BayWa Bundle

Who Truly Owns BayWa?

Unraveling the ownership of a company is key to understanding its strategic direction and future prospects. BayWa AG, a global powerhouse in agriculture, energy, and building materials, boasts a fascinating ownership structure that has evolved significantly since its inception in 1923. Understanding who owns BayWa is crucial for investors and stakeholders alike.

From its roots as a cooperative supporting Bavarian agriculture to its current status as a diversified global player, BayWa's ownership structure reflects its rich BayWa SWOT Analysis and strategic growth. This article explores the intricate details of BayWa's ownership, examining its shareholders, key stakeholders, and the impact of these relationships on its operations and long-term goals. Discover the answers to questions like: Who owns BayWa and how does this influence its decisions?

Who Founded BayWa?

The origins of the BayWa company trace back to 1923, stemming from the cooperative movement in Bavaria. Unlike modern corporations with easily identifiable founders and initial equity structures, the early BayWa ownership was deeply intertwined with the agricultural cooperative system. The company was established with the goal of supporting the agricultural community.

Who owns BayWa is a question rooted in its cooperative beginnings. The initial ownership was distributed among numerous agricultural cooperatives, rather than concentrated in a few individuals. This structure was designed to serve the collective interests of the Bavarian agricultural community, fostering mutual support and economic empowerment for farmers.

Early backing for BayWa AG came from the member cooperatives themselves, who contributed capital to establish the central trading and service organization. This cooperative model emphasized member participation and democratic control, with voting rights often linked to cooperative membership.

The initial ownership structure of the company was based on the cooperative model.

Member cooperatives had a significant role in the company's governance.

Voting rights were primarily linked to cooperative membership.

The company served as a central entity for agricultural supplies and marketing.

Over time, the company evolved into a stock corporation, but retained its cooperative influences.

The shareholder base and governance were influenced by the original cooperative interests.

Understanding the early BayWa history is crucial to grasping its current structure. The company's foundation in the cooperative system shaped its initial ownership, emphasizing collective interests over individual ownership. The shift to a stock corporation did not fully erase this cooperative influence, which continues to affect the company's shareholder base and governance. For more insights, you can explore the Growth Strategy of BayWa.

- BayWa's early ownership was rooted in the agricultural cooperative system.

- Ownership was initially dispersed among numerous agricultural cooperatives.

- The cooperative model emphasized member participation and democratic control.

- The company evolved into a stock corporation while retaining cooperative influences.

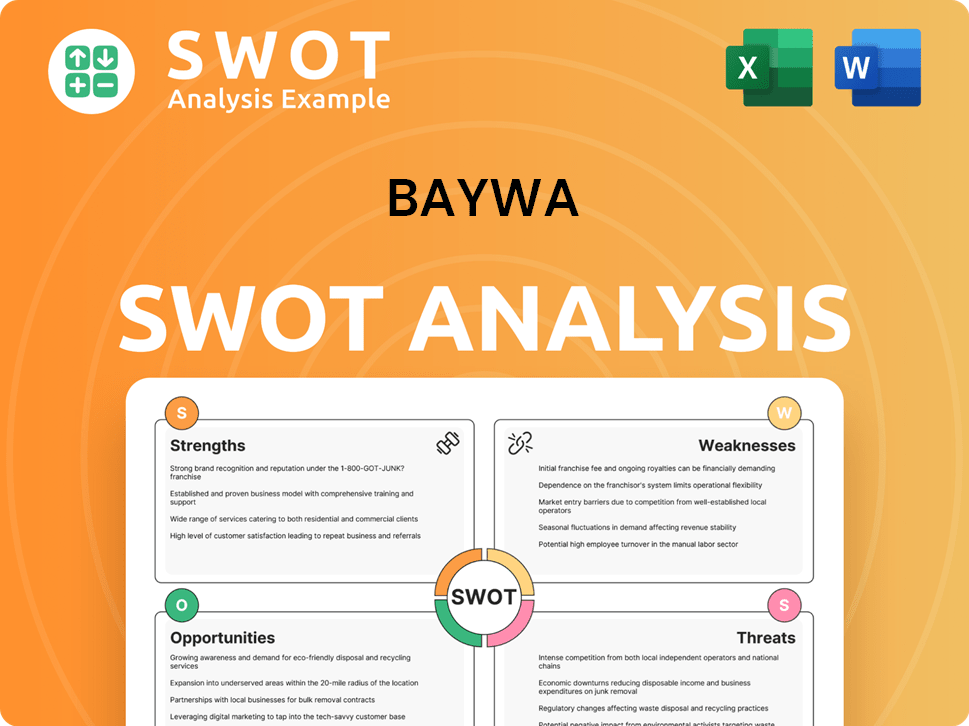

BayWa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BayWa’s Ownership Changed Over Time?

