BayWa Bundle

How Well Do You Know BayWa?

BayWa AG, a global powerhouse, is a key player in agriculture, energy, and building materials. But how does this multifaceted BayWa SWOT Analysis company really work? Understanding its operations is critical for anyone looking to navigate these dynamic sectors. From its

This deep dive into

What Are the Key Operations Driving BayWa’s Success?

The core operations of the BayWa company are structured around three primary segments: Agriculture, Energy, and Building Materials. These segments collectively define the BayWa business model and contribute to its multifaceted value proposition. The company's integrated approach, leveraging its trading and logistics expertise, allows it to create unique synergies and deliver comprehensive solutions to its diverse customer base.

In Agriculture, BayWa AG provides a comprehensive range of products and services, including agricultural inputs, machinery, and digital farming solutions. The Energy segment, primarily driven by BayWa r.e., focuses on renewable energy project development, operation, and services. Building Materials supplies a wide array of construction materials, catering to both commercial and residential projects. This diversified approach allows BayWa to serve a broad market and mitigate risks associated with sector-specific fluctuations.

The company's value proposition lies in its ability to offer integrated solutions across these sectors, supported by robust supply chains and a strong global presence. This operational structure enables BayWa to meet the evolving needs of its customers while driving sustainable growth. Learn more about the company's origins in the Brief History of BayWa.

This segment offers agricultural inputs, machinery, and digital farming solutions. It serves farmers and agricultural businesses, supporting efficient and sustainable food production. Operational processes include global sourcing, advanced logistics, and a robust sales network.

Focuses on renewable energy project development, operation, and services, including solar, wind, and bioenergy. It serves utilities, investors, and commercial clients. This segment's strength lies in its global project development capabilities and technical expertise.

Supplies a wide array of construction materials, including raw materials and finishing products. It caters to both commercial and residential projects. Operational effectiveness is driven by efficient inventory management and localized distribution.

BayWa's integrated approach leverages trading and logistics expertise to create synergies. This allows the company to offer comprehensive solutions to its diverse customer base, differentiating it from more specialized competitors.

The operational strengths of BayWa include a global project development capability in the Energy segment, efficient inventory management in Building Materials, and a robust supply chain across all segments. These strengths contribute to the company's ability to deliver value to its customers and maintain a competitive edge.

- Global project development in renewable energy.

- Efficient inventory management in building materials.

- Robust supply chain and logistics network.

- Strong supplier relationships.

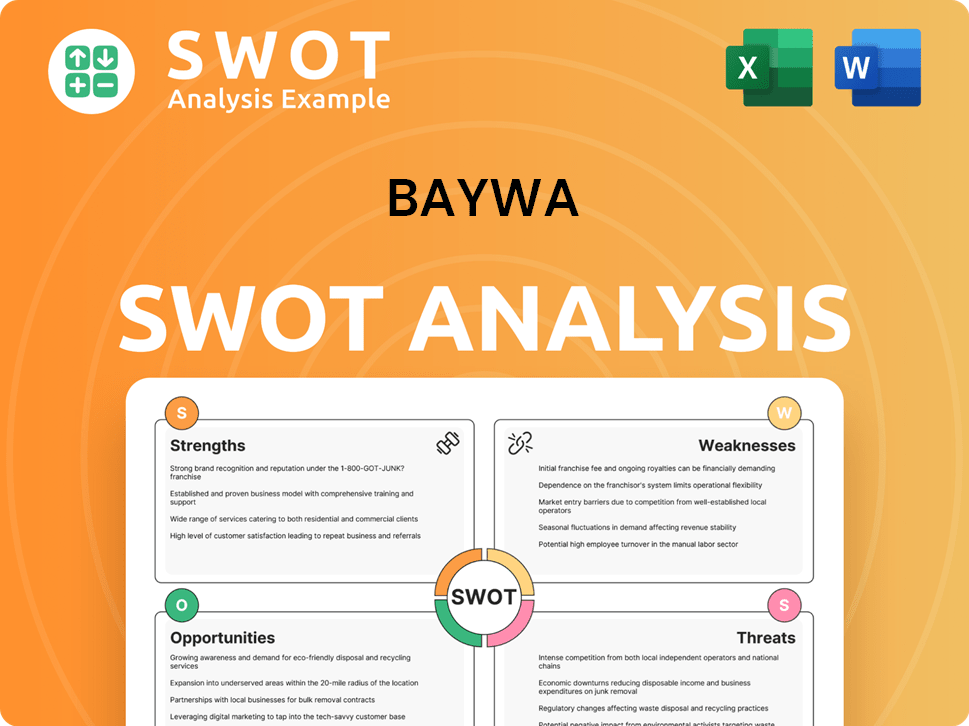

BayWa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BayWa Make Money?

