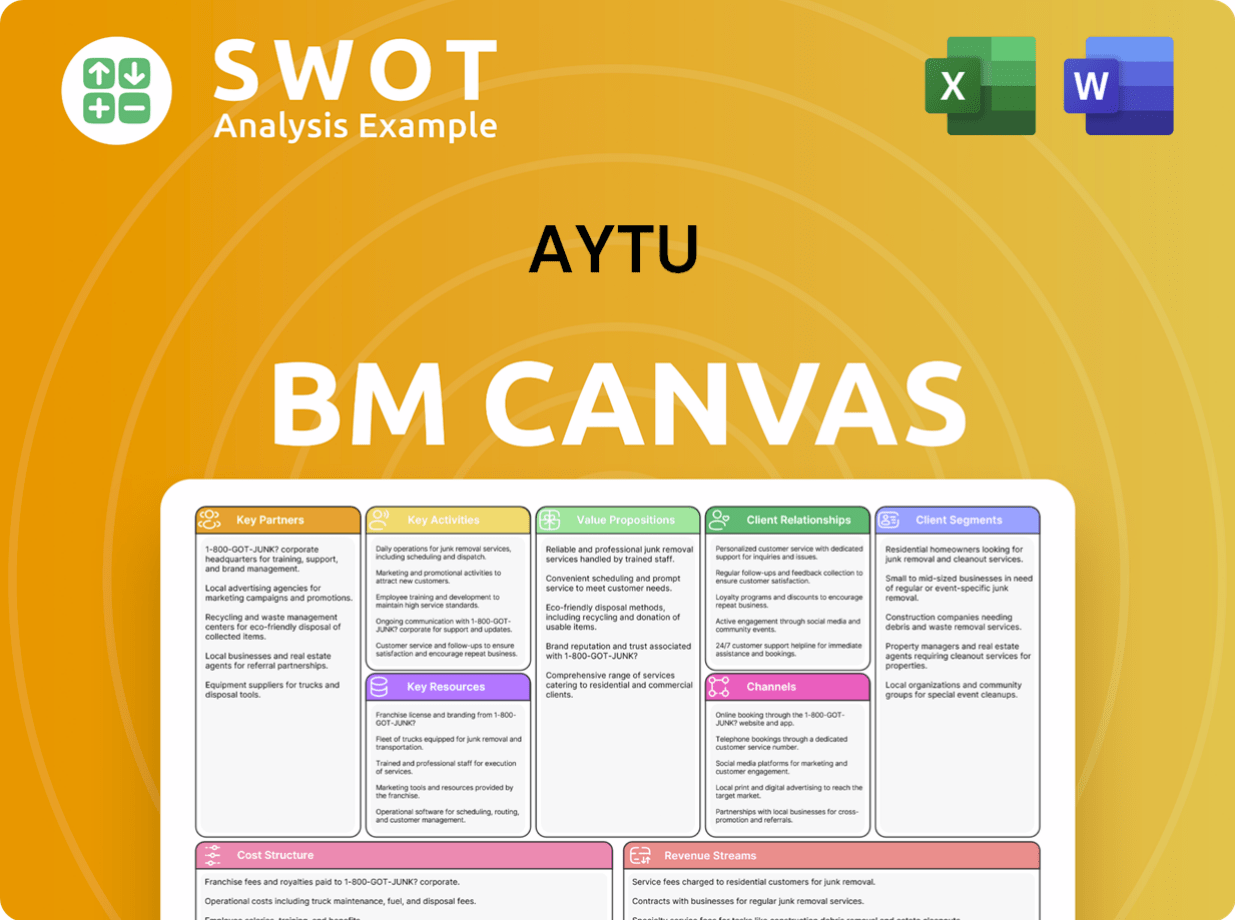

Aytu Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Aytu’s Ownership Landscape?

Over the past few years, Aytu BioScience has seen significant shifts in its ownership and strategic direction. The company has focused on expanding its product portfolio through acquisitions and licensing agreements. A notable example is the global license for AR101 (enzastaurin) acquired in April 2021. More recently, in June 2025, Aytu entered an exclusive agreement to commercialize EXXUA (gepirone) in the United States. This transaction was supported by a public offering that raised $16.6 million, with major institutional shareholders like Nantahala Capital Management and Stonepine Capital Management participating, along with Aytu management.

The company's share buyback activity, as indicated by the 6-Month Share Buyback Ratio of -0.34% as of March 2025, suggests a slight decrease in outstanding shares or potential share issuance rather than substantial buybacks. Leadership changes have also occurred, with Ryan Selhorn appointed as Chief Financial Officer in November 2024. Furthermore, the roles of Chairman of the Board and Chief Executive Officer were separated in November 2024, with John A. Donofrio, Jr. becoming Chairman. Jarrett Disbrow transitioned from President, Consumer Health to Chief Business Officer in July 2024.

Industry trends have influenced Aytu BioPharma, particularly an increased reliance on institutional ownership to fund growth. Institutional investors held 30.01% of Aytu BioPharma shares as of May 2025, and mutual funds increased their holdings to 2.09%. This backing is crucial for the commercialization of new products like EXXUA. Aytu has also streamlined operations, winding down its Consumer Health Segment in fiscal 2024, completing its divestiture in the first quarter of fiscal 2025 to concentrate on its prescription segment. Analysts have given the stock a 'buy' rating with a target price of $8.00, reflecting a positive outlook despite recent revenue declines and the volatility typical of small-cap biotech companies. This shows who owns Aytu and the current Aytu BioScience ownership structure.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership | 30.01% | May 2025 |

| Mutual Fund Holdings | 2.09% | May 2025 |

| 6-Month Share Buyback Ratio | -0.34% | March 2025 |

The acquisition of a global license to AR101 (enzastaurin) in April 2021 from Rumpus Therapeutics. This expands Aytu's product portfolio.

A public offering raised $16.6 million in gross proceeds to finance the commercialization of EXXUA (gepirone) in the U.S.

Ryan Selhorn appointed as CFO in November 2024. John A. Donofrio, Jr. became Chairman in November 2024.

Streamlining operations by winding down the Consumer Health Segment to focus on the prescription segment.

Aytu Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Aytu Company?

- What is Competitive Landscape of Aytu Company?

- What is Growth Strategy and Future Prospects of Aytu Company?

- How Does Aytu Company Work?

- What is Sales and Marketing Strategy of Aytu Company?

- What is Brief History of Aytu Company?

- What is Customer Demographics and Target Market of Aytu Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.