BayWa Bundle

Can BayWa's 'Strategy 2030' Redefine Its Future?

BayWa AG, a global powerhouse in agriculture, energy, and building materials, is embarking on a transformative journey. This strategic shift, formalized in May 2025, aims to boost profitability and streamline operations. From its origins in 1923, BayWa has evolved significantly, and this analysis explores its ambitious plans for future growth.

This deep dive into BayWa SWOT Analysis will dissect the company's 'Strategy 2030,' examining its BayWa growth strategy and the potential impact on its BayWa future prospects. We'll analyze BayWa's business model, market position, and financial performance, providing crucial insights into its international expansion plans and the competitive landscape analysis. Furthermore, the analysis will explore BayWa's renewable energy strategy, digital transformation strategy, and sustainability initiatives, offering a comprehensive understanding of its long-term growth potential and investment opportunities.

How Is BayWa Expanding Its Reach?

The expansion initiatives of the company are primarily focused on strengthening its core segments and divesting non-profitable areas, as outlined in its 'Strategy 2030.' This strategy emphasizes growth within the Renewable Energies Segment and optimization across its agricultural and building materials business units. The company's strategic direction includes a significant push into international markets, particularly within the renewable energy sector.

A core element of the company's growth strategy involves channeling proceeds from the sale of its solar trading business, expected to conclude in 2025, into debt reduction and the core business of BayWa r.e. AG. These funds will specifically support the expansion of wind and solar project pipelines, the Independent Power Producer (IPP) portfolio, and the growth of Energy Solutions and Services. This strategic financial allocation underscores the company's commitment to sustainable energy solutions and its long-term growth potential.

The company's international expansion plans are centered on markets with lower economic risks and promising growth opportunities, aiming to realize projects exceeding 2 GW per year. This global approach, combined with strategic financial management, positions the company for sustained growth and market leadership in the renewable energy sector. For a deeper understanding, you can explore the Brief History of BayWa.

The company aims to triple the capacity of its wind and solar project portfolio by the end of 2026, compared to 2023. In 2023, BayWa r.e. had 0.8 GW of operational wind and solar parks in Europe, North America, and Australia, with an additional 0.5 GW under construction or about to start. This aggressive expansion highlights the company's commitment to increasing its market share in renewable energy projects.

The company is undergoing a thorough review of its over 500 group companies to identify growth opportunities and businesses to divest. The sale of its stake in Austrian Raiffeisen Ware Austria AG (RWA AG) in May 2025 for €176 million is expected to reduce the company's bank liabilities by approximately €500 million. These strategic financial moves support the company's long-term financial performance.

The company continues to expand internationally, focusing on markets with favorable conditions. In 2024, BayWa r.e. completed the 43.2 MW Broken Cross Wind Farm in South Lanarkshire. The company is also expanding in Japan with key milestones in sustainable energy solutions. In the U.S., BayWa r.e. completed the sale of a solar portfolio delivering 517 MWDC of renewable energy, significantly increasing capacity on the U.S. grid by 2025.

The company aims to expand its Independent Power Producer (IPP) portfolio to over 1 GW after optimization starting in 2026. This strategic focus on IPP projects is a key element of the company's renewable energy strategy, contributing to its long-term growth potential and market position. This move will enhance its revenue growth forecast.

The company's expansion initiatives are multifaceted, focusing on renewable energy, strategic investments, and international growth. These efforts are designed to enhance the company's market position and financial performance.

- Tripling the capacity of its wind and solar project portfolio by the end of 2026.

- Expanding the Independent Power Producer (IPP) portfolio to over 1 GW after optimization starting in 2026.

- Focusing on markets with lower economic risks and growth opportunities.

- Completing strategic divestitures, such as the sale of its stake in RWA AG.

