Cognex Bundle

How Does Cognex Dominate the Machine Vision Arena?

Cognex Corporation isn't just a company; it's a visionary in the machine vision industry, leveraging cutting-edge AI to give machines the power of sight. Founded in 1981, Cognex has evolved from a pioneer to a global leader, revolutionizing automated manufacturing. This evolution highlights the dynamic Cognex SWOT Analysis, which offers a deeper understanding of its strategic positioning.

The machine vision sector is fiercely competitive, and understanding the Cognex competitive landscape is crucial. Recent innovations, such as VisionPro Deep Learning 4.0 and the AI-driven DataMan series, showcase Cognex's commitment to staying ahead. This exploration delves into Cognex competitors, offering a detailed Cognex market analysis to understand its strategic moves and competitive advantages within the Vision systems industry.

Where Does Cognex’ Stand in the Current Market?

Cognex Corporation holds a leading position in the machine vision industry. The company's core operations revolve around providing vision systems, software, sensors, and industrial barcode readers. These products are critical for automation in manufacturing and logistics across the globe.

The value proposition of Cognex lies in its ability to enhance production efficiency, improve product quality, and reduce costs for its customers. By offering advanced machine vision solutions, Cognex enables businesses to automate and optimize their operations, leading to increased productivity and reduced errors. This is a key factor in the Target Market of Cognex.

Cognex demonstrated a strong financial performance in 2024. The company's revenue reached $915 million, marking a 9% increase from the previous year. This growth underscores Cognex's strong position within the vision systems industry and its ability to capture market share.

As of December 31, 2024, Cognex reported a robust financial standing. The company had $587 million in cash and investments and no debt. Cognex generated $51 million of cash from operating activities in Q4 2024, highlighting its financial stability and operational efficiency.

Cognex serves a diverse customer base, including manufacturers, OEMs, and system integrators. Key industries include logistics, automotive, consumer electronics, and semiconductors. These industries represented approximately 60% of Cognex's total revenue in 2024.

Cognex has a significant global presence, with offices and distributors across the Americas, Europe, and Asia. This extensive network supports its worldwide customer base and facilitates the distribution of its products and services.

Cognex is actively expanding its market presence and product offerings. The acquisition of Moritex Corporation in 2023 contributed to revenue growth in 2024. The company is also investing in expanding its sales coverage and enhancing its R&D capabilities.

- Continued momentum in Logistics and Semiconductor businesses.

- Focus on new sales resources to reach more customers.

- Diversification of the customer base to mitigate risks.

- Investment in R&D to stay ahead of market trends.

