Balfour Beatty Bundle

How Does Balfour Beatty Dominate the Infrastructure Game?

Balfour Beatty, a titan in global infrastructure, is constantly reshaping the world with its ambitious projects. From bustling transportation networks to essential power systems, the company's influence is undeniable. But in a fiercely competitive market, how does Balfour Beatty maintain its leading position?

This exploration of the Balfour Beatty SWOT Analysis will dissect the company's competitive landscape, providing a comprehensive market analysis. We'll examine Balfour Beatty's competitors, evaluate its strengths and weaknesses, and assess its strategic initiatives to understand its industry position. Understanding the Balfour Beatty competitive landscape is crucial for anyone looking to navigate the complexities of the construction industry.

Where Does Balfour Beatty’ Stand in the Current Market?

The company holds a strong market position as a leading international infrastructure group. Its core operations span construction services, support services, and infrastructure investments. This diversified approach has been key to its consistent financial results, allowing it to navigate the complexities of the Balfour Beatty's target market effectively.

The company's value proposition lies in its ability to deliver complex infrastructure projects across various sectors. They provide end-to-end solutions, from design and construction to maintenance and investment. This integrated model ensures project efficiency and quality, which strengthens its competitive edge in the construction industry analysis.

In 2024, the company reported a 4% increase in revenue, reaching £10 billion. The underlying profit from operations (PFO) for its earnings-based businesses (Construction Services and Support Services) increased by 7% to £252 million. The company's order book also saw healthy growth, rising by 12% to £18.4 billion in 2024, up from £16.5 billion in 2023.

Construction Services PFO increased by 2% to £159 million in 2024. The UK construction PFO margin continued to improve, reflecting the company's focus on operational efficiency. This segment remains a core part of the company's strategy within the broader construction companies landscape.

Support Services delivered strong growth, with revenue increasing by 20% and PFO rising by 16% to £93 million. The segment maintained its margin near the top of its targeted range of 6% to 8%, showcasing its robust performance and contribution to the overall financial health of the company.

The company's Infrastructure Investments portfolio was valued at £1.3 billion in 2024, a 3% increase from £1.2 billion in 2023. This segment demonstrates the company's commitment to long-term infrastructure projects and its ability to generate value from its investments.

The company's financial health is robust, with average net cash increasing to £766 million in 2024, up from £700 million in 2023, and year-end net cash reaching £943 million. For 2025, the board expects average net cash to be in the range of £900 million to £1 billion.

The UK market led the group's portfolio performance in 2024, reflecting its strong presence and project pipeline. In the US, the company has seen growth in its buildings and civils segments, with notable projects like the $889 million contract from the Texas Department of Transportation and the $385 million deal for the Grand Hyatt Miami Beach.

- The company's joint venture in Hong Kong, Gammon, recorded 14% revenue growth in 2024.

- The company’s focus on major infrastructure projects and its diversified portfolio contribute to its strong market position.

- The company's strategic initiatives include a focus on operational efficiency and sustainable growth.

- The company's strong financial performance and order book growth indicate a positive outlook for the future.