The BayWa company generates revenue through a diversified set of streams across its core segments: Agriculture, Energy, and Building Materials. This approach allows for a robust financial model, with each segment contributing significantly to the overall revenue. The company's ability to adapt and expand its revenue streams is a key factor in its sustained performance.

The monetization strategies of BayWa AG include product sales, service fees, and recurring revenue models, especially in the renewable energy sector. This diversification helps to mitigate risks and ensure stable financial results. The company's focus on customer value through bundled services also supports its monetization efforts.

The geographical distribution of BayWa's business also plays a crucial role in its revenue generation. The company has a significant presence in Europe, North America, and Australia. This global footprint allows BayWa to tap into diverse markets and capitalize on regional opportunities.

The primary revenue streams and monetization strategies of BayWa are segmented across its business units. This includes the sale of agricultural products, the development and sale of renewable energy projects, and the distribution of construction materials. The company also leverages service fees and recurring revenue models to enhance its financial stability.

- Agriculture: This segment primarily generates revenue through the sale of agricultural inputs, machinery, and digital farming solutions. In 2023, this segment accounted for approximately €12.5 billion in revenue. This demonstrates the significance of the agricultural sector to BayWa's overall financial performance.

- Energy: Through BayWa r.e., this segment derives revenue from the development and sale of renewable energy projects (wind and solar farms), the sale of electricity, and the distribution of photovoltaic components. In 2023, the Energy segment contributed about €6.2 billion to the total revenues, highlighting its growing importance.

- Building Materials: This segment generates revenue from the sale of construction materials. In 2023, this segment recorded revenues of approximately €2.5 billion. This segment provides a stable revenue stream, catering to both commercial and private customers.

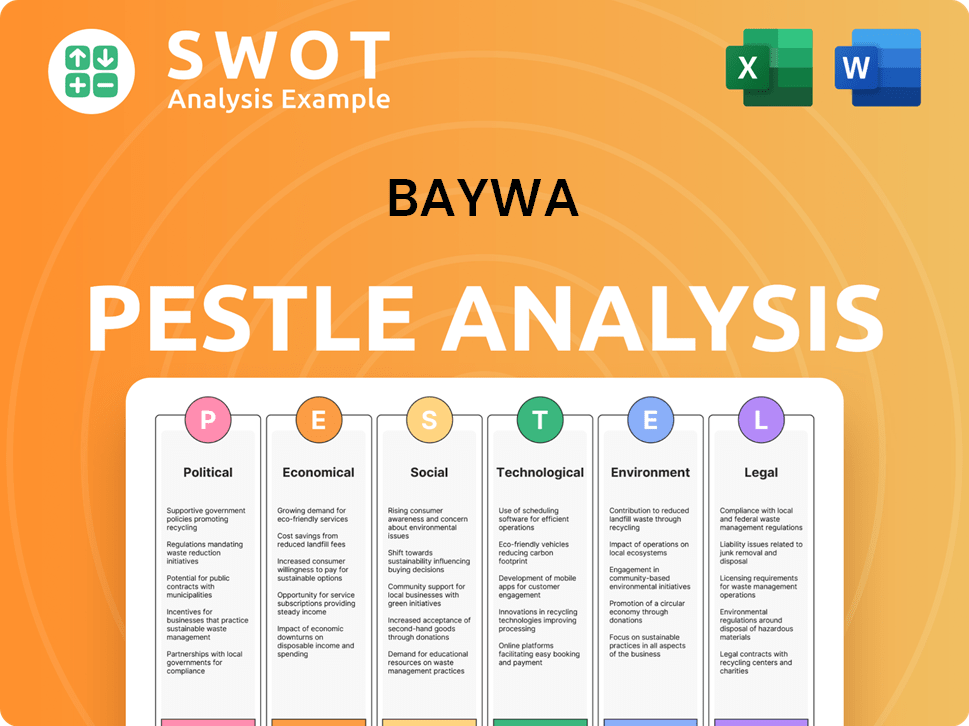

BayWa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BayWa’s Business Model?

The journey of the BayWa company has been marked by significant milestones and strategic shifts that have shaped its operational and financial landscape. A key strategic move has been the consistent expansion of its renewable energy division, BayWa r.e., which has become a globally recognized player in solar and wind project development and operation. This strategic focus reflects a proactive response to the global energy transition and a diversification away from traditional agricultural markets. The company's evolution showcases its adaptability and commitment to sustainable growth.

