China Grand Automotive Services Bundle

Can China Grand Automotive Services Revitalize Its Strategy?

Established in 1999, China Grand Automotive Services has become a key player in China's vast automotive market, but recent challenges loom large. Facing a fiercely competitive environment, including a dramatic surge in electric vehicle (EV) adoption and the threat of delisting, the company's future hinges on its ability to adapt. This analysis delves into the China Grand Automotive Services SWOT Analysis, exploring its position within the Competitive Landscape China Automotive.

The Chinese Automotive Industry is experiencing unprecedented change, making a thorough China Auto Market Analysis essential for understanding the dynamics at play. With China Grand Automotive Services's financial performance under scrutiny and the rise of new Automotive Service Companies China, this analysis will examine the company's market share, key competitors, and strategic responses. Understanding the challenges facing China's automotive sector is crucial for anyone looking to navigate the complexities of the China Car Dealerships landscape.

Where Does China Grand Automotive Services’ Stand in the Current Market?

China Grand Automotive Services Group Co. Ltd. is a major player in China's automotive services sector, operating a vast network of over 730 outlets. The company focuses on selling and servicing passenger vehicles, distributing nearly 50 brands across a wide geographic area in China. Its comprehensive services include new and used car sales, maintenance, repairs, spare parts, car rentals, and financing.

As of 2023, it was the second-largest car dealer in China by sales volume, having delivered 713,500 vehicles. This extensive network and diverse service offerings highlight its significant presence in the China Auto Market Analysis.

In 2023, the company delivered 713,500 vehicles, positioning it as the second-largest car dealer in China by sales volume. This substantial sales volume underscores its significant market share within the Chinese Automotive Industry.

The company provides a wide range of services, including new and used car sales, maintenance, repair, spare parts, car rental, and financing. This comprehensive approach aims to cater to various customer needs within the automotive sector.

With over 730 outlets across 25 provinces, autonomous regions, and municipalities, the company has a broad geographic footprint. This wide presence enables it to serve a large customer base across China.

Despite its scale, the company faces financial challenges. The trailing 12-month revenue as of March 31, 2024, was $18.8 billion, with a net loss of -$9.311 million. The stock price as of July 17, 2024, was $0.11, with a market capitalization of $906 million. This indicates financial strain.

The company faces challenges, including the potential delisting from the Shanghai Stock Exchange due to its stock price falling below 1 yuan. The Competitive Landscape China Automotive is characterized by slowing sales and intense price competition. The industry is expected to see a revenue decrease at an annualized rate of 0.1% through 2025, reaching $454.8 billion.

- The industry's profitability is expected to decrease to 1.9% in 2025, from 4.0% in 2018.

- Revenue has decreased by 3.1% in the last year and 14% over the past three years.

- The stock price as of July 17, 2024, was $0.11.

- The company's market capitalization is $906 million.