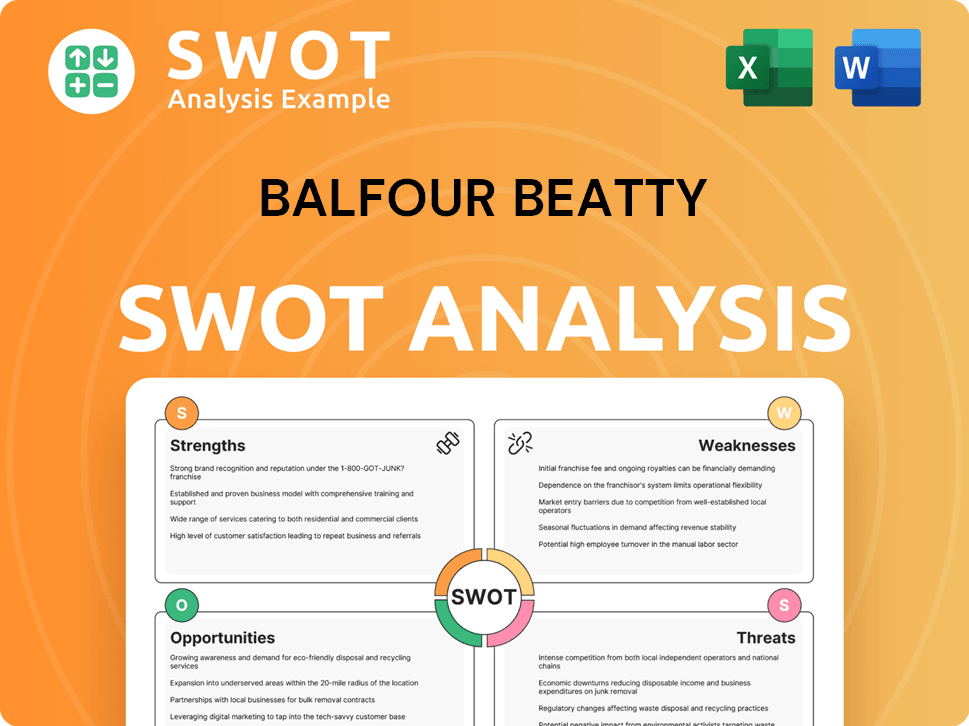

Balfour Beatty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Balfour Beatty?

The global infrastructure and construction market is a complex arena where Growth Strategy of Balfour Beatty operates, facing competition from a variety of firms. The competitive landscape includes both direct and indirect rivals, varying across its key operating regions: the UK, US, and Hong Kong. Analyzing the competitive environment is crucial for understanding the company's position and strategic challenges.

Understanding the competitive landscape of Balfour Beatty involves assessing its key competitors across different geographical locations and market segments. This analysis helps in evaluating the company's strengths, weaknesses, and strategic positioning within the construction and infrastructure sectors. The competitive dynamics are shaped by factors such as project delivery capabilities, technological adoption, and sustainability efforts.

The construction industry analysis reveals a mix of large international players and specialized regional firms that compete with Balfour Beatty. These companies often bid for large-scale infrastructure projects in sectors like energy, transportation, and defense, which are key growth markets for Balfour Beatty. The competitive dynamics involve project delivery capabilities, technological adoption, cost efficiency, and sustainability initiatives.

Direct competitors include major international players in the construction and civil engineering sectors. These firms often compete for large-scale infrastructure projects globally.

Within the UK market, the competition includes companies that focus on public-sector projects and construction services. These companies have a strong presence in the UK infrastructure market.

In the US, competitors vary depending on the specific segments, such as student housing solutions. These companies compete with Balfour Beatty Campus Solutions in certain areas.

The Hong Kong infrastructure market sees competition from major players involved in the city's development. These companies are crucial for the infrastructure projects in Hong Kong.

Competitive dynamics are influenced by project delivery, technological adoption, cost efficiency, safety, and sustainability. These factors are key in shaping the competitive landscape.

New market entrants and technological advancements are reshaping the competitive environment. AI and modular construction are examples of trends impacting the industry.

The

The

- Direct Competitors: Major international construction firms like Bechtel, Skanska, and Kiewit compete for large-scale infrastructure projects. Bechtel is known for mega-projects, and Skanska focuses on sustainable design.

- UK Market: Kier Group, with an order book valued at £10.8 billion in FY24, and Wates Group, with an order book of £3.63 billion in 2024, are significant competitors.

- US Market: American Campus Communities and Lendlease compete in specific segments like student housing.

- Hong Kong Market: MTR Corporation and Airport Authority Hong Kong are key competitors in infrastructure development. Gammon, a Balfour Beatty joint venture, had 14% revenue growth in 2024.

- Competitive Factors: Project delivery, technological adoption (AI, BIM), cost efficiency, safety, and sustainability are critical.

- Market Trends: New entrants and technological disruptions, particularly in AI and modular construction, are reshaping the industry.