The BayWa AG has faced operational challenges, such as supply chain disruptions, particularly in the wake of global events. In response, BayWa has strengthened its logistics networks and diversified sourcing channels to ensure resilience. Its competitive advantages stem from its strong brand recognition, particularly in the agricultural sector, and its extensive network of branches and customer relationships. Furthermore, its integrated business model, combining trading, logistics, and services, provides economies of scale and allows for cross-selling opportunities across its segments. The technological leadership in digital farming solutions and renewable energy project development further enhances its competitive edge.

The company continues to adapt to new trends, such as precision agriculture and energy storage solutions, by investing in research and development and fostering strategic partnerships to maintain its market position and drive future growth. The BayWa business model is built on a foundation of diverse operations, including agriculture, energy, and building materials. This diversification helps mitigate risks and capitalize on opportunities across various sectors. For a deeper dive into their marketing strategies, consider reading this article: Marketing Strategy of BayWa.

In 2023, BayWa r.e. commissioned wind and solar projects with a total output of 1.2 gigawatts (GW). This expansion is a testament to the company's commitment to renewable energy. The company's strategic moves have positioned it well in the evolving energy landscape.

The company has focused on strengthening its logistics networks and diversifying sourcing channels. This has been crucial in navigating supply chain disruptions. BayWa has made significant investments in digital farming solutions.

The company's strong brand recognition and extensive network are key advantages. Its integrated business model provides economies of scale. BayWa's technological leadership in digital farming is a competitive advantage.

In recent financial reports, BayWa's renewable energy segment has shown strong growth. The company's diversified business model contributes to its financial stability. The company's investments in R&D are expected to drive future growth.

The BayWa company structure explained involves three main segments: Agriculture, Energy, and Building Materials. BayWa services include trading, logistics, and project development. The company's global presence extends to numerous countries, enhancing its market reach.

- Agriculture: Focuses on trading agricultural products and providing related services.

- Energy: Develops, operates, and maintains renewable energy projects.

- Building Materials: Supplies building materials and construction services.

- Logistics: Manages the transportation and storage of goods.

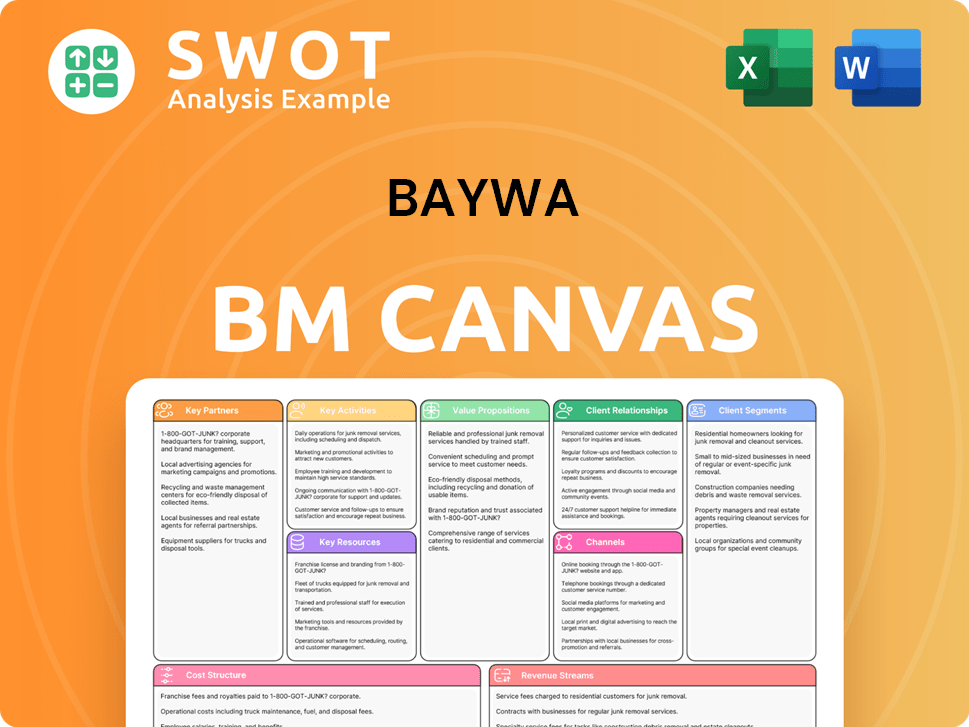

BayWa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BayWa Positioning Itself for Continued Success?

The BayWa company holds a strong market position across its core segments. In agriculture, it's a leader in Germany and has a significant international presence, especially in specialty crops and digital farming. BayWa AG is a global player in renewable energy through BayWa r.e., involved in project development and independent power production. The building materials segment has a strong regional presence in Germany and Austria. Its customer loyalty is supported by comprehensive service offerings and long-standing relationships.