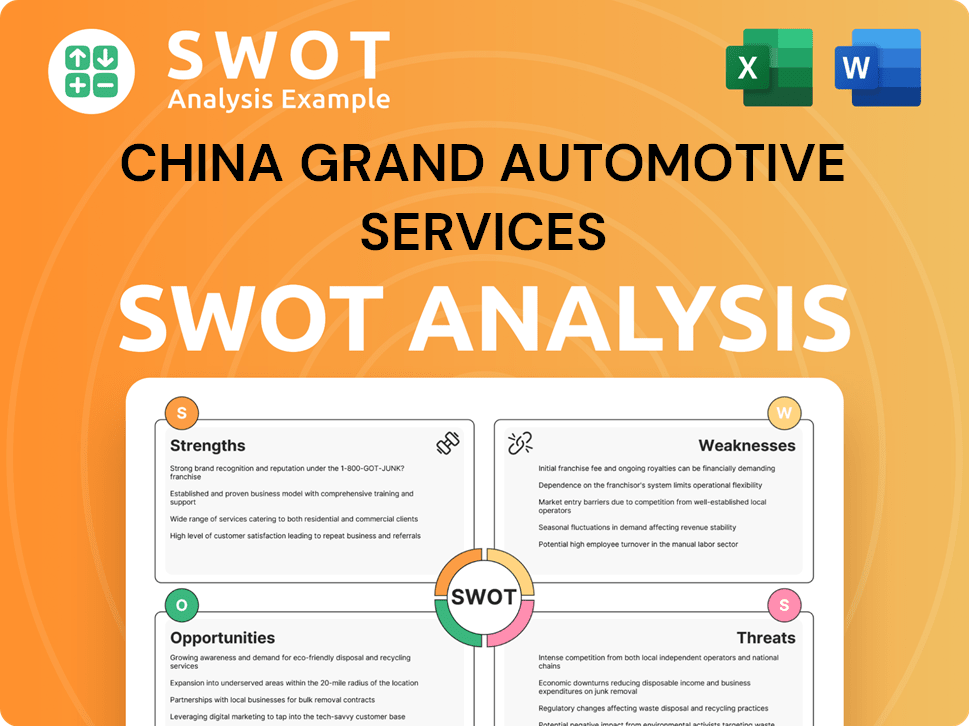

China Grand Automotive Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging China Grand Automotive Services?

The China Grand Automotive Services operates within a dynamic and highly competitive environment. Understanding the Competitive Landscape China Automotive is crucial for assessing its position and prospects. The company faces a mix of direct and indirect competitors, all vying for market share in the Chinese Automotive Industry.

The China Auto Market Analysis reveals a landscape shaped by both traditional dealerships and emerging players, particularly in the electric vehicle (EV) sector. This competitive pressure is further intensified by price wars and evolving consumer preferences. Analyzing the Automotive Service Companies China helps to understand the challenges and opportunities.

The industry's fragmentation, combined with the rapid evolution of the automotive market, necessitates a detailed examination of the key players and their strategies. This analysis provides insights into the competitive dynamics and the factors influencing the China Car Dealerships.

Direct competitors include established dealership groups that offer similar services. These companies compete directly with China Grand Automotive Services in sales and after-sales services. They are key players in the China's automotive service industry analysis.

Zhongsheng Group is a leading competitor and the market leader in terms of sales. It operates an extensive network of dealerships across China. Its financial performance is a key indicator of the competitive landscape.

China Yongda is another major player in the dealership sector, offering a wide range of automotive services. It competes directly with China Grand Automotive Services in various regions. The company's strategies are vital for understanding the competition.

LSH Auto operates in the Chinese market with a focus on premium and luxury vehicles. It competes for a specific segment of the market. Understanding its market position is crucial for a complete analysis.

Hengxin Automobile Group is a significant competitor in the auto dealership industry. Its operations and strategies are essential for understanding the competitive dynamics. The company's performance influences the overall market.

Indirect competitors include companies that offer specialized services or operate in related sectors. These players influence the overall market dynamics. Their presence adds complexity to the competitive landscape.

The automotive market is experiencing significant disruption from new players and changing consumer behaviors. The rise of electric vehicles (EVs) and online platforms is reshaping the competitive landscape. The Challenges facing China's automotive sector are substantial.

- Electric Vehicle (EV) Brands: Tesla, Nio, and Xpeng are building their own sales networks, challenging the traditional dealership model. This is a major shift in the Future of car sales in China.

- Online Platforms: E-commerce platforms and online marketplaces are gaining prominence, offering alternative channels for sales and services. This impacts the China's used car market trends.

- Specialized Service Providers: Companies like Autohome, Guazi, Yixin Group, and Casstime compete in various segments of the value chain. The China Grand Automotive Services recent acquisitions are part of the strategy.

- Price Wars: Intense price competition since early 2023 has affected sales and profit margins. This impacts the China Grand Automotive Services financial performance.