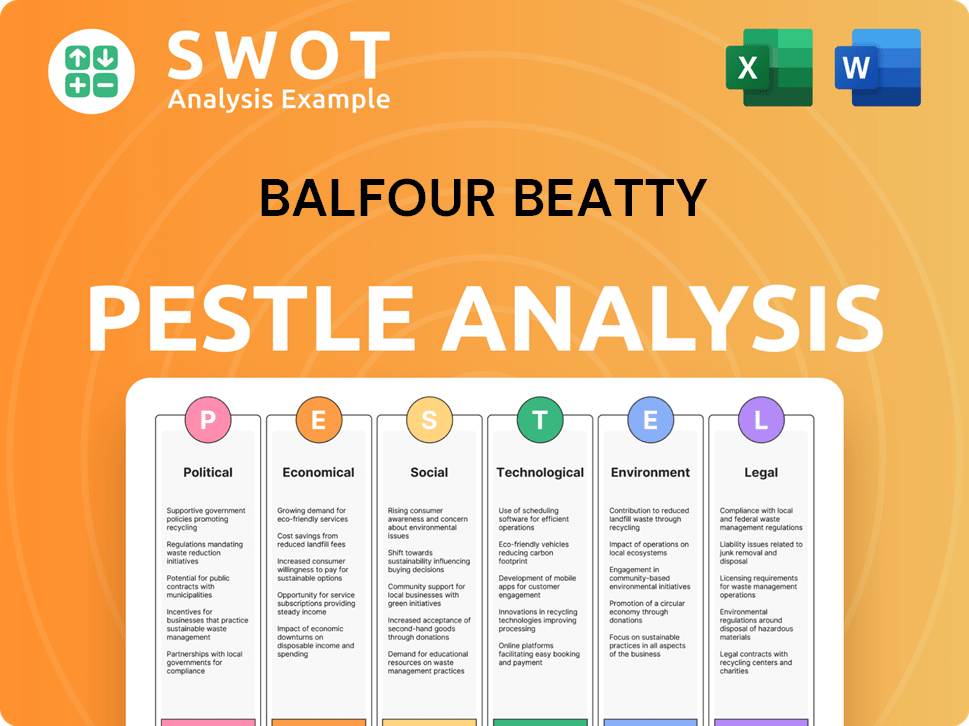

Balfour Beatty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Balfour Beatty a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Balfour Beatty involves examining its competitive advantages within the construction industry. The company's success is rooted in its diversified portfolio, extensive experience, and financial strength. These factors enable it to navigate market challenges and capitalize on opportunities effectively.

Balfour Beatty's strategic focus on high-growth markets and innovation further enhances its competitive edge. By leveraging its expertise in key sectors and adopting a 'digital-first approach', the company aims to improve project delivery and meet evolving client needs. Recent financial performance, including a revenue of £10 billion in 2024, underscores its robust position in the market.

The company's ability to secure large-scale, intricate projects, such as the Hinkley Point C nuclear power station, demonstrates its capability and experience. With a strong order book of £18.4 billion as of 2024 and a commitment to sustainable practices, Balfour Beatty is well-positioned for future growth.

Balfour Beatty's diversified approach provides financial result consistency and risk management across different regions, including the UK, US, and Hong Kong. This diversification allows the company to operate in various sectors, such as transportation, power, and commercial buildings.

With over 114 years of experience, Balfour Beatty has built deep expertise in financing, developing, building, and maintaining complex infrastructure projects. This extensive experience allows the company to undertake large-scale projects efficiently, such as the Hinkley Point C nuclear power station.

Balfour Beatty's financial strength is a key advantage in the capital-intensive construction industry. In 2024, the company reported a revenue of £10 billion and an underlying profit from operations of £252 million. The average net cash increased to £766 million in 2024, with a forecast of £900 million to £1 billion for 2025.

Balfour Beatty leverages its capabilities in specific growth markets, such as UK energy, transport, and defense, and US buildings. The company's 'digital-first approach' enhances safety and productivity. The evolved Sustainability Strategy, launched in 2024, focuses on climate change and resource efficiency.