Despite its robust position, BayWa business faces risks such as regulatory changes in agriculture and energy, volatile commodity prices, and increasing competition. Technological disruption, particularly in digital farming and energy storage, presents both opportunities and risks. The company focuses on sustainability, digitalization, and international expansion, aiming to expand its renewable energy portfolio, enhance digital platforms in agriculture, and optimize its logistics and supply chain operations.

BayWa is a leading agricultural trading and service company in Germany, with a substantial international footprint. In renewable energy, it's a global player in project development. The building materials segment maintains a strong regional presence, especially in Germany and Austria. Its diversified business model helps it to sustain and expand its revenue generation.

BayWa faces risks including regulatory changes, volatile commodity prices, and intense competition. Technological disruption in digital farming and energy storage presents challenges. Fluctuating raw material prices can significantly impact trading profitability. These factors can affect the company's financial performance and operational stability.

BayWa is committed to sustainability, digitalization, and international expansion. The company aims to expand its renewable energy portfolio and enhance digital platforms in agriculture. Optimizing logistics and supply chain operations is also a key focus. Leadership emphasizes innovation to sustain and expand revenue generation.

BayWa's global presence is significant, with operations spanning multiple continents. It has a strong foothold in Europe, particularly in Germany, and is expanding in North America, South America, and Asia-Pacific. This international diversification helps mitigate regional risks and capitalize on global market opportunities. Learn more about the Growth Strategy of BayWa.

BayWa is focusing on expanding its renewable energy portfolio, enhancing digital platforms in agriculture, and optimizing its logistics and supply chain. These initiatives aim to drive growth and improve operational efficiency. The company is investing in innovation to stay competitive and meet evolving market demands.

- Expanding Renewable Energy: Increasing investments in solar and wind projects.

- Digital Farming Enhancements: Developing and integrating advanced digital tools.

- Supply Chain Optimization: Improving logistics and supply chain efficiency.

- Sustainability Focus: Integrating sustainable practices across all operations.

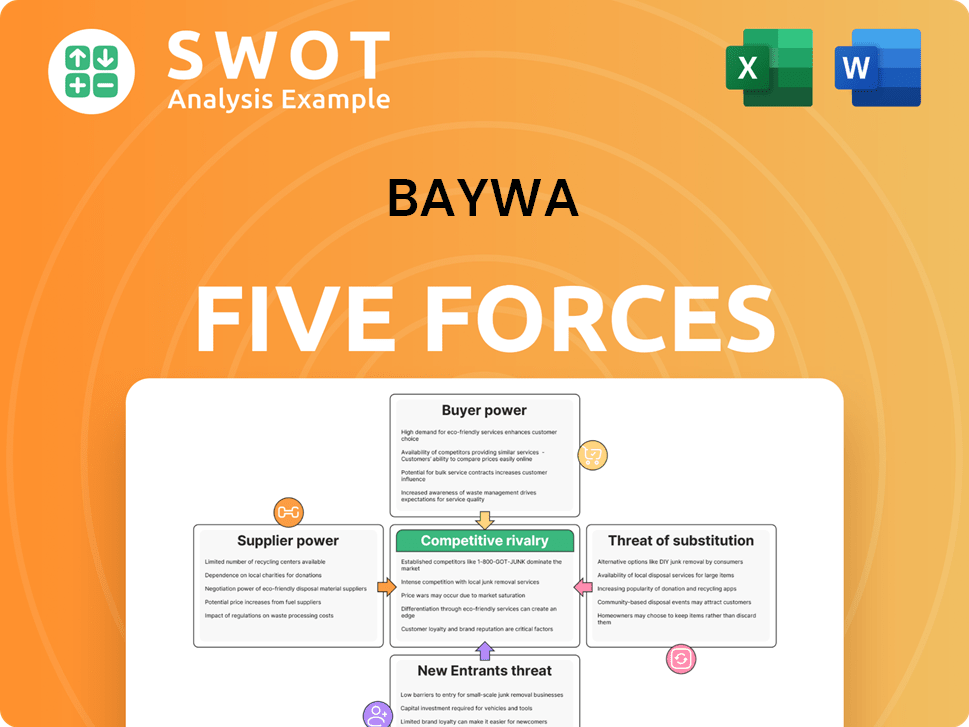

BayWa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BayWa Company?

- What is Competitive Landscape of BayWa Company?

- What is Growth Strategy and Future Prospects of BayWa Company?

- What is Sales and Marketing Strategy of BayWa Company?

- What is Brief History of BayWa Company?

- Who Owns BayWa Company?

- What is Customer Demographics and Target Market of BayWa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.