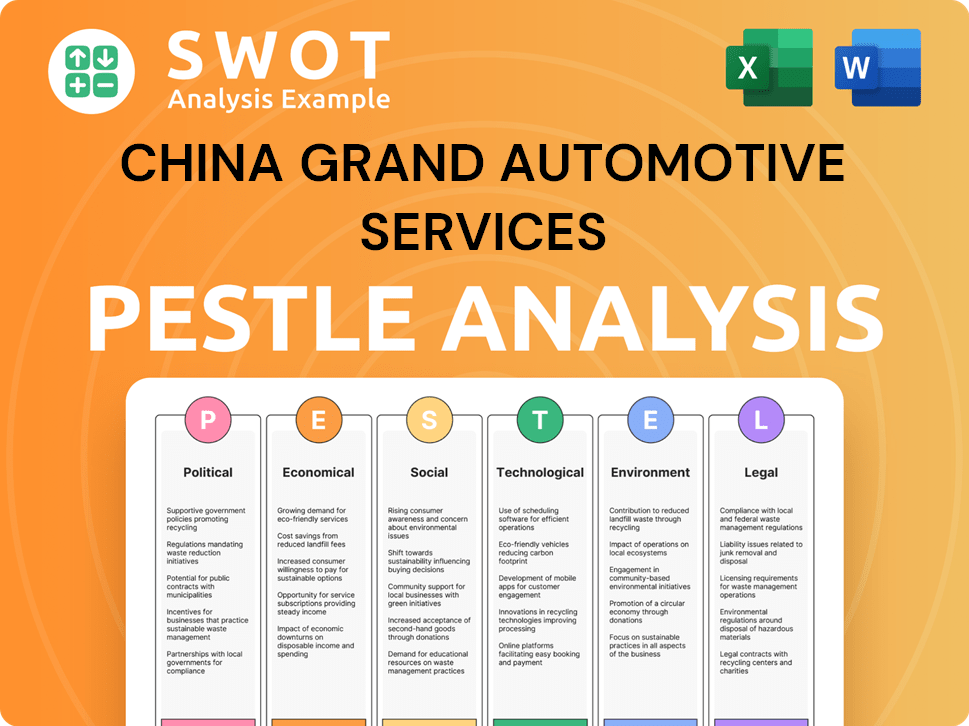

China Grand Automotive Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives China Grand Automotive Services a Competitive Edge Over Its Rivals?

China Grand Automotive Services Group Co. Ltd. has historically held several competitive advantages, primarily stemming from its extensive dealership network and comprehensive service offerings. The company's strategic focus on expanding its physical presence and diversifying its services has been key to its market positioning. This approach has allowed it to capture a significant share of the Chinese automotive market, particularly in the realm of sales and after-sales services.

The company's ability to offer a wide variety of automotive brands, including premium ones, has also contributed to its competitive edge. This diverse portfolio caters to a broad customer base, allowing China Grand Automotive Services to adapt to various consumer preferences and market trends. The integration of services like used car sales, car rentals, and financial leasing further enhances customer loyalty and generates multiple revenue streams.

However, the competitive landscape in China's automotive sector is rapidly evolving, posing both challenges and opportunities for China Grand Automotive Services. The rise of electric vehicles and the increasing prevalence of direct sales models from EV manufacturers are reshaping the industry. Furthermore, intense price competition is impacting profit margins, necessitating strategic adaptations to maintain a strong market position.

China Grand Automotive Services boasts a vast network of over 730 outlets across 25 provinces, autonomous regions, and municipalities in China. This widespread presence allows for broad accessibility for vehicle sales and after-sales services. The extensive network provides a significant advantage in reaching a large customer base and offering convenient services.

The company provides a full spectrum of automotive services, including new and used car sales, car rentals, and financial leasing. This integrated approach enhances customer stickiness and generates multiple revenue streams. By offering a one-stop-shop experience, China Grand Automotive Services captures a larger share of customer spending throughout the vehicle ownership lifecycle.

China Grand Automotive Services has established relationships with numerous automotive brands, including premium ones like BMW, Audi, and Volvo. This provides access to a diverse portfolio of vehicles, catering to various consumer segments. The ability to distribute nearly 50 different automotive brands further diversifies its offerings and caters to a wide customer base.

The company is adapting to the rapidly changing Chinese Automotive Industry. The rise of electric vehicles and the increasing trend of EV manufacturers developing their own direct sales channels pose a threat to traditional dealership models. To maintain its competitive edge, the company would need to adapt to these shifts, potentially by enhancing its digital transformation efforts, optimizing its operational efficiencies, and exploring new service models that align with emerging consumer preferences and technological advancements.

