BayWa Bundle

How Does BayWa Navigate a Complex Global Market?

BayWa AG, a global powerhouse since 1923, operates across agriculture, energy, and building materials. Its evolution from a regional cooperative to an international leader showcases remarkable strategic foresight. But how does BayWa SWOT Analysis stack up against its rivals in today's dynamic environment?

To understand BayWa's current standing, we must dissect its competitive landscape. This deep dive into the BayWa competitive landscape will identify key BayWa competitors and analyze the company's market position. We'll explore BayWa's business strategy, examining its strengths and weaknesses to provide a comprehensive BayWa market analysis.

Where Does BayWa’ Stand in the Current Market?

The market position of BayWa AG is robust and diversified, primarily operating across agriculture, energy, and building materials sectors. In agriculture, BayWa is a leading trading partner and service provider, supplying a wide array of products like fertilizers, crop protection, seeds, and agricultural machinery. This extensive network and logistical prowess provide a significant competitive edge, especially in Germany and other European markets. The company's strategic focus on renewable energies has significantly boosted its market standing.

BayWa r.e. is a prominent global player in developing, realizing, and operating wind and solar parks. This segment has experienced substantial growth, with BayWa commissioning wind and solar plants totaling 3.2 gigawatts (GW) in 2023. This demonstrates their leadership in the renewable energy transition. In the building materials sector, BayWa serves as a key supplier for construction projects, catering to both commercial and private customers with a comprehensive range of products and services.

Geographically, BayWa has a significant presence across Europe, North America, and Asia-Pacific, reflecting its global reach. The company's strategic focus on digital transformation has also enhanced its market positioning, enabling more efficient operations and improved customer engagement. For more insights into the company's ownership structure, you can explore Owners & Shareholders of BayWa.

BayWa's strong position in the agricultural sector is supported by its extensive trading and service offerings. They provide essential products and services, including fertilizers, crop protection, seeds, and agricultural machinery, ensuring a strong foothold in key markets.

The energy segment, especially renewable energies, has seen substantial growth. BayWa r.e. is a global leader in developing and operating wind and solar parks. This strategic shift diversifies revenue streams and strengthens overall market resilience, highlighting BayWa's business strategy.

BayWa operates as a key supplier in the building materials segment, serving both commercial and private customers. They offer a wide range of products and services, supporting construction projects. This segment contributes to the company's diversified market presence.

BayWa's global reach extends across Europe, North America, and Asia-Pacific. The company's focus on digital transformation enhances operations and customer engagement. This strategic approach enables more efficient operations and strengthens customer engagement.

BayWa's financial performance in 2023, with earnings before interest and taxes (EBIT) of EUR 304.1 million, demonstrates solid financial health despite market challenges. The increasing contribution from renewable energies highlights a strategic shift toward sustainable and high-growth areas.

- The agricultural segment remains a cornerstone of BayWa's business.

- Renewable energy is a key area of growth.

- Digital transformation enhances operational efficiency.

- Global presence strengthens market position.

