Balfour Beatty Bundle

How Does Balfour Beatty Thrive in the Infrastructure Arena?

Balfour Beatty, a global infrastructure powerhouse, showcased impressive financial results in 2024, with a 4% revenue surge to £10 billion. This growth highlights the company's robust performance, particularly from its Hong Kong joint venture, Gammon, and its Support Services division. With earnings-based businesses seeing a 7% profit increase to £252 million, the company demonstrates its ability to execute and deliver. Understanding Balfour Beatty SWOT Analysis can provide further insights into its strategic positioning.

Balfour Beatty, a leading construction company, operates across the UK, US, and Hong Kong, specializing in infrastructure projects. Its strong financial health, with a substantial order book and increasing net cash, underscores its capacity to undertake complex projects. This positions Balfour Beatty favorably for future endeavors, making it a compelling subject for those interested in project management and the infrastructure sector.

What Are the Key Operations Driving Balfour Beatty’s Success?

The Balfour Beatty company operates across the entire infrastructure lifecycle, from financing and development to construction and maintenance. This integrated approach allows it to offer comprehensive solutions for infrastructure projects. The company's value proposition lies in its ability to deliver complex projects, manage risks effectively, and provide long-term value to its clients and stakeholders.

The company's core operations are structured around three main segments: Construction Services, Support Services, and Infrastructure Investments. These segments work together to provide a wide range of services to various sectors, including commercial, defense, education, and healthcare. This diversified approach helps to mitigate risks and capitalize on opportunities across different markets.

The Balfour Beatty company's commitment to innovation and sustainability is evident in its 'digital-first approach' and its evolved Sustainability Strategy. These initiatives are designed to enhance efficiency, improve safety, and create social value, as highlighted in the Target Market of Balfour Beatty article.

This segment offers building and civil engineering, fit-out, rail engineering, refurbishment, and ground engineering services. Key projects include the Hinkley Point C nuclear power station and the Lyric Theatre in Hong Kong. These projects showcase the company's capabilities in delivering large-scale and complex infrastructure.

Focused on the UK market, this division designs, upgrades, manages, and maintains highways, rail, and electricity networks. This segment has demonstrated strong growth, with revenue increasing by 20% in 2024, indicating its importance to the company's overall performance.

This segment develops and finances both private and public infrastructure projects in the US and UK. It allows Balfour Beatty to participate in projects from their inception, providing long-term investment opportunities and revenue streams. This segment is crucial for the company's sustainable growth.

The 'digital-first approach' uses AI, data lakes, and digital tools to improve safety, productivity, and assurance. This focus on technology helps Balfour Beatty to stay competitive and deliver projects more efficiently. This approach is key to enhancing project management.

The company's end-to-end capabilities, experience in complex infrastructure delivery, and highly engaged workforce set it apart. These factors enable Balfour Beatty to deliver high-quality projects and create value for its customers.

- Selective bidding approach to secure a high-quality forward order book.

- Emphasis on supply chain integrity within its Sustainability Strategy.

- An employee engagement score of 84%, significantly higher than its peer group.

- Target to create £3 billion of social value by 2025.