The intense price war in the Chinese automotive market has put significant pressure on profit margins, impacting even established players like China Grand Automotive Services. The company faces challenges from the rise of electric vehicles and direct sales models. To maintain its competitive edge, China Grand Automotive Services needs to focus on digital transformation, operational efficiency, and new service models.

- Enhancing digital transformation to improve customer experience and streamline operations.

- Optimizing operational efficiencies to reduce costs and improve profitability.

- Exploring new service models, such as subscription services and integrated mobility solutions, to align with evolving consumer preferences.

- Strengthening relationships with existing brand partners and potentially expanding its brand portfolio.

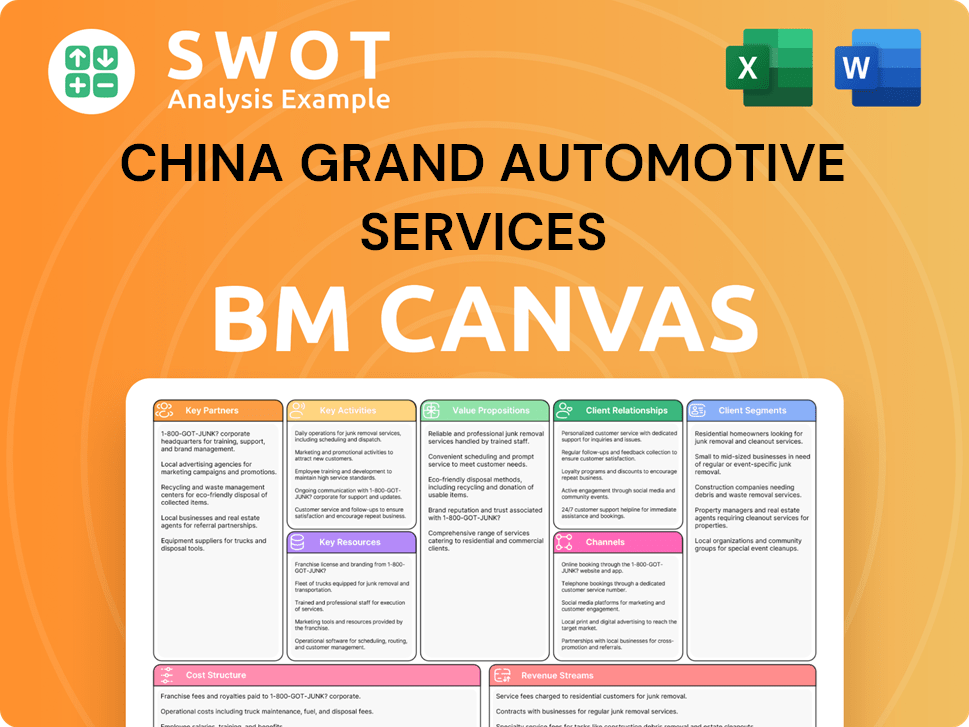

China Grand Automotive Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping China Grand Automotive Services’s Competitive Landscape?

The Chinese automotive services industry is experiencing significant shifts, creating a complex competitive landscape for China Grand Automotive Services. This evolution is driven by the rapid adoption of electric vehicles (EVs), technological advancements, and changing consumer preferences. Understanding these trends is crucial for assessing the company's position, identifying associated risks, and evaluating its future outlook within the context of the China Auto Market Analysis.

China Grand Automotive Services faces both challenges and opportunities in this dynamic environment. While the overall automotive market remains substantial, the industry's transformation requires strategic adaptation and proactive measures to maintain and enhance competitiveness. The company's ability to navigate these changes will determine its long-term success in the Chinese Automotive Industry.

The primary trend is the rapid growth of electric vehicles (EVs), with projections indicating that over 55% of total vehicle sales in China will be NEVs by 2025. Technological advancements in smart driving features and software-defined vehicles are also reshaping consumer expectations. The automotive industry is also facing slower growth compared to previous years.