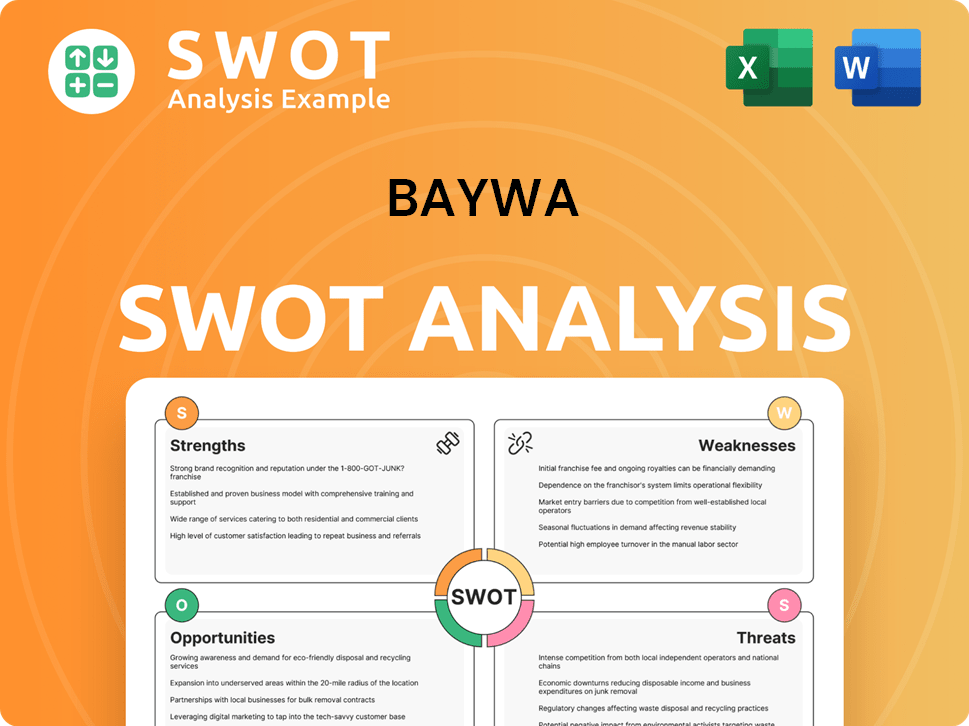

BayWa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BayWa Invest in Innovation?

The innovation and technology strategy of the company is central to its sustained growth, particularly in renewable energies and digital transformation. The company's subsidiary, BayWa r.e., spearheads these efforts. This strategic focus is designed to enhance efficiency, expand market reach, and solidify its position in the competitive landscape.

The company's approach involves integrating cutting-edge technologies across its operations, with a strong emphasis on sustainability. This commitment is reflected in its investments in renewable energy projects, digital solutions, and sustainable practices. This approach is vital for navigating the challenges and capitalizing on the opportunities within the dynamic energy sector.

The company's growth strategy is closely tied to its ability to adapt and innovate. Through strategic partnerships and investments in new technologies, the company aims to maintain its competitive edge and drive long-term value creation. This proactive stance is crucial for ensuring the company's future prospects in a rapidly evolving market.

The company's renewable energy subsidiary, BayWa r.e., is a key driver of its growth strategy. In 2024, the company focused on advancing hybrid project developments, such as the Scurf Dyke Solar Farm, which included the installation of a co-located battery storage system. This demonstrates the company's commitment to innovation in renewable energy solutions.

The company emphasizes digital innovation across its operations to enhance efficiency and performance. The launch of Ampero in March 2024, a FinTech company using AI for portfolio management of wind and solar plants, exemplifies this commitment. The company also partners with 3E to use SynaptiQ for PV monitoring and analytics.

Sustainability is deeply embedded in the company's innovation strategy. Since 2020, BayWa r.e. has operated with 100% green electricity. The company's Sustainability Framework 2025 guides its efforts to go 'beyond carbon.' The company is aiming for climate neutrality (Scope 1 and 2 greenhouse gas emissions) by 2030.