Balfour Beatty's financial performance and strategic initiatives highlight its strong market position. The company's robust financial health, coupled with a high-quality order book, provides a stable platform for future growth. The company's commitment to sustainability and technological advancement further strengthens its competitive advantage.

- Revenue of £10 billion in 2024.

- Underlying profit from operations of £252 million in 2024.

- Average net cash increased to £766 million in 2024.

- High-quality order book of £18.4 billion as of 2024.

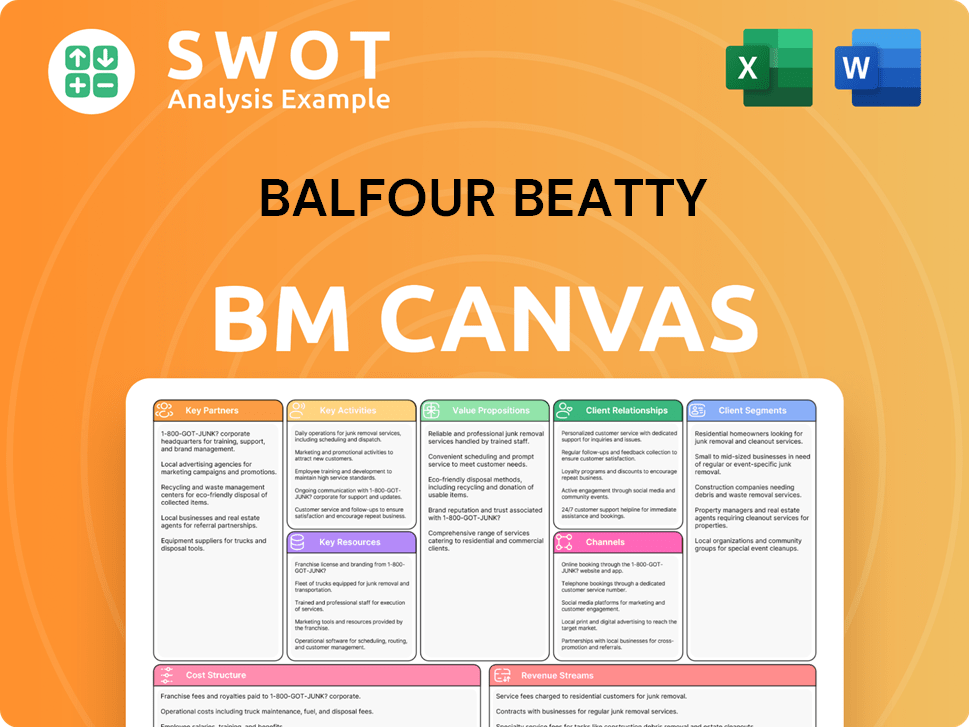

Balfour Beatty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Balfour Beatty’s Competitive Landscape?

The construction and infrastructure sector is currently experiencing significant transformation, significantly impacting the competitive landscape of companies like Balfour Beatty. This evolution is driven by technological advancements, a growing emphasis on sustainability, and shifting economic dynamics. Analyzing the Balfour Beatty competitive landscape requires understanding these trends and their implications for the company's strategic positioning and future performance. The industry faces both challenges and opportunities, necessitating adaptability and strategic foresight.

The construction industry is also subject to various risks. These risks include economic fluctuations, supply chain disruptions, and the availability of skilled labor. The company's future outlook depends on its ability to navigate these challenges while capitalizing on emerging opportunities in areas like sustainable construction and infrastructure projects. A thorough Balfour Beatty market analysis reveals critical factors influencing its success in the coming years.

Technological advancements are reshaping the construction sector. AI, BIM, VR/AR, 3D printing, and data analytics are being widely adopted. Sustainability and green building practices are also crucial, with a focus on reducing carbon emissions and conserving resources. The industry is also seeing an increase in government investments in infrastructure projects.