The evolution of BayWa's ownership reflects its journey from a cooperative to a publicly listed company. Initially rooted in agricultural cooperatives, the company's structure has adapted to include public and institutional investors. This transformation has allowed BayWa to expand its operations and diversify its business interests, particularly in renewable energy and digital solutions. This strategic shift has been crucial for the company's growth and its ability to adapt to changing market dynamics. The Growth Strategy of BayWa has been significantly influenced by these ownership changes.

The listing on the stock exchange was a pivotal moment, enabling BayWa to access capital markets and broaden its investor base. However, the company has maintained strong ties to its cooperative origins through strategic shareholders. This blend of cooperative and public ownership has provided a balance between long-term strategic vision and the demands of the capital markets. This structure has supported BayWa's commitment to its core values while fostering innovation and expansion.

| Ownership Evolution | Key Events | Impact |

|---|---|---|

| Cooperative Foundation (1923) | Establishment as a cooperative | Focused on agricultural services and supply. |

| Initial Public Offering (IPO) | Listing on the stock exchange | Access to broader capital markets, increased investor base. |

| Strategic Partnerships | Formation of alliances and joint ventures | Expansion into new markets and technologies, especially in renewable energy. |

The major stakeholders in BayWa include entities with strong ties to the cooperative sector, such as Bayerische Raiffeisen-Beteiligungs AG (BRB), which holds a significant stake. Other key shareholders include RWG Raiffeisen Warengenossenschaften and Raiffeisen Agrar Invest AG. Additionally, ZMP Beteiligungsgesellschaft mbH holds a substantial share. The free float, representing shares held by various institutional and individual investors, makes up a considerable portion of the ownership structure. These stakeholders play a crucial role in shaping the company's strategic direction and ensuring its long-term stability. As of the latest available information, BRB holds approximately 34.00% of BayWa AG's shares, RWG Raiffeisen Warengenossenschaften holds 3.90%, Raiffeisen Agrar Invest AG holds approximately 2.90%, and ZMP Beteiligungsgesellschaft mbH holds about 26.50%, while the free float accounts for approximately 32.70%.

BayWa's ownership structure is a blend of cooperative and public shareholders.

- Bayerische Raiffeisen-Beteiligungs AG (BRB) is a major stakeholder, representing Bavarian cooperatives.

- The company's evolution includes a transition from a cooperative to a publicly listed entity.

- The free float accounts for a significant portion of the shares.

- This structure supports both long-term strategic vision and capital market demands.

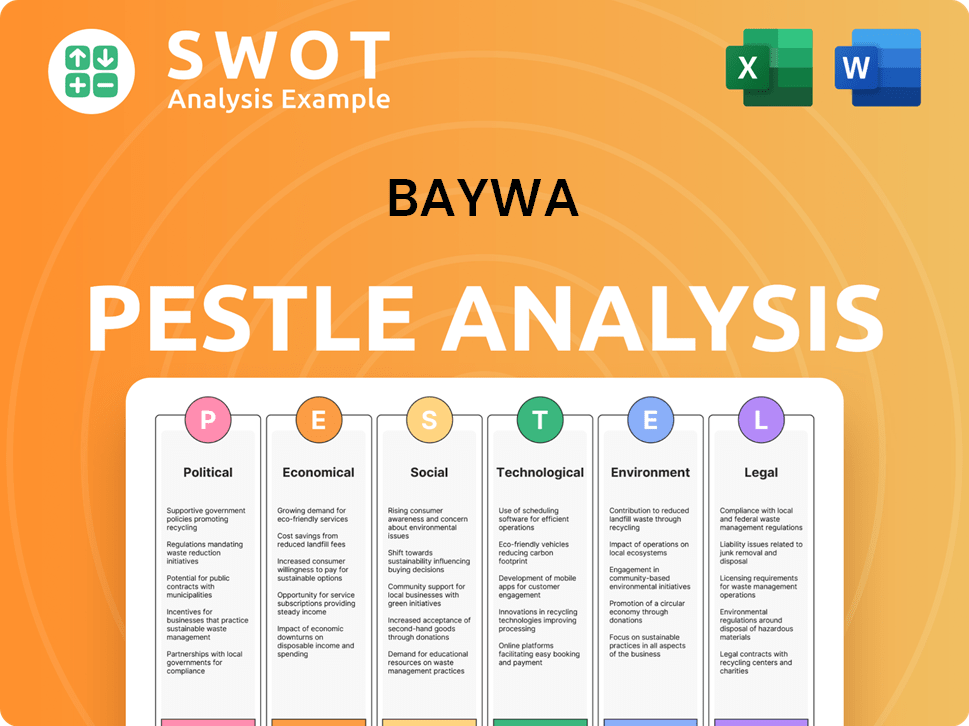

BayWa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BayWa’s Board?