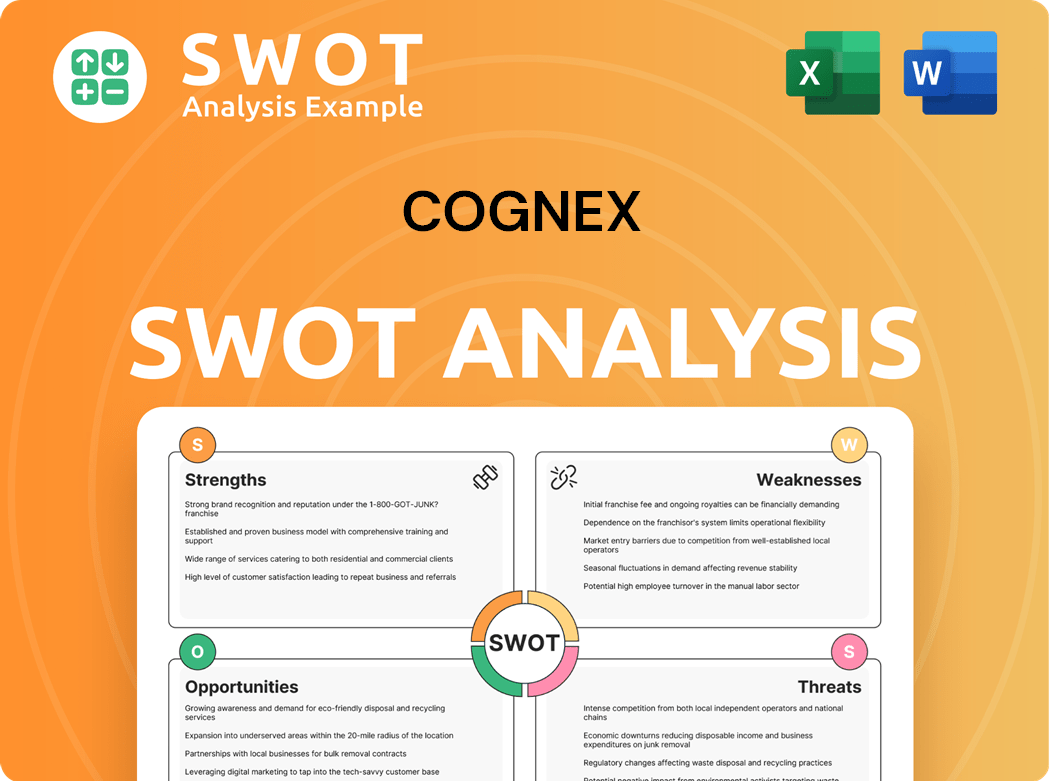

Cognex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Cognex?

The Cognex competitive landscape is shaped by a dynamic mix of direct and indirect rivals. The company, a leader in the vision systems industry, faces challenges from established players and emerging innovators. Understanding these competitors is crucial for a comprehensive Cognex market analysis.

Cognex's performance is influenced by the strategies and innovations of its competitors. Key factors include pricing, technological advancements, and market reach. The company's ability to maintain its Cognex market share depends on its competitive advantages and its response to market trends.

The Cognex company overview reveals a focus on providing machine vision solutions for a wide range of industries. This positioning puts it in direct competition with several key players in the automation and vision systems markets. The competitive dynamics are constantly evolving, with new technologies and market entrants reshaping the landscape.

Key direct competitors include Keyence, Omron Corporation, and Basler AG. These companies offer similar products and services, competing for market share in the machine vision sector. The competitive landscape is intense, with each company vying for market leadership through innovation and strategic initiatives.

Keyence is a major competitor, providing a wide range of automation solutions. Its products, including sensors and machine vision systems, are known for high quality and reliability. Keyence's strong market presence makes it a significant player in the Cognex competitive landscape.

Omron Corporation competes with Cognex through its machine vision products. It is a global industrial automation giant. Omron's broad portfolio and extensive market reach make it a key competitor in the vision systems market.

Basler AG offers a range of vision systems and sensors. It directly targets similar markets as Cognex. Basler's product offerings and market strategies contribute to the competitive dynamics within the industry.

Other companies that compete with Cognex include Trax Technology Solutions, OPT Machine Vision, Cyient North America, Teledyne, Ifm Electronic, Yokogawa Electric, Wenglor Sensoric, and PNI Sensor. These companies offer various solutions in the vision systems and related automation fields.

Emerging players like EasyODM are disrupting the traditional competitive landscape. They offer open architecture, customizable, and cost-effective vision solutions. These new entrants challenge established companies with innovative approaches and flexible solutions.

Cognex faces challenges from its competitors in terms of pricing, technology, and market reach. For instance, Cognex's premium pricing and closed system design may limit flexibility in multi-vendor environments. Keyence's high-performance systems may require significant initial investment. The acquisition of Moritex Corporation in 2023 by Cognex is an example of strategic moves to expand market presence and product offerings. For more insights into Cognex's strategic approach, consider reading about the Marketing Strategy of Cognex.

- Pricing and Market Positioning: Cognex's premium pricing strategy contrasts with the cost-effective solutions offered by some competitors.

