China Grand Automotive Services Bundle

Can China Grand Automotive Navigate the Shifting Sands of the Chinese Auto Market?

China Grand Automotive Services, a titan in China's automotive sector since 1999, faces a pivotal moment. With the Chinese auto market undergoing rapid transformation, including fierce price wars and the rise of electric vehicles, the company's future hinges on its ability to adapt and thrive. This analysis dives deep into China Grand Automotive's China Grand Automotive Services SWOT Analysis, exploring its growth strategy amidst intense competition and evolving consumer preferences.

Understanding the China Grand Automotive Growth Strategy is critical for anyone invested in the Automotive Services China landscape. The company's impressive revenue of 138 billion yuan in 2023, generated from selling 713,500 vehicles, highlights its significant market share. This report will dissect the company's expansion plans, evaluate its financial performance, and provide a comprehensive Market Analysis China to assess its future outlook in the dynamic Chinese Auto Market.

How Is China Grand Automotive Services Expanding Its Reach?

China Grand Automotive Services' expansion strategy is vital for navigating the dynamic automotive market in China, especially with the rise of electric vehicles and increased competition. The company, with over 730 outlets nationwide, focuses on maintaining and potentially expanding its dealership network and service offerings. This includes sales of premium brands, used car services, and financial leasing.

The automotive industry in China is poised for more competition and mergers and acquisitions. This trend suggests that China Grand Automotive Services may pursue consolidation or strategic partnerships to boost its market share and diversify its revenue. The company's involvement in financial leasing and other automotive services offers opportunities for expansion, catering to evolving consumer preferences for flexible ownership models and comprehensive service packages. The shift to new energy vehicles (NEVs) also indicates a need for expansion into EV-specific sales and service infrastructure.

The company's strategic focus likely involves adapting to the changing market landscape. This includes catering to the growing demand for electric vehicles and enhancing its service offerings to align with evolving consumer preferences. Understanding the Revenue Streams & Business Model of China Grand Automotive Services is crucial to assessing the company's expansion capabilities.

China Grand Automotive Services may aim to increase its dealership network by acquiring existing dealerships or establishing new locations. This expansion could focus on geographical areas with high growth potential and increasing the presence of premium brands. The company's current network provides a solid foundation for further growth.

The company may diversify its service offerings to include more comprehensive automotive solutions. This could involve expanding its used car business, offering more financial leasing options, and providing enhanced after-sales services. Diversification can help to attract a broader customer base.

Strategic partnerships and acquisitions could be key to China Grand Automotive's expansion. The company might collaborate with EV manufacturers or other automotive service providers to enhance its market position. Acquisitions can help to quickly expand market share and diversify revenue streams.

Entering the EV market is crucial for future growth. This might involve establishing dedicated EV sales and service centers, partnering with EV brands, and investing in charging infrastructure. Adapting to the EV market is essential for long-term competitiveness.

The company's expansion strategy likely involves dealership network growth, service diversification, strategic partnerships, and entry into the EV market. These initiatives are vital for maintaining competitiveness and capitalizing on market opportunities. These strategies are essential for navigating the changing automotive landscape in China.

- Geographic Expansion: Targeting high-growth regions for new dealerships.

- Service Enhancements: Expanding financial leasing and after-sales services.

- Strategic Alliances: Partnering with EV manufacturers and service providers.

- EV Infrastructure: Investing in EV sales, service, and charging solutions.

China Grand Automotive Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does China Grand Automotive Services Invest in Innovation?

Innovation and technology are critical for the sustained growth of China Grand Automotive Services within the rapidly evolving automotive industry in China. The company's ability to adapt and integrate new technologies will significantly influence its future success. This includes enhancing its service offerings, operational efficiency, and customer experience.

The Chinese automotive sector is experiencing significant technological advancements, particularly in intelligent mobility, electrification, and digital transformation. For China Grand Automotive Services, this presents both challenges and opportunities. The company needs to leverage these trends to stay competitive and meet evolving customer demands.

While specific proprietary R&D investments or patents of China Grand Automotive Services are not readily available, the broader industry context suggests the importance of technological integration. This includes digital transformation initiatives to streamline sales and after-sales services, and potentially incorporating advanced diagnostics and maintenance technologies.

Enhancing sales and after-sales services through digital platforms is crucial. This includes online tools and digital customer relationship management (CRM) systems.

With the increasing penetration of EVs, servicing EV components, especially batteries, is essential. This will require specialized training and equipment.

Implementing advanced diagnostic tools and technologies in repair centers can improve service efficiency and accuracy. This could lead to better customer satisfaction and operational efficiency.

Improving the customer experience through digital tools and platforms can enhance customer loyalty. This includes online booking, service updates, and personalized communications.

