DZS Bundle

Can DZS Conquer the Telecom Titans?

In the fast-paced world of telecommunications, DZS Inc. has carved out a significant niche. From its origins in South Korea to its current global presence, DZS has been a key player in providing network access solutions. This article will explore the intricacies of the DZS SWOT Analysis to understand its position in the market.

This deep dive into the DZS competitive landscape will dissect its strategic positioning within the DZS industry. We'll analyze DZS competitors, evaluate DZS's business strategy, and assess its market share to understand how DZS navigates a competitive environment. Furthermore, we'll examine DZS's market position and future outlook, providing a detailed analysis of DZS's competitive strategy and the key players shaping its destiny. This DZS market analysis aims to equip you with the knowledge to assess DZS's potential.

Where Does DZS’ Stand in the Current Market?

DZS Inc. carves out a significant niche within the global telecommunications infrastructure market. The company is particularly focused on fiber access and mobile transport solutions. DZS plays a crucial role in enabling service providers to deploy next-generation broadband networks, including fiber-to-the-home (FTTH) and 5G mobile backhaul.

DZS's core offerings include Velocity access optical line terminals (OLTs) and optical network terminals (ONTs), Helix for intelligent edge and home Wi-Fi, and Chronos for mobile transport and timing solutions. These products are designed to meet the evolving needs of a diverse customer base. DZS serves tier-1 and tier-2 service providers, as well as enterprises across North America, EMEA, and Asia.

The company has strategically pivoted towards software-defined networking (SDN) and cloud-native solutions. This shift reflects a broader industry trend towards network disaggregation and virtualization. Furthermore, you can find more information about the company's growth strategy in the article Growth Strategy of DZS.

DZS maintains a specialized market position within the telecommunications sector, concentrating on fiber access and mobile transport. This focus allows DZS to serve the growing demand for high-speed internet and 5G infrastructure. The company's strategic emphasis on SDN and cloud-native solutions positions it for future growth.

DZS offers a comprehensive suite of products, including Velocity OLTs and ONTs, Helix for intelligent edge and home Wi-Fi, and Chronos for mobile transport. These products enable service providers to deliver advanced broadband and mobile services. DZS's solutions support the deployment of FTTH and 5G networks.

DZS serves a diverse customer base, including tier-1 and tier-2 service providers and enterprises across North America, EMEA, and Asia. This broad reach underscores the company's ability to meet the needs of different markets. The company's focus on fiber access and mobile transport solutions caters to the specific demands of these regions.

For the full year 2023, DZS reported total revenue of $356.5 million. This financial performance reflects the company's scale within the industry. DZS's financial results highlight its presence and impact in the telecommunications market.

The DZS competitive landscape includes larger, more diversified players. DZS maintains a strong position in niche markets and regions where its fiber access and mobile transport solutions are highly valued. The company's focus on SDN and cloud-native solutions helps it to stay competitive.

- DZS's market share is particularly strong in regions investing in fiber broadband rollouts.

- The company's competitive advantages analysis includes its focus on fiber access and mobile transport.

- DZS's strategic partnerships and product offerings help it compete effectively.

- The company's financial performance, such as the $356.5 million in revenue for 2023, reflects its market position.