- Technological Innovation: The company's focus on AI-driven sensors and high accuracy is a key differentiator.

- Strategic Acquisitions: Acquisitions like Moritex Corporation help expand product offerings and market reach.

- Open vs. Closed Systems: The closed system design of some Cognex products may limit flexibility compared to open architecture solutions.

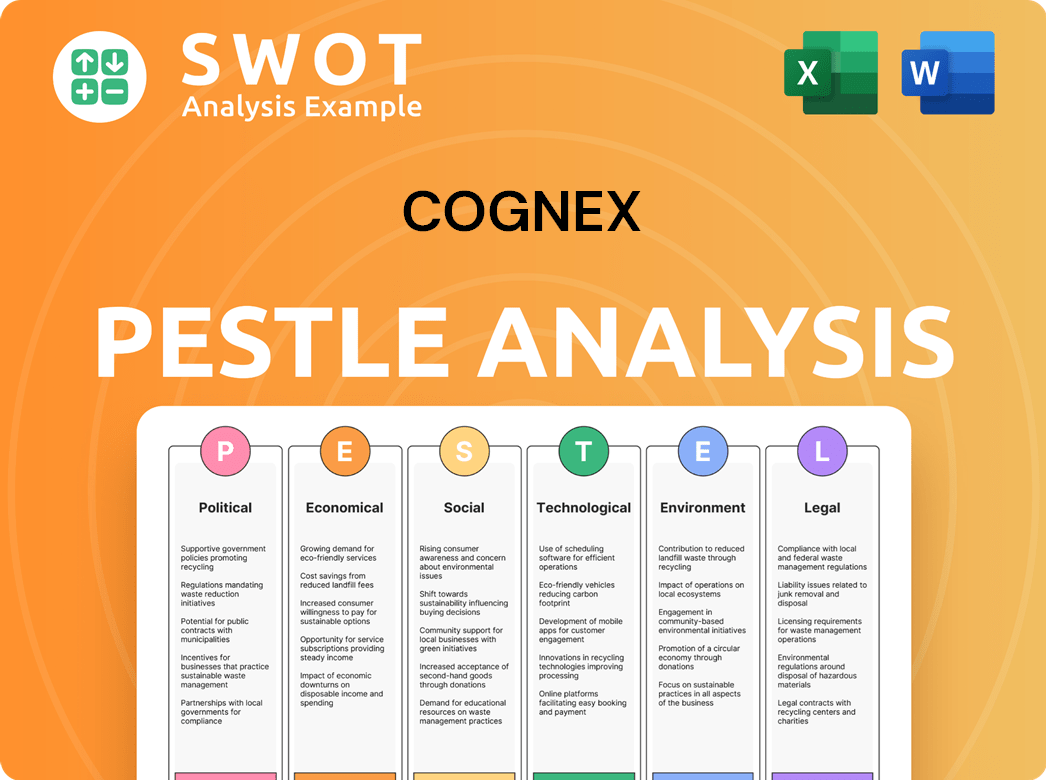

Cognex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Cognex a Competitive Edge Over Its Rivals?

Understanding the Cognex competitive landscape requires a deep dive into its strengths. The company has built a formidable position in the vision systems industry. Its focus on innovation and customer satisfaction has helped it maintain a strong market presence.

Cognex's strategic moves, including acquisitions and continuous R&D investments, highlight its commitment to staying ahead of the competition. These efforts are geared towards maintaining and expanding its market share. The company's ability to adapt to evolving technological advancements is also a key factor.

Cognex's competitive edge is evident in its technological prowess and customer-centric approach. This has allowed it to secure significant contracts and build lasting relationships with major clients. Analyzing Cognex's financial performance and Cognex market share provides further insights into its competitive standing.

Cognex excels through its proprietary technologies and robust intellectual property. Its advanced vision software, like VisionPro, offers a suite of patented vision tools. This includes both traditional rule-based and deep learning-enabled functionalities.

