Cognex Bundle

Can Cognex Continue Its Machine Vision Dominance?

Cognex Corporation, a titan in the industrial automation arena, has consistently demonstrated a potent growth strategy. Its 2023 acquisition of Moritex Corporation, a $275 million move, expanded its product offerings and market reach, notably in Japan. This strategic maneuver, the largest in Cognex's history, immediately boosted its financial performance in 2024.

With a 15% share of the $8 billion vision systems market, Cognex's Cognex SWOT Analysis reveals a company poised for continued expansion. The company's focus on machine vision technology and strategic acquisitions, like Moritex, positions it well for future growth. This analysis delves into Cognex's revenue growth forecast, competitive landscape analysis, and potential investment opportunities within the dynamic industrial automation sector, offering a comprehensive look at the Cognex company analysis.

How Is Cognex Expanding Its Reach?

The expansion initiatives of the company are primarily focused on entering new markets, diversifying revenue streams, and staying ahead of industry changes. This is achieved through strategic acquisitions and sales force transformation, key elements of the overall Cognex growth strategy.

A significant step in this direction was the acquisition of Moritex Corporation in late 2023. This strategic move broadened the company's product lines and brought in new optical engineering talent. The acquisition is projected to be accretive to GAAP EPS in 2025 and is intended to increase the company's served market and strengthen its presence in Japan.

The company is also actively expanding its sales coverage. In 2024, it invested $23 million, following a $28 million investment in 2023, to grow and broaden its sales force. This sales transformation initiative resulted in the addition of over 3,000 new customers in 2024, with a focus on expanding beyond the top 10% of the market. As part of its five-year strategic objectives, the company aims to double its customer base.

The acquisition of Moritex Corporation in late 2023 expanded the company's product lines and brought in new optical engineering talent. This acquisition is expected to be accretive to GAAP EPS in 2025. It is a strategic move to increase the company's served market and deepen its presence in Japan.

The company invested $23 million in 2024, following $28 million in 2023, to grow and broaden its sales force. This initiative added over 3,000 new customers in 2024. The company aims to double its customer base as part of its five-year strategic objectives, focusing on expansion beyond the top 10% of the market.

The company is experiencing mixed market dynamics, but it continues to see strength in the logistics and semiconductor businesses. The logistics industry represented approximately 23% of total revenue in 2024, with a 20% increase from the prior year due to investments by e-commerce customers.

- The semiconductor industry also saw significant growth, representing about 11% of total revenue with an 80% increase in 2024.

- This growth was driven by Moritex's contribution and higher global demand for computing chips, particularly from AI demand for high-end logic process chips.

- The company anticipates significant growth in logistics as the industry moves beyond barcode reading to more complex vision applications.

- The company expects a multi-year wave of investment in hybrid and electric vehicle manufacturing, especially in battery manufacturing and inspection.

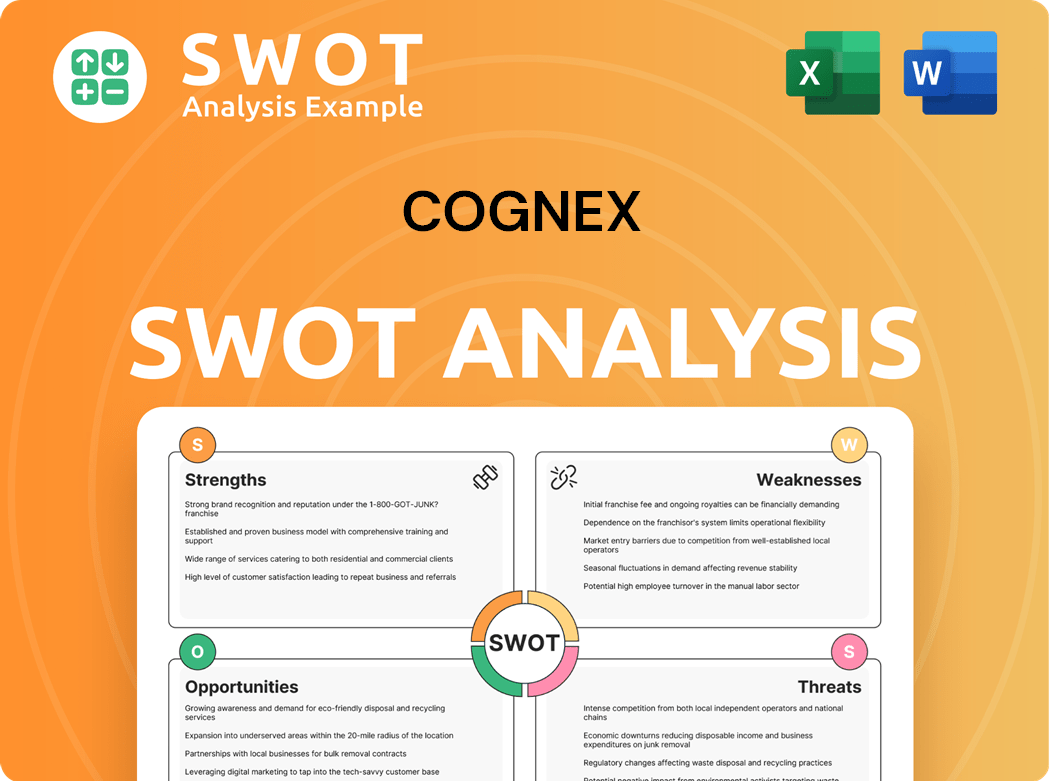

Cognex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Cognex Invest in Innovation?

The company's innovation strategy centers on leveraging cutting-edge technologies, especially artificial intelligence (AI), to drive growth and maintain its leadership in the industrial machine vision sector. This approach is critical for understanding the Mission, Vision & Core Values of Cognex and its future direction. The company's focus on AI integration across its product lines is a key element of its growth strategy.

The company's strategic priorities in 2024 included further integrating AI into its products and tools. The company has been consistently launching new products with AI components. This focus aims to make machine vision more accessible and easier to use for a broader customer base, extending use cases and potentially unlocking more demand for industrial robots. This strategy is essential for navigating the dynamic vision systems market.

Cognex's commitment to research and development is substantial, with an allocation of 15% of its revenue to RD&E in 2024. This significant investment underscores the company's dedication to innovation and its long-term growth potential. The company's focus on digital transformation and automation is evident in how their products are used in factories and distribution centers to automate manufacturing and tracking.

The company has introduced AI-powered machine vision technologies, including the In-Sight L38, the first AI-enabled 3D smart camera, and VisionPro Deep Learning 4.0. These advancements are designed to improve performance and usability. The company's focus on AI is a core element of its product portfolio overview.

The company has launched new AI-driven DataMan series ID readers and updated its product tunnel offerings with the DataMan 380, optimized for logistics applications. These product launches contribute to the company's overall revenue growth forecast.

Cognex invests heavily in R&D, allocating a significant portion of its revenue to this area. The acquisition of Moritex Corporation enhanced their R&D capabilities. This investment is crucial for the company's competitive landscape analysis.

The company holds a substantial number of patents, with 1,400 patents issued and pending across 618 patent families. This robust patent portfolio supports its market share 2024 and future innovation efforts.

Cognex aims to be the leading AI technology provider for industrial machine vision applications. This objective is a key part of its expansion into new markets.

The company's products are designed to automate manufacturing and tracking processes in factories and distribution centers. This focus on digital transformation is a key driver of its sustainable business practices.

Cognex's innovation strategy is centered on AI and its integration into machine vision systems. This approach is designed to improve product performance and usability, which is essential for industrial automation. The company's focus on AI is a significant factor in its long-term growth potential.

- AI-enabled 3D smart cameras, such as the In-Sight L38.

- VisionPro Deep Learning 4.0, which utilizes next-generation AI Transformer models.

- New AI-driven DataMan series ID readers.

- DataMan 380, optimized for logistics applications.

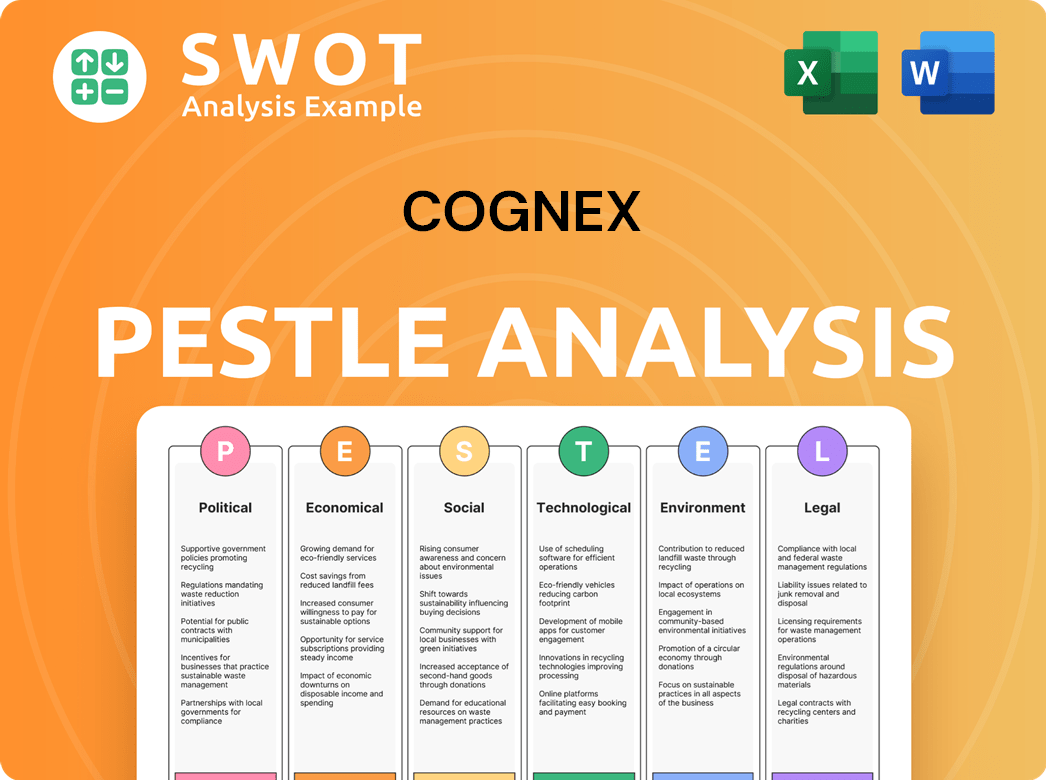

Cognex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Cognex’s Growth Forecast?

The financial performance of the company in 2024 showed robust results, with total revenue reaching $915 million, marking a 9% increase compared to the previous year. This growth underscores the company's strong position in the vision systems market and its ability to capitalize on opportunities within industrial automation. Adjusted gross margin stood at 69.3%, and adjusted EBITDA margin was 17.1%, demonstrating effective cost management and operational efficiency.

Net income for 2024 was $106.171 million, translating to $0.62 per share. The company's financial stability is further highlighted by its substantial cash and investments of $587 million and zero debt as of December 31, 2024. This strong financial foundation positions the company well for future investments and strategic initiatives aimed at driving further growth in the machine vision technology sector.

Looking ahead, the company's guidance for Q1 2025 anticipates revenue between $200 million and $220 million. While this represents a similar revenue level year-on-year at the midpoint, the company expects growth in Logistics and Semiconductor to be partially offset by weaker Automotive performance and a $5 million FX headwind. For Q2 2025, revenue is projected to be between $235 million and $255 million, indicating approximately 2.5% year-over-year growth at the midpoint compared to Q2 2024's $239 million. The company's strategic focus on key growth areas should support its Cognex growth strategy.

Total Revenue: $915 million, up 9% year-over-year.

Net Income: $106.171 million, or $0.62 per share.

Cash and Investments: $587 million, with no debt.

Revenue: $216 million, a 2% increase year-over-year (5% on a constant-currency basis).

Net Income: $24 million, up 96% year-over-year.

Adjusted Diluted EPS: $0.16, up 41% year-over-year.

Cash from Operating Activities: $41 million, up 197% year-over-year.

Free Cash Flow: $38 million, up 297% year-over-year.

Shareholder Returns: $116 million, the highest since Q1 2022, through share repurchases and dividends.

Q1 2025 Revenue Guidance: $200 million to $220 million.

Q2 2025 Revenue Guidance: $235 million to $255 million.

Analyst Forecast: Earnings to grow by 17.6% and revenue by 8.3% per annum; EPS expected to grow by 22.6% per annum.

The company's financial outlook remains positive, driven by strategic investments and a focus on key growth markets. The company's performance in Q1 2025, with revenue up 2% year-over-year, showcases its resilience and ability to navigate market challenges. The significant increase in net income and cash flow further underscores the company's strong financial health and operational efficiency.

- Adjusted gross margin is expected to be in the high 60 percent range for both Q1 and Q2 2025.

- Adjusted EBITDA margin for Q1 2025 was projected between 12% and 15%, with Q2 2025 guidance at 18.5%-21.5%.

- The company's strategy includes a focus on innovation and expansion into new markets, which is expected to drive long-term growth.

- The company's strong financial position, with substantial cash reserves and no debt, provides flexibility for future investments and acquisitions.

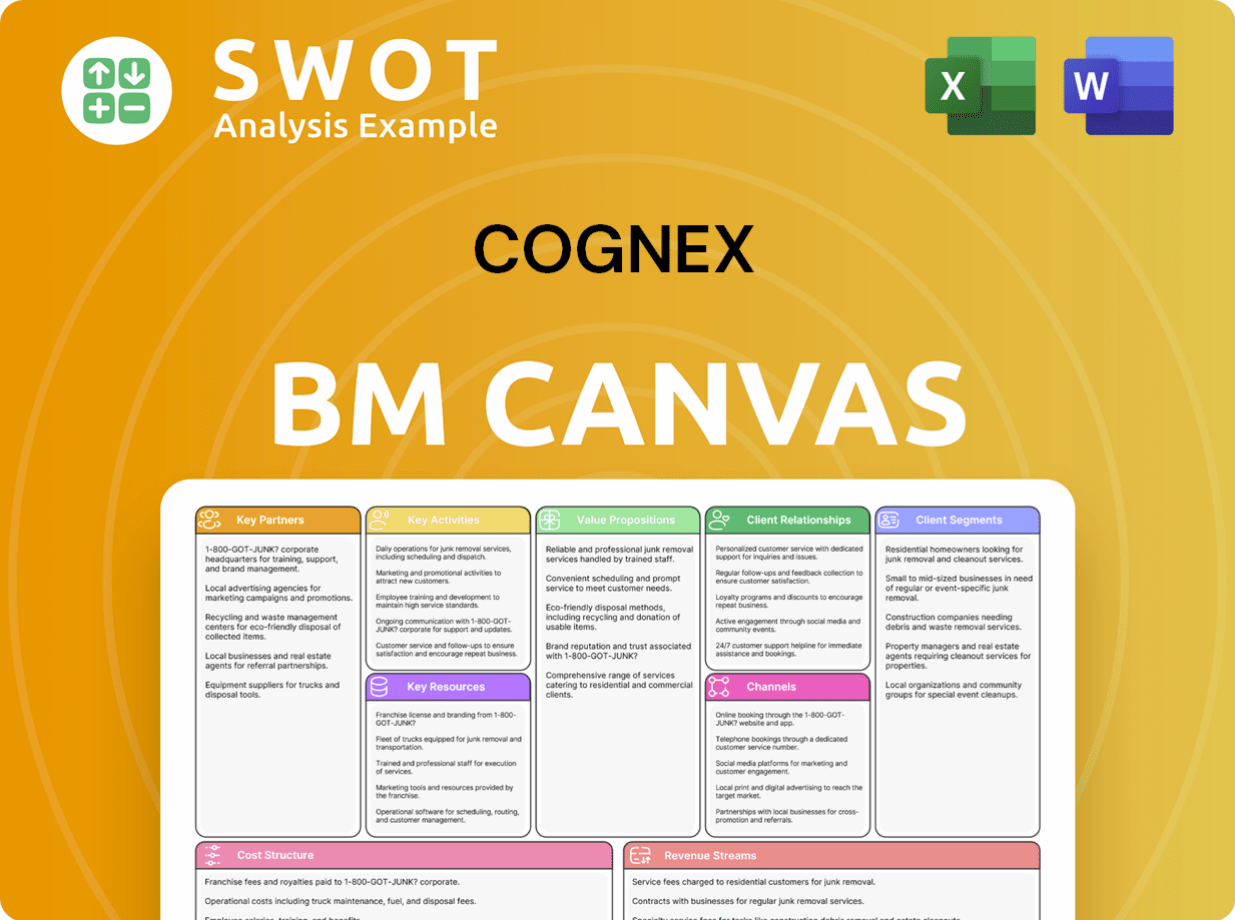

Cognex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Cognex’s Growth?

The path to growth for Cognex, like any technology company, is fraught with potential pitfalls. Understanding these risks is crucial for assessing the company's Cognex future prospects. Several internal and external factors could impede its progress, affecting its financial performance and market position.

One of the most significant challenges for Cognex company analysis is the competitive landscape of the vision systems market. The machine vision sector is intensely competitive and rapidly evolving, which could impact Cognex growth strategy. This includes competition from established players and the emergence of new technologies.

Supply chain disruptions and geopolitical tensions pose considerable risks. These factors could affect the availability of components and disrupt customer relationships, especially given Cognex's international market presence. Additionally, economic uncertainties and the automotive industry's volatility add layers of complexity to Cognex's strategic planning.

The machine vision market is highly competitive, featuring rivals like Keyence Corporation and SICK AG. The rapid advancement of technology, including AI and open-source platforms, intensifies pricing pressures. Maintaining product differentiation is a constant challenge in this environment.

Cognex relies on third-party manufacturers, making it susceptible to supply chain disruptions. Obtaining components, particularly integrated circuit chips, can lead to production delays and increased costs. Geopolitical factors, such as the China-Taiwan situation, also pose risks.

The automotive industry has been a consistent area of weakness, with a 12% decrease in revenue in 2024, and continued uncertainty expected in 2025. Consumer electronics also remained weak in 2024. Economic uncertainties, including interest rate increases and inflation, could impact financial results.

Attracting and retaining skilled employees, especially in machine vision and AI, is challenging. Stock price volatility can impact the competitiveness of stock-based compensation. These factors can affect the company's ability to innovate and execute its strategy.

Changes in regulations, particularly concerning data privacy and AI, could increase operational costs and delay product launches. The integration of acquisitions, such as Moritex, carries risks related to integration challenges and the realization of anticipated synergies.

Economic uncertainty, including increasing interest rates, and elevated inflation rates, poses risks. These macroeconomic factors can influence investment decisions and affect demand across various industries, potentially impacting financial results. The Cognex investment opportunities may be affected by these conditions.

The Cognex competitive landscape analysis reveals a fragmented market with strong players like Keyence and SICK AG. Competitors Landscape of Cognex provides a detailed look at the competitive dynamics. The increasing commoditization of machine vision technology further intensifies competition.

Rapid technological changes, including advancements in AI and open-source platforms, pose both opportunities and risks. While AI offers new capabilities, it also increases the pressure on product differentiation. Innovation is key for maintaining a competitive edge.

Supply chain vulnerabilities, particularly the reliance on third-party manufacturers, can lead to disruptions. The availability of critical components, like integrated circuits, is a significant concern. Geopolitical tensions add to the complexity of managing the supply chain.

The automotive industry has shown weakness, with a decline in revenue in 2024. The consumer electronics sector also remained weak. These market dynamics can significantly impact Cognex revenue growth forecast and overall financial performance.

Cognex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cognex Company?

- What is Competitive Landscape of Cognex Company?

- How Does Cognex Company Work?

- What is Sales and Marketing Strategy of Cognex Company?

- What is Brief History of Cognex Company?

- Who Owns Cognex Company?

- What is Customer Demographics and Target Market of Cognex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.