In 2025, the company plans to continue its focus on hybrid project developments and PV repowering efforts. This includes deepening partnerships and expanding its portfolio. These initiatives are crucial for enhancing the company's market position and driving revenue growth.

In 2024, the company shifted from a carbon compensation approach to a climate contribution approach. This involves actively investing in internal and external actions to enhance its holistic sustainability impact. This includes continuous identification of emission reduction potentials and implementation of reduction projects.

The company introduced an internal CO2 price of €50 per tonne of CO2 at the beginning of 2023. This initiative is designed to encourage emission reductions across its operations. The company aims to invest an additional €19 million in climate change mitigation by 2025.

The company's innovation and technology strategy is multifaceted, focusing on renewable energy projects, digital transformation, and sustainability. These initiatives are designed to drive the company's long-term growth potential and enhance its competitive position. For a deeper understanding of the competitive environment, explore the Competitors Landscape of BayWa.

- Hybrid Project Developments: Continuing to develop hybrid projects, such as solar farms with integrated battery storage, to enhance efficiency and expand renewable energy capacity.

- Digital Solutions: Utilizing AI-driven FinTech solutions like Ampero for portfolio management and advanced analytics systems like SynaptiQ for asset management.

- Sustainability Framework: Implementing the Sustainability Framework 2025, focusing on climate contribution and emission reduction projects, to achieve climate neutrality by 2030.

- Strategic Partnerships: Deepening partnerships within the renewable energy sector to expand its portfolio and market reach.

- Internal CO2 Pricing: Applying an internal CO2 price of €50 per tonne of CO2 to encourage emission reductions and invest in climate change mitigation.

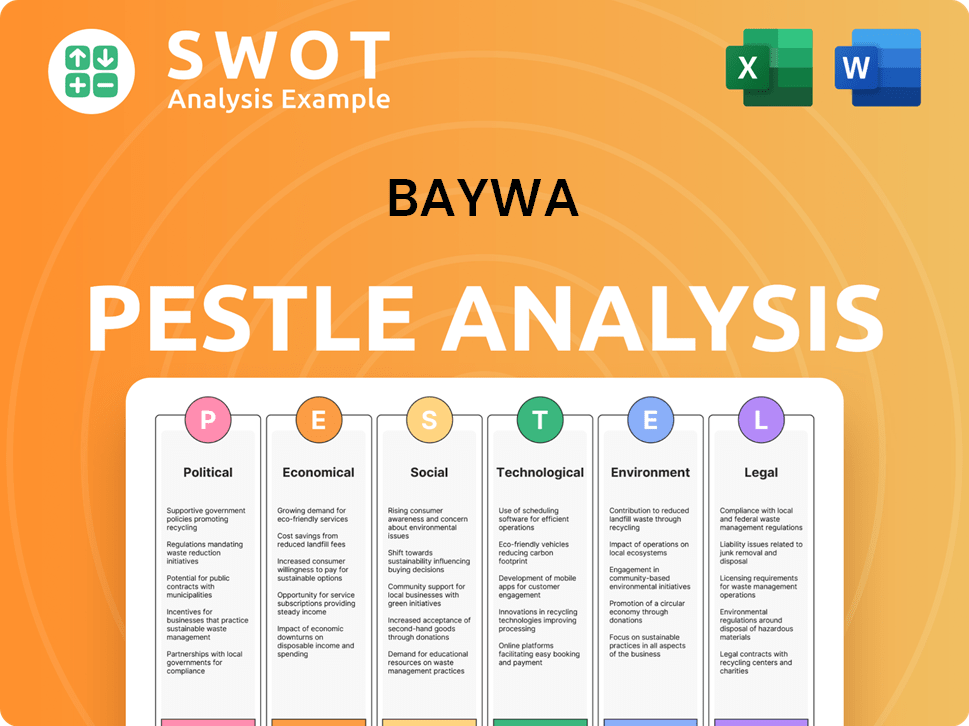

BayWa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BayWa’s Growth Forecast?