Collaborations with technology providers can provide access to the latest innovations. This can help in integrating new technologies and services.

Utilizing technology for more efficient processing and personalized customer solutions in financial leasing and related services. This can streamline operations and improve customer service.

The automotive aftermarket in China is projected to reach approximately US$85,538.3 million by 2030, with a compound annual growth rate (CAGR) of 5.5% from 2025 to 2030. This growth indicates a rising demand for technologically advanced repair and maintenance services. Furthermore, the Target Market of China Grand Automotive Services will be influenced by these technological advancements, which will impact the company's service offerings and strategic positioning in the Chinese Auto Market.

China Grand Automotive Services needs to focus on several key technological areas to maintain its competitive edge. These include digital transformation, EV servicing, and strategic partnerships.

- Digital Transformation: Implementing digital tools for sales, after-sales services, and customer relationship management.

- EV Servicing: Developing expertise in servicing electric vehicles, including battery systems and related components.

- Strategic Partnerships: Collaborating with technology providers to integrate advanced technologies.

- Advanced Diagnostics: Utilizing advanced diagnostic tools and technologies in repair centers.

- Smart Interiors and Exteriors: Adapting to advancements in innovative automotive interiors and exteriors.

China Grand Automotive Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is China Grand Automotive Services’s Growth Forecast?

The financial health of China Grand Automotive Services Group is currently under scrutiny. The company's stock has been trading below par value, raising concerns about its financial stability and potential delisting from the Shanghai Stock Exchange. This situation reflects broader challenges within the Automotive Industry China, where market dynamics are significantly impacting performance.

As of March 31, 2024, the company reported a trailing 12-month revenue of $18.8 billion (USD) and an EBITDA of $361 million (USD). While the company showed a recovery in 2023 with a net profit of 392 million yuan, the trailing 12-month net income as of March 31, 2024, was -$9.3 million (USD). This indicates ongoing financial pressures despite revenue figures.

The company's financial position includes total assets of $15.7 billion (USD) and total debt of $6.8 billion (USD) as of March 31, 2024. The gross margin is currently at 7.5%, significantly lower than the industry average of 33.1%. The stock price was ¥0.78 (RMB) as of May 24, 2024, with a market capitalization of $906 million (USD) as of July 17, 2024, based on 8.29 billion shares outstanding. These figures highlight the challenges faced by China Grand Automotive financial performance.

The Chinese Auto Market is undergoing significant changes. The broader car dealer industry is expected to see a revenue decline of 0.1% annually through 2025, reaching an estimated $454.8 billion (USD). Profitability is projected to be 1.9% in 2025, reflecting a tough environment.

- The automotive market has been experiencing a fierce price war since early 2023.

- Slowing sales and economic uncertainties are impacting the sector.

- The surge in electric vehicle penetration is also reshaping the market.

- These factors directly affect companies like China Grand Automotive, impacting its Growth Strategy.

China Grand Automotive faces a challenging competitive landscape. The company's struggles highlight broader issues within the automotive sector. Companies are grappling with declining sales and profit margins.

The future outlook for China Grand Automotive is closely tied to its ability to navigate the current market dynamics. The company must adapt its strategies to address declining sales and profit margins. Understanding the Brief History of China Grand Automotive Services can provide context to the current challenges.

Strategic partnerships may be crucial for China Grand Automotive to enhance its market position. These partnerships could provide access to new technologies and markets. They could also help in managing costs and improving operational efficiency.

The investment potential of China Grand Automotive depends on its ability to overcome current financial challenges. Investors should carefully assess the company's strategies for revenue growth and cost control. The company's ability to adapt to the changing automotive market will be key.

The business model of China Grand Automotive needs to be flexible to respond to market changes. The company's ability to diversify its service offerings will be critical. Adapting to changing consumer preferences is also essential.

China Grand Automotive's service offerings include sales, after-sales services, and other related businesses. The company's ability to expand and improve these services will impact its revenue streams. Focusing on customer satisfaction is also very important.

China Grand Automotive Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow China Grand Automotive Services’s Growth?

The strategic trajectory of China Grand Automotive Services faces several significant risks and obstacles. A primary concern is the potential delisting from the Shanghai Stock Exchange, reflecting underlying operational pressures and investor confidence issues. This situation underscores the urgency for strategic adjustments to maintain market presence and financial stability within the competitive Chinese auto market.

The automotive sector in China is undergoing rapid transformation, marked by intense competition and a shift towards electric vehicles (EVs). This dynamic environment presents considerable challenges for traditional dealerships like China Grand Automotive Services. The rise of EVs and their associated sales models further complicates the landscape, requiring the company to adapt quickly to remain competitive.