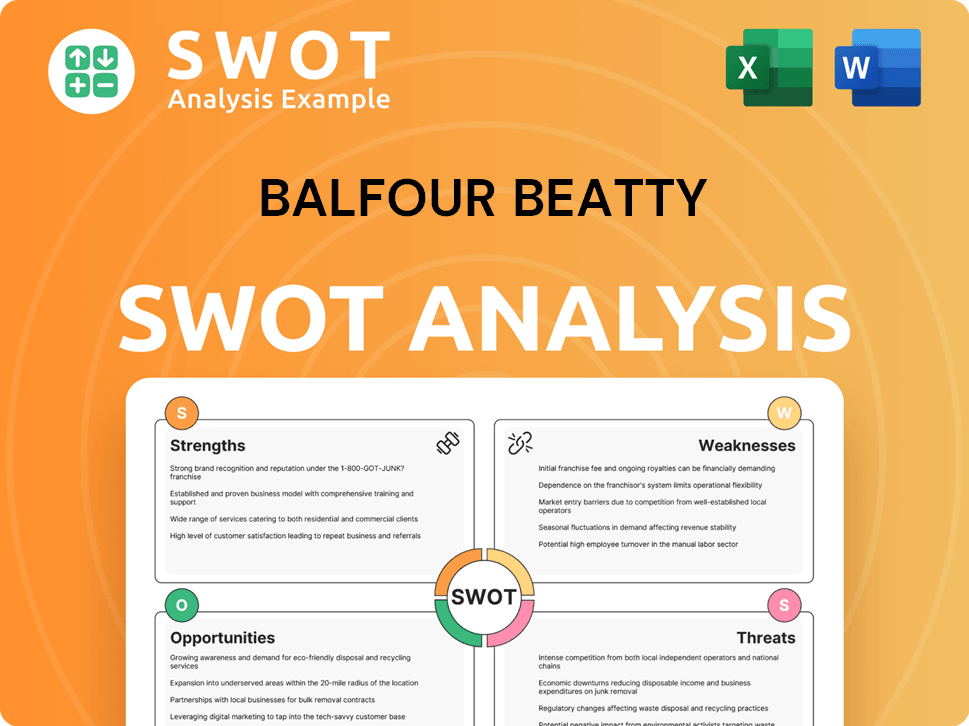

Balfour Beatty SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Balfour Beatty Make Money?

The revenue streams and monetization strategies of the Balfour Beatty company are primarily driven by its operations in construction services, support services, and infrastructure investments. The company's financial performance in 2024 highlights its diverse revenue model and strategic focus on profitable growth. Understanding how Balfour Beatty generates and manages its income is crucial for assessing its overall financial health and future prospects.

In 2024, the company's total revenue grew by 4% to £10 billion, demonstrating resilience and strategic execution across its business segments. This growth reflects the company's ability to secure and deliver projects effectively, as well as its focus on operational efficiency and strategic investments. For more insights, consider exploring the Marketing Strategy of Balfour Beatty.

Let's delve into the specifics of each segment and how they contribute to the overall financial performance of Balfour Beatty.

The Construction Services segment is a major revenue driver for Balfour Beatty, contributing significantly to the company's overall financial performance. This segment includes UK Construction, US Construction, and Gammon, the Hong Kong joint venture. It focuses on delivering a wide range of infrastructure projects.

Support Services provides essential services that complement the core construction activities. This segment's growth is driven by strong revenue performance, with profit margins remaining near the top of its target range. It focuses on maintaining and improving existing infrastructure assets.

Infrastructure Investments represent a strategic part of the company's portfolio, generating revenue through long-term projects. The Directors' valuation of the Investments portfolio increased by 3% to £1.3 billion in 2024, with new projects added. This segment contributes to the company's overall profitability and long-term growth.

In 2024, the Construction Services segment contributed £8.199 billion in revenue, with a profit from operations (PFO) of £159 million. The Support Services segment reported revenue of £1.210 billion, with a PFO of £93 million. Infrastructure Investments generated a PFO of £35 million from £606 million in revenue.

UK Construction's PFO increased to £81 million, driven by improved margins and a lower-risk project portfolio. The Support Services segment's PFO margins remained near the top of its target range of 6% to 8%. Gains on investment disposals are expected to be in the range of £20-£30 million for 2025.

Balfour Beatty is committed to returning cash to shareholders, with an expected total cash return of approximately £188 million in 2025 (including the final 2024 dividend and 2025 interim dividend), up from £161 million in 2024. The company announced a £125 million share buyback for 2025.

The Balfour Beatty company utilizes a multifaceted approach to generate revenue and maximize profitability. This includes a focus on efficient project management, strategic investments, and returning value to shareholders. The company's diverse portfolio of projects and services allows it to capitalize on various market opportunities.