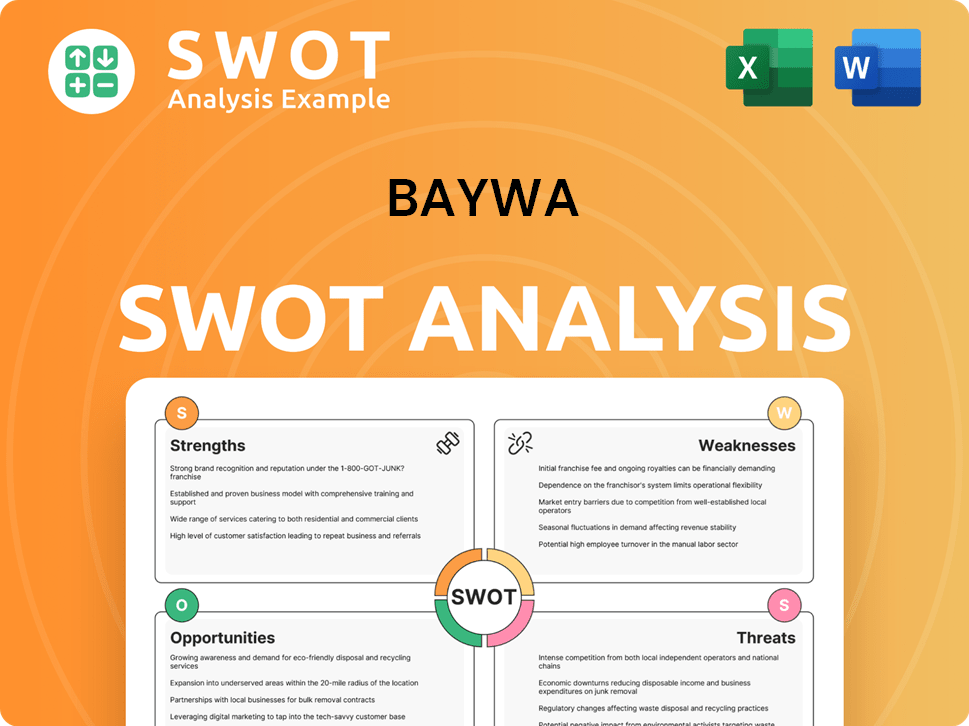

BayWa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BayWa?

Understanding the BayWa competitive landscape requires a deep dive into its diverse business segments: agriculture, energy, and building materials. The company faces a range of rivals, from global giants to regional specialists, each vying for market share. Analyzing these competitors provides insights into BayWa's business strategy and its position within the BayWa industry.

BayWa AG navigates a complex competitive environment. Its ability to adapt and innovate is crucial for maintaining its market position. This analysis aims to provide a clear picture of the key players challenging BayWa across its core business areas.

The competitive dynamics vary significantly across BayWa's operational segments. Each sector presents unique challenges and opportunities, requiring tailored strategies to succeed. This assessment will highlight the major competitors and their impact on BayWa's market analysis.

In the agricultural sector, BayWa competes with large agricultural cooperatives and international trading houses. These rivals have extensive supply chains and global networks. For example, Archer Daniels Midland (ADM) and Bunge Limited are major players.

The renewable energy sector sees BayWa r.e. facing off against major project developers and independent power producers (IPPs). Companies like Enel Green Power and Ørsted are significant competitors. These companies often have substantial financial backing.

Within the building materials segment, BayWa competes with national and regional building material retailers. Saint-Gobain and Heidelberg Materials are key rivals. Competition is influenced by regional economic conditions.

Emerging digital platforms for agricultural services, energy management, and building materials distribution also pose indirect competition. These platforms push BayWa to enhance its digital offerings. Innovation is key to staying competitive.

BayWa's competitive advantages include its diversified business model and strong presence in key markets. Its ability to offer integrated solutions and adapt to market changes is crucial. Strategic partnerships also play a vital role.

Market dynamics are continuously evolving due to technological advancements and policy changes. The renewable energy sector, in particular, sees rapid innovation. Adaptation is key to maintaining a competitive edge.

BayWa's main competitors in renewable energy include Enel Green Power, which had a total installed capacity of approximately 59 GW worldwide as of 2024. Ørsted, another major player, focuses on offshore wind and had a capacity of around 17.5 GW in 2024. These companies leverage their financial strength and large project portfolios to compete for new projects. In the agricultural sector, ADM and Bunge utilize their extensive global networks and grain origination capabilities, with ADM reporting revenues of over $94 billion in 2024, and Bunge reporting revenues of over $60 billion in the same year. These companies use their scale to exert pricing pressure and offer integrated services.

- ADM: With a vast global network, ADM's strategy focuses on grain origination, processing, and trading. In 2024, ADM's net earnings were approximately $3.9 billion.

- Bunge: Bunge emphasizes its global supply chain and trading capabilities. Bunge's adjusted EBITDA for 2024 was around $3.5 billion.

- Enel Green Power: Enel Green Power's strategy centers on large-scale renewable energy projects. Enel's total installed renewable capacity reached about 59 GW by the end of 2024.

- Ørsted: Ørsted specializes in offshore wind and other renewable energy projects. Ørsted's operating profit (EBITDA) for 2024 was approximately $4.6 billion.