Supply chain disruptions, regulatory changes, and cybersecurity threats add further complexity to China Grand Automotive Services' operational environment. These factors necessitate proactive strategies to mitigate risks and ensure sustained growth. Addressing these multifaceted challenges is critical for the company's future success in the evolving automotive industry in China.

The most immediate risk is delisting from the Shanghai Stock Exchange, signaling financial strain. This could significantly impact investor confidence and access to capital. The company must address underlying operational challenges swiftly to avoid this outcome.

Intense competition and price wars in the Chinese auto market squeeze profit margins. Traditional dealerships face challenges from EV brands establishing their own sales networks. This requires innovative strategies to maintain market share.

The rapid adoption of EVs, now accounting for approximately 40% of the market, poses a significant challenge. Many EV brands are bypassing traditional dealers. This shift necessitates a strategic pivot towards new energy vehicles (NEVs).

Lingering semiconductor shortages continue to impact production and output. The automotive industry faces ongoing supply chain uncertainties. While marginal improvements have been seen, risks persist for 2025.

New GB standards for automotive parts and updated certification rules, effective in 2025, present compliance challenges. Potential tariffs on autos and parts, particularly from the US, could disrupt supply chains. These changes necessitate proactive adaptation.

Increasing cybersecurity threats, particularly in connected and software-defined vehicles, are emerging. These risks can impact onboard systems and cloud infrastructure. Protecting against cyber threats is crucial for operational integrity.

To mitigate these risks, diversification into new energy vehicles (NEVs) is crucial. Adopting new technologies and exploring strategic partnerships can strengthen competitiveness. Restructuring efforts and strategic shifts are essential to stabilize market position. The industry focus on smart manufacturing and supply chain resilience provides potential avenues for growth.

The Chinese auto market is highly competitive, with EV sales growing rapidly, impacting traditional dealerships. The shift towards EVs and direct sales models by EV brands necessitates strategic adjustments. Understanding and adapting to these market dynamics is vital for survival and growth. The market share of EVs continues to increase, influencing the China Grand Automotive's future outlook.

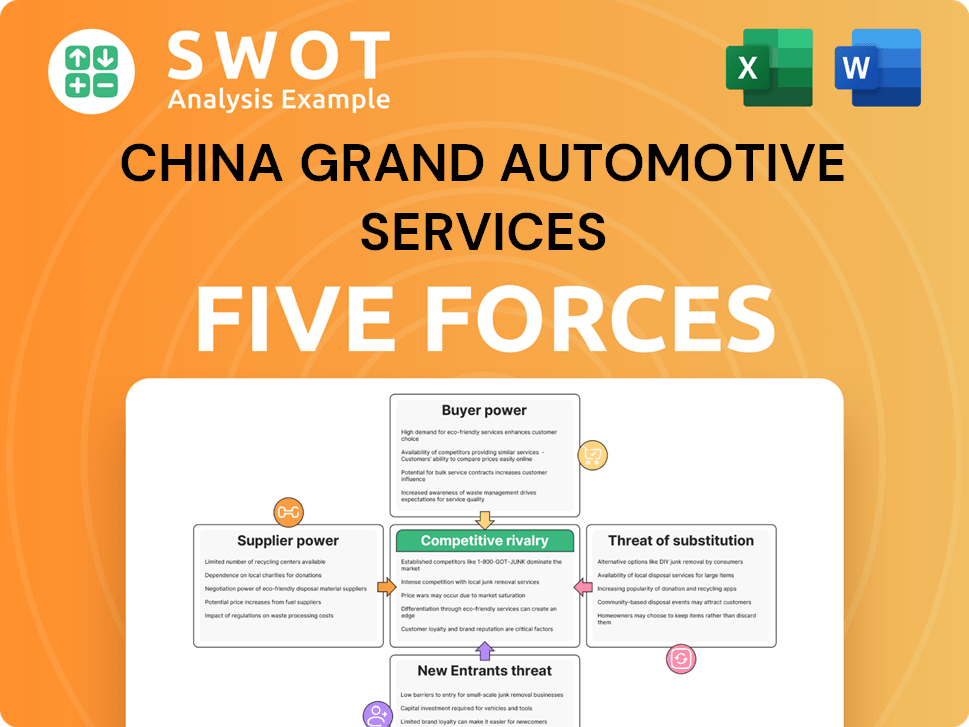

China Grand Automotive Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of China Grand Automotive Services Company?

- What is Competitive Landscape of China Grand Automotive Services Company?

- How Does China Grand Automotive Services Company Work?

- What is Sales and Marketing Strategy of China Grand Automotive Services Company?

- What is Brief History of China Grand Automotive Services Company?

- Who Owns China Grand Automotive Services Company?

- What is Customer Demographics and Target Market of China Grand Automotive Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.