A significant talent shortage poses a major challenge. The construction industry had an average of 382,000 job openings per month in 2024. High initial investment costs for new technologies and supply chain uncertainties also present difficulties. Potential impacts from future tariffs, particularly in the US, are another concern for companies like Balfour Beatty.

The industry's outlook is optimistic, with anticipated decreases in interest rates and improving economic conditions in 2025. Government investments, such as the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) in the US, are expected to drive demand. The company's strong order book of £18.4 billion provides good short-term visibility and significant medium-to long-term potential.

Balfour Beatty is embracing a digital-first approach, leveraging AI and digital tools. The company launched an evolved Sustainability Strategy in 2024, setting new net-zero targets. A selective bidding approach is used to maintain a high-quality order book. The company is also exploring investment opportunities in student accommodation and residential sectors.

Balfour Beatty's competitive advantages include its strong order book, strategic focus on growth markets, and commitment to sustainability. The company's digital-first approach and strategic initiatives position it well for future growth. To further understand the company's marketing approach, read about the Marketing Strategy of Balfour Beatty.

- Strong Order Book: £18.4 billion provides a solid foundation for future projects.

- Strategic Focus: Targeting growth markets such as UK energy, transport, and defense, and US buildings.

- Sustainability Strategy: With new net-zero targets for Scope 1 and 2 emissions by 2045 and Scope 3 by 2050.

- Digital Transformation: Embracing AI and digital tools to enhance productivity and safety.

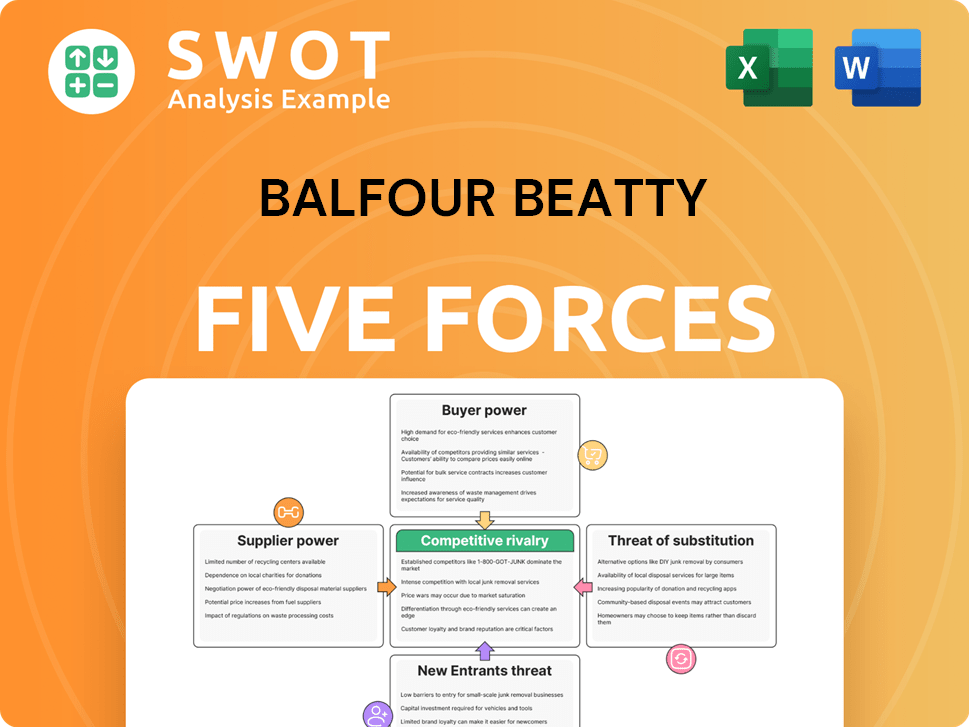

Balfour Beatty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Balfour Beatty Company?

- What is Growth Strategy and Future Prospects of Balfour Beatty Company?

- How Does Balfour Beatty Company Work?

- What is Sales and Marketing Strategy of Balfour Beatty Company?

- What is Brief History of Balfour Beatty Company?

- Who Owns Balfour Beatty Company?

- What is Customer Demographics and Target Market of Balfour Beatty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.