China Grand Automotive Services must navigate declining profitability in the traditional car dealer segment and adapt to direct sales models of EV manufacturers. The company's financial performance, including a net loss in the trailing twelve months ending March 2024, and the risk of delisting, highlight the difficulties. Adapting to the direct sales models of EV manufacturers and the increasing focus on 3rd and 4th tier cities for dealership expansion will also be critical.

The burgeoning aftermarket for out-of-warranty vehicles in China, expected to reach 245 million units by the end of 2025, offers a vast market for parts, servicing, and repairs. Strategic partnerships, diversification of product offerings, and adoption of new technologies, particularly in the EV and connected car space, could strengthen the company's competitiveness. Leveraging government support for green mobility and engaging digital-first consumers present further avenues for growth.

The car dealer industry's profitability is declining, estimated at 1.9% in 2025, down from 4.0% in 2018. The intense price war since early 2023 further exacerbates these pressures. China remains the world's largest automotive market with projected sales of 32 million units in 2025.

To succeed, China Grand Automotive Services must focus on several key areas. These include adapting to the EV revolution, enhancing service capabilities, and exploring new revenue streams. Addressing the challenges presented by the evolving market while capitalizing on emerging opportunities is essential for sustainable growth.

- Invest in EV-related infrastructure and training.

- Explore strategic partnerships for parts and services.

- Develop digital sales channels and integrated services.

- Focus on the used car market and aftermarket services.

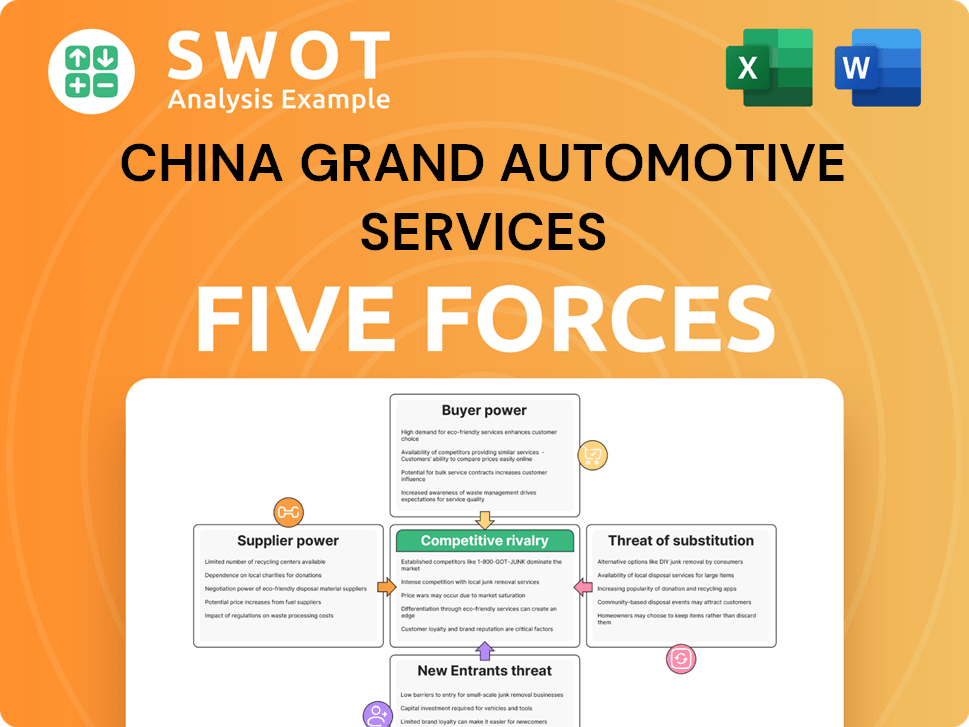

China Grand Automotive Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of China Grand Automotive Services Company?

- What is Growth Strategy and Future Prospects of China Grand Automotive Services Company?

- How Does China Grand Automotive Services Company Work?

- What is Sales and Marketing Strategy of China Grand Automotive Services Company?

- What is Brief History of China Grand Automotive Services Company?

- Who Owns China Grand Automotive Services Company?

- What is Customer Demographics and Target Market of China Grand Automotive Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.