- Construction Services: Revenue from construction projects, including UK Construction, US Construction, and Gammon.

- Support Services: Revenue from providing maintenance and other support services for infrastructure assets.

- Infrastructure Investments: Revenue and profits from long-term infrastructure projects.

- Operational Efficiency: Focus on improving margins and reducing project risks to enhance profitability.

- Shareholder Returns: Regular dividends and share buybacks to provide value to shareholders.

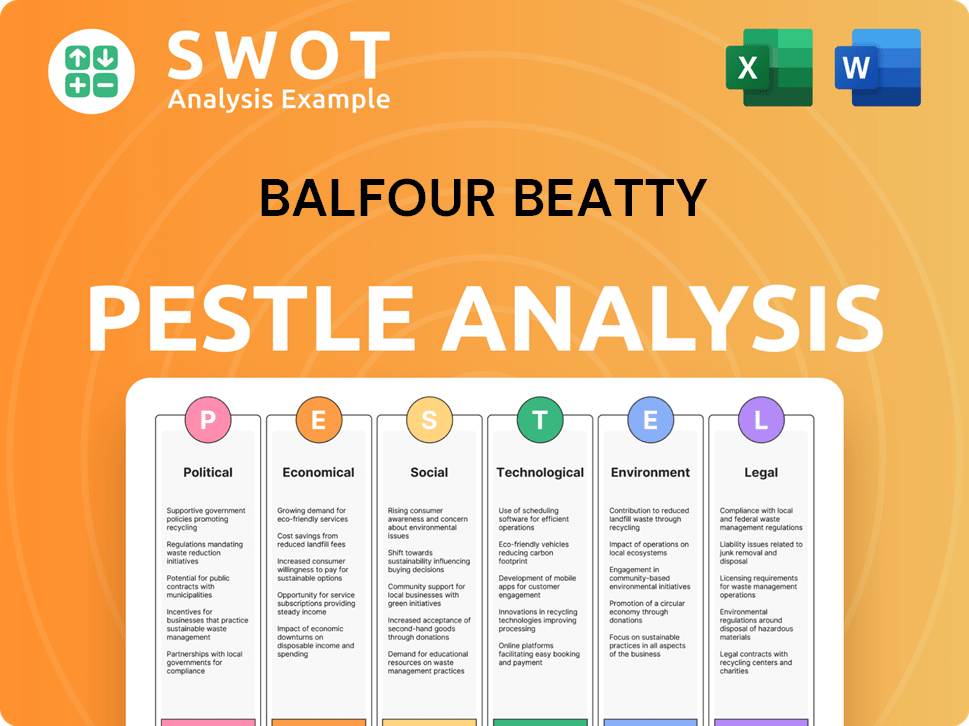

Balfour Beatty PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Balfour Beatty’s Business Model?

The Balfour Beatty company has a history marked by significant achievements and strategic shifts. In 2024, the firm demonstrated strong operational performance, which led to growth in earnings, cash flow, and its order book. A key focus was on expanding profits from its earnings-based businesses, specifically Construction Services and Support Services.

Recent developments include substantial contract awards, such as approximately £450 million in new UK rail work in early 2025. The company also secured a $385 million contract for the Grand Hyatt Miami Beach in the US and an $889 million contract for Interstate 30 reconstruction in Dallas County, Texas. These wins highlight its ability to secure large-scale infrastructure projects.

However, the company has faced operational challenges, including delays in some US civils projects, which affected profitability in 2024. Despite this, Balfour Beatty anticipates improved performance in US Construction PFO in 2025 as these projects advance. The firm also addressed obligations under the UK Building Safety Act, incurring a £49 million non-underlying charge in 2024.

In 2024, the company saw a 7% increase in underlying profit from operations (PFO) to £252 million from its earnings-based businesses. The year-end order book expanded by 12% to £18.4 billion. The company's strong performance is an important part of its story, as highlighted in the Brief History of Balfour Beatty.