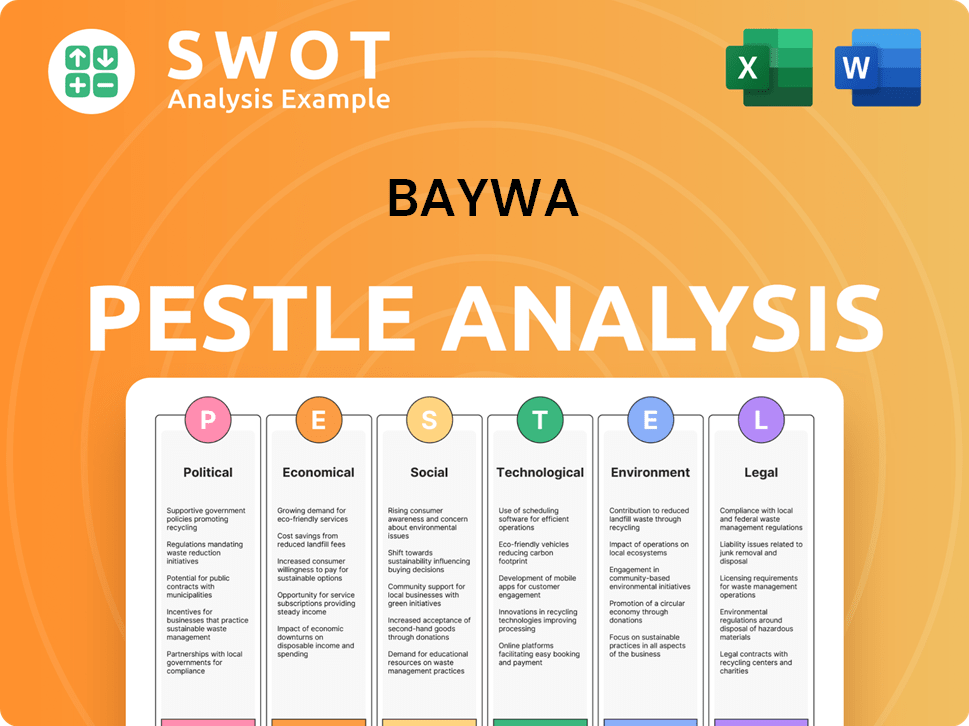

BayWa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BayWa a Competitive Edge Over Its Rivals?

Understanding the Marketing Strategy of BayWa requires an examination of its competitive advantages. BayWa AG's strengths lie in its diversified business model, extensive logistical network, and strong regional presence, particularly in agriculture and building materials. Its long-standing relationships with customers and integrated service offerings create a comprehensive ecosystem, enhancing customer loyalty and market understanding.

In the renewable energy sector, BayWa r.e. excels through its end-to-end expertise in project development, financing, construction, and operation of wind and solar plants. This integrated approach allows for greater control over project quality and efficiency. BayWa's strategic focus on digital innovation across all segments provides a growing competitive edge, enhancing operational efficiency and opening new revenue streams.

BayWa's robust supply chain and logistics infrastructure enable efficient distribution of goods, ensuring timely delivery and cost-effectiveness. These advantages, combined with a strong brand reputation and a commitment to sustainability, collectively reinforce BayWa's market position and differentiate it from rivals, making it resilient against market fluctuations and competitive pressures. For example, BayWa r.e. had a pipeline of 3.2 GW in 2023, underscoring its capacity in delivering large-scale renewable energy solutions.

BayWa AG operates across multiple sectors, including agriculture, building materials, and renewable energy, reducing its reliance on any single market. This diversification provides stability and resilience against economic downturns in specific industries. Its diverse portfolio enables it to capture opportunities across various markets, enhancing its overall financial performance.

BayWa provides comprehensive services that span from supplying essential agricultural inputs to offering expert advice and digital solutions. This integrated approach creates a complete ecosystem for its clients, fostering customer loyalty and repeat business. The ability to offer a one-stop-shop experience differentiates BayWa from competitors and enhances customer satisfaction.