The financial outlook for BayWa AG is currently shaped by a significant restructuring effort aimed at improving profitability and solidifying its financial standing. The company's BayWa growth strategy involves several key initiatives, including a capital increase and asset sales, to strengthen its financial position. These measures are crucial for navigating the current market conditions and achieving its long-term goals.

In 2023, BayWa faced a challenging year, with consolidated revenues decreasing and a net loss reported. However, the company's focus on restructuring and strategic adjustments indicates a proactive approach to address these financial challenges. The BayWa company analysis reveals a commitment to adapting its business model and improving efficiency to ensure future success.

The company's commitment to BayWa future prospects is evident through its strategic initiatives and financial targets. The restructuring plan, including the capital increase and asset sales, is designed to improve the company's financial health and support its growth objectives. The focus on renewable energy and agricultural solutions highlights the company's adaptability to market trends and its commitment to sustainable practices.

In 2023, BayWa's consolidated revenues were €23.9 billion, a decrease from €27.1 billion in 2022. Operating earnings before interest and tax (EBIT) were €304.0 million, falling short of the forecast. The company reported a consolidated net loss of €93.4 million, a significant drop from a net profit of €239.5 million the previous year.

BayWa aims for an EBIT between €470 million and €520 million by the end of 2026. For 2024, the confirmed EBIT guidance is between €365 million and €385 million. However, due to ongoing restructuring, a full-year earnings forecast was not possible as of October 2024. The company is implementing a €150 million capital increase expected to be finalized in the first quarter of 2025.

Revenues for the first six months of 2024 were €10.7 billion, down from €12.6 billion in the previous year. EBIT before impairment tests was €0.0 million. Impairment losses totaled €222.2 million, primarily in the Renewable Energies Segment.

For the first nine months of 2024, revenues were €16.0 billion, and EBIT was minus €77.6 million without impairment, increasing to minus €299.8 million with impairment losses. The consolidated net loss for the first nine months of 2024 was €640.8 million.

The sale of its stake in RWA Raiffeisen Ware Austria AG, completed in May 2025 for €176 million, will reduce BayWa Group's bank liabilities by approximately €500 million. BayWa aims to move its equity ratio towards 20% in the medium term. The company's transformation is on track and expected to be completed by 2028. For more insights into the company's core values, check out Mission, Vision & Core Values of BayWa.

A €150 million capital increase is underway, backed by major shareholders, expected to be finalized in the first quarter of 2025. This is part of an updated financing concept and restructuring agreement extending until 2028. This move is crucial for the BayWa business model.

The sale of the stake in RWA Raiffeisen Ware Austria AG for €176 million will reduce bank liabilities by approximately €500 million. This strategic move supports the company's efforts to improve its BayWa market position.

BayWa aims to increase its equity ratio towards 20% in the medium term. This is a key financial goal that reflects the company's commitment to financial stability and long-term sustainability. This will influence the BayWa financial performance.

The company's transformation is on track and expected to be completed by 2028. This timeline underscores the company's long-term vision and its dedication to achieving its strategic goals. The BayWa renewable energy strategy is a key part of this.

Impairment losses significantly impacted the financial results, particularly in the Renewable Energies Segment. These losses highlight the challenges and the need for strategic adjustments within the company's portfolio. This affects the BayWa agricultural solutions growth.

While revenues decreased in the first half of 2024, the company is focused on improving EBIT. The financial performance in the first nine months of 2024 reflects the ongoing impact of restructuring and impairment losses. The BayWa international expansion plans are key to this.