The company is focused on key growth markets like UK energy, transport, and defense, and US buildings. It is also embracing a 'digital-first approach,' incorporating AI and data tools to enhance productivity and safety. These moves are designed to position the company for long-term success and capitalize on emerging opportunities.

The firm's competitive edge stems from its brand strength and unique end-to-end capabilities. It has a diversified portfolio across the UK, US, and Hong Kong. The company's commitment to sustainability and excellent safety record further strengthen its market position.

The company's order book reached £18.4 billion by the end of 2024, reflecting its robust project pipeline. Underlying profit from operations (PFO) increased to £252 million in 2024. These figures suggest a strong financial position and the ability to secure and deliver large-scale projects.

Balfour Beatty's competitive advantages include brand strength, end-to-end capabilities, and a diversified portfolio. The company's disciplined bidding process ensures a high-quality and low-risk order book. Its focus on sustainability and safety further enhances its market position.

- Strong brand recognition and reputation.

- Unique end-to-end capabilities in project delivery.

- A diversified portfolio across key geographic markets.

- A commitment to sustainability and safety.

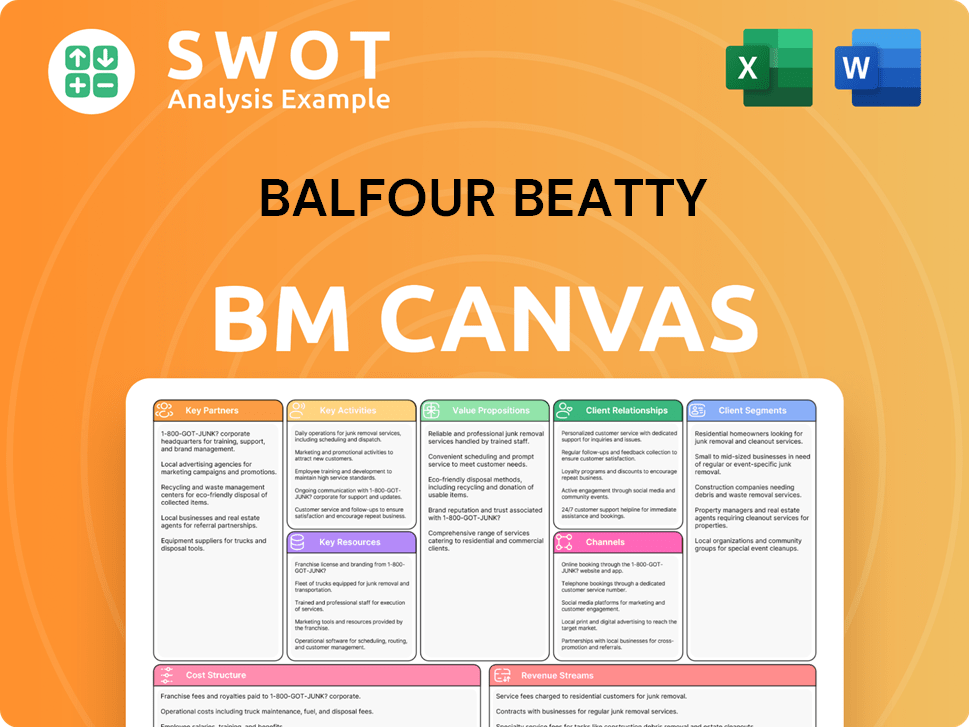

Balfour Beatty Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Balfour Beatty Positioning Itself for Continued Success?

The Balfour Beatty company maintains a strong industry position as a leading international infrastructure group. It boasts a diversified portfolio spanning the UK, US, and Hong Kong. This broad presence is reflected in its substantial order book and sustained demand for its services, indicating a solid market share and customer loyalty within the construction company sector.

Key risks for Balfour Beatty include potential future tariffs and regulatory changes like the UK Building Safety Act, which led to a £49 million charge in 2024. The company also faces ongoing challenges from new competitors and technological disruption. However, strategic initiatives, such as digital transformation, aim to mitigate these risks and ensure continued growth. For more information on the company, you can read the article about Owners & Shareholders of Balfour Beatty.