BayWa has a strong presence in key regions, particularly in Germany and other European countries, which allows it to understand local market dynamics. This regional focus enables the company to tailor its products and services to meet specific customer needs. Its established regional networks provide a competitive advantage in terms of market access and distribution.

BayWa r.e. possesses end-to-end expertise in the renewable energy sector, covering project development, financing, construction, and operation. This integrated approach ensures greater control over project quality and efficiency. This comprehensive capability allows BayWa to manage projects from start to finish, providing a significant competitive edge in the renewable energy market.

BayWa's competitive edge is built on several key factors, including its diversified business model, strong regional presence, and integrated service offerings. The company's long-standing relationships with customers and its end-to-end expertise in renewable energy further enhance its market position. These advantages collectively contribute to BayWa's resilience and ability to compete effectively.

- Diversified Business Model: Operating across agriculture, building materials, and renewable energy.

- Integrated Service Offerings: Providing comprehensive solutions from inputs to expert advice.

- End-to-End Renewable Energy Expertise: Covering project development, financing, and operation.

- Strong Regional Presence: Focusing on key regions to understand local market dynamics.

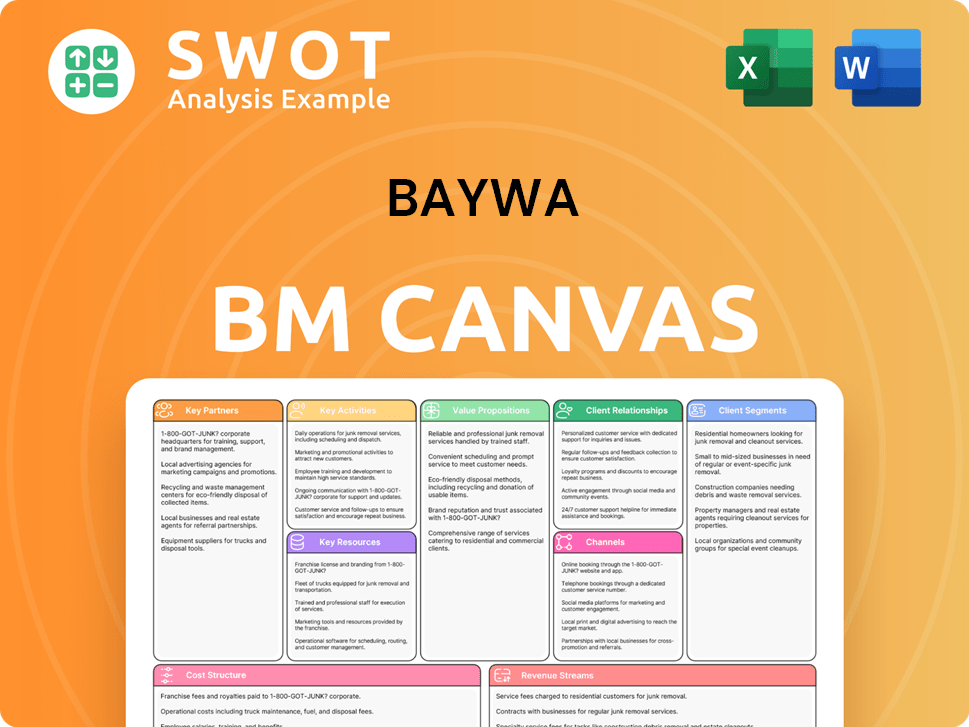

BayWa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BayWa’s Competitive Landscape?

The BayWa competitive landscape is influenced by significant industry trends, presenting both challenges and opportunities. The company's strategic positioning is crucial in navigating these shifts. This analysis considers digital transformation, sustainability efforts, and the impact of geopolitical and economic uncertainties on BayWa AG.

BayWa's market analysis reveals a need for agility in response to evolving market dynamics. The company's ability to adapt to digital advancements, capitalize on sustainability trends, and mitigate risks from external factors will determine its future success. Understanding these factors is critical for evaluating BayWa's business strategy and its competitive position.

Digital transformation is reshaping the agricultural, energy, and construction sectors. In agriculture, precision farming and e-commerce are growing. In energy, smart grids and decentralized systems are becoming more common. The construction sector is seeing the adoption of digital planning tools. Failure to adapt to these changes could negatively impact BayWa's competitive landscape.