The Board of Directors (Aufsichtsrat) of the BayWa company, also known as BayWa AG, is responsible for overseeing the company's management and representing shareholder interests. The composition of the Supervisory Board reflects the major ownership stakes, alongside independent members and employee representatives as mandated by German corporate law. Understanding the structure of Who owns BayWa is crucial for grasping the company's governance.

The Supervisory Board includes members who represent the interests of major shareholders, ensuring their perspectives are considered in strategic decisions. This structure helps maintain a balance between different stakeholder groups, which is vital for the long-term success of the BayWa company. For more insights into the BayWa ownership and its impact on the company, further research into the shareholder structure is recommended.

| Board Member | Role | Representative of |

|---|---|---|

| Klaus Josef Lutz | Chairman | Bayerische Raiffeisen-Beteiligungs AG (BRB) |

| Roland Zeller | Deputy Chairman | Employee Representative |

| Dr. Reinhard Bauer | Member | BRB |

The voting structure of BayWa AG generally follows the 'one-share-one-vote' principle for ordinary shares. However, the influence of major shareholders, such as Bayerische Raiffeisen-Beteiligungs AG (BRB) and ZMP Beteiligungsgesellschaft mbH, is significant due to their substantial holdings. These large blockholders can exert considerable influence on resolutions proposed at the Annual General Meeting, including the election of Supervisory Board members and key strategic decisions. The BayWa shareholders thus play a crucial role in shaping the company's direction.

BayWa's Supervisory Board oversees management and represents shareholder interests, reflecting major ownership stakes and employee representatives.

- Major shareholders, like BRB, have significant influence due to their substantial holdings.

- The voting structure generally adheres to the 'one-share-one-vote' principle.

- The cooperative-affiliated entities hold strong collective voting power.

- There have been no significant proxy battles or activist investor campaigns in recent years.

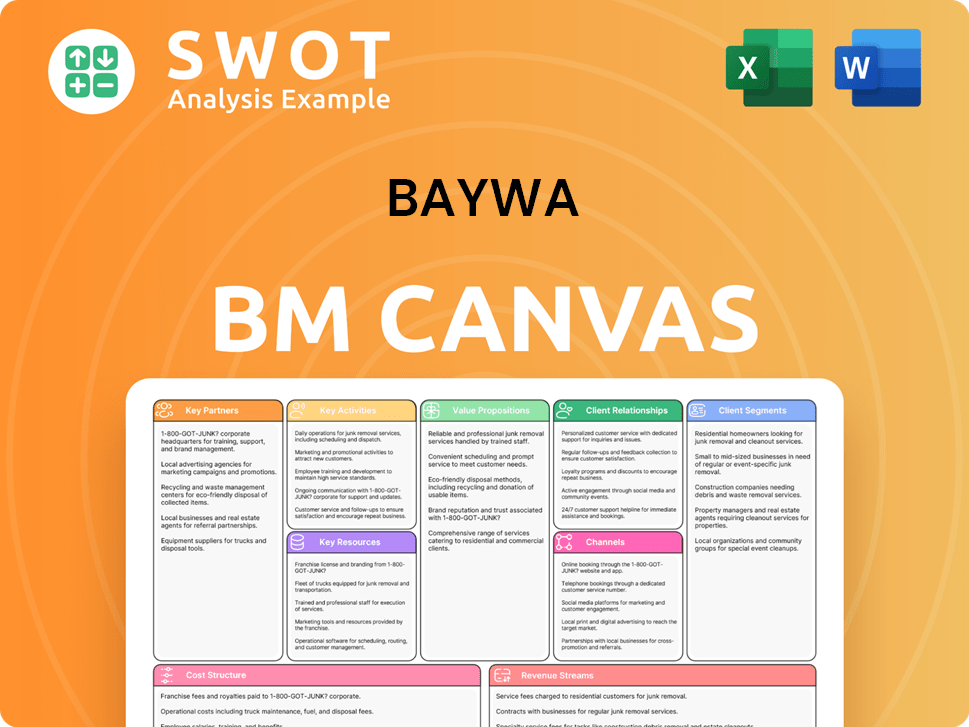

BayWa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BayWa’s Ownership Landscape?