Balfour Beatty is a leading international infrastructure group. Its global presence includes operations in the UK, US, and Hong Kong. The company's order book reached £18.4 billion in 2024, demonstrating its strong market position.

Potential future tariffs and regulatory changes pose risks. The UK Building Safety Act resulted in a £49 million charge in 2024. New competitors and technological disruption also present challenges for the company.

The company anticipates further profitable growth in 2025 and 2026. Strategic initiatives include investments in key growth markets. Balfour Beatty plans to deliver significant shareholder returns, targeting an additional £1 billion in capital returns over the next five years.

Balfour Beatty is committed to creating social value, with a UK target of £3 billion by 2025. The company's net-zero targets, part of its evolved Sustainability Strategy, underscore its commitment to sustainable growth and project management.

The company is focused on securing a high-quality and low-risk forward order book through selective bidding. Balfour Beatty's strategic initiatives include continued investment in key growth markets such as UK energy, transport, and defense, and US buildings.

- Continued investment in key growth markets.

- Focus on securing a high-quality, low-risk order book.

- Targeting an additional £1 billion in capital returns over five years.

- Commitment to creating social value, with a UK target of £3 billion by 2025.

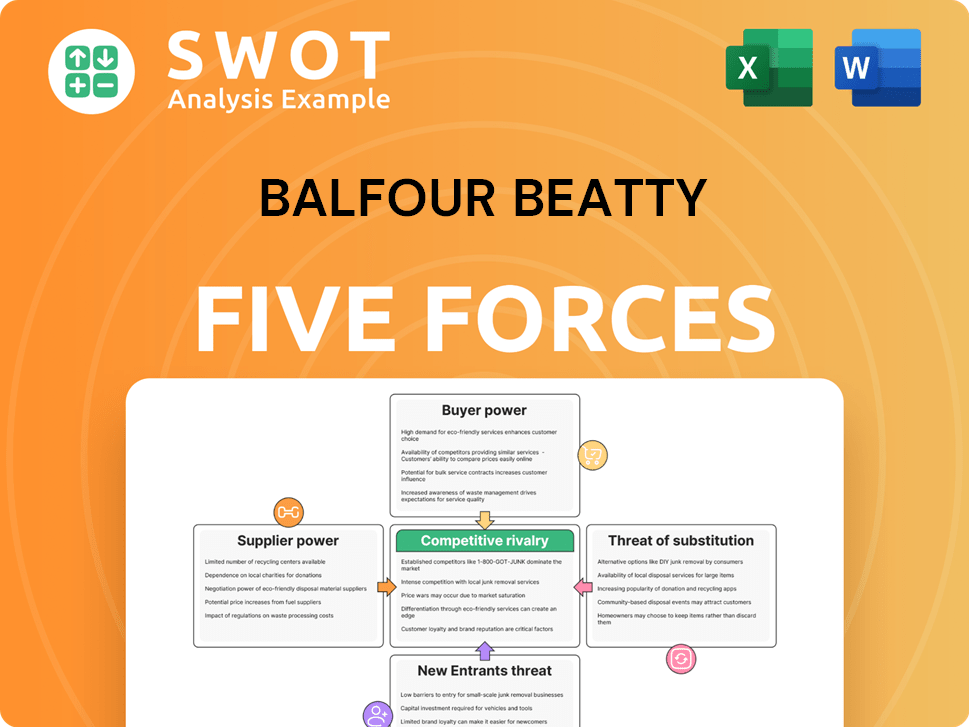

Balfour Beatty Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Balfour Beatty Company?

- What is Competitive Landscape of Balfour Beatty Company?

- What is Growth Strategy and Future Prospects of Balfour Beatty Company?

- What is Sales and Marketing Strategy of Balfour Beatty Company?

- What is Brief History of Balfour Beatty Company?

- Who Owns Balfour Beatty Company?

- What is Customer Demographics and Target Market of Balfour Beatty Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.