The integration of AI, particularly through 'edge learning,' enhances ease of use. This broadens the capabilities of its machine vision systems. Products like the In-Sight SnAPP Vision Sensor exemplify this, offering user-friendly interfaces and robust capabilities.

Cognex benefits from strong brand equity and customer loyalty. This is fostered by its comprehensive post-sale support and global network of service professionals. This commitment is critical for sustained revenue growth and repeat business.

The company's global sales and support network enables effective market penetration across various segments. Cognex's economies of scale in manufacturing ensure high-quality products. This global presence supports its competitive position.

Cognex leverages several key advantages to maintain its market position. These include technological leadership, strong customer relationships, and a global presence. These advantages are largely sustainable due to ongoing investment in R&D and protected intellectual property.

- Proprietary Technologies: Cognex invests heavily in R&D, resulting in a substantial portfolio of patents.

- AI-Powered Solutions: The integration of AI enhances the capabilities of its machine vision systems.

- Customer Support: Comprehensive post-sale support and a global service network foster customer loyalty.

- Global Presence: A strong global sales and support network ensures effective market penetration.

For more details on Cognex's journey and evolution, consider reading Brief History of Cognex. The company's focus on innovation and customer satisfaction continues to drive its success in the vision systems industry. Understanding these factors is essential for a thorough Cognex market analysis.

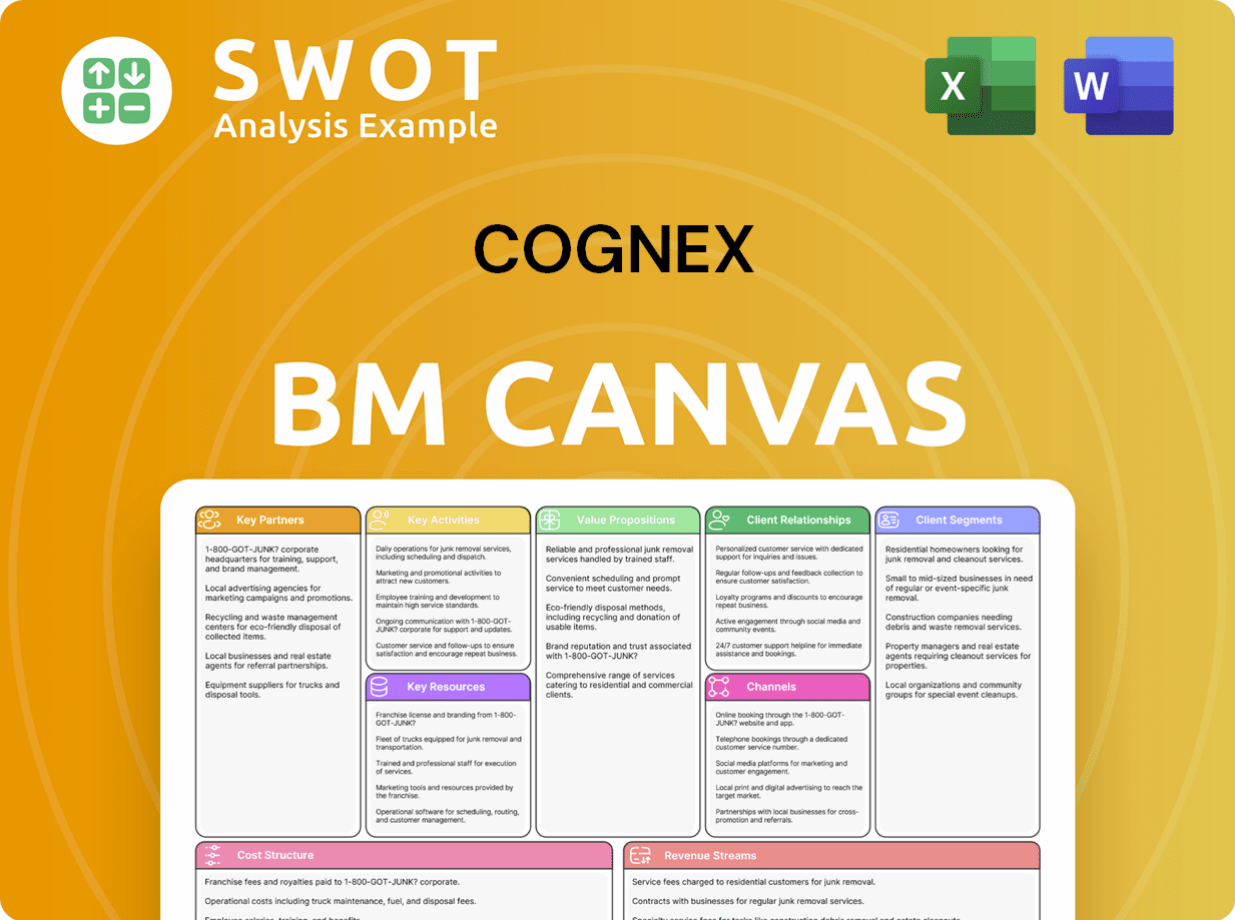

Cognex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Cognex’s Competitive Landscape?

The machine vision industry is currently experiencing significant growth, driven by automation and the increasing demand for quality control. This environment presents both challenges and opportunities for companies like Cognex. Understanding the Cognex competitive landscape and the broader vision systems industry is crucial for investors and strategists alike, especially when considering the company's future outlook.

Several factors influence Cognex's position, including market trends, competitive pressures, and the company's strategic initiatives. Analyzing Cognex market analysis requires a deep dive into these dynamics to assess potential risks and rewards. The company's ability to navigate these complexities will determine its success in the coming years. For an in-depth look at how Cognex operates, consider exploring the Revenue Streams & Business Model of Cognex.

Key trends shaping the industry include increased automation due to Industry 4.0, the growth of e-commerce, and a rising need for quality inspection. AI and deep learning advancements are enabling more sophisticated vision systems. These trends create opportunities for companies that can leverage these technologies to provide innovative solutions.

Challenges include potential softness in certain factory automation markets, particularly the automotive sector. Geopolitical factors and trade policies, such as tariffs, also present hurdles, although Cognex anticipates mitigating their direct impact in 2025. The intensification of the Cognex competitors landscape requires continuous innovation and strategic adaptation.

Significant growth opportunities exist in the logistics sector, driven by e-commerce and supply chain efficiency needs. The semiconductor market is also expected to grow substantially. Cognex is well-positioned to capture a share of investments in hybrid and electric vehicle manufacturing, especially in battery production and inspection.

Cognex is focusing on its 'Emerging Customer initiative' to expand its customer base, aiming to add around 3,000 new customers in 2024. The company is also leveraging its strong cash position for strategic acquisitions and R&D investments. This strategy aims to maintain resilience and capitalize on growth avenues.

The Cognex market share is influenced by its ability to adapt to industry trends and address challenges. Strategic initiatives and a strong financial position are crucial for future success. Understanding Cognex product offerings and how they address market needs is essential for evaluating the company's potential.

- The vision systems industry is experiencing growth driven by automation and quality control demands.

- Challenges include market softness and geopolitical factors; opportunities lie in logistics, semiconductors, and EV manufacturing.

- Cognex is focusing on expanding its customer base and leveraging its financial strength for acquisitions and R&D.

- Key competitors include Cognex vs Keyence and Cognex vs Omron, among other machine vision companies.

Cognex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cognex Company?

- What is Growth Strategy and Future Prospects of Cognex Company?

- How Does Cognex Company Work?

- What is Sales and Marketing Strategy of Cognex Company?

- What is Brief History of Cognex Company?

- Who Owns Cognex Company?

- What is Customer Demographics and Target Market of Cognex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.