There is an increasing global emphasis on sustainability and decarbonization. This presents opportunities for BayWa's renewable energy segment, BayWa r.e. Demand for renewable energy, green building materials, and sustainable practices in agriculture is rising. However, intense competition and regulatory complexities pose challenges.

Geopolitical uncertainties, supply chain disruptions, and commodity price fluctuations pose risks. The agricultural sector is particularly sensitive to weather and trade policies. BayWa must manage these risks to maintain profitability across all segments. Strategic planning and diversification are essential for navigating these challenges.

Opportunities include expanding into emerging markets and developing innovative product lines. Advanced biofuels and circular economy solutions in building materials offer potential. Strategic partnerships can leverage new technologies and market access. These initiatives can enhance BayWa's growth prospects and competitive position. For more details, see the Growth Strategy of BayWa.

BayWa is investing in digitalization and expanding its renewable energy portfolio to maintain its competitive edge. These investments are crucial for adapting to industry changes and fostering growth. The company's focus on renewable energy, such as wind and solar projects, positions it well to capitalize on the growing demand for sustainable energy solutions.

- BayWa's renewable energy segment, BayWa r.e., is a key player in wind and solar project development.

- The company is focusing on digital tools for planning and procurement in the building materials sector.

- BayWa is expanding its presence in the agricultural sector through precision farming and e-commerce platforms.

- Strategic partnerships are being formed to leverage new technologies and market access.

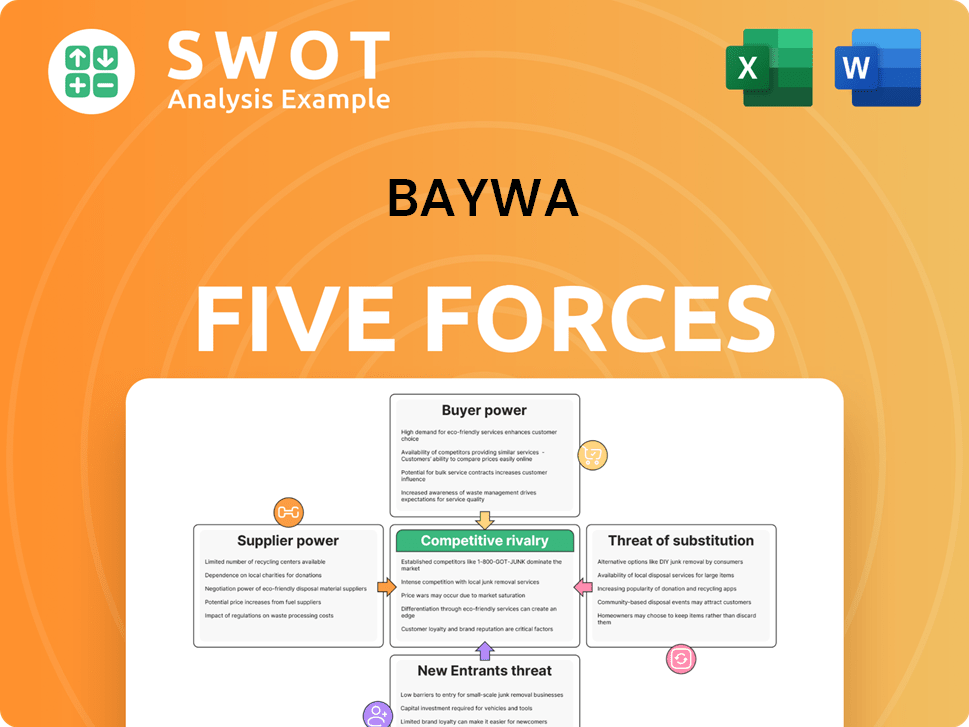

BayWa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BayWa Company?

- What is Growth Strategy and Future Prospects of BayWa Company?

- How Does BayWa Company Work?

- What is Sales and Marketing Strategy of BayWa Company?

- What is Brief History of BayWa Company?

- Who Owns BayWa Company?

- What is Customer Demographics and Target Market of BayWa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.