Over the past few years, the ownership landscape of the BayWa company (BayWa AG) has remained relatively stable, with no major shifts in its core ownership structure. However, the company's strategic focus on renewable energies and digital innovation has likely attracted increased interest from institutional investors. The free float, currently around 32.70%, suggests a significant portion of shares are actively traded, allowing for shifts in the institutional investor base. This is a key aspect to consider when analyzing BayWa ownership.

Industry trends indicate a general increase in institutional ownership across various sectors, driven by the growth of passive funds and ESG (Environmental, Social, and Governance) investing. For BayWa, this could mean a gradual increase in the proportion of shares held by large asset managers and sustainability-oriented funds, even without changes in the dominant anchor shareholders. The company's consistent performance and strategic investments, particularly in the energy sector, make it an attractive proposition for long-term investors. Public statements from BayWa often highlight its growth trajectory and commitment to sustainable business practices, influencing investor sentiment and, consequently, the composition of its free float. To learn more about the company's approach, you can explore the Marketing Strategy of BayWa.

| Metric | Value | Notes |

|---|---|---|

| Free Float | ~32.70% | Approximate percentage of shares available for public trading. |

| Institutional Ownership Trend | Increasing | Reflects broader market trends towards ESG and passive investing. |

| Major Shareholders | Mostly stable | No significant changes in anchor shareholders in recent years. |

While there haven't been any explicit announcements of significant ownership changes, the company's continued expansion and potential for capital raises could lead to subtle shifts in its ownership profile over time. Understanding the BayWa shareholders and their interests is crucial for anyone looking into the BayWa company owner details.

The free float percentage is a key indicator of trading activity. Institutional investors are increasingly interested in sustainable businesses. The company's strategic investments drive investor interest.

Core ownership structure has remained relatively stable. No major changes in anchor shareholders. Consistent performance attracts long-term investors.

Potential capital raises could lead to subtle shifts. Expansion plans may influence ownership profiles. Monitoring institutional investor trends is important.

Commitment to sustainable practices influences sentiment. Growth trajectory is a key focus for investors. Public statements shape investor perceptions.

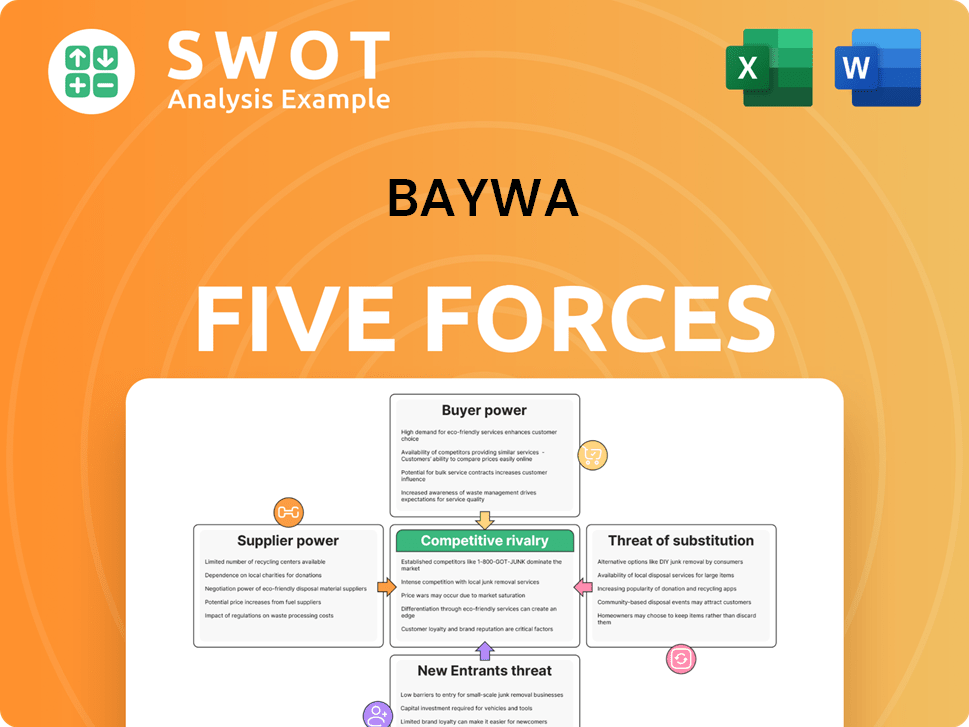

BayWa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BayWa Company?

- What is Competitive Landscape of BayWa Company?

- What is Growth Strategy and Future Prospects of BayWa Company?

- How Does BayWa Company Work?

- What is Sales and Marketing Strategy of BayWa Company?

- What is Brief History of BayWa Company?

- What is Customer Demographics and Target Market of BayWa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.