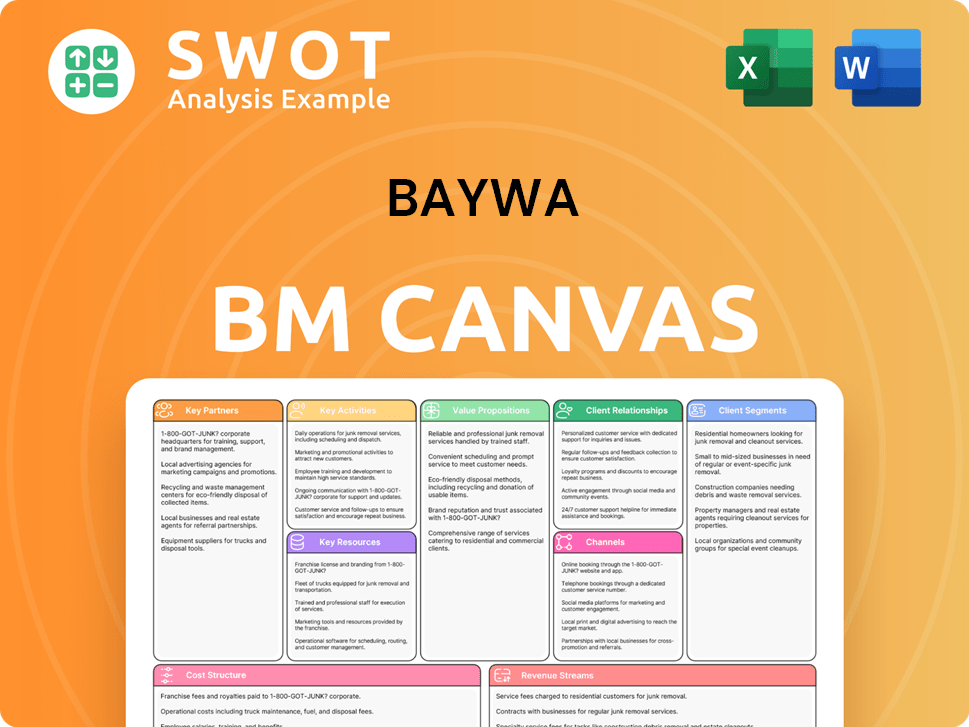

BayWa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BayWa’s Growth?

The company faces several potential risks and obstacles that could hinder its BayWa growth strategy, especially during its restructuring phase. These challenges include macroeconomic conditions, market competition, and supply chain vulnerabilities. The ability to navigate these issues will be crucial for determining the BayWa future prospects.

The macroeconomic environment, significantly altered in 2023, has negatively affected the company's financial performance. Rising interest rates have put pressure on earnings across all business divisions, and market competition and price volatility pose significant challenges. Addressing these risks is essential for the BayWa company analysis to identify its strengths and weaknesses.

Internal resource constraints and the need for cost reduction also present obstacles. The company's 'Strategy 2030' aims to address these issues through restructuring and optimization. Successfully implementing these measures is vital for the long-term sustainability and growth of the company.

The macroeconomic environment massively changed in 2023, leading to a consolidated net loss of €93.4 million. Rising interest rates have negatively impacted all business divisions, putting pressure on earnings. These conditions create significant challenges for the company's financial performance.

Market competition and price volatility are notable obstacles, especially in the Renewable Energies Segment. The solar trading business struggled with overcapacity and declining module prices. Lower revenues in energy trading also negatively impacted the segment's EBIT.

The Renewable Energies Segment recorded a loss of €164.8 million for the first nine months of 2024. The Energy Segment saw declines in revenues and EBIT due to consumer reluctance and a mild winter. The Building Materials Segment faced a drastic drop in demand, with revenues falling by 20.8% in the first quarter of 2025.

Supply chain vulnerabilities and internal resource constraints are being addressed through the 'Strategy 2030'. The company is undertaking a review of its group companies to identify areas for optimization and divestment. This aims to ensure each entity is profitable.

Personnel measures, including the reduction of around 700 jobs, and site closures are being implemented to achieve a leaner cost structure. Restructuring proceedings under StaRUG are underway to ensure the process proceeds without disruption. The restructuring process is expected to be completed by the end of 2028.

The drastic slump in German residential construction led to a huge drop in demand in the Building Materials Segment. The Energy Segment also experienced a decline in revenues and EBIT in the first half of 2024. These segment-specific challenges highlight the need for strategic adjustments.

The company is focusing on increasing profitability and reducing costs across all business divisions and administrative units. Personnel measures, including the reduction of around 700 jobs, are being implemented. Site closures, particularly in the Building Materials Segment, are also part of this strategy.

BayWa has initiated restructuring proceedings under the German Act on the Stabilization and Restructuring Framework for Companies (StaRUG). These proceedings aim to ensure the planned restructuring proceeds without disruption, especially to include dissenting creditors. Daily operations, customers, suppliers, and employees are not affected.

BayWa is undertaking a thorough review of its over 500 group companies to identify areas for optimization and divestment. This strategy aims to ensure each entity is profitable. The focus is on increasing profitability and reducing costs across all divisions.

The macroeconomic environment, particularly rising interest rates, has negatively impacted all business divisions. The Renewable Energies Segment recorded a loss of €164.8 million for the first nine months of 2024. The Building Materials Segment saw revenues fall by 20.8% in the first quarter of 2025.

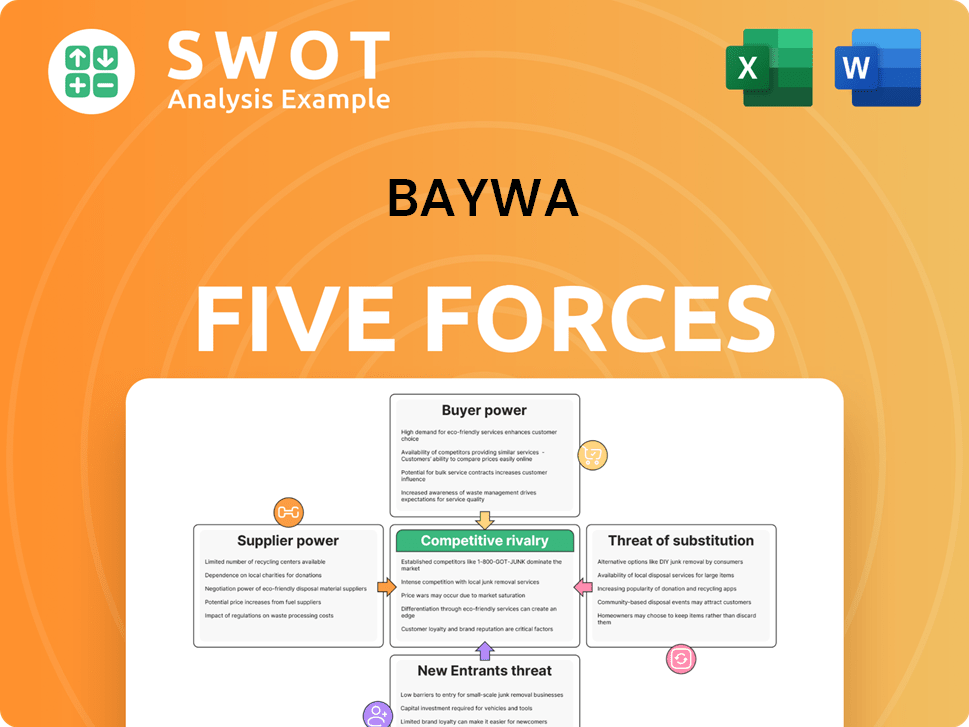

BayWa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BayWa Company?

- What is Competitive Landscape of BayWa Company?

- How Does BayWa Company Work?

- What is Sales and Marketing Strategy of BayWa Company?

- What is Brief History of BayWa Company?

- Who Owns BayWa Company?

- What is Customer Demographics and Target Market of BayWa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.