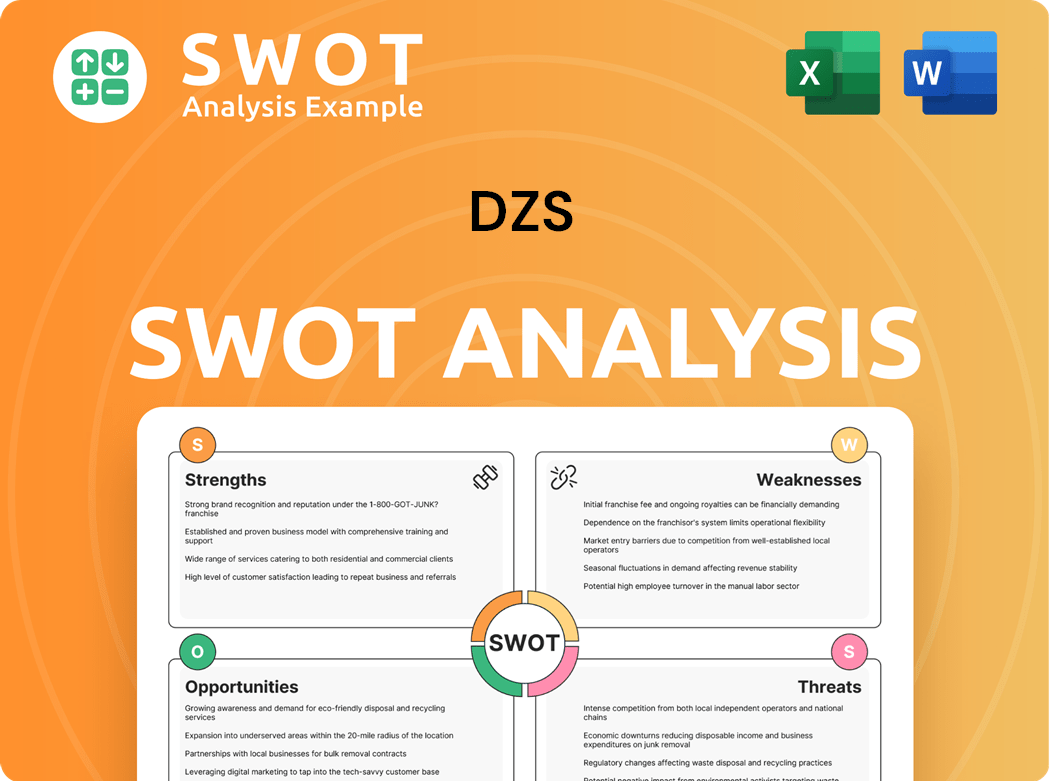

DZS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging DZS?

The DZS competitive landscape is characterized by intense rivalry across its product segments. The company faces both direct and indirect competition in the telecommunications equipment market. Understanding the competitive dynamics is crucial for evaluating its market position and future outlook.

Key players in the DZS market include established giants and emerging specialists. These competitors vary in size, technological prowess, and market reach. A thorough DZS market analysis reveals the strengths and weaknesses of each competitor, influencing DZS's business strategy.

The competitive environment is dynamic, with mergers, acquisitions, and strategic partnerships constantly reshaping the landscape. This requires continuous monitoring and adaptation to maintain or improve DZS's market share.

In the fiber access domain, DZS faces competition from major players like Nokia, Huawei, and CommScope. These companies offer comprehensive solutions, including OLTs and ONTs. The competitive landscape is shaped by product portfolios and global market presence.

Nokia is a significant competitor, leveraging its extensive global reach and strong relationships with tier-1 operators. Nokia's broad product range and R&D capabilities challenge DZS. In 2024, Nokia reported net sales of approximately €22.2 billion.

Despite geopolitical challenges, Huawei remains a formidable competitor, particularly in Asia and emerging markets. Huawei's aggressive pricing and advanced technological offerings pose a threat. Huawei's revenue for 2023 was around $99.4 billion.

CommScope competes with its own set of access network solutions, often leveraging its installed base and brand recognition. CommScope's revenue in 2023 was approximately $7.4 billion.

In the mobile transport and timing solutions space, DZS competes with Ericsson and Cisco. These companies provide backhaul and fronthaul solutions for mobile networks. The competitive dynamics are influenced by 5G infrastructure and networking platforms.

Ericsson's strong position in 5G infrastructure gives it an edge in offering integrated mobile transport solutions. Ericsson's net sales for 2023 were approximately SEK 263.4 billion.

Emerging players and specialized vendors also pose a threat, particularly those focused on open-source solutions or niche applications within software-defined networking and network functions virtualization (NFV). These companies often concentrate on specific market segments or technologies, challenging the established players.

- Focus on open-source solutions and specialized applications.

- Competition in software-defined networking and network functions virtualization (NFV).

- Dynamic landscape shaped by mergers and acquisitions.

- Strategic partnerships to bolster portfolios.

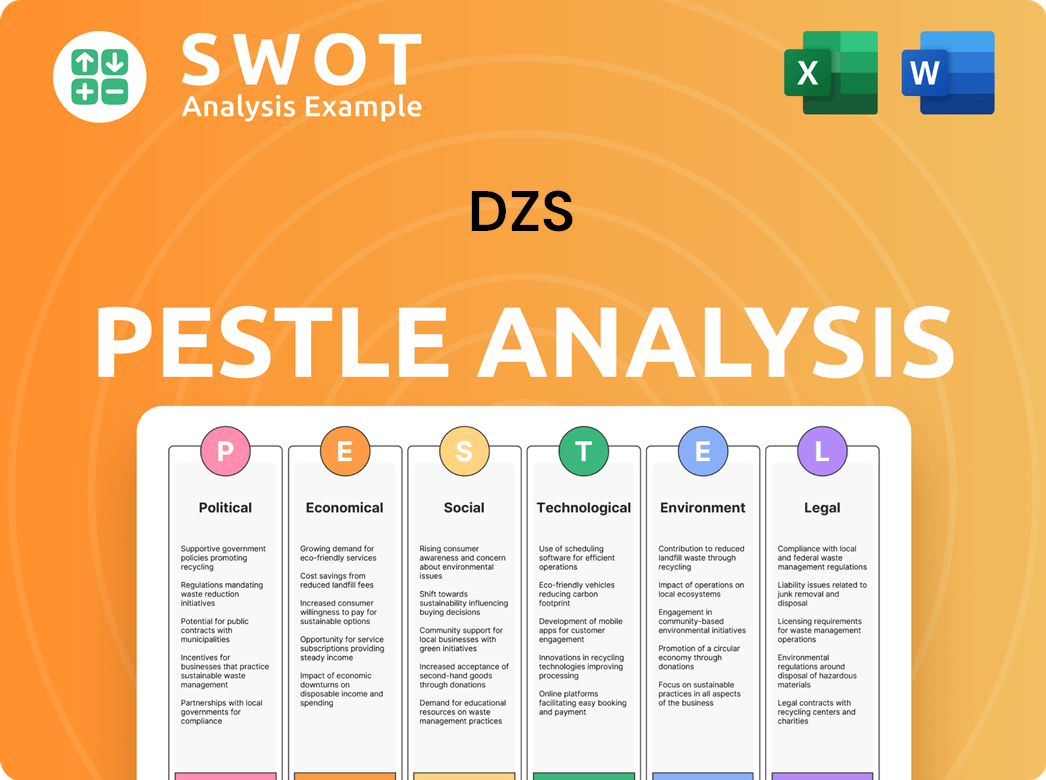

DZS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives DZS a Competitive Edge Over Its Rivals?

Analyzing the DZS competitive landscape reveals several key strengths that set it apart in the telecommunications sector. The company's strategic focus on open, software-defined, and cloud-native solutions provides a significant advantage, offering greater flexibility and efficiency compared to traditional network architectures. This approach is crucial as service providers increasingly seek disaggregated and virtualized network components. DZS's commitment to innovation and customer-centric strategies further solidifies its position in the market.

DZS competitors face a dynamic market, where technological advancements and evolving customer demands are constant. The company's ability to adapt and respond to specific customer needs, along with its focus on interoperability and open standards, allows it to compete effectively. While brand recognition may not match that of larger global players, DZS has built a solid reputation for reliable and innovative solutions within its target segments. This agility is a key factor in navigating the complexities of the DZS industry.

A thorough DZS market analysis indicates that the company's competitive advantages are rooted in its expertise in optical networking and its transition to software-centric platforms. This evolution allows DZS to offer advanced, flexible, and cost-effective solutions that are critical for the next generation of network deployments. The company's success depends on its continued investment in research and development, along with its ability to anticipate and adapt to rapid technological changes. These factors contribute to a sustainable competitive edge in the telecommunications market.

DZS differentiates itself through its emphasis on open, software-defined, and cloud-native solutions. This approach offers service providers greater flexibility, scalability, and operational efficiency. This strategy allows DZS to meet the evolving needs of customers who are increasingly seeking disaggregated and virtualized network components.

The company leverages its intellectual property in fiber access and mobile transport technologies. This includes patents related to optical networking and timing synchronization. These technological assets strengthen its market position and provide a competitive edge in the industry.

DZS's agility and customer-centric approach enable it to be more responsive to specific customer requirements. This responsiveness allows for stronger relationships and tailored solutions. This is evident in its partnerships with service providers deploying advanced fiber broadband and 5G networks.

The company's commitment to interoperability and open standards makes its solutions attractive to operators. This helps operators avoid vendor lock-in and integrate diverse network elements. This strategy is important for maintaining a competitive edge in the market.

DZS's competitive advantages include a focus on open, software-defined, and cloud-native solutions, which provide greater flexibility and efficiency for service providers. The company’s intellectual property in fiber access and mobile transport technologies, including patents in optical networking, further strengthens its position. DZS also benefits from its agility and customer-centric approach, allowing it to respond quickly to specific customer needs and regional market demands.

- Open and Cloud-Native Solutions: Providing flexibility and efficiency.

- Intellectual Property: Patents in optical networking and timing synchronization.

- Customer-Centric Approach: Stronger relationships and tailored solutions.

- Interoperability and Open Standards: Avoiding vendor lock-in for operators.

DZS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping DZS’s Competitive Landscape?

The telecommunications industry is currently experiencing significant shifts, creating a dynamic environment for companies like DZS. The ongoing deployment of 5G and fiber optic networks is a primary driver, creating demand for advanced networking solutions. Understanding the DZS competitive landscape is crucial for investors and strategists to assess its position and future prospects.

Key trends include the adoption of cloud-native architectures and network disaggregation, which are reshaping the industry. This environment presents both opportunities and challenges, influencing the DZS industry and requiring strategic adaptation to maintain market share. A robust DZS market analysis is essential for navigating these changes effectively.

The telecommunications sector is seeing accelerated 5G and fiber broadband deployments, driving the need for advanced network infrastructure. Cloud-native architectures and network disaggregation are becoming more prevalent. Regulatory changes and supply chain considerations are also reshaping the market dynamics.

Intense price competition from large manufacturers can pressure margins. Rapid technological advancements require continuous R&D investments. Economic shifts and supply chain issues can impact production and delivery timelines. Consolidation among service providers might lead to fewer, larger purchasing decisions.

Emerging markets with expanding broadband infrastructure offer significant growth potential. The expansion of private 5G networks for enterprises is creating new opportunities. Increasing demand for edge computing solutions provides avenues for expansion. Strategic partnerships can enhance market reach and innovation.

DZS can capitalize on these trends by innovating in software-defined platforms and expanding partnerships. Focusing on niche markets where specialized solutions offer a distinct advantage is crucial. Adapting to become a key enabler of disaggregated, intelligent networks is vital for maintaining a competitive edge. For further insights, consider the Revenue Streams & Business Model of DZS.

The telecommunications market is projected to grow. The global 5G infrastructure market is expected to reach $40.9 billion by 2025. Fiber optic cable deployments are increasing, with FTTH/FTTP deployments expanding rapidly. Network disaggregation is gaining traction, with a focus on open standards and software-defined networking.

- The increasing demand for higher bandwidth and lower latency is driving investments in 5G and fiber.

- Cloud-native architectures are becoming a standard for network operations.

- Regulatory changes, such as those related to national security, are influencing vendor selection.

- Supply chain volatility remains a challenge for all industry participants.

DZS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DZS Company?

- What is Growth Strategy and Future Prospects of DZS Company?

- How Does DZS Company Work?

- What is Sales and Marketing Strategy of DZS Company?

- What is Brief History of DZS Company?

- Who Owns DZS Company?

- What is Customer Demographics and